Key Insights

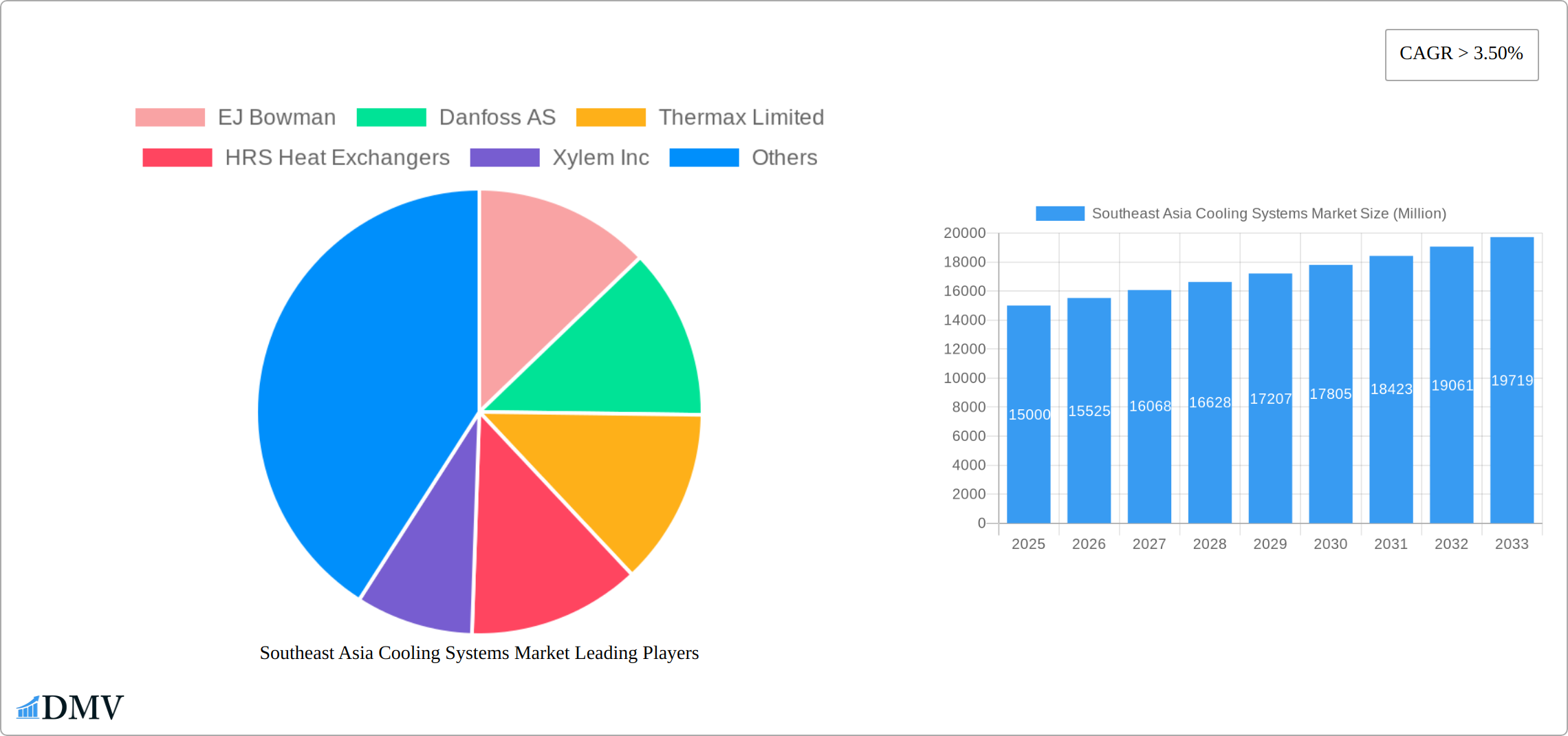

The Southeast Asia cooling systems market is experiencing robust growth, driven by rising industrialization, urbanization, and increasing energy demands across various sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2019-2024 indicates a significant upward trajectory. Key drivers include the expansion of the energy sector (particularly oil and gas and power generation), the burgeoning chemicals and petrochemicals industry, and the growth of the agricultural and construction sectors. These industries rely heavily on efficient cooling solutions for process optimization, product preservation, and worker safety in increasingly hot and humid climates. Furthermore, stringent government regulations aimed at improving energy efficiency are stimulating demand for advanced cooling technologies. The market is segmented by cooling equipment (heat exchangers, fans and blowers, and other equipment) and end-user industries. While heat exchangers currently dominate the market due to their widespread application, the demand for energy-efficient fans and blowers is growing rapidly due to advancements in technology and increased focus on sustainability. Leading players like Danfoss, Thermax, and Alfa Laval are strategically investing in research and development, focusing on innovative solutions to meet the evolving needs of diverse industries. The Asia Pacific region, particularly countries like China, India, and Japan, are major contributors to market growth due to their significant industrial expansion and infrastructure development. However, challenges remain, including the high initial investment costs associated with advanced cooling systems and potential supply chain disruptions.

Despite these challenges, the long-term outlook for the Southeast Asia cooling systems market remains positive. The continued economic development of the region, coupled with the growing focus on sustainable and efficient cooling solutions, is poised to fuel considerable market expansion through 2033. Emerging technologies, such as advanced refrigerants and smart cooling systems, are expected to further stimulate growth by enhancing efficiency and reducing environmental impact. The market is likely to witness increased competition among existing and new players, driving innovation and pricing pressures. The successful players will be those that can effectively adapt to changing regulations, customer demands, and technological advancements while maintaining a strong supply chain and distribution network. Factors like the increasing adoption of smart technologies and the growing awareness of environmental concerns will further shape market trends.

Southeast Asia Cooling Systems Market Market Composition & Trends

The Southeast Asia Cooling Systems Market is characterized by a diverse array of players, ranging from established giants to innovative startups, creating a moderately concentrated market landscape. Key companies such as EJ Bowman, Danfoss AS, and Alfa Laval AB hold significant market shares, with Alfa Laval leading the market with a xx% share in 2025. The market is driven by innovation catalysts such as technological advancements in heat exchanger efficiency and the growing demand for energy-efficient cooling solutions across industries.

- Regulatory Landscape: Governments in Southeast Asia are increasingly promoting energy efficiency through regulations and incentives, which are shaping the market dynamics. For instance, Singapore's Energy Conservation Act has spurred the adoption of advanced cooling technologies.

- Substitute Products: While traditional cooling systems remain dominant, there is a growing interest in alternative solutions like evaporative cooling, especially in regions with high humidity.

- End-User Profiles: The energy sector, including oil & gas and power, remains the largest end-user segment, accounting for xx% of the market. The chemicals and petrochemicals industry follows closely, driven by the need for precise temperature control in manufacturing processes.

- M&A Activities: The market has seen several strategic mergers and acquisitions, with a total deal value reaching xx Million in 2025. Notable M&As include the acquisition of a regional cooling solutions provider by SPX Flow Inc, aimed at expanding its market presence in Southeast Asia.

Southeast Asia Cooling Systems Market Industry Evolution

The Southeast Asia Cooling Systems Market has experienced substantial growth from 2019 to 2033, with 2025 serving as the base year for this analysis. The market exhibited a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), propelled by rapid industrialization and urbanization across the region. Technological advancements, particularly in heat exchanger design and materials, have been instrumental in this growth, resulting in more efficient and sustainable cooling solutions. The integration of IoT and AI technologies has further enhanced market expansion by enabling predictive maintenance and energy optimization.

Consumer preferences are increasingly leaning towards sustainability and energy efficiency, directly influencing the development of eco-friendly cooling technologies. The energy sector, specifically oil & gas and power generation, has been a key growth driver, with projected demand for cooling systems to increase by xx% over the forecast period (2025-2033). The chemicals and petrochemicals industry also shows robust growth, relying on cooling systems to maintain optimal production parameters. Future market evolution will be characterized by a continued emphasis on minimizing carbon footprints and maximizing operational efficiency.

Leading Regions, Countries, or Segments in Southeast Asia Cooling Systems Market

The Southeast Asia Cooling Systems Market is dominated by the heat exchangers segment, which accounts for xx% of the market share in 2025. This dominance is driven by the segment's critical role in various industries, particularly in the energy sector. Singapore emerges as a leading country in the region, with its robust regulatory framework and high investment in energy-efficient technologies.

Key Drivers for Heat Exchangers:

Investment in advanced manufacturing technologies.

Government incentives for energy-efficient solutions.

Growing demand from the energy sector.

Key Drivers for Singapore:

Strong regulatory support for sustainability.

High investment in R&D for cooling technologies.

Presence of major industry players.

The heat exchangers segment's dominance can be attributed to its versatility and efficiency in cooling applications across industries. In Singapore, the government's commitment to reducing carbon emissions and promoting energy conservation has created a favorable environment for the adoption of advanced cooling systems. The country's strategic location and robust infrastructure further enhance its position as a hub for cooling technology in Southeast Asia. As the market continues to grow, the focus on sustainable and efficient cooling solutions will likely intensify, with Singapore leading the way in innovation and adoption.

Southeast Asia Cooling Systems Market Product Innovations

The Southeast Asia Cooling Systems Market is characterized by significant product innovation, notably in energy-efficient heat exchangers and smart cooling systems incorporating IoT capabilities. These innovations are designed to boost performance while lowering operational costs. Advanced materials used in heat exchangers are delivering energy savings of up to 50% and a 40% reduction in CO2 emissions. The key differentiator of these advanced products lies in their ability to provide sustainable cooling solutions that meet the region's stringent regulatory standards and growing environmental concerns.

Propelling Factors for Southeast Asia Cooling Systems Market Growth

Several factors are driving the growth of the Southeast Asia Cooling Systems Market. Technological advancements, such as the integration of IoT and AI in cooling systems, are enhancing efficiency and reducing energy consumption. Economically, the rapid industrialization and urbanization in the region are increasing the demand for cooling solutions across various sectors. Regulatory influences, including government incentives for energy-efficient technologies, are also propelling market growth. For instance, Singapore's Energy Conservation Act has significantly boosted the adoption of advanced cooling systems.

Obstacles in the Southeast Asia Cooling Systems Market Market

Despite the growth potential, the Southeast Asia Cooling Systems Market faces several obstacles. Regulatory challenges, such as varying standards across countries, can hinder market expansion. Supply chain disruptions, particularly those caused by global events, impact the availability of critical components, leading to delays and increased costs. Competitive pressures are also intense, with numerous players vying for market share, which can result in price wars and reduced profit margins. These barriers require strategic solutions to maintain growth momentum.

Future Opportunities in Southeast Asia Cooling Systems Market

The Southeast Asia Cooling Systems Market offers promising future opportunities. The emergence of new market segments, such as the expanding demand for cooling solutions in the agriculture and construction sectors, presents significant growth potential. Continued technological advancements, particularly in eco-friendly and smart cooling systems, are expected to be major drivers of market growth. Furthermore, the prevailing consumer trend towards sustainability and energy efficiency will continue to shape market dynamics, creating opportunities for innovative cooling solutions that cater to these demands. The increasing focus on data centers and the expanding need for efficient cooling in the food processing industry will provide further impetus for future growth.

Major Players in the Southeast Asia Cooling Systems Market Ecosystem

- EJ Bowman

- Danfoss AS

- Thermax Limited

- HRS Heat Exchangers

- Xylem Inc

- SPX Flow Inc

- Hydac International GmbH

- General Electric Company

- Parker Hannifin Corp

- Alfa Laval AB

*List Not Exhaustive

Key Developments in Southeast Asia Cooling Systems Market Industry

- May 2022: Alfa Laval signed an agreement with SSAB to develop and commercialize the world's first heat exchanger made of fossil-free steel. The companies aim to create the first unit of heat exchangers made with hydrogen-reduced steel by 2023. This collaboration is an essential step in Alfa Laval's aim to become carbon neutral by 2030, as these heat exchangers could save energy by 50% and reduce CO2 emissions by 40%. This development is expected to significantly impact the market dynamics by promoting the adoption of sustainable cooling solutions.

Strategic Southeast Asia Cooling Systems Market Market Forecast

The Southeast Asia Cooling Systems Market is poised for robust growth over the forecast period of 2025-2033, driven by technological advancements and increasing demand for energy-efficient solutions. The market is expected to grow at a CAGR of xx%, with significant opportunities in the energy, chemicals, and petrochemicals sectors. Future opportunities lie in the development of smart and eco-friendly cooling systems, which align with the region's focus on sustainability and regulatory support for energy conservation. The strategic forecast highlights the potential for market expansion and the importance of innovation in meeting the evolving needs of end-users.

Southeast Asia Cooling Systems Market Segmentation

-

1. Cooling Equipment

- 1.1. Heat Exchangers

- 1.2. Fans and Blowers

- 1.3. Other Cooling Equipment

-

2. End User

- 2.1. Energy Sector (Oil & Gas, Power, etc.)

- 2.2. Chemicals and Petrochemicals

- 2.3. Agriculture and Construction

- 2.4. Other End Users

-

3. Geography

- 3.1. Malaysia

- 3.2. Thailand

- 3.3. Indonesia

- 3.4. Vietnam

- 3.5. Rest of Southeast Asia

Southeast Asia Cooling Systems Market Segmentation By Geography

- 1. Malaysia

- 2. Thailand

- 3. Indonesia

- 4. Vietnam

- 5. Rest of Southeast Asia

Southeast Asia Cooling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Energy Sector to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 5.1.1. Heat Exchangers

- 5.1.2. Fans and Blowers

- 5.1.3. Other Cooling Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Energy Sector (Oil & Gas, Power, etc.)

- 5.2.2. Chemicals and Petrochemicals

- 5.2.3. Agriculture and Construction

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Malaysia

- 5.3.2. Thailand

- 5.3.3. Indonesia

- 5.3.4. Vietnam

- 5.3.5. Rest of Southeast Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.4.2. Thailand

- 5.4.3. Indonesia

- 5.4.4. Vietnam

- 5.4.5. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 6. Malaysia Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 6.1.1. Heat Exchangers

- 6.1.2. Fans and Blowers

- 6.1.3. Other Cooling Equipment

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Energy Sector (Oil & Gas, Power, etc.)

- 6.2.2. Chemicals and Petrochemicals

- 6.2.3. Agriculture and Construction

- 6.2.4. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Malaysia

- 6.3.2. Thailand

- 6.3.3. Indonesia

- 6.3.4. Vietnam

- 6.3.5. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 7. Thailand Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 7.1.1. Heat Exchangers

- 7.1.2. Fans and Blowers

- 7.1.3. Other Cooling Equipment

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Energy Sector (Oil & Gas, Power, etc.)

- 7.2.2. Chemicals and Petrochemicals

- 7.2.3. Agriculture and Construction

- 7.2.4. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Malaysia

- 7.3.2. Thailand

- 7.3.3. Indonesia

- 7.3.4. Vietnam

- 7.3.5. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 8. Indonesia Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 8.1.1. Heat Exchangers

- 8.1.2. Fans and Blowers

- 8.1.3. Other Cooling Equipment

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Energy Sector (Oil & Gas, Power, etc.)

- 8.2.2. Chemicals and Petrochemicals

- 8.2.3. Agriculture and Construction

- 8.2.4. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Malaysia

- 8.3.2. Thailand

- 8.3.3. Indonesia

- 8.3.4. Vietnam

- 8.3.5. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 9. Vietnam Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 9.1.1. Heat Exchangers

- 9.1.2. Fans and Blowers

- 9.1.3. Other Cooling Equipment

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Energy Sector (Oil & Gas, Power, etc.)

- 9.2.2. Chemicals and Petrochemicals

- 9.2.3. Agriculture and Construction

- 9.2.4. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Malaysia

- 9.3.2. Thailand

- 9.3.3. Indonesia

- 9.3.4. Vietnam

- 9.3.5. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 10. Rest of Southeast Asia Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 10.1.1. Heat Exchangers

- 10.1.2. Fans and Blowers

- 10.1.3. Other Cooling Equipment

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Energy Sector (Oil & Gas, Power, etc.)

- 10.2.2. Chemicals and Petrochemicals

- 10.2.3. Agriculture and Construction

- 10.2.4. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Malaysia

- 10.3.2. Thailand

- 10.3.3. Indonesia

- 10.3.4. Vietnam

- 10.3.5. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Cooling Equipment

- 11. China Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 13. India Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Southeast Asia Cooling Systems Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 EJ Bowman

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Danfoss AS

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Thermax Limited

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 HRS Heat Exchangers

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Xylem Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 SPX Flow Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Hydac International GmbH*List Not Exhaustive

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 General Electric Company

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Parker Hannifin Corp

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Alfa Laval AB

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 EJ Bowman

List of Figures

- Figure 1: Southeast Asia Cooling Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Southeast Asia Cooling Systems Market Share (%) by Company 2024

List of Tables

- Table 1: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Cooling Equipment 2019 & 2032

- Table 3: Southeast Asia Cooling Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Southeast Asia Cooling Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Southeast Asia Cooling Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Southeast Asia Cooling Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Southeast Asia Cooling Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Southeast Asia Cooling Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Southeast Asia Cooling Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Southeast Asia Cooling Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Cooling Equipment 2019 & 2032

- Table 15: Southeast Asia Cooling Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Cooling Equipment 2019 & 2032

- Table 19: Southeast Asia Cooling Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Cooling Equipment 2019 & 2032

- Table 23: Southeast Asia Cooling Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Cooling Equipment 2019 & 2032

- Table 27: Southeast Asia Cooling Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Cooling Equipment 2019 & 2032

- Table 31: Southeast Asia Cooling Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Southeast Asia Cooling Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Cooling Systems Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Southeast Asia Cooling Systems Market?

Key companies in the market include EJ Bowman, Danfoss AS, Thermax Limited, HRS Heat Exchangers, Xylem Inc, SPX Flow Inc, Hydac International GmbH*List Not Exhaustive, General Electric Company, Parker Hannifin Corp, Alfa Laval AB.

3. What are the main segments of the Southeast Asia Cooling Systems Market?

The market segments include Cooling Equipment, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants.

6. What are the notable trends driving market growth?

Energy Sector to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

May 2022: Alfa Laval signed an agreement with SSAB to develop and commercialize the world's first heat exchanger made of fossil-free steel. The companies aim to create the first unit of heat exchangers made with hydrogen-reduced steel by 2023. This collaboration is an essential step in Alfa Laval's aim to become carbon neutral by 2030, as these heat exchangers could save energy by 50% and reduce CO2 emissions by 40%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Cooling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Cooling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Cooling Systems Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Cooling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence