Key Insights

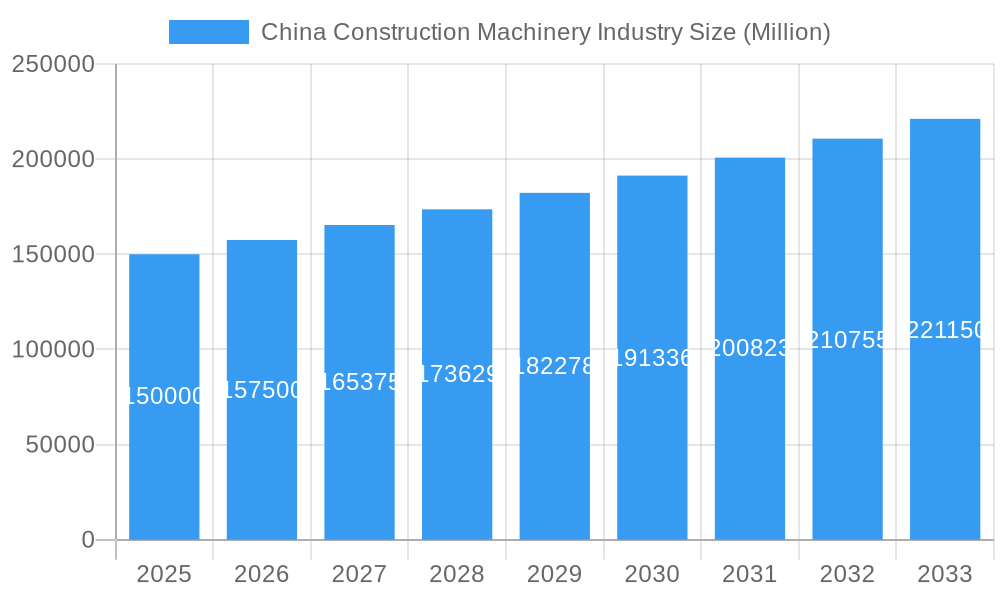

The China construction machinery market, valued at approximately $XXX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 5.10% and the unspecified 2019 market size), is poised for robust growth throughout the forecast period (2025-2033). This expansion is fueled by several key drivers: substantial government investment in infrastructure projects aligned with China's Belt and Road Initiative, rapid urbanization and industrialization leading to increased construction activity, and a burgeoning renewable energy sector requiring heavy machinery for project development. Further accelerating growth are technological advancements, particularly in the adoption of hybrid and electric machinery to meet stricter emission regulations and improve operational efficiency. Market segmentation reveals strong demand across diverse applications, including building construction, infrastructure development, and energy projects, with cranes, telescopic handlers, excavators, loaders, and backhoe loaders constituting major machinery types. While the OEM sales channel currently dominates, the aftermarket segment is anticipated to witness significant growth due to increasing machinery lifecycles and a rising need for maintenance and repair services.

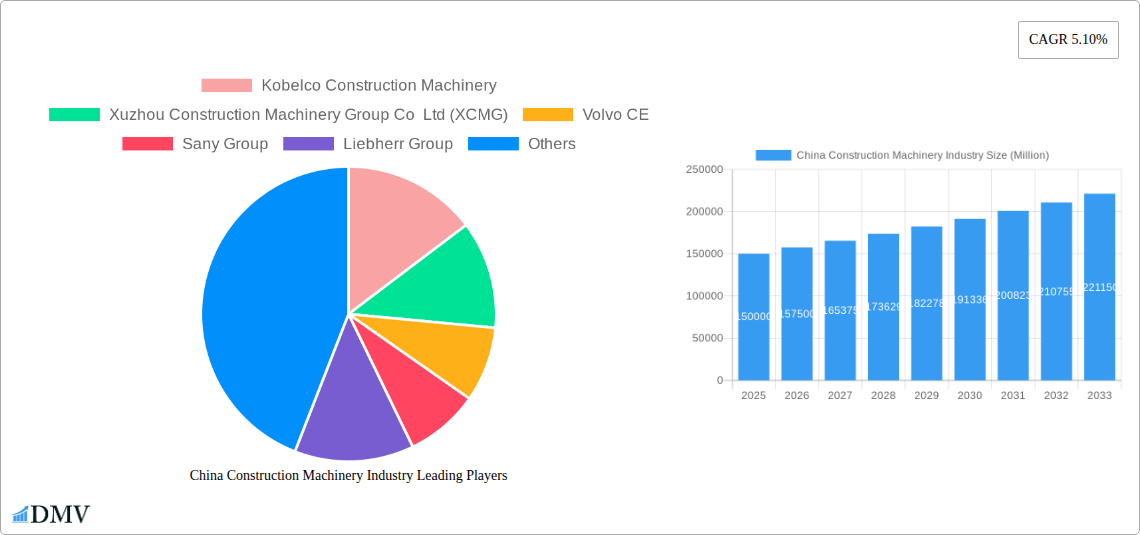

China Construction Machinery Industry Market Size (In Billion)

However, the market is not without its challenges. Potential restraints include fluctuations in raw material prices, supply chain disruptions, and the impact of global economic uncertainties on investment decisions. Competition is fierce, with both domestic giants like XCMG and Sany Group, and international players such as Caterpillar and Volvo CE vying for market share. The ongoing shift towards sustainable construction practices and the increasing adoption of technologically advanced machinery present both opportunities and challenges for industry participants. To thrive in this dynamic landscape, companies must focus on innovation, strategic partnerships, and efficient supply chain management to meet the ever-evolving demands of the Chinese construction sector. Continuous adaptation to government policies and regulatory changes will also be crucial for sustained success.

China Construction Machinery Industry Company Market Share

China Construction Machinery Industry Market Composition & Trends

This comprehensive report provides an in-depth analysis of the China construction machinery industry, covering the period 2019-2033. The study unveils the market's intricate composition, revealing key trends shaping its evolution. We dissect market concentration, identifying dominant players and their respective market share distribution, with data revealing a highly competitive landscape. Innovation catalysts, including technological advancements and government initiatives, are examined, alongside the regulatory environment and its impact on industry participants. The report also explores the influence of substitute products and the changing profiles of end-users, providing insights into evolving demand patterns. Finally, we analyze mergers and acquisitions (M&A) activity, evaluating deal values and their implications for market consolidation.

- Market Concentration: The Chinese construction machinery market shows high concentration with the top 5 players controlling approximately xx% of the market.

- Innovation Catalysts: Government investment in infrastructure projects and increasing adoption of automation technologies are significant drivers.

- Regulatory Landscape: Stringent emission norms and safety regulations are reshaping the industry.

- Substitute Products: Growing use of alternative construction methods, such as 3D printing, presents a challenge.

- End-User Profiles: The market is heavily reliant on large-scale infrastructure projects, with government investment playing a crucial role.

- M&A Activity: Deal values in the period 2019-2024 totaled approximately USD xx Million, indicative of ongoing consolidation.

China Construction Machinery Industry Industry Evolution

This section delves into the dynamic evolution of the China construction machinery industry. We analyze historical and projected market growth trajectories, providing concrete data points, including compound annual growth rates (CAGR) for the historical period (2019-2024) of xx% and projected CAGR for the forecast period (2025-2033) of xx%. We examine the impact of technological advancements, such as the integration of artificial intelligence (AI) and the Internet of Things (IoT), on industry efficiency and productivity. Shifting consumer demands, focusing on sustainability and the increasing adoption of hybrid and electric drive types, are also thoroughly examined. The report incorporates detailed analysis of the adoption rates of new technologies and shifts in consumer preferences, providing a clear picture of industry transformation.

Leading Regions, Countries, or Segments in China Construction Machinery Industry

This report identifies the dominant regions, countries, and segments within the China construction machinery market. Analysis will highlight the leading segments across drive type, sales channel, application type, and machinery type. Detailed analysis of dominant factors is provided including market size, growth rates and key drivers.

Drive Type: Conventional drive types still dominate, but Hybrid and Electric are experiencing increasing adoption driven by stricter emission regulations and sustainability goals.

Sales Channel: OEM (Original Equipment Manufacturer) sales remain the primary channel, however, the Aftermarket segment is gaining traction with growing emphasis on equipment maintenance and repairs.

Application Type: Infrastructure projects continue to be the largest application area, while the Building and Energy sectors also exhibit substantial growth potential.

Machinery Type: Excavators and Loaders & Backhoes remain the largest segments by volume, followed by Cranes, Telehandlers, and Motor Graders.

Key Drivers:

- Government investment in infrastructure (Belt and Road Initiative).

- Rapid urbanization and industrialization.

- Rising disposable incomes boosting private construction activities.

China Construction Machinery Industry Product Innovations

The industry showcases continuous product innovation driven by efficiency demands, technological advancements, and increasingly stringent environmental regulations. Recent product launches highlight features like enhanced fuel efficiency, improved safety systems, autonomous capabilities, and the integration of advanced telematics for remote monitoring and predictive maintenance. Companies are focusing on developing equipment that meets the needs of both large-scale infrastructure projects and specialized applications. Key innovations include improved hydraulic systems, advanced control systems, and hybrid/electric powertrains to enhance efficiency and reduce environmental impact.

Propelling Factors for China Construction Machinery Industry Growth

Several key factors fuel the growth of the China construction machinery industry. Government investments in large-scale infrastructure projects, including the Belt and Road Initiative, are a major driver. Rapid urbanization and industrialization are also contributing significantly to increased demand. Technological advancements, such as the adoption of automation and IoT technologies, enhance productivity and efficiency. Moreover, the industry benefits from supportive government policies encouraging domestic manufacturing and technological innovation. Finally, the growing middle class and increased disposable income are boosting private sector construction activities.

Obstacles in the China Construction Machinery Industry Market

Despite significant growth potential, the China construction machinery industry faces challenges. Supply chain disruptions, particularly the impact of global geopolitical events and component shortages, can significantly impact production and delivery timelines. Intense competition from both domestic and international players exerts downward pressure on pricing. Regulatory hurdles and environmental concerns create additional complexities. Furthermore, cyclical nature of construction activity makes it susceptible to economic downturns. These combined factors create uncertainty and potentially dampen growth.

Future Opportunities in China Construction Machinery Industry

Significant opportunities exist for growth in the China construction machinery industry. The expanding renewable energy sector presents a strong demand for specialized equipment, like wind turbine installation machinery and solar panel installation systems. Government initiatives to promote green construction and sustainable infrastructure development are creating new markets for environmentally friendly equipment. Technological advancements, particularly in automation, robotics, and AI, open avenues for increased efficiency and productivity. Expansion into international markets further presents considerable opportunities for industry players.

Major Players in the China Construction Machinery Industry Ecosystem

Key Developments in China Construction Machinery Industry Industry

- August 2022: XCMG announced the building of its second XE7000 hydraulic excavator, enhancing its mining equipment portfolio.

- October 2022: Shantui delivered its first DL300G bulldozer to a customer in Hong Kong for high-profile projects, showcasing market penetration.

- November 2022: XCMG signed USD 60 Million worth of contracts with global suppliers (Kawasaki, Linde, Danfoss, Daimler), strengthening its supply chain resilience.

- November 2022: XCMG partnered with Allison Transmission for its all-terrain cranes, integrating superior transmission technology.

Strategic China Construction Machinery Industry Market Forecast

The China construction machinery market is poised for robust growth over the forecast period (2025-2033). Continued government investment in infrastructure, coupled with technological advancements and a growing focus on sustainability, will drive demand for advanced and environmentally friendly equipment. The expanding renewable energy sector and increasing urbanization present further opportunities. However, mitigating supply chain risks and managing intense competition remain critical for sustained growth. The market is expected to reach USD xx Million by 2033, fueled by these diverse opportunities.

China Construction Machinery Industry Segmentation

-

1. Machinery Type

- 1.1. Crane

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders and Backhoe

- 1.5. Motor Graders

-

2. Drive Type

- 2.1. Conventional

- 2.2. Hybrid and Electric

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

-

4. Application Type

- 4.1. Building

- 4.2. Infrastructure

- 4.3. Energy

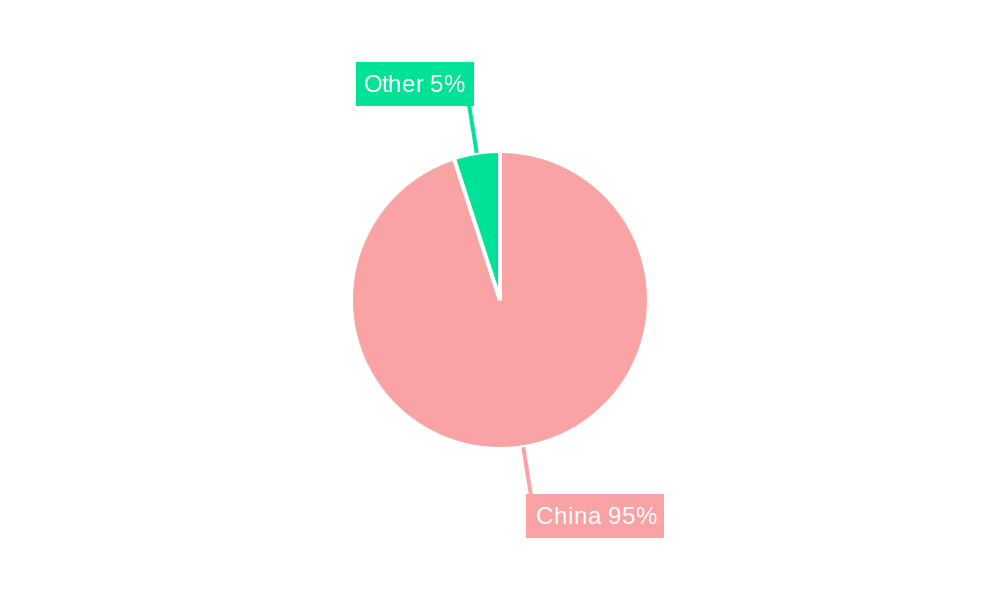

China Construction Machinery Industry Segmentation By Geography

- 1. China

China Construction Machinery Industry Regional Market Share

Geographic Coverage of China Construction Machinery Industry

China Construction Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electrification of Construction Equipment May Propel the Market Growth

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Excavators to Drive the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoe

- 5.1.5. Motor Graders

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Conventional

- 5.2.2. Hybrid and Electric

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Application Type

- 5.4.1. Building

- 5.4.2. Infrastructure

- 5.4.3. Energy

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xuzhou Construction Machinery Group Co Ltd (XCMG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volvo CE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sany Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Communications Construction Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Caterpillar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zoomlion Heavy Industry Science and Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tadano Ltd*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: China Construction Machinery Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Construction Machinery Industry Share (%) by Company 2025

List of Tables

- Table 1: China Construction Machinery Industry Revenue undefined Forecast, by Machinery Type 2020 & 2033

- Table 2: China Construction Machinery Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 3: China Construction Machinery Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 4: China Construction Machinery Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 5: China Construction Machinery Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: China Construction Machinery Industry Revenue undefined Forecast, by Machinery Type 2020 & 2033

- Table 7: China Construction Machinery Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 8: China Construction Machinery Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 9: China Construction Machinery Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 10: China Construction Machinery Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Construction Machinery Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the China Construction Machinery Industry?

Key companies in the market include Kobelco Construction Machinery, Xuzhou Construction Machinery Group Co Ltd (XCMG), Volvo CE, Sany Group, Liebherr Group, China Communications Construction Company, Caterpillar Inc, Zoomlion Heavy Industry Science and Technology Co Ltd, Tadano Ltd*List Not Exhaustive.

3. What are the main segments of the China Construction Machinery Industry?

The market segments include Machinery Type, Drive Type, Sales Channel, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Electrification of Construction Equipment May Propel the Market Growth.

6. What are the notable trends driving market growth?

Growing Demand for Excavators to Drive the Market..

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: XCMG confirmed signed purchasing contracts worth USD 60 million with four major global suppliers, Kawasaki Heavy Industries, Linde Hydraulics AG, Danfoss A/S, and Daimler SE, to build a high-end global supply chain network and maintain resilience in the global construction equipment manufacturing industry. The contracts were signed at the ongoing China International Import Expo (CIIE) in Shanghai.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Construction Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Construction Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Construction Machinery Industry?

To stay informed about further developments, trends, and reports in the China Construction Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence