Key Insights

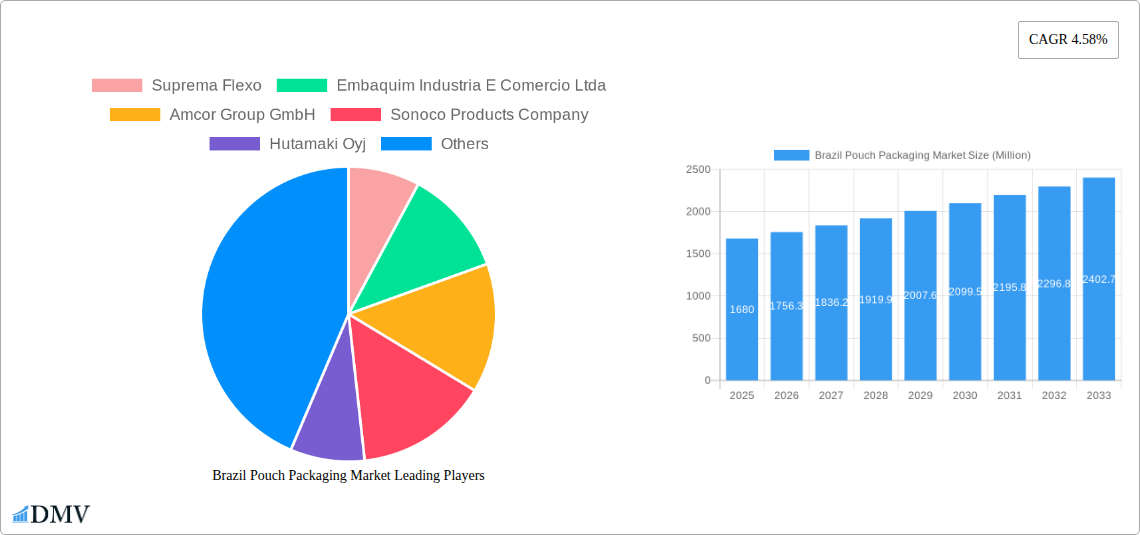

The Brazil pouch packaging market, valued at $1.68 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising demand for convenient and flexible packaging solutions across various sectors, including food and beverages, personal care, and pharmaceuticals, is a significant catalyst. Increased consumer preference for single-serve and on-the-go products fuels this demand, further amplified by the expanding e-commerce sector in Brazil, necessitating efficient and tamper-evident packaging. Technological advancements in pouch packaging materials, such as the adoption of sustainable and recyclable options like flexible films and laminates, are also contributing to market expansion. Furthermore, the growing focus on extending product shelf life and maintaining product quality through innovative packaging solutions is driving investment in the sector.

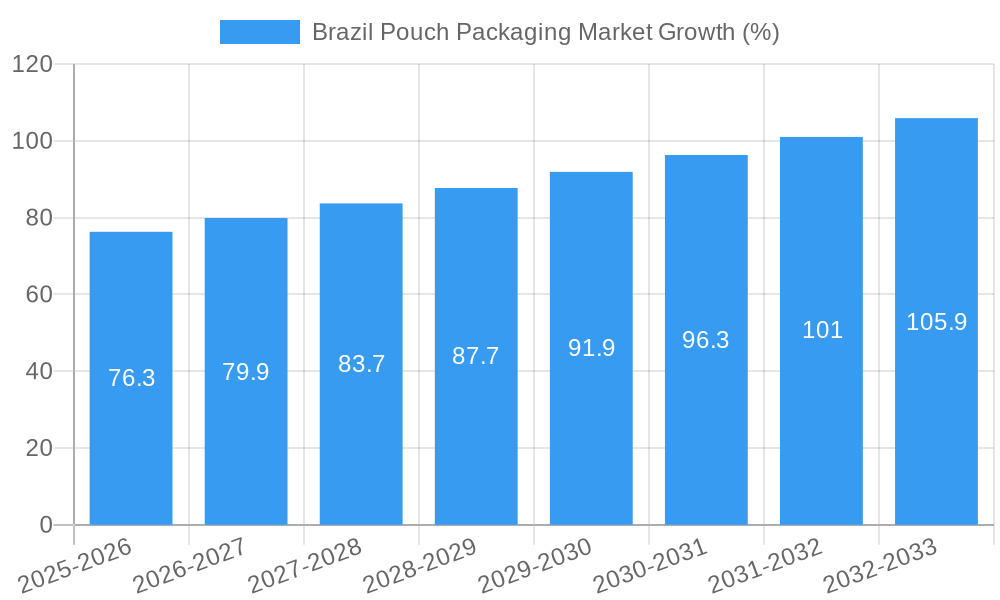

However, certain challenges restrain market growth. Fluctuations in raw material prices, particularly for polymers, can impact production costs and profitability. Stringent environmental regulations regarding plastic waste management are prompting manufacturers to explore eco-friendly alternatives, representing both an opportunity and a challenge. Competition from alternative packaging formats, such as rigid containers and bottles, also puts pressure on the market. Nevertheless, the overall outlook remains positive, with the market projected to maintain a compound annual growth rate (CAGR) of 4.58% from 2025 to 2033, fueled by the ongoing demand for convenient, cost-effective, and sustainable packaging solutions across diverse sectors within the Brazilian economy. This growth will be particularly apparent in regions with high population density and growing disposable incomes.

Brazil Pouch Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Brazil pouch packaging market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this lucrative market. The market size is projected to reach xx Million by 2033, showcasing significant growth potential.

Brazil Pouch Packaging Market Composition & Trends

This section delves into the intricate structure of the Brazilian pouch packaging market, examining market concentration, innovative drivers, regulatory landscapes, substitute products, end-user profiles, and M&A activities. We analyze the market share distribution among key players, revealing a moderately concentrated market with the top 5 companies holding approximately xx% of the market share in 2024. The report further explores the impact of recent M&A activities, estimating a total deal value of approximately xx Million during the historical period (2019-2024). Key factors influencing the market include:

- Market Concentration: A detailed breakdown of market share held by major players, including Suprema Flexo, Embaquim Industria E Comercio Ltda, Amcor Group GmbH, Sonoco Products Company, Hutamaki Oyj, Sealed Air Corporation, Gualapack SpA, Parnaplast Industria De Plasticos Ltda, and Plaszom Industria De Plasticos Ltda.

- Innovation Catalysts: Analysis of technological advancements driving innovation, such as sustainable materials and improved barrier properties.

- Regulatory Landscape: An overview of relevant regulations impacting packaging materials and safety standards.

- Substitute Products: Examination of alternative packaging solutions and their competitive impact.

- End-User Profiles: Detailed segmentation of end-users across various industries, including food & beverage, pharmaceuticals, and cosmetics.

- M&A Activities: A review of significant mergers and acquisitions, along with their impact on market dynamics.

Brazil Pouch Packaging Market Industry Evolution

This section provides a comprehensive analysis of the Brazil pouch packaging market's evolution, focusing on growth trajectories, technological advancements, and shifting consumer demands. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by factors such as increasing consumer preference for convenient packaging and the growing demand for flexible packaging solutions. Technological advancements, such as the adoption of advanced materials and printing techniques, have further propelled market growth. Consumer demand for sustainable and eco-friendly packaging is also significantly influencing market trends, with a notable increase in the adoption of recyclable and compostable pouch packaging. Detailed data points on growth rates and adoption metrics for various technologies are included.

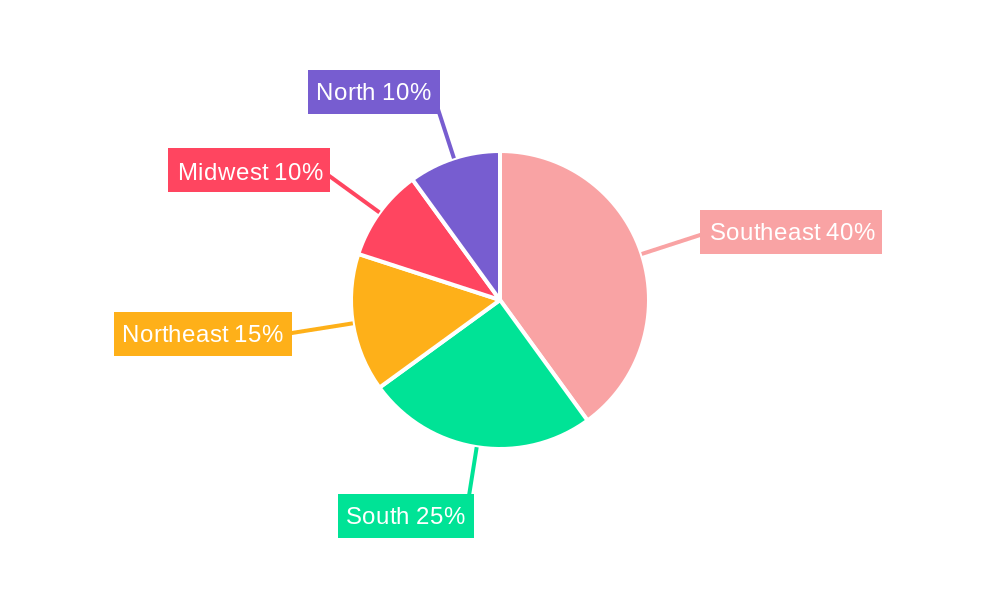

Leading Regions, Countries, or Segments in Brazil Pouch Packaging Market

This section identifies the dominant regions, countries, or segments within the Brazilian pouch packaging market. The Southeast region consistently holds the largest market share due to its high population density, advanced infrastructure, and established manufacturing base.

- Key Drivers for Southeast Region Dominance:

- Significant investments in manufacturing facilities.

- Strong governmental support for the packaging industry.

- High consumer demand and purchasing power.

- In-depth Analysis: This section delves deeper into the factors contributing to the Southeast region’s dominance, analyzing economic conditions, infrastructure development, consumer behavior, and regulatory environments. Other regions, such as South and Northeast, are also analyzed, highlighting their growth potential and specific market characteristics.

Brazil Pouch Packaging Market Product Innovations

Recent product innovations focus on enhanced barrier properties, improved material sustainability (e.g., increased use of recycled content and biodegradable materials), and advanced printing techniques for enhanced branding and product appeal. These innovations cater to the growing demand for eco-friendly and aesthetically pleasing packaging solutions, meeting evolving consumer preferences and stringent regulatory requirements. New pouch designs offer improved functionality and convenience, such as resealable closures and stand-up pouches.

Propelling Factors for Brazil Pouch Packaging Market Growth

Several factors contribute to the robust growth of the Brazilian pouch packaging market. Technological advancements in materials science and manufacturing processes are driving efficiency and innovation. The burgeoning food and beverage industry, with its growing demand for convenient and shelf-stable packaging, is a major growth catalyst. Furthermore, favorable government regulations promoting sustainable packaging practices are stimulating market expansion.

Obstacles in the Brazil Pouch Packaging Market

The Brazilian pouch packaging market faces challenges such as fluctuating raw material prices, impacting production costs and profitability. Supply chain disruptions and logistical hurdles pose significant operational challenges, leading to potential delays and increased costs. Intense competition among established and emerging players creates pricing pressure and necessitates continuous innovation to maintain a competitive edge.

Future Opportunities in Brazil Pouch Packaging Market

Significant opportunities exist for growth in the Brazilian pouch packaging market. The increasing demand for sustainable packaging solutions presents a lucrative avenue for companies offering eco-friendly materials and designs. Expansion into niche segments, such as medical devices and personal care products, presents further growth prospects. Furthermore, leveraging advanced technologies like smart packaging solutions and improved traceability systems can enhance market competitiveness.

Major Players in the Brazil Pouch Packaging Market Ecosystem

- Suprema Flexo

- Embaquim Industria E Comercio Ltda

- Amcor Group GmbH

- Sonoco Products Company

- Hutamaki Oyj

- Sealed Air Corporation

- Gualapack SpA

- Parnaplast Industria De Plasticos Ltda

- Plaszom Industria De Plasticos Ltda

- List Not Exhaustive

Key Developments in Brazil Pouch Packaging Market Industry

- May 2024: Gualapack SpA showcased advanced flexible packaging solutions at Vitafoods 2024, highlighting innovation in the market.

- April 2023: Amcor Group's Brazilian facility achieved ISCC Plus certification, signifying a commitment to sustainability within the industry.

Strategic Brazil Pouch Packaging Market Forecast

The Brazilian pouch packaging market is poised for continued growth, driven by technological advancements, increasing consumer demand for convenience, and a rising focus on sustainability. The forecast period (2025-2033) anticipates a strong CAGR, driven by expanding end-use sectors and the adoption of innovative packaging solutions. This presents significant opportunities for companies to establish a strong presence in this dynamic market.

Brazil Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Brazil Pouch Packaging Market Segmentation By Geography

- 1. Brazil

Brazil Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food Processing Industry in Brazil; New Product Development and Innovation Drives the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Growing Food Processing Industry in Brazil; New Product Development and Innovation Drives the Market's Growth

- 3.4. Market Trends

- 3.4.1. The Food Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Pouch Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Suprema Flexo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Embaquim Industria E Comercio Ltda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor Group GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sonoco Products Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hutamaki Oyj

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sealed Air Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gualapack SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Parnaplast Industria De Plasticos Ltda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plaszom Industria De Plasticos Ltda*List Not Exhaustive 8 2 Heat Map Analysi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Suprema Flexo

List of Figures

- Figure 1: Brazil Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Pouch Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Brazil Pouch Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Brazil Pouch Packaging Market Volume Billion Forecast, by Material 2019 & 2032

- Table 5: Brazil Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Brazil Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 7: Brazil Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Brazil Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 9: Brazil Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Brazil Pouch Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: Brazil Pouch Packaging Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: Brazil Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Brazil Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 15: Brazil Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: Brazil Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 17: Brazil Pouch Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Pouch Packaging Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Pouch Packaging Market?

The projected CAGR is approximately 4.58%.

2. Which companies are prominent players in the Brazil Pouch Packaging Market?

Key companies in the market include Suprema Flexo, Embaquim Industria E Comercio Ltda, Amcor Group GmbH, Sonoco Products Company, Hutamaki Oyj, Sealed Air Corporation, Gualapack SpA, Parnaplast Industria De Plasticos Ltda, Plaszom Industria De Plasticos Ltda*List Not Exhaustive 8 2 Heat Map Analysi.

3. What are the main segments of the Brazil Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Food Processing Industry in Brazil; New Product Development and Innovation Drives the Market's Growth.

6. What are the notable trends driving market growth?

The Food Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Food Processing Industry in Brazil; New Product Development and Innovation Drives the Market's Growth.

8. Can you provide examples of recent developments in the market?

May 2024: Gualapack SpA, an Italian packaging company with operations in Brazil, showcased its advanced, flexible packaging solutions at the Vitafoods 2024 Expo in Geneva, Switzerland.April 2023: Amcor Group, an Australian packaging company, proudly announced that its Brazilian manufacturing facility became the inaugural Amcor plant in Latin America to secure the prestigious International Sustainability and Carbon Certification Plus (ISCC Plus) accolade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Brazil Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence