Key Insights

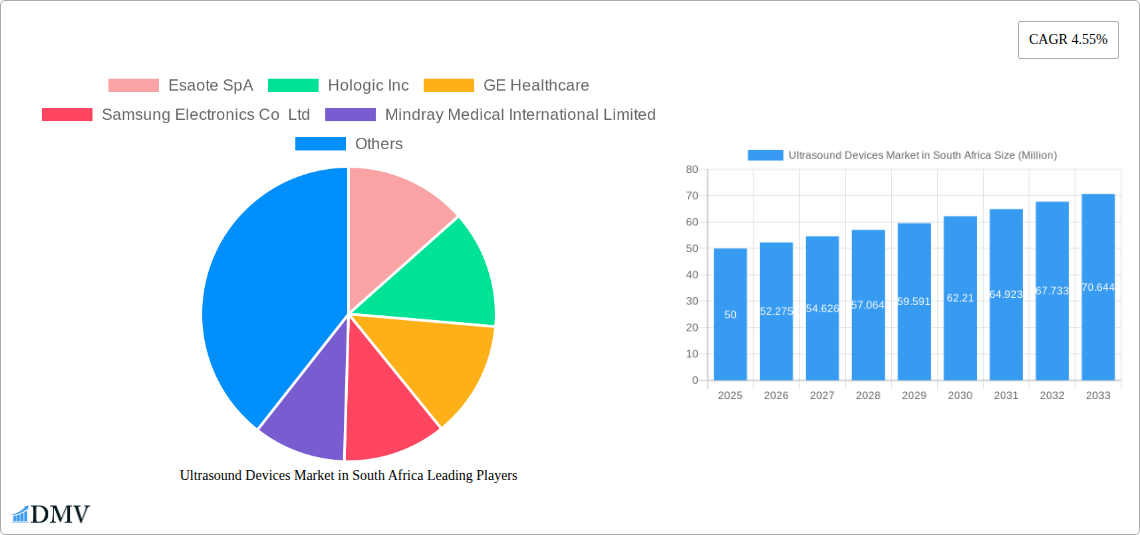

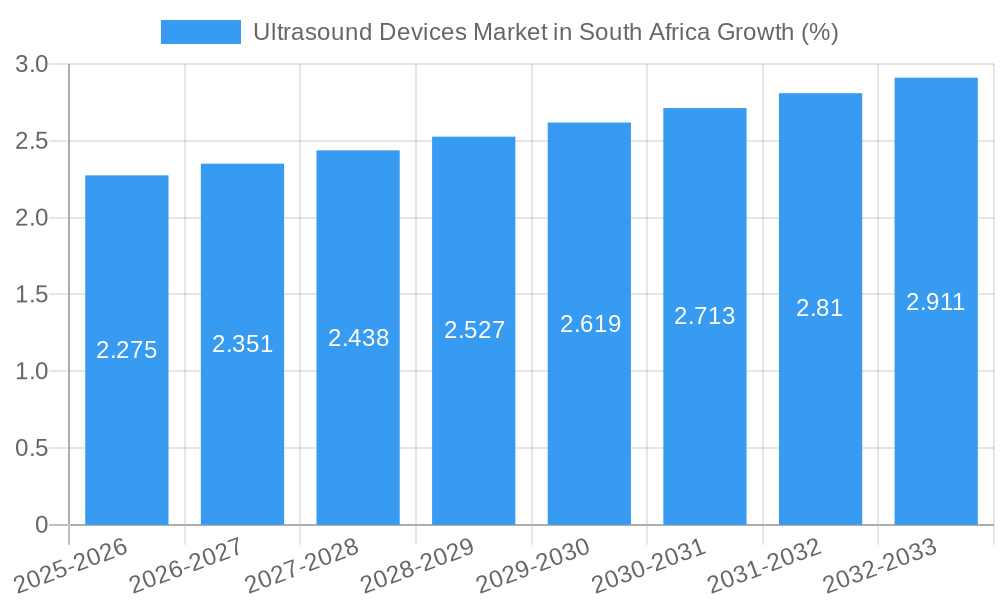

The South African ultrasound devices market, while lacking precise figures for market size in the provided data, exhibits strong growth potential mirroring global trends. Considering a global CAGR of 4.55% and the increasing prevalence of chronic diseases requiring ultrasound diagnosis (cardiology, gynecology/obstetrics, radiology), coupled with rising healthcare expenditure in South Africa, we can reasonably project substantial growth in the coming years. The market is segmented by application (cardiology leading due to the high incidence of heart disease, followed by gynecology/obstetrics and radiology), technology (2D remaining dominant but with increasing adoption of 3D/4D for enhanced visualization), and type (portable ultrasound showing higher growth driven by increased accessibility in remote areas). Key drivers include increasing demand for improved diagnostic capabilities, technological advancements leading to more efficient and portable devices, and government initiatives to improve healthcare infrastructure. However, challenges persist, including high costs of advanced ultrasound systems, limited healthcare infrastructure in certain regions, and the need for skilled technicians to operate these devices. This necessitates strategic investments in training and technology to fully unlock the market's potential.

The competitive landscape includes both international giants like GE Healthcare, Philips, and Siemens, alongside local distributors. These companies are likely focused on expanding their market share by introducing innovative products tailored to the specific needs of the South African healthcare system, including solutions for cost-effectiveness and accessibility. The forecast period (2025-2033) will witness significant growth fueled by factors mentioned above, with the market possibly exceeding projected values based on the accelerating adoption of advanced technologies and a growing emphasis on preventative healthcare. The market is expected to witness a shift towards portable and advanced imaging technologies, further contributing to overall market expansion and accessibility.

Ultrasound Devices Market in South Africa: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Ultrasound Devices market in South Africa, covering market size, segmentation, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This comprehensive analysis is crucial for stakeholders seeking to understand the dynamics of this vital medical technology sector in South Africa. The report leverages extensive data analysis to offer actionable insights and forecast future market trends, helping businesses make informed strategic decisions. The market value reached approximately xx Million in 2024 and is projected to achieve xx Million by 2033.

Ultrasound Devices Market in South Africa Market Composition & Trends

The South African ultrasound devices market exhibits a moderately consolidated structure, with key players such as Esaote SpA, Hologic Inc, GE Healthcare, and Siemens Healthineers AG holding significant market share. However, the market also accommodates several smaller, specialized players focusing on niche applications. Market share distribution fluctuates based on technological advancements and successful marketing strategies. The average M&A deal value in the last five years has been approximately xx Million, reflecting a moderate level of consolidation activity. Innovation is primarily driven by the demand for improved image quality, portability, and connectivity. The regulatory landscape, largely aligned with international standards, ensures product safety and efficacy. Substitute products, such as MRI and CT scans, exist but ultrasound maintains its edge due to cost-effectiveness and portability, making it particularly crucial in underserved areas. End-users consist primarily of hospitals, clinics, and diagnostic imaging centers, both public and private.

- Market Concentration: Moderately consolidated, with a few major players dominating.

- Innovation Catalysts: Demand for improved image quality, portability, and connectivity.

- Regulatory Landscape: Aligned with international standards, ensuring product safety.

- Substitute Products: MRI, CT scans, but ultrasound remains cost-effective and portable.

- End-User Profile: Hospitals, clinics, and diagnostic imaging centers (public and private).

- M&A Activity: Moderate, with an average deal value of approximately xx Million in the past five years.

Ultrasound Devices Market in South Africa Industry Evolution

The South African ultrasound devices market has witnessed consistent growth over the historical period (2019-2024), driven by increasing healthcare expenditure, rising prevalence of chronic diseases necessitating diagnostic imaging, and government initiatives to improve healthcare infrastructure. Technological advancements, particularly in 3D/4D imaging and portable ultrasound systems, have significantly impacted market growth. The adoption rate of advanced technologies is increasing steadily, with a projected xx% annual growth in the adoption of 3D/4D ultrasound systems during the forecast period. Shifting consumer demands favor user-friendly interfaces, wireless connectivity, and improved image quality. This evolution is further catalyzed by the growing emphasis on preventative healthcare and point-of-care diagnostics. The market experienced a xx% CAGR between 2019 and 2024 and is expected to exhibit a xx% CAGR between 2025 and 2033. This growth is fueled by factors such as government initiatives to improve healthcare infrastructure, increased healthcare expenditure, and the rising prevalence of chronic diseases that necessitate diagnostic imaging.

Leading Regions, Countries, or Segments in Ultrasound Devices Market in South Africa

While data on regional segmentation within South Africa is limited, Gynecology/Obstetrics remains a dominant application segment, driven by high birth rates and the increasing prevalence of maternal health concerns. Cardiovascular applications also show significant growth potential, fueled by the rising incidence of heart diseases. 2D ultrasound imaging continues to hold the largest market share due to its cost-effectiveness and widespread availability. However, the adoption of 3D/4D and portable ultrasound systems is rapidly increasing. Stationary ultrasound systems currently maintain a larger market share compared to portable systems, although the latter segment is expected to grow rapidly due to their increased versatility and convenience.

- Key Drivers (Gynecology/Obstetrics): High birth rates, increased focus on maternal health, and improved access to healthcare.

- Key Drivers (Cardiology): Rising prevalence of heart diseases, government initiatives for cardiovascular health.

- Key Drivers (2D Ultrasound): Cost-effectiveness and established infrastructure.

- Key Drivers (3D/4D Ultrasound): Improved diagnostic capabilities and enhanced visualization.

- Key Drivers (Portable Ultrasound): Increased convenience, portability, and applicability in remote areas.

Ultrasound Devices Market in South Africa Product Innovations

Recent innovations in ultrasound technology include advancements in AI-powered image analysis, improved transducer designs for enhanced resolution, and the development of more compact and portable devices. Wireless connectivity features are also increasingly incorporated for seamless data transfer and remote diagnostics. These innovations enhance diagnostic accuracy, improve workflow efficiency, and expand the accessibility of ultrasound services. The unique selling propositions focus on ease of use, improved image quality, portability, and advanced diagnostic capabilities.

Propelling Factors for Ultrasound Devices Market in South Africa Growth

The growth of the South African ultrasound devices market is propelled by several factors. Technological advancements, such as the development of more portable and user-friendly devices, have significantly improved accessibility and affordability. Economic growth and rising healthcare expenditure have also contributed to increased demand. Finally, government initiatives to improve healthcare infrastructure and expand access to healthcare services play a crucial role in market expansion.

Obstacles in the Ultrasound Devices Market in South Africa Market

The South African ultrasound market faces challenges including potential regulatory hurdles in the approval and registration of new devices, supply chain disruptions that could impact product availability, and intense competition from both domestic and international players. These factors can lead to price fluctuations and limit market growth. Furthermore, the uneven distribution of healthcare resources across the country presents a significant barrier to market penetration in certain regions.

Future Opportunities in Ultrasound Devices Market in South Africa

Future opportunities lie in expanding into underserved areas through the adoption of portable and cost-effective ultrasound systems. The integration of AI and machine learning for automated image analysis and diagnostic support offers significant growth potential. The rising demand for point-of-care diagnostics also presents a significant opportunity for the expansion of the portable ultrasound segment.

Major Players in the Ultrasound Devices Market in South Africa Ecosystem

- Esaote SpA

- Hologic Inc

- GE Healthcare

- Samsung Electronics Co Ltd

- Mindray Medical International Limited

- Siemens Healthineers AG

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- Carestream Health Inc

- Avacare Health

- Fujifilm Holdings Corporation

Key Developments in Ultrasound Devices Market in South Africa Industry

- March 2023: Innov8 Group Holdings and Avacare Global launch a wireless ultrasound solution in South Africa. This signifies a significant advancement in technology accessibility and affordability.

- August 2022: Hisense donates its Hisense Ultrasound HD60 to Mowbray Maternity Hospital, boosting healthcare infrastructure and impacting patient care.

Strategic Ultrasound Devices Market in South Africa Market Forecast

The South African ultrasound devices market is poised for continued growth, driven by technological advancements, increasing healthcare expenditure, and government initiatives. The forecast period (2025-2033) anticipates robust expansion, fueled by the adoption of innovative technologies, expanding access to healthcare in underserved areas, and a growing emphasis on preventative care. This positive outlook positions the market for substantial growth and opportunities for stakeholders.

Ultrasound Devices Market in South Africa Segmentation

-

1. Application

- 1.1. Cardiology

- 1.2. Gynecology/Obstetrics

- 1.3. Radiology

- 1.4. Other Applications

-

2. Technology

- 2.1. 2D Ultrasound Imaging

- 2.2. 3D and 4D Ultrasound Imaging

- 2.3. Other technologies

-

3. Type

- 3.1. Stationary Ultrasound

- 3.2. Portable Ultrasound

Ultrasound Devices Market in South Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ultrasound Devices Market in South Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Chronic Diseases; Improving Healthcare Infrastructure

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. 3D and 4D Ultrasound Imaging segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cardiology

- 5.1.2. Gynecology/Obstetrics

- 5.1.3. Radiology

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. 2D Ultrasound Imaging

- 5.2.2. 3D and 4D Ultrasound Imaging

- 5.2.3. Other technologies

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Stationary Ultrasound

- 5.3.2. Portable Ultrasound

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cardiology

- 6.1.2. Gynecology/Obstetrics

- 6.1.3. Radiology

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. 2D Ultrasound Imaging

- 6.2.2. 3D and 4D Ultrasound Imaging

- 6.2.3. Other technologies

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Stationary Ultrasound

- 6.3.2. Portable Ultrasound

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cardiology

- 7.1.2. Gynecology/Obstetrics

- 7.1.3. Radiology

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. 2D Ultrasound Imaging

- 7.2.2. 3D and 4D Ultrasound Imaging

- 7.2.3. Other technologies

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Stationary Ultrasound

- 7.3.2. Portable Ultrasound

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cardiology

- 8.1.2. Gynecology/Obstetrics

- 8.1.3. Radiology

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. 2D Ultrasound Imaging

- 8.2.2. 3D and 4D Ultrasound Imaging

- 8.2.3. Other technologies

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Stationary Ultrasound

- 8.3.2. Portable Ultrasound

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cardiology

- 9.1.2. Gynecology/Obstetrics

- 9.1.3. Radiology

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. 2D Ultrasound Imaging

- 9.2.2. 3D and 4D Ultrasound Imaging

- 9.2.3. Other technologies

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Stationary Ultrasound

- 9.3.2. Portable Ultrasound

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cardiology

- 10.1.2. Gynecology/Obstetrics

- 10.1.3. Radiology

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. 2D Ultrasound Imaging

- 10.2.2. 3D and 4D Ultrasound Imaging

- 10.2.3. Other technologies

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Stationary Ultrasound

- 10.3.2. Portable Ultrasound

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. South Africa Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 12. Sudan Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 13. Uganda Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 15. Kenya Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa Ultrasound Devices Market in South Africa Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Esaote SpA

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Hologic Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 GE Healthcare

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Samsung Electronics Co Ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Mindray Medical International Limited

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Siemens Healthineers AG

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Koninklijke Philips NV

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Canon Medical Systems Corporation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Carestream Health Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Avacare Health*List Not Exhaustive

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Fujifilm Holdings Corporation

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 Esaote SpA

List of Figures

- Figure 1: Global Ultrasound Devices Market in South Africa Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Africa Ultrasound Devices Market in South Africa Revenue (Million), by Country 2024 & 2032

- Figure 3: Africa Ultrasound Devices Market in South Africa Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Ultrasound Devices Market in South Africa Revenue (Million), by Application 2024 & 2032

- Figure 5: North America Ultrasound Devices Market in South Africa Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Ultrasound Devices Market in South Africa Revenue (Million), by Technology 2024 & 2032

- Figure 7: North America Ultrasound Devices Market in South Africa Revenue Share (%), by Technology 2024 & 2032

- Figure 8: North America Ultrasound Devices Market in South Africa Revenue (Million), by Type 2024 & 2032

- Figure 9: North America Ultrasound Devices Market in South Africa Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Ultrasound Devices Market in South Africa Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Ultrasound Devices Market in South Africa Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Ultrasound Devices Market in South Africa Revenue (Million), by Application 2024 & 2032

- Figure 13: South America Ultrasound Devices Market in South Africa Revenue Share (%), by Application 2024 & 2032

- Figure 14: South America Ultrasound Devices Market in South Africa Revenue (Million), by Technology 2024 & 2032

- Figure 15: South America Ultrasound Devices Market in South Africa Revenue Share (%), by Technology 2024 & 2032

- Figure 16: South America Ultrasound Devices Market in South Africa Revenue (Million), by Type 2024 & 2032

- Figure 17: South America Ultrasound Devices Market in South Africa Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Ultrasound Devices Market in South Africa Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Ultrasound Devices Market in South Africa Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Ultrasound Devices Market in South Africa Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Ultrasound Devices Market in South Africa Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Ultrasound Devices Market in South Africa Revenue (Million), by Technology 2024 & 2032

- Figure 23: Europe Ultrasound Devices Market in South Africa Revenue Share (%), by Technology 2024 & 2032

- Figure 24: Europe Ultrasound Devices Market in South Africa Revenue (Million), by Type 2024 & 2032

- Figure 25: Europe Ultrasound Devices Market in South Africa Revenue Share (%), by Type 2024 & 2032

- Figure 26: Europe Ultrasound Devices Market in South Africa Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Ultrasound Devices Market in South Africa Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Ultrasound Devices Market in South Africa Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East & Africa Ultrasound Devices Market in South Africa Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East & Africa Ultrasound Devices Market in South Africa Revenue (Million), by Technology 2024 & 2032

- Figure 31: Middle East & Africa Ultrasound Devices Market in South Africa Revenue Share (%), by Technology 2024 & 2032

- Figure 32: Middle East & Africa Ultrasound Devices Market in South Africa Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East & Africa Ultrasound Devices Market in South Africa Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East & Africa Ultrasound Devices Market in South Africa Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Ultrasound Devices Market in South Africa Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Ultrasound Devices Market in South Africa Revenue (Million), by Application 2024 & 2032

- Figure 37: Asia Pacific Ultrasound Devices Market in South Africa Revenue Share (%), by Application 2024 & 2032

- Figure 38: Asia Pacific Ultrasound Devices Market in South Africa Revenue (Million), by Technology 2024 & 2032

- Figure 39: Asia Pacific Ultrasound Devices Market in South Africa Revenue Share (%), by Technology 2024 & 2032

- Figure 40: Asia Pacific Ultrasound Devices Market in South Africa Revenue (Million), by Type 2024 & 2032

- Figure 41: Asia Pacific Ultrasound Devices Market in South Africa Revenue Share (%), by Type 2024 & 2032

- Figure 42: Asia Pacific Ultrasound Devices Market in South Africa Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Ultrasound Devices Market in South Africa Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Technology 2019 & 2032

- Table 15: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Technology 2019 & 2032

- Table 29: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Germany Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: France Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Italy Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Spain Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Russia Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Benelux Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Nordics Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Technology 2019 & 2032

- Table 42: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Turkey Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Israel Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: GCC Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: North Africa Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East & Africa Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Technology 2019 & 2032

- Table 52: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 53: Global Ultrasound Devices Market in South Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Ultrasound Devices Market in South Africa Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultrasound Devices Market in South Africa?

The projected CAGR is approximately 4.55%.

2. Which companies are prominent players in the Ultrasound Devices Market in South Africa?

Key companies in the market include Esaote SpA, Hologic Inc, GE Healthcare, Samsung Electronics Co Ltd, Mindray Medical International Limited, Siemens Healthineers AG, Koninklijke Philips NV, Canon Medical Systems Corporation, Carestream Health Inc, Avacare Health*List Not Exhaustive, Fujifilm Holdings Corporation.

3. What are the main segments of the Ultrasound Devices Market in South Africa?

The market segments include Application, Technology, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Chronic Diseases; Improving Healthcare Infrastructure.

6. What are the notable trends driving market growth?

3D and 4D Ultrasound Imaging segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

In March 2023, Innov8 Group Holdings, a South African medical technology company, in collaboration with Avacare Global, launched its wireless ultrasound solution in South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultrasound Devices Market in South Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultrasound Devices Market in South Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultrasound Devices Market in South Africa?

To stay informed about further developments, trends, and reports in the Ultrasound Devices Market in South Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence