Key Insights

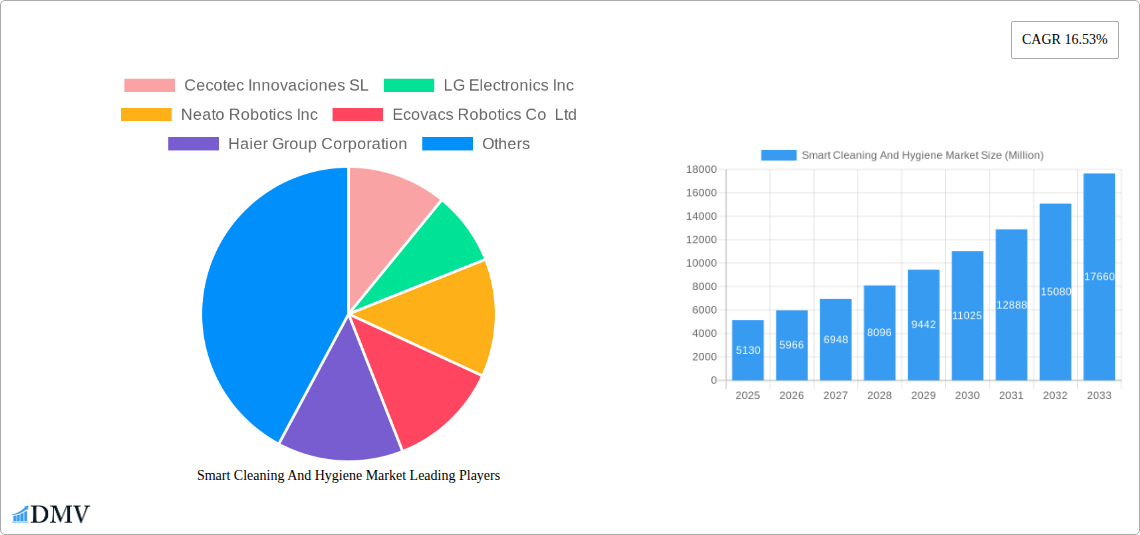

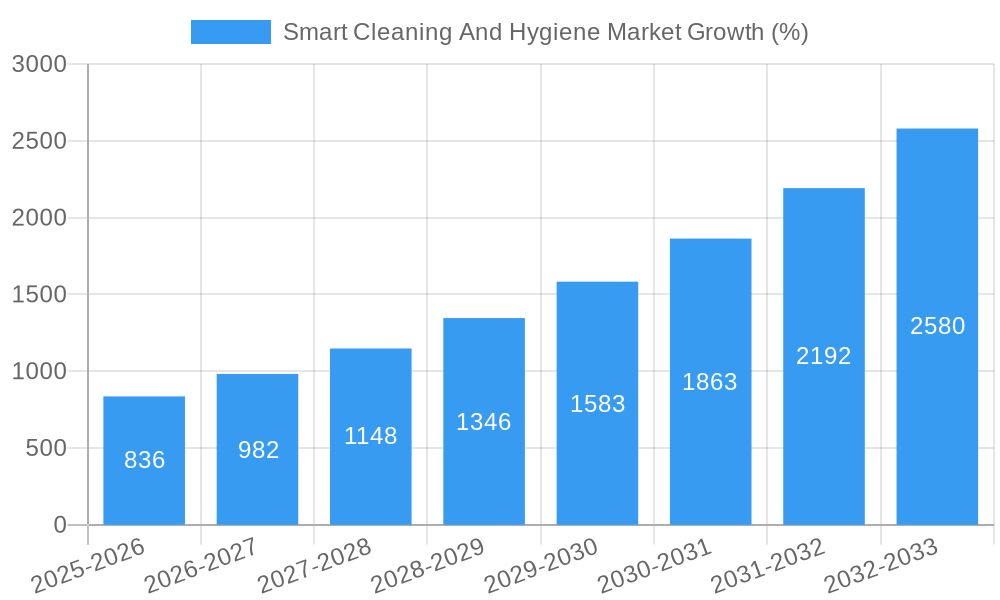

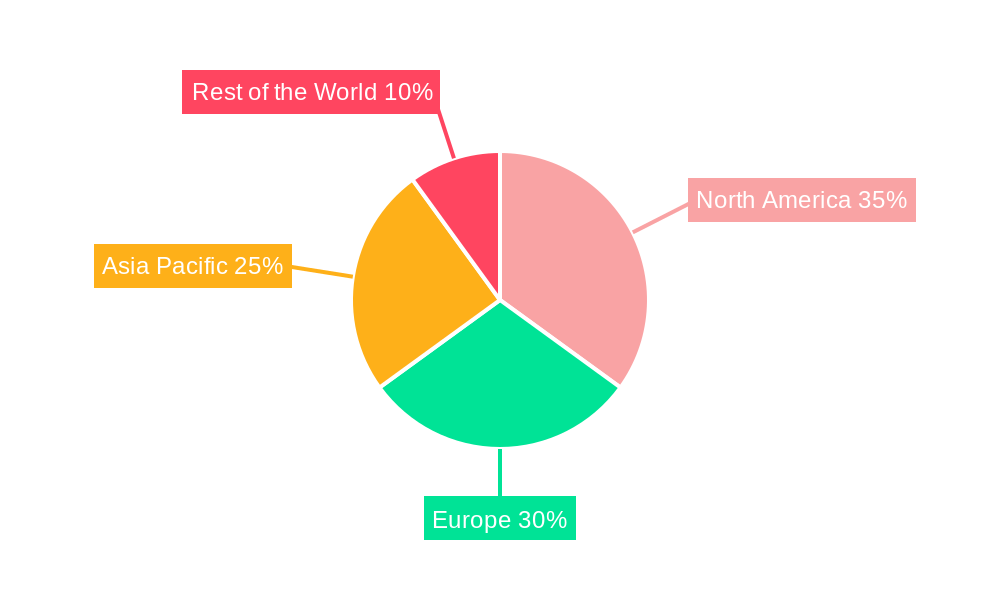

The smart cleaning and hygiene market is experiencing robust growth, projected to reach a value of $5.13 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 16.53% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of smart home technology, coupled with consumers' growing demand for convenience and time-saving solutions, significantly contributes to market growth. Technological advancements in robotics, AI-powered navigation, and improved sensor capabilities are leading to more efficient and effective cleaning robots. Furthermore, rising disposable incomes, especially in developing economies, are expanding the market's addressable base. The market is segmented by product type, including robotic vacuum cleaners, pool cleaning robots, window cleaning robots, and other hygiene-based products such as disinfecting robots and automated laundry systems. Robotic vacuum cleaners currently hold the largest market share, driven by their widespread adoption and affordability. However, other segments are poised for significant growth, particularly pool and window cleaning robots, as their technological advancements improve efficiency and user-friendliness. Competitive intensity is high, with major players such as iRobot, Ecovacs, and Samsung constantly innovating to improve product features and expand their market reach. Geographic variations exist, with North America and Europe currently dominating market share, while the Asia-Pacific region is projected to witness the fastest growth rate in the forecast period due to increasing urbanization and technological adoption. Challenges include high initial costs of smart cleaning devices and potential concerns about data privacy and security.

Despite these challenges, the long-term outlook for the smart cleaning and hygiene market remains positive. The continued integration of smart technologies into home appliances, coupled with the development of more sophisticated and affordable robotic solutions, is expected to drive market expansion. The increasing awareness of hygiene and sanitation, especially post-pandemic, also plays a crucial role. Growth will likely be driven by the introduction of innovative features, such as enhanced mapping capabilities, improved object recognition, and increased connectivity with other smart home devices. Companies are focusing on strategic partnerships and acquisitions to broaden their product portfolios and expand their global footprint. Furthermore, the focus on sustainability and energy efficiency will contribute to the development of environmentally friendly cleaning solutions. The industry is ripe for further innovation in areas such as advanced cleaning agents, autonomous waste disposal systems, and AI-driven personalized cleaning schedules.

Smart Cleaning and Hygiene Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Smart Cleaning and Hygiene Market, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving sector. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The market is projected to reach xx Million by 2033, demonstrating significant growth potential. This report covers key market segments, including robotic vacuum cleaners, pool cleaning robots, window cleaning robots, and other hygiene-based products, and analyzes the competitive landscape, highlighting major players and their strategic initiatives.

Smart Cleaning and Hygiene Market Composition & Trends

The Smart Cleaning and Hygiene Market is characterized by a moderately concentrated landscape with key players holding significant market share. The market share distribution among the top ten players is estimated to be approximately xx%, with iRobot Corporation and Samsung Electronics Co Ltd holding leading positions in specific segments. Innovation is a crucial driver, with continuous advancements in robotics, AI, and sensor technologies fueling new product development and enhanced cleaning capabilities. Regulatory landscapes vary across regions, impacting product approvals and safety standards. Substitute products, such as traditional cleaning methods, still exist but are facing growing competition from the convenience and efficiency of smart cleaning solutions. End-users predominantly include residential households and commercial establishments, with growing adoption in healthcare and hospitality sectors. M&A activities have been moderate, with deal values averaging approximately xx Million in recent years. Notable mergers and acquisitions have involved companies focusing on strategic expansion into new product segments or geographical markets.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% of the market share.

- Innovation Catalysts: Advancements in robotics, AI, and sensor technologies.

- Regulatory Landscape: Varies by region, influencing product approvals and safety standards.

- Substitute Products: Traditional cleaning methods, facing increasing competition.

- End-User Profiles: Residential households, commercial establishments, healthcare, and hospitality.

- M&A Activities: Moderate activity, with average deal values around xx Million.

Smart Cleaning and Hygiene Market Industry Evolution

The Smart Cleaning and Hygiene Market has witnessed substantial growth from 2019 to 2024, driven by increasing consumer demand for convenient and efficient cleaning solutions. The market expanded at a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a strong growth trajectory throughout the forecast period (2025-2033), reaching xx Million by 2033. Technological advancements, such as improved navigation systems, enhanced suction power, and smart connectivity features, have significantly boosted market adoption. Consumer preferences are shifting towards automated, intelligent cleaning systems offering personalized cleaning experiences and seamless integration with smart home ecosystems. The increasing disposable income in developing economies further fuels market growth. The market is witnessing a gradual shift from basic robotic vacuum cleaners to more sophisticated models incorporating advanced features like self-emptying dustbins, object recognition, and zone cleaning capabilities. Adoption rates are highest in developed regions but are experiencing rapid growth in emerging markets as awareness and affordability increase.

Leading Regions, Countries, or Segments in Smart Cleaning and Hygiene Market

The Robotic Vacuum Cleaner segment dominates the Smart Cleaning and Hygiene Market, accounting for the largest market share due to high consumer demand for convenient floor cleaning solutions. North America and Europe currently hold leading positions, driven by high disposable incomes, technological advancements, and early adoption of smart home technologies. However, Asia-Pacific is emerging as a key growth region, fueled by rapid urbanization, rising disposable incomes, and increasing consumer awareness.

Key Drivers for Robotic Vacuum Cleaner Dominance:

- High consumer demand for convenient floor cleaning.

- Technological advancements leading to enhanced features and performance.

- Increasing adoption of smart home technologies.

- Growing disposable incomes in developing economies.

Key Drivers for Growth in Asia-Pacific:

- Rapid urbanization and expanding middle class.

- Rising disposable incomes and increasing consumer spending.

- Growing awareness of smart home technologies.

- Government initiatives promoting technological adoption.

The Pool Cleaning Robot and Window Cleaning Robot segments are also experiencing growth, albeit at a slower pace compared to robotic vacuum cleaners. Other hygiene-based products are witnessing increasing innovation, with smart air purifiers and automated disinfection systems gaining popularity.

Smart Cleaning and Hygiene Market Product Innovations

Recent product innovations focus on enhanced navigation, improved suction power, self-emptying dustbins, and advanced object recognition capabilities. These advancements ensure more efficient and convenient cleaning experiences, tailored to diverse user needs. Unique selling propositions include features like app-based control, voice assistants integration, and mapping technologies for personalized cleaning routines. Technological advancements in AI and machine learning enable more sophisticated cleaning strategies and better obstacle avoidance.

Propelling Factors for Smart Cleaning and Hygiene Market Growth

Technological advancements are the primary drivers of market growth, with ongoing innovations in robotics, AI, and sensor technologies resulting in more powerful, efficient, and intelligent cleaning solutions. Economic factors like rising disposable incomes and increased consumer spending power play a crucial role, particularly in developing economies. Favorable government regulations and initiatives promoting energy efficiency and smart home technologies further stimulate market expansion.

Obstacles in the Smart Cleaning and Hygiene Market

High initial costs of smart cleaning devices remain a significant barrier for many consumers. Supply chain disruptions can affect the availability and pricing of components, impacting production and market supply. Intense competition from established players and new entrants leads to price wars and pressures profit margins. Regulatory hurdles and safety standards vary across different regions, creating compliance challenges for manufacturers.

Future Opportunities in Smart Cleaning and Hygiene Market

Untapped markets in developing countries present significant growth opportunities. The integration of smart cleaning solutions with other smart home devices and platforms offers further expansion potential. New technologies like UV-C disinfection and advanced air purification systems will open new market segments. The rising focus on hygiene and sanitation creates demand for advanced cleaning solutions in healthcare and commercial settings.

Major Players in the Smart Cleaning and Hygiene Market Ecosystem

- Cecotec Innovaciones SL

- LG Electronics Inc

- Neato Robotics Inc

- Ecovacs Robotics Co Ltd

- Haier Group Corporation

- Hitachi Ltd

- Roborock Technology Co Ltd

- SharkNinja Operating LLC

- iRobot Corporation

- Electrolux AB

- Samsung Electronics Co Ltd

- Panasonic Corporation

Key Developments in Smart Cleaning and Hygiene Market Industry

- March 2023: Samsung launched the Bespoke Jet and Robotic Jet Bot+ robotic vacuum cleaners in India, featuring advanced features like a 210W suction capacity and a self-emptying dustbin.

- March 2023: Sunpure entered the Indian market, providing robotic cleaning systems for Spring Energy's solar projects, showcasing the application of robotic cleaning in renewable energy.

- February 2023: Ecoppia launched a waterless robotic cleaning solution with a helix design, highlighting innovation in sustainable cleaning technologies.

Strategic Smart Cleaning and Hygiene Market Forecast

The Smart Cleaning and Hygiene Market is poised for sustained growth, driven by technological innovation, increasing consumer demand, and expansion into new markets. Future opportunities lie in the development of more sophisticated, AI-powered cleaning solutions, integrating smart home ecosystems, and tapping into emerging markets. The market's expansion will be further fueled by increasing awareness of hygiene and the demand for efficient and convenient cleaning solutions across various sectors.

Smart Cleaning And Hygiene Market Segmentation

-

1. Product

- 1.1. Robotic Vacuum Cleaner

- 1.2. Pool Cleaning Robot

- 1.3. Window Cleaning Robot

- 1.4. Other Hygiene-based Products

Smart Cleaning And Hygiene Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Smart Cleaning And Hygiene Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Changing Consumer Preferences and Socio-economic Factors Along with Reduced Unit Prices

- 3.3. Market Restrains

- 3.3.1. Security Concern and Prevailing Pandemic Disrupt Supply Chain Activities

- 3.4. Market Trends

- 3.4.1. Robotic Vacuum Cleaner Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Robotic Vacuum Cleaner

- 5.1.2. Pool Cleaning Robot

- 5.1.3. Window Cleaning Robot

- 5.1.4. Other Hygiene-based Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Robotic Vacuum Cleaner

- 6.1.2. Pool Cleaning Robot

- 6.1.3. Window Cleaning Robot

- 6.1.4. Other Hygiene-based Products

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Robotic Vacuum Cleaner

- 7.1.2. Pool Cleaning Robot

- 7.1.3. Window Cleaning Robot

- 7.1.4. Other Hygiene-based Products

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Robotic Vacuum Cleaner

- 8.1.2. Pool Cleaning Robot

- 8.1.3. Window Cleaning Robot

- 8.1.4. Other Hygiene-based Products

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Robotic Vacuum Cleaner

- 9.1.2. Pool Cleaning Robot

- 9.1.3. Window Cleaning Robot

- 9.1.4. Other Hygiene-based Products

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. North America Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Smart Cleaning And Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Cecotec Innovaciones SL

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 LG Electronics Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Neato Robotics Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Ecovacs Robotics Co Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Haier Group Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Hitachi Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Roborock Technology Co Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 SharkNinja Operating LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 iRobot Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Electrolux AB

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Samsung Electronics Co Ltd

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Panasonic Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Cecotec Innovaciones SL

List of Figures

- Figure 1: Global Smart Cleaning And Hygiene Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Smart Cleaning And Hygiene Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Smart Cleaning And Hygiene Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Smart Cleaning And Hygiene Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Smart Cleaning And Hygiene Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Smart Cleaning And Hygiene Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Smart Cleaning And Hygiene Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Smart Cleaning And Hygiene Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Smart Cleaning And Hygiene Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Smart Cleaning And Hygiene Market Revenue (Million), by Product 2024 & 2032

- Figure 11: North America Smart Cleaning And Hygiene Market Revenue Share (%), by Product 2024 & 2032

- Figure 12: North America Smart Cleaning And Hygiene Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Smart Cleaning And Hygiene Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Smart Cleaning And Hygiene Market Revenue (Million), by Product 2024 & 2032

- Figure 15: Europe Smart Cleaning And Hygiene Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: Europe Smart Cleaning And Hygiene Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Smart Cleaning And Hygiene Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Smart Cleaning And Hygiene Market Revenue (Million), by Product 2024 & 2032

- Figure 19: Asia Pacific Smart Cleaning And Hygiene Market Revenue Share (%), by Product 2024 & 2032

- Figure 20: Asia Pacific Smart Cleaning And Hygiene Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Smart Cleaning And Hygiene Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Smart Cleaning And Hygiene Market Revenue (Million), by Product 2024 & 2032

- Figure 23: Rest of the World Smart Cleaning And Hygiene Market Revenue Share (%), by Product 2024 & 2032

- Figure 24: Rest of the World Smart Cleaning And Hygiene Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Smart Cleaning And Hygiene Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Smart Cleaning And Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Smart Cleaning And Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Smart Cleaning And Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Smart Cleaning And Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Product 2019 & 2032

- Table 13: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Product 2019 & 2032

- Table 15: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Global Smart Cleaning And Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Cleaning And Hygiene Market?

The projected CAGR is approximately 16.53%.

2. Which companies are prominent players in the Smart Cleaning And Hygiene Market?

Key companies in the market include Cecotec Innovaciones SL, LG Electronics Inc, Neato Robotics Inc, Ecovacs Robotics Co Ltd, Haier Group Corporation, Hitachi Ltd, Roborock Technology Co Ltd, SharkNinja Operating LLC, iRobot Corporation, Electrolux AB, Samsung Electronics Co Ltd , Panasonic Corporation.

3. What are the main segments of the Smart Cleaning And Hygiene Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Changing Consumer Preferences and Socio-economic Factors Along with Reduced Unit Prices.

6. What are the notable trends driving market growth?

Robotic Vacuum Cleaner Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Security Concern and Prevailing Pandemic Disrupt Supply Chain Activities.

8. Can you provide examples of recent developments in the market?

March 2023: Samsung launched the Bespoke Jet and Robotic Jet Bot+ robotic vacuum cleaners in India. These cleaners feature a Digital Inverter Motor with a 210W suction capacity and can operate continuously for up to two hours. Additionally, they come with a charging dock that automatically empties the dustbin and displays charging levels, running time, suction power, maintenance, and error guides. The telescopic pipe and washable dustbin are other notable features. The cleaners can be remotely controlled and monitored using the smartphone SmartThings app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Cleaning And Hygiene Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Cleaning And Hygiene Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Cleaning And Hygiene Market?

To stay informed about further developments, trends, and reports in the Smart Cleaning And Hygiene Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence