Key Insights

The United States wall coverings market demonstrates substantial growth potential, driven by increasing investment in home renovation and interior design. Rising disposable incomes and a preference for personalized living spaces are key demand drivers. The residential segment is anticipated to lead, supported by extensive remodeling activities. E-commerce channels are expanding rapidly, offering wider product selections and convenient purchasing. Popular materials such as wallpaper and wall panels are in high demand, with emerging trends in innovative and sustainable options. Challenges include fluctuating raw material costs and competition from alternative finishes. The market is projected to experience a CAGR of 3.23%, indicating steady expansion. Diverse end-users, including specialty stores, home centers, and online platforms, ensure broad market penetration. The ongoing emphasis on aesthetics and functionality in home design solidifies the market's outlook. With a projected market size of 586.7 million by 2025, the US wall coverings market is poised for significant growth.

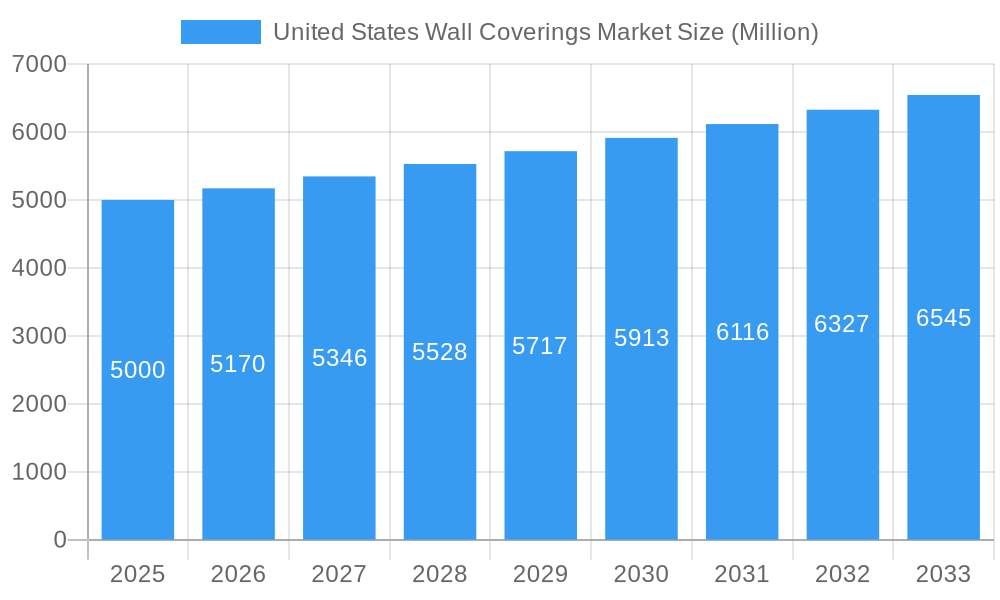

United States Wall Coverings Market Market Size (In Million)

United States Wall Coverings Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States wall coverings market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market value is predicted to reach xx Million by 2033, driven by several key factors detailed within.

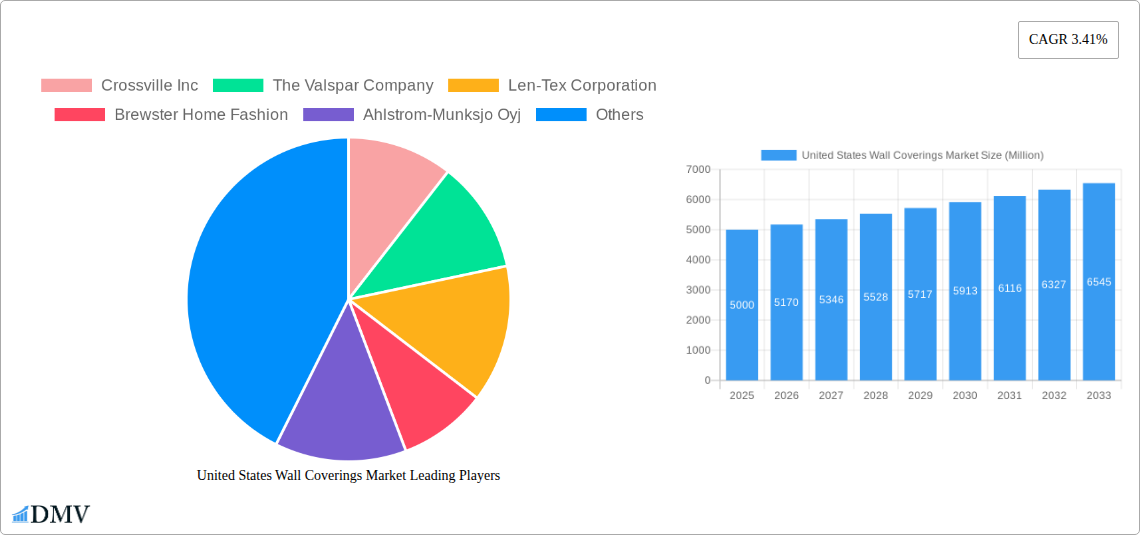

United States Wall Coverings Market Company Market Share

United States Wall Coverings Market Composition & Trends

This section delves into the competitive landscape of the US wall coverings market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We analyze market share distribution among key players, including Crossville Inc, The Valspar Company, Sherwin-Williams Company, and others, revealing the level of market concentration. The report also examines the impact of recent M&A activities, providing estimates of deal values where available. Innovation catalysts, such as advancements in materials science and design, are assessed for their influence on market growth. Regulatory landscapes impacting the industry, including environmental regulations and building codes, are thoroughly scrutinized. Furthermore, the analysis considers substitute products and their competitive impact, and offers a detailed segmentation of end-users, including specialty stores, home centers, and e-commerce platforms.

- Market Concentration: The market exhibits a [Describe level of concentration: e.g., moderately concentrated] structure, with the top 5 players holding an estimated xx% market share in 2024.

- M&A Activity: Recent M&A activity has been [Describe activity level: e.g., moderate], with deal values ranging from xx Million to xx Million in the past five years.

- Innovation Catalysts: Technological advancements in sustainable materials and digital printing are key drivers of innovation.

- Regulatory Landscape: Environmental regulations and building codes significantly impact product development and manufacturing processes.

United States Wall Coverings Market Industry Evolution

This section traces the evolution of the US wall coverings market, charting growth trajectories from 2019 to 2024 and projecting future trends through 2033. The analysis incorporates technological advancements, including the rise of smart wall coverings and sustainable materials, and examines shifts in consumer preferences, such as the growing demand for personalized and eco-friendly products. Growth rates are quantified for each segment, providing a clear picture of market dynamics. The adoption of new technologies and the impact on consumer behavior are meticulously evaluated.

[Insert 600 words of detailed analysis here, using specific data points on growth rates and adoption metrics. Include information on shifting trends in design preferences, the influence of sustainability concerns on purchasing decisions, and the impact of economic fluctuations on market demand.]

Leading Regions, Countries, or Segments in United States Wall Coverings Market

This section pinpoints the leading segments within the US wall coverings market across various categories: end-user, type, and application. We identify the dominant regions, countries, or segments and delve into the underlying factors driving their success.

By End User:

- Home Centers: Dominant due to broad reach and established distribution channels.

- Specialty Stores: Significant growth driven by curated selections and personalized service.

- E-commerce: Rapid expansion fueled by convenience and accessibility.

By Type:

- Wallpaper: Remains a leading segment due to versatility and design options.

- Wall Panels: Growing popularity due to ease of installation and durability.

By Application:

- Residential: The largest segment driven by strong demand for home renovation and new construction.

- Commercial: Growing demand fueled by increased investment in office spaces and hospitality.

[Insert 600 words of in-depth analysis, including detailed explanations of the dominance factors for each leading segment. Use bullet points for key drivers like investment trends and regulatory support, and paragraphs for in-depth analysis.]

United States Wall Coverings Market Product Innovations

Recent innovations in the US wall coverings market encompass sustainable materials like recycled paper and bamboo, along with digitally printed designs offering unparalleled customization. These innovations cater to evolving consumer preferences for eco-friendly and personalized products. Performance metrics, such as durability, ease of installation, and cleaning, are key selling points driving market expansion. The introduction of antimicrobial coatings and sound-dampening properties further enhances market appeal. These advancements demonstrate significant improvement over traditional wall coverings, leading to increased demand across both residential and commercial applications.

Propelling Factors for United States Wall Coverings Market Growth

Several key factors are driving growth in the US wall coverings market. Technological advancements, such as improved digital printing techniques and sustainable materials, are expanding design possibilities and reducing environmental impact. Strong economic growth, particularly in the residential construction sector, fuels high demand for wall coverings. Favorable government policies supporting green building initiatives further enhance market expansion. Furthermore, the increasing popularity of home renovations and interior design trends is driving consumer demand.

Obstacles in the United States Wall Coverings Market

The US wall coverings market faces challenges from fluctuating raw material costs, impacting production expenses and potentially limiting market expansion. Supply chain disruptions, particularly those related to international sourcing, can lead to delays and increased costs, negatively affecting profitability. Intense competition among established players and new entrants puts pressure on pricing and margins, necessitating continuous product innovation and differentiation. Finally, strict environmental regulations can increase manufacturing costs and limit the availability of certain materials.

Future Opportunities in United States Wall Coverings Market

Emerging opportunities lie in the development of smart wall coverings incorporating technology for interactive displays and energy efficiency. The increasing adoption of sustainable and eco-friendly materials presents a significant growth avenue. Expansion into new markets, such as the healthcare and hospitality sectors, offers untapped potential. Finally, personalized design services and customized wall coverings cater to the growing demand for tailored aesthetics.

Major Players in the United States Wall Coverings Market Ecosystem

- Crossville Inc

- The Valspar Company

- Len-Tex Corporation

- Brewster Home Fashion

- Ahlstrom-Munksjo Oyj

- Rust-Oleum Corporation

- Sherwin-Williams Company

- Johns Manville Corporation

- York Wall Coverings

- Benjamin Moore & Co

- Georgia-Pacific

- F Schumacher

- Koroseal Wall Protection

- Mohawk Industries Inc

- Wallquest Inc

Key Developments in United States Wall Coverings Market Industry

- May 2021: Crossville launches "Laminam by Crossville," large-format tile panels, expanding its product portfolio and capturing a new market segment.

- April 2022: Georgia-Pacific collaborates on a net-zero carbon, mass timber office building, showcasing sustainable construction practices and potentially influencing demand for eco-friendly wall coverings.

Strategic United States Wall Coverings Market Forecast

The US wall coverings market is poised for robust growth, driven by ongoing technological advancements, sustainable material adoption, and expanding consumer preferences for personalization and eco-consciousness. New market segments and product innovation will further stimulate market expansion, creating significant opportunities for established players and new entrants alike. The forecast predicts strong growth through 2033, with potential for even higher figures depending on economic conditions and technological breakthroughs.

United States Wall Coverings Market Segmentation

-

1. Type

- 1.1. Wall Panel

- 1.2. Tiles

- 1.3. Metal Wall

-

1.4. Wallpaper

- 1.4.1. Vinyl

- 1.4.2. Non-woven Wallpaper

- 1.4.3. Paper-based Wallpaper

- 1.4.4. Fabric Wallpapers

- 1.4.5. Other Wallpaper Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. End User

- 3.1. Specialty Store

- 3.2. Home Center

- 3.3. Furniture Store

- 3.4. Mass Merchandizer

- 3.5. E-commerce

- 3.6. Other End Users

United States Wall Coverings Market Segmentation By Geography

- 1. United States

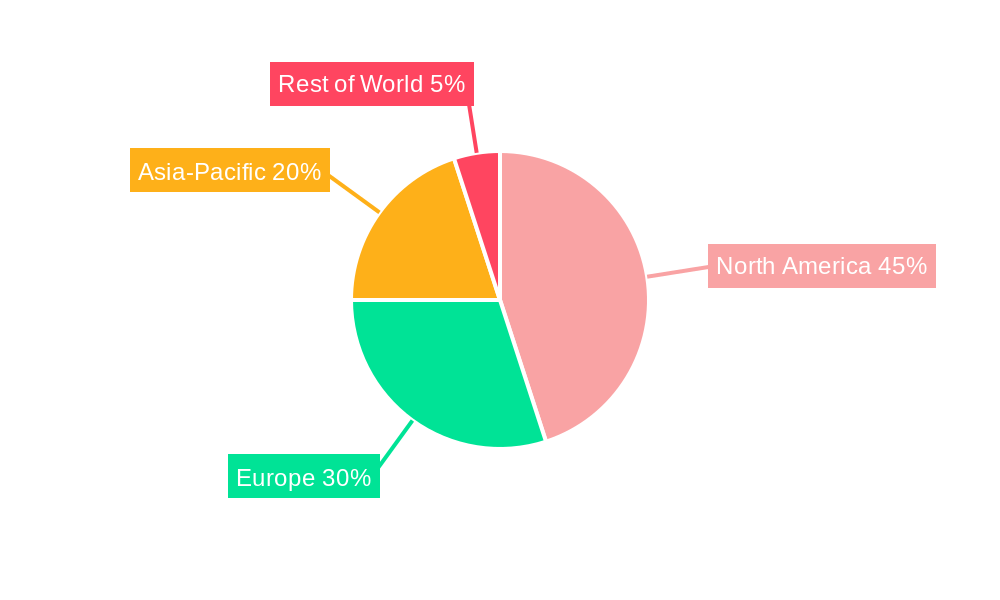

United States Wall Coverings Market Regional Market Share

Geographic Coverage of United States Wall Coverings Market

United States Wall Coverings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rebounding Residential Construction Activity; Recovery in Wall Panel Sales Aided by Higher Awareness; Increasing Demand for Digitally Printed Solutions; Growth in Non-woven and Paper-based Wallpapers

- 3.3. Market Restrains

- 3.3.1. Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending

- 3.4. Market Trends

- 3.4.1. Rebounding Residential Construction Activity in the United States is Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Wall Coverings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall Panel

- 5.1.2. Tiles

- 5.1.3. Metal Wall

- 5.1.4. Wallpaper

- 5.1.4.1. Vinyl

- 5.1.4.2. Non-woven Wallpaper

- 5.1.4.3. Paper-based Wallpaper

- 5.1.4.4. Fabric Wallpapers

- 5.1.4.5. Other Wallpaper Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Specialty Store

- 5.3.2. Home Center

- 5.3.3. Furniture Store

- 5.3.4. Mass Merchandizer

- 5.3.5. E-commerce

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Crossville Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Valspar Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Len-Tex Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brewster Home Fashion

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ahlstrom-Munksjo Oyj

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rust-Oleum Coproration

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sherwin-Williams Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johns Manville Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 York Wall Coverings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Benjamin Moore & Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Georgia-Pacific

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 F Schumacher

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Koroseal Wall Protection

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mohawk Industries Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Wallquest Inc *List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Crossville Inc

List of Figures

- Figure 1: United States Wall Coverings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United States Wall Coverings Market Share (%) by Company 2025

List of Tables

- Table 1: United States Wall Coverings Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: United States Wall Coverings Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: United States Wall Coverings Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: United States Wall Coverings Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: United States Wall Coverings Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: United States Wall Coverings Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: United States Wall Coverings Market Revenue million Forecast, by End User 2020 & 2033

- Table 8: United States Wall Coverings Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Wall Coverings Market?

The projected CAGR is approximately 3.23%.

2. Which companies are prominent players in the United States Wall Coverings Market?

Key companies in the market include Crossville Inc, The Valspar Company, Len-Tex Corporation, Brewster Home Fashion, Ahlstrom-Munksjo Oyj, Rust-Oleum Coproration, Sherwin-Williams Company, Johns Manville Corporation, York Wall Coverings, Benjamin Moore & Co, Georgia-Pacific, F Schumacher, Koroseal Wall Protection, Mohawk Industries Inc, Wallquest Inc *List Not Exhaustive.

3. What are the main segments of the United States Wall Coverings Market?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 586.7 million as of 2022.

5. What are some drivers contributing to market growth?

Rebounding Residential Construction Activity; Recovery in Wall Panel Sales Aided by Higher Awareness; Increasing Demand for Digitally Printed Solutions; Growth in Non-woven and Paper-based Wallpapers.

6. What are the notable trends driving market growth?

Rebounding Residential Construction Activity in the United States is Boosting the Market.

7. Are there any restraints impacting market growth?

Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending.

8. Can you provide examples of recent developments in the market?

April 2022 - Georgia-Pacific lumber business is collaborating with leaders in the mass timber industry on a new office building in Atlanta's famous Ponce City Market development to support the construction of a four-story mass timber loft office building. The building will have 90,000 square feet of office space and 23,000 square feet of ground-level retail space, and it will be LEED-certified and run on net-zero carbon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Wall Coverings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Wall Coverings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Wall Coverings Market?

To stay informed about further developments, trends, and reports in the United States Wall Coverings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence