Key Insights

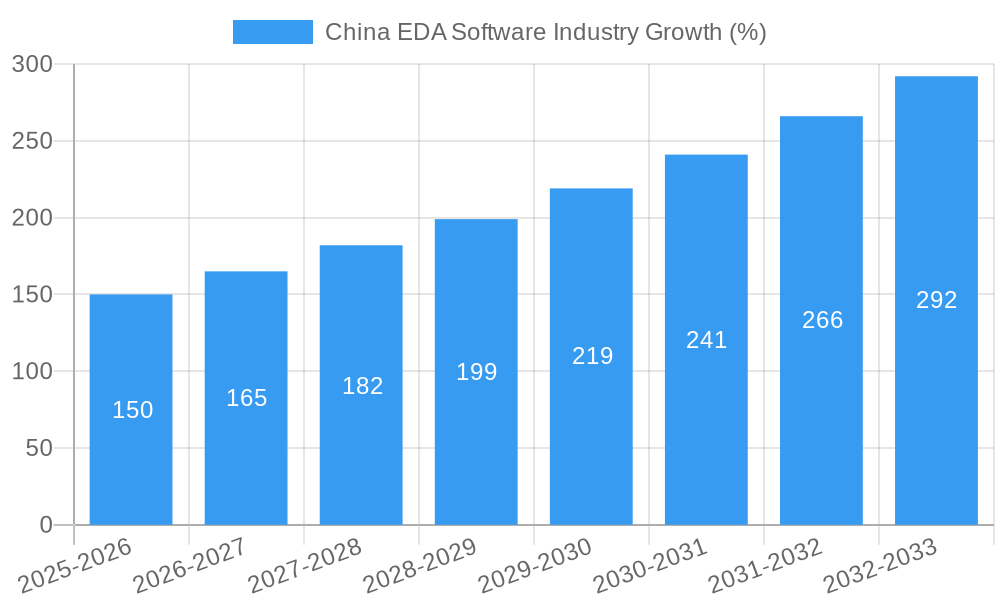

The China EDA (Electronic Design Automation) software market is experiencing robust growth, driven by the nation's rapid advancements in semiconductor manufacturing and the expanding electronics industry. With a Compound Annual Growth Rate (CAGR) of 10.2% from 2019 to 2024, and a projected continuation of this trend, the market presents significant opportunities for both established international players and burgeoning domestic companies. The market's segmentation reveals strong demand across various applications, including communication, consumer electronics, automotive, and industrial sectors. Computer-aided engineering (CAE) tools, crucial for designing complex systems, represent a substantial segment, alongside IC physical design and verification software, reflecting the increasing complexity of integrated circuits. The growth is further fueled by increasing government investments in domestic semiconductor capabilities and the nation's strategic push for technological self-reliance. This creates a favorable environment for both international companies seeking to establish a strong presence in the Chinese market and for domestic firms aiming to compete on a global scale.

However, challenges remain. While the market is expanding rapidly, international players face regulatory hurdles and competition from domestically developed solutions. The need for specialized talent and the continuous evolution of EDA technology also pose significant ongoing challenges. The market's future trajectory will depend on factors such as government policy, the pace of technological innovation, and the ability of both domestic and international firms to adapt to a rapidly changing technological landscape. The ongoing development of advanced nodes in semiconductor manufacturing in China will further propel the demand for sophisticated EDA software. A potential area of further growth lies in the integration of artificial intelligence and machine learning within EDA tools, promising greater efficiency and design automation capabilities, particularly in areas such as PCB and MCM design and verification. The dominance of specific segments, like CAE and IC design, underlines the need for specialized solutions and expertise in the industry.

China EDA Software Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning China EDA software market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers invaluable data and projections to inform strategic decision-making. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

China EDA Software Industry Market Composition & Trends

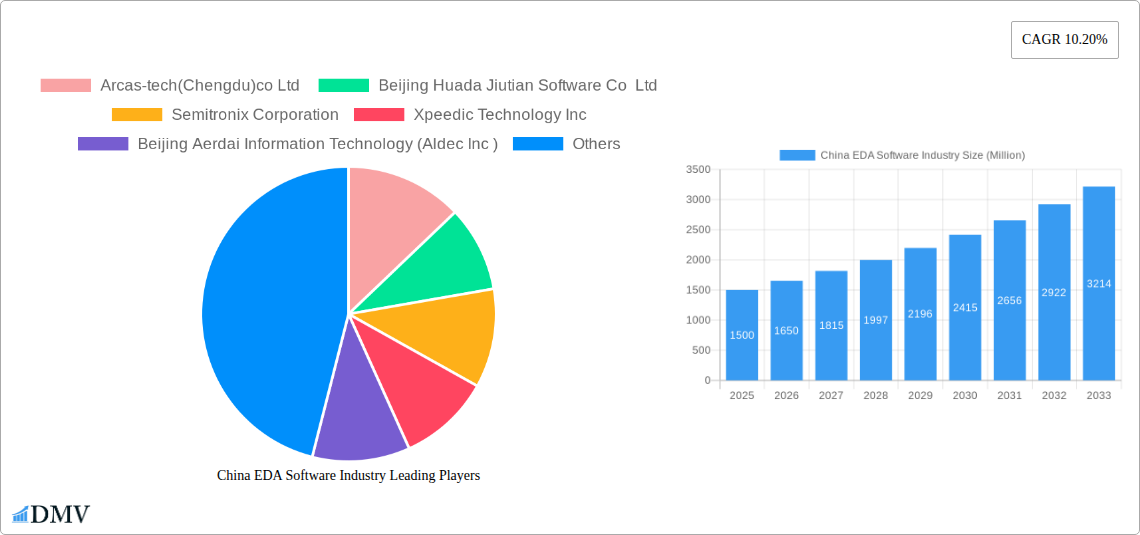

This section dissects the competitive dynamics of the Chinese EDA software market, examining market concentration, innovation drivers, regulatory influences, substitute product threats, and end-user behaviors. We analyze the market share distribution among key players, revealing the dominance of international giants like Synopsys and Cadence, alongside the growing presence of domestic companies such as Beijing Huada Jiutian Software Co Ltd and Arcas-tech(Chengdu)co Ltd. The report also explores M&A activity within the sector, quantifying deal values in Millions and identifying key trends impacting market consolidation. The regulatory landscape, including government initiatives promoting domestic semiconductor development, is meticulously examined. Finally, we profile end-users across various segments – including Communication, Consumer Electronics, Automotive, and Industrial – to understand their unique needs and purchasing behaviors.

- Market Concentration: Highly concentrated, with top 3 players holding approximately xx% market share in 2025.

- Innovation Catalysts: Government funding, rising R&D investments, and the need for advanced design capabilities.

- Regulatory Landscape: Favorable policies promoting domestic chip design and manufacturing.

- Substitute Products: Limited direct substitutes, but open-source solutions pose a growing challenge.

- M&A Activity: Total M&A deal value in 2024 estimated at xx Million, driven by strategic acquisitions.

China EDA Software Industry Industry Evolution

This section charts the evolutionary trajectory of the China EDA software industry, analyzing market growth trajectories, technological advancements, and shifting consumer demands over the period 2019-2033. We delve into the adoption rates of different EDA software types, detailing growth rates across segments like IC Physical Design and Verification and PCB and MCM. The report tracks the emergence of new technologies such as AI-driven design automation and the increasing demand for cloud-based EDA solutions. We also examine how evolving consumer needs – such as faster design cycles and increased design complexity – are shaping market trends. The analysis incorporates specific data points, illustrating market growth rates and adoption metrics across different EDA software types and application areas. The impact of the global chip shortage and increasing geopolitical tensions on market dynamics is also explored.

Leading Regions, Countries, or Segments in China EDA Software Industry

This section identifies the dominant regions, countries, and segments within the Chinese EDA software market. We analyze market performance across different application areas (Communication, Consumer Electronics, Automotive, Industrial, Other Applications) and software types (Computer-aided Engineering (CAE), IC Physical Design and Verification, Printed Circuit Board and Multi-chip Module (PCB and MCM), Semiconductor Intellectual Property (SIP)). The analysis highlights key drivers of market leadership in each segment, focusing on investment trends, regulatory support, and technological advancements.

- By Application: The Communication segment is projected to lead in 2025, driven by the rapid expansion of 5G infrastructure.

- By Type: The IC Physical Design and Verification segment exhibits the highest growth rate due to increasing complexity of integrated circuits.

- Key Drivers: Government subsidies for domestic semiconductor development, robust investment in R&D, and a growing domestic demand for advanced technologies.

China EDA Software Industry Product Innovations

This section showcases recent product innovations within the China EDA software market, emphasizing their unique selling propositions (USPs) and performance metrics. We highlight advancements in areas like AI-powered design automation, cloud-based EDA platforms, and enhanced simulation capabilities, examining their impact on design efficiency and product quality. The discussion also touches upon the integration of advanced technologies like machine learning and high-performance computing into EDA software.

Propelling Factors for China EDA Software Industry Growth

Several key factors drive the growth of the China EDA software market. Government initiatives promoting domestic semiconductor self-reliance have injected significant funding into the sector, fueling innovation and expanding market capabilities. The burgeoning domestic electronics manufacturing industry necessitates advanced design tools, driving up demand for sophisticated EDA software. Furthermore, technological advancements, including AI-powered design automation, are enhancing efficiency and creating new possibilities for design innovation.

Obstacles in the China EDA Software Industry Market

Despite significant growth potential, the China EDA software market faces certain challenges. The dominance of international players presents stiff competition for domestic companies. Supply chain disruptions caused by geopolitical tensions could hinder growth and impact product availability. Furthermore, certain regulatory hurdles and intellectual property concerns create obstacles for some companies.

Future Opportunities in China EDA Software Industry

The future of the China EDA software market is promising. The rising demand for advanced semiconductor technologies in emerging applications, such as AI and IoT, presents significant opportunities. Furthermore, the increasing adoption of cloud-based EDA solutions and the integration of AI and machine learning into EDA software will continue to drive market growth. New opportunities lie in specialized EDA solutions tailored for niche industries, as well as expansion into international markets.

Major Players in the China EDA Software Industry Ecosystem

- Arcas-tech(Chengdu)co Ltd

- Beijing Huada Jiutian Software Co Ltd

- Semitronix Corporation

- Xpeedic Technology Inc

- Beijing Aerdai Information Technology (Aldec Inc )

- Zuken Ltd

- Altium Limited

- Shanghai Lomicro Information Technology Co Ltd (Agnisys Inc )

- Mentor Graphic Corporation (Siemens PLM Software)

- Synopsys Inc

- Cadence Design Systems Inc

- Platform Design Automation Inc

Key Developments in China EDA Software Industry Industry

- 2023-03: Synopsys launches new AI-powered EDA software for faster chip design.

- 2022-10: Cadence announces strategic partnership with a major Chinese semiconductor manufacturer.

- 2021-07: Government invests xx Million in supporting domestic EDA companies. (Further specific developments with dates and impacts to be added)

Strategic China EDA Software Industry Market Forecast

The China EDA software market is poised for sustained growth, driven by increasing domestic semiconductor production, technological advancements, and supportive government policies. The market is expected to witness strong expansion across various application segments, particularly in the communication and automotive sectors. The integration of AI and cloud technologies will further accelerate innovation and market penetration, creating opportunities for both established and emerging players. The overall market exhibits strong growth potential driven by factors described earlier in the report.

China EDA Software Industry Segmentation

-

1. Type

- 1.1. Computer-aided Engineering (CAE)

- 1.2. IC Physical Design and Verification

- 1.3. Printed

- 1.4. Semiconductor Intellectual Property (SIP)

-

2. Application

- 2.1. Communication

- 2.2. Consumer Electronics

- 2.3. Automotive

- 2.4. Industrial

- 2.5. Other Applications

China EDA Software Industry Segmentation By Geography

- 1. China

China EDA Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increasing Government Support for EDA Tool Development; Growing Prevalence of PCB Design

- 3.2.2 System Design and PL/FPGA Design

- 3.3. Market Restrains

- 3.3.1. ; Lack of Comprehensiveness of Chinese Digital Design Tools

- 3.4. Market Trends

- 3.4.1. Automotive Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China EDA Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Computer-aided Engineering (CAE)

- 5.1.2. IC Physical Design and Verification

- 5.1.3. Printed

- 5.1.4. Semiconductor Intellectual Property (SIP)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Communication

- 5.2.2. Consumer Electronics

- 5.2.3. Automotive

- 5.2.4. Industrial

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Arcas-tech(Chengdu)co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Beijing Huada Jiutian Software Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Semitronix Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xpeedic Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Beijing Aerdai Information Technology (Aldec Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zuken Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Altium Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Lomicro Information Technology Co Ltd (Agnisys Inc )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mentor Graphic Corporation (Siemens PLM Software)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Synopsys Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cadence Design Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Platform Design Automation Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Arcas-tech(Chengdu)co Ltd

List of Figures

- Figure 1: China EDA Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China EDA Software Industry Share (%) by Company 2024

List of Tables

- Table 1: China EDA Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China EDA Software Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: China EDA Software Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: China EDA Software Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: China EDA Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: China EDA Software Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: China EDA Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China EDA Software Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: China EDA Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China EDA Software Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: China EDA Software Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: China EDA Software Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 13: China EDA Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: China EDA Software Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 15: China EDA Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China EDA Software Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China EDA Software Industry?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the China EDA Software Industry?

Key companies in the market include Arcas-tech(Chengdu)co Ltd , Beijing Huada Jiutian Software Co Ltd, Semitronix Corporation, Xpeedic Technology Inc, Beijing Aerdai Information Technology (Aldec Inc ), Zuken Ltd, Altium Limited, Shanghai Lomicro Information Technology Co Ltd (Agnisys Inc ), Mentor Graphic Corporation (Siemens PLM Software), Synopsys Inc, Cadence Design Systems Inc, Platform Design Automation Inc.

3. What are the main segments of the China EDA Software Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Government Support for EDA Tool Development; Growing Prevalence of PCB Design. System Design and PL/FPGA Design.

6. What are the notable trends driving market growth?

Automotive Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Lack of Comprehensiveness of Chinese Digital Design Tools.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China EDA Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China EDA Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China EDA Software Industry?

To stay informed about further developments, trends, and reports in the China EDA Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence