Key Insights

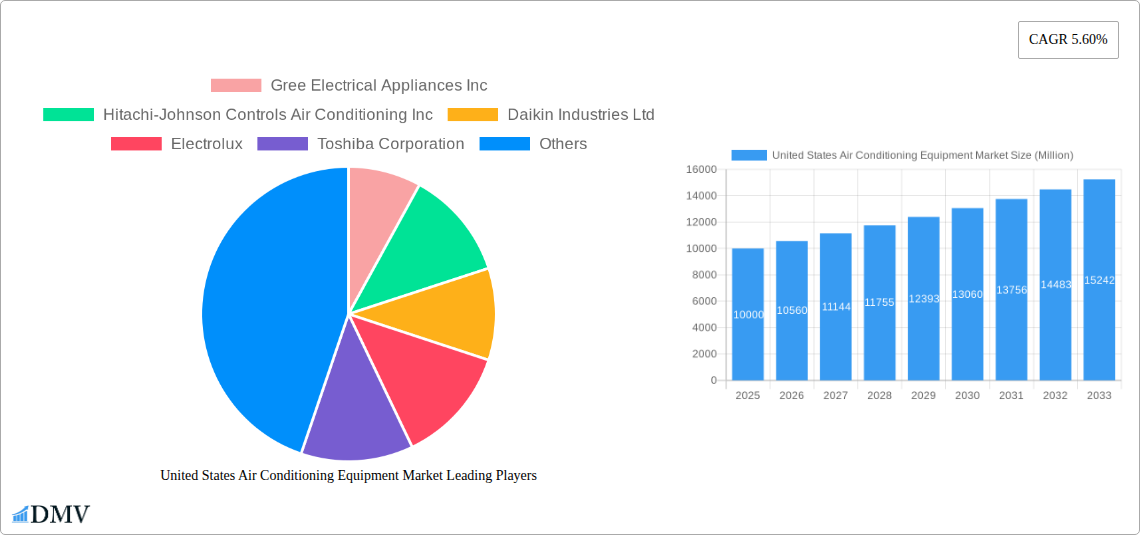

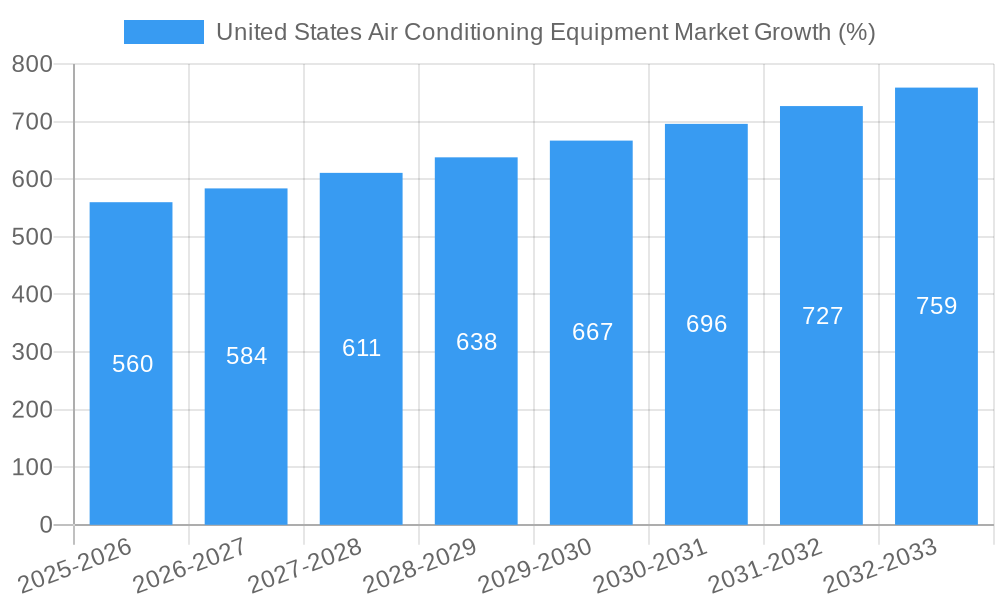

The United States air conditioning equipment market, a significant segment of the global HVAC industry, is experiencing robust growth fueled by several key factors. Rising temperatures driven by climate change are increasing demand for residential and commercial cooling solutions. Stringent energy efficiency regulations, like those enforced by the Department of Energy, are driving adoption of higher-efficiency equipment, such as inverter-driven systems and smart thermostats. Furthermore, the construction boom, particularly in the commercial and industrial sectors, contributes to sustained demand for new air conditioning installations. The market is segmented by equipment type (single-splits, multi-splits, VRF systems, air handling units, chillers, fan coils, packaged and rooftop units), distribution channels (exclusive stores, online retailers, multi-brand stores), and end-user segments (residential, commercial, industrial). Leading players like Gree, Daikin, Carrier, and LG Electronics are leveraging technological advancements and strategic partnerships to maintain their market share.

While the market exhibits promising growth prospects, certain challenges remain. Fluctuations in raw material prices, particularly for refrigerants and metals, can impact manufacturing costs and profitability. Supply chain disruptions, although less prevalent than in recent years, still pose a risk to timely project completions. Furthermore, the increasing focus on sustainable and environmentally friendly refrigerants necessitates significant investments in research and development by manufacturers to comply with evolving regulations. The market is expected to continue its upward trajectory, driven by ongoing urbanization and infrastructural development, although the pace may be influenced by macroeconomic factors and potential regulatory shifts. The 5.60% CAGR suggests a healthy and steadily growing market, ripe for investment and expansion. Considering the substantial US population and its dependence on air conditioning, the long-term outlook for the market remains positive.

United States Air Conditioning Equipment Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United States air conditioning equipment market, offering invaluable insights for stakeholders seeking to navigate this dynamic industry. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report meticulously examines market segmentation, competitive landscape, technological advancements, and future growth opportunities, equipping readers with the knowledge necessary to make informed strategic decisions. The market size is projected to reach xx Million by 2033, presenting significant potential for investment and expansion.

United States Air Conditioning Equipment Market Composition & Trends

This section delves into the intricate composition of the US air conditioning equipment market, evaluating its concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with key players like Carrier, Daikin Industries Ltd, and Trane Technologies holding significant market share. However, the presence of several smaller, specialized players fosters healthy competition.

- Market Share Distribution (2024): Carrier (20%), Daikin Industries Ltd (18%), Trane Technologies (15%), Others (47%). These figures are estimates based on available market data.

- Innovation Catalysts: Stringent energy efficiency regulations (e.g., ASHRAE standards), rising consumer demand for smart home technology integration, and advancements in refrigerant technology are key drivers of innovation.

- Regulatory Landscape: EPA regulations concerning refrigerants and energy efficiency standards significantly impact market dynamics.

- Substitute Products: While air conditioning remains the dominant solution for climate control, passive cooling techniques and improved building insulation are emerging as substitutes in specific applications.

- End-User Profiles: The market is segmented across residential, commercial, and industrial sectors, with commercial applications representing a significant portion of the overall demand.

- M&A Activities: The past five years have witnessed several notable M&A deals, with aggregate transaction values exceeding xx Million. These consolidations reflect industry consolidation and expansion strategies.

United States Air Conditioning Equipment Market Industry Evolution

This section analyzes the evolution of the US air conditioning equipment market, tracing its growth trajectory, technological advancements, and evolving consumer demands from 2019 to 2024 and projecting trends until 2033. The market has experienced robust growth driven by increasing disposable incomes, urbanization, and rising awareness of indoor air quality. Technological advancements, such as the integration of smart features, energy-efficient designs, and the adoption of eco-friendly refrigerants, are reshaping the market landscape. Consumer preferences are shifting towards energy-efficient and technologically advanced systems, emphasizing both functionality and sustainability. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Adoption of smart HVAC systems is anticipated to increase by xx% annually during the same period, reflecting growing consumer preference for automation and remote control capabilities.

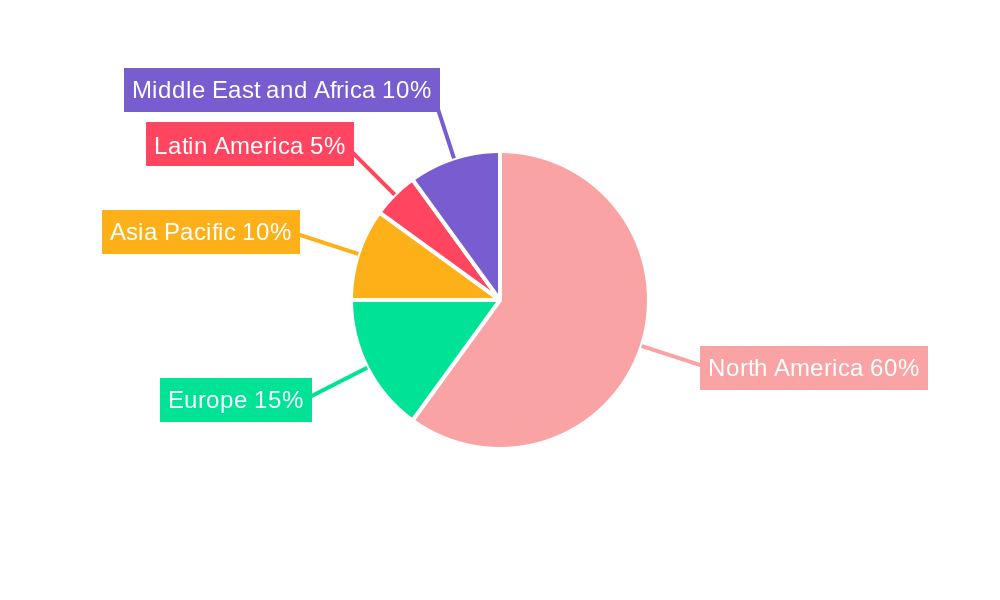

Leading Regions, Countries, or Segments in United States Air Conditioning Equipment Market

The Southern and Southwestern regions of the United States represent the dominant market segments due to their hot and humid climates. Within these regions, states such as Florida, Texas, and California exhibit exceptionally high demand. Among the equipment types, single splits/multi-splits dominate, representing approximately xx% of the total market, driven by their cost-effectiveness and suitability for residential applications.

- Key Drivers (Southern & Southwestern Regions): High ambient temperatures, increasing construction activity in commercial and residential sectors, and supportive government incentives for energy-efficient appliances.

- Commercial Sector Dominance: The commercial sector displays the highest growth rate, driven by the increasing need for climate control in office buildings, retail spaces, and hospitality facilities.

- Online Distribution Channel Growth: Online sales channels are gaining traction due to enhanced customer convenience and competitive pricing, projected to increase by xx% by 2033.

United States Air Conditioning Equipment Market Product Innovations

Recent innovations focus on enhancing energy efficiency, improving indoor air quality, and integrating smart features. This includes the development of inverter-based systems with variable-speed compressors, air purification systems incorporating HEPA filters and UV sterilization, and smart thermostats with remote control and predictive capabilities. These innovations offer enhanced user experience, reduced energy consumption, and improved environmental sustainability. The incorporation of IoT (Internet of Things) technology enables remote monitoring, diagnostics, and predictive maintenance, minimizing downtime and optimizing operational efficiency.

Propelling Factors for United States Air Conditioning Equipment Market Growth

Several factors fuel the market's growth. Stringent government regulations promoting energy efficiency stimulate demand for advanced HVAC systems. Rising disposable incomes, particularly in the Southern and Southwestern regions, boost consumer spending on comfort-enhancing appliances. Furthermore, technological advancements like IoT integration and smart home solutions enhance product appeal.

Obstacles in the United States Air Conditioning Equipment Market

Supply chain disruptions caused by global events and component shortages can lead to production delays and price increases, affecting market growth. Fluctuations in raw material prices, particularly for metals and refrigerants, also pose challenges. Intense competition among established players and new entrants impacts pricing strategies and profitability.

Future Opportunities in United States Air Conditioning Equipment Market

The market presents several exciting opportunities. The increasing adoption of sustainable building practices and demand for environmentally friendly refrigerants drive growth. Expansion into new markets, such as smart home integration and advanced building automation systems, presents significant potential. Demand for improved air quality solutions, especially in response to increased health awareness, is another significant growth driver.

Major Players in the United States Air Conditioning Equipment Market Ecosystem

- Gree Electrical Appliances Inc

- Hitachi-Johnson Controls Air Conditioning Inc

- Daikin Industries Ltd

- Electrolux

- Toshiba Corporation

- LG Electronics Inc

- Haier Group Corporation

- Carrier

- Panasonic Corporation

- Emerson Electric Company

Key Developments in United States Air Conditioning Equipment Industry

- January 2023: Carrier launches a new line of energy-efficient air conditioners.

- March 2024: Daikin acquires a smaller competitor, expanding its market share.

- June 2024: New EPA regulations concerning refrigerants come into effect.

(Further developments to be added with specific dates and impacts)

Strategic United States Air Conditioning Equipment Market Forecast

The US air conditioning equipment market is poised for continued growth, driven by technological advancements, supportive government policies, and sustained demand across all market segments. The increasing focus on sustainable solutions and smart home integration will shape the future market landscape. The market’s expansion will be driven by both residential and commercial demand, particularly in high-growth regions. This report offers invaluable insights into the market’s evolution, empowering stakeholders to make strategic decisions and capitalize on emerging opportunities.

United States Air Conditioning Equipment Market Segmentation

-

1. Equipment

-

1.1. Air Conditioning/Ventilation Equipment

-

1.1.1. Type

- 1.1.1.1. Single Splits/Multi-Splits

- 1.1.1.2. VRF

- 1.1.1.3. Air Handling Units

- 1.1.1.4. Chillers

- 1.1.1.5. Fans Coils

- 1.1.1.6. Indoor Packaged And Roof Tops

- 1.1.1.7. Other Types

-

1.1.1. Type

-

1.1. Air Conditioning/Ventilation Equipment

-

2. Distribution Channel

- 2.1. Exclusive Stores

- 2.2. Online

- 2.3. Multi Brand Stores

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

United States Air Conditioning Equipment Market Segmentation By Geography

- 1. United States

United States Air Conditioning Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Replacement Of Existing Equipment With Better Performing Ones; Supportive Government Regulations Including Incentives For Saving Energy Through Tax Credit Programs

- 3.3. Market Restrains

- 3.3.1. Rising Competition among key vendors to limit margins

- 3.4. Market Trends

- 3.4.1. Commercial Segment is one of the Factor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Air Conditioning/Ventilation Equipment

- 5.1.1.1. Type

- 5.1.1.1.1. Single Splits/Multi-Splits

- 5.1.1.1.2. VRF

- 5.1.1.1.3. Air Handling Units

- 5.1.1.1.4. Chillers

- 5.1.1.1.5. Fans Coils

- 5.1.1.1.6. Indoor Packaged And Roof Tops

- 5.1.1.1.7. Other Types

- 5.1.1.1. Type

- 5.1.1. Air Conditioning/Ventilation Equipment

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Exclusive Stores

- 5.2.2. Online

- 5.2.3. Multi Brand Stores

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America United States Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United States Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa United States Air Conditioning Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Gree Electrical Appliances Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hitachi-Johnson Controls Air Conditioning Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daikin Industries Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Electrolux

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toshiba Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG Electronics Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Haier Group Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Carrier

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Panasonic Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Emerson Electric Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Gree Electrical Appliances Inc

List of Figures

- Figure 1: United States Air Conditioning Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Air Conditioning Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: United States Air Conditioning Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United States Air Conditioning Equipment Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 4: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Equipment 2019 & 2032

- Table 5: United States Air Conditioning Equipment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: United States Air Conditioning Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: United States Air Conditioning Equipment Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: United States Air Conditioning Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: United States Air Conditioning Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: United States Air Conditioning Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: United States Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United States Air Conditioning Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: United States Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: United States Air Conditioning Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: United States Air Conditioning Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United States Air Conditioning Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States Air Conditioning Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: United States Air Conditioning Equipment Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 32: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Equipment 2019 & 2032

- Table 33: United States Air Conditioning Equipment Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 35: United States Air Conditioning Equipment Market Revenue Million Forecast, by End User 2019 & 2032

- Table 36: United States Air Conditioning Equipment Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 37: United States Air Conditioning Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Air Conditioning Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Air Conditioning Equipment Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the United States Air Conditioning Equipment Market?

Key companies in the market include Gree Electrical Appliances Inc, Hitachi-Johnson Controls Air Conditioning Inc, Daikin Industries Ltd, Electrolux, Toshiba Corporation, LG Electronics Inc, Haier Group Corporation, Carrier, Panasonic Corporation, Emerson Electric Company.

3. What are the main segments of the United States Air Conditioning Equipment Market?

The market segments include Equipment, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Replacement Of Existing Equipment With Better Performing Ones; Supportive Government Regulations Including Incentives For Saving Energy Through Tax Credit Programs.

6. What are the notable trends driving market growth?

Commercial Segment is one of the Factor Driving the Market.

7. Are there any restraints impacting market growth?

Rising Competition among key vendors to limit margins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Air Conditioning Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Air Conditioning Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Air Conditioning Equipment Market?

To stay informed about further developments, trends, and reports in the United States Air Conditioning Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence