Key Insights

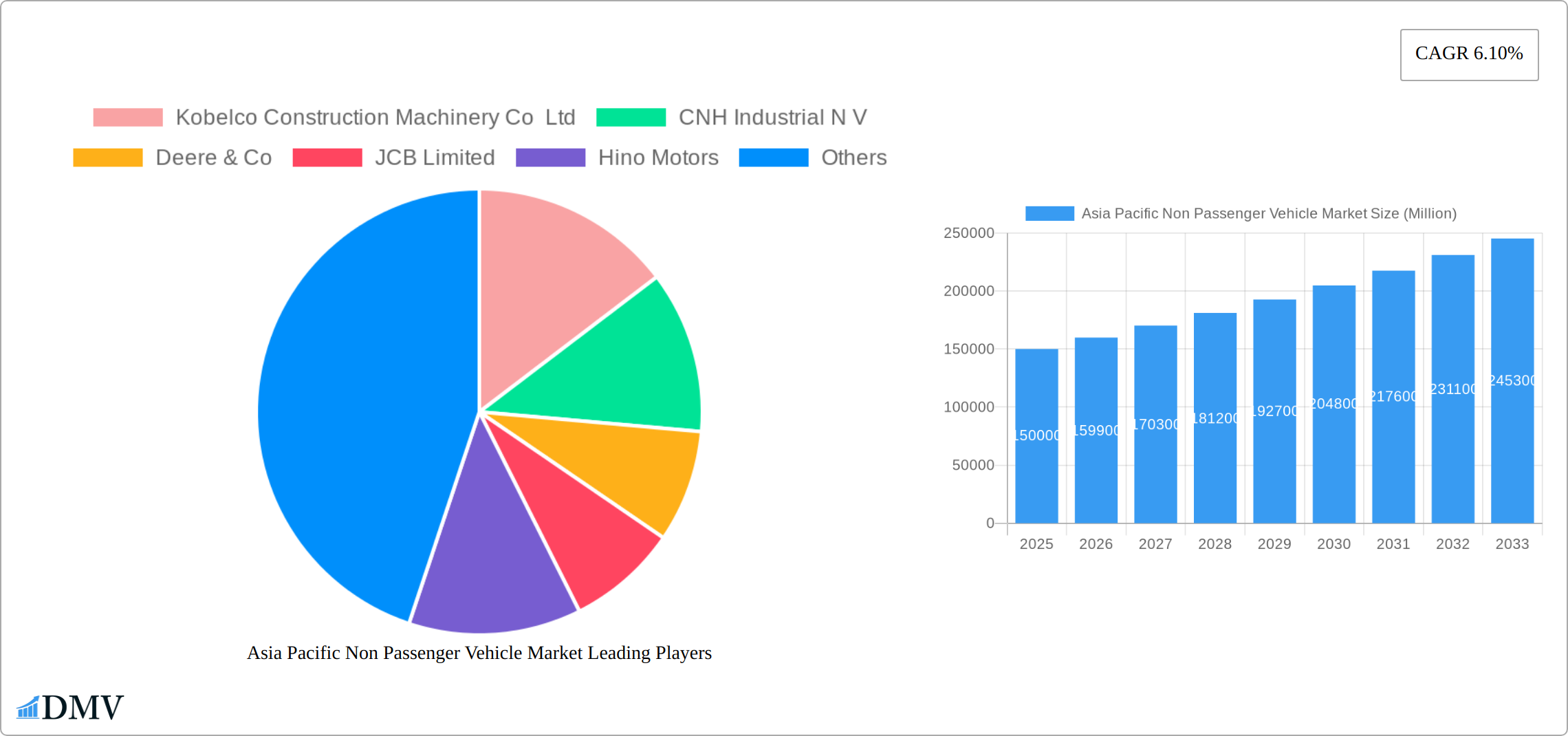

The Asia Pacific non-passenger vehicle market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.10% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region's booming construction and infrastructure development, particularly in rapidly developing economies like China and India, significantly increases demand for construction equipment, mining machinery, and heavy-duty trucks. Secondly, the agricultural sector's ongoing modernization and expansion, coupled with government initiatives promoting mechanized farming, boosts demand for agricultural machinery. Furthermore, the rising popularity of recreational vehicles and specialized vehicles like firetrucks and ambulances contributes to market growth. However, the market faces some restraints, including fluctuating raw material prices, stringent emission norms, and supply chain disruptions. The market segmentation reveals that construction equipment and mining machinery currently hold the largest market share, while the "others" segment exhibits promising future growth potential due to increasing urbanization and infrastructure investment. China and India are the key growth drivers within the Asia-Pacific region, followed by other countries experiencing rapid industrialization and economic growth. The competitive landscape features a mix of global giants and regional players, each vying for market dominance through technological innovation, strategic partnerships, and aggressive expansion strategies.

The forecast period (2025-2033) is expected to witness further diversification of the market. We anticipate increased adoption of electric and hybrid non-passenger vehicles driven by environmental concerns and governmental regulations. Technological advancements, such as automation and improved fuel efficiency, will also play a crucial role in shaping market dynamics. Specific segments like agricultural machinery could see particularly strong growth due to increasing food security concerns and technological advancements in precision farming. Competition is likely to intensify as companies invest in R&D and explore new markets. Companies will need to adapt to evolving customer needs and technological disruptions to maintain a competitive edge in this dynamic market.

Asia Pacific Non Passenger Vehicle Market: A Comprehensive Market Analysis (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific Non-Passenger Vehicle market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). The report delves into market dynamics, key players, technological advancements, and future growth potential, equipping stakeholders with the knowledge to navigate this rapidly evolving landscape. The market is projected to reach xx Million by 2033, driven by robust infrastructure development and increasing industrialization across the region.

Asia Pacific Non Passenger Vehicle Market Market Composition & Trends

The Asia Pacific Non-Passenger Vehicle market exhibits a moderately concentrated landscape, with key players like Caterpillar Inc, Komatsu, and Volvo Construction Equipment holding significant market share. However, the presence of several regional players and emerging startups fosters healthy competition. Innovation is primarily driven by the demand for enhanced efficiency, sustainability, and automation in various sectors. Stringent emission regulations across many APAC countries are pushing manufacturers to adopt cleaner technologies, while a growing focus on infrastructure projects fuels demand for construction and mining equipment. Substitute products, such as electric vehicles and autonomous systems, are slowly gaining traction, posing both challenges and opportunities. End-user profiles are diverse, encompassing construction companies, mining operators, agricultural businesses, and government entities. The market has witnessed several mergers and acquisitions (M&A) in recent years, with deal values totaling approximately xx Million in the last five years. These M&A activities indicate consolidation within the industry and a drive towards expansion into new markets and technologies.

- Market Share Distribution (2024): Caterpillar Inc (xx%), Komatsu (xx%), Volvo CE (xx%), Others (xx%)

- M&A Deal Values (2019-2024): Approximately xx Million

- Key Innovation Catalysts: Automation, Electrification, Improved Fuel Efficiency, Remote Operation Capabilities

- Regulatory Landscape: Stringent emission norms, safety regulations, and infrastructure development initiatives.

Asia Pacific Non Passenger Vehicle Market Industry Evolution

The Asia Pacific Non-Passenger Vehicle market has witnessed robust growth over the past few years, driven by a surge in infrastructure development, urbanization, and industrialization across the region. The market experienced a CAGR of xx% from 2019 to 2024, and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising investments in construction, mining, and agriculture sectors, coupled with increasing demand for heavy-duty trucks and specialized vehicles like firetrucks and ambulances. Technological advancements, such as the incorporation of advanced sensors, GPS systems, and telematics, are enhancing vehicle performance, efficiency, and safety. Shifting consumer demands towards sustainability are further driving the adoption of electric and hybrid vehicles. The increased adoption of autonomous systems in mining operations and construction projects represents a significant technological transformation currently unfolding.

Leading Regions, Countries, or Segments in Asia Pacific Non Passenger Vehicle Market

China remains the dominant region within the Asia Pacific Non-Passenger Vehicle market, accounting for xx% of the total market value in 2024, followed by India and Australia. This dominance is primarily attributed to robust infrastructure development, rapid industrialization, and significant investments in construction and mining projects.

Key Drivers for China's Dominance: Massive infrastructure projects, including Belt and Road Initiative investments; rapidly growing industrial sector; and a substantial domestic manufacturing base.

Construction Equipment: This segment represents the largest share within the Non-Passenger Vehicle market, driven by sustained infrastructure investment across the region and ongoing urbanization.

Mining Equipment: Demand is concentrated in countries with significant mining operations, such as Australia and Indonesia. The shift towards autonomous mining solutions fuels further growth.

Agricultural Machinery: High agricultural output in countries like India and China, coupled with increasing farm mechanization, are key growth factors.

Medium & Heavy-Duty Trucks: Rapid growth of e-commerce and the expansion of logistics networks drive demand in this segment.

Asia Pacific Non Passenger Vehicle Market Product Innovations

Recent innovations in the Asia Pacific Non-Passenger Vehicle market focus on enhancing efficiency, sustainability, and safety. Manufacturers are incorporating advanced technologies such as hybrid and electric powertrains, improved fuel-efficient engines, advanced driver-assistance systems (ADAS), and autonomous capabilities. These innovations not only address environmental concerns but also enhance productivity and operational efficiency for end-users, creating unique selling propositions that drive market adoption. Furthermore, the integration of telematics and data analytics allows for improved fleet management and predictive maintenance.

Propelling Factors for Asia Pacific Non Passenger Vehicle Market Growth

The Asia Pacific Non-Passenger Vehicle market growth is propelled by several factors, including substantial government investments in infrastructure projects, rising urbanization, growing agricultural production, and burgeoning industrial sectors. The increasing demand for efficient and sustainable solutions is driving innovation in vehicle technology, resulting in the adoption of advanced features such as electric and hybrid powertrains and autonomous capabilities. Favorable government policies promoting infrastructure development and technological advancements further bolster market growth.

Obstacles in the Asia Pacific Non Passenger Vehicle Market Market

Challenges facing the Asia Pacific Non-Passenger Vehicle market include fluctuating commodity prices, supply chain disruptions, and stringent emission regulations. These factors impact manufacturing costs and vehicle availability. Intense competition among established players and new entrants puts pressure on profit margins. Furthermore, navigating complex regulatory landscapes across diverse markets adds to the operational complexity. The pandemic-related lockdowns and global chip shortages have further aggravated the challenges, leading to xx% decrease in production during 2021.

Future Opportunities in Asia Pacific Non Passenger Vehicle Market

The Asia Pacific Non-Passenger Vehicle market presents significant future opportunities in the realms of electric and autonomous vehicles, the development of specialized vehicles for niche markets, and expansion into emerging economies. Growing adoption of precision agriculture technologies coupled with the increasing demand for specialized mining equipment in resource-rich countries represent promising avenues for future growth. Investments in smart infrastructure and the integration of connected vehicle technologies will further unlock potential market expansion.

Major Players in the Asia Pacific Non Passenger Vehicle Market Ecosystem

- Kobelco Construction Machinery Co Ltd

- CNH Industrial N V

- Deere & Co

- JCB Limited

- Hino Motors

- Kubota Corporation

- Mahindra & Mahindra

- Isuzu Motors Limited

- Liebherr Group

- Hitachi Construction Machinery Co Ltd

- Volvo Construction Equipment

- AGCO Corporation

- Caterpillar Inc

- Hyundai Construction Equipment

- Escorts Group

- Ivec

Key Developments in Asia Pacific Non Passenger Vehicle Market Industry

- May, 2022: Sany Bharat launched 22 new products during Excon 2022 in India, demonstrating strong focus on the local market.

- April, 2022: Manitowoc launched the Potain MCT 805, expanding its product portfolio in the Chinese market.

- June, 2022: Cummins Inc. and Komatsu Corp. collaborated to develop zero-emission mining haul trucks, signifying a significant step towards sustainable mining practices.

- August, 2022: Volvo CE announced the development of its Bengaluru, India facility into an export hub, indicating increased commitment to the Indian market and regional expansion.

Strategic Asia Pacific Non Passenger Vehicle Market Market Forecast

The Asia Pacific Non-Passenger Vehicle market is poised for significant growth driven by infrastructure development, industrialization, technological advancements, and favorable government policies. The increasing adoption of electric and autonomous vehicles, coupled with the expansion into new markets and the development of specialized vehicles, will further fuel market expansion in the coming years. The market is expected to witness a robust growth trajectory, reaching a projected value of xx Million by 2033, presenting lucrative opportunities for stakeholders.

Asia Pacific Non Passenger Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Construction Equipment

- 1.2. Mining Equipment

- 1.3. Agricultural Machinery

- 1.4. Medium & Heavy Duty Trucks

- 1.5. Others(Firetrucks, Ambulances, Recreational Boats)

-

2. Geography

-

2.1. Asia Pacific

- 2.1.1. China

- 2.1.2. Japan

- 2.1.3. India

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Rest of Asia-Pacific

-

2.1. Asia Pacific

Asia Pacific Non Passenger Vehicle Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

Asia Pacific Non Passenger Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric School Buses

- 3.3. Market Restrains

- 3.3.1. Uncertainty of The Global Pandemic

- 3.4. Market Trends

- 3.4.1. Rising Focus On Infrastructure Activities To Drive Demand In The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Construction Equipment

- 5.1.2. Mining Equipment

- 5.1.3. Agricultural Machinery

- 5.1.4. Medium & Heavy Duty Trucks

- 5.1.5. Others(Firetrucks, Ambulances, Recreational Boats)

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia Pacific

- 5.2.1.1. China

- 5.2.1.2. Japan

- 5.2.1.3. India

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Rest of Asia-Pacific

- 5.2.1. Asia Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Kobelco Construction Machinery Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CNH Industrial N V

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Deere & Co

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 JCB Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hino Motors

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Kubota Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mahindra & Mahindra

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Isuzu Motors Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Liebherr Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Hitachi Construction Machinery Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Volvo Construction Equipment

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 AGCO Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Caterpillar Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Hyundai Construction Equipment

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Escorts Group

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Ivec

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Kobelco Construction Machinery Co Ltd

List of Figures

- Figure 1: Asia Pacific Non Passenger Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Non Passenger Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Non Passenger Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Non Passenger Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Asia Pacific Non Passenger Vehicle Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia Pacific Non Passenger Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Non Passenger Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Non Passenger Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Asia Pacific Non Passenger Vehicle Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia Pacific Non Passenger Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Asia Pacific Non Passenger Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Non Passenger Vehicle Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Asia Pacific Non Passenger Vehicle Market?

Key companies in the market include Kobelco Construction Machinery Co Ltd, CNH Industrial N V, Deere & Co, JCB Limited, Hino Motors, Kubota Corporation, Mahindra & Mahindra, Isuzu Motors Limited, Liebherr Group, Hitachi Construction Machinery Co Ltd, Volvo Construction Equipment, AGCO Corporation, Caterpillar Inc, Hyundai Construction Equipment, Escorts Group, Ivec.

3. What are the main segments of the Asia Pacific Non Passenger Vehicle Market?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric School Buses.

6. What are the notable trends driving market growth?

Rising Focus On Infrastructure Activities To Drive Demand In The Market.

7. Are there any restraints impacting market growth?

Uncertainty of The Global Pandemic.

8. Can you provide examples of recent developments in the market?

August, 2022: Volvo CE announced to development of its manufacturing facility located in Bengaluru in India into an export hub. The company stated that this investment will allow Volvo Construction Equipment to produce medium-sized excavators at the plant. The company further stated that these machines will primarily be used in the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Non Passenger Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Non Passenger Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Non Passenger Vehicle Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Non Passenger Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence