Key Insights

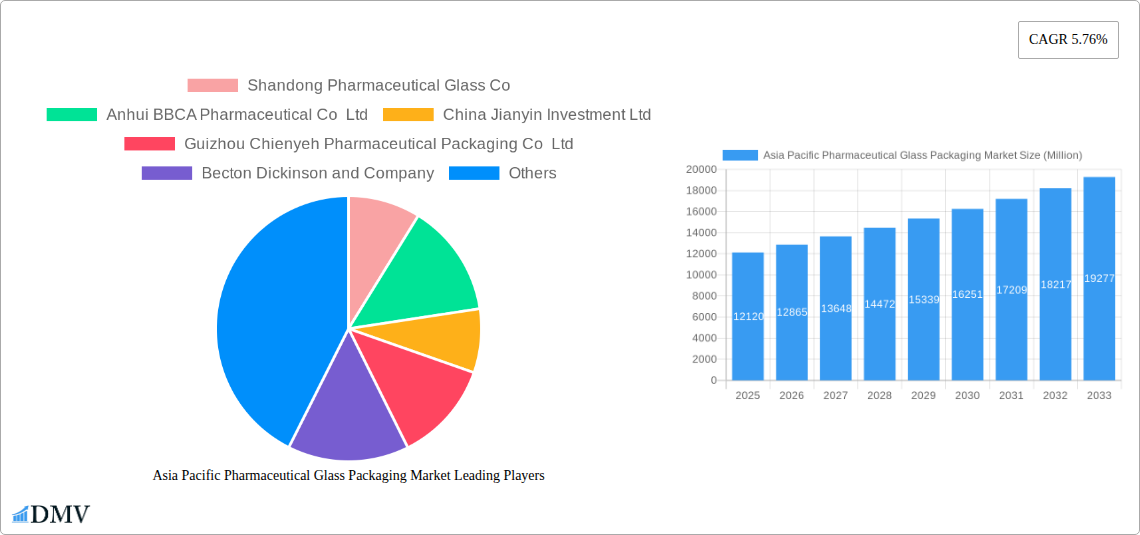

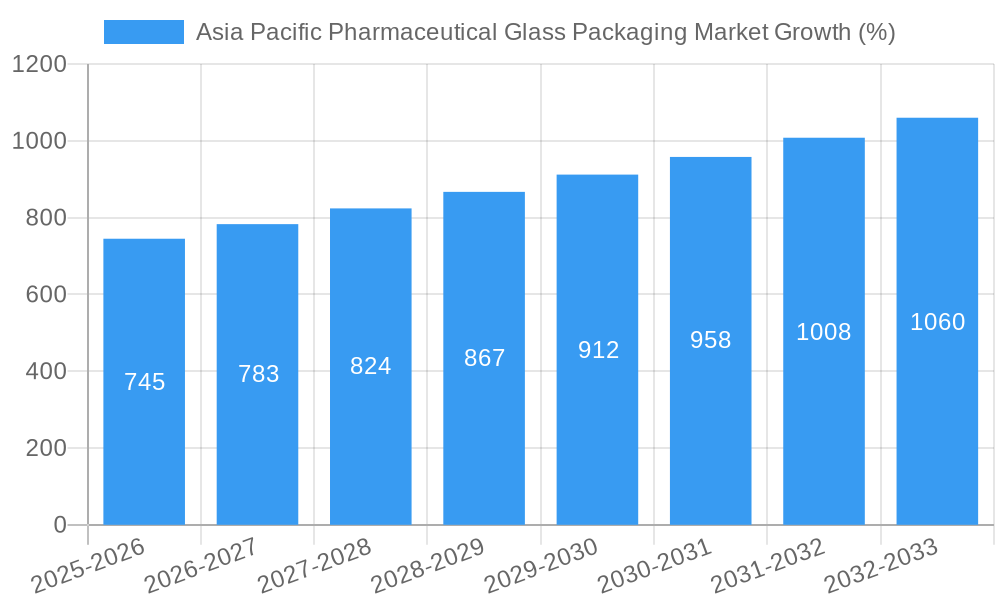

The Asia Pacific pharmaceutical glass packaging market is experiencing robust growth, projected to reach a market size of $12.12 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.76% from 2025 to 2033. This expansion is fueled by several key factors. The region's burgeoning pharmaceutical industry, driven by increasing healthcare expenditure and a growing aging population, necessitates a reliable supply of high-quality glass packaging for drug delivery. Stringent regulatory standards regarding drug safety and efficacy are also pushing manufacturers to adopt more robust and tamper-evident packaging solutions, thus boosting demand for specialized glass containers. Furthermore, the rising prevalence of chronic diseases like diabetes and cardiovascular ailments, coupled with increased demand for injectable drugs and vaccines, further contributes to market growth. Technological advancements in glass manufacturing, leading to lighter, more durable, and recyclable options, are also driving market expansion. Competitive pricing strategies by established players and the emergence of new players in the market add to the dynamism of this sector.

However, the market is not without challenges. Fluctuations in raw material prices, particularly silica sand, can impact production costs and profitability. Furthermore, the increasing popularity of alternative packaging materials, such as plastics and polymers, poses a competitive threat. Sustaining the necessary infrastructure for efficient production and distribution across diverse geographical locations within the Asia Pacific region presents an ongoing operational hurdle. Nevertheless, the strong growth fundamentals, underpinned by demographic shifts and evolving healthcare needs, suggest a positive outlook for the Asia Pacific pharmaceutical glass packaging market over the forecast period. Key players like Shandong Pharmaceutical Glass Co, Anhui BBCA Pharmaceutical Co Ltd, and international giants such as Becton Dickinson and Company and Gerresheimer AG are well-positioned to capitalize on these trends.

Asia Pacific Pharmaceutical Glass Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific Pharmaceutical Glass Packaging Market, offering a comprehensive overview of market dynamics, growth drivers, challenges, and future opportunities. Covering the period 2019-2033, with a focus on 2025, this research is invaluable for stakeholders seeking to understand and capitalize on the evolving landscape of this crucial industry.

Asia Pacific Pharmaceutical Glass Packaging Market Market Composition & Trends

This section delves into the competitive dynamics of the Asia Pacific pharmaceutical glass packaging market. We analyze market concentration, identifying key players like Shandong Pharmaceutical Glass Co, Anhui BBCA Pharmaceutical Co Ltd, China Jianyin Investment Ltd, Guizhou Chienyeh Pharmaceutical Packaging Co Ltd, Becton Dickinson and Company, Gerresheimer AG, Schott AG, AGI glaspac - AGI Greenpac Limited, Ningbo Zhengli Pharmaceutical Packaging, and Baotou KONRE Pharma Glass Packaging Co Ltd (list not exhaustive). Market share distribution among these companies is assessed, revealing the degree of market concentration and competition. The report also explores innovation catalysts, such as advancements in glass formulation and manufacturing processes, impacting the market's evolution. Regulatory landscapes across the region, including variations in quality standards and safety regulations, are examined. We further analyze the presence of substitute packaging materials and their impact on market share. The report profiles end-users, including pharmaceutical companies of varying sizes, and assesses the influence of their needs on market growth. Finally, we analyze M&A activities within the sector, including deal values and their implications for market consolidation (estimated value of M&A deals in 2024: $XX Million).

- Market Concentration: High/Medium/Low (specify based on analysis)

- Innovation Catalysts: Advancements in glass type, barrier properties, and manufacturing efficiency.

- Regulatory Landscape: Analysis of regional variations in regulatory compliance.

- Substitute Products: Impact of plastic and other packaging materials.

- End-User Profiles: Analysis of pharmaceutical company needs and influence.

- M&A Activity: Summary of key deals and their impact on market dynamics (estimated value of M&A deals in 2024: $XX Million).

Asia Pacific Pharmaceutical Glass Packaging Market Industry Evolution

This section provides a detailed analysis of the Asia Pacific pharmaceutical glass packaging market's evolution from 2019 to 2033. We examine market growth trajectories, identifying periods of expansion and contraction, influenced by factors like economic growth, pharmaceutical production increases, and regulatory changes. Technological advancements, such as automation in manufacturing and the introduction of novel glass formulations, are meticulously analyzed, highlighting their impact on production efficiency and packaging quality. Shifting consumer demands—driven by sustainability concerns and the desire for enhanced product protection—are explored. The analysis will also cover the influence of changing healthcare trends, including the rise of injectable drugs, influencing packaging material demands. We present specific data points, including compound annual growth rates (CAGR) for different market segments during the forecast period and adoption metrics for new technologies. (Projected CAGR 2025-2033: XX%).

Leading Regions, Countries, or Segments in Asia Pacific Pharmaceutical Glass Packaging Market

This section identifies the dominant regions, countries, or segments within the Asia Pacific pharmaceutical glass packaging market. A thorough analysis will be conducted to pinpoint the leading player and comprehensively analyze the factors driving its prominence.

- Key Drivers (Examples):

- High pharmaceutical production in [Country/Region].

- Favorable government policies and incentives.

- Strong investment in pharmaceutical infrastructure.

- Advanced manufacturing capabilities.

- Growing demand for injectables.

[Detailed paragraph explaining the dominance of the leading region/country/segment, including market size, growth rate, and competitive landscape.]

Asia Pacific Pharmaceutical Glass Packaging Market Product Innovations

This section highlights recent product innovations in the Asia Pacific pharmaceutical glass packaging market. This includes details on new glass formulations offering enhanced barrier properties, improved chemical resistance, and reduced breakage rates. We will also cover innovations in manufacturing processes, leading to increased efficiency and reduced costs. The unique selling propositions of these new products and their technological advancements will be examined, providing insights into how they are shaping market competition and meeting evolving industry demands.

Propelling Factors for Asia Pacific Pharmaceutical Glass Packaging Market Growth

Several key factors are driving the growth of the Asia Pacific pharmaceutical glass packaging market. Technological advancements, such as improved automation and precision in manufacturing, contribute to higher production efficiency and lower costs. Economic factors like increasing healthcare spending and the expansion of the pharmaceutical industry fuel market growth. Regulatory support for quality standards and initiatives promoting pharmaceutical innovation create a supportive environment. The increasing prevalence of chronic diseases and the rise in demand for injectable medications also fuel demand for glass packaging.

Obstacles in the Asia Pacific Pharmaceutical Glass Packaging Market Market

Despite the positive growth trajectory, the Asia Pacific pharmaceutical glass packaging market faces several challenges. Regulatory hurdles, including stringent quality and safety standards, can increase compliance costs. Supply chain disruptions, such as raw material shortages or logistical bottlenecks, can impact production and delivery timelines. Intense competition among established and emerging players puts pressure on pricing and profit margins. The environmental impact of glass production and disposal also poses a growing concern for companies. (Estimated impact of supply chain disruptions on market growth in 2024: XX%).

Future Opportunities in Asia Pacific Pharmaceutical Glass Packaging Market

The Asia Pacific pharmaceutical glass packaging market presents several lucrative opportunities. Expanding into new markets with emerging pharmaceutical industries creates significant potential. The adoption of sustainable and eco-friendly glass packaging solutions is attracting considerable interest. Technological innovations, such as specialized coatings and smart packaging, will provide opportunities for value-added products. The growing demand for injectable biologics and specialized pharmaceutical products creates further avenues for growth.

Major Players in the Asia Pacific Pharmaceutical Glass Packaging Market Ecosystem

- Shandong Pharmaceutical Glass Co

- Anhui BBCA Pharmaceutical Co Ltd

- China Jianyin Investment Ltd

- Guizhou Chienyeh Pharmaceutical Packaging Co Ltd

- Becton Dickinson and Company

- Gerresheimer AG

- Schott AG

- AGI glaspac - AGI Greenpac Limited

- Ningbo Zhengli Pharmaceutical Packaging

- Baotou KONRE Pharma Glass Packaging Co Ltd *List Not Exhaustive

Key Developments in Asia Pacific Pharmaceutical Glass Packaging Market Industry

June 2024 saw a significant development: Chugai Pharmaceutical Co. Ltd announced that Maruho Co. Ltd (Maruho) launched Mitchga Subcutaneous Injection 30mg Vials (Japanese Accepted Name (JAN): nemolizumab (Genetical Recombination)) in Japan. This launch, for treating pruritus associated with Atopic dermatitis (children aged ≥6 and adults), signifies the increasing demand for specialized glass packaging solutions within the region, potentially boosting the market for specific vial types.

Strategic Asia Pacific Pharmaceutical Glass Packaging Market Market Forecast

The Asia Pacific pharmaceutical glass packaging market is poised for sustained growth driven by factors such as increasing healthcare expenditure, expanding pharmaceutical production, and technological advancements. New product innovations and a growing focus on sustainability will create additional opportunities. The market is expected to witness a significant expansion in the coming years, making it an attractive sector for investment and strategic partnerships. (Projected Market Size in 2033: $XX Million).

Asia Pacific Pharmaceutical Glass Packaging Market Segmentation

-

1. Products

- 1.1. Bottles

- 1.2. Vials

- 1.3. Ampoules

- 1.4. Cartridges and Syringes

- 1.5. Other Products

Asia Pacific Pharmaceutical Glass Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Pharmaceutical Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Spending in R&D and Capacity Expansion; Rising Preference for Environment-friendly Packaging is Expected to have a Positive Impact on Pharmaceutical Glass Packaging

- 3.3. Market Restrains

- 3.3.1. Increasing Spending in R&D and Capacity Expansion; Rising Preference for Environment-friendly Packaging is Expected to have a Positive Impact on Pharmaceutical Glass Packaging

- 3.4. Market Trends

- 3.4.1. China is Expected to have a Significant Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Pharmaceutical Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Bottles

- 5.1.2. Vials

- 5.1.3. Ampoules

- 5.1.4. Cartridges and Syringes

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shandong Pharmaceutical Glass Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Anhui BBCA Pharmaceutical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Jianyin Investment Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Guizhou Chienyeh Pharmaceutical Packaging Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Becton Dickinson and Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gerresheimer AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schott AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGI glaspac - AGI Greenpac Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ningbo Zhengli Pharmaceutical Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Baotou KONRE Pharma Glass Packaging Co Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shandong Pharmaceutical Glass Co

List of Figures

- Figure 1: Asia Pacific Pharmaceutical Glass Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Pharmaceutical Glass Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Products 2019 & 2032

- Table 4: Asia Pacific Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Products 2019 & 2032

- Table 5: Asia Pacific Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Asia Pacific Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Products 2019 & 2032

- Table 8: Asia Pacific Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Products 2019 & 2032

- Table 9: Asia Pacific Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia Pacific Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: China Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: South Korea Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Australia Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: New Zealand Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Indonesia Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Malaysia Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Singapore Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Thailand Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailand Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Vietnam Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia Pacific Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Philippines Asia Pacific Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Pharmaceutical Glass Packaging Market?

The projected CAGR is approximately 5.76%.

2. Which companies are prominent players in the Asia Pacific Pharmaceutical Glass Packaging Market?

Key companies in the market include Shandong Pharmaceutical Glass Co, Anhui BBCA Pharmaceutical Co Ltd, China Jianyin Investment Ltd, Guizhou Chienyeh Pharmaceutical Packaging Co Ltd, Becton Dickinson and Company, Gerresheimer AG, Schott AG, AGI glaspac - AGI Greenpac Limited, Ningbo Zhengli Pharmaceutical Packaging, Baotou KONRE Pharma Glass Packaging Co Ltd*List Not Exhaustive.

3. What are the main segments of the Asia Pacific Pharmaceutical Glass Packaging Market?

The market segments include Products.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Spending in R&D and Capacity Expansion; Rising Preference for Environment-friendly Packaging is Expected to have a Positive Impact on Pharmaceutical Glass Packaging.

6. What are the notable trends driving market growth?

China is Expected to have a Significant Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Spending in R&D and Capacity Expansion; Rising Preference for Environment-friendly Packaging is Expected to have a Positive Impact on Pharmaceutical Glass Packaging.

8. Can you provide examples of recent developments in the market?

June 2024: Chugai Pharmaceutical Co. Ltd announced that Maruho Co. Ltd (hereafter, Maruho) launch of Mitchga Subcutaneous Injection 30mg Vials (Japanese Accepted Name (JAN): nemolizumab (Genetical Recombination)) in Japan for the treatment of the following conditions only when existing treatment is insufficiently effective: pruritus associated with Atopic dermatitis (children aged ≥6 and <13 years) and Prurigo nodularis (adults and children aged ≥13 years). Mitchga originated from Chugai and has been licensed out to Maruho in Japan.March 2024: Aurobindo Pharma commissioned four state-of-the-art manufacturing facilities for penicillin-G, 6-amino Penicillanic Acid (6-APA), Injectable products, and Granulation through its wholly owned subsidiaries. The penicillin-G (Pen-G) facility in an SEZ at Kakinada in Andhra Pradesh, India, has a production capacity of 15,000 tonnes per annum and 180,000 tonnes of glucose. In comparison, the 6-Amino Penicillanic Acid plant can produce 3,600 tonnes yearly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Pharmaceutical Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Pharmaceutical Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Pharmaceutical Glass Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Pharmaceutical Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence