Key Insights

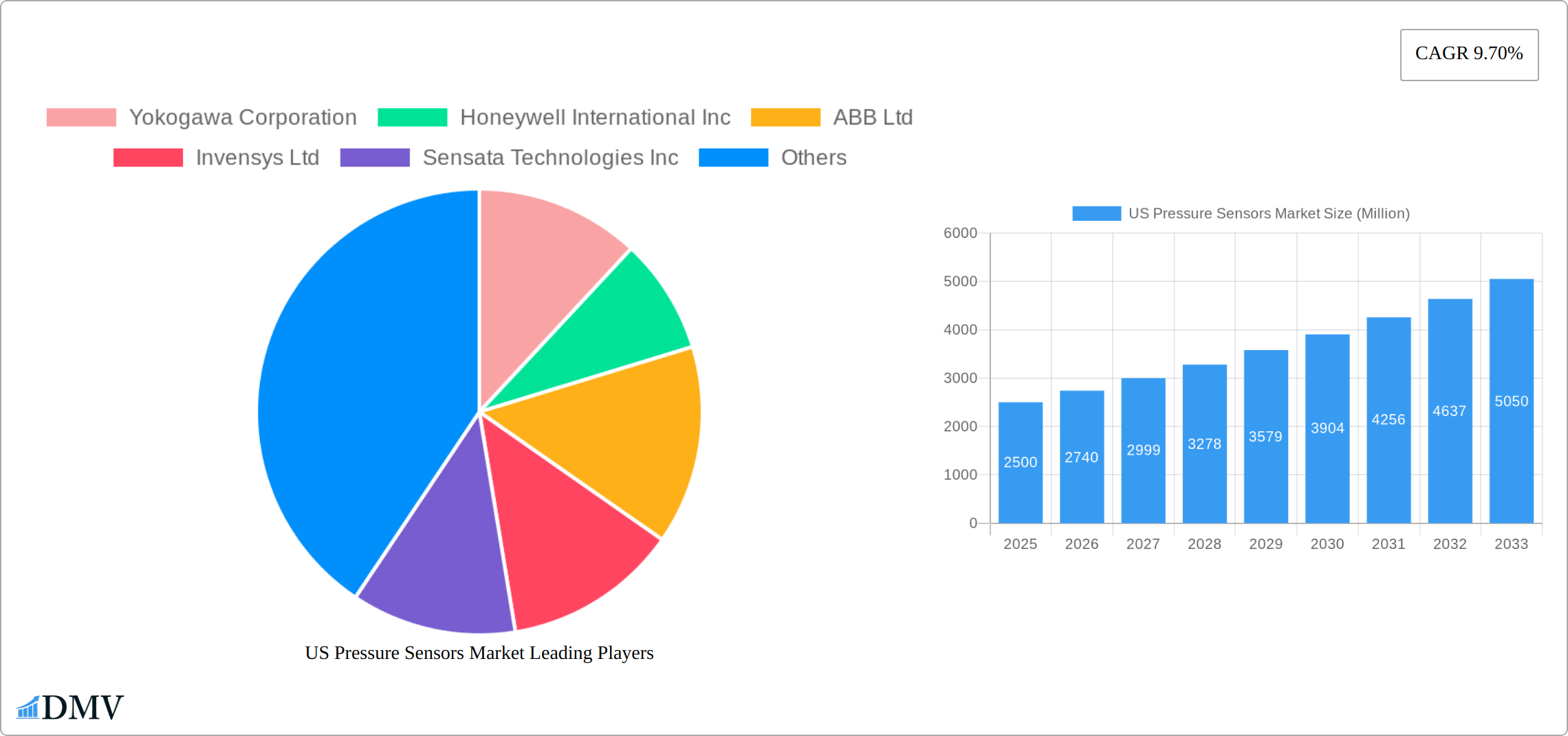

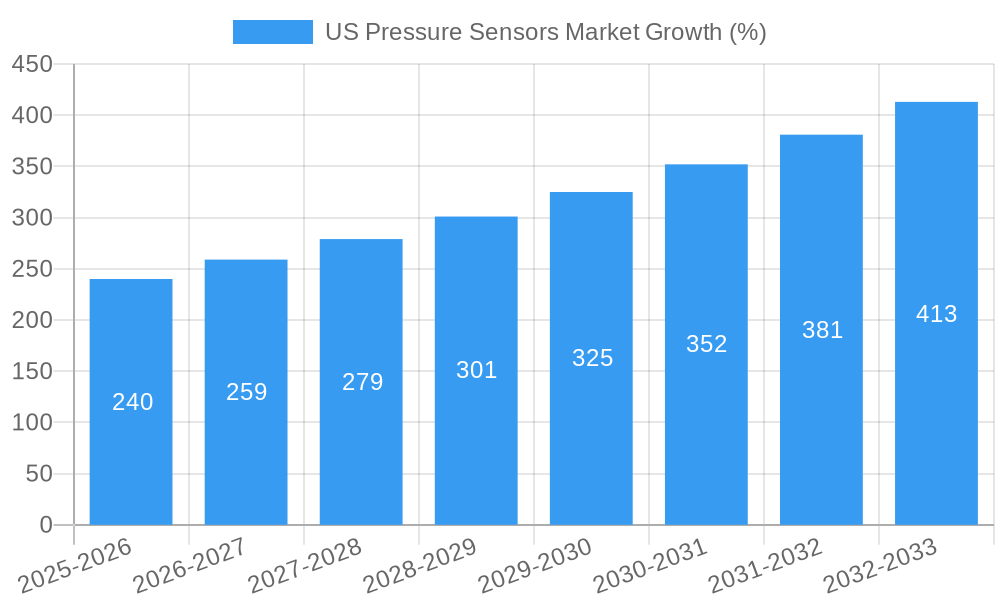

The US pressure sensor market is experiencing robust growth, driven by increasing demand across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 9.70% from 2019 to 2024 indicates a significant upward trajectory, projected to continue through 2033. Key application areas like automotive (tire pressure monitoring, fuel systems, and braking) and medical (CPAP machines, ventilators, and blood pressure monitors) are major contributors to this expansion. The automotive industry's ongoing push for advanced driver-assistance systems (ADAS) and enhanced safety features fuels demand for high-precision pressure sensors. Simultaneously, the medical sector’s technological advancements and rising healthcare spending contribute to increased sensor adoption in medical devices. Consumer electronics, industrial automation, aerospace & defense, and food & beverage industries also represent substantial market segments, each contributing to the overall growth. While specific market size figures for the US are not provided, we can infer a substantial market value based on global trends and the provided CAGR, indicating millions of dollars in revenue. Competitive pressures exist among major players like Yokogawa, Honeywell, ABB, and Sensata Technologies, fostering innovation and driving prices down.

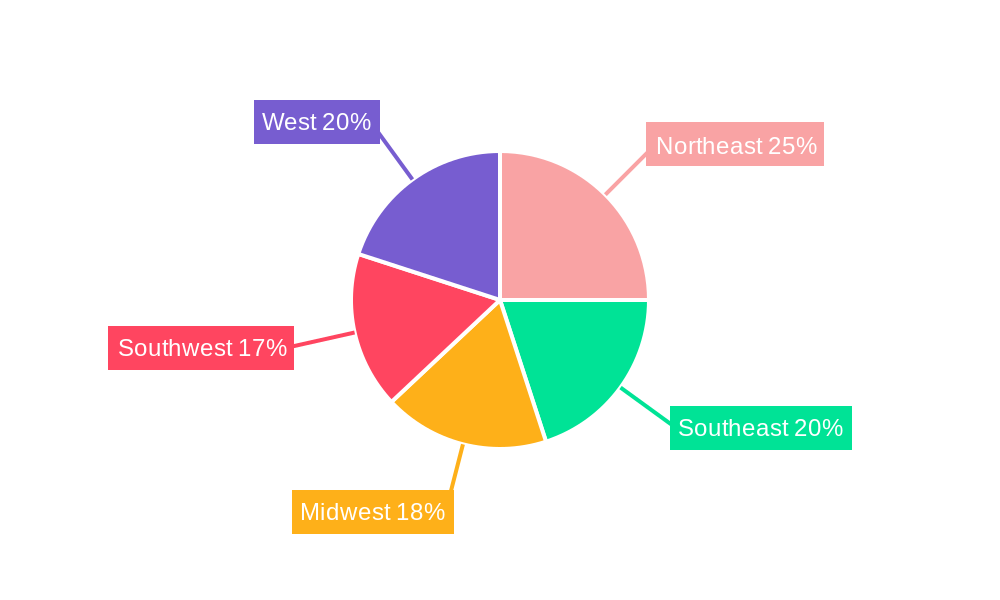

Regional analysis within the US points to varied growth rates across the Northeast, Southeast, Midwest, Southwest, and West. While precise regional breakdowns are unavailable, it's reasonable to assume that regions with strong manufacturing bases and technological hubs (e.g., the Northeast and West) may exhibit faster growth compared to others. However, the consistent nationwide demand across various sectors contributes to relatively balanced growth across regions. Future growth will likely be shaped by technological advancements in sensor miniaturization, improved accuracy, and the integration of pressure sensors into smart devices and the Internet of Things (IoT). Furthermore, government regulations promoting safety and environmental monitoring are expected to further stimulate market expansion in various sectors.

US Pressure Sensors Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the US Pressure Sensors Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is estimated to be worth xx Million in 2025.

US Pressure Sensors Market Composition & Trends

The US pressure sensors market is characterized by a moderately concentrated landscape, with key players like Honeywell International Inc, Sensata Technologies Inc, and Siemens AG holding significant market share. However, the presence of numerous smaller, specialized players indicates a competitive environment. Market share distribution fluctuates based on technological advancements, product innovation, and successful M&A activities. For instance, the February 2021 acquisition of Xirgo Technologies by Sensata Technologies for USD 400 Million significantly impacted market dynamics.

- Market Concentration: Moderate, with a few dominant players and many smaller competitors. Market share distribution is dynamic.

- Innovation Catalysts: Miniaturization, improved accuracy, increased integration with other technologies (e.g., IoT), and the demand for higher performance in various applications drive innovation.

- Regulatory Landscape: Compliance with industry-specific regulations (e.g., automotive safety standards) influences product development and market access.

- Substitute Products: Alternative technologies exist but often lack the precision or performance of pressure sensors.

- End-User Profiles: Diverse end-user base including automotive, medical, industrial, aerospace, consumer electronics, and more.

- M&A Activities: Significant M&A activity reflects market consolidation and expansion efforts by major players, with deal values exceeding USD 400 Million in recent years.

US Pressure Sensors Market Industry Evolution

The US pressure sensors market has witnessed consistent growth over the historical period (2019-2024), driven by increased adoption across diverse sectors. Technological advancements such as the development of MEMS (Microelectromechanical Systems) sensors have led to smaller, more cost-effective, and highly accurate pressure sensors. This has expanded the market's reach into new applications and consumer electronics, particularly wearables and hearables. Growth is expected to continue at a CAGR of xx% during the forecast period (2025-2033), fueled by the increasing demand for automation, precision measurement, and data-driven insights across industries. Shifting consumer preferences towards smart and connected devices further contribute to this growth. The integration of pressure sensors into IoT applications is anticipated to create significant opportunities, while advancements in material science and sensor technology are poised to enhance accuracy and reliability further.

Leading Regions, Countries, or Segments in US Pressure Sensors Market

The automotive segment currently dominates the US pressure sensors market, driven by stringent safety regulations and the increasing adoption of advanced driver-assistance systems (ADAS). The medical segment is also experiencing significant growth, propelled by the rising demand for advanced medical devices and remote patient monitoring systems.

Key Drivers (Automotive Segment):

- Stringent safety regulations mandating pressure sensors in various automotive applications.

- High investment in ADAS and autonomous driving technologies.

- Growing demand for fuel-efficient vehicles and emission control systems.

Key Drivers (Medical Segment):

- Increasing prevalence of chronic diseases requiring continuous monitoring.

- Growing demand for remote patient monitoring solutions.

- Technological advancements leading to improved accuracy and portability of medical devices.

The Industrial segment also shows substantial growth due to increasing automation and process optimization needs across manufacturing and other industrial processes. Other segments like consumer electronics, aerospace & defense, and HVAC are also exhibiting steady growth, albeit at a slower pace compared to the automotive and medical segments. The dominance of the automotive segment is mainly due to its large scale, high demand, and integration into various critical automotive functions.

US Pressure Sensors Market Product Innovations

Recent product innovations focus on improving sensor accuracy, miniaturization, power efficiency, and integration with smart systems. For example, Bosch Sensortec's BMP390 offers significantly improved accuracy for altitude tracking in smartphones and wearables, while other companies are developing sensors with increased durability and resistance to harsh environmental conditions. These advancements enhance the applicability of pressure sensors across various industries, leading to wider adoption and market expansion. The unique selling propositions often center around improved performance metrics like accuracy, response time, and power consumption.

Propelling Factors for US Pressure Sensors Market Growth

The US pressure sensors market's growth is driven by several factors. Technological advancements leading to higher accuracy, smaller form factors, and lower costs are paramount. The increasing demand for automation across various industries creates a substantial market for pressure sensors in process control and monitoring systems. Stringent government regulations, particularly in sectors like automotive and medical, mandate the use of pressure sensors in many applications, further driving market growth. Additionally, the rising adoption of IoT devices and connected systems provides further impetus for the expansion of the market.

Obstacles in the US Pressure Sensors Market

Despite significant growth potential, the US pressure sensors market faces challenges. Supply chain disruptions and potential shortages of raw materials can impact production and delivery, leading to cost increases. Intense competition among established players and the emergence of new entrants can put downward pressure on prices. Furthermore, stringent regulatory compliance requirements can increase development costs and time-to-market for new products. These factors can impede market growth and profitability.

Future Opportunities in US Pressure Sensors Market

The future of the US pressure sensors market is bright. Emerging applications in sectors like renewable energy (monitoring pressure in wind turbines and solar panels) and smart agriculture (precision irrigation) offer significant opportunities for growth. Advancements in sensor technology, such as the development of more durable and reliable sensors for extreme environments, will further expand the market's reach. Furthermore, integration with AI and machine learning for advanced data analytics can unlock new value propositions for end-users.

Major Players in the US Pressure Sensors Market Ecosystem

- Yokogawa Corporation

- Honeywell International Inc

- ABB Ltd

- Invensys Ltd

- Sensata Technologies Inc

- Endress+Hauser AG

- Rockwell Automation Inc

- Kistler Group

- All Sensors Corporation

- GMS Instruments BV

- Bosch Sensortec GmbH

- Rosemount Inc (Emerson Electric Company)

- Siemens AG

Key Developments in US Pressure Sensors Market Industry

- April 2020: Bosch Sensortec announced the BMP390, a barometric pressure sensor for altitude tracking in smartphones and wearable and hearable devices, enhancing accuracy by 50%.

- February 2021: Sensata Technologies acquired Xirgo Technologies for USD 400 Million, expanding its telematics and data insights capabilities.

Strategic US Pressure Sensors Market Forecast

The US pressure sensors market is poised for continued growth, driven by technological advancements, increasing automation, and the expansion into new applications across various sectors. The integration of pressure sensors into IoT and smart systems presents substantial opportunities for market expansion. Continued innovation in sensor technology, coupled with rising demand across key end-user industries, will significantly contribute to the market's sustained growth trajectory over the forecast period.

US Pressure Sensors Market Segmentation

-

1. Application

- 1.1. Automoti

- 1.2. Medical

- 1.3. Consumer Electronics

- 1.4. Industrial

- 1.5. Aerospace & Defence

- 1.6. Food & Beverage

- 1.7. HVAC

US Pressure Sensors Market Segmentation By Geography

- 1. United States

US Pressure Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth Of End-user Verticals

- 3.2.2 such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Sensing Products

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automoti

- 5.1.2. Medical

- 5.1.3. Consumer Electronics

- 5.1.4. Industrial

- 5.1.5. Aerospace & Defence

- 5.1.6. Food & Beverage

- 5.1.7. HVAC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Northeast US Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7. Southeast US Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8. Midwest US Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9. Southwest US Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10. West US Pressure Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Yokogawa Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ABB Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Invensys Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sensata Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Endress+Hauser AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rockwell Automation Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kistler Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 All Sensors Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GMS Instruments BV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bosch Sensortec GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rosemount Inc (Emerson Electric Company)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Siemens AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Yokogawa Corporation

List of Figures

- Figure 1: Global US Pressure Sensors Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Pressure Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Pressure Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: United States US Pressure Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 5: United States US Pressure Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 6: United States US Pressure Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 7: United States US Pressure Sensors Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Pressure Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Pressure Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global US Pressure Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global US Pressure Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Northeast US Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Southeast US Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Midwest US Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southwest US Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West US Pressure Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global US Pressure Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Global US Pressure Sensors Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Pressure Sensors Market?

The projected CAGR is approximately 9.70%.

2. Which companies are prominent players in the US Pressure Sensors Market?

Key companies in the market include Yokogawa Corporation, Honeywell International Inc, ABB Ltd, Invensys Ltd, Sensata Technologies Inc, Endress+Hauser AG, Rockwell Automation Inc, Kistler Group, All Sensors Corporation, GMS Instruments BV, Bosch Sensortec GmbH, Rosemount Inc (Emerson Electric Company), Siemens AG.

3. What are the main segments of the US Pressure Sensors Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth Of End-user Verticals. such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry.

6. What are the notable trends driving market growth?

Automotive Industry to Show Significant Growth.

7. Are there any restraints impacting market growth?

High Costs Associated with Sensing Products.

8. Can you provide examples of recent developments in the market?

April 2020 - Bosch Sensortec announced the BMP390, a barometric pressure sensor for altitude tracking in smartphones and wearable and hearable devices. According to Bosch, the new sensor can measure height changes below 10 centimeters and is 50 percent more accurate than its predecessor. The new BMP390 supports GPS applications for outdoor navigation and calorie expenditure estimation tasks and is available for high-volume smartphones, wearable, and hearable manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Pressure Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Pressure Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Pressure Sensors Market?

To stay informed about further developments, trends, and reports in the US Pressure Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence