Key Insights

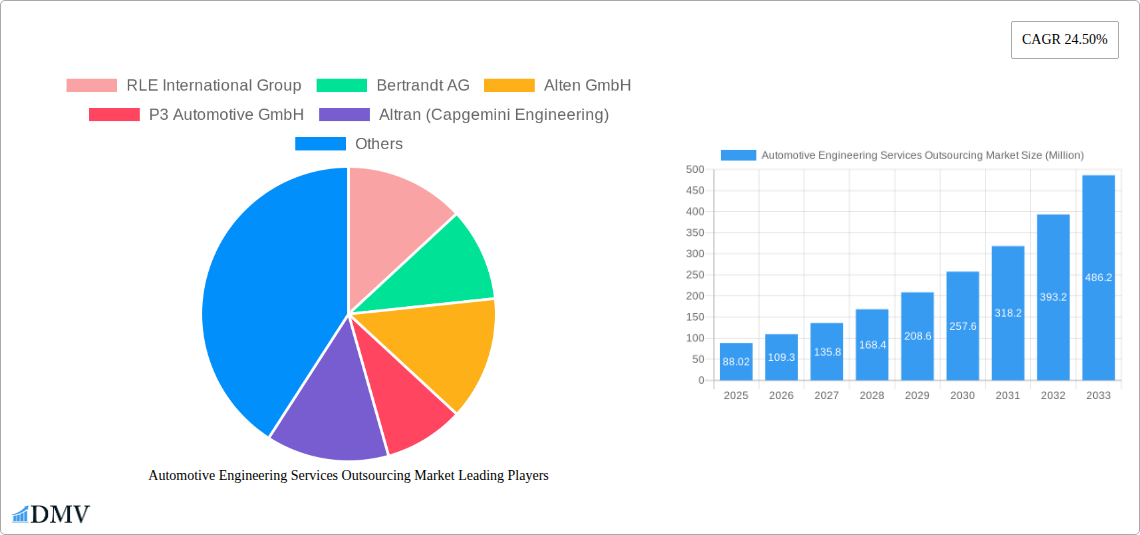

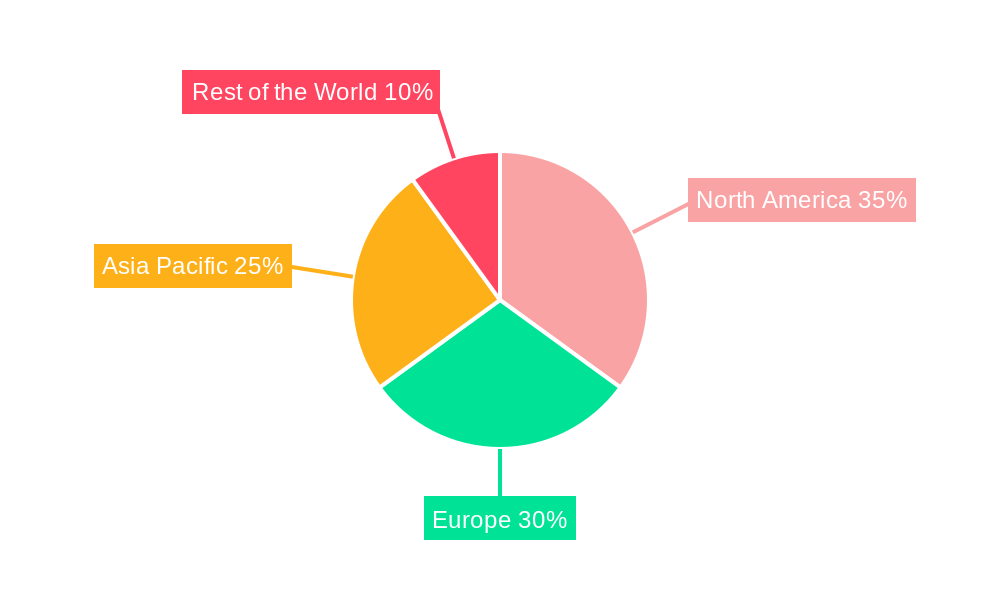

The Automotive Engineering Services Outsourcing market is experiencing robust growth, projected to reach \$88.02 million in 2025 and expand significantly over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 24.50% underscores the market's dynamism, driven by several key factors. The increasing complexity of vehicle designs, particularly with the rise of electric vehicles (EVs) and autonomous driving technologies, necessitates specialized engineering expertise that many OEMs are outsourcing to reduce costs and accelerate time-to-market. Furthermore, the global shift towards lightweight materials and advanced driver-assistance systems (ADAS) is fueling demand for sophisticated engineering services. The market is segmented by service type (designing, prototyping, system integration, testing), location type (onshore, offshore), vehicle type (passenger and commercial vehicles), and propulsion type (internal combustion engine and electric engine). While the offshore segment is expected to show faster growth due to cost advantages, the onshore segment retains a significant market share, driven by the need for close collaboration and shorter turnaround times for critical projects. The North American and European markets currently hold a significant share, but the Asia-Pacific region, particularly China and India, is poised for substantial growth, fueled by expanding automotive manufacturing bases and increased EV adoption.

The competitive landscape is characterized by a mix of large multinational engineering firms and specialized niche players. Established players like AVL List GmbH, FEV Group GmbH, and Bosch (through ITK Engineering GmbH) benefit from their extensive experience and global reach. However, smaller, agile firms focusing on specific areas like EV development or ADAS are gaining traction. The market's future hinges on technological advancements, evolving regulatory landscapes (emission standards, safety regulations), and the pace of EV adoption globally. Continuous innovation in areas such as simulation and digital twin technology is expected to further shape the market's trajectory, creating opportunities for those offering cutting-edge engineering solutions. Strategic partnerships between automotive OEMs and engineering service providers will be crucial for successfully navigating the complex challenges of the evolving automotive industry.

Automotive Engineering Services Outsourcing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Automotive Engineering Services Outsourcing Market, offering a comprehensive overview of market trends, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report meticulously examines market segmentation by service type (Designing, Prototyping, System Integration, Testing), location type (Onshore, Offshore), vehicle type (Passenger Vehicles, Commercial Vehicles), and propulsion type (IC Engine, Electric Engine). Expect a thorough examination of market dynamics, competitive landscapes, and lucrative opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033.

Automotive Engineering Services Outsourcing Market Composition & Trends

The Automotive Engineering Services Outsourcing market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. However, the presence of numerous smaller, specialized firms contributes to a dynamic and competitive environment. Market share distribution among the top players, including RLE International Group, Bertrandt AG, Alten GmbH, and others, will be detailed in the full report. Innovation, driven by advancements in electric vehicles (EVs) and autonomous driving technologies, is a key catalyst for market growth. Stringent emission regulations globally are further propelling demand for outsourced engineering services, particularly in areas like powertrain development and system integration. Substitute products, such as in-house engineering departments, face increasing pressure due to cost efficiency and specialized expertise offered by outsourcing providers. The report analyzes end-user profiles, revealing a strong presence of OEMs (Original Equipment Manufacturers) and Tier-1 automotive suppliers. Significant M&A activities, such as the Altair Engineering Inc. acquisition of Concept Engineering in June 2022 and Bertrandt’s acquisition of Evopro Systems Engineering AG in October 2023, are contributing to market consolidation and expansion of service offerings. The total value of M&A deals within the studied period is estimated to be xx Million.

- Market concentration: Moderately concentrated, with key players holding significant but not dominant shares.

- Innovation catalysts: Advancements in EV and autonomous driving technologies, stringent emission regulations.

- Regulatory landscape: Increasingly stringent emission and safety standards driving demand for specialized services.

- Substitute products: In-house engineering, facing increasing cost and expertise challenges.

- End-user profiles: Dominated by OEMs and Tier-1 automotive suppliers.

- M&A activities: Significant consolidation through acquisitions, expanding service portfolios.

Automotive Engineering Services Outsourcing Market Industry Evolution

The Automotive Engineering Services Outsourcing market has experienced substantial growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to the increasing complexity of vehicle technologies, rising R&D expenditure by automotive manufacturers, and the growing preference for outsourcing non-core engineering functions. The forecast period (2025-2033) anticipates continued growth, driven by the burgeoning EV market, increasing adoption of advanced driver-assistance systems (ADAS), and the expansion of connected car technologies. Technological advancements such as digital twins, AI-powered simulation, and cloud-based engineering platforms are significantly impacting market evolution, enhancing efficiency and accelerating development cycles. Shifting consumer demands towards sustainable and feature-rich vehicles further contribute to market expansion. Specific data points, including growth rates for various segments and adoption metrics for key technologies, will be comprehensively analyzed in the full report. The rising adoption of electric engines is driving the demand for related engineering services and the market is expected to see a CAGR of xx% for electric engine services during the forecast period.

Leading Regions, Countries, or Segments in Automotive Engineering Services Outsourcing Market

The report identifies key regions, countries, and segments driving market growth. While specific market share data for each segment will be presented in the complete report, preliminary observations highlight the substantial contributions of several areas.

By Service Type: Testing and System Integration are expected to witness robust growth due to the increasing complexity of modern vehicles and associated rigorous validation requirements. Designing also holds considerable significance, fueled by continuous innovation in vehicle architectures and functionalities. Prototyping is a critical segment that contributes to efficient product development cycles and early identification of design flaws.

By Location Type: The offshore segment, particularly in regions with competitive labor costs and skilled engineering talent, is experiencing rapid expansion. However, Onshore remains a key segment, reflecting the need for proximity and collaboration in certain specialized engineering projects.

By Vehicle Type: Passenger vehicles currently dominate the market, but the commercial vehicle segment is projected to show strong growth, driven by the increasing demand for efficient and technologically advanced commercial vehicles.

By Propulsion Type: While the Internal Combustion Engine (ICE) segment will witness a decline, the electric engine segment is emerging as a dominant force, demonstrating exponential growth potential.

Key Drivers:

- Significant investments in R&D by automotive OEMs and suppliers.

- Government incentives and supportive regulatory frameworks promoting the adoption of EVs and autonomous vehicles.

- The availability of skilled engineering talent at competitive costs in certain regions.

Automotive Engineering Services Outsourcing Market Product Innovations

The Automotive Engineering Services Outsourcing market is characterized by continuous product innovation, encompassing advanced simulation tools, AI-driven design optimization, and cloud-based collaborative platforms. These innovations enhance efficiency, reduce development times, and optimize product performance. Unique selling propositions include improved accuracy, reduced costs, and faster time-to-market. The integration of virtual reality (VR) and augmented reality (AR) technologies further enhances design and testing processes. Specific examples of innovative service offerings and their performance metrics will be detailed in the complete report.

Propelling Factors for Automotive Engineering Services Outsourcing Market Growth

Several factors are driving the expansion of the Automotive Engineering Services Outsourcing market. Technological advancements, particularly in electric vehicles (EVs) and autonomous driving, necessitate specialized engineering expertise, fueling outsourcing. The economic advantages of cost reduction and access to a global talent pool are key drivers. Furthermore, supportive government regulations in many countries promoting the transition to sustainable mobility further stimulate demand for outsourcing services. Examples include the growing number of EV mandates and incentives for the development of green technologies.

Obstacles in the Automotive Engineering Services Outsourcing Market

The market faces certain challenges. Regulatory hurdles, such as data security and compliance regulations, can impede operations. Supply chain disruptions, especially concerning specialized components and software, can impact project timelines and costs. Intense competition among outsourcing providers, both large global firms and smaller niche players, exerts pressure on pricing and profitability. These challenges are quantified in the detailed report with estimates of their financial impact on the market's growth.

Future Opportunities in Automotive Engineering Services Outsourcing Market

Emerging opportunities include expanding into new geographic markets, particularly in developing economies with growing automotive industries. The integration of new technologies, such as blockchain for secure data management and 5G connectivity for remote vehicle testing, presents significant growth potential. The rise of new vehicle architectures and emerging consumer preferences for personalized mobility solutions will further drive demand for specialized outsourced engineering services.

Major Players in the Automotive Engineering Services Outsourcing Market Ecosystem

- RLE International Group

- Bertrandt AG

- Alten GmbH

- P3 Automotive GmbH

- Altran (Capgemini Engineering)

- ASAP Holding GmbH

- Altair Engineering Inc

- Kistler Holding AG

- FEV Group GmbH

- AVL List GmbH

- ESG Elektroniksystem- und Logistik-GmbH

- EDAG Engineering GmbH

- IAV GmbH

- MBtech Group GmbH (A subsidiary of AKKA Technologies)

- HORIBA Ltd

- ITK Engineering GmbH (Robert Bosch GmbH)

Key Developments in Automotive Engineering Services Outsourcing Market Industry

June 2022: Altair Engineering Inc. acquired Concept Engineering, enhancing its capabilities in electrical circuit visualization and boosting its offerings for automotive and aerospace clients. This acquisition strengthens Altair’s position in the market by broadening its services in the rapidly expanding EV sector.

November 2022: AVL opened a new vehicle engineering center, expanding its capacity for advanced testing and development, positioning it to better serve the growing demand for next-generation vehicle technologies. This investment signals AVL's commitment to future mobility and enhances its competitiveness.

October 2023: Bertrandt acquired Evopro Systems Engineering AG, expanding its production service offerings and solidifying its position in the end-to-end engineering services market. This acquisition strengthens Bertrandt's capabilities in the production sector, enabling them to offer more comprehensive support to customers.

Strategic Automotive Engineering Services Outsourcing Market Forecast

The Automotive Engineering Services Outsourcing market is poised for significant growth in the coming years. The increasing complexity of vehicle technologies, combined with the rising adoption of EVs and autonomous driving, will continue to fuel demand for specialized engineering expertise. The expansion of the EV market, coupled with supportive government regulations and the cost-effectiveness of outsourcing, present substantial market potential. The full report provides a detailed quantitative forecast, broken down by segment, region, and key players. Further market expansion is expected through acquisitions, technological developments, and rising customer demand for next-generation vehicle technologies.

Automotive Engineering Services Outsourcing Market Segmentation

-

1. Service Type

- 1.1. Designing

- 1.2. Prototyping

- 1.3. System Integration

- 1.4. Testing

-

2. Location Type

- 2.1. Onshore

- 2.2. Offshore

-

3. Vehicle Type

- 3.1. Passenger Vehicles

- 3.2. Commercial Vehicles

-

4. Propulsion Type

- 4.1. IC Engine

- 4.2. Electric Engine

Automotive Engineering Services Outsourcing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Engineering Services Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Passenger Cars Hold the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Designing

- 5.1.2. Prototyping

- 5.1.3. System Integration

- 5.1.4. Testing

- 5.2. Market Analysis, Insights and Forecast - by Location Type

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Vehicles

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. IC Engine

- 5.4.2. Electric Engine

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Designing

- 6.1.2. Prototyping

- 6.1.3. System Integration

- 6.1.4. Testing

- 6.2. Market Analysis, Insights and Forecast - by Location Type

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Vehicles

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.4.1. IC Engine

- 6.4.2. Electric Engine

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Designing

- 7.1.2. Prototyping

- 7.1.3. System Integration

- 7.1.4. Testing

- 7.2. Market Analysis, Insights and Forecast - by Location Type

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Vehicles

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.4.1. IC Engine

- 7.4.2. Electric Engine

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Designing

- 8.1.2. Prototyping

- 8.1.3. System Integration

- 8.1.4. Testing

- 8.2. Market Analysis, Insights and Forecast - by Location Type

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Vehicles

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.4.1. IC Engine

- 8.4.2. Electric Engine

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of the World Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Designing

- 9.1.2. Prototyping

- 9.1.3. System Integration

- 9.1.4. Testing

- 9.2. Market Analysis, Insights and Forecast - by Location Type

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Vehicles

- 9.3.2. Commercial Vehicles

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.4.1. IC Engine

- 9.4.2. Electric Engine

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. North America Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Engineering Services Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 RLE International Group

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Bertrandt AG

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Alten GmbH

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 P3 Automotive GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Altran (Capgemini Engineering)

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 ASAP Holding GmbH

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Altair Engineering Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Kistler Holding AG*List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 FEV Group GmbH

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 AVL List GmbH

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 ESG Elektroniksystem- und Logistik-GmbH

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 EDAG Engineering GmbH

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 IAV GmbH

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 MBtech Group GmbH (A subsidiary of AKKA Technologies)

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 HORIBA Ltd

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 ITK Engineering GmbH (Robert Bosch GmbH)

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.1 RLE International Group

List of Figures

- Figure 1: Global Automotive Engineering Services Outsourcing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Engineering Services Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Engineering Services Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Engineering Services Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Engineering Services Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Engineering Services Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Engineering Services Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Engineering Services Outsourcing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 11: North America Automotive Engineering Services Outsourcing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 12: North America Automotive Engineering Services Outsourcing Market Revenue (Million), by Location Type 2024 & 2032

- Figure 13: North America Automotive Engineering Services Outsourcing Market Revenue Share (%), by Location Type 2024 & 2032

- Figure 14: North America Automotive Engineering Services Outsourcing Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: North America Automotive Engineering Services Outsourcing Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: North America Automotive Engineering Services Outsourcing Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 17: North America Automotive Engineering Services Outsourcing Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 18: North America Automotive Engineering Services Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Automotive Engineering Services Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Automotive Engineering Services Outsourcing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 21: Europe Automotive Engineering Services Outsourcing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 22: Europe Automotive Engineering Services Outsourcing Market Revenue (Million), by Location Type 2024 & 2032

- Figure 23: Europe Automotive Engineering Services Outsourcing Market Revenue Share (%), by Location Type 2024 & 2032

- Figure 24: Europe Automotive Engineering Services Outsourcing Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Europe Automotive Engineering Services Outsourcing Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Europe Automotive Engineering Services Outsourcing Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 27: Europe Automotive Engineering Services Outsourcing Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 28: Europe Automotive Engineering Services Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Automotive Engineering Services Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 31: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 32: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue (Million), by Location Type 2024 & 2032

- Figure 33: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue Share (%), by Location Type 2024 & 2032

- Figure 34: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 35: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 36: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 37: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 38: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Automotive Engineering Services Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 40: Rest of the World Automotive Engineering Services Outsourcing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 41: Rest of the World Automotive Engineering Services Outsourcing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 42: Rest of the World Automotive Engineering Services Outsourcing Market Revenue (Million), by Location Type 2024 & 2032

- Figure 43: Rest of the World Automotive Engineering Services Outsourcing Market Revenue Share (%), by Location Type 2024 & 2032

- Figure 44: Rest of the World Automotive Engineering Services Outsourcing Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 45: Rest of the World Automotive Engineering Services Outsourcing Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 46: Rest of the World Automotive Engineering Services Outsourcing Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 47: Rest of the World Automotive Engineering Services Outsourcing Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 48: Rest of the World Automotive Engineering Services Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of the World Automotive Engineering Services Outsourcing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Location Type 2019 & 2032

- Table 4: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 6: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: South America Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Middle East and Africa Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 28: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Location Type 2019 & 2032

- Table 29: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 30: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 31: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of North America Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 36: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Location Type 2019 & 2032

- Table 37: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 38: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 39: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 47: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Location Type 2019 & 2032

- Table 48: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 49: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 50: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Japan Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: India Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 57: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Location Type 2019 & 2032

- Table 58: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 59: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 60: Global Automotive Engineering Services Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 61: South America Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Middle East and Africa Automotive Engineering Services Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Engineering Services Outsourcing Market?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the Automotive Engineering Services Outsourcing Market?

Key companies in the market include RLE International Group, Bertrandt AG, Alten GmbH, P3 Automotive GmbH, Altran (Capgemini Engineering), ASAP Holding GmbH, Altair Engineering Inc, Kistler Holding AG*List Not Exhaustive, FEV Group GmbH, AVL List GmbH, ESG Elektroniksystem- und Logistik-GmbH, EDAG Engineering GmbH, IAV GmbH, MBtech Group GmbH (A subsidiary of AKKA Technologies), HORIBA Ltd, ITK Engineering GmbH (Robert Bosch GmbH).

3. What are the main segments of the Automotive Engineering Services Outsourcing Market?

The market segments include Service Type, Location Type, Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Passenger Cars Hold the Highest Share.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

June 2022: Altair Engineering Inc. acquired Concept Engineering, which provides advanced visualization of electrical circuits, wire harnesses, and components for rapid and reliable development, manufacture, and service for industries demanding highly specialized debugging and visualization mechanisms for development and post-production product maintenance. Among these industries are automotive and aerospace.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Engineering Services Outsourcing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Engineering Services Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Engineering Services Outsourcing Market?

To stay informed about further developments, trends, and reports in the Automotive Engineering Services Outsourcing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence