Key Insights

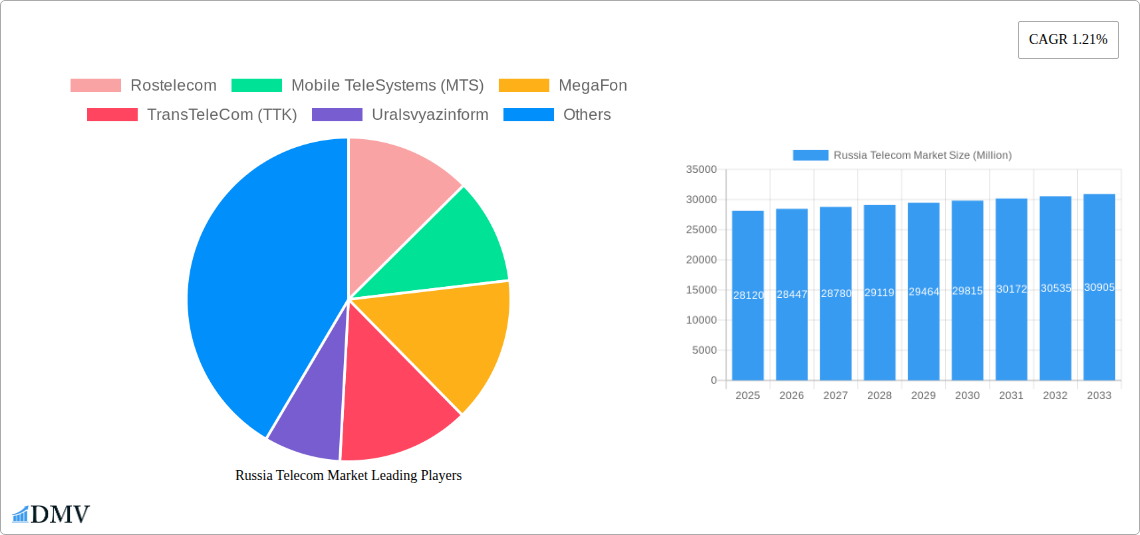

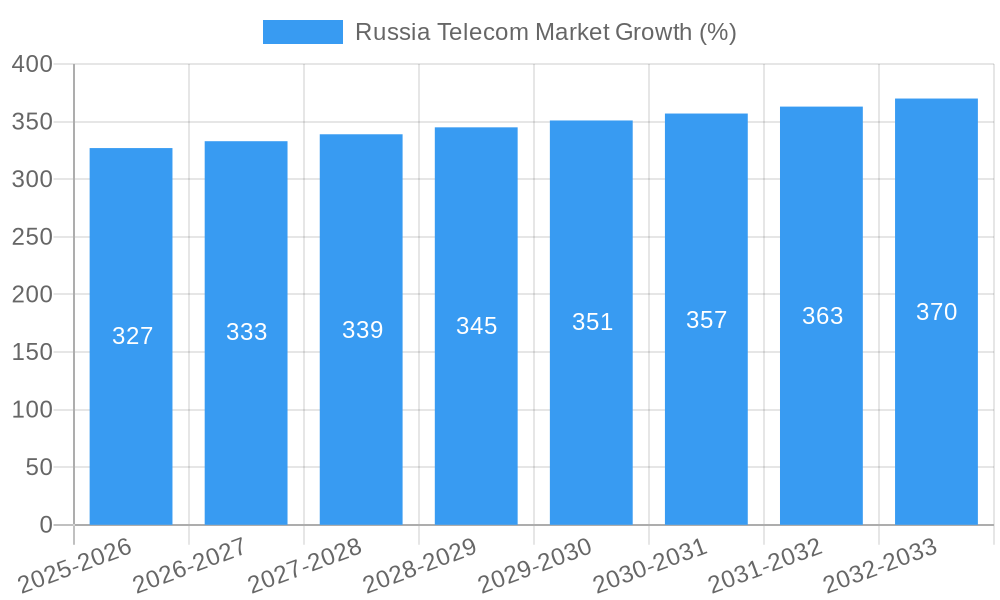

The Russia Telecom market, valued at $28.12 billion in 2025, exhibits a modest Compound Annual Growth Rate (CAGR) of 1.21% from 2025 to 2033. This relatively low growth rate suggests a market nearing maturity, with existing players vying for market share in a relatively saturated landscape. Key drivers include the ongoing expansion of 4G and 5G networks, increasing mobile penetration, and the government's push for digitalization initiatives. However, factors such as economic sanctions, geopolitical instability, and intense competition among established players like Rostelecom, MTS, MegaFon, and others, are acting as significant restraints. The market's segmentation is likely driven by service type (mobile, fixed-line, broadband internet, etc.) and geographic location, with major players focusing on both urban and rural areas. The increasing adoption of cloud computing and IoT solutions presents opportunities for growth, but this requires investment in infrastructure and technological upgrades. Successful players will focus on improving customer service, offering competitive pricing, and innovating in areas such as data analytics and cybersecurity.

Looking ahead to the forecast period (2025-2033), the Russia Telecom market is expected to experience incremental growth, largely driven by the continued adoption of mobile data services and the expansion of broadband access in less-developed regions. While the overall growth is projected to be moderate, strategic partnerships, mergers and acquisitions, and technological advancements will be crucial for companies to maintain competitiveness. The market will likely see increased emphasis on value-added services and tailored packages to meet the evolving needs of a diverse customer base. Maintaining regulatory compliance and navigating the complexities of the geopolitical landscape will also be key to success within this sector.

Russia Telecom Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Russia Telecom Market, covering the period 2019-2033, with a focus on the estimated year 2025. It offers a comprehensive overview of market composition, industry evolution, key players, and future opportunities, equipping stakeholders with crucial data for informed decision-making. The report analyzes market trends, technological advancements, and regulatory changes impacting the sector, providing valuable insights into the dynamic Russian telecom landscape. With a meticulous forecast period spanning 2025-2033, this report is an indispensable resource for investors, industry professionals, and anyone seeking a deep understanding of this rapidly evolving market. The total market value is projected to reach xx Million by 2033.

Russia Telecom Market Composition & Trends

This section meticulously examines the competitive landscape of the Russian telecom market, focusing on market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The report analyzes market share distribution among key players, including Rostelecom, Mobile TeleSystems (MTS), MegaFon, and others. The analysis incorporates data from the historical period (2019-2024) to provide a comprehensive understanding of market dynamics.

Market Concentration: The Russian telecom market exhibits a moderately concentrated structure, with a few major players holding significant market share. The report quantifies this concentration using metrics like the Herfindahl-Hirschman Index (HHI) and market share distribution among the top 5 players. The xx% market share held by the top three players reflects the sector's oligopolistic nature.

Innovation Catalysts: Government initiatives promoting digitalization and technological advancements, such as the push for 5G infrastructure and the development of domestic equipment, act as key drivers of innovation. Increased investment in R&D by major players further fuels innovation.

Regulatory Landscape: The report analyzes the impact of regulatory frameworks on market competition, pricing strategies, and technological deployments. The detailed examination includes an assessment of the current regulatory environment's strengths and weaknesses.

Substitute Products: The emergence of alternative communication technologies, such as Over-the-Top (OTT) services, poses a significant challenge, impacting the traditional telecom services market. The report assesses the impact of these substitutes on market growth and revenue streams.

End-User Profiles: The report segments end-users based on demographics, consumption patterns, and technology adoption rates. This detailed analysis provides valuable insights into consumer preferences and market demand.

M&A Activities: The report analyzes past and projected M&A activities, providing quantitative data on deal values and their influence on market consolidation. Total M&A deal value for the period 2019-2024 was estimated at xx Million, with an anticipated xx Million in deals during the forecast period.

Russia Telecom Market Industry Evolution

This section delves into the evolutionary trajectory of the Russian telecom market, analyzing market growth, technological progress, and evolving consumer preferences. Leveraging historical data (2019-2024) and projections (2025-2033), the report illustrates growth rates, adoption metrics for various technologies (e.g., 4G, 5G, fiber optics), and shifting consumer demands for bundled services and data consumption.

The market demonstrated a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024. Factors such as increasing smartphone penetration, rising data consumption, and government-led digitalization initiatives propelled this growth. The forecast period (2025-2033) anticipates a slightly moderated CAGR of xx%, driven by market saturation in certain segments and the economic climate. The increasing adoption of 5G technology is projected to drive significant growth, with penetration rates expected to reach xx% by 2033. Consumer demand for higher bandwidth services and improved network quality will continue to be key drivers. The shift towards digital entertainment and cloud-based services will also contribute significantly to the growth of the market.

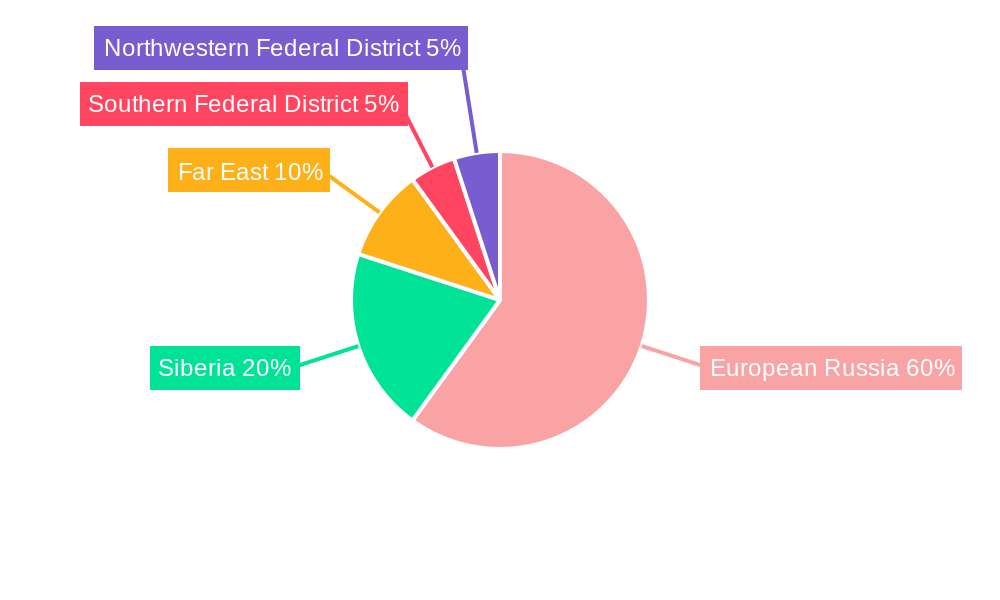

Leading Regions, Countries, or Segments in Russia Telecom Market

This section identifies the dominant regions or segments within the Russian telecom market. The analysis considers key drivers like investment trends, regulatory support, and infrastructure development.

Key Drivers:

- Government Investment: Significant government investments in infrastructure development, particularly in expanding broadband access to rural areas, drive market growth in specific regions.

- Regulatory Support: Favorable regulatory policies and licensing frameworks encourage market competition and investment in network expansion.

- Technological Advancements: Early adoption of new technologies, such as 5G, in specific regions creates growth opportunities.

Dominance Factors: The dominance of certain regions or segments often stems from a combination of factors. High population density, significant economic activity, and readily available infrastructure contribute to higher demand and investment. The report presents detailed analysis of the factors determining regional disparities in market growth. Moscow and St. Petersburg consistently remain leading regions due to high population density, robust economies, and advanced infrastructure.

Russia Telecom Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics within the Russian telecom market. The focus is on unique selling propositions (USPs) and technological breakthroughs. The market is seeing innovation in areas such as IoT solutions, cloud-based services, and the development of domestically produced 5G equipment. Companies are differentiating themselves through improved network coverage, faster speeds, and enhanced customer service offerings. The emergence of 5G NTN technology, as seen with Bureau 1440's satellite deployment, represents a significant leap in connectivity. This innovation unlocks communication opportunities in remote areas, offering a competitive advantage in the market. Specific performance metrics, such as latency, download speeds, and network reliability, are presented to demonstrate these advancements.

Propelling Factors for Russia Telecom Market Growth

Several factors propel the growth of the Russia Telecom Market. Technological advancements, particularly the rollout of 5G networks, are increasing bandwidth and connectivity, fueling demand for data-intensive services. Economic growth and rising disposable incomes drive consumer spending on telecom services. Government initiatives supporting digitalization and infrastructure development create a conducive environment for market expansion. The increasing adoption of smart devices and IoT applications further boosts the demand for robust connectivity.

Obstacles in the Russia Telecom Market

The Russian telecom market faces several challenges. Regulatory hurdles, including complex licensing processes and evolving regulations, can hinder market expansion. Supply chain disruptions, particularly for imported equipment, affect the timely deployment of infrastructure. Intense competition among established players and the emergence of new entrants create price pressures. Sanctions and geopolitical factors also significantly influence market stability and investment. These factors may affect projected growth rates and market penetration of new technologies.

Future Opportunities in Russia Telecom Market

The Russian telecom market presents numerous future opportunities. Expanding broadband access to underserved regions opens vast growth potential. The deployment of advanced technologies, including 5G and satellite-based communication systems, will create new market segments. The increasing adoption of IoT and cloud computing solutions will fuel demand for sophisticated network services. The development of domestic 5G equipment, as demonstrated by Irteya's initiatives, provides a pathway for reducing reliance on imports and building local technological expertise.

Major Players in the Russia Telecom Market Ecosystem

- Rostelecom

- Mobile TeleSystems (MTS)

- MegaFon

- TransTeleCom (TTK)

- Uralsvyazinform

- VolgaTelecom

- VEON

- PeterStar

- ER-Telecom

Key Developments in Russia Telecom Market Industry

April 2024: Irteya, an MTS subsidiary, plans to commence production of 4G LTE and 5G base stations, establishing a domestic manufacturing capability. This development reduces reliance on imported equipment and strengthens the domestic telecom industry.

May 2024: Bureau 1440 successfully launched three 5G NTN satellites, marking a significant advancement in satellite communication technology and expanding connectivity to remote areas. This development positions Russia at the forefront of 5G NTN technology and enhances its capabilities in providing communication services.

Strategic Russia Telecom Market Forecast

The Russia Telecom Market is poised for continued growth, driven by increasing digitalization, technological advancements, and government support. The forecast period (2025-2033) anticipates a robust expansion, with significant opportunities in areas such as 5G deployment, satellite communication, and the burgeoning IoT sector. The development of domestic manufacturing capabilities, such as Irteya's initiative, presents a significant catalyst for growth and reduces dependence on foreign technology. The market's potential for growth is considerable, with the projected market value reaching xx Million by 2033.

Russia Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and Pay TV Services

-

1.1. Voice Services

Russia Telecom Market Segmentation By Geography

- 1. Russia

Russia Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Rising Demand for 5G to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and Pay TV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rostelecom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mobile TeleSystems (MTS)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MegaFon

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TransTeleCom (TTK)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Uralsvyazinform

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VolgaTelecom

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VEON

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PeterStar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ER-Telecom

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MTS*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rostelecom

List of Figures

- Figure 1: Russia Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Russia Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 4: Russia Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 5: Russia Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Russia Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Russia Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 8: Russia Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 9: Russia Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Russia Telecom Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Telecom Market?

The projected CAGR is approximately 1.21%.

2. Which companies are prominent players in the Russia Telecom Market?

Key companies in the market include Rostelecom, Mobile TeleSystems (MTS), MegaFon, TransTeleCom (TTK), Uralsvyazinform, VolgaTelecom, VEON, PeterStar, ER-Telecom, MTS*List Not Exhaustive.

3. What are the main segments of the Russia Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Rising Demand for 5G to Drive the Market.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

April 2024: Irteya, a Russian company under the ownership of MTS, planned to commence the production of 4G LTE and 5G base stations in 2024. In late 2023, Irteya unveiled its initiative to manufacture its proprietary 4G LTE and 5G base stations. Initially, the company intended to utilize facilities at Mikran, a Tomsk-based company, for production. However, Irteya has since pivoted, opting to establish its production line, and is in the preparatory stages.May 2024: The Digital Ministry of Russia reported that "Bureau 1440," a Russian company, successfully deployed three new domestic low-orbit communication satellites. These satellites mark a significant milestone as they are the first in Russian space history to utilize 5G connectivity, specifically the 5G NTN standard, for communication with subscribers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Telecom Market?

To stay informed about further developments, trends, and reports in the Russia Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence