Key Insights

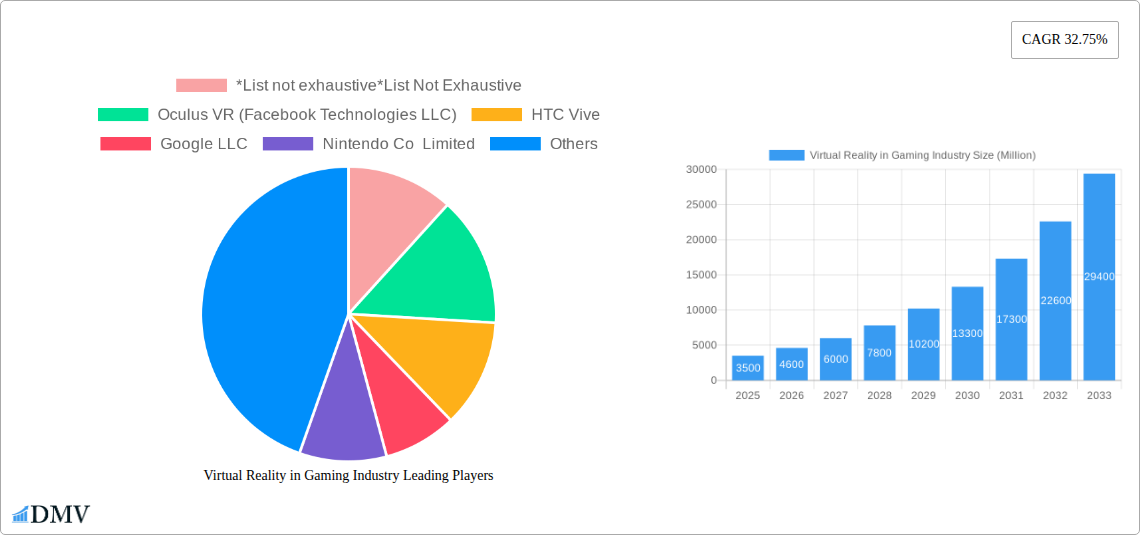

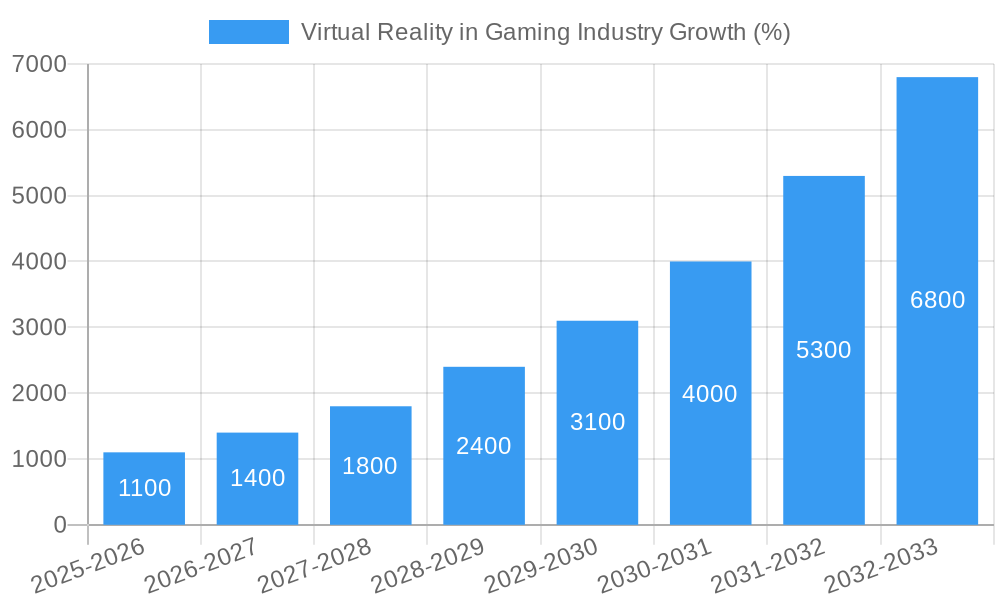

The Virtual Reality (VR) in gaming market is experiencing explosive growth, driven by advancements in technology, decreasing hardware costs, and the increasing popularity of immersive gaming experiences. The market, currently valued in the billions (a precise figure requires more data, but considering a CAGR of 32.75% and a substantial base year, a reasonable estimation places it in the multi-billion dollar range in 2025), is projected to maintain a high compound annual growth rate (CAGR) of approximately 30% through 2033. This significant expansion is fueled by several key factors: the release of more affordable and accessible VR headsets, the development of high-quality VR gaming software and experiences, and the expanding adoption of VR technology across various gaming platforms including PC, standalone headsets, consoles, and even mobile devices. The increasing sophistication of VR technology allows for more realistic and engaging gaming interactions, further driving market growth. While challenges remain, such as the need for higher processing power and the potential for motion sickness in some users, ongoing innovations continually address these limitations. The market is segmented by VR type (PC, standalone, console, mobile) and application (hardware and software), with each segment showing strong growth potential. Major players like Oculus VR, HTC Vive, and others are constantly innovating, fostering a competitive landscape that benefits consumers.

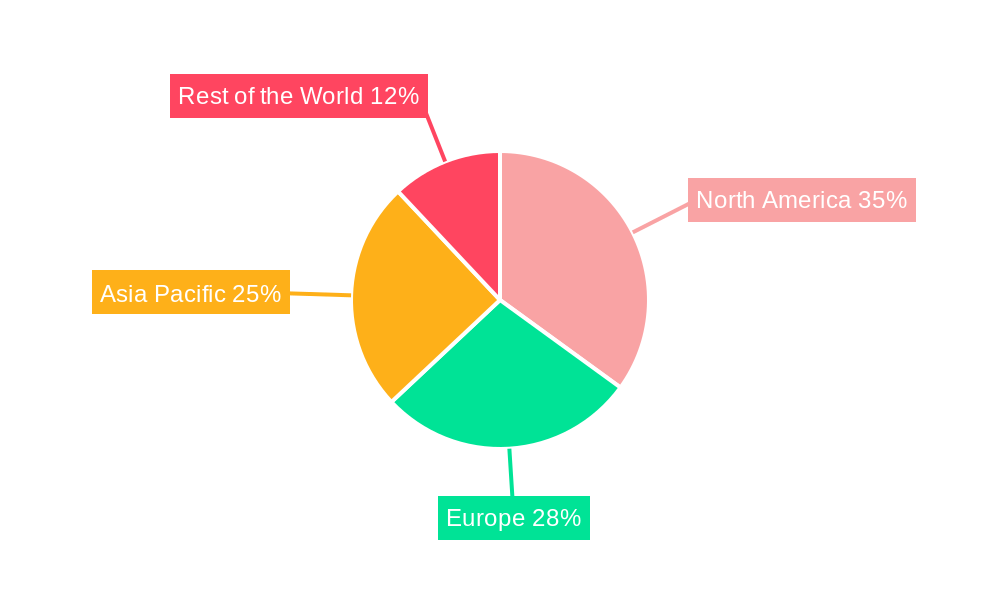

The regional distribution of the VR gaming market reflects global trends in technology adoption. North America and Europe currently hold a larger market share due to early adoption and higher disposable incomes. However, the Asia-Pacific region is poised for significant expansion given its burgeoning gaming market and rapidly increasing smartphone penetration. The sustained high CAGR indicates a strong future outlook for the VR gaming industry, fueled by technological innovation, wider market accessibility, and the ongoing development of engaging and immersive gaming experiences. The continuous development of advanced VR hardware and software, along with a growing user base, ensures the long-term growth trajectory of the VR gaming sector. This continuous evolution positions the VR gaming market for continued success in the coming years.

Virtual Reality in Gaming Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Virtual Reality (VR) gaming market, projecting a market value exceeding $XX Million by 2033. We delve into market composition, technological advancements, key players, and future growth opportunities, offering invaluable insights for stakeholders across the VR gaming ecosystem. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024.

Virtual Reality in Gaming Industry Market Composition & Trends

This section evaluates the competitive landscape of the VR gaming market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user demographics. We examine M&A activities, quantifying deal values in Millions and providing insights into market share distribution amongst key players. The analysis reveals a dynamic market with significant consolidation through M&A, valued at over $XX Million in the period 2019-2024. Leading companies, including Oculus VR (Facebook Technologies LLC), HTC Vive, Google LLC, and others, are aggressively pursuing innovation, driving market growth. Regulatory landscapes vary across regions, impacting market entry and growth trajectory. The emergence of alternative gaming technologies and the changing preferences of gamers influence market dynamics.

- Market Share Distribution (2024): Oculus VR: XX%; HTC Vive: XX%; Google: XX%; Others: XX%

- M&A Deal Value (2019-2024): $XX Million

- Key Innovation Catalysts: Enhanced graphics processing, haptic feedback improvements, advancements in motion tracking, and the development of more immersive VR experiences.

- Significant Substitutes: Augmented Reality (AR) gaming, traditional console/PC gaming.

Virtual Reality in Gaming Industry Industry Evolution

This section charts the evolution of the VR gaming industry, exploring market growth trajectories, technological breakthroughs, and evolving consumer preferences. The market demonstrated robust growth between 2019 and 2024, achieving a Compound Annual Growth Rate (CAGR) of XX%. Technological advancements, such as higher-resolution displays, improved processing power, and more comfortable headsets, have fueled market expansion. Consumer demand has shifted toward more realistic and immersive VR experiences, driving the development of advanced software and hardware. Adoption metrics indicate an increasing number of gamers embracing VR technology, fostering industry growth and innovation. The market is expected to continue its upward trajectory, reaching $XX Million by 2033.

Leading Regions, Countries, or Segments in Virtual Reality in Gaming Industry

This section identifies the leading regions, countries, and segments within the VR gaming market. Analysis across segments (By VR Type: PC, Stand-alone, Console, Cartridges, Premium Mobile; By VR in Gaming: Hardware, Software) reveals the dominant players and key growth drivers.

By VR Type: The Stand-alone segment is projected to hold the largest market share by 2033, driven by affordability and accessibility.

By VR in Gaming: The Hardware segment currently dominates, but the Software segment is poised for significant growth due to increasing demand for high-quality VR games and experiences.

- Key Drivers (North America): High disposable income, strong technological infrastructure, early adoption of new technologies.

- Key Drivers (Asia-Pacific): Rapid technological advancements, increasing smartphone penetration, growing investment in VR gaming infrastructure.

- Dominance Factors: Strong consumer demand for immersive gaming experiences, continuous technological advancements leading to improved hardware and software, and favorable regulatory environments in some key regions.

Virtual Reality in Gaming Industry Product Innovations

Recent product innovations have focused on improving immersion, comfort, and user experience. Advancements include higher-resolution displays, improved tracking systems, and haptic feedback technology that enhance the realism and engagement of VR games. Unique selling propositions include lightweight headsets, enhanced field of view, and intuitive user interfaces designed to minimize motion sickness. These advancements are significantly impacting the user experience, driving adoption and market expansion.

Propelling Factors for Virtual Reality in Gaming Industry Growth

Several factors contribute to the VR gaming market's growth. Technological advancements, including improvements in processing power, display resolution, and tracking accuracy, are major drivers. Economic factors like rising disposable incomes in key markets contribute to increased consumer spending on gaming products. Moreover, supportive regulatory environments in certain regions facilitate market expansion. For example, government initiatives and investments in VR technology are creating a favorable climate for industry growth.

Obstacles in the Virtual Reality in Gaming Industry Market

The VR gaming market faces several challenges. High initial investment costs for hardware can be a barrier for entry for consumers. Supply chain disruptions and component shortages can impact production and market availability. Furthermore, intense competition from established players and emerging rivals creates pressure on pricing and market share. These factors can collectively impact overall market growth and expansion.

Future Opportunities in Virtual Reality in Gaming Industry

Emerging opportunities in the VR gaming market include the expansion into new geographic markets, particularly in developing economies with rising disposable incomes. Further technological innovation, such as the integration of artificial intelligence (AI) and advanced haptic feedback, will significantly enhance the user experience. Furthermore, evolving consumer trends towards more social and interactive gaming experiences will drive growth in this sector.

Major Players in the Virtual Reality in Gaming Industry Ecosystem

- Oculus VR (Facebook Technologies LLC)

- HTC Vive

- Google LLC

- Nintendo Co Limited

- Virtuix Omni

- Microsoft Corporation

- Valve Corporation

- Samsung Corporation

- Intel Corporation

Key Developments in Virtual Reality in Gaming Industry Industry

- November 2022: Meta launched the XTADIUM app on Meta Quest, offering 180-degree VR sports viewing experiences, expanding the application of VR beyond gaming.

- October 2022: Microsoft partnered with Meta to integrate Microsoft's productivity tools into VR headsets, potentially blurring lines between work and VR gaming experiences, influencing adoption and market expansion.

Strategic Virtual Reality in Gaming Industry Market Forecast

The VR gaming market is poised for significant growth driven by continuous technological innovation, rising consumer demand for immersive experiences, and expansion into new geographic markets. The forecast for 2025-2033 anticipates a robust CAGR, pushing the market value to $XX Million by 2033. This growth will be fueled by the convergence of gaming and other sectors, like entertainment and education. The market's future hinges on the ability of key players to deliver innovative products that meet evolving consumer expectations and address technological challenges.

Virtual Reality in Gaming Industry Segmentation

-

1. VR Type

- 1.1. PC

- 1.2. Stand-alone

- 1.3. Console

- 1.4. Cartridges

- 1.5. Premium Mobile

-

2. VR in Gaming

- 2.1. Hardware

- 2.2. Software

Virtual Reality in Gaming Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of The World

Virtual Reality in Gaming Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 32.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Availability of Compelling and Theme-based Games in the VR Format; Millennial and High-income Groups to Drive Adoption in the Near and Medium-term; Premium Mobile Platform Contributing to the Growth of Market

- 3.3. Market Restrains

- 3.3.1. Threshold Related to Visual and Auditory Aspects | High Demand for Mobile AR Gaming

- 3.4. Market Trends

- 3.4.1. Premium Mobile Platform Contributing to the Growth of Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by VR Type

- 5.1.1. PC

- 5.1.2. Stand-alone

- 5.1.3. Console

- 5.1.4. Cartridges

- 5.1.5. Premium Mobile

- 5.2. Market Analysis, Insights and Forecast - by VR in Gaming

- 5.2.1. Hardware

- 5.2.2. Software

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of The World

- 5.1. Market Analysis, Insights and Forecast - by VR Type

- 6. North America Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by VR Type

- 6.1.1. PC

- 6.1.2. Stand-alone

- 6.1.3. Console

- 6.1.4. Cartridges

- 6.1.5. Premium Mobile

- 6.2. Market Analysis, Insights and Forecast - by VR in Gaming

- 6.2.1. Hardware

- 6.2.2. Software

- 6.1. Market Analysis, Insights and Forecast - by VR Type

- 7. Europe Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by VR Type

- 7.1.1. PC

- 7.1.2. Stand-alone

- 7.1.3. Console

- 7.1.4. Cartridges

- 7.1.5. Premium Mobile

- 7.2. Market Analysis, Insights and Forecast - by VR in Gaming

- 7.2.1. Hardware

- 7.2.2. Software

- 7.1. Market Analysis, Insights and Forecast - by VR Type

- 8. Asia Pacific Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by VR Type

- 8.1.1. PC

- 8.1.2. Stand-alone

- 8.1.3. Console

- 8.1.4. Cartridges

- 8.1.5. Premium Mobile

- 8.2. Market Analysis, Insights and Forecast - by VR in Gaming

- 8.2.1. Hardware

- 8.2.2. Software

- 8.1. Market Analysis, Insights and Forecast - by VR Type

- 9. Rest of The World Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by VR Type

- 9.1.1. PC

- 9.1.2. Stand-alone

- 9.1.3. Console

- 9.1.4. Cartridges

- 9.1.5. Premium Mobile

- 9.2. Market Analysis, Insights and Forecast - by VR in Gaming

- 9.2.1. Hardware

- 9.2.2. Software

- 9.1. Market Analysis, Insights and Forecast - by VR Type

- 10. North America Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of The World Virtual Reality in Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 *List not exhaustive*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Oculus VR (Facebook Technologies LLC)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 HTC Vive

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Google LLC

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Nintendo Co Limited

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Virtuix Omni

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Microsoft Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Valve Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Samsung Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Intel Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 *List not exhaustive*List Not Exhaustive

List of Figures

- Figure 1: Global Virtual Reality in Gaming Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Virtual Reality in Gaming Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Virtual Reality in Gaming Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Virtual Reality in Gaming Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Virtual Reality in Gaming Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Virtual Reality in Gaming Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Virtual Reality in Gaming Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of The World Virtual Reality in Gaming Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of The World Virtual Reality in Gaming Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Virtual Reality in Gaming Industry Revenue (Million), by VR Type 2024 & 2032

- Figure 11: North America Virtual Reality in Gaming Industry Revenue Share (%), by VR Type 2024 & 2032

- Figure 12: North America Virtual Reality in Gaming Industry Revenue (Million), by VR in Gaming 2024 & 2032

- Figure 13: North America Virtual Reality in Gaming Industry Revenue Share (%), by VR in Gaming 2024 & 2032

- Figure 14: North America Virtual Reality in Gaming Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Virtual Reality in Gaming Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Virtual Reality in Gaming Industry Revenue (Million), by VR Type 2024 & 2032

- Figure 17: Europe Virtual Reality in Gaming Industry Revenue Share (%), by VR Type 2024 & 2032

- Figure 18: Europe Virtual Reality in Gaming Industry Revenue (Million), by VR in Gaming 2024 & 2032

- Figure 19: Europe Virtual Reality in Gaming Industry Revenue Share (%), by VR in Gaming 2024 & 2032

- Figure 20: Europe Virtual Reality in Gaming Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Virtual Reality in Gaming Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Virtual Reality in Gaming Industry Revenue (Million), by VR Type 2024 & 2032

- Figure 23: Asia Pacific Virtual Reality in Gaming Industry Revenue Share (%), by VR Type 2024 & 2032

- Figure 24: Asia Pacific Virtual Reality in Gaming Industry Revenue (Million), by VR in Gaming 2024 & 2032

- Figure 25: Asia Pacific Virtual Reality in Gaming Industry Revenue Share (%), by VR in Gaming 2024 & 2032

- Figure 26: Asia Pacific Virtual Reality in Gaming Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Virtual Reality in Gaming Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of The World Virtual Reality in Gaming Industry Revenue (Million), by VR Type 2024 & 2032

- Figure 29: Rest of The World Virtual Reality in Gaming Industry Revenue Share (%), by VR Type 2024 & 2032

- Figure 30: Rest of The World Virtual Reality in Gaming Industry Revenue (Million), by VR in Gaming 2024 & 2032

- Figure 31: Rest of The World Virtual Reality in Gaming Industry Revenue Share (%), by VR in Gaming 2024 & 2032

- Figure 32: Rest of The World Virtual Reality in Gaming Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of The World Virtual Reality in Gaming Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR Type 2019 & 2032

- Table 3: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR in Gaming 2019 & 2032

- Table 4: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Virtual Reality in Gaming Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Virtual Reality in Gaming Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Virtual Reality in Gaming Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Virtual Reality in Gaming Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR Type 2019 & 2032

- Table 14: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR in Gaming 2019 & 2032

- Table 15: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR Type 2019 & 2032

- Table 17: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR in Gaming 2019 & 2032

- Table 18: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR Type 2019 & 2032

- Table 20: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR in Gaming 2019 & 2032

- Table 21: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR Type 2019 & 2032

- Table 23: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by VR in Gaming 2019 & 2032

- Table 24: Global Virtual Reality in Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Reality in Gaming Industry?

The projected CAGR is approximately 32.75%.

2. Which companies are prominent players in the Virtual Reality in Gaming Industry?

Key companies in the market include *List not exhaustive*List Not Exhaustive, Oculus VR (Facebook Technologies LLC), HTC Vive, Google LLC, Nintendo Co Limited, Virtuix Omni, Microsoft Corporation, Valve Corporation, Samsung Corporation, Intel Corporation.

3. What are the main segments of the Virtual Reality in Gaming Industry?

The market segments include VR Type, VR in Gaming.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Availability of Compelling and Theme-based Games in the VR Format; Millennial and High-income Groups to Drive Adoption in the Near and Medium-term; Premium Mobile Platform Contributing to the Growth of Market.

6. What are the notable trends driving market growth?

Premium Mobile Platform Contributing to the Growth of Market.

7. Are there any restraints impacting market growth?

Threshold Related to Visual and Auditory Aspects | High Demand for Mobile AR Gaming.

8. Can you provide examples of recent developments in the market?

Nov 2022: Meta launched the XTADIUM app on Meta Quest, bringing the customers closer to their favorite sports in 180-degree VR.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virtual Reality in Gaming Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virtual Reality in Gaming Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virtual Reality in Gaming Industry?

To stay informed about further developments, trends, and reports in the Virtual Reality in Gaming Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence