Key Insights

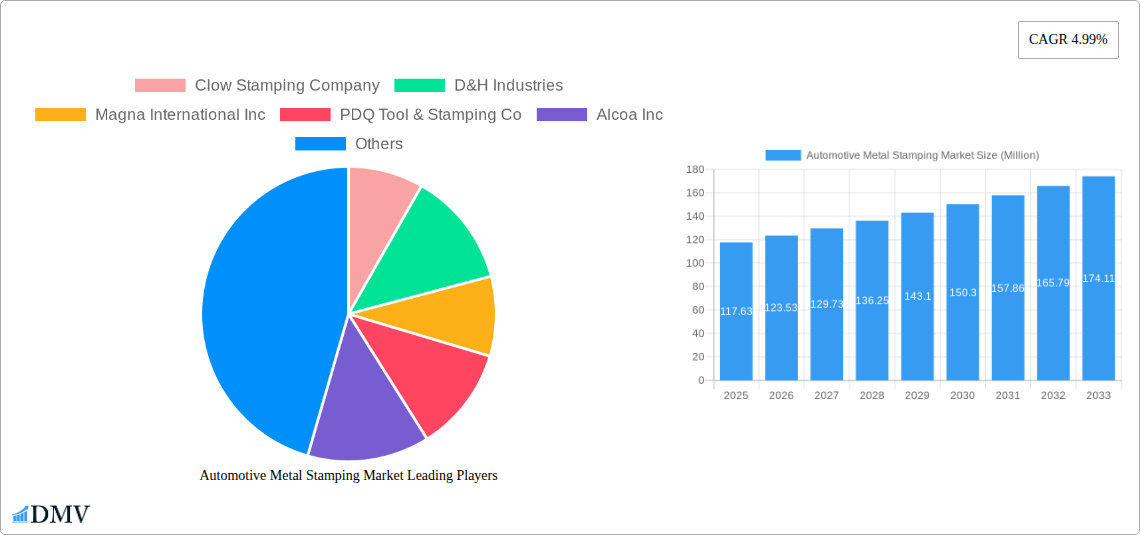

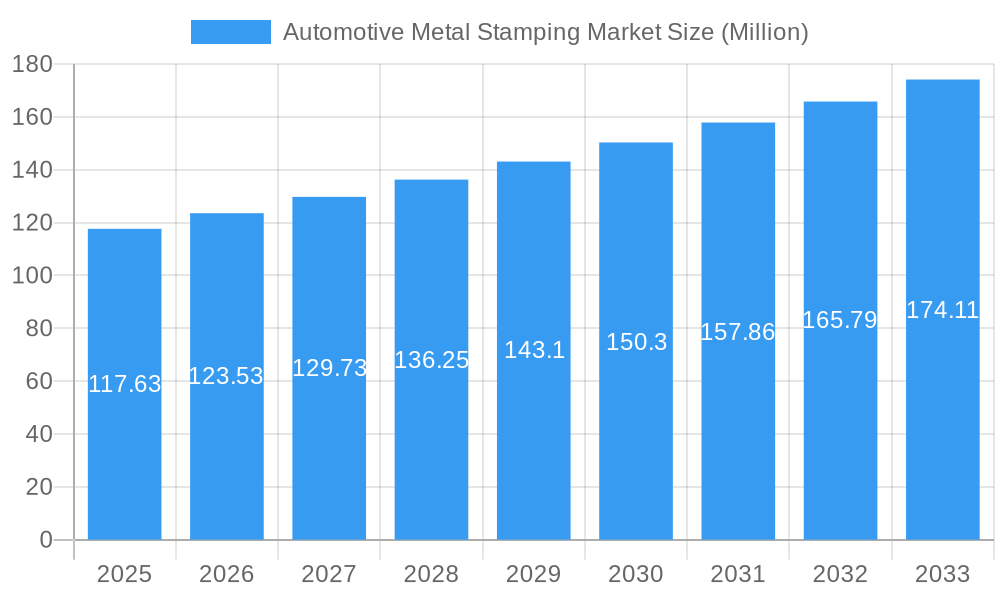

The automotive metal stamping market, valued at $117.63 million in 2025, is projected to experience robust growth, driven by the increasing demand for lightweight vehicles and the rising adoption of electric vehicles (EVs). The market's Compound Annual Growth Rate (CAGR) of 4.99% from 2025 to 2033 reflects a consistent upward trajectory. Key drivers include the ongoing need for cost-effective manufacturing processes in the automotive sector, advancements in stamping technology leading to improved precision and efficiency, and the growing preference for high-strength steel and aluminum alloys to enhance vehicle safety and fuel economy. Furthermore, the automotive industry's focus on reducing carbon emissions fuels the demand for lighter vehicle components, a key advantage offered by metal stamping. While potential supply chain disruptions and fluctuations in raw material prices present challenges, technological innovations and strategic partnerships within the industry are mitigating these risks. The market is segmented by various factors such as vehicle type (passenger cars, commercial vehicles), stamping process (progressive, transfer, fine blanking), and material type (steel, aluminum, etc.). Leading players, including Clow Stamping Company, D&H Industries, and Magna International, are actively investing in research and development to maintain their competitive edge and cater to evolving market demands.

Automotive Metal Stamping Market Market Size (In Million)

This growth is further amplified by the expanding global automotive market, particularly in developing economies experiencing rapid industrialization and urbanization. The market's continued expansion is expected to be influenced by factors such as government regulations promoting fuel efficiency and emission reduction, and the increasing adoption of advanced driver-assistance systems (ADAS), which often incorporate metal-stamped components. Competitive landscape analysis reveals that established players are focusing on strategic acquisitions and collaborations to broaden their product portfolio and expand their global reach. The forecast period of 2025-2033 promises significant growth opportunities for both established and emerging players in the automotive metal stamping market, as technological advancements and evolving consumer preferences continue to shape the industry landscape.

Automotive Metal Stamping Market Company Market Share

Automotive Metal Stamping Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the global Automotive Metal Stamping Market, offering a comprehensive overview of market trends, key players, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The market is projected to reach xx Million by 2033.

Automotive Metal Stamping Market Composition & Trends

This section delves into the intricate landscape of the automotive metal stamping market, examining its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze market share distribution among key players, revealing the competitive dynamics at play. The report also quantifies the value of significant M&A deals, shedding light on strategic investment trends and their impact on market consolidation. The analysis considers factors such as the increasing demand for lightweight vehicles, advancements in metal forming technologies, and the growing adoption of electric vehicles. The regulatory landscape's influence on material sourcing, manufacturing processes, and emissions is also meticulously evaluated. Finally, the report assesses the impact of substitute materials and processes on market dynamics and forecasts.

- Market Concentration: Analysis of market share held by top players (e.g., Magna International Inc. holds approximately xx% market share).

- Innovation Catalysts: Discussion on advancements in hot stamping, high-strength steel usage, and automation technologies driving market growth.

- Regulatory Landscape: Evaluation of emission standards, material regulations, and their impact on market participants.

- Substitute Products: Assessment of alternative materials and manufacturing processes such as plastic components and casting.

- End-User Profiles: Detailed analysis of automotive OEMs and Tier-1 suppliers as major consumers of metal stampings.

- M&A Activities: Review of significant mergers, acquisitions, and joint ventures, with an analysis of deal values and their strategic implications. (e.g., Total M&A deal value in the last five years estimated at xx Million).

Automotive Metal Stamping Market Industry Evolution

This section provides a detailed analysis of the automotive metal stamping market's evolutionary trajectory, encompassing growth patterns, technological advancements, and evolving consumer preferences. We meticulously examine historical data (2019-2024) and project future trends (2025-2033), offering a comprehensive understanding of market growth rates and technological adoption. The report identifies key technological advancements such as the emergence of advanced high-strength steels (AHSS), multi-material stamping, and the pervasive integration of Industry 4.0 technologies including AI-driven process optimization, predictive maintenance, and smart factory automation. These innovations are significantly reshaping production efficiency, product quality, and overall market dynamics. The profound influence of shifting consumer preferences toward fuel-efficient, lightweight, and sustainable vehicles, including the rapid rise of electric vehicles (EVs), is thoroughly explored. Data points include compound annual growth rates (CAGR) across different segments, penetration rates of new technologies like progressive dies and transfer dies, and dynamic shifts in consumer demand for specific metal stamping applications in both internal combustion engine (ICE) vehicles and EVs. The impact of global economic shifts, geopolitical influences, and the evolving supply chain landscapes, including localization efforts and the increasing demand for resilient and agile supply networks, on industry dynamics is also assessed. Emerging trends like the use of digitalization for design and simulation are also highlighted.

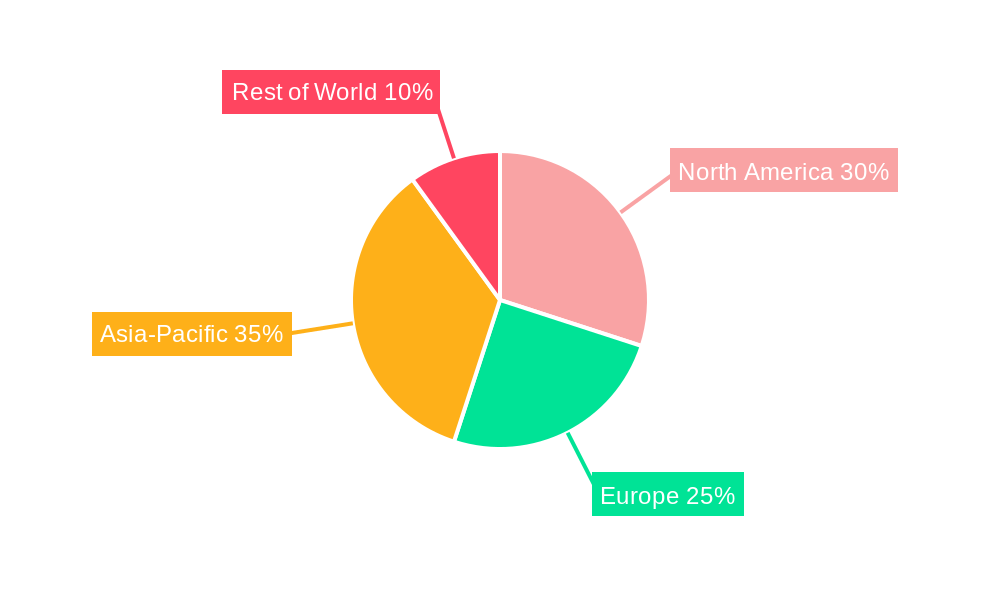

Leading Regions, Countries, or Segments in Automotive Metal Stamping Market

This section pinpoints the dominant regions, countries, or segments within the automotive metal stamping market, offering a detailed explanation of their leadership positions. Through in-depth analysis, the report identifies the key drivers behind this dominance, supported by compelling data and insights, and further elaborates on the specific contributions of various segments and geographical areas to the overall market landscape.

-

Key Drivers:

- Investment Trends: Significant levels of Foreign Direct Investment (FDI) in specific regions are driving substantial capacity expansion and technological upgrades. This includes investments in new stamping facilities and the modernization of existing ones.

- Regulatory Support & Government Initiatives: Favorable government incentives, tax breaks, and supportive policies aimed at boosting domestic manufacturing, promoting automotive production hubs, and encouraging the adoption of sustainable manufacturing practices are crucial.

- Technological Advancements & Adoption Rates: Early and widespread adoption of advanced manufacturing technologies, including high-precision stamping presses, automation, robotics, and advanced material handling systems, in certain regions provides a significant competitive edge.

- Automotive Manufacturing Hubs & OEM Presence: The concentration of major Original Equipment Manufacturers (OEMs) and their Tier-1 suppliers in specific geographical locations directly influences the demand for automotive metal stampings and fosters a robust ecosystem for the industry.

- Skilled Workforce Availability: Access to a skilled and experienced workforce proficient in operating advanced machinery, performing complex stamping operations, and driving innovation is a critical factor for regional leadership.

- Proximity to Raw Material Sources and Downstream Industries: Strategic location relative to steel mills and other raw material suppliers, as well as proximity to automotive assembly plants, contributes to logistical efficiencies and cost savings.

-

Dominance Factors: The report thoroughly explores the multifaceted factors such as cost competitiveness achieved through economies of scale and efficient operations, access to a deep pool of skilled labor, strategic proximity to essential raw materials, and the presence of supportive government policies that collectively contribute to regional dominance. Specific examples are provided for leading regions, detailing their unique competitive advantages, such as specialized expertise in stamping complex components, their role in the global EV supply chain, and their projected future growth trajectories driven by innovation and market demand.

Automotive Metal Stamping Market Product Innovations

The automotive metal stamping market is witnessing continuous product innovations driven by the need for lighter, stronger, and more cost-effective components. This includes advancements in materials like high-strength steels and aluminum alloys, enabling the production of thinner yet stronger parts. Furthermore, the integration of advanced manufacturing processes like hot stamping and hydroforming has significantly improved the performance characteristics of stamped components. These improvements enhance vehicle fuel efficiency, safety, and overall durability. Unique selling propositions are centered on improved lightweighting, enhanced strength-to-weight ratios, and superior crash performance.

Propelling Factors for Automotive Metal Stamping Market Growth

Several key factors fuel the growth of the automotive metal stamping market. Technological advancements, such as the development of high-strength steels and innovative forming processes, allow for the creation of lighter and stronger automotive parts, improving fuel efficiency. Economic factors, including increasing vehicle production and the rising demand for automobiles globally, significantly impact market growth. Finally, supportive government regulations promoting fuel efficiency and reducing emissions further stimulate demand for lightweight metal stampings.

Obstacles in the Automotive Metal Stamping Market

The automotive metal stamping market, while robust, faces several significant challenges that can impede its growth and profitability. Fluctuations in the prices of key raw materials, particularly steel and aluminum, can substantially impact production costs and squeeze profit margins, especially in a volatile commodity market. Disruptions in global supply chains, exacerbated by geopolitical events, trade disputes, or unforeseen crises such as pandemics, can lead to critical production delays, material shortages, and increased lead times. The market is characterized by intense competition among established, large-scale players and the continuous emergence of new entrants, necessitating relentless innovation, aggressive cost optimization strategies, and superior quality control to maintain and expand market share. Furthermore, increasingly stringent regulatory compliance with evolving environmental standards, emissions regulations, and safety requirements adds significant complexity and operational costs for manufacturers, requiring substantial investment in cleaner technologies and sustainable practices.

Future Opportunities in Automotive Metal Stamping Market

The future of the automotive metal stamping market is ripe with significant opportunities, largely driven by transformative shifts in the automotive industry. The burgeoning electric vehicle (EV) market presents a substantial growth avenue, as EVs require a diverse range of lightweight, high-strength, and precisely stamped components for battery enclosures, chassis, and body structures, driving demand for advanced metal stamping technologies. The increasing integration of advanced driver-assistance systems (ADAS) and the progressive development of autonomous driving features necessitate the production of sophisticated, high-precision, and often complex metal stampings for sensors, housings, and structural components that ensure safety and functionality. Moreover, the exploration and widespread adoption of new and advanced materials, such as lightweight aluminum alloys, advanced high-strength steels (AHSS), and composite materials, coupled with the application of innovative manufacturing processes like hot stamping, hydroforming, and additive manufacturing for tooling, present promising avenues for market expansion, product innovation, and the development of next-generation automotive solutions.

Major Players in the Automotive Metal Stamping Market Ecosystem

- Clow Stamping Company

- D&H Industries

- Magna International Inc

- PDQ Tool & Stamping Co

- Alcoa Inc

- Shiloh Industries Inc

- Manor Tool & Manufacturing Company

- Lindy Manufacturing

- American Industrial Company

- Tempco Manufacturing

- Wisconsin Metal Parts Inc

- Goshen Stamping Co Inc

- Interplex Industries Inc

Key Developments in Automotive Metal Stamping Market Industry

- January 2023: Gestamp announces its fourth hot stamping line in India, expanding its manufacturing capacity and strengthening its presence in a key growth market.

- February 2023: Hyundai Motor Corporation invests USD 300 Million in a new metal stamping plant in Savannah, Georgia, signifying significant investment in the North American automotive market and boosting the region's manufacturing capabilities.

- October 2022: ThyssenKrupp Steel showcases AS Pro-coated MBW steels, representing a significant advancement in hot stamping technology and enhancing the properties of automotive components.

Strategic Automotive Metal Stamping Market Forecast

The automotive metal stamping market is poised for substantial growth, driven by several key factors. The increasing demand for lightweight vehicles, technological advancements in materials and manufacturing processes, and rising investments in the automotive sector are all contributing to a positive outlook. Emerging opportunities in electric vehicles and autonomous driving technology are expected to further fuel market expansion in the coming years. The market is projected to experience a significant CAGR of xx% during the forecast period, presenting lucrative opportunities for stakeholders.

Automotive Metal Stamping Market Segmentation

-

1. Technology

- 1.1. Blanking

- 1.2. Embossing

- 1.3. Coining

- 1.4. Flanging

- 1.5. Bending

- 1.6. Other Technologies

-

2. Process

- 2.1. Roll Forming

- 2.2. Hot Stamping

- 2.3. Sheet Metal Forming

- 2.4. Metal Fabrication

- 2.5. Other Processes

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Metal Stamping Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Metal Stamping Market Regional Market Share

Geographic Coverage of Automotive Metal Stamping Market

Automotive Metal Stamping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Automobile Production is Anticipated to Boosts the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Automobile Production is Anticipated to Boosts the Market

- 3.4. Market Trends

- 3.4.1. Blanking Process Segment to Hold Significant Market Share -

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Metal Stamping Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Blanking

- 5.1.2. Embossing

- 5.1.3. Coining

- 5.1.4. Flanging

- 5.1.5. Bending

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Process

- 5.2.1. Roll Forming

- 5.2.2. Hot Stamping

- 5.2.3. Sheet Metal Forming

- 5.2.4. Metal Fabrication

- 5.2.5. Other Processes

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Automotive Metal Stamping Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Blanking

- 6.1.2. Embossing

- 6.1.3. Coining

- 6.1.4. Flanging

- 6.1.5. Bending

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Process

- 6.2.1. Roll Forming

- 6.2.2. Hot Stamping

- 6.2.3. Sheet Metal Forming

- 6.2.4. Metal Fabrication

- 6.2.5. Other Processes

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Automotive Metal Stamping Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Blanking

- 7.1.2. Embossing

- 7.1.3. Coining

- 7.1.4. Flanging

- 7.1.5. Bending

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Process

- 7.2.1. Roll Forming

- 7.2.2. Hot Stamping

- 7.2.3. Sheet Metal Forming

- 7.2.4. Metal Fabrication

- 7.2.5. Other Processes

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Automotive Metal Stamping Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Blanking

- 8.1.2. Embossing

- 8.1.3. Coining

- 8.1.4. Flanging

- 8.1.5. Bending

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Process

- 8.2.1. Roll Forming

- 8.2.2. Hot Stamping

- 8.2.3. Sheet Metal Forming

- 8.2.4. Metal Fabrication

- 8.2.5. Other Processes

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Automotive Metal Stamping Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Blanking

- 9.1.2. Embossing

- 9.1.3. Coining

- 9.1.4. Flanging

- 9.1.5. Bending

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Process

- 9.2.1. Roll Forming

- 9.2.2. Hot Stamping

- 9.2.3. Sheet Metal Forming

- 9.2.4. Metal Fabrication

- 9.2.5. Other Processes

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Clow Stamping Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 D&H Industries

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Magna International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PDQ Tool & Stamping Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Alcoa Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Shiloh Industries Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Manor Tool & Manufacturing Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lindy Manufacturing

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 American Industrial Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Tempco Manufacturing

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Wisconsin Metal Parts Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Goshen Stamping Co Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Interplex Industries Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Clow Stamping Company

List of Figures

- Figure 1: Global Automotive Metal Stamping Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Automotive Metal Stamping Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Automotive Metal Stamping Market Revenue (Million), by Technology 2025 & 2033

- Figure 4: North America Automotive Metal Stamping Market Volume (Billion), by Technology 2025 & 2033

- Figure 5: North America Automotive Metal Stamping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Automotive Metal Stamping Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Automotive Metal Stamping Market Revenue (Million), by Process 2025 & 2033

- Figure 8: North America Automotive Metal Stamping Market Volume (Billion), by Process 2025 & 2033

- Figure 9: North America Automotive Metal Stamping Market Revenue Share (%), by Process 2025 & 2033

- Figure 10: North America Automotive Metal Stamping Market Volume Share (%), by Process 2025 & 2033

- Figure 11: North America Automotive Metal Stamping Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 12: North America Automotive Metal Stamping Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 13: North America Automotive Metal Stamping Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: North America Automotive Metal Stamping Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 15: North America Automotive Metal Stamping Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Automotive Metal Stamping Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Automotive Metal Stamping Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Automotive Metal Stamping Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Automotive Metal Stamping Market Revenue (Million), by Technology 2025 & 2033

- Figure 20: Europe Automotive Metal Stamping Market Volume (Billion), by Technology 2025 & 2033

- Figure 21: Europe Automotive Metal Stamping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Europe Automotive Metal Stamping Market Volume Share (%), by Technology 2025 & 2033

- Figure 23: Europe Automotive Metal Stamping Market Revenue (Million), by Process 2025 & 2033

- Figure 24: Europe Automotive Metal Stamping Market Volume (Billion), by Process 2025 & 2033

- Figure 25: Europe Automotive Metal Stamping Market Revenue Share (%), by Process 2025 & 2033

- Figure 26: Europe Automotive Metal Stamping Market Volume Share (%), by Process 2025 & 2033

- Figure 27: Europe Automotive Metal Stamping Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 28: Europe Automotive Metal Stamping Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 29: Europe Automotive Metal Stamping Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Europe Automotive Metal Stamping Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 31: Europe Automotive Metal Stamping Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Automotive Metal Stamping Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Automotive Metal Stamping Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Automotive Metal Stamping Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Automotive Metal Stamping Market Revenue (Million), by Technology 2025 & 2033

- Figure 36: Asia Pacific Automotive Metal Stamping Market Volume (Billion), by Technology 2025 & 2033

- Figure 37: Asia Pacific Automotive Metal Stamping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Asia Pacific Automotive Metal Stamping Market Volume Share (%), by Technology 2025 & 2033

- Figure 39: Asia Pacific Automotive Metal Stamping Market Revenue (Million), by Process 2025 & 2033

- Figure 40: Asia Pacific Automotive Metal Stamping Market Volume (Billion), by Process 2025 & 2033

- Figure 41: Asia Pacific Automotive Metal Stamping Market Revenue Share (%), by Process 2025 & 2033

- Figure 42: Asia Pacific Automotive Metal Stamping Market Volume Share (%), by Process 2025 & 2033

- Figure 43: Asia Pacific Automotive Metal Stamping Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 44: Asia Pacific Automotive Metal Stamping Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 45: Asia Pacific Automotive Metal Stamping Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 46: Asia Pacific Automotive Metal Stamping Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 47: Asia Pacific Automotive Metal Stamping Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Automotive Metal Stamping Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Automotive Metal Stamping Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Automotive Metal Stamping Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Automotive Metal Stamping Market Revenue (Million), by Technology 2025 & 2033

- Figure 52: Rest of the World Automotive Metal Stamping Market Volume (Billion), by Technology 2025 & 2033

- Figure 53: Rest of the World Automotive Metal Stamping Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Rest of the World Automotive Metal Stamping Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Rest of the World Automotive Metal Stamping Market Revenue (Million), by Process 2025 & 2033

- Figure 56: Rest of the World Automotive Metal Stamping Market Volume (Billion), by Process 2025 & 2033

- Figure 57: Rest of the World Automotive Metal Stamping Market Revenue Share (%), by Process 2025 & 2033

- Figure 58: Rest of the World Automotive Metal Stamping Market Volume Share (%), by Process 2025 & 2033

- Figure 59: Rest of the World Automotive Metal Stamping Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 60: Rest of the World Automotive Metal Stamping Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 61: Rest of the World Automotive Metal Stamping Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 62: Rest of the World Automotive Metal Stamping Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 63: Rest of the World Automotive Metal Stamping Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Rest of the World Automotive Metal Stamping Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Rest of the World Automotive Metal Stamping Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Automotive Metal Stamping Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Metal Stamping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Automotive Metal Stamping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 3: Global Automotive Metal Stamping Market Revenue Million Forecast, by Process 2020 & 2033

- Table 4: Global Automotive Metal Stamping Market Volume Billion Forecast, by Process 2020 & 2033

- Table 5: Global Automotive Metal Stamping Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Metal Stamping Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Metal Stamping Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Automotive Metal Stamping Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Automotive Metal Stamping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Automotive Metal Stamping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 11: Global Automotive Metal Stamping Market Revenue Million Forecast, by Process 2020 & 2033

- Table 12: Global Automotive Metal Stamping Market Volume Billion Forecast, by Process 2020 & 2033

- Table 13: Global Automotive Metal Stamping Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Metal Stamping Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Metal Stamping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Automotive Metal Stamping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of North America Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of North America Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Metal Stamping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Automotive Metal Stamping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 25: Global Automotive Metal Stamping Market Revenue Million Forecast, by Process 2020 & 2033

- Table 26: Global Automotive Metal Stamping Market Volume Billion Forecast, by Process 2020 & 2033

- Table 27: Global Automotive Metal Stamping Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Automotive Metal Stamping Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Automotive Metal Stamping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Automotive Metal Stamping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Germany Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: France Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Italy Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Automotive Metal Stamping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 42: Global Automotive Metal Stamping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 43: Global Automotive Metal Stamping Market Revenue Million Forecast, by Process 2020 & 2033

- Table 44: Global Automotive Metal Stamping Market Volume Billion Forecast, by Process 2020 & 2033

- Table 45: Global Automotive Metal Stamping Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 46: Global Automotive Metal Stamping Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 47: Global Automotive Metal Stamping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Automotive Metal Stamping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: India Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: India Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: China Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Japan Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: South Korea Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Asia Pacific Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Automotive Metal Stamping Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 60: Global Automotive Metal Stamping Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 61: Global Automotive Metal Stamping Market Revenue Million Forecast, by Process 2020 & 2033

- Table 62: Global Automotive Metal Stamping Market Volume Billion Forecast, by Process 2020 & 2033

- Table 63: Global Automotive Metal Stamping Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 64: Global Automotive Metal Stamping Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 65: Global Automotive Metal Stamping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Automotive Metal Stamping Market Volume Billion Forecast, by Country 2020 & 2033

- Table 67: South America Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: South America Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Middle East and Africa Automotive Metal Stamping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Middle East and Africa Automotive Metal Stamping Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Metal Stamping Market?

The projected CAGR is approximately 4.99%.

2. Which companies are prominent players in the Automotive Metal Stamping Market?

Key companies in the market include Clow Stamping Company, D&H Industries, Magna International Inc, PDQ Tool & Stamping Co, Alcoa Inc, Shiloh Industries Inc, Manor Tool & Manufacturing Company, Lindy Manufacturing, American Industrial Company, Tempco Manufacturing, Wisconsin Metal Parts Inc, Goshen Stamping Co Inc, Interplex Industries Inc.

3. What are the main segments of the Automotive Metal Stamping Market?

The market segments include Technology, Process, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 117.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automobile Production is Anticipated to Boosts the Market.

6. What are the notable trends driving market growth?

Blanking Process Segment to Hold Significant Market Share -.

7. Are there any restraints impacting market growth?

Increasing Automobile Production is Anticipated to Boosts the Market.

8. Can you provide examples of recent developments in the market?

In January 2023, Gestamp, a Spain-based company specializing in the design, development, and manufacture of highly engineered metal components for the automotive industry, announced its fourth hot stamping line in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Metal Stamping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Metal Stamping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Metal Stamping Market?

To stay informed about further developments, trends, and reports in the Automotive Metal Stamping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence