Key Insights

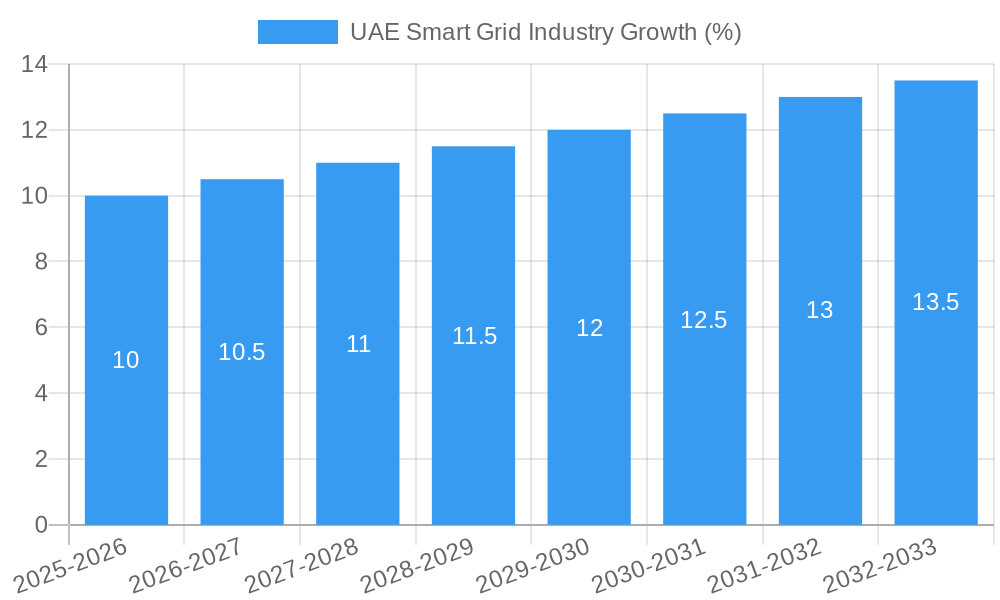

The UAE smart grid market is experiencing robust growth, driven by the nation's commitment to sustainable energy and infrastructure modernization. With a CAGR exceeding 2.5% and a 2025 market value in the hundreds of millions (a precise figure requires more detailed market data but a reasonable estimate given the context would be between $300-500 million USD), the sector is poised for significant expansion throughout the forecast period (2025-2033). Key growth drivers include increasing electricity demand, the government's ambitious renewable energy targets (such as the UAE Energy Strategy 2050), and the need for improved grid reliability and efficiency. The integration of advanced metering infrastructure (AMI) is a major trend, enabling better energy management and reducing losses. Technological advancements in transmission and communication technologies are further fueling this growth. While the market faces potential restraints such as high initial investment costs and the need for skilled workforce development, the long-term benefits and government support are expected to outweigh these challenges. Leading companies like Honeywell, ABB, Schneider Electric, and General Electric are actively participating in the market, contributing to the deployment of cutting-edge smart grid solutions. The significant investments in infrastructure projects across the UAE, coupled with the government's focus on digital transformation, strongly indicate a promising future for the smart grid sector in the region. The segmentation by technology application area highlights the diverse opportunities available within the market, with transmission and communication technologies currently dominating the landscape.

The UAE's strategic focus on smart city initiatives and digitalization significantly contributes to the smart grid's growth trajectory. The involvement of key utilities like the Abu Dhabi Distribution Company, Dubai Electricity and Water Authority, and Sharjah Electricity and Water Board underlines the governmental support and active participation in shaping the sector's future. The historical period (2019-2024) likely saw a steady rise in adoption, setting the stage for the accelerated growth predicted during the forecast period. The regional concentration currently within the UAE may broaden to other GCC countries in coming years, creating further opportunities for expansion and market consolidation among leading players. Continued focus on renewable energy integration, grid modernization, and enhanced cybersecurity measures will be crucial for sustaining this positive growth momentum and ensuring the long-term viability of the UAE smart grid.

UAE Smart Grid Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the UAE smart grid industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. With a detailed examination of market trends, technological advancements, and key players, this report is an indispensable resource for strategic decision-making. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. The market is projected to reach xx Million by 2033.

UAE Smart Grid Industry Market Composition & Trends

This section delves into the competitive landscape of the UAE smart grid market, examining market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user profiles, and mergers and acquisitions (M&A) activities. The report analyzes market share distribution among key players, including Honeywell International Inc, ABB Ltd, Abu Dhabi Distribution Company, Korea Electric Power Corporation, Schneider Electric SE, Dubai Electricity and Water Authority (DEWA), General Electric Company, and Sharjah Electricity and Water Board (among others). While precise market share figures require further analysis, the report estimates a xx Million market value in 2025, indicating a highly concentrated market with specific players holding significant shares. The impact of M&A activity, including deal values (estimated at xx Million in total for the period 2019-2024), is also analyzed to determine its influence on market consolidation and innovation. Innovation is driven by the UAE's commitment to sustainability and technological advancement, fostering a dynamic environment for new product development and deployment. Regulatory factors, such as government initiatives promoting renewable energy integration and smart grid adoption, are also considered, along with an assessment of substitute technologies and their potential impact on market growth. The end-user analysis focuses on the electricity distribution companies and their evolving needs and adoption strategies in the context of broader national sustainability targets.

- Market Concentration: High, with several major players dominating the market.

- M&A Activity: xx Million in total deal value (2019-2024), significantly impacting market consolidation.

- Innovation Catalysts: Government initiatives supporting renewable energy integration and smart grid technologies.

- Regulatory Landscape: Supportive of smart grid deployment, driving market growth.

UAE Smart Grid Industry Industry Evolution

This section provides a detailed analysis of the UAE smart grid industry's evolution from 2019 to 2033. It examines market growth trajectories, technological advancements, and shifts in consumer demand. Growth is significantly influenced by the UAE's ambitious energy diversification strategies and its commitment to achieving a low-carbon economy. Specific data points, including annual growth rates (projected at xx% CAGR from 2025-2033) and adoption metrics for key technologies like AMI and communication technologies, are presented to illustrate market maturity and future potential. The increasing adoption of AI and IoT technologies in grid management significantly impacts the growth trajectory, with predictive maintenance solutions and improved grid stability contributing to increased efficiency and reduced operational costs. This evolution is shaped by consumer expectations of greater reliability, efficiency, and sustainability in energy services.

Leading Regions, Countries, or Segments in UAE Smart Grid Industry

This section identifies the dominant segments within the UAE smart grid industry based on technology application areas: Transmission, Communication Technology, Advanced Metering Infrastructure (AMI), and Other Technology Application Areas.

- AMI: Is currently experiencing substantial growth due to government initiatives promoting smart metering and energy efficiency programs. This segment's dominance is driven by substantial investments (xx Million projected in 2025) in AMI infrastructure upgrades across various emirates. Strong regulatory support and demand for improved energy management contribute to its leading position.

- Transmission: The transmission segment is crucial for efficient electricity delivery. The ongoing expansion of the national grid and investment in high-voltage transmission lines significantly drives its market share. Furthermore, initiatives promoting renewable energy integration into the grid strongly contribute to this segment's expansion.

- Communication Technology: This is a critical enabler for smart grid functionalities. The increasing demand for reliable and secure communication networks supporting advanced grid management systems and smart meters drives growth within this segment. The investments in 5G and other advanced communication infrastructure further amplify this trend.

- Other Technology Application Areas: This segment comprises a variety of solutions, including energy storage, grid automation, and demand-side management technologies. The increasing focus on grid modernization and resilience drives growth in these areas.

The report provides detailed analysis of each segment's contributing factors to dominance, considering investments, technological advancements, and regulatory influences.

UAE Smart Grid Industry Product Innovations

The UAE smart grid market witnesses continuous innovation in areas such as AI-driven predictive maintenance for smart meters (as seen in DEWA's "iService"), and sophisticated software solutions for optimizing electricity distribution network designs (DEWA's SDEDNs). These innovations focus on enhancing grid reliability, efficiency, and security, utilizing advanced analytics and machine learning to improve operational performance and minimize disruptions. Unique selling propositions include reduced operational costs, improved grid stability, and enhanced customer experience.

Propelling Factors for UAE Smart Grid Industry Growth

Several key factors drive the UAE smart grid industry's growth: The UAE's commitment to diversifying its energy sources and transitioning towards a low-carbon economy is a primary driver. Government initiatives providing financial incentives and regulatory frameworks supporting smart grid adoption significantly influence market growth. The continuous technological advancements in areas like AI, IoT, and renewable energy integration further fuel market expansion, creating opportunities for innovation and efficiency gains. Furthermore, the increasing demand for reliable and resilient energy infrastructure supports the market's robust expansion.

Obstacles in the UAE Smart Grid Industry Market

Despite significant growth potential, the UAE smart grid market faces challenges, including the high initial investment costs associated with smart grid infrastructure deployment. Supply chain disruptions and global economic fluctuations could impact the availability and cost of essential components and technologies. Competition among various technology providers can also impact profitability. These challenges need to be addressed to ensure a smooth and sustainable development of the smart grid infrastructure.

Future Opportunities in UAE Smart Grid Industry

Future opportunities exist in expanding smart grid deployments across various sectors, particularly in integrating renewable energy sources effectively. Further developments in AI and IoT technologies will offer opportunities for enhanced grid management, predictive maintenance, and demand-side management strategies. The rise of electric vehicles (EVs) creates a need for improved grid infrastructure to manage increased energy demand, generating further growth. The increasing focus on grid resilience and cybersecurity further presents opportunities for innovative solutions.

Major Players in the UAE Smart Grid Industry Ecosystem

- Honeywell International Inc

- ABB Ltd

- Abu Dhabi Distribution Company

- Korea Electric Power Corporation

- Schneider Electric SE

- Dubai Electricity and Water Authority

- General Electric Company

- Sharjah Electricity and Water Board

Key Developments in UAE Smart Grid Industry Industry

- August 2022: DEWA announced new software for Smart Design of Electricity Distribution Networks (SDEDNs), enhancing network design efficiency.

- August 2022: DEWA implemented AI-powered "iService" for smart meter malfunction prediction, improving grid reliability and fraud detection.

Strategic UAE Smart Grid Industry Market Forecast

The UAE smart grid market is poised for significant growth driven by government initiatives, technological advancements, and the increasing demand for reliable and sustainable energy solutions. The forecast period (2025-2033) projects substantial market expansion, driven by continued investments in smart grid infrastructure and the integration of renewable energy sources. The market's evolution will be shaped by ongoing innovations in areas like AI, IoT, and advanced metering infrastructure, leading to increased efficiency and reduced operational costs. The market's growth potential is significant, presenting considerable opportunities for both established players and new entrants.

UAE Smart Grid Industry Segmentation

-

1. Technology Application Area

- 1.1. Transmission

- 1.2. Communication Technology

- 1.3. Advanced Metering Infrastructure (AMI)

- 1.4. Other Technology Application Areas

UAE Smart Grid Industry Segmentation By Geography

- 1. UAE

UAE Smart Grid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Policies; Growing Demand for Heating and Cooling Systems

- 3.3. Market Restrains

- 3.3.1. Adoption of Alternative Clean Energy Sources Like Solar and Wind

- 3.4. Market Trends

- 3.4.1. Advanced Metering Infrastructure to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Smart Grid Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 5.1.1. Transmission

- 5.1.2. Communication Technology

- 5.1.3. Advanced Metering Infrastructure (AMI)

- 5.1.4. Other Technology Application Areas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. UAE

- 5.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abu Dhabi Distribution Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Korea Electric Power Corporation*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dubai Electricity and Water Authority

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sharjah Electricity and Water Board

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global UAE Smart Grid Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Smart Grid Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Smart Grid Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: UAE UAE Smart Grid Industry Revenue (Million), by Technology Application Area 2024 & 2032

- Figure 5: UAE UAE Smart Grid Industry Revenue Share (%), by Technology Application Area 2024 & 2032

- Figure 6: UAE UAE Smart Grid Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: UAE UAE Smart Grid Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Smart Grid Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Smart Grid Industry Revenue Million Forecast, by Technology Application Area 2019 & 2032

- Table 3: Global UAE Smart Grid Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UAE Smart Grid Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global UAE Smart Grid Industry Revenue Million Forecast, by Technology Application Area 2019 & 2032

- Table 6: Global UAE Smart Grid Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Smart Grid Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the UAE Smart Grid Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Abu Dhabi Distribution Company, Korea Electric Power Corporation*List Not Exhaustive, Schneider Electric SE, Dubai Electricity and Water Authority, General Electric Company, Sharjah Electricity and Water Board.

3. What are the main segments of the UAE Smart Grid Industry?

The market segments include Technology Application Area.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Policies; Growing Demand for Heating and Cooling Systems.

6. What are the notable trends driving market growth?

Advanced Metering Infrastructure to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Adoption of Alternative Clean Energy Sources Like Solar and Wind.

8. Can you provide examples of recent developments in the market?

August 2022: DEWA announced software to augment its electricity distribution network. The software is dedicated to the Smart Design of Electricity Distribution Networks (SDEDNs), which will merge databases and electric network designs (11kV) through developed solutions. This will help network engineers to design a more effective and effective network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Smart Grid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Smart Grid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Smart Grid Industry?

To stay informed about further developments, trends, and reports in the UAE Smart Grid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence