Key Insights

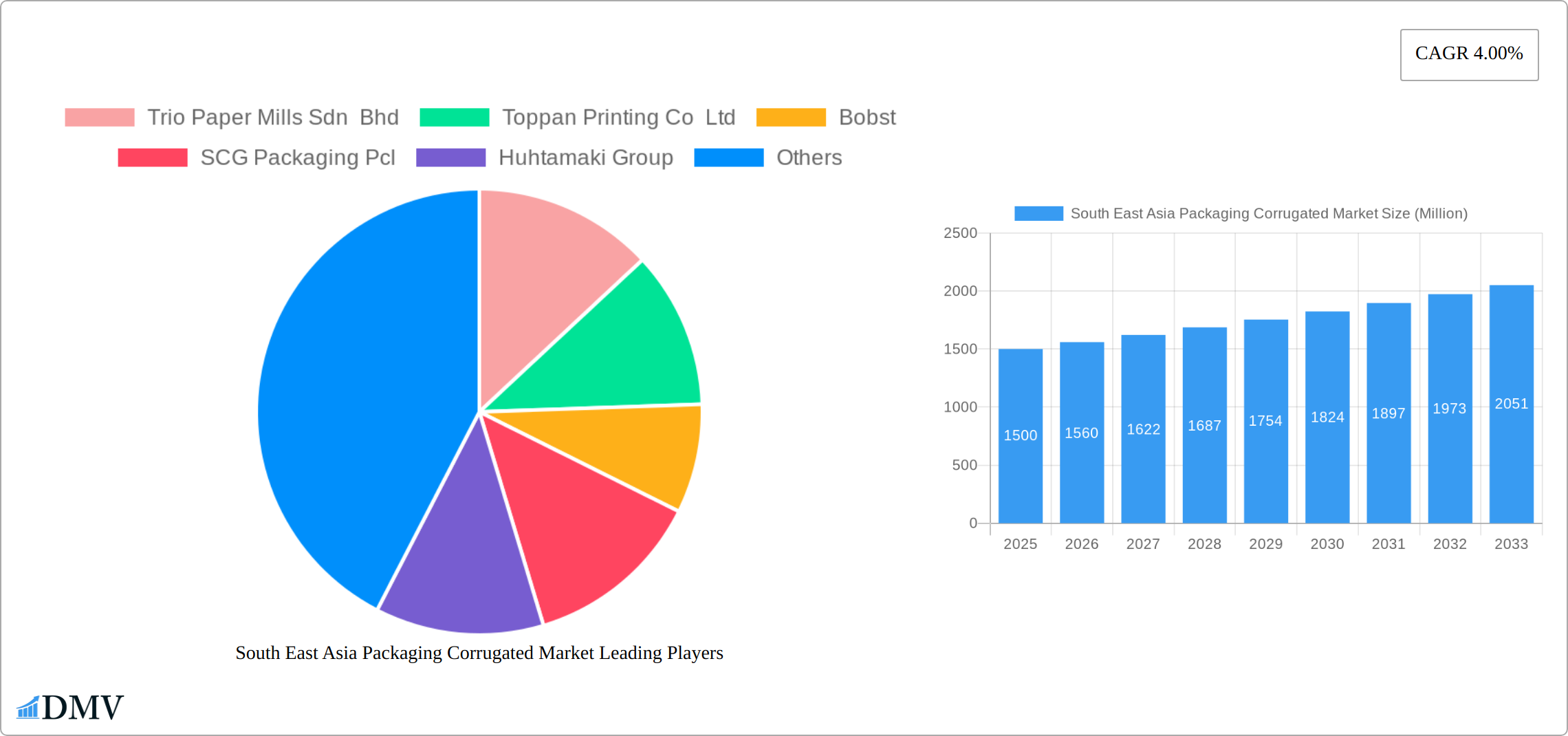

The Southeast Asia corrugated packaging market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage industry across the region, particularly in rapidly developing economies like Indonesia and Thailand, necessitates increased packaging solutions for efficient product distribution and preservation. Similarly, the cosmetics and household care sectors, witnessing significant growth in consumer spending, contribute significantly to demand. E-commerce proliferation further stimulates the need for reliable and sustainable corrugated packaging for online deliveries. While increased raw material costs and fluctuating energy prices pose potential restraints, the overall market outlook remains positive, particularly given the growing emphasis on environmentally friendly packaging materials and solutions. Strong growth is anticipated across various segments, with Indonesia, Thailand, and Malaysia leading the charge due to their large populations and expanding manufacturing sectors. The competitive landscape comprises both multinational players and regional manufacturers, indicating a dynamic interplay of innovation and localized expertise.

The market segmentation reveals significant opportunities for targeted investment and growth strategies. The Food and Beverage sector consistently remains the largest consumer of corrugated packaging, highlighting the potential for specialized solutions focused on food safety and preservation. The increasing adoption of sustainable packaging practices presents a further opportunity for companies to innovate and capture market share. While China, Japan, and India dominate the broader Asia-Pacific region, Southeast Asia presents a unique opportunity owing to its rapidly growing middle class, increasing urbanization, and a surge in industrial activity. This translates to heightened demand for robust, protective, and cost-effective packaging solutions. Companies strategically positioned within this dynamic ecosystem stand to capitalize on this expansion, emphasizing the importance of effective supply chains and product innovation.

South East Asia Packaging Corrugated Market Market Composition & Trends

The South East Asia Packaging Corrugated Market is characterized by a dynamic interplay of market concentration, innovation catalysts, and regulatory landscapes. The market is moderately concentrated, with the top five players holding approximately 35% of the market share. Trio Paper Mills Sdn Bhd, Toppan Printing Co Ltd, and SCG Packaging Pcl are among the key players shaping the market dynamics. Innovation is driven by the need for sustainable packaging solutions, with companies investing in biodegradable and recyclable materials. The regulatory environment is supportive, with governments in countries like Indonesia and Thailand promoting eco-friendly packaging through incentives and regulations.

Market Share Distribution:

Trio Paper Mills Sdn Bhd: 10%

Toppan Printing Co Ltd: 8%

SCG Packaging Pcl: 7%

Others: 75%

Innovation Catalysts:

Increased demand for sustainable packaging

Advancements in material science

Consumer awareness and preference for eco-friendly products

Regulatory Landscapes:

Indonesia's Green Industry Standard

Thailand's Eco-friendly Packaging Regulations

Singapore's Zero Waste Masterplan

Substitute Products:

Plastic packaging

Paperboard packaging

Flexible packaging

End-user Profiles:

Food and Beverage: 40%

Manufacturing and Automotive: 25%

Healthcare and Pharmaceutical: 15%

Others: 20%

M&A Activities:

Notable M&A deal values in 2024 reached $150 Million, with SCG Packaging Pcl acquiring a smaller competitor to expand its footprint in Indonesia.

South East Asia Packaging Corrugated Market Industry Evolution

The South East Asia Packaging Corrugated Market has witnessed significant evolution over the study period from 2019 to 2033. The market has grown at a CAGR of 5.5% during the historical period of 2019-2024, driven by the burgeoning e-commerce sector and increased consumer demand for packaged goods. Technological advancements have played a pivotal role, with the adoption of digital printing technologies enabling more customized and efficient packaging solutions. The shift in consumer demands towards sustainability has further propelled the market, with corrugated packaging emerging as a preferred choice due to its recyclability.

In Indonesia, the market has seen a growth rate of 6.2% annually, fueled by a robust manufacturing sector and government initiatives promoting green packaging. Thailand, with a growth rate of 5.8%, has capitalized on its strong food and beverage industry, while Malaysia's market has expanded at 5.3%, driven by automotive and electronics manufacturing. The adoption of smart packaging solutions, which integrate RFID tags and sensors, has increased by 10% year-over-year, enhancing product traceability and consumer engagement. The market's trajectory indicates a continued emphasis on innovation and sustainability, with corrugated packaging poised to capture a larger share of the packaging industry in South East Asia.

Leading Regions, Countries, or Segments in South East Asia Packaging Corrugated Market

Indonesia emerges as the dominant country in the South East Asia Packaging Corrugated Market, driven by its vast manufacturing base and supportive government policies. The country's market is expected to grow at a CAGR of 6.5% during the forecast period of 2025-2033, reaching a market size of $2.5 Billion by 2033.

- Key Drivers in Indonesia:

- Investment in manufacturing sectors

- Government incentives for eco-friendly packaging

- Growing e-commerce sector

In-depth analysis reveals that Indonesia's dominance is underpinned by its strategic location, which facilitates efficient distribution across the region. The country's focus on sustainable development aligns well with the global push for green packaging solutions, making it an attractive market for corrugated packaging manufacturers.

The Food and Beverage segment leads the market by end-user industry, accounting for 40% of the total demand. This segment's growth is driven by the increasing consumption of packaged food and beverages, particularly in urban areas. The segment is expected to grow at a CAGR of 6.0% during the forecast period, reaching a market size of $1.8 Billion by 2033.

- Key Drivers in Food and Beverage Segment:

- Rising urban population

- Changing consumer lifestyles

- Increased demand for convenience foods

The dominance of the Food and Beverage segment is further bolstered by the need for robust packaging solutions that can protect products during transportation and storage. The segment's growth trajectory indicates a strong market potential, with opportunities for innovation in packaging design and materials.

South East Asia Packaging Corrugated Market Product Innovations

Innovations in the South East Asia Packaging Corrugated Market are centered around sustainability and functionality. Companies are developing corrugated packaging with enhanced strength and moisture resistance, suitable for a variety of end-user industries. The introduction of smart packaging solutions, integrating RFID tags and sensors, has revolutionized product tracking and consumer engagement. These innovations offer unique selling propositions such as improved product protection, reduced environmental impact, and enhanced consumer interaction.

Propelling Factors for South East Asia Packaging Corrugated Market Growth

The growth of the South East Asia Packaging Corrugated Market is propelled by several key factors. Technological advancements in digital printing and smart packaging technologies enable more efficient and customized packaging solutions. Economically, the region's robust manufacturing sector and the rise of e-commerce contribute significantly to market expansion. Regulatory influences, such as government incentives for sustainable packaging, further drive the market. For instance, Indonesia's Green Industry Standard has encouraged companies to adopt eco-friendly packaging, boosting the demand for corrugated materials.

Obstacles in the South East Asia Packaging Corrugated Market Market

The South East Asia Packaging Corrugated Market faces several obstacles that could impede growth. Regulatory challenges, such as varying standards across countries, can complicate compliance for manufacturers. Supply chain disruptions, particularly during global crises, have led to increased costs and delayed deliveries, impacting the market by approximately 5%. Competitive pressures from alternative packaging materials like plastic and flexible packaging also pose a threat, with these substitutes capturing 20% of the market share in certain segments.

Future Opportunities in South East Asia Packaging Corrugated Market

Emerging opportunities in the South East Asia Packaging Corrugated Market include the expansion into new markets such as the burgeoning healthcare sector, where demand for sterile and secure packaging is rising. Technological advancements in biodegradable materials present a significant opportunity for sustainable packaging solutions. Additionally, shifting consumer trends towards online shopping and home delivery services are expected to drive demand for corrugated packaging, particularly in the e-commerce segment.

Major Players in the South East Asia Packaging Corrugated Market Ecosystem

- Trio Paper Mills Sdn Bhd

- Toppan Printing Co Ltd

- Bobst

- SCG Packaging Pcl

- Huhtamaki Group

- Pura Group

- Thai Packaging & Printing Public Company Limited

- Sarnti Packaging Co Ltd

- Harta Packaging Industries (Selangor) Sdn Bhd

- New Asia Industries Co Ltd (Rengo Co Ltd)

- Vina Kraft Paper Co Ltd

Key Developments in South East Asia Packaging Corrugated Market Industry

- January 2024: SCG Packaging Pcl announced the acquisition of a local packaging company in Indonesia, expanding its market presence.

- March 2024: Toppan Printing Co Ltd launched a new line of eco-friendly corrugated packaging, targeting the food and beverage industry.

- May 2024: Bobst introduced advanced digital printing technology for corrugated packaging, enhancing customization capabilities.

Strategic South East Asia Packaging Corrugated Market Market Forecast

The South East Asia Packaging Corrugated Market is poised for significant growth during the forecast period of 2025-2033, with a projected CAGR of 6.0%. The market is expected to reach a value of $5.0 Billion by 2033, driven by increasing demand for sustainable packaging solutions and the expansion of e-commerce. Future opportunities lie in the adoption of smart packaging technologies and the penetration of new end-user industries such as healthcare and pharmaceuticals. The market's potential is underscored by the region's commitment to environmental sustainability and the ongoing technological advancements in packaging materials and processes.

South East Asia Packaging Corrugated Market Segmentation

-

1. End-user Industry

- 1.1. Food and Beverage

- 1.2. Cosmetics and Household Care

- 1.3. Manufacturing and Automotive

- 1.4. Healthcare and Pharmaceutical

- 1.5. Other En

South East Asia Packaging Corrugated Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South East Asia Packaging Corrugated Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Strong demand From the E-commerce Sector; Growing Adoption of Light Weighting Materials & Scope for Printing Innovations Propelling Growth in Electronics & Personal Care Segment

- 3.3. Market Restrains

- 3.3.1. ; Concerns Over Material Availability & Durability of Corrugated Board-based Products

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry Expected to Gain Maximum Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South East Asia Packaging Corrugated Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Food and Beverage

- 5.1.2. Cosmetics and Household Care

- 5.1.3. Manufacturing and Automotive

- 5.1.4. Healthcare and Pharmaceutical

- 5.1.5. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. China South East Asia Packaging Corrugated Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan South East Asia Packaging Corrugated Market Analysis, Insights and Forecast, 2019-2031

- 8. India South East Asia Packaging Corrugated Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea South East Asia Packaging Corrugated Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan South East Asia Packaging Corrugated Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia South East Asia Packaging Corrugated Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific South East Asia Packaging Corrugated Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Trio Paper Mills Sdn Bhd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Toppan Printing Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Bobst

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SCG Packaging Pcl

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Huhtamaki Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pura Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Thai Packaging & Printing Public Company Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sarnti Packaging Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Harta Packaging Industries (Selangor) Sdn Bhd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 New Asia Industries Co Ltd (Rengo Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Vina Kraft Paper Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Trio Paper Mills Sdn Bhd

List of Figures

- Figure 1: South East Asia Packaging Corrugated Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South East Asia Packaging Corrugated Market Share (%) by Company 2024

List of Tables

- Table 1: South East Asia Packaging Corrugated Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South East Asia Packaging Corrugated Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: South East Asia Packaging Corrugated Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: South East Asia Packaging Corrugated Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South East Asia Packaging Corrugated Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 13: South East Asia Packaging Corrugated Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Malaysia South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Singapore South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Thailand South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Vietnam South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Philippines South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Myanmar South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Cambodia South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Laos South East Asia Packaging Corrugated Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South East Asia Packaging Corrugated Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the South East Asia Packaging Corrugated Market?

Key companies in the market include Trio Paper Mills Sdn Bhd, Toppan Printing Co Ltd, Bobst, SCG Packaging Pcl, Huhtamaki Group, Pura Group, Thai Packaging & Printing Public Company Limited, Sarnti Packaging Co Ltd, Harta Packaging Industries (Selangor) Sdn Bhd, New Asia Industries Co Ltd (Rengo Co Ltd, Vina Kraft Paper Co Ltd.

3. What are the main segments of the South East Asia Packaging Corrugated Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Strong demand From the E-commerce Sector; Growing Adoption of Light Weighting Materials & Scope for Printing Innovations Propelling Growth in Electronics & Personal Care Segment.

6. What are the notable trends driving market growth?

Food and Beverage Industry Expected to Gain Maximum Traction.

7. Are there any restraints impacting market growth?

; Concerns Over Material Availability & Durability of Corrugated Board-based Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South East Asia Packaging Corrugated Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South East Asia Packaging Corrugated Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South East Asia Packaging Corrugated Market?

To stay informed about further developments, trends, and reports in the South East Asia Packaging Corrugated Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence