Key Insights

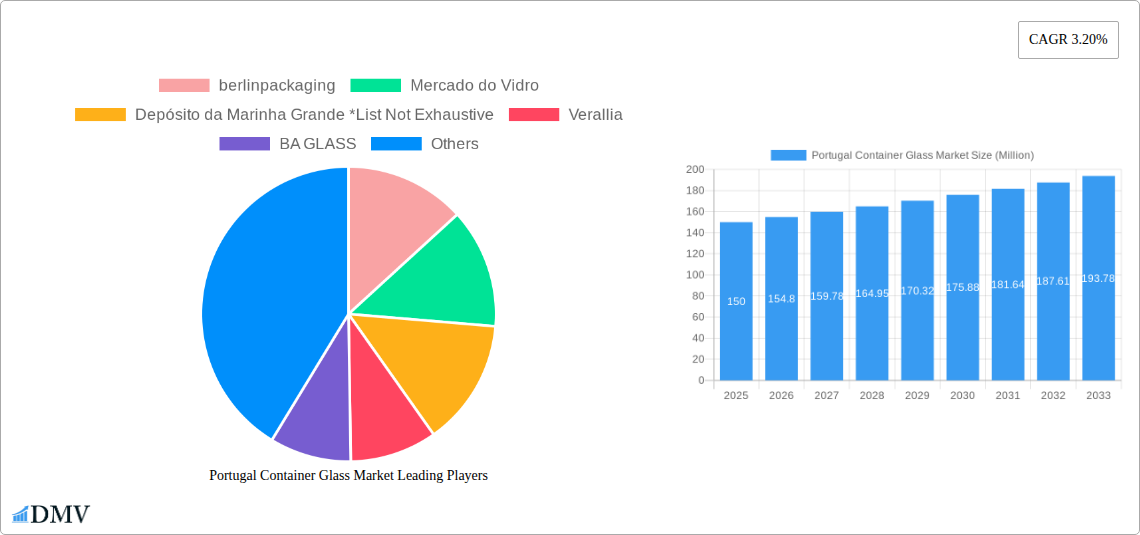

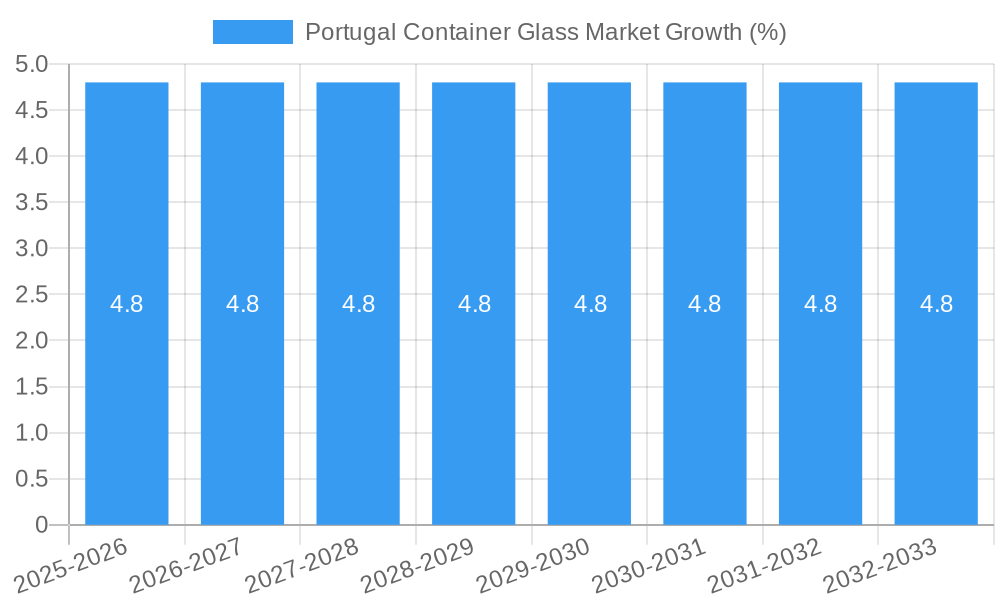

The Portugal container glass market, valued at approximately €[Estimate based on market size XX and value unit Million. For example, if XX = 150, then the value would be €150 million] in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.20% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning food and beverage sector in Portugal, particularly within the non-alcoholic segment, is a significant contributor, demanding increased packaging solutions. Furthermore, the growing popularity of sustainable packaging alternatives and consumer preference for eco-friendly glass containers are bolstering market expansion. The cosmetics and pharmaceuticals industries also contribute to the demand, albeit to a lesser extent. Key players like Berlin Packaging, Mercado do Vidro, and Verallia are actively shaping the market landscape through innovation and strategic expansions.

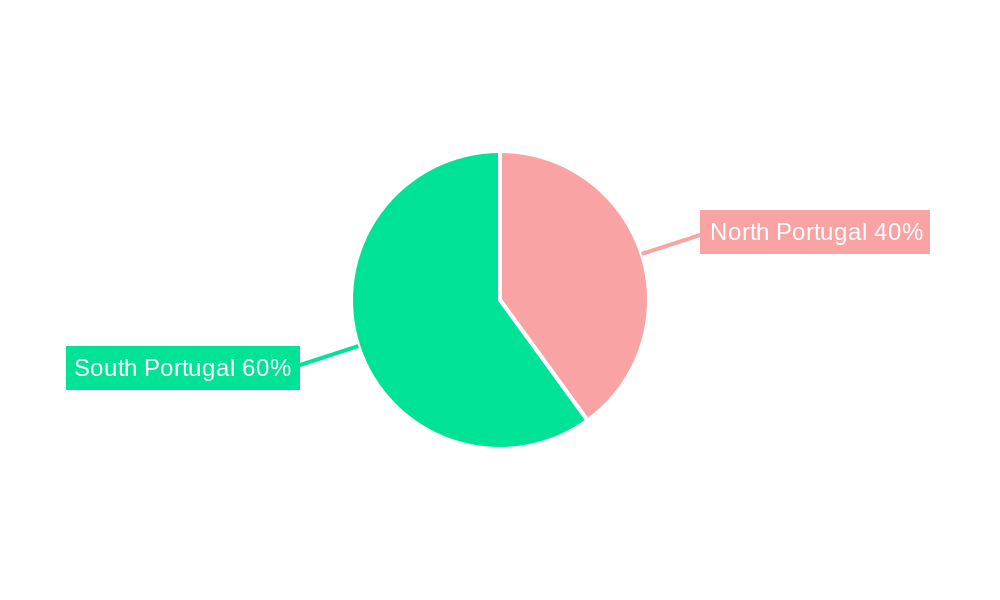

However, the market faces certain restraints. Fluctuations in raw material prices, particularly silica sand and energy costs, pose a challenge to profitability. Additionally, competition from alternative packaging materials like plastics and aluminum, albeit moderated by growing environmental concerns, remains a factor influencing market dynamics. Segment-wise, the beverage industry currently holds the largest share, followed by the food sector. The forecast indicates continued dominance of these segments, driven by robust domestic consumption and potential export opportunities within the European Union. Regional variations within Portugal are likely to exist, reflecting differences in industrial concentration and consumer preferences, however, detailed regional data was not provided in the initial information.

Portugal Container Glass Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Portugal container glass market, offering a comprehensive overview of its current state, future trends, and key players. With a focus on market size, growth trajectories, and competitive dynamics, this study is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers invaluable data and insights for strategic decision-making. The market size is estimated at XX Million in 2025, poised for significant growth throughout the forecast period.

Portugal Container Glass Market Composition & Trends

The Portugal container glass market is characterized by a moderately concentrated landscape, with key players like Verallia, BA GLASS, and Vidrala holding significant market share. However, smaller players such as berlinpackaging, Mercado do Vidro, and Depósito da Marinha Grande also contribute to the overall market dynamism. Innovation in this sector is driven by the need for lighter, more sustainable packaging solutions, responding to growing environmental concerns and consumer demand for eco-friendly products. Regulatory landscapes, particularly concerning recycling and waste management, significantly influence market practices. Substitute products, such as plastic and aluminum containers, pose a competitive challenge, impacting market growth. The end-user profile is diverse, encompassing the beverage (including alcoholic and non-alcoholic), food, cosmetics, pharmaceutical, and other end-user verticals. M&A activities within the sector have been relatively limited in recent years, with deal values estimated at approximately XX Million in the past five years.

- Market Share Distribution: Verallia holds approximately XX%, BA GLASS holds approximately XX%, and Vidrala holds approximately XX%. Remaining share is distributed amongst smaller players.

- M&A Activity: Recent M&A activity has primarily focused on strategic partnerships and capacity expansions rather than large-scale acquisitions.

- Regulatory Landscape: EU regulations on packaging waste and recycling are key drivers for innovation and sustainability initiatives.

- Substitute Products: The threat of substitution from alternative packaging materials remains a considerable factor.

Portugal Container Glass Market Industry Evolution

The Portugal container glass market has witnessed steady growth throughout the historical period (2019-2024). This growth is primarily attributable to increasing demand from the beverage sector, particularly for beer and wine. Technological advancements, including the adoption of lighter weight glass and improved manufacturing processes, have enhanced efficiency and reduced costs. Shifting consumer preferences towards premium and sustainable packaging have further fueled market expansion. Growth rates have averaged approximately XX% annually during the historical period, with projections for continued growth, albeit at a slightly moderated pace, throughout the forecast period. The adoption of advanced technologies such as automated production lines and improved quality control measures has contributed to efficiency gains and enhanced product quality.

Leading Regions, Countries, or Segments in Portugal Container Glass Market

The beverage sector, specifically alcoholic beverages like wine and beer, dominates the Portugal container glass market. This dominance stems from several key factors:

- High Consumption of Alcoholic Beverages: Portugal boasts a robust wine and beer culture, driving substantial demand for glass bottles.

- Premiumization Trend: Consumers increasingly favor premium brands, many of which rely on glass packaging for their perceived quality and aesthetics.

- Strong Tourism Sector: Tourism further bolsters demand, with many tourists purchasing alcoholic beverages as souvenirs.

The food sector also represents a substantial market segment, with growing demand for glass jars and containers for preserved foods and gourmet products. The cosmetics and pharmaceuticals sectors exhibit moderate growth, driven by the perception of glass as a hygienic and premium material.

Portugal Container Glass Market Product Innovations

Recent innovations in the Portuguese container glass market focus on lighter weight glass formulations to reduce transportation costs and environmental impact. New designs offer enhanced aesthetics and functionality, such as improved closure systems and enhanced branding opportunities. Performance metrics are improving through the adoption of high-speed production lines and advanced quality control technologies. The use of recycled glass content is also on the rise, meeting growing environmental standards and consumer demand for sustainable packaging.

Propelling Factors for Portugal Container Glass Market Growth

Several factors propel the growth of the Portugal container glass market:

- Strong Domestic Demand: The thriving beverage and food sectors provide strong domestic demand.

- Tourism Influence: Tourism significantly contributes to demand, particularly for alcoholic beverages.

- Sustainable Packaging Trends: Growing consumer awareness of environmental issues fuels demand for sustainable glass packaging.

Obstacles in the Portugal Container Glass Market

The Portugal container glass market faces certain challenges:

- Competition from Alternative Packaging: Plastic and aluminum containers pose a significant competitive threat.

- Energy Costs: High energy costs associated with glass manufacturing impact profitability.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of raw materials and affect production.

Future Opportunities in Portugal Container Glass Market

Future opportunities lie in:

- Lightweight Glass Solutions: Continuing innovation in lightweight glass reduces environmental impact and costs.

- Recycled Glass Usage: Increasing the proportion of recycled glass content addresses sustainability concerns.

- Premiumization and Brand Differentiation: Glass packaging is frequently associated with premiumization and can facilitate brand differentiation.

Major Players in the Portugal Container Glass Market Ecosystem

- berlinpackaging

- Mercado do Vidro

- Depósito da Marinha Grande

- Verallia

- BA GLASS

- Vidrala

Key Developments in Portugal Container Glass Market Industry

- July 2022: Super Bock's shift to brown glass bottles for cider highlights the impact of glass shortages on market dynamics and packaging choices.

Strategic Portugal Container Glass Market Forecast

The Portugal container glass market is poised for continued growth, driven by strong domestic demand, the increasing preference for sustainable packaging, and ongoing innovations in glass manufacturing. Future opportunities lie in expanding into new segments, such as the cosmetics and pharmaceuticals sectors, and capitalizing on trends toward lighter weight, recycled glass containers. The market is projected to reach XX Million by 2033.

Portugal Container Glass Market Segmentation

-

1. End-User Industry

-

1.1. Beverage

-

1.1.1. Alcoholic Beverages

- 1.1.1.1. Beer and Cider

- 1.1.1.2. Wine and Spirits

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alcoholic Beverages

- 1.1.2.1. Carbonated Soft Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water and Other Non-Alcoholic Beverages

-

1.1.1. Alcoholic Beverages

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceutical (Excluding Vials and Ampoules)

- 1.5. Other End-User Industries

-

1.1. Beverage

Portugal Container Glass Market Segmentation By Geography

- 1. Portugal

Portugal Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Demand for Sustainable Products; Food and Beverage Sector to Propel Growth

- 3.3. Market Restrains

- 3.3.1. Operational and Return On Investment Concerns

- 3.4. Market Trends

- 3.4.1. Beverage End User Segment are Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Portugal Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic Beverages

- 5.1.1.1.1. Beer and Cider

- 5.1.1.1.2. Wine and Spirits

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alcoholic Beverages

- 5.1.1.2.1. Carbonated Soft Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water and Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholic Beverages

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceutical (Excluding Vials and Ampoules)

- 5.1.5. Other End-User Industries

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Portugal

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 berlinpackaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mercado do Vidro

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Depósito da Marinha Grande *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Verallia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BA GLASS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vidrala

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 berlinpackaging

List of Figures

- Figure 1: Portugal Container Glass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Portugal Container Glass Market Share (%) by Company 2024

List of Tables

- Table 1: Portugal Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Portugal Container Glass Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 3: Portugal Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Portugal Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Portugal Container Glass Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Portugal Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portugal Container Glass Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Portugal Container Glass Market?

Key companies in the market include berlinpackaging, Mercado do Vidro, Depósito da Marinha Grande *List Not Exhaustive, Verallia, BA GLASS, Vidrala.

3. What are the main segments of the Portugal Container Glass Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Demand for Sustainable Products; Food and Beverage Sector to Propel Growth.

6. What are the notable trends driving market growth?

Beverage End User Segment are Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Operational and Return On Investment Concerns.

8. Can you provide examples of recent developments in the market?

July 2022 - Super Bock, a Portuguese beer and cider company that produces a range of beers under the same name, has announced that it has started bottling its cider in brown bottles - usually only reserved for beer owing to the shortage of clear glass.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portugal Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portugal Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portugal Container Glass Market?

To stay informed about further developments, trends, and reports in the Portugal Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence