Key Insights

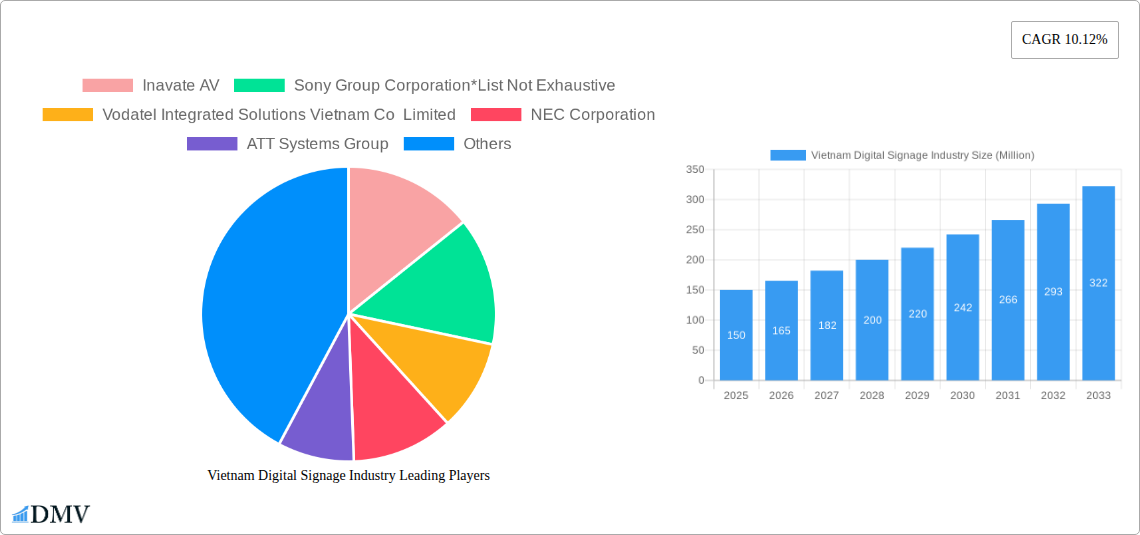

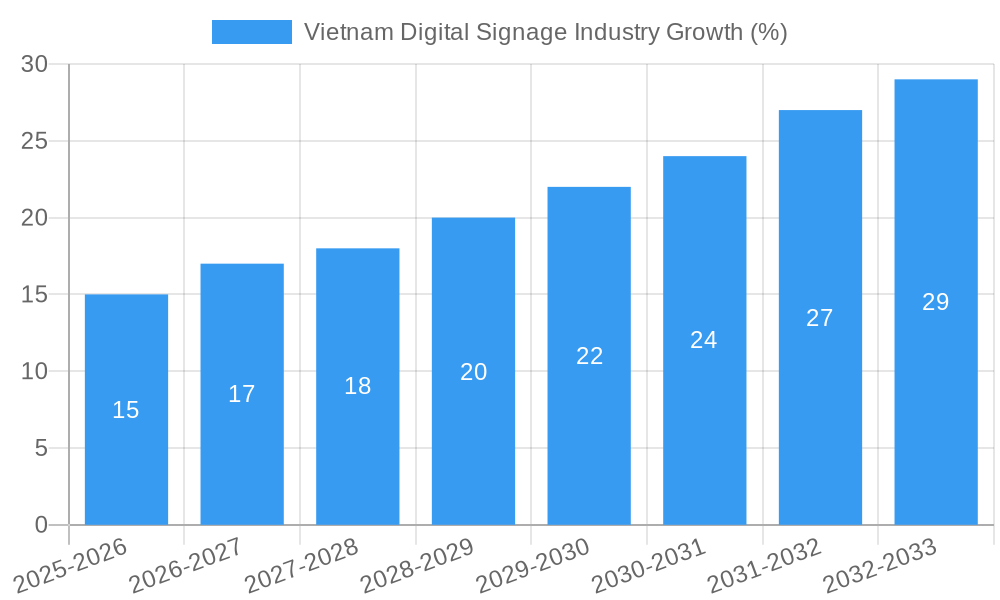

The Vietnam digital signage market is experiencing robust growth, driven by increasing adoption across diverse sectors like retail, hospitality, and transportation. The market's Compound Annual Growth Rate (CAGR) of 10.12% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. This growth is fueled by several key factors: rising urbanization leading to higher foot traffic in commercial areas, the need for enhanced customer engagement and brand promotion, and the increasing affordability of advanced display technologies like LEDs and OLEDs. Furthermore, the government's initiatives to modernize infrastructure and boost tourism contribute to the market's expansion. The preference for dynamic and engaging content over static advertising, coupled with the integration of smart technologies like interactive displays and data analytics, are shaping the market's trajectory. Segmentation analysis indicates strong demand for LED displays due to their energy efficiency and cost-effectiveness. Software solutions are also gaining traction, as businesses increasingly seek integrated management systems for their digital signage networks. Key players like Inavate AV, Sony, and Panasonic are contributing to market growth through innovative product offerings and strategic partnerships.

While the market presents significant opportunities, certain challenges exist. These include the initial high investment costs associated with deploying digital signage systems, especially for smaller businesses. Furthermore, ensuring consistent content updates and maintenance can pose operational complexities. However, the long-term return on investment (ROI) offered by improved brand visibility, targeted advertising capabilities, and enhanced customer experience is expected to outweigh these initial hurdles. The market's future growth hinges on continued technological advancements, government support for digital infrastructure, and the increasing adoption of innovative digital signage solutions by businesses across various sectors in Vietnam. Competition is expected to intensify, particularly among providers of software and integrated solutions, leading to further innovation and competitive pricing.

Vietnam Digital Signage Industry: Market Report 2019-2033

This comprehensive report offers a detailed analysis of the Vietnam digital signage industry, providing valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete picture of the industry's evolution. The market is projected to reach xx Million by 2033, driven by technological advancements and increasing government investments.

Vietnam Digital Signage Industry Market Composition & Trends

The Vietnam digital signage market is characterized by a moderately concentrated landscape, with key players like Inavate AV, Sony Group Corporation, Vodatel Integrated Solutions Vietnam Co Limited, NEC Corporation, ATT Systems Group, Net & Com Integrated Telecom, Panasonic Corporation, Intel Corporation, and LG Corporation holding significant market share. However, the emergence of innovative startups and smaller players is increasing competition. Market share distribution is dynamic, with the top five players accounting for approximately xx% of the total revenue in 2024. The industry's growth is fueled by increasing government initiatives promoting digital transformation and a rising demand for interactive displays across various sectors. Regulatory frameworks, while generally supportive, are constantly evolving, requiring businesses to adapt to new compliance requirements. Substitute products, such as traditional print media and billboards, continue to exist but their market share is gradually decreasing due to the superior advantages of digital signage. The M&A landscape is active, with deal values averaging xx Million in recent years.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Innovation Catalysts: Government initiatives, technological advancements (e.g., AI integration), rising consumer demand for interactive experiences.

- Regulatory Landscape: Supportive but constantly evolving, necessitating continuous compliance efforts.

- Substitute Products: Traditional print media and billboards, gradually losing market share.

- End-User Profiles: Diverse, including infrastructure, industrial, commercial, and retail sectors.

- M&A Activities: Active, with average deal values of xx Million in recent years.

Vietnam Digital Signage Industry Industry Evolution

The Vietnam digital signage industry has witnessed robust growth over the historical period (2019-2024), expanding at a CAGR of xx%. This growth trajectory is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%. Technological advancements, particularly in display technologies (LEDs, OLEDs, and interactive touchscreens), have been key drivers of this growth. The increasing adoption of cloud-based solutions and software applications for content management and analytics further contributes to the industry's expansion. Consumer demand is shifting towards more engaging, interactive, and data-driven digital signage solutions. Furthermore, government initiatives promoting digital transformation and smart city projects are significantly boosting market growth, creating an increased need for advanced digital signage infrastructure. This aligns with increasing adoption rates across various sectors, with the commercial and retail sectors showing particular promise. The market’s evolution is punctuated by major technological shifts and rising consumer expectations for engaging, data-driven digital signage experiences.

Leading Regions, Countries, or Segments in Vietnam Digital Signage Industry

The Commercial sector dominates the Vietnam digital signage market, driven by high adoption rates across retail outlets, restaurants, and corporate offices. The Liquid Crystal Display (LCD)/Plasma segment holds the largest market share among display modes, while Hardware accounts for the most significant share in the solution type segment. Key drivers include:

- Commercial Sector: High adoption rates in retail, restaurants, and corporate offices. Strong demand for interactive displays, informative signage, and targeted advertising.

- LCD/Plasma Displays: Cost-effectiveness, wide availability, and established technology make it the dominant display mode.

- Hardware Segment: High initial investment requirements for hardware components, pushing this segment to a prominent position.

In contrast, the industrial sector is a steadily growing segment, with the government’s push toward industry 4.0 increasing the demand for digital signage in factories and manufacturing plants.

Vietnam Digital Signage Industry Product Innovations

Recent product innovations focus on improving display quality, energy efficiency, and interactivity. Advancements include higher-resolution displays, improved brightness and color accuracy, energy-saving features, and seamless integration with analytics platforms for real-time data monitoring and targeted advertising. Unique selling propositions center around user-friendly interfaces, intuitive content management systems, and data-driven insights to optimize advertising campaigns and enhance customer experiences. The adoption of AI and machine learning is opening up new opportunities to personalize content delivery and optimize operational efficiency.

Propelling Factors for Vietnam Digital Signage Industry Growth

Several factors propel the growth of Vietnam's digital signage market. Firstly, government initiatives promoting digital transformation and smart city development create a huge demand for advanced digital signage solutions. Secondly, the expanding retail and hospitality sectors significantly increase the need for interactive and engaging customer experiences. Lastly, the increasing adoption of cloud-based services facilitates streamlined content management and improved analytics capabilities, further stimulating market growth.

Obstacles in the Vietnam Digital Signage Industry Market

The industry faces challenges including the high initial investment costs for hardware and software, potential supply chain disruptions, and intense competition from both domestic and international players. Furthermore, the evolving regulatory landscape requires ongoing compliance efforts, adding complexity to business operations. These factors can impact market growth, especially among smaller players with limited resources.

Future Opportunities in Vietnam Digital Signage Industry

Future opportunities lie in the increasing adoption of AI-powered digital signage, integration with IoT devices, and the expansion into new sectors such as healthcare and education. The development of immersive and interactive experiences, augmented reality (AR) and virtual reality (VR) integration, will provide additional growth opportunities. Furthermore, focusing on energy-efficient solutions will increasingly appeal to environmentally conscious businesses and consumers.

Major Players in the Vietnam Digital Signage Industry Ecosystem

- Inavate AV

- Sony Group Corporation

- Vodatel Integrated Solutions Vietnam Co Limited

- NEC Corporation

- ATT Systems Group

- Net & Com Integrated Telecom

- Panasonic Corporation

- Intel Corporation

- LG Corporation

Key Developments in Vietnam Digital Signage Industry Industry

- December 2022: Samsung Electronics opens its largest R&D facility in Southeast Asia in Hanoi, boosting Vietnam's role as a tech hub.

- March 2020: Samsung Electronics begins construction on a USD 220 Million R&D facility in Hanoi, signaling increased investment in the tech sector.

- March 2022: NEC Corporation completes the modernization of Vietnam's national ID system, showcasing the adoption of advanced digital technologies in government services.

Strategic Vietnam Digital Signage Industry Market Forecast

The Vietnam digital signage market is poised for significant growth in the coming years, driven by technological innovation, government support, and the increasing adoption of digital solutions across various sectors. The expanding middle class, coupled with rising urbanization, will further stimulate demand for advanced digital signage solutions. The market's future will be characterized by increasing adoption of AI-powered solutions, cloud-based platforms, and an overall shift towards creating more engaging and data-driven customer experiences. The market is expected to reach xx Million by 2033, exceeding the current market value significantly.

Vietnam Digital Signage Industry Segmentation

-

1. Mode of Display

- 1.1. Liquid Crystal Display/Plasma

- 1.2. LEDs

- 1.3. Projection Screens

- 1.4. OLEDs

- 1.5. Other Modes of Display

-

2. Solution Type

- 2.1. Hardware

- 2.2. Software

-

3. Application

- 3.1. Infrastructure

- 3.2. Industrial

- 3.3. Commercial

- 3.4. Other Applications

Vietnam Digital Signage Industry Segmentation By Geography

- 1. Vietnam

Vietnam Digital Signage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in Displays; Contactless Interaction is Becoming Increasingly Popular

- 3.3. Market Restrains

- 3.3.1. Issues with Digital Signs that are Currently being Addressed in Terms of Security

- 3.4. Market Trends

- 3.4.1. OLED to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Display

- 5.1.1. Liquid Crystal Display/Plasma

- 5.1.2. LEDs

- 5.1.3. Projection Screens

- 5.1.4. OLEDs

- 5.1.5. Other Modes of Display

- 5.2. Market Analysis, Insights and Forecast - by Solution Type

- 5.2.1. Hardware

- 5.2.2. Software

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Infrastructure

- 5.3.2. Industrial

- 5.3.3. Commercial

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Mode of Display

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Inavate AV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sony Group Corporation*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vodatel Integrated Solutions Vietnam Co Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NEC Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ATT Systems Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Net & Com Integrated Telecom

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panasonic Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LG Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Inavate AV

List of Figures

- Figure 1: Vietnam Digital Signage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Digital Signage Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Digital Signage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Digital Signage Industry Revenue Million Forecast, by Mode of Display 2019 & 2032

- Table 3: Vietnam Digital Signage Industry Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 4: Vietnam Digital Signage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Vietnam Digital Signage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Vietnam Digital Signage Industry Revenue Million Forecast, by Mode of Display 2019 & 2032

- Table 8: Vietnam Digital Signage Industry Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 9: Vietnam Digital Signage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Vietnam Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Digital Signage Industry?

The projected CAGR is approximately 10.12%.

2. Which companies are prominent players in the Vietnam Digital Signage Industry?

Key companies in the market include Inavate AV, Sony Group Corporation*List Not Exhaustive, Vodatel Integrated Solutions Vietnam Co Limited, NEC Corporation, ATT Systems Group, Net & Com Integrated Telecom, Panasonic Corporation, Intel Corporation, LG Corporation.

3. What are the main segments of the Vietnam Digital Signage Industry?

The market segments include Mode of Display, Solution Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in Displays; Contactless Interaction is Becoming Increasingly Popular.

6. What are the notable trends driving market growth?

OLED to Show Significant Growth.

7. Are there any restraints impacting market growth?

Issues with Digital Signs that are Currently being Addressed in Terms of Security.

8. Can you provide examples of recent developments in the market?

December 2022 - On December 23, Samsung Electronics opened its largest research and development facility in Southeast Asia in Hanoi, signaling an increase in the significance of Vietnam as a center for research and development as well as manufacturing. In March 2020, Samsung Electronics started construction on the USD 220 million research and development facility in Hanoi, which the tech giant claimed would be the biggest R&D facility in Southeast Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Digital Signage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Digital Signage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Digital Signage Industry?

To stay informed about further developments, trends, and reports in the Vietnam Digital Signage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence