Key Insights

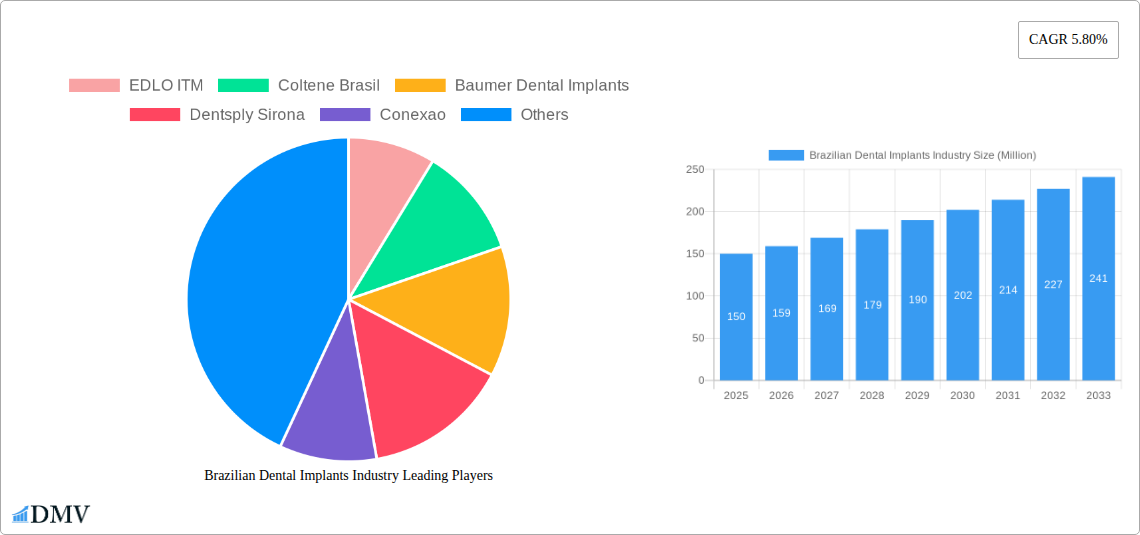

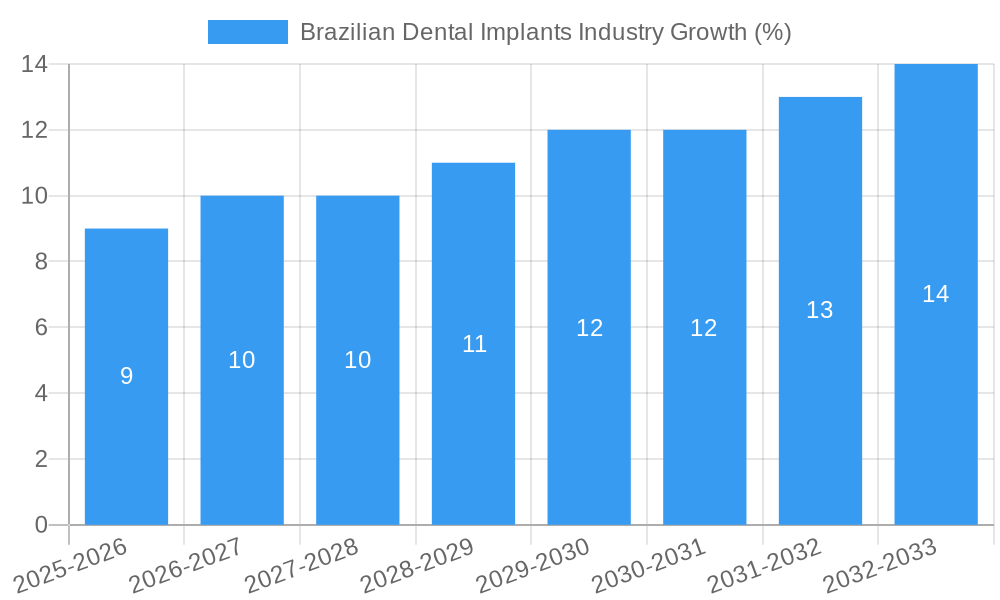

The Brazilian dental implants market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing prevalence of periodontal diseases and tooth loss, coupled with a rising middle class possessing greater disposable income for aesthetic and restorative dental procedures, fuels demand. Secondly, advancements in implant technology, including minimally invasive techniques and improved biocompatible materials, enhance treatment efficacy and patient comfort, further stimulating market growth. Finally, a growing number of dental clinics and hospitals equipped with state-of-the-art facilities are expanding access to dental implant services across Brazil. The market is segmented by treatment type (Orthodontic, Endodontic, Periodontic, Prosthodontic), end-user (Hospitals, Clinics, Other End-Users), and product type (General and Diagnostic Equipment, Other Dental Consumables, Other General and Diagnostic equipment). The competitive landscape is characterized by a mix of global giants like Dentsply Sirona and Straumann, alongside local players such as Angelus Dental and Derig Implantes do Brasil, indicating a dynamic and evolving market structure.

Significant growth opportunities lie in expanding access to affordable dental implants in underserved regions of Brazil. Furthermore, the increasing adoption of digital dentistry technologies, including CAD/CAM systems and 3D printing, presents avenues for innovation and efficiency improvements. However, challenges persist, including high treatment costs that can limit accessibility for a significant portion of the population. Government regulations and reimbursement policies also play a crucial role in shaping market dynamics. The projected growth trajectory indicates a promising future for the Brazilian dental implants market, but success hinges on addressing affordability concerns and embracing technological advancements to cater to the diverse needs of the Brazilian population.

Brazilian Dental Implants Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Brazilian dental implants market, offering a comprehensive overview of its current state and future trajectory. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market size, growth drivers, key players, and emerging trends, providing invaluable insights for stakeholders across the value chain. With a projected market value exceeding xx Million by 2033, this report is an essential resource for informed decision-making.

Brazilian Dental Implants Industry Market Composition & Trends

This section delves into the competitive landscape, innovative advancements, regulatory environment, and market dynamics within the Brazilian dental implants industry. The market is characterized by a moderately concentrated structure, with key players such as Dentsply Sirona, Straumann Group (through Neodent), and other international and domestic players vying for market share. The estimated market size in 2025 is xx Million.

Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating a moderately consolidated market. This concentration is further analyzed, considering the presence of both multinational corporations and domestic players.

Innovation Catalysts: The Brazilian market is witnessing significant innovation driven by advancements in materials science (e.g., zirconia implants) and digital dentistry (CAD/CAM technologies). This fuels the adoption of minimally invasive techniques and improved patient outcomes.

Regulatory Landscape: The regulatory framework governing dental implants in Brazil is examined, including approval processes and compliance standards. Any significant changes or upcoming regulations impacting market dynamics are also discussed.

Substitute Products: The report analyzes the presence and impact of alternative treatment options like dentures or bridges on the overall market demand for dental implants.

End-User Profiles: The report segments the end-user base into hospitals, clinics, and other end-users, analyzing their respective contributions to market demand.

M&A Activities: The report explores recent mergers and acquisitions within the Brazilian dental implants sector, including deal values (e.g., xx Million for a significant transaction) and their impact on market consolidation and competition.

Brazilian Dental Implants Industry Evolution

This section provides a historical and projected analysis of the Brazilian dental implants market's growth trajectory. It examines technological advancements, shifting consumer demands (e.g., increasing preference for aesthetically pleasing and durable solutions), and market penetration rates across different segments. The historical period (2019-2024) reveals a compound annual growth rate (CAGR) of xx%, while the forecast period (2025-2033) projects a CAGR of xx%, leading to a market value of xx Million by 2033. This growth is attributed to factors such as rising disposable incomes, increasing awareness of dental health, and technological advancements in implant technology. The report will also discuss the impact of the COVID-19 pandemic on the market's trajectory and its subsequent recovery.

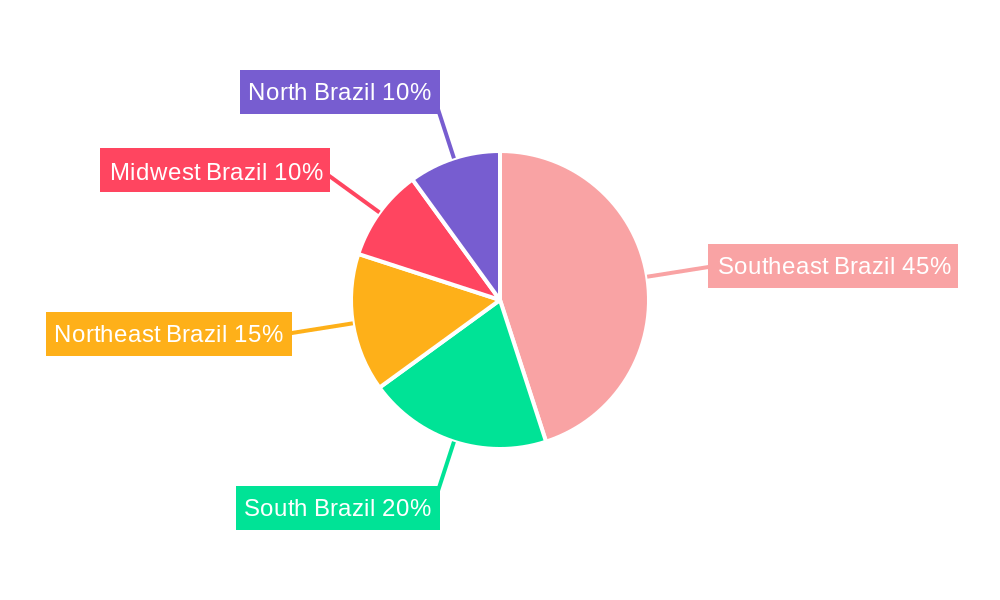

Leading Regions, Countries, or Segments in Brazilian Dental Implants Industry

This section identifies the dominant regions, countries, and segments within the Brazilian dental implants market. Considering the national scope of the market, the analysis focuses on segment performance and key factors driving their prominence.

Dominant Segments:

- Treatment: Prosthodontic procedures, driven by increasing demand for aesthetic and functional restorations, are projected to be the leading treatment segment.

- End-User: Private clinics are expected to constitute the largest segment in the end-user market due to higher patient preference for advanced treatment and technology available there.

- Product: General dental equipment, encompassing implant systems, instruments, and related consumables, makes up the largest product category.

Key Drivers for Segment Dominance:

- Investment Trends: Significant investments in dental infrastructure, particularly in private clinics, drive demand for high-quality dental implants and equipment.

- Regulatory Support: Supportive government policies aimed at promoting better oral healthcare access contribute to market growth in specific segments.

Brazilian Dental Implants Industry Product Innovations

Recent innovations in the Brazilian dental implants market focus on enhancing implant design, biocompatibility, and surgical techniques. The introduction of zirconia implants, known for their strength and aesthetics, exemplifies the trend towards improved materials and designs. Digital dentistry solutions like CAD/CAM systems are also gaining traction, enabling greater precision and efficiency in implant placement.

Propelling Factors for Brazilian Dental Implants Industry Growth

Several factors drive the growth of the Brazilian dental implants market. These include:

- Rising disposable incomes: An expanding middle class with increased disposable income fuels demand for aesthetic and functional dental improvements.

- Enhanced awareness of oral health: Public health campaigns promoting oral hygiene and dental health contribute to greater acceptance of dental implants.

- Technological advancements: Innovations in materials science, implant design, and surgical techniques continuously improve implant success rates and patient outcomes.

- Government initiatives: Government support for oral health initiatives further drives market expansion.

Obstacles in the Brazilian Dental Implants Industry Market

The Brazilian dental implants market faces certain challenges, including:

- High treatment costs: The relatively high cost of dental implants can limit access for a segment of the population.

- Supply chain disruptions: Global supply chain disruptions can affect the availability of implants and related equipment.

- Competitive pressures: Intense competition from both domestic and international players can affect pricing and profitability.

Future Opportunities in Brazilian Dental Implants Industry

Future opportunities in the Brazilian dental implants market include:

- Expanding into underserved regions: Reaching patients in remote or underserved areas through mobile dental clinics or tele-dentistry.

- Adoption of advanced technologies: Integrating artificial intelligence (AI) and machine learning (ML) for improved diagnostics and treatment planning.

- Growth in the digital dentistry sector: Increased adoption of CAD/CAM technologies and digital workflows.

Major Players in the Brazilian Dental Implants Industry Ecosystem

- EDLO ITM

- Coltene Brasil

- Baumer Dental Implants

- Dentsply Sirona

- Conexao

- Bicon LLC

- SDI Limited

- Derig Implantes do Brasil

- Angelus Dental

- Institut Straumann AG

- SIN Implant System

- ZimVie Inc

Key Developments in Brazilian Dental Implants Industry Industry

- September 2022: DENTSPLY SIRONA Inc. announced new products and solutions for its digital dentistry ecosystem at Dentsply Sirona World 2022. This signifies a strong push towards digitalization within the Brazilian market.

- March 2022: Neodent, part of the Straumann Group, launched its new Zi zirconia implant system, highlighting the growing demand for high-strength, aesthetic implants. The virtual launch event reached 1,600 viewers across 92 countries, indicating global interest in this innovation.

Strategic Brazilian Dental Implants Industry Market Forecast

The Brazilian dental implants market is poised for continued growth, driven by technological advancements, rising disposable incomes, and increasing awareness of oral health. The forecast period (2025-2033) anticipates significant expansion, with a projected market value exceeding xx Million by 2033. Opportunities lie in expanding access to care, adopting innovative technologies, and capitalizing on the growing demand for aesthetic and functional dental solutions. The market’s steady expansion will be further supported by increased public and private investments in oral healthcare infrastructure.

Brazilian Dental Implants Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

- 1.1.1. Dental Laser

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic equipment

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Periodontic

- 2.4. Prosthodontic

-

3. End-User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End-Users

Brazilian Dental Implants Industry Segmentation By Geography

- 1. Brazil

Brazilian Dental Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Government Initiatives; High Number of Dentists and Growing Cosmetic Dentistry; Technological Advancements in Dentistry

- 3.3. Market Restrains

- 3.3.1. High Cost of Device

- 3.4. Market Trends

- 3.4.1. Periodontics Segment is Expected to Witness Considerable Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Laser

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic equipment

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Periodontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EDLO ITM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coltene Brasil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Baumer Dental Implants

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dentsply Sirona

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Conexao

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bicon LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SDI Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Derig Implantes do Brasil

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Angelus Dental

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Institut Straumann AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SIN Implant System

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ZimVie Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 EDLO ITM

List of Figures

- Figure 1: Brazilian Dental Implants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian Dental Implants Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazilian Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Brazilian Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 4: Brazilian Dental Implants Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Brazilian Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazilian Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazilian Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 8: Brazilian Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 9: Brazilian Dental Implants Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Brazilian Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Dental Implants Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Brazilian Dental Implants Industry?

Key companies in the market include EDLO ITM, Coltene Brasil, Baumer Dental Implants, Dentsply Sirona, Conexao, Bicon LLC, SDI Limited, Derig Implantes do Brasil, Angelus Dental, Institut Straumann AG, SIN Implant System, ZimVie Inc.

3. What are the main segments of the Brazilian Dental Implants Industry?

The market segments include Product, Treatment, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Initiatives; High Number of Dentists and Growing Cosmetic Dentistry; Technological Advancements in Dentistry.

6. What are the notable trends driving market growth?

Periodontics Segment is Expected to Witness Considerable Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Device.

8. Can you provide examples of recent developments in the market?

September 2022- DENTSPLY SIRONA Inc. announced that at Dentsply Sirona World 2022, it would be launching new products and solutions as part of its digital universe, which are designed to bring innovation in dentistry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Dental Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Dental Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Dental Implants Industry?

To stay informed about further developments, trends, and reports in the Brazilian Dental Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence