Key Insights

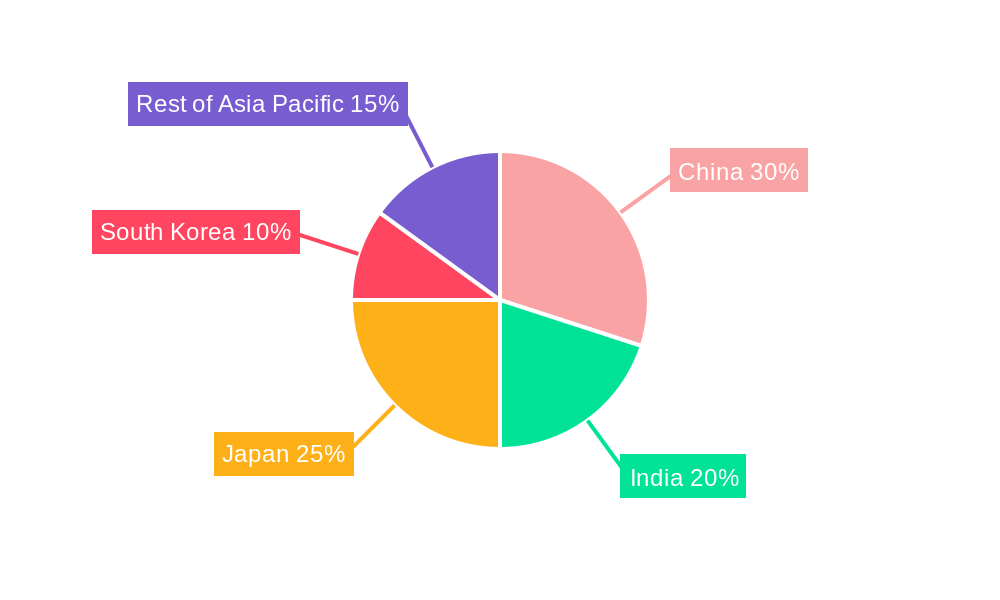

The Asia-Pacific healthcare analytics market is experiencing robust growth, driven by factors such as increasing adoption of electronic health records (EHRs), rising prevalence of chronic diseases, and government initiatives promoting digital health. The region's large and aging population, coupled with expanding healthcare infrastructure, fuels the demand for data-driven insights to improve patient care, optimize resource allocation, and enhance operational efficiency. The market is segmented by deployment (on-premise and cloud), application (clinical, financial, and operational/administrative data analytics), end-user (healthcare providers, pharmaceutical companies, biotech firms, and academic organizations), and country (with significant contributions from China, Japan, India, and South Korea). The cloud-based segment is expected to witness faster growth due to its scalability, cost-effectiveness, and accessibility. Clinical data analytics holds a significant market share, driven by the need for improved diagnosis, treatment planning, and personalized medicine. However, data security and privacy concerns, along with the high initial investment costs associated with implementing analytics solutions, pose challenges to market growth. Furthermore, the lack of skilled professionals in data analytics and interoperability issues among healthcare systems can hinder the wider adoption of healthcare analytics solutions.

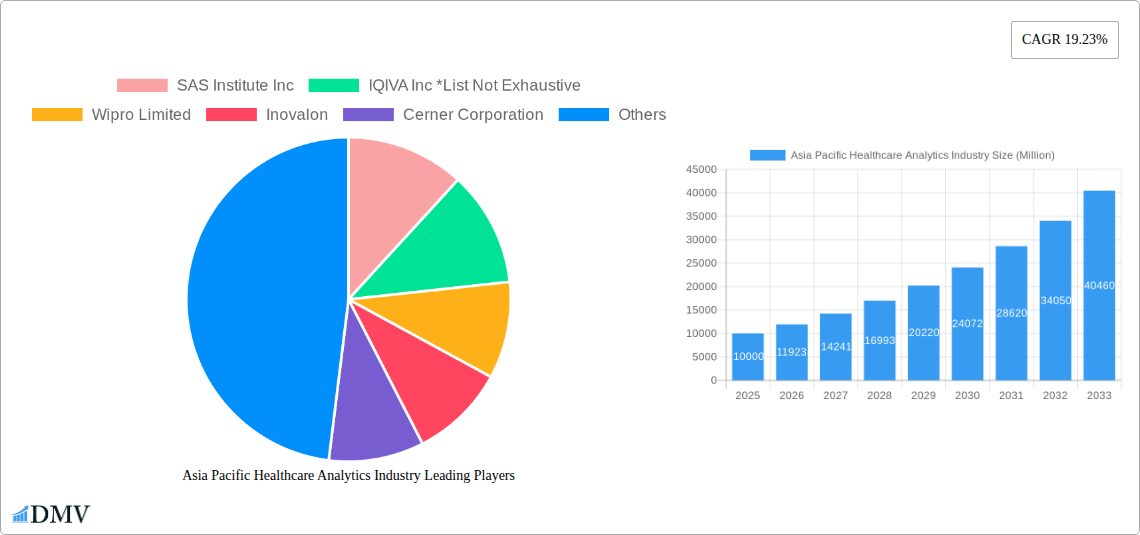

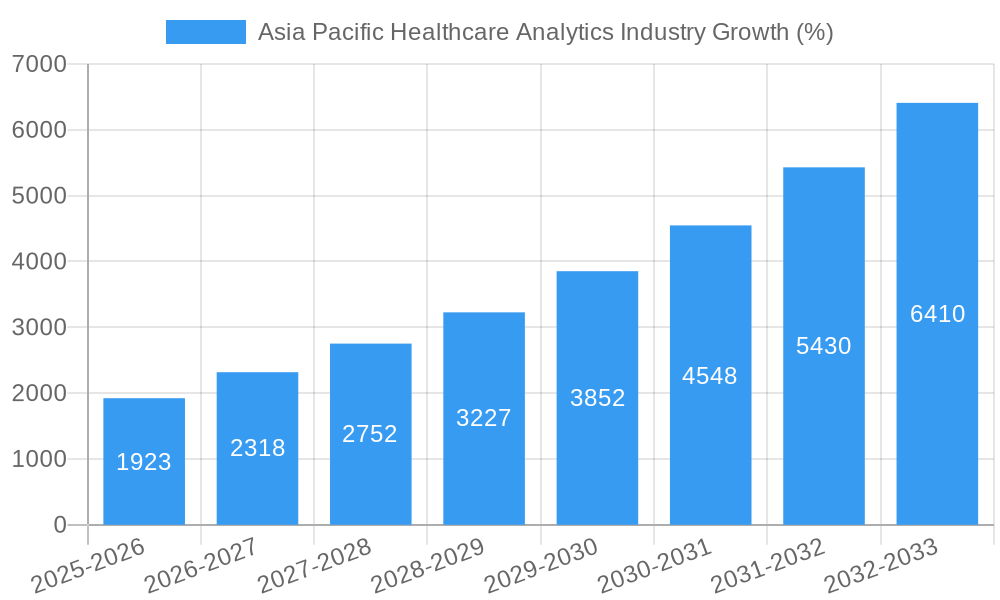

Given a 2025 market size (let's assume it's $10 billion based on typical market values for this sector and the provided CAGR), and a CAGR of 19.23%, the market is projected for substantial growth throughout the forecast period (2025-2033). The high CAGR reflects the increasing technological advancements, such as AI and machine learning integration within healthcare analytics, enhancing the analytical capabilities and driving market expansion. The competition among various established players and new entrants will likely intensify, leading to innovation and improved offerings in the years ahead. China and India are expected to be key growth drivers due to their large populations, burgeoning healthcare sectors, and growing investments in digital healthcare initiatives. However, variations in regulatory landscapes across different countries in the Asia-Pacific region might influence market growth differently in individual countries.

Asia Pacific Healthcare Analytics Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific healthcare analytics market, offering crucial insights for stakeholders seeking to understand its current state and future trajectory. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, and potential challenges. The market size is predicted to reach xx Million by 2033, showcasing significant growth potential.

Asia Pacific Healthcare Analytics Industry Market Composition & Trends

The Asia Pacific healthcare analytics market is characterized by a moderately concentrated landscape, with key players like SAS Institute Inc, IQIVA Inc, Wipro Limited, Inovalon, Cerner Corporation, Optum Inc, Health Catalyst, and McKesson Corporation vying for market share. The market exhibits strong innovation, driven by advancements in big data, artificial intelligence (AI), and cloud computing. Regulatory landscapes vary across countries, impacting data privacy and interoperability. Substitute products, such as traditional data analysis methods, pose a competitive threat, albeit a diminishing one. End-users are increasingly adopting analytics solutions to improve efficiency and patient outcomes.

- Market Share Distribution (2024): SAS Institute Inc (15%), IQVIA Inc (12%), Wipro Limited (8%), Others (65%) (Note: These figures are estimated)

- M&A Activity (2019-2024): A total of xx M&A deals valued at approximately xx Million have been recorded, indicating significant consolidation within the sector.

- Innovation Catalysts: AI, machine learning, cloud computing, and the rising adoption of connected devices are driving innovation.

- Regulatory Landscape: Data privacy regulations like GDPR and HIPAA, alongside country-specific regulations, are shaping market dynamics.

Asia Pacific Healthcare Analytics Industry Industry Evolution

The Asia Pacific healthcare analytics market has experienced significant growth over the historical period (2019-2024), fueled by increasing healthcare expenditure, rising adoption of electronic health records (EHRs), and government initiatives promoting digital health. The market is projected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by technological advancements like the implementation of predictive analytics and real-time data processing. This evolution is also shaped by changing consumer demands, with patients increasingly expecting personalized and efficient healthcare services. The increasing availability of affordable high-speed internet and the rise in smartphone penetration are also contributing factors. Specific growth trajectories vary across segments and countries.

Leading Regions, Countries, or Segments in Asia Pacific Healthcare Analytics Industry

- Dominant Region: China is projected to be the leading market due to its large population, increasing healthcare spending, and government initiatives promoting digital health.

- Dominant Country: While China leads in overall market size, India shows significant growth potential due to its expanding healthcare infrastructure and a growing IT sector.

- Dominant Segment (By Deployment): Cloud-based solutions are gaining traction due to scalability, cost-effectiveness, and ease of access.

- Dominant Segment (By Application): Clinical data analytics is currently the largest segment, driven by the need for improved diagnosis and treatment.

- Dominant Segment (By End-User): Healthcare providers represent the largest end-user segment, followed by the pharmaceutical and biotechnology industries.

Key Drivers:

- China: Government support for digital healthcare initiatives, massive healthcare expenditure increase.

- India: Growing IT sector, rising awareness of the benefits of data analytics in healthcare.

- Cloud-based solutions: Cost-effectiveness, scalability, and improved accessibility.

- Clinical data analytics: Critical for improved patient care, diagnostics, and treatment.

Asia Pacific Healthcare Analytics Industry Product Innovations

Recent innovations include the integration of AI and machine learning algorithms for predictive modeling and personalized medicine, as well as the development of cloud-based platforms that facilitate data sharing and collaboration across healthcare organizations. These innovations offer enhanced data visualization, improved accuracy in diagnosis and treatment, streamlined workflows, and substantial cost savings for healthcare providers. The unique selling propositions of these solutions include their ability to handle large and complex datasets, providing actionable insights that ultimately lead to better patient outcomes.

Propelling Factors for Asia Pacific Healthcare Analytics Industry Growth

Technological advancements in AI, machine learning, and big data analytics are key growth drivers. The increasing adoption of EHRs and the rising volume of healthcare data are fueling the demand for sophisticated analytics solutions. Favorable government policies and initiatives promoting digital health across the region also play a significant role. Economic factors such as rising healthcare expenditure and increasing insurance coverage contribute to market expansion.

Obstacles in the Asia Pacific Healthcare Analytics Industry Market

Data security and privacy concerns are major obstacles, along with the lack of standardization in data formats and interoperability challenges across different systems. High implementation costs and the need for specialized expertise can also limit adoption. Competitive pressures from established players and new entrants create a challenging market environment. Regulatory hurdles vary across the region and can hinder market penetration. Supply chain disruptions, though less pronounced than in other sectors, can still impact the timely availability of necessary hardware and software components.

Future Opportunities in Asia Pacific Healthcare Analytics Industry

Emerging opportunities exist in the development and adoption of predictive analytics for disease prevention, personalized medicine based on genomic data analysis, and the use of blockchain technology for secure data management. The expansion into rural and underserved areas, as well as the integration of wearables and IoT devices into healthcare analytics, presents significant growth potential. Further development of AI-powered solutions for disease prediction and treatment optimization will be key future opportunities.

Major Players in the Asia Pacific Healthcare Analytics Industry Ecosystem

- SAS Institute Inc

- IQIVA Inc

- Wipro Limited

- Inovalon

- Cerner Corporation

- Optum Inc

- Health Catalyst

- McKesson Corporation

Key Developments in Asia Pacific Healthcare Analytics Industry Industry

- March 2022: Optum, Inc. launched Optum Specialty Fusion, achieving potential 17% cost reductions in medical and pharmaceutical expenses.

- March 2022: Microsoft launched Azure Health Data Services, a cloud-based platform for efficient PHI management.

Strategic Asia Pacific Healthcare Analytics Industry Market Forecast

The Asia Pacific healthcare analytics market is poised for continued strong growth, driven by technological advancements, increasing healthcare expenditure, and government initiatives. The market's future potential lies in leveraging AI, cloud computing, and personalized medicine to improve healthcare delivery and outcomes. The ongoing focus on data security and interoperability will be crucial for sustained market expansion. The predicted market size of xx Million by 2033 reflects this substantial growth potential.

Asia Pacific Healthcare Analytics Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. Cloud

-

2. Application

- 2.1. Clinical Data Analytics

- 2.2. Financial Data Analytics

- 2.3. Operational/Administrative Data Analytics

-

3. End-User

- 3.1. Healthcare Provider

- 3.2. Pharmaceutical Industry

- 3.3. Biotechnology Industry

- 3.4. Academic Organization

Asia Pacific Healthcare Analytics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Healthcare Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements and Favorable Governemnt Initiatives; Emergence of Big Data in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. Cost and Complexity of Software; Data Integrity and Privacy Concerns; Lack of Proper Skilled Labors

- 3.4. Market Trends

- 3.4.1. Expanding IT sector and demand for improved medical services to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Clinical Data Analytics

- 5.2.2. Financial Data Analytics

- 5.2.3. Operational/Administrative Data Analytics

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Healthcare Provider

- 5.3.2. Pharmaceutical Industry

- 5.3.3. Biotechnology Industry

- 5.3.4. Academic Organization

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. China Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SAS Institute Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 IQIVA Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Wipro Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Inovalon

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cerner Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Optum Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Health Catalyst

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 McKesson Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 SAS Institute Inc

List of Figures

- Figure 1: Asia Pacific Healthcare Analytics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Healthcare Analytics Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 15: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Healthcare Analytics Industry?

The projected CAGR is approximately 19.23%.

2. Which companies are prominent players in the Asia Pacific Healthcare Analytics Industry?

Key companies in the market include SAS Institute Inc, IQIVA Inc *List Not Exhaustive, Wipro Limited, Inovalon, Cerner Corporation, Optum Inc, Health Catalyst, McKesson Corporation.

3. What are the main segments of the Asia Pacific Healthcare Analytics Industry?

The market segments include Deployment, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements and Favorable Governemnt Initiatives; Emergence of Big Data in the Healthcare Industry.

6. What are the notable trends driving market growth?

Expanding IT sector and demand for improved medical services to drive the market.

7. Are there any restraints impacting market growth?

Cost and Complexity of Software; Data Integrity and Privacy Concerns; Lack of Proper Skilled Labors.

8. Can you provide examples of recent developments in the market?

March 2022: Optum, Inc. has introduced Optum Specialty Fusion, a specialty drug management solution that simplifies treatment for those using certain medications and minimizes pharmaceutical expenditures. According to the company, which is part of UnitedHealth Group, the method has the potential to achieve 17% overall cost reductions in health plans' medical and pharmaceutical costs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Healthcare Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Healthcare Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Healthcare Analytics Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Healthcare Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence