Key Insights

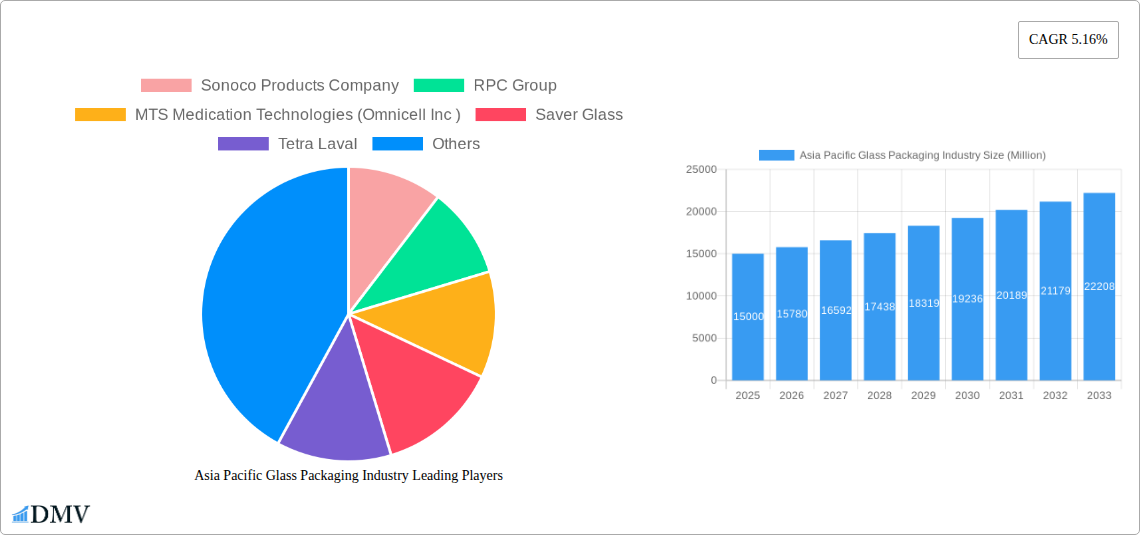

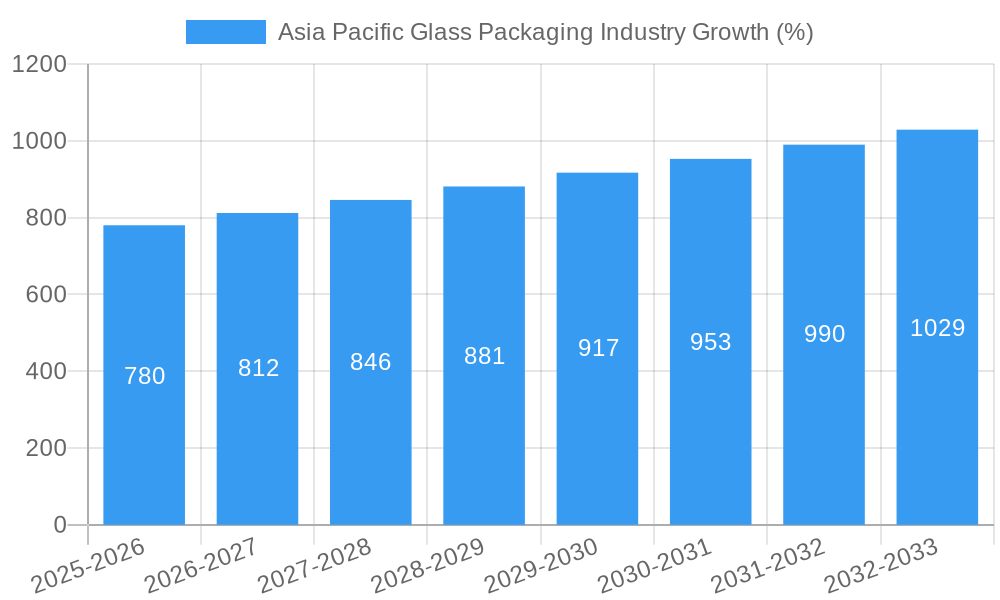

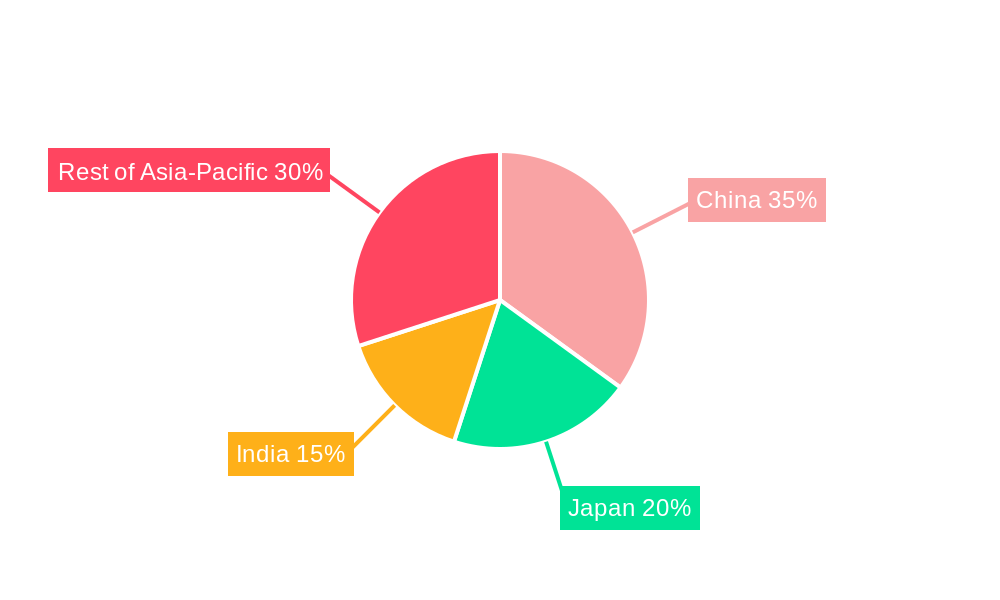

The Asia Pacific glass packaging market, exhibiting a robust CAGR of 5.16%, is poised for significant growth between 2025 and 2033. Driven by the increasing demand for sustainable and recyclable packaging solutions across diverse end-user industries, the market is experiencing a surge in popularity. The region's burgeoning food and beverage sector, coupled with the rising personal care and pharmaceutical industries, are key catalysts for this growth. China, Japan, and India are major contributors, representing a substantial portion of the overall market size. While factors like fluctuating raw material prices and the emergence of alternative packaging materials present challenges, the inherent benefits of glass – its inertness, recyclability, and brand-enhancing aesthetics – are countering these restraints. The market segmentation by product type (bottles, jars, caps, closures, etc.) reveals a strong demand across the board, with bottles and jars holding a dominant position. Key players like Sonoco Products Company, Amcor Ltd, and Gerresheimer AG are strategically expanding their manufacturing capabilities and product portfolios to cater to the growing market demands. Further growth is fueled by increasing consumer preference for premium, eco-friendly products, driving innovation in glass packaging design and functionality. The shift towards e-commerce is also creating opportunities for specialized glass packaging solutions, particularly for fragile goods.

The forecast period (2025-2033) anticipates sustained growth, driven by continued economic expansion, evolving consumer preferences, and government regulations promoting sustainability. Companies are focusing on enhancing their supply chain efficiency and adopting advanced technologies to meet the increasing demand while addressing environmental concerns. Strategic partnerships and mergers & acquisitions are expected to reshape the market landscape. While competition is intensifying, the inherent advantages of glass packaging ensure its continued relevance and growth prospects in the Asia Pacific region. The market will likely see further diversification of products and applications, leading to innovations in lightweighting, design, and functional features.

Asia Pacific Glass Packaging Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Asia Pacific glass packaging industry, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a base year of 2025, this research unveils market trends, competitive dynamics, and future growth projections, empowering informed decision-making. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Asia Pacific Glass Packaging Industry Market Composition & Trends

This section delves into the competitive landscape of the Asia Pacific glass packaging market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activity. We examine the market share distribution amongst key players and analyze the value of significant M&A deals. The report unveils the impact of regulatory changes on market dynamics and explores the influence of substitute packaging materials on market growth. A detailed profile of end-users across various sectors like food, beverage, pharmaceuticals, and personal care is also presented.

- Market Concentration: The Asia Pacific glass packaging market exhibits a moderately consolidated structure, with the top five players holding an estimated xx% market share in 2025.

- Innovation Catalysts: Sustainability concerns and increasing demand for premium packaging are driving innovation in lightweighting, eco-friendly materials, and advanced closure systems.

- Regulatory Landscape: Government regulations on recyclability and material composition significantly impact market dynamics, particularly in countries like China and Japan.

- Substitute Products: The rise of alternative packaging materials like plastic and metal poses a competitive challenge to glass, forcing innovation in sustainability and cost-effectiveness.

- M&A Activity: The report analyzes recent M&A deals, detailing the value of transactions and their impact on market consolidation and competitive dynamics. For example, in 2024, xx Million worth of deals were recorded.

Asia Pacific Glass Packaging Industry Industry Evolution

This section provides a comprehensive overview of the industry's evolution, tracing market growth trajectories, technological advancements, and the shift in consumer preferences from 2019 to 2024, and forecasting to 2033. We examine the adoption rate of new technologies and innovations, assessing their impact on market growth and production efficiency. This analysis incorporates historical data and future projections, providing a detailed picture of industry evolution. The market registered a CAGR of xx% from 2019 to 2024, driven by increasing demand from various end-use industries and technological advancements enabling lighter, more sustainable glass packaging. The forecast period (2025-2033) predicts continued growth at a CAGR of xx%, propelled by expanding consumer markets and sustained technological innovation.

Leading Regions, Countries, or Segments in Asia Pacific Glass Packaging Industry

This section identifies the dominant regions, countries, and segments within the Asia Pacific glass packaging market. Detailed analysis explores the key factors driving the dominance of these specific areas.

- By Product Type: Bottles and Jars constitute the largest segment, driven by high demand from the food and beverage industry.

- By End-user Industry: The food and beverage sector accounts for the largest share, followed by the pharmaceutical and personal care sectors.

- By Country: China dominates the market due to its large population, robust manufacturing base, and expanding consumer market. Japan and India are also significant markets with substantial growth potential. The "Rest of Asia-Pacific" region shows a steady growth trajectory.

Key Drivers:

- China: Strong economic growth, expanding middle class, and government support for infrastructure development.

- India: Rapid urbanization, increasing disposable incomes, and a growing preference for packaged goods.

- Japan: Established consumer markets, high-quality standards, and technological advancements in glass production.

Asia Pacific Glass Packaging Industry Product Innovations

Recent innovations in glass packaging focus on lightweighting, improved barrier properties, and enhanced design aesthetics. Advancements in furnace technology and automation have enabled greater efficiency and reduced production costs. Companies are increasingly focusing on sustainable packaging solutions, incorporating recycled glass content and developing easily recyclable designs. This emphasis on sustainability is shaping consumer preferences and driving market trends.

Propelling Factors for Asia Pacific Glass Packaging Industry Growth

Several factors are driving growth in the Asia Pacific glass packaging industry. These include:

- Technological advancements: Improvements in manufacturing processes, resulting in lighter, stronger, and more sustainable glass packaging.

- Economic growth: Rising disposable incomes and expanding middle class in developing economies are fueling demand for packaged goods.

- Regulatory changes: Government regulations promoting recyclability and sustainable packaging are impacting market dynamics.

Obstacles in the Asia Pacific Glass Packaging Industry Market

Despite significant growth potential, the Asia Pacific glass packaging industry faces several challenges:

- Supply chain disruptions: Global events and geopolitical factors can lead to raw material shortages and transportation delays.

- Regulatory hurdles: Varying regulations across different countries can increase compliance costs and complexity.

- Competitive pressures: Competition from alternative packaging materials like plastic and metal necessitates continuous innovation and cost optimization.

Future Opportunities in Asia Pacific Glass Packaging Industry

The Asia Pacific glass packaging industry presents several exciting future opportunities:

- Growth in e-commerce: The expansion of online retail is driving demand for tamper-evident and visually appealing packaging.

- Premiumization: Consumers' increasing preference for premium and sustainable products offers opportunities for high-value glass packaging.

- New applications: Expansion into new markets and applications, such as food delivery and personalized medicine, presents significant potential.

Major Players in the Asia Pacific Glass Packaging Industry Ecosystem

- Sonoco Products Company

- RPC Group

- MTS Medication Technologies (Omnicell Inc)

- Saver Glass

- Tetra Laval

- Bemis Company Inc

- Hindustan National Glass & Industries Ltd

- Gerresheimer AG

- Piramal Glass Company

- Amcor Ltd

Key Developments in Asia Pacific Glass Packaging Industry Industry

- November 2022: Weigand-Glass GmBH's Epice won the Trendtag Glas award for innovative glass bottle packaging.

- May 2022: Gerresheimer announced new, sustainable glass production facilities in India, aligned with its Formula G growth strategy.

Strategic Asia Pacific Glass Packaging Industry Market Forecast

The Asia Pacific glass packaging market is poised for sustained growth, driven by factors such as increasing demand from various end-use industries, technological advancements in sustainable and lightweight packaging, and rising consumer preference for premium and eco-friendly products. The market is expected to witness significant expansion in the coming years, with promising opportunities in emerging economies and new market segments. The continued focus on innovation and sustainability will be crucial for companies to thrive in this dynamic market.

Asia Pacific Glass Packaging Industry Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Caps and Closures

- 1.3. Trays and Containers

- 1.4. Vials

- 1.5. Labels

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Personal Care

- 2.4. Healthcare

- 2.5. Household Care

- 2.6. Pharmaceutical

- 2.7. Other End-user Industries

Asia Pacific Glass Packaging Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Glass Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.16% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Longer-lasting Packaging Products; Rising Demand for Sustainable and Innovative Food Packaging Products

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations

- 3.4. Market Trends

- 3.4.1. The Beverage Segment is Expected to Account for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Glass Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Caps and Closures

- 5.1.3. Trays and Containers

- 5.1.4. Vials

- 5.1.5. Labels

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Personal Care

- 5.2.4. Healthcare

- 5.2.5. Household Care

- 5.2.6. Pharmaceutical

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Glass Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Glass Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Glass Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Glass Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Glass Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Glass Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Glass Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Sonoco Products Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 RPC Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 MTS Medication Technologies (Omnicell Inc )

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Saver Glass

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tetra Laval

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Bemis Company Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hindustan National Glass & Industries Lt

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gerresheimer AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Piramal Glass Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Amcor Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Sonoco Products Company

List of Figures

- Figure 1: Asia Pacific Glass Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Glass Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Glass Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Glass Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia Pacific Glass Packaging Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Pacific Glass Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Glass Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Glass Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Asia Pacific Glass Packaging Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Asia Pacific Glass Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Glass Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Glass Packaging Industry?

The projected CAGR is approximately 5.16%.

2. Which companies are prominent players in the Asia Pacific Glass Packaging Industry?

Key companies in the market include Sonoco Products Company, RPC Group, MTS Medication Technologies (Omnicell Inc ), Saver Glass, Tetra Laval, Bemis Company Inc, Hindustan National Glass & Industries Lt, Gerresheimer AG, Piramal Glass Company, Amcor Ltd.

3. What are the main segments of the Asia Pacific Glass Packaging Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Longer-lasting Packaging Products; Rising Demand for Sustainable and Innovative Food Packaging Products.

6. What are the notable trends driving market growth?

The Beverage Segment is Expected to Account for Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations.

8. Can you provide examples of recent developments in the market?

November 2022 - Weigand-Glass GmBH announced that Epice won the Trendtag Glas award for harmonious packaging of the delicate glass bottle, emphasizing the quality of the contents and safely protecting the aroma-sensitive dried flowers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Glass Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Glass Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Glass Packaging Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Glass Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence