Key Insights

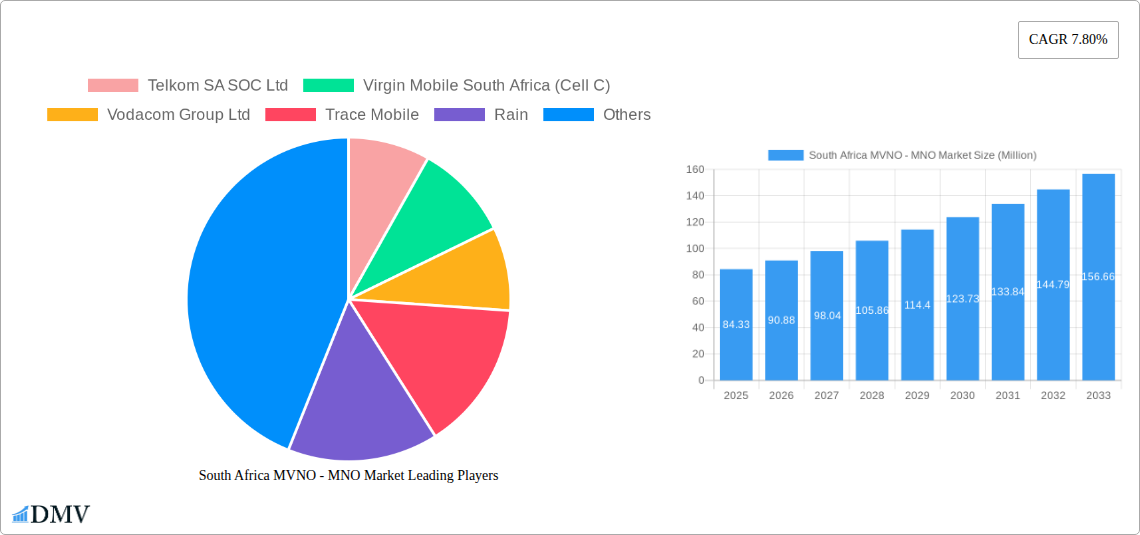

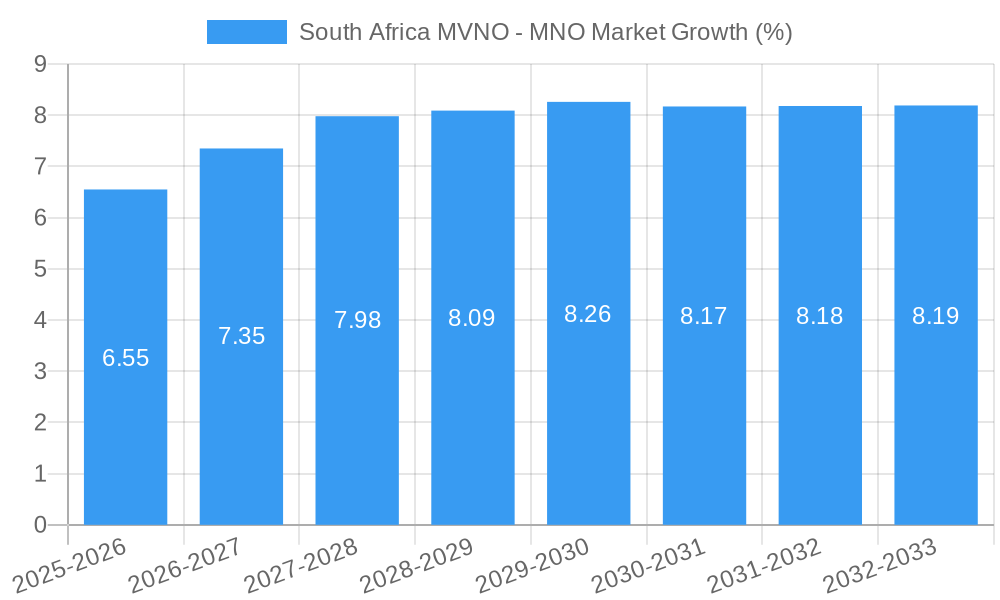

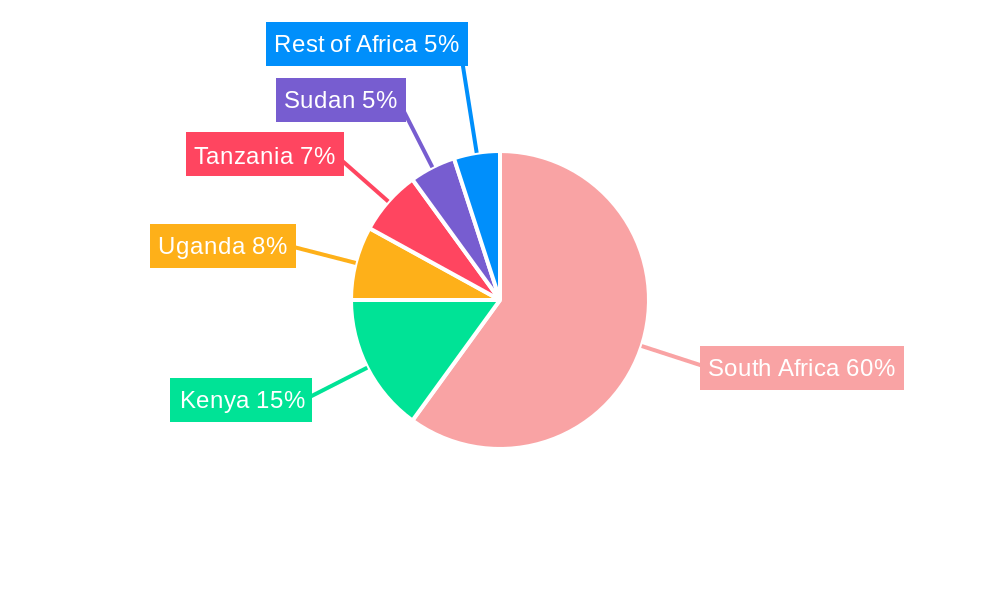

The South African MVNO (Mobile Virtual Network Operator) and MNO (Mobile Network Operator) market, valued at $84.33 million in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising data consumption, and the expanding adoption of mobile financial services. The 7.80% CAGR indicates a significant market expansion through 2033. Key drivers include the competitive pricing strategies employed by MVNOs, catering to price-sensitive consumers and businesses. Growing demand for flexible and customized mobile plans, especially among younger demographics, further fuels market expansion. However, regulatory hurdles and infrastructure limitations in certain regions could pose challenges. The market is segmented by subscriber type (Enterprise and Consumer), with the consumer segment anticipated to dominate due to its larger user base. Leading players like Vodacom, MTN, Cell C, and Telkom, along with smaller MVNOs like Rain and Virgin Mobile, are actively competing, driving innovation and service diversification. The market's growth is uneven across Africa, with South Africa representing the largest share, followed by other key markets like Kenya, Uganda and Tanzania. Further expansion is likely driven by increased 4G/5G network coverage and the growing demand for reliable and affordable mobile connectivity.

The competitive landscape is characterized by both intense rivalry among established MNOs and the emergence of innovative MVNOs offering niche services. This competitive dynamic is likely to continue driving down prices, spurring innovation in service offerings, and increasing the overall value proposition for consumers and businesses. The expansion of mobile money services, integrated with mobile telecommunications packages, is a major growth catalyst. The forecast period (2025-2033) will likely witness continued consolidation within the industry, as smaller players either merge with larger entities or focus on specific niche markets. Sustained investment in network infrastructure and expansion into underserved rural areas will be critical for future market growth. The Rest of Africa region within this study presents significant, though less defined, growth opportunities.

South Africa MVNO-MNO Market: A Comprehensive Report (2019-2033)

This insightful report delivers a meticulous analysis of South Africa's dynamic MVNO-MNO market, providing crucial data and forecasts for informed strategic decision-making. Spanning the period from 2019 to 2033, with a focus on the estimated year 2025, this report unveils the market's composition, evolution, and future trajectory. It dissects key players like MTN Group Ltd, Vodacom Group Ltd, and Telkom SA SOC Ltd, and examines the impact of major developments such as the proposed MTN-Telkom merger. Ideal for investors, industry professionals, and government agencies, this report is an indispensable resource for navigating the complexities and opportunities of this rapidly evolving sector.

South Africa MVNO - MNO Market Market Composition & Trends

This section provides a detailed overview of the South Africa MVNO-MNO market landscape, encompassing market concentration, innovation, regulatory frameworks, substitute products, and M&A activity. The study period covers 2019-2024 (historical period), with a focus on the base year 2025 and forecast period 2025-2033.

Market Concentration & Share Distribution:

The South African MVNO-MNO market exhibits a moderately concentrated structure, with the top four players – MTN Group Ltd, Vodacom Group Ltd, Cell C Pty Ltd, and Telkom SA SOC Ltd – commanding approximately xx% of the market share in 2024. Smaller players like Rain and Virgin Mobile South Africa (Cell C) contribute significantly to market competition, though their individual market shares remain relatively smaller.

Innovation Catalysts & Regulatory Landscape: The market is driven by ongoing 4G and 5G network expansion, fueled by the completion of the radio frequency spectrum auction in March 2022. ICASA's (Independent Communications Authority of South Africa) regulatory framework plays a critical role, shaping competition and investment strategies. The potential merger between MTN and Telkom, valued at over USD 1 Billion, is a significant factor shaping future market dynamics.

Substitute Products & End-User Profiles: Fixed-line broadband services and satellite internet act as partial substitutes for mobile services. The end-user base is segmented into enterprise and consumer markets, with varying demand and service needs.

M&A Activities: The proposed MTN-Telkom merger, coupled with past consolidation within the market, signifies a trend toward greater concentration and potential for enhanced economies of scale. Total M&A deal value in the observed period amounts to approximately xx Million USD. Deal sizes vary widely, from smaller acquisitions of MVNOs to large-scale mergers between major MNOs.

South Africa MVNO - MNO Market Industry Evolution

This section analyzes the evolutionary path of the South Africa MVNO-MNO market, examining growth trajectories, technological advancements, and shifting consumer preferences.

The South African mobile market has experienced substantial growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is primarily attributed to increased smartphone penetration, rising data consumption, and the expansion of 4G and 5G networks. The projected CAGR for the forecast period (2025-2033) is estimated to be xx%, driven by the continued rollout of 5G technology and the increasing adoption of mobile financial services. The market has witnessed significant technological advancements, including the introduction of 5G technology, the expansion of mobile money services, and the growth of IoT (Internet of Things). These technological advancements are continually reshaping market dynamics. The evolution of consumer demands has shifted from primarily voice services towards data-intensive applications like video streaming and online gaming. The market has also responded to this shifting preference by increasing data allowances and introducing unlimited data packages. This evolution is reflected in the increase in data traffic over the past few years. The projected growth in data consumption for the coming decade is expected to further drive market evolution and innovation.

Leading Regions, Countries, or Segments in South Africa MVNO - MNO Market

This section analyzes the leading segments within the South African MVNO-MNO market, focusing on the key drivers of their dominance.

Dominant Segment: Consumer

The consumer segment significantly outweighs the enterprise segment in terms of subscriber numbers and revenue generation in South Africa. This dominance stems from several factors:

High Smartphone Penetration: South Africa boasts a high rate of smartphone penetration, leading to a large potential consumer base for mobile services.

Affordability: The proliferation of affordable smartphones and prepaid mobile plans makes mobile services accessible to a broad consumer base.

Data Consumption Growth: The ever-increasing demand for mobile data for various applications like social media, video streaming, and online gaming fuels continuous revenue growth in this segment.

Mobile Money: The widespread adoption of mobile money services like M-Pesa further expands the consumer segment's market size and revenue opportunities.

The consumer segment's dominance will continue into the forecast period, driven by increasing affordability, the expansion of 4G and 5G networks, and the proliferation of data-driven applications. While the enterprise segment is expected to grow in the coming years, the sheer size and demand within the consumer market ensures its continued leadership position.

South Africa MVNO - MNO Market Product Innovations

The South African MVNO-MNO market showcases considerable product innovation, driven by competition and evolving consumer preferences. Recent innovations encompass enhanced data packages tailored to specific usage patterns, bundled services offering data, voice, and SMS in integrated packages, and the introduction of mobile financial services. The integration of mobile money wallets with mobile operators' platforms has also enhanced customer experience and service reach. Furthermore, the expansion of 5G connectivity has enabled the introduction of high-speed data plans catering to increasing bandwidth demands. These innovations are aimed at improving service quality, increasing customer value, and creating unique selling propositions, leading to the expansion of market reach and increased customer loyalty.

Propelling Factors for South Africa MVNO - MNO Market Growth

Several factors contribute to the growth of South Africa's MVNO-MNO market. Technological advancements, particularly the expansion of 4G and 5G networks, play a crucial role. The increasing affordability of smartphones and data plans broadens market access. Regulatory changes that encourage competition and investment, such as spectrum auctions, further stimulate growth. The increasing demand for mobile financial services and the rising adoption of mobile devices for daily tasks also contribute significantly. Furthermore, the growing use of mobile data for various applications, from social media to online gaming, drives continuous growth in data consumption, thereby enhancing market revenue.

Obstacles in the South Africa MVNO - MNO Market Market

The South African MVNO-MNO market faces certain challenges. Regulatory hurdles, such as licensing requirements and spectrum allocation, can hinder expansion. Infrastructure limitations, including network coverage gaps in rural areas, pose an obstacle to complete market penetration. Intense competition among established players also pressures smaller players' profitability. Economic factors, such as fluctuating exchange rates and inflation, affect both consumer spending on mobile services and the operational costs of mobile network operators. These combined factors can constrain market growth and create challenges for profitability for all involved.

Future Opportunities in South Africa MVNO - MNO Market

Future opportunities abound in South Africa's MVNO-MNO market. The expansion of 5G networks presents significant opportunities for new services and revenue streams. The growth of the IoT sector creates a demand for scalable and reliable mobile connectivity. The ongoing development of mobile financial services opens up new possibilities for financial inclusion and service diversification. Untapped rural markets present a significant growth opportunity as network coverage expands and mobile penetration increases in these regions. Furthermore, innovations in cloud technologies and artificial intelligence will shape the offerings available in the coming decade.

Major Players in the South Africa MVNO - MNO Market Ecosystem

- Telkom SA SOC Ltd

- Virgin Mobile South Africa (Cell C)

- Vodacom Group Ltd

- Trace Mobile

- Rain

- MTN Group Ltd

- First National Bank (Cell C)

- Me & You

- MRP Mobile (Pty) Limited

- Cell C Pty Ltd

Key Developments in South Africa MVNO - MNO Market Industry

March 2022: South Africa completed a radio frequency spectrum auction, paving the way for 5G rollout. This significantly impacted the market, leading to increased investment and competition in the 5G space.

July 2022: MTN Group Ltd announced plans to acquire Telkom SA SOC Ltd for more than USD 1 Million in a stock or cash-and-stock deal. This proposed merger has the potential to reshape the competitive landscape, leading to market consolidation and influencing pricing strategies and network expansions.

Strategic South Africa MVNO - MNO Market Market Forecast

The South African MVNO-MNO market is poised for sustained growth, fueled by continued technological advancements, increasing affordability of devices and services, and expanding mobile data consumption. The rollout of 5G technology will be a key catalyst for growth, opening opportunities for new services and applications. The market's future potential is further enhanced by the increasing adoption of mobile financial services and the expansion of connectivity into previously underserved areas. The proposed merger between MTN and Telkom, if finalized, will further influence market dynamics and consolidate market share among major players. This overall positive outlook suggests significant growth potential for the coming years.

South Africa MVNO - MNO Market Segmentation

-

1. Subscriber

- 1.1. Enterprise

- 1.2. Consumer

South Africa MVNO - MNO Market Segmentation By Geography

- 1. South Africa

South Africa MVNO - MNO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Digital Banking Solutions

- 3.4. Market Trends

- 3.4.1. The Full MVNO Segment is Expected to Hold a Significant Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa MVNO - MNO Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Subscriber

- 5.1.1. Enterprise

- 5.1.2. Consumer

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Subscriber

- 6. South Africa South Africa MVNO - MNO Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa MVNO - MNO Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa MVNO - MNO Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa MVNO - MNO Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa MVNO - MNO Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa MVNO - MNO Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Telkom SA SOC Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Virgin Mobile South Africa (Cell C)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vodacom Group Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Trace Mobile

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rain

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MTN Group Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 First National Bank (Cell C)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Me & You

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 MRP Mobile (Pty) Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cell C Pty Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Telkom SA SOC Ltd

List of Figures

- Figure 1: South Africa MVNO - MNO Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa MVNO - MNO Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa MVNO - MNO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa MVNO - MNO Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa MVNO - MNO Market Revenue Million Forecast, by Subscriber 2019 & 2032

- Table 4: South Africa MVNO - MNO Market Volume K Unit Forecast, by Subscriber 2019 & 2032

- Table 5: South Africa MVNO - MNO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa MVNO - MNO Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: South Africa MVNO - MNO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa MVNO - MNO Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: South Africa South Africa MVNO - MNO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa South Africa MVNO - MNO Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Sudan South Africa MVNO - MNO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sudan South Africa MVNO - MNO Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Uganda South Africa MVNO - MNO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Uganda South Africa MVNO - MNO Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Tanzania South Africa MVNO - MNO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania South Africa MVNO - MNO Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Kenya South Africa MVNO - MNO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya South Africa MVNO - MNO Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of Africa South Africa MVNO - MNO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Africa South Africa MVNO - MNO Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: South Africa MVNO - MNO Market Revenue Million Forecast, by Subscriber 2019 & 2032

- Table 22: South Africa MVNO - MNO Market Volume K Unit Forecast, by Subscriber 2019 & 2032

- Table 23: South Africa MVNO - MNO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South Africa MVNO - MNO Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa MVNO - MNO Market?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the South Africa MVNO - MNO Market?

Key companies in the market include Telkom SA SOC Ltd, Virgin Mobile South Africa (Cell C), Vodacom Group Ltd, Trace Mobile, Rain, MTN Group Ltd, First National Bank (Cell C), Me & You, MRP Mobile (Pty) Limited, Cell C Pty Ltd.

3. What are the main segments of the South Africa MVNO - MNO Market?

The market segments include Subscriber.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

The Full MVNO Segment is Expected to Hold a Significant Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Adoption of Digital Banking Solutions.

8. Can you provide examples of recent developments in the market?

July 2022 - The South African mobile operator MTN Group Ltd planned to buy its smaller domestic rival, Telkom, for more than USD 1 million in stock or a cash-and-stock deal. Telkom's shares increased by nearly 30% following the announcement, while MTN's shares were up by nearly 5%. The deal between MTN and Telkom may help MTN strengthen its competition against Vodacom Group as both the carriers aim to expand 4G and 5G connectivity to more parts of the country. South Africa completed a radio frequency spectrum auction in March 2022, which was needed to roll out 5G.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa MVNO - MNO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa MVNO - MNO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa MVNO - MNO Market?

To stay informed about further developments, trends, and reports in the South Africa MVNO - MNO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence