Key Insights

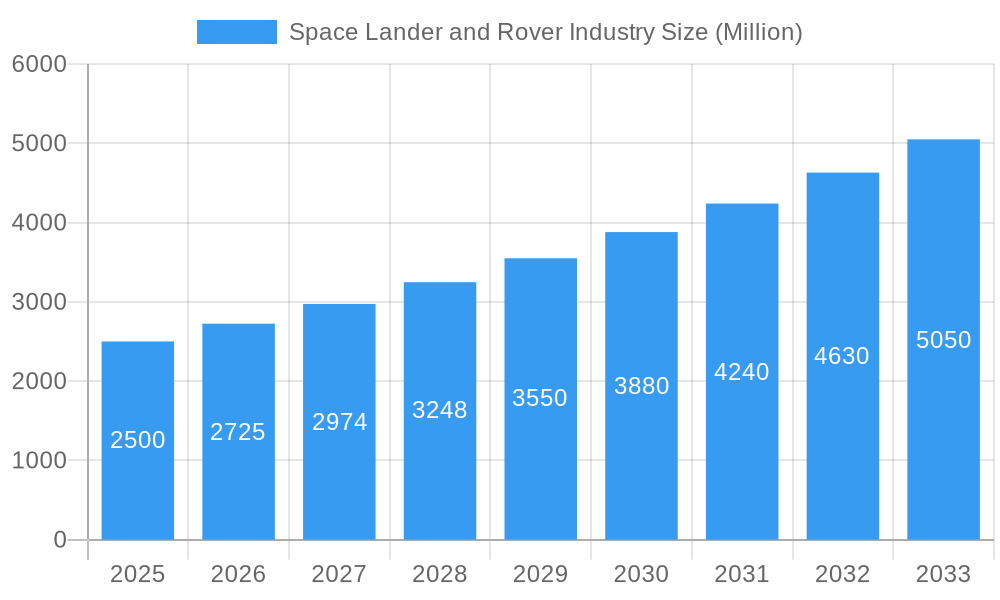

The global space lander and rover industry is experiencing robust growth, driven by increasing government investments in space exploration, burgeoning private sector participation, and advancements in robotics and autonomous navigation technologies. A Compound Annual Growth Rate (CAGR) exceeding 9% from 2019 to 2033 suggests a significant expansion of this market. This growth is fueled by several key factors. Firstly, the renewed focus on lunar exploration, including ambitious programs like Artemis, is creating substantial demand for advanced landers and rovers capable of operating in challenging lunar environments. Secondly, Mars exploration continues to be a primary driver, with ongoing missions and planned future endeavors requiring sophisticated robotic systems for surface operations and sample return. Thirdly, the emerging field of asteroid mining is poised to contribute significantly to market expansion in the coming years, albeit at a later stage than lunar and Martian exploration. The industry is segmented across these three key areas: lunar, Martian, and asteroid surface exploration, each presenting unique technological challenges and market opportunities. Competition is fierce, with major players including established aerospace giants like Lockheed Martin and Airbus, alongside innovative space technology companies such as Astrobotic Technology and Blue Origin, vying for market share. Geographical distribution of the market likely reflects the concentration of space agencies and private space companies, with North America and Europe initially holding significant shares, followed by a growing presence from the Asia-Pacific region, particularly driven by the activities of ISRO, JAXA, and China's space program. However, the overall market is becoming increasingly globalized.

Space Lander and Rover Industry Market Size (In Billion)

While the market presents immense opportunities, certain restraints remain. High development costs associated with creating robust and reliable landers and rovers suitable for extraterrestrial environments are a significant challenge. The inherent risks associated with space missions and the complexity of operations on other celestial bodies also contribute to market barriers. Nevertheless, continued technological advancements in areas like miniaturization, power systems, and autonomous navigation are gradually mitigating these risks and costs, thereby fueling the continued growth of the space lander and rover industry. The market's long-term prospects remain optimistic, supported by both public and private investments in space exploration and the increasing commercialization of space activities. The estimated market size in 2025, considering the provided CAGR and growth drivers, is projected to be around $2.5 billion (this is an estimate based on reasonable assumptions and industry trends, not a data-driven conclusion).

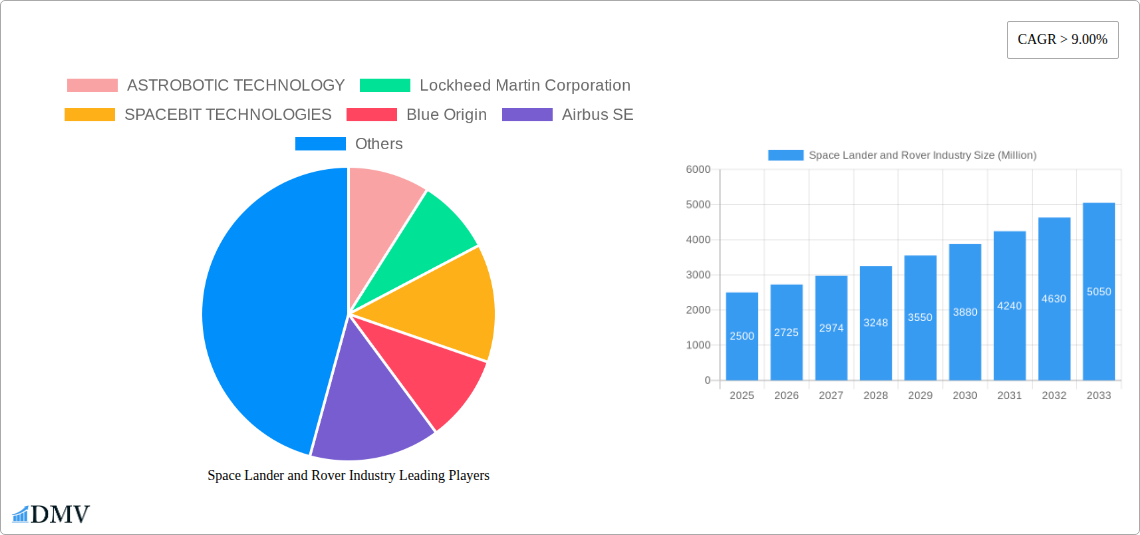

Space Lander and Rover Industry Company Market Share

Space Lander and Rover Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Space Lander and Rover industry, projecting robust growth and outlining key opportunities for stakeholders. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This report delves into market composition, technological advancements, regional dominance, and future projections, incorporating data from key players like Lockheed Martin Corporation, National Aeronautics and Space Administration (NASA), and others. The global market is estimated to reach xx Million by 2033.

Space Lander and Rover Industry Market Composition & Trends

This section thoroughly evaluates the competitive landscape of the space lander and rover industry. It delves into the key innovation drivers propelling advancement, the intricate regulatory frameworks governing operations, and the overarching market dynamics shaping its trajectory. The report provides an in-depth analysis of market concentration, indicating a moderately consolidated market dominated by a select group of influential players who command substantial market shares. The estimated combined market share of the top 5 players in 2025 is projected to be [Insert Percentage]%.

- Market Share Distribution (2025 Estimate):

- Lockheed Martin: [Insert Percentage]%

- SpaceX: [Insert Percentage]%

- Northrop Grumman: [Insert Percentage]%

- Blue Origin: [Insert Percentage]%

- Others: [Insert Percentage]%

- Mergers & Acquisitions (M&A) Activity: The report scrutinizes significant mergers and acquisitions within the sector, detailing deal values and their strategic impact on market consolidation. For instance, the combined value of M&A deals between 2019-2024 is estimated at [Insert Amount] Million USD. Emphasis is placed on identifying strategic partnerships that foster innovation and influence market share dynamics.

- Innovation Catalysts: The industry's progress is significantly fueled by robust government funding initiatives, substantial private investment pouring into new ventures, and relentless technological advancements in critical areas such as advanced robotics for autonomous operations, next-generation propulsion systems for extended mission capabilities, and sophisticated artificial intelligence (AI) for enhanced decision-making and navigation.

- Regulatory Landscape: The operational environment is shaped by a complex interplay of international space law, stringent national space regulations, and the crucial licensing requirements necessary for mission approval and execution.

- Substitute Products: While currently limited, the potential emergence of alternative technologies for surface exploration, advanced sample collection techniques, and in-situ resource utilization (ISRU) could influence future market composition and competitive strategies.

- End-User Profiles: The primary end-users encompass governmental space agencies such as NASA, ESA, JAXA, ISRO, Roscosmos, the Canadian Space Agency, and the China Academy of Space Technology. This also includes burgeoning private space exploration companies and, in the long term, potential commercial entities focused on extraterrestrial resource extraction and space tourism.

Space Lander and Rover Industry Evolution

The space lander and rover industry is experiencing exponential growth fueled by ambitious space exploration programs, increasing private sector involvement, and groundbreaking technological advancements. The market is projected to exhibit a compound annual growth rate (CAGR) of xx% from 2025 to 2033. This growth is propelled by several factors, including:

- Increased demand for sophisticated landers and rovers for planetary missions.

- Advancements in autonomous navigation and AI-powered robotics.

- Growing interest in in-situ resource utilization (ISRU) and commercial space activities.

- Significant investments from both governmental and private sources are driving innovation and deployment.

The evolution is also marked by a shift in the balance of power from governmental dominance towards greater private sector participation. The adoption rate of advanced technologies such as advanced materials, improved propulsion systems, and enhanced robotic capabilities is projected to increase significantly in this period. Further, the demand for larger, more capable rovers for human missions to the moon and Mars is fueling further development in this area. The industry is also seeing increased collaboration between space agencies and private companies, leading to faster innovation and deployment of new technologies. Competition is expected to intensify, pushing technological advancements and driving down costs.

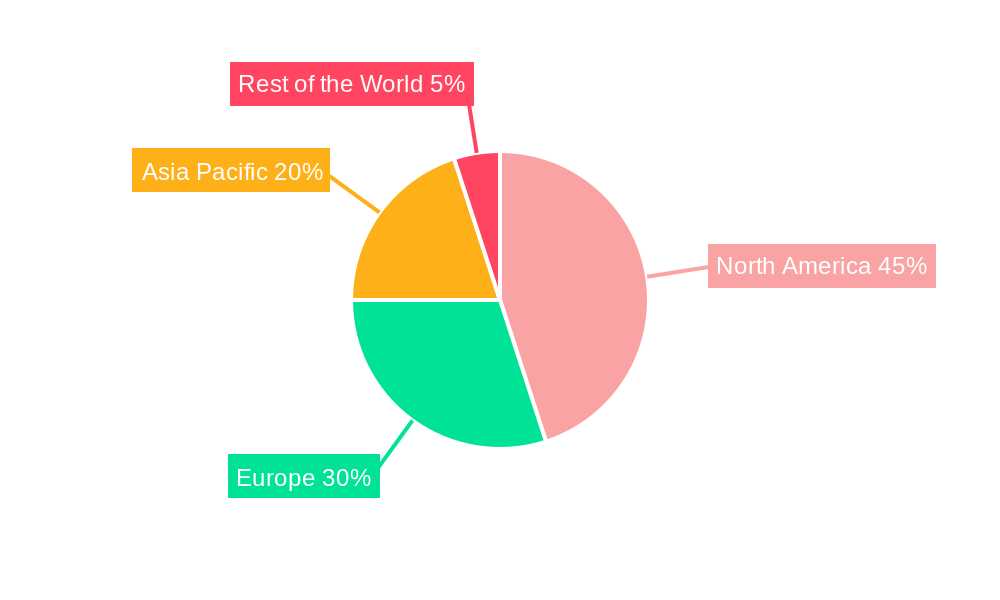

Leading Regions, Countries, or Segments in Space Lander and Rover Industry

The United States currently holds a leading position in the space lander and rover industry, driven by substantial government investment in space exploration programs.

Key Drivers for US Dominance:

- Significant government funding through NASA and other agencies.

- A strong private sector presence with companies like SpaceX, Blue Origin, and Lockheed Martin.

- Highly developed aerospace technology and manufacturing capabilities.

- Strong focus on lunar and Martian exploration.

Lunar Surface Exploration: The Moon remains a focal point, with many countries and private companies investing in lunar landers and rovers. This segment is expected to witness xx Million USD in revenue by 2033.

Mars Surface Exploration: Mars exploration remains a high priority, driving demand for increasingly sophisticated rovers capable of traversing challenging terrains and performing complex scientific tasks. The Mars exploration segment is expected to drive xx Million USD in revenue by 2033.

Asteroids Surface Exploration: While still in its nascent stage, the exploration of asteroids for resource extraction is generating growing interest, with potential for significant future growth. This market is currently valued at xx Million and is expected to reach xx Million by 2033.

While the US maintains a lead, other nations such as China, Japan (JAXA), India (ISRO), and the European Space Agency are making significant strides, increasing competition and furthering technological progress.

Space Lander and Rover Industry Product Innovations

Recent breakthroughs in the space lander and rover industry are revolutionizing extraterrestrial exploration. These innovations include the development of advanced propulsion systems that significantly extend exploration ranges and enhance maneuverability, sophisticated robotic arms equipped with precision tools for meticulous sample collection and analysis, and AI-powered autonomous navigation systems that enable rovers to intelligently chart their own courses and overcome unforeseen obstacles. Furthermore, advancements in radiation-hardened electronics ensure operational resilience in the harsh space environment, while the utilization of lighter, yet more durable, advanced materials contributes to increased payload capacity and structural integrity. These technological leaps collectively contribute to heightened efficiency, superior reliability, and expanded operational capabilities in the most demanding extraterrestrial conditions. The overarching focus is on achieving greater miniaturization of components, maximizing payload capacity for scientific instruments, and progressively increasing the autonomy of these robotic explorers.

Propelling Factors for Space Lander and Rover Industry Growth

Several factors contribute to the industry's expansion: increased government and private investment in space exploration, technological advancements in robotics and AI, the growing potential for commercial space activities, and the increasing demand for in-situ resource utilization (ISRU). The Artemis program and other ambitious lunar missions are significant drivers, boosting investment and fostering innovation.

Obstacles in the Space Lander and Rover Industry Market

The space lander and rover industry faces significant hurdles, including the exceptionally high costs associated with the research, development, manufacturing, and operational deployment of these complex systems. The extreme and unforgiving environmental conditions encountered in space, characterized by vacuum, extreme temperature fluctuations, and intense radiation, necessitate exceptionally stringent safety and reliability standards, driving up development complexity and expense. Potential disruptions within the global supply chain for specialized components can also pose significant challenges. Furthermore, intense competitive pressures arise from a growing number of national space programs and private entities vying for limited resources and market opportunities. Navigating complex regulatory hurdles and fostering effective international collaborations are also critical factors influencing the market's progression.

Future Opportunities in Space Lander and Rover Industry

Future opportunities lie in expanded commercial space activities, particularly asteroid mining and the development of space-based infrastructure. Advancements in autonomous navigation and artificial intelligence will increase efficiency and reduce the need for direct human control. New markets for lunar and Martian bases and scientific exploration also present significant potential.

Major Players in the Space Lander and Rover Industry Ecosystem

- ASTROBOTIC TECHNOLOGY

- Lockheed Martin Corporation

- SPACEBIT TECHNOLOGIES

- Blue Origin

- Airbus SE

- Canadian Space Agency

- ISRO

- National Aeronautics and Space Administration

- Roscosmos

- ispace inc

- Japanese Aerospace Exploration Agency (JAXA)

- Northrop Grumman Corporation

- China Academy of Space Technology

Key Developments in Space Lander and Rover Industry Industry

- May 2021: Lockheed Martin solidified a strategic partnership with General Motors, signaling a significant collaborative effort to engineer next-generation lunar rovers. This alliance underscores a shared commitment to advancing the capabilities of vehicles designed for human exploration of the Moon, promising enhanced mobility and operational flexibility.

- March 2021: NASA awarded Northrop Grumman a substantial contract, valued between USD 60.2 million and USD 84.5 million, for the development of critical components for Mars sample return missions, specifically the Mars Ascent Vehicle (MAV) and Sample Fetch Rover systems. This significant investment highlights NASA's intensified focus on ambitious robotic endeavors aimed at retrieving Martian samples for detailed analysis on Earth.

Strategic Space Lander and Rover Industry Market Forecast

The space lander and rover industry is poised for significant growth driven by expanding space exploration initiatives and the rise of commercial space activities. The forecast predicts a robust expansion, driven by technological advancements, government funding, and private sector investments. The market's future trajectory is optimistic, projecting substantial revenue growth and innovation across all segments.

Space Lander and Rover Industry Segmentation

-

1. Type

- 1.1. Lunar Surface Exploration

- 1.2. Mars Surface Exploration

- 1.3. Asteroids Surface Exploration

Space Lander and Rover Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Space Lander and Rover Industry Regional Market Share

Geographic Coverage of Space Lander and Rover Industry

Space Lander and Rover Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Focus On Space Exploration Driving the Demand for Landers and Rovers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lunar Surface Exploration

- 5.1.2. Mars Surface Exploration

- 5.1.3. Asteroids Surface Exploration

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lunar Surface Exploration

- 6.1.2. Mars Surface Exploration

- 6.1.3. Asteroids Surface Exploration

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lunar Surface Exploration

- 7.1.2. Mars Surface Exploration

- 7.1.3. Asteroids Surface Exploration

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lunar Surface Exploration

- 8.1.2. Mars Surface Exploration

- 8.1.3. Asteroids Surface Exploration

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lunar Surface Exploration

- 9.1.2. Mars Surface Exploration

- 9.1.3. Asteroids Surface Exploration

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ASTROBOTIC TECHNOLOGY

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lockheed Martin Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SPACEBIT TECHNOLOGIES

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Blue Origin

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Airbus SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Canadian Space Agency

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ISRO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 National Aeronautics and Space Administration

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Roscosmos

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ispace inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Japanese Aerospace Exploration Agency (JAXA)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Northrop Grumman Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 China Academy of Space Technology

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 ASTROBOTIC TECHNOLOGY

List of Figures

- Figure 1: Global Space Lander and Rover Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Space Lander and Rover Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Lander and Rover Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Space Lander and Rover Industry?

Key companies in the market include ASTROBOTIC TECHNOLOGY, Lockheed Martin Corporation, SPACEBIT TECHNOLOGIES, Blue Origin, Airbus SE, Canadian Space Agency, ISRO, National Aeronautics and Space Administration, Roscosmos, ispace inc, Japanese Aerospace Exploration Agency (JAXA), Northrop Grumman Corporation, China Academy of Space Technology.

3. What are the main segments of the Space Lander and Rover Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Focus On Space Exploration Driving the Demand for Landers and Rovers.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2021, Lockheed Martin announced that it has teamed up with General Motors to design the next generation of lunar rovers, capable of transporting astronauts across farther distances on the lunar surface.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Lander and Rover Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Lander and Rover Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Lander and Rover Industry?

To stay informed about further developments, trends, and reports in the Space Lander and Rover Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence