Key Insights

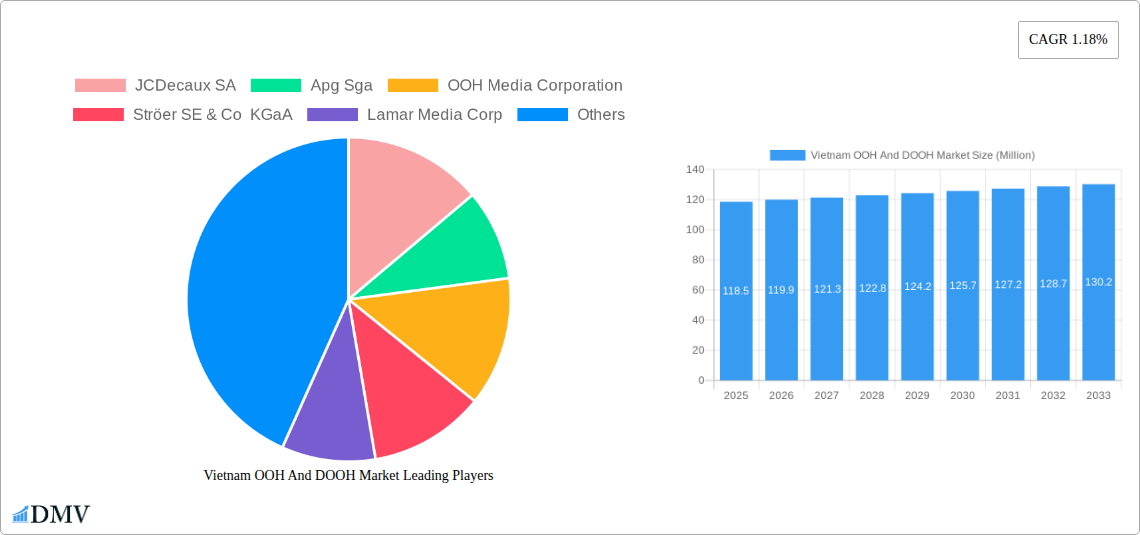

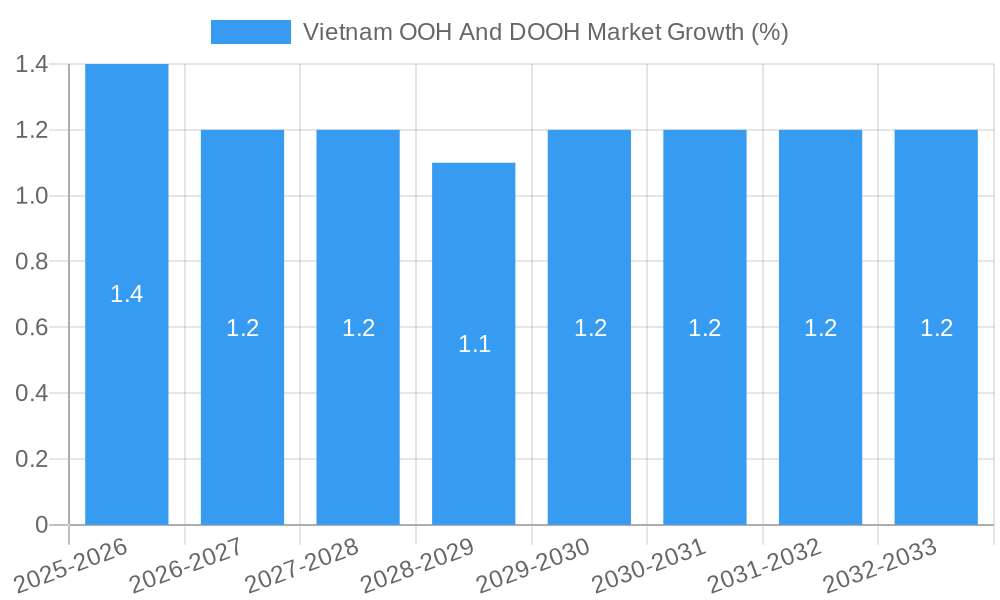

The Vietnam Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, valued at $118.5 million in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 1.18% from 2025 to 2033. This moderate growth reflects a maturing market, where traditional OOH remains significant, but is gradually being supplemented by the increasing adoption of DOOH technologies. Drivers for market expansion include rising urbanization, increased disposable incomes fueling consumer spending, and a growing preference for visually engaging advertising formats among businesses. The increasing use of data analytics in optimizing OOH campaigns and the integration of DOOH with mobile technologies further contribute to this growth. However, constraints include competition from digital advertising channels and the potential impact of economic fluctuations on advertising budgets. The market is segmented by advertising format (billboards, transit advertising, street furniture, etc.), geographic location (urban vs. rural), and advertising industry (retail, FMCG, entertainment, etc.). Key players include JCDecaux SA, APG SGA, OOH Media Corporation, Ströer SE & Co KGaA, and several prominent Vietnamese companies, indicating a mix of international and domestic market presence. The market's future hinges on strategic investments in DOOH infrastructure and the creative development of engaging, data-driven campaigns.

Further analysis suggests a potential shift towards a greater emphasis on DOOH in the forecast period. This is anticipated due to the inherent advantages of DOOH, including targeted advertising capabilities and real-time data integration that allows advertisers to precisely track campaign performance and ROI. The continued growth of e-commerce and the expansion of mobile technology will further drive the adoption of DOOH, as brands look for effective ways to reach digitally engaged consumers offline. While traditional OOH is expected to maintain a substantial market share, the innovative aspects of DOOH and its capacity for creative integrations and data analysis is projected to accelerate its penetration within the overall OOH landscape of Vietnam. This trend will likely reshape the competitive dynamics within the market, favoring companies with robust technological capabilities and data-driven campaign strategies.

Vietnam OOH & DOOH Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Vietnam Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, offering a comprehensive overview of its current state and future trajectory. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Vietnam OOH And DOOH Market Market Composition & Trends

This section delves into the intricate composition of the Vietnam OOH and DOOH market, analyzing key market dynamics and competitive landscapes. We examine market concentration, identifying the leading players and their respective market share distributions. For instance, while precise market share figures for each company are unavailable, preliminary estimates suggest JCDecaux SA and Apg Sga hold significant portions of the market. The report further investigates innovation catalysts, regulatory frameworks, the impact of substitute products, and the evolving profiles of end-users. Furthermore, a detailed analysis of mergers and acquisitions (M&A) activities within the sector is included, examining deal values and their implications for market consolidation. The historical period (2019-2024) provides a foundation for understanding the current market landscape and predicting future trends. Estimated M&A deal values for the period are estimated at xx Million.

- Market Concentration: High, with a few major players dominating.

- Innovation Catalysts: Technological advancements in DOOH, increasing demand for data-driven campaigns.

- Regulatory Landscape: Analysis of existing regulations and their impact on market growth.

- Substitute Products: Examination of alternative advertising methods and their competitive pressure.

- End-User Profiles: Detailed segmentation of advertisers based on industry, size, and advertising objectives.

- M&A Activities: Analysis of completed deals, deal values (estimated at xx Million for the period 2019-2024), and strategic implications.

Vietnam OOH And DOOH Market Industry Evolution

This section traces the evolution of the Vietnam OOH and DOOH market, examining growth trajectories, technological advancements, and shifting consumer preferences. We analyze the market's historical growth (2019-2024) and project future growth rates (2025-2033), highlighting key milestones and technological disruptions. The impact of increasing smartphone penetration and changing consumer behavior on OOH and DOOH advertising strategies are comprehensively assessed. Specific data points, including compound annual growth rates (CAGR) and adoption rates for specific DOOH technologies, are provided. We also explore the changing landscape of media consumption and how it affects the effectiveness of OOH and DOOH campaigns. The influence of government policies and initiatives on market expansion is also considered.

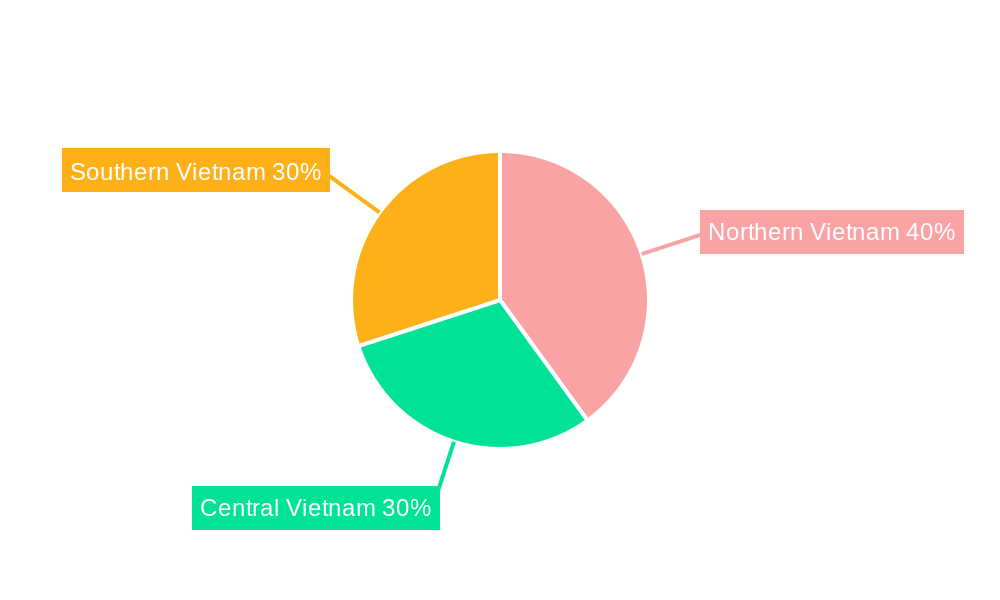

Leading Regions, Countries, or Segments in Vietnam OOH And DOOH Market

This section identifies the dominant regions, countries, or segments within the Vietnam OOH and DOOH market. Detailed analysis pinpoints the factors contributing to their dominance, providing insights into investment trends, regulatory support, and consumer behavior. The analysis focuses on the key characteristics that have driven market leadership in specific areas.

- Key Drivers of Dominance:

- High population density in urban areas.

- Favorable government policies promoting advertising and infrastructure development.

- Strong economic growth leading to increased advertising expenditure.

- High adoption of digital technologies and mobile devices.

Vietnam OOH And DOOH Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics within the Vietnam OOH and DOOH market. We discuss the unique selling propositions (USPs) of innovative DOOH technologies and advancements in programmatic advertising, highlighting their impact on campaign effectiveness and audience engagement. The integration of data analytics and AI for improved targeting and measurement is also covered.

Propelling Factors for Vietnam OOH And DOOH Market Growth

Several factors contribute to the growth of the Vietnam OOH and DOOH market. Technological advancements, such as the increased use of digital screens and interactive displays, are key drivers. Economic growth, leading to increased advertising spending, further fuels market expansion. Supportive government regulations, easing the process of obtaining advertising permits, also contribute. Lastly, the growing urban population and increasing consumer spending are significant factors.

Obstacles in the Vietnam OOH And DOOH Market Market

The Vietnam OOH and DOOH market faces certain challenges. Regulatory hurdles in obtaining advertising permits in certain locations can slow down growth. Supply chain disruptions, particularly in the procurement of digital displays and related technology, create bottlenecks. Furthermore, intense competition among existing players can lead to pricing pressure and reduced profit margins. The exact quantifiable impact of these factors is difficult to pinpoint precisely, but these obstacles are noteworthy and require consideration.

Future Opportunities in Vietnam OOH And DOOH Market

The Vietnam OOH and DOOH market presents several emerging opportunities. Expansion into new geographic markets, particularly in less saturated areas, presents growth potential. The adoption of innovative technologies like augmented reality (AR) and virtual reality (VR) in OOH campaigns offers exciting possibilities. Catering to evolving consumer trends, such as the increasing preference for personalized and interactive advertising experiences, also creates opportunities for market players.

Major Players in the Vietnam OOH And DOOH Market Ecosystem

- JCDecaux SA

- Apg Sga

- OOH Media Corporation

- Ströer SE & Co KGaA

- Lamar Media Corp

- Golden Communications Group

- DatvietVAC Group Holdings

- Goldsun Media Group

- NSG Ads Vietnam

- Vietnam Outdoor Advertising JSC

- List Not Exhaustive

Key Developments in Vietnam OOH And DOOH Market Industry

- August 2023: LG Electronics launched its global "Life's Good" campaign, featuring DOOH ads in Vietnam, demonstrating the increasing adoption of DOOH for major international brands.

- December 2023: Unicom Marketing's partnership with Location Media Xchange (LMX) enhances DOOH measurement and automation capabilities in the Vietnamese market, suggesting a trend towards more sophisticated data-driven strategies.

Strategic Vietnam OOH And DOOH Market Market Forecast

The Vietnam OOH and DOOH market is poised for substantial growth. Continued technological advancements, favorable economic conditions, and increasing adoption of digital advertising strategies will fuel this expansion. The market's potential is significant, driven by a growing urban population and increased advertising expenditure. The integration of data analytics and programmatic buying will further enhance the effectiveness of OOH and DOOH campaigns, leading to continued market expansion.

Vietnam OOH And DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-Based Media

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

Vietnam OOH And DOOH Market Segmentation By Geography

- 1. Vietnam

Vietnam OOH And DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in Vietnam

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in Vietnam

- 3.4. Market Trends

- 3.4.1. Digital OOH (LED Screens) to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam OOH And DOOH Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-Based Media

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JCDecaux SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Apg Sga

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OOH Media Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ströer SE & Co KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lamar Media Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Golden Communications Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DatvietVAC Group Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goldsun Media Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NSG Ads Vietnam

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vietnam Outdoor Advertising JSC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SA

List of Figures

- Figure 1: Vietnam OOH And DOOH Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam OOH And DOOH Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam OOH And DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam OOH And DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Vietnam OOH And DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Vietnam OOH And DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: Vietnam OOH And DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Vietnam OOH And DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 7: Vietnam OOH And DOOH Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Vietnam OOH And DOOH Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 9: Vietnam OOH And DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Vietnam OOH And DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Vietnam OOH And DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Vietnam OOH And DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: Vietnam OOH And DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Vietnam OOH And DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 15: Vietnam OOH And DOOH Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Vietnam OOH And DOOH Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Vietnam OOH And DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Vietnam OOH And DOOH Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam OOH And DOOH Market?

The projected CAGR is approximately 1.18%.

2. Which companies are prominent players in the Vietnam OOH And DOOH Market?

Key companies in the market include JCDecaux SA, Apg Sga, OOH Media Corporation, Ströer SE & Co KGaA, Lamar Media Corp, Golden Communications Group, DatvietVAC Group Holdings, Goldsun Media Group, NSG Ads Vietnam, Vietnam Outdoor Advertising JSC*List Not Exhaustive.

3. What are the main segments of the Vietnam OOH And DOOH Market?

The market segments include Type , Application , End-user Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 118.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in Vietnam.

6. What are the notable trends driving market growth?

Digital OOH (LED Screens) to Drive the Market.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in Vietnam.

8. Can you provide examples of recent developments in the market?

August 2023 - LG Electronics (LG) unveiled its latest global campaign, "Life's Good." The campaign marks a significant step in LG's efforts to revamp its brand image, infusing it with a more dynamic and youthful essence. As part of the campaign, LG launched digital out-of-home (OOH) ads in prominent global locations, such as Dubai, London, New York, Vietnam, and Seoul. These ads, comprising vibrant images and engaging videos, are thoughtfully designed to highlight LG's refreshed visual direction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam OOH And DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam OOH And DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam OOH And DOOH Market?

To stay informed about further developments, trends, and reports in the Vietnam OOH And DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence