Key Insights

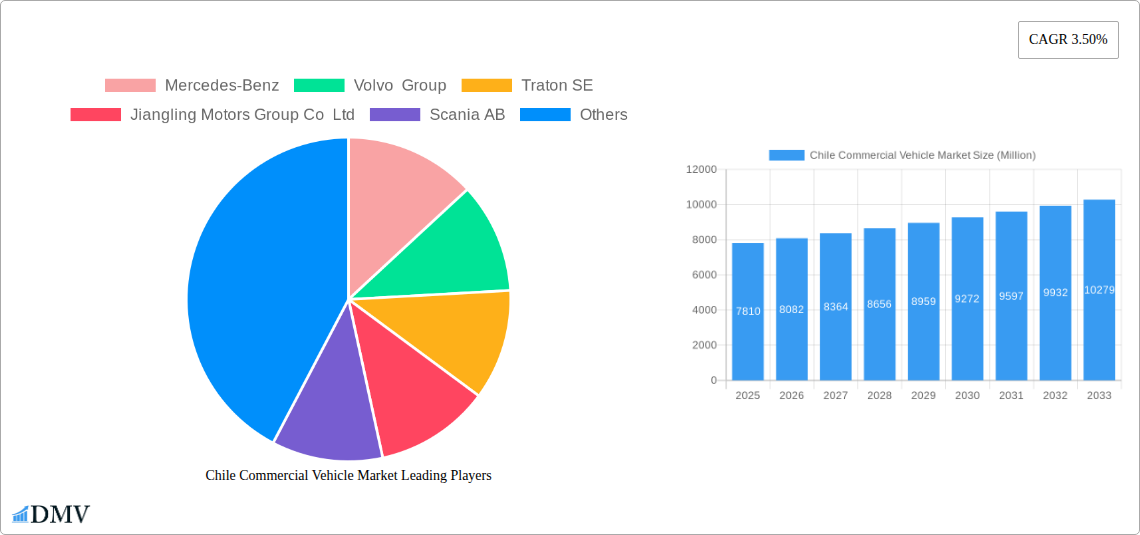

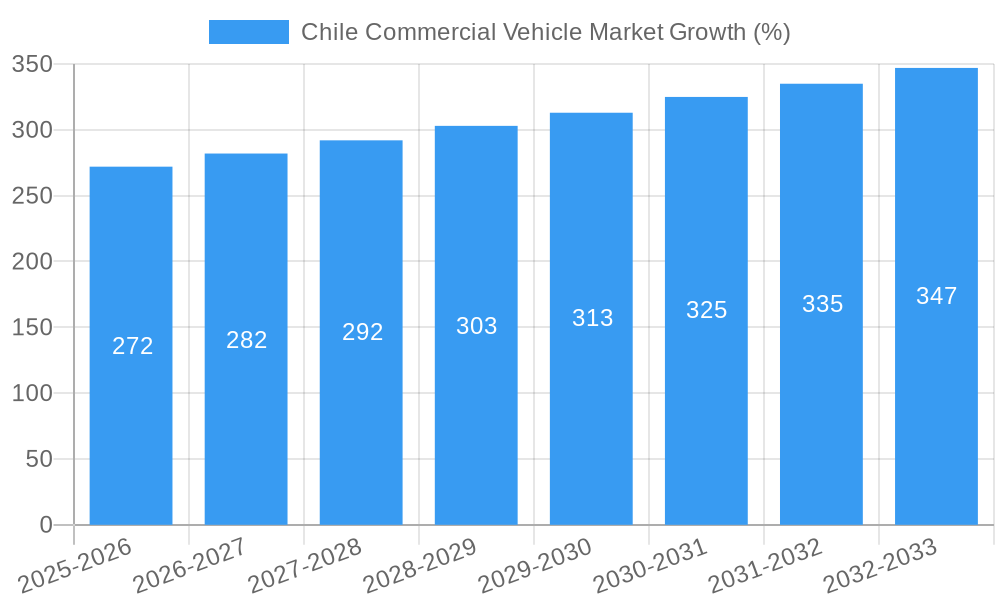

The Chilean commercial vehicle market, valued at $7.81 billion in 2025, is projected to experience steady growth, driven by factors such as increasing infrastructure development, expanding e-commerce logistics, and a growing mining sector demanding robust transportation solutions. The market's Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033 indicates a consistent upward trajectory, although this growth might be influenced by economic fluctuations and government policies impacting the transportation sector. Key players like Mercedes-Benz, Volvo Group, and Scania are vying for market share, leveraging their established reputations and technological advancements in fuel efficiency and safety features. While the market faces potential restraints such as fluctuating commodity prices and dependence on imports for certain vehicle components, the long-term outlook remains positive, fueled by ongoing investments in national infrastructure projects and a robust agricultural sector demanding efficient transportation of goods.

The competitive landscape is highly fragmented, with both international and domestic players competing. Growth will likely be uneven across segments, with heavy-duty trucks potentially outperforming lighter vehicles due to the demands of mining and construction. Regional variations within Chile may also exist, reflecting infrastructure disparities and varying economic activity levels. To capitalize on opportunities, manufacturers must focus on adapting vehicles to the specific needs of the Chilean market, including altitude considerations and rugged terrain, and prioritize sustainable solutions to meet growing environmental concerns. Moreover, effective after-sales services and strong dealership networks are crucial for securing market share in this increasingly competitive landscape.

Chile Commercial Vehicle Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Chilean commercial vehicle market, covering the period from 2019 to 2033. It delves into market dynamics, growth drivers, challenges, and future opportunities, providing stakeholders with crucial data-driven insights for strategic decision-making. The report utilizes data from the base year 2025, with estimations for 2025 and forecasts spanning 2025-2033. The historical period covered is 2019-2024. Key players analyzed include Mercedes-Benz, Volvo Group, Traton SE, Jiangling Motors Group Co Ltd, Scania AB, Foton Motor, Freightliner Trucks, FUSO Trucks, JAC Group, and Hino Motors – but the list is not exhaustive.

Chile Commercial Vehicle Market Composition & Trends

This section provides a detailed overview of the Chilean commercial vehicle market's structure and trends. We analyze market concentration, revealing the market share distribution among key players. We estimate that the top 5 players control approximately XX% of the market in 2025, with Mercedes-Benz holding the largest share at approximately XX%. Innovation catalysts, such as government incentives for electric vehicles and investments in sustainable transportation infrastructure, are explored. The evolving regulatory landscape, including emission standards and safety regulations, and its impact on market participants are also examined. The report also looks at substitute products (e.g., rail transport) and their competitive impact, and analyzes end-user profiles across various sectors like logistics, construction, and public transport. Finally, the report examines M&A activity within the Chilean commercial vehicle sector, including deal values (estimated at XX Million USD in total for the period 2019-2024).

- Market Concentration: Top 5 players control approximately XX% of the market in 2025.

- Innovation Catalysts: Government incentives for EVs and investments in sustainable infrastructure.

- Regulatory Landscape: Stringent emission standards and safety regulations shaping market dynamics.

- Substitute Products: Rail transport, impacting market share of certain commercial vehicle segments.

- End-User Profiles: Logistics, construction, public transport are key end-user segments.

- M&A Activity: Estimated total deal value of XX Million USD (2019-2024).

Chile Commercial Vehicle Market Industry Evolution

This section analyzes the evolution of the Chilean commercial vehicle market, charting its growth trajectory from 2019 to 2033. We examine technological advancements, such as the increasing adoption of electric and hydrogen-powered vehicles, and their impact on market growth. The report also investigates shifting consumer demands, including a preference for fuel-efficient and environmentally friendly vehicles. We project a Compound Annual Growth Rate (CAGR) of XX% for the forecast period (2025-2033), driven primarily by increasing urbanization, expanding infrastructure projects, and a growing e-commerce sector. Adoption rates of electric and alternative fuel vehicles are projected to increase from XX% in 2025 to XX% by 2033. The analysis also considers macroeconomic factors, such as fluctuations in commodity prices and economic growth, which influence demand for commercial vehicles. Furthermore, the effects of governmental policies on vehicle emissions and technological adaptation are integrated into our projection models.

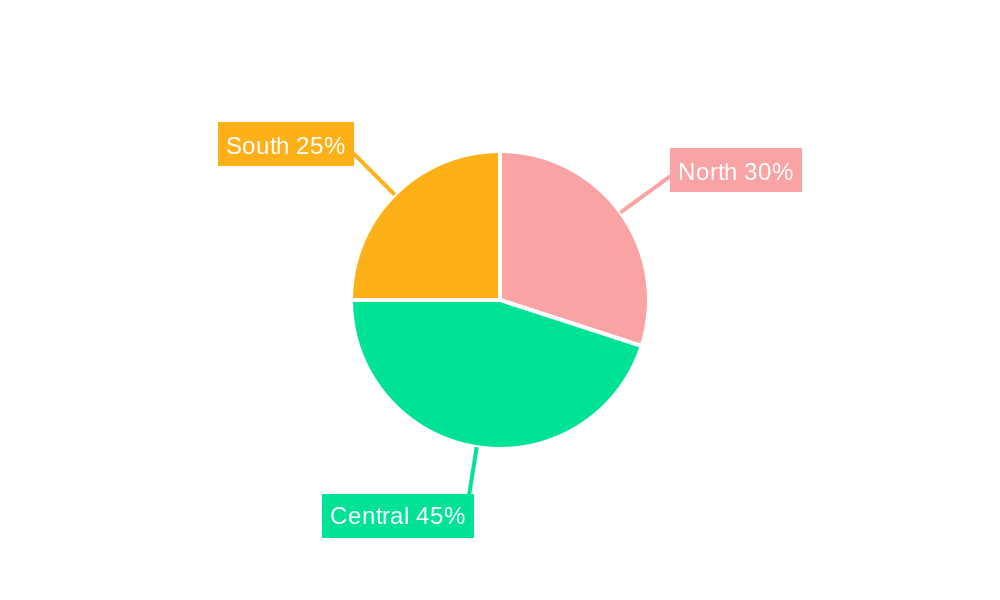

Leading Regions, Countries, or Segments in Chile Commercial Vehicle Market

This section identifies the dominant regions, countries, or segments within the Chilean commercial vehicle market. The report finds that the Metropolitan Region of Santiago holds the largest market share, accounting for approximately XX% of total sales in 2025.

- Key Drivers for Santiago's Dominance:

- High population density and concentrated economic activity.

- Extensive infrastructure development projects.

- Significant logistics and transportation needs.

- Higher concentration of key players and distribution networks.

The dominance of the Metropolitan Region is primarily attributed to its high population density, significant economic activity, and the concentration of key industries driving the demand for commercial vehicles. The region's well-established infrastructure also facilitates the smooth functioning of its supply chains and allows for efficient distribution, thereby reinforcing its position as the market leader. Government investment in infrastructure projects further fuels growth in this area.

Chile Commercial Vehicle Market Product Innovations

Recent innovations in the Chilean commercial vehicle market focus on enhancing fuel efficiency, reducing emissions, and improving safety features. Manufacturers are introducing electric and hydrogen-powered vehicles, incorporating advanced driver-assistance systems (ADAS), and optimizing vehicle designs for better cargo capacity and fuel consumption. These innovations aim to cater to the growing demand for sustainable and technologically advanced commercial vehicles, responding to stringent environmental regulations and consumer preferences. The unique selling propositions include improved fuel efficiency, reduced emissions, and enhanced safety features, which are attracting significant market interest.

Propelling Factors for Chile Commercial Vehicle Market Growth

Several factors are driving the growth of the Chilean commercial vehicle market. These include increasing urbanization, leading to higher demand for transportation and logistics services; government initiatives promoting infrastructure development, boosting the need for construction and transportation vehicles; and the growth of e-commerce, fueling demand for last-mile delivery vehicles. Furthermore, the introduction of more fuel-efficient and environmentally friendly vehicles is also a significant growth driver.

Obstacles in the Chile Commercial Vehicle Market Market

The Chilean commercial vehicle market faces several challenges. High import duties on certain vehicle types and components can increase prices, impacting affordability. Supply chain disruptions, particularly experienced during recent global events, affect vehicle availability and pricing. Furthermore, intense competition among established and emerging players increases pressure on profit margins.

Future Opportunities in Chile Commercial Vehicle Market

Future opportunities exist in the adoption of alternative fuel vehicles (electric, hydrogen), catering to growing environmental concerns and governmental regulations. Expansion into underserved rural markets presents potential for growth. The development of innovative financing solutions to make commercial vehicles more accessible to small and medium-sized enterprises can also unlock new market segments.

Major Players in the Chile Commercial Vehicle Market Ecosystem

- Mercedes-Benz

- Volvo Group

- Traton SE

- Jiangling Motors Group Co Ltd

- Scania AB

- Foton Motor

- Freightliner Trucks

- FUSO Trucks

- JAC Group

- Hino Motors

Key Developments in Chile Commercial Vehicle Market Industry

March 2024: HORSE supplied its first 1.0-litre, low-emission engine to REBORN Electric Motors for use in range extender technology in electric buses. This signals a significant step towards the adoption of more sustainable transportation solutions within Chile.

October 2023: Anglo American, in partnership with Andes Motor, Foton, Copec, and Linde, launched its first hydrogen-powered bus. This demonstrates a commitment to hydrogen fuel cell technology and its potential to decarbonize the transportation sector within the country. The bus's 400km range and 47-passenger capacity highlights its viability for practical application.

Strategic Chile Commercial Vehicle Market Forecast

The Chilean commercial vehicle market is poised for significant growth in the coming years. Driven by ongoing infrastructure development, the expansion of e-commerce, and increasing adoption of environmentally friendly vehicles, we anticipate a sustained growth trajectory. The market's potential is further enhanced by government support for sustainable transportation initiatives. This positive outlook presents attractive opportunities for both established and new market entrants.

Chile Commercial Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Light Commercial Vehicles

- 1.2. Medium & Heavy-duty Trucks

- 1.3. Buses & Coaches

-

2. Propulsion Type

-

2.1. Internal Combustion Engine (ICE)

- 2.1.1. Petrol

- 2.1.2. Diesel

- 2.2. Electric & Hybrid

-

2.1. Internal Combustion Engine (ICE)

Chile Commercial Vehicle Market Segmentation By Geography

- 1. Chile

Chile Commercial Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing E-Commerce Is Creating A Conducive Environment

- 3.3. Market Restrains

- 3.3.1. Growing E-Commerce Is Creating A Conducive Environment

- 3.4. Market Trends

- 3.4.1. Light Commercial Vehicles Are Leading the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Commercial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light Commercial Vehicles

- 5.1.2. Medium & Heavy-duty Trucks

- 5.1.3. Buses & Coaches

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Internal Combustion Engine (ICE)

- 5.2.1.1. Petrol

- 5.2.1.2. Diesel

- 5.2.2. Electric & Hybrid

- 5.2.1. Internal Combustion Engine (ICE)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mercedes-Benz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Volvo Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Traton SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jiangling Motors Group Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Scania AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Foton Motor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Freightliner Trucks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FUSO Trucks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JAC Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hino Motors*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mercedes-Benz

List of Figures

- Figure 1: Chile Commercial Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Chile Commercial Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Chile Commercial Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Chile Commercial Vehicle Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Chile Commercial Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Chile Commercial Vehicle Market Volume Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Chile Commercial Vehicle Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 6: Chile Commercial Vehicle Market Volume Million Forecast, by Propulsion Type 2019 & 2032

- Table 7: Chile Commercial Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Chile Commercial Vehicle Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Chile Commercial Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 10: Chile Commercial Vehicle Market Volume Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Chile Commercial Vehicle Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 12: Chile Commercial Vehicle Market Volume Million Forecast, by Propulsion Type 2019 & 2032

- Table 13: Chile Commercial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Chile Commercial Vehicle Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Commercial Vehicle Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Chile Commercial Vehicle Market?

Key companies in the market include Mercedes-Benz, Volvo Group, Traton SE, Jiangling Motors Group Co Ltd, Scania AB, Foton Motor, Freightliner Trucks, FUSO Trucks, JAC Group, Hino Motors*List Not Exhaustive.

3. What are the main segments of the Chile Commercial Vehicle Market?

The market segments include Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing E-Commerce Is Creating A Conducive Environment.

6. What are the notable trends driving market growth?

Light Commercial Vehicles Are Leading the Market.

7. Are there any restraints impacting market growth?

Growing E-Commerce Is Creating A Conducive Environment.

8. Can you provide examples of recent developments in the market?

In March 2024, HORSE supplied its first 1.0-litre, low-emission engine to REBORN Electric Motors, one of the leading electric bus factory operators in the country. The engine will power Range Extender technology within the vehicle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Commercial Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Commercial Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Commercial Vehicle Market?

To stay informed about further developments, trends, and reports in the Chile Commercial Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence