Key Insights

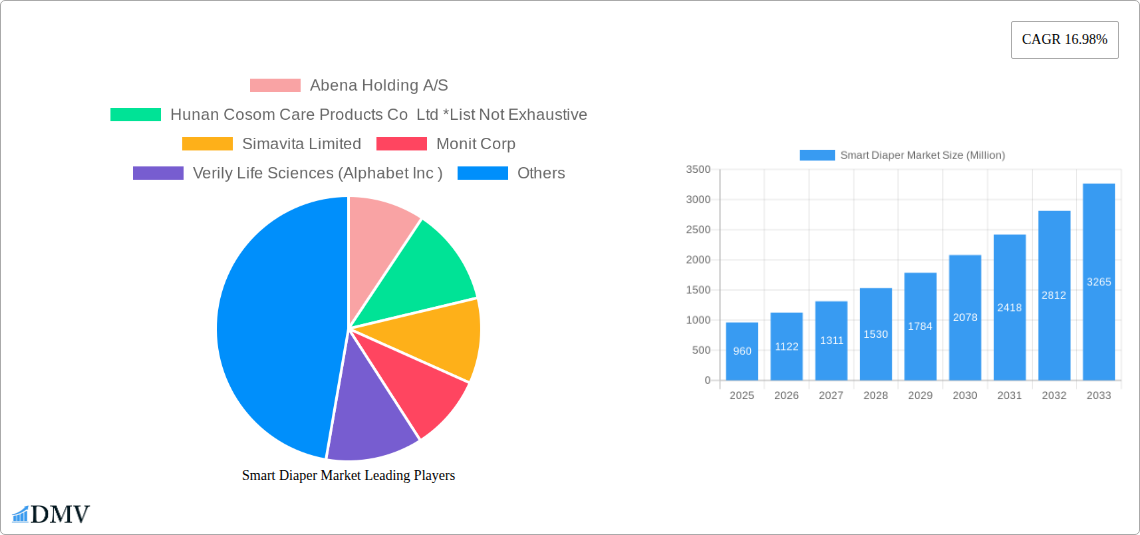

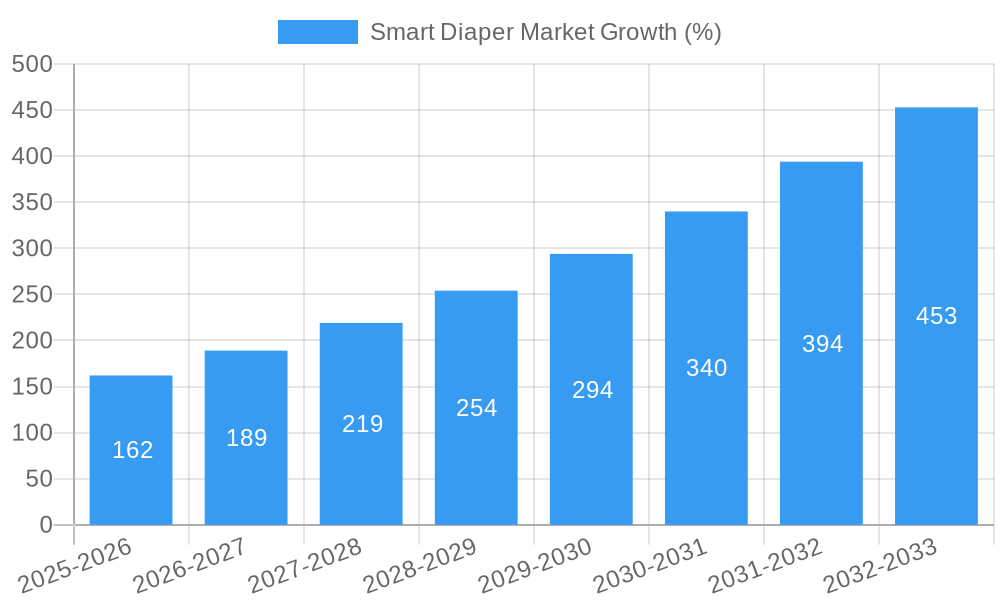

The smart diaper market, currently valued at $0.96 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 16.98% from 2025 to 2033. This surge is driven by several key factors. Increasing parental awareness of infant health and well-being fuels demand for technologically advanced solutions offering real-time monitoring of diaper status. The convenience and peace of mind offered by smart diaper systems, which alert caregivers to wetness or fullness, are significant drivers, particularly amongst busy parents and caregivers of children with specific health needs. Furthermore, the integration of smart diaper technology with mobile applications and wearables enhances data accessibility and improves preventative healthcare practices. The market's segmentation into baby and adult diapers reflects the broad applicability of this technology, with growth opportunities across diverse demographics. Technological advancements, such as improved sensors and data analytics, along with the increasing affordability of smart diaper systems, are expected to further propel market expansion.

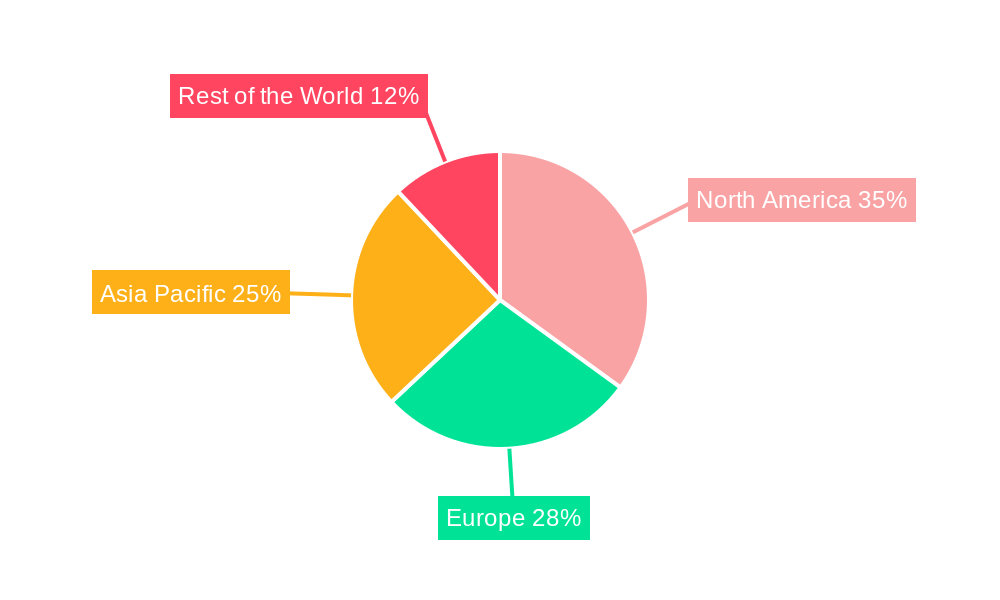

However, challenges remain. High initial costs associated with smart diapers compared to traditional options could pose a barrier to adoption, especially in price-sensitive markets. Concerns regarding data privacy and security related to the collection and storage of sensitive health information also warrant attention from manufacturers and regulators. Nevertheless, the market's strong growth trajectory indicates a considerable future potential, especially given ongoing innovations in sensor technology, improved data processing capabilities, and the potential for integration with broader healthcare ecosystems. The competitive landscape includes established players like Abena Holding A/S and Hunan Cosom Care Products Co Ltd, alongside emerging companies like Smardii and Pixie Scientific, fostering innovation and driving market expansion across North America, Europe, Asia Pacific and the Rest of the World. The market's future will be shaped by further technological advancements, consumer acceptance, and the effective addressing of data privacy concerns.

Smart Diaper Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Smart Diaper Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This report is invaluable for stakeholders seeking to understand the current market landscape and strategize for future success in this rapidly evolving sector. The market is projected to reach xx Million by 2033.

Smart Diaper Market Market Composition & Trends

This section delves into the intricate composition of the smart diaper market, analyzing market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated landscape, with a few key players holding significant market share. Abena Holding A/S, Hunan Cosom Care Products Co Ltd, Simavita Limited, Monit Corp, Verily Life Sciences (Alphabet Inc), Smardii, Sinopulsar Technology Inc, and Pixie Scientific are some of the prominent players. However, the market is witnessing increased competition due to the entry of new players and technological advancements.

- Market Share Distribution: Abena Holding A/S holds an estimated xx% market share in 2025, followed by Hunan Cosom Care Products Co Ltd with xx%. The remaining market share is distributed among other players, with many holding smaller individual shares.

- M&A Activities: The smart diaper market has seen xx Million in M&A deal value over the past five years, primarily driven by companies seeking to expand their product portfolio and geographic reach. Recent acquisitions have focused on technology integration and expansion into new market segments.

- Innovation Catalysts: Technological advancements such as AI-powered sensors, improved absorbent materials, and the development of self-powered health monitoring systems are key drivers of innovation.

- Regulatory Landscape: Regulations concerning the safety and efficacy of smart diapers vary across different regions. Compliance with these regulations is crucial for market entry and success.

- Substitute Products: Traditional diapers remain the primary substitute, but the increasing demand for smart diaper features is gradually reducing the market share of the traditional diapers.

- End-User Profiles: The primary end-users are babies and adults, with differing requirements in terms of features and functionalities.

Smart Diaper Market Industry Evolution

The smart diaper market has experienced significant growth over the past few years, driven by factors such as increasing disposable incomes, rising awareness of hygiene, and technological advancements. The market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the rising demand for smart features, such as leak detection, wetness indication, and health monitoring capabilities. Technological advancements, including the integration of AI, IoT, and advanced sensors, are transforming the industry, providing more precise and efficient solutions for both babies and adults.

Consumer demands are also evolving, with a greater focus on convenience, hygiene, and health benefits. The increasing adoption of smart home technologies and the growing interest in personalized healthcare are further propelling market growth. The market is expected to witness a significant shift towards more sophisticated products with enhanced features and improved usability. Adoption rates for smart diapers are currently at xx% globally, but are expected to reach xx% by 2033 due to several factors mentioned above.

Leading Regions, Countries, or Segments in Smart Diaper Market

The North American region currently dominates the global smart diaper market, driven by high disposable incomes, strong technological infrastructure, and early adoption of innovative products.

- Key Drivers for North American Dominance:

- High levels of investment in R&D and technological advancements in smart diaper technology.

- Favorable regulatory environment supporting the introduction and adoption of these products.

- Strong consumer preference for advanced features and high spending capacity on baby products.

- Analysis of Dominance Factors: The high prevalence of technologically savvy consumers coupled with supportive government policies supporting smart technologies fuels adoption. The presence of several major players within the region contributes to increased competition and innovation, further boosting market growth. The baby segment, with its higher demand for reliable and safe products, holds a larger share of the market than the adult segment. This is driven by higher parental willingness to pay for convenience and enhanced safety features.

Smart Diaper Market Product Innovations

Recent innovations in the smart diaper market focus on enhancing sensor technology, improving data analytics capabilities, and integrating advanced features. New products offer real-time monitoring of diaper wetness, temperature, and even potential health indicators. Unique selling propositions include improved comfort, reduced risk of diaper rash, and enhanced parental peace of mind through timely alerts. These advancements are achieved through the integration of miniature sensors, advanced algorithms, and wireless connectivity. These features are gradually expanding the application of smart diapers beyond mere wetness indication to include health monitoring and personalized baby care.

Propelling Factors for Smart Diaper Market Growth

Several factors are contributing to the rapid growth of the smart diaper market. These include:

- Technological Advancements: The development of highly sensitive and cost-effective sensors, miniaturization of electronics, and the integration of AI and machine learning are driving innovation and creating opportunities for more sophisticated and functional smart diapers.

- Economic Factors: Rising disposable incomes, particularly in developing economies, are increasing the affordability of premium baby and adult care products, stimulating demand.

- Regulatory Support: Governments in many countries are promoting the adoption of smart technologies in healthcare, which encourages further investment in and development of smart diaper technology.

Obstacles in the Smart Diaper Market Market

Despite the growth potential, several challenges hinder the widespread adoption of smart diapers:

- High Initial Costs: The high cost of production and the sophisticated technology involved leads to higher retail prices, making them inaccessible to some consumer segments.

- Privacy Concerns: The collection and use of personal health data raise concerns about data privacy and security. This requires strict adherence to data protection regulations.

- Battery Life and Durability: Limitations in battery life and the overall durability of the integrated sensors remain an obstacle to improved user experience.

Future Opportunities in Smart Diaper Market

The future of the smart diaper market holds substantial growth opportunities:

- Expansion into Emerging Markets: The increasing disposable incomes and rising awareness of hygiene in developing countries create significant potential for market expansion.

- Integration with Smart Home Systems: Connecting smart diapers with smart home systems will provide comprehensive baby care solutions, facilitating seamless monitoring and data sharing.

- Advancements in Sensor Technology: The development of more advanced, smaller, and energy-efficient sensors will allow the integration of more functionalities within the smart diaper itself.

Major Players in the Smart Diaper Market Ecosystem

- Abena Holding A/S

- Hunan Cosom Care Products Co Ltd

- Simavita Limited

- Monit Corp

- Verily Life Sciences (Alphabet Inc)

- Smardii

- Sinopulsar Technology Inc

- Pixie Scientific

Key Developments in Smart Diaper Market Industry

- March 2023: An innovative smart diaper with a low-cost, efficient urine-detecting sensor array was developed at Penn State, potentially revolutionizing wearable health monitors.

- January 2023: Chillax showcased advanced AI-powered baby monitors at CES, highlighting the increasing integration of smart technology into infant care.

Strategic Smart Diaper Market Market Forecast

The smart diaper market is poised for significant growth, driven by technological innovation, increasing consumer demand, and favorable regulatory environments. The market's future will likely be shaped by further integration with smart home ecosystems, the development of more sophisticated health monitoring features, and expansion into emerging markets. The increasing demand for convenience, improved hygiene, and personalized healthcare will further fuel market growth and drive continued innovation in this sector.

Smart Diaper Market Segmentation

-

1. End-User Industry

- 1.1. Baby

- 1.2. Adult

Smart Diaper Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Smart Diaper Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Large Geriatric Population in Developed Countries; High Birth Rates and Rise in Disposable Incomes in Emerging Markets

- 3.3. Market Restrains

- 3.3.1. Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth

- 3.4. Market Trends

- 3.4.1. The Rising Baby Care Will Act as a Major Driver of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Baby

- 5.1.2. Adult

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. North America Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Baby

- 6.1.2. Adult

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. Europe Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Baby

- 7.1.2. Adult

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Asia Pacific Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Baby

- 8.1.2. Adult

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. Rest of the World Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9.1.1. Baby

- 9.1.2. Adult

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10. North America Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Smart Diaper Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Abena Holding A/S

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Hunan Cosom Care Products Co Ltd *List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Simavita Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Monit Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Verily Life Sciences (Alphabet Inc )

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Smardii

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Sinopulsar Technology Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Pixie Scientific

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.1 Abena Holding A/S

List of Figures

- Figure 1: Global Smart Diaper Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Smart Diaper Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 11: North America Smart Diaper Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 12: North America Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Smart Diaper Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 15: Europe Smart Diaper Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 16: Europe Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Smart Diaper Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 19: Asia Pacific Smart Diaper Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 20: Asia Pacific Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Smart Diaper Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 23: Rest of the World Smart Diaper Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 24: Rest of the World Smart Diaper Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Smart Diaper Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Diaper Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 3: Global Smart Diaper Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Smart Diaper Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Smart Diaper Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Smart Diaper Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Smart Diaper Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 13: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 15: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Smart Diaper Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 19: Global Smart Diaper Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Diaper Market?

The projected CAGR is approximately 16.98%.

2. Which companies are prominent players in the Smart Diaper Market?

Key companies in the market include Abena Holding A/S, Hunan Cosom Care Products Co Ltd *List Not Exhaustive, Simavita Limited, Monit Corp, Verily Life Sciences (Alphabet Inc ), Smardii, Sinopulsar Technology Inc, Pixie Scientific.

3. What are the main segments of the Smart Diaper Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Large Geriatric Population in Developed Countries; High Birth Rates and Rise in Disposable Incomes in Emerging Markets.

6. What are the notable trends driving market growth?

The Rising Baby Care Will Act as a Major Driver of the Market.

7. Are there any restraints impacting market growth?

Infections and Kidney Problems Associated with their Prolonged Use might Act as a Restraint for Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023 - An innovative smart diaper has been created by an international team of scientists, with funding from the National Institutes of Health (NIH) and the National Science Foundation (NSF). Developed at Penn State, this diaper utilizes a basic pencil-on-paper design, incorporating an electrode sensor array treated with a sodium chloride solution. This array can detect dampness caused by urine. The simplicity and affordability of this sensor array could potentially pave the way for wearable, self-powered health monitors. These monitors could be used not only in smart diapers but also to predict serious health issues such as cardiac arrest and pneumonia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Diaper Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Diaper Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Diaper Market?

To stay informed about further developments, trends, and reports in the Smart Diaper Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence