Key Insights

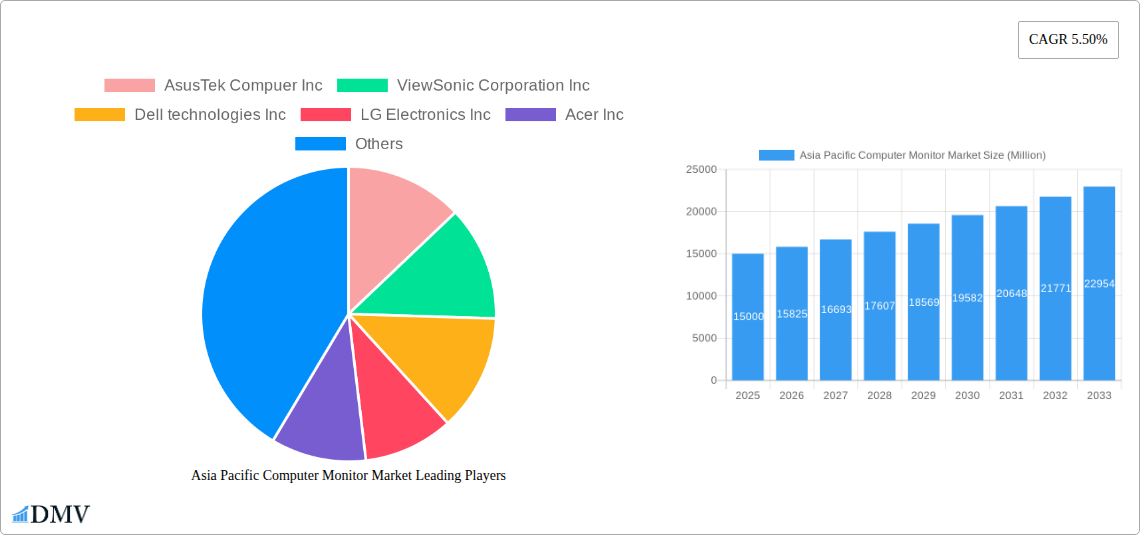

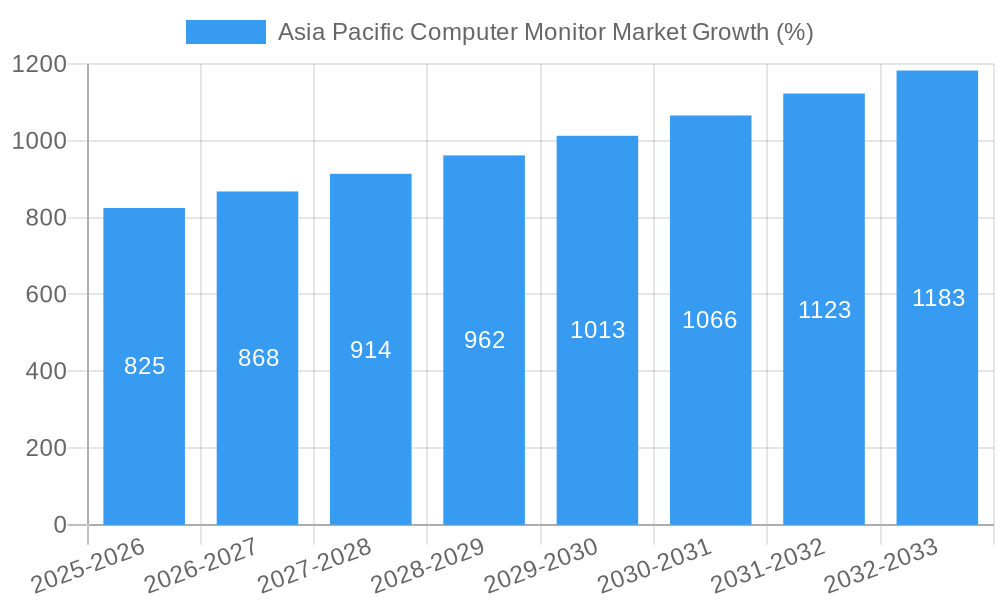

The Asia Pacific computer monitor market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.50% from 2025 to 2033. This growth is fueled by several key factors. The increasing adoption of high-resolution monitors, driven by the rising popularity of gaming and the expanding work-from-home trend, is a significant driver. Furthermore, the burgeoning demand for larger screen sizes, particularly in the commercial sector for improved productivity, and the consistent upgrade cycles within both consumer and business segments are contributing to market expansion. Technological advancements, such as the introduction of curved monitors, ultrawide displays, and monitors with improved color accuracy and refresh rates, are also stimulating demand. China, Japan, India, and South Korea are key regional contributors, reflecting the high concentration of technological hubs and a large consumer base within the Asia-Pacific region. While the market faces potential restraints like fluctuating component prices and economic uncertainties, the overall positive growth trajectory is expected to continue throughout the forecast period.

The market segmentation reveals a dynamic landscape. High-resolution monitors (1920x1080 and above) are experiencing the fastest growth, driven by premium gaming and professional applications. The consumer segment is a major contributor, followed by commercial applications in sectors like finance, design, and education. However, the commercial segment is showing stronger growth potential, spurred by the increasing adoption of sophisticated display technology to enhance workplace efficiency. While established players like AsusTek, ViewSonic, Dell, LG, Acer, Samsung, BenQ, HP, Lenovo, and Apple dominate the market, the emergence of niche players specializing in specific technologies and features presents competitive dynamics. The continued expansion of e-commerce and digital infrastructure further boosts market accessibility and ultimately fuels demand within the Asia-Pacific region. Strategic partnerships, technological innovations, and expansion into new markets remain crucial for sustained growth in the competitive landscape.

Asia Pacific Computer Monitor Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific computer monitor market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study delivers invaluable insights for stakeholders seeking to understand and capitalize on this dynamic market. The market size is projected to reach xx Million by 2033, presenting significant growth opportunities.

Asia Pacific Computer Monitor Market Composition & Trends

This section delves into the competitive landscape of the Asia Pacific computer monitor market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players such as AsusTek Computer Inc, ViewSonic Corporation Inc, Dell Technologies Inc, LG Electronics Inc, Acer Inc, Samsung Electronics Co Ltd, BenQ Corporation, HP Inc, Lenovo Group, and Apple Inc holding significant market share. Market share distribution varies across segments and countries.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Catalysts: Technological advancements such as mini-LED backlighting, higher refresh rates, and improved color accuracy are driving innovation.

- Regulatory Landscape: Government regulations related to energy efficiency and e-waste management impact market dynamics.

- Substitute Products: Large-screen televisions and tablets pose some competition to computer monitors.

- End-User Profiles: The market caters to a diverse range of end-users, including consumers, businesses, and gaming enthusiasts.

- M&A Activities: Several M&A deals have been observed in the past five years, with deal values ranging from xx Million to xx Million. These activities have contributed to market consolidation and technological advancements.

Asia Pacific Computer Monitor Market Industry Evolution

The Asia Pacific computer monitor market has witnessed substantial growth over the historical period (2019-2024). Driven by rising disposable incomes, increasing internet penetration, and the proliferation of remote work and online gaming, the market has experienced a Compound Annual Growth Rate (CAGR) of approximately xx% during this period. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace, due to market saturation in some segments. Technological advancements, such as the introduction of curved monitors, ultra-wide displays, and higher resolution screens, have significantly impacted consumer preferences. The shift towards larger screen sizes and improved display technologies has been a key driver of market evolution. The increasing adoption of 4K and higher resolutions is expected to continue shaping the market. Furthermore, growing demand for gaming monitors with high refresh rates and response times is a significant factor. The transition towards more sustainable and energy-efficient monitors is also a notable trend.

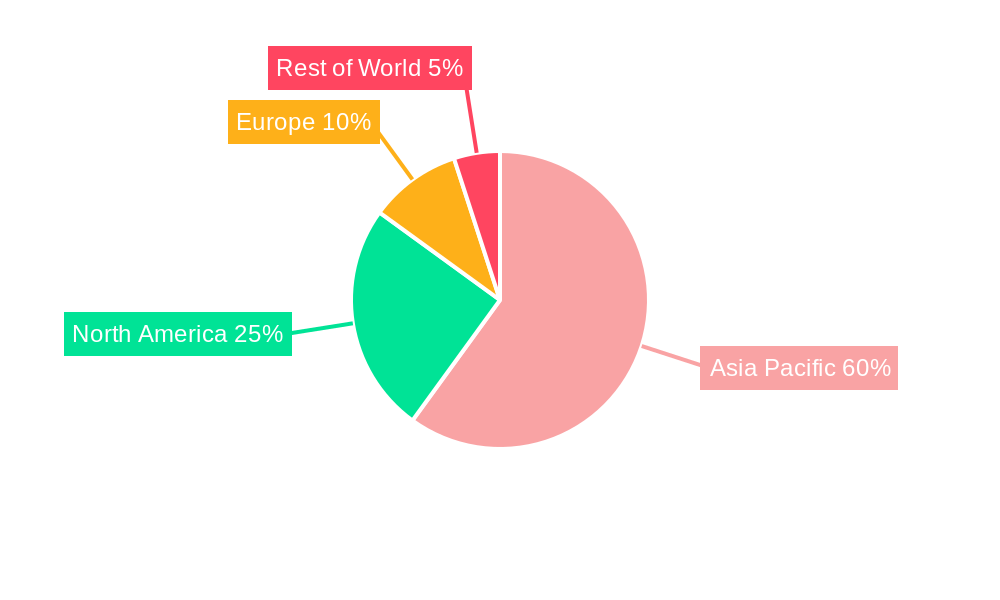

Leading Regions, Countries, or Segments in Asia Pacific Computer Monitor Market

China remains the dominant market in the Asia Pacific region, accounting for approximately xx% of the total market value in 2025. This dominance is primarily attributed to its large population, expanding middle class, and robust electronics manufacturing sector.

By Country:

- China: High demand from both consumers and businesses, strong domestic manufacturing capabilities.

- Japan: Mature market with high demand for high-quality monitors, particularly in corporate settings.

- India: Rapidly growing market driven by increasing disposable incomes and rising internet penetration.

- South Korea: Strong presence of electronics manufacturers, supporting domestic demand.

- Rest of Asia Pacific: Steady growth across various countries driven by expanding digital economies.

By Resolution: 1920x1080 (Full HD) remains the most popular resolution, capturing xx% of market share in 2025. However, higher resolutions like 2560x1440 (QHD) and 3840x2160 (4K) are experiencing rapid adoption due to their superior visual quality.

By Application: The consumer segment holds the largest market share, driven by the rising adoption of personal computers, laptops, and gaming consoles. The commercial segment also demonstrates considerable growth due to increasing corporate demand for high-quality displays. The gaming segment is rapidly expanding due to growing popularity of e-sports and online gaming.

Asia Pacific Computer Monitor Market Product Innovations

Recent years have witnessed significant product innovations in the Asia Pacific computer monitor market. Manufacturers are focusing on enhancing features such as higher resolutions (4K and beyond), HDR support, adaptive sync technologies (FreeSync and G-Sync), and curved displays to cater to evolving consumer demands. The introduction of mini-LED backlighting technology offers improved contrast ratios and local dimming capabilities, enhancing visual experience. Smart monitors with integrated speakers, webcams, and built-in smart features are gaining popularity. Furthermore, manufacturers are emphasizing sustainable designs using recycled materials and energy-efficient technologies.

Propelling Factors for Asia Pacific Computer Monitor Market Growth

The Asia Pacific computer monitor market is propelled by several factors. Rising disposable incomes, particularly in developing economies, are driving demand for electronic devices, including computer monitors. The increasing adoption of remote work, online education, and e-commerce fuels demand for high-quality displays. Technological advancements, such as improved resolution, refresh rates, and response times, attract consumers. Government initiatives promoting digitalization and infrastructure development further stimulate market growth. Furthermore, the rise of e-sports and online gaming significantly boosts the demand for high-performance gaming monitors.

Obstacles in the Asia Pacific Computer Monitor Market

Despite the growth potential, the market faces several challenges. Supply chain disruptions and component shortages impact production and pricing. Intense competition among manufacturers leads to price wars and margin pressures. Fluctuations in raw material costs affect profitability. Moreover, regulatory changes related to environmental standards and import/export regulations can pose barriers to market entry and expansion.

Future Opportunities in Asia Pacific Computer Monitor Market

The future holds significant opportunities for growth. The adoption of innovative display technologies, such as OLED and micro-LED, offers higher contrast ratios and better color reproduction. Demand for curved, ultrawide, and foldable monitors is expected to rise. The increasing focus on ergonomic designs and health-conscious features, such as eye-care technologies, presents opportunities for manufacturers. Expanding into underserved markets across the Asia Pacific region and catering to specific niche applications, such as healthcare and industrial settings, offers further growth potential.

Major Players in the Asia Pacific Computer Monitor Market Ecosystem

- AsusTek Computer Inc

- ViewSonic Corporation Inc

- Dell Technologies Inc

- LG Electronics Inc

- Acer Inc

- Samsung Electronics Co Ltd

- BenQ Corporation

- HP Inc

- Lenovo Group

- Apple Inc

Key Developments in Asia Pacific Computer Monitor Market Industry

- February 2022: Lenovo announced the latest additions to its ThinkPad laptops and ThinkVision monitor portfolios in Singapore, including the ThinkVision M14-D mobile USB-C monitor. This launch demonstrates Lenovo’s commitment to innovation in the portable monitor segment.

- March 2022: Samsung Electronics announced the M8, a new stylish smart monitor series, highlighting the growing trend of smart monitors with integrated features.

Strategic Asia Pacific Computer Monitor Market Forecast

The Asia Pacific computer monitor market is poised for continued growth over the forecast period (2025-2033). Technological innovation, increasing demand from various applications (gaming, commercial, and consumer), and expanding markets will drive market expansion. While challenges remain in terms of supply chain stability and competition, the long-term outlook remains positive, with significant opportunities for companies that can adapt to evolving consumer preferences and technological advancements. The market is expected to witness a CAGR of xx% during this period, reaching a market value of xx Million by 2033.

Asia Pacific Computer Monitor Market Segmentation

-

1. Resolution

- 1.1. 1366x768

- 1.2. 1920x1080

- 1.3. 1534x864

- 1.4. 1440x900

- 1.5. 1280x720

- 1.6. Other Resolutions

-

2. Application

- 2.1. Consumer and Commercial

- 2.2. Gaming

Asia Pacific Computer Monitor Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Computer Monitor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Technologies and Proliferation of Internet Users is Driving the Market; Increased Adoption of Gaming

- 3.3. Market Restrains

- 3.3.1. Data security concerns

- 3.4. Market Trends

- 3.4.1. Gaming to Have a Significant Growth in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Computer Monitor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resolution

- 5.1.1. 1366x768

- 5.1.2. 1920x1080

- 5.1.3. 1534x864

- 5.1.4. 1440x900

- 5.1.5. 1280x720

- 5.1.6. Other Resolutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer and Commercial

- 5.2.2. Gaming

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Resolution

- 6. China Asia Pacific Computer Monitor Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Computer Monitor Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Computer Monitor Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Computer Monitor Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Computer Monitor Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Computer Monitor Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Computer Monitor Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 AsusTek Compuer Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ViewSonic Corporation Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Dell technologies Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LG Electronics Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Acer Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Samsung Electronics Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BenQ Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 HP Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lenovo Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Apple Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 AsusTek Compuer Inc

List of Figures

- Figure 1: Asia Pacific Computer Monitor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Computer Monitor Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Computer Monitor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Computer Monitor Market Revenue Million Forecast, by Resolution 2019 & 2032

- Table 3: Asia Pacific Computer Monitor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Computer Monitor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Computer Monitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Computer Monitor Market Revenue Million Forecast, by Resolution 2019 & 2032

- Table 14: Asia Pacific Computer Monitor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Asia Pacific Computer Monitor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Computer Monitor Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Computer Monitor Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Asia Pacific Computer Monitor Market?

Key companies in the market include AsusTek Compuer Inc, ViewSonic Corporation Inc , Dell technologies Inc, LG Electronics Inc, Acer Inc, Samsung Electronics Co Ltd, BenQ Corporation, HP Inc, Lenovo Group, Apple Inc.

3. What are the main segments of the Asia Pacific Computer Monitor Market?

The market segments include Resolution, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Technologies and Proliferation of Internet Users is Driving the Market; Increased Adoption of Gaming.

6. What are the notable trends driving market growth?

Gaming to Have a Significant Growth in the Region.

7. Are there any restraints impacting market growth?

Data security concerns.

8. Can you provide examples of recent developments in the market?

February 2022 - Lenovo announced the latest additions to its ThinkPad laptops and ThinkVision monitor portfolios in Singapore. The new ThinkVision M14-D mobile USB-C monitor, weighing less than 1.3 pounds, provides a super narrow bezel 14-inch 16:10 aspect ratio display with high resolution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Computer Monitor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Computer Monitor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Computer Monitor Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Computer Monitor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence