Key Insights

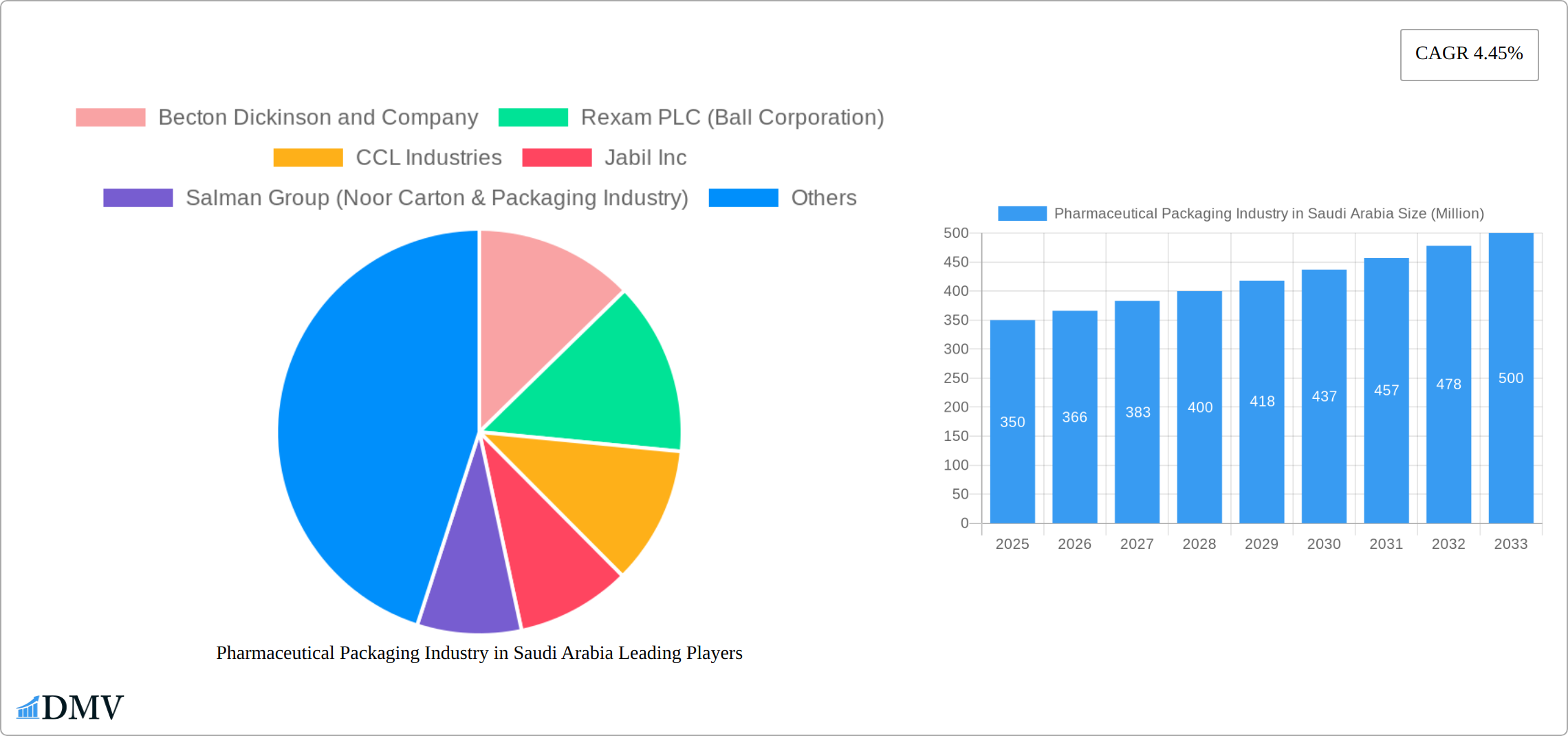

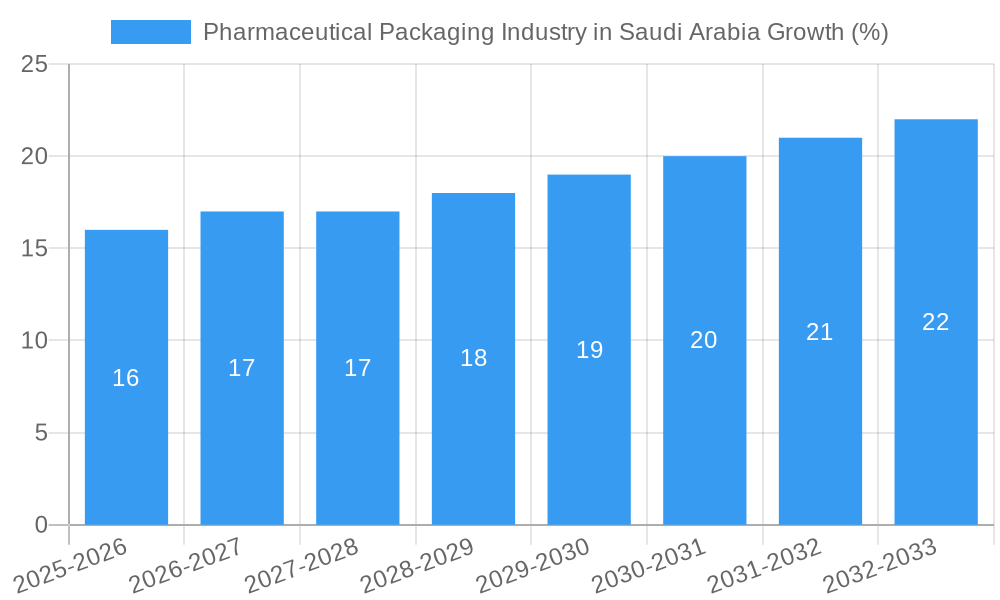

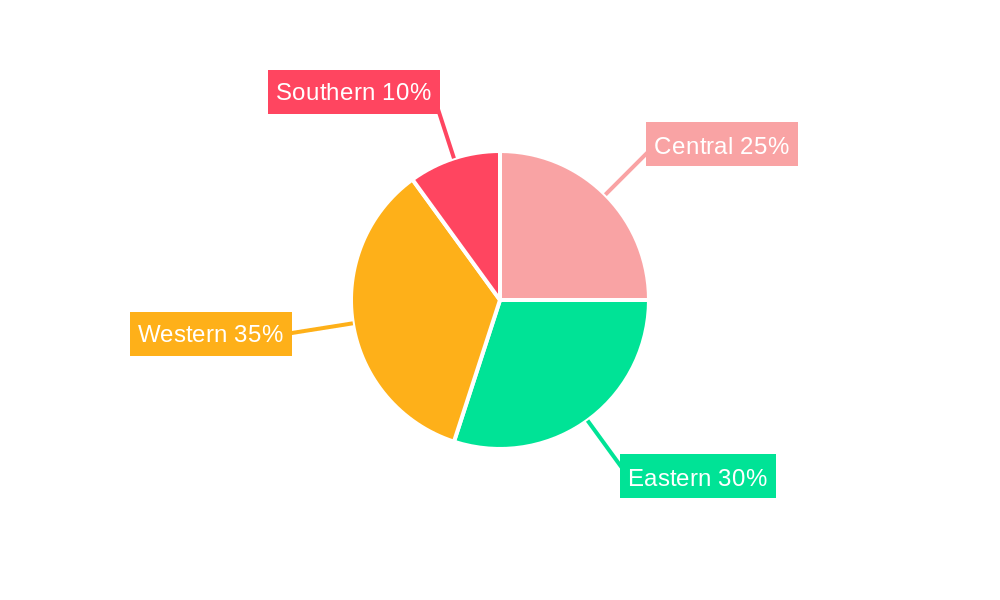

The pharmaceutical packaging market in Saudi Arabia is experiencing robust growth, driven by factors such as a rising geriatric population, increasing prevalence of chronic diseases, and a growing focus on improving healthcare infrastructure. The market's Compound Annual Growth Rate (CAGR) of 4.45% from 2019-2024 suggests a steady expansion, projected to continue over the forecast period (2025-2033). This growth is fueled by increasing demand for advanced packaging solutions that enhance drug efficacy, stability, and patient safety. The market is segmented by material (plastic, paperboard, glass, aluminum foil, others) and packaging type (bottles, ampoules, closures, cartridges, IV bags, etc.), with plastic and glass currently dominating due to their compatibility with various pharmaceutical products. However, there is increasing adoption of innovative packaging materials like modified-atmosphere packaging and blister packs to extend shelf life and enhance patient convenience. Major players like Becton Dickinson, Rexam PLC (Ball Corporation), and CCL Industries are actively shaping the market, introducing new technologies and expanding their product portfolios to cater to evolving industry needs. Regional variations exist, with potentially higher growth in regions like the Western and Eastern provinces due to higher population density and healthcare infrastructure development. While regulatory compliance and pricing pressures pose challenges, the overall outlook for the pharmaceutical packaging market in Saudi Arabia remains highly promising.

The sustained growth is expected to be driven by government initiatives to modernize the healthcare sector, coupled with increasing investments in pharmaceutical manufacturing and distribution within the country. The significant growth in the regional pharmaceutical industry directly impacts packaging demand, stimulating the need for sophisticated solutions such as tamper-evident seals, child-resistant packaging, and serialization technologies. Though precise market size figures are not provided, considering the 4.45% CAGR and the presence of numerous significant players, a conservative estimate of the market's value in 2025 would be in the hundreds of millions of Saudi Riyals, based on industry trends and known growth rates in neighboring markets with similar developmental stages. The market is likely to witness further consolidation as larger players acquire smaller companies to enhance their market share and expand their reach.

Pharmaceutical Packaging Industry in Saudi Arabia: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabian pharmaceutical packaging market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report meticulously examines market size, growth trajectories, key players, and future opportunities, presenting a comprehensive overview of this multi-Million SAR industry.

Pharmaceutical Packaging Industry in Saudi Arabia Market Composition & Trends

The Saudi Arabian pharmaceutical packaging market exhibits a moderately concentrated landscape, with several multinational corporations and local players vying for market share. The estimated market value in 2025 is xx Million SAR. Innovation is driven by stringent regulatory requirements, the need for enhanced drug stability, and growing demand for convenient and tamper-evident packaging. The regulatory landscape is evolving, with a focus on ensuring product safety and quality, influencing packaging material selection and manufacturing processes. Substitute products, such as biodegradable packaging, are gaining traction, driven by environmental concerns. End-users predominantly include pharmaceutical companies, hospitals, and pharmacies. M&A activity has been moderate, with deal values estimated to reach xx Million SAR annually in the forecast period. Key players are strategically investing to expand their regional footprint.

- Market Share Distribution (2025): Plastic packaging holds the largest share, estimated at xx%, followed by Paper and Paperboard at xx%.

- M&A Deal Values (2025-2033): Projected at xx Million SAR annually, primarily driven by strategic acquisitions to expand product portfolios and market reach.

Pharmaceutical Packaging Industry in Saudi Arabia Industry Evolution

The Saudi Arabian pharmaceutical packaging market has witnessed robust growth over the past few years, fueled by rising healthcare expenditure and an increasing prevalence of chronic diseases. The market is expected to maintain a Compound Annual Growth Rate (CAGR) of xx% during 2025-2033. Technological advancements, such as the adoption of smart packaging incorporating RFID and barcodes, are revolutionizing supply chain management and enhancing product traceability. Consumer demand for sustainable packaging is increasing, leading to the growing adoption of eco-friendly materials and processes. The government's initiatives to promote local manufacturing and attract foreign investment are further accelerating industry growth. Technological advancements, especially in materials science and automation, are driving increased efficiency and reducing costs. The introduction of innovative packaging formats tailored for specific drug types is enhancing patient convenience and adherence to medication regimens.

Leading Regions, Countries, or Segments in Pharmaceutical Packaging Industry in Saudi Arabia

The Riyadh region commands the largest share of the pharmaceutical packaging market due to high concentration of pharmaceutical companies and distribution channels. The plastic packaging segment enjoys the leading position owing to its versatility, cost-effectiveness, and suitability for diverse drug forms.

- Key Drivers for Plastic Packaging Dominance:

- Extensive product portfolio catering to varied pharmaceutical needs.

- Cost-effectiveness compared to other materials.

- Ease of manufacturing and customization.

- Extensive government support for plastic manufacturing industry.

- Key Drivers for Riyadh Region's Dominance:

- High concentration of pharmaceutical manufacturing facilities.

- Robust distribution infrastructure for effective packaging supply.

- Strong government investments in the region's healthcare sector.

Pharmaceutical Packaging Industry in Saudi Arabia Product Innovations

Recent innovations encompass the development of tamper-evident closures, child-resistant packaging, and sustainable materials such as biodegradable plastics and recycled paperboard. These advancements are aimed at enhancing product security, safety, and environmental sustainability, aligning with global trends in pharmaceutical packaging. The introduction of innovative designs, such as unit-dose packaging and blister packs, promotes patient compliance and reduces medication errors. Improved barrier properties in packaging are maintaining product quality and extending shelf life.

Propelling Factors for Pharmaceutical Packaging Industry in Saudi Arabia Growth

Several factors are propelling the growth of the Saudi Arabian pharmaceutical packaging industry. Government initiatives to boost local manufacturing, coupled with increasing healthcare spending, are significant contributors. Technological advancements, like the adoption of automation and smart packaging, are also boosting efficiency and market expansion. Moreover, the rising prevalence of chronic diseases fuels demand for effective and safe drug packaging solutions. The increasing awareness about sustainable practices is driving demand for eco-friendly packaging materials.

Obstacles in the Pharmaceutical Packaging Industry in Saudi Arabia Market

The industry faces challenges like stringent regulatory approvals, which can delay product launches and increase costs. Supply chain disruptions, particularly concerning raw materials, can impact production timelines and pricing. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization strategies. Fluctuations in oil prices can significantly impact production costs, particularly for plastic-based packaging.

Future Opportunities in Pharmaceutical Packaging Industry in Saudi Arabia

The market presents significant growth opportunities in the adoption of smart packaging technologies, including RFID and digital printing, for improved traceability and anti-counterfeiting measures. Increased demand for sustainable packaging solutions creates opportunities for manufacturers of eco-friendly materials and packaging formats. Expansion into niche areas such as personalized medicine and specialized drug delivery systems will drive further growth.

Major Players in the Pharmaceutical Packaging Industry in Saudi Arabia Ecosystem

- Becton Dickinson and Company

- Rexam PLC (Ball Corporation)

- CCL Industries

- Jabil Inc

- Salman Group (Noor Carton & Packaging Industry)

- Napco Group

- Aptar Group

- Amber Packaging Industries LL

- Sealed Air Saudi Arabia

Key Developments in Pharmaceutical Packaging Industry in Saudi Arabia Industry

- Jan 2022: The Saudi Deputy Minister of Industry and Mineral Resources announced a SAR 35 billion investment in the plastic industry, creating over 1,300 factories and boosting the overall packaging sector.

- Mar 2022: SABIC's partnership with Polivouga for the TRUCIRCLE project signifies a commitment to sustainable practices within the industry and opens new avenues for recycling and waste management.

Strategic Pharmaceutical Packaging Industry in Saudi Arabia Market Forecast

The Saudi Arabian pharmaceutical packaging market is poised for sustained growth, driven by technological advancements, government initiatives, and a rising demand for sophisticated and sustainable packaging solutions. The market's potential is substantial, with continued expansion anticipated throughout the forecast period. The focus on innovation and sustainability will shape the industry's trajectory, attracting further investments and fostering technological breakthroughs. The increasing adoption of smart packaging, coupled with the growing need for eco-friendly materials, presents lucrative opportunities for market players.

Pharmaceutical Packaging Industry in Saudi Arabia Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper and Paperboard

- 1.3. Glass

- 1.4. Aluminum Foil

- 1.5. Other Materials

-

2. Type

- 2.1. Bottles

- 2.2. Ampoules

- 2.3. Caps and Closures

- 2.4. Cartridges

- 2.5. IV (Intravenous) Bags

- 2.6. Canisters

- 2.7. Medication Tubes

- 2.8. Vials

- 2.9. Syringes

- 2.10. Strip and Blister Packs

- 2.11. Pouches

- 2.12. Sachets

Pharmaceutical Packaging Industry in Saudi Arabia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical Packaging Industry in Saudi Arabia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Health Concerns in the Country; Technological Advancements to Contribute to the Growth of Pharmaceutical Packaging

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Related to Pharmaceutical Packaging of Raw Materials

- 3.4. Market Trends

- 3.4.1. Growing Health Concerns in the Country Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper and Paperboard

- 5.1.3. Glass

- 5.1.4. Aluminum Foil

- 5.1.5. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Bottles

- 5.2.2. Ampoules

- 5.2.3. Caps and Closures

- 5.2.4. Cartridges

- 5.2.5. IV (Intravenous) Bags

- 5.2.6. Canisters

- 5.2.7. Medication Tubes

- 5.2.8. Vials

- 5.2.9. Syringes

- 5.2.10. Strip and Blister Packs

- 5.2.11. Pouches

- 5.2.12. Sachets

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Paper and Paperboard

- 6.1.3. Glass

- 6.1.4. Aluminum Foil

- 6.1.5. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Bottles

- 6.2.2. Ampoules

- 6.2.3. Caps and Closures

- 6.2.4. Cartridges

- 6.2.5. IV (Intravenous) Bags

- 6.2.6. Canisters

- 6.2.7. Medication Tubes

- 6.2.8. Vials

- 6.2.9. Syringes

- 6.2.10. Strip and Blister Packs

- 6.2.11. Pouches

- 6.2.12. Sachets

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Paper and Paperboard

- 7.1.3. Glass

- 7.1.4. Aluminum Foil

- 7.1.5. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Bottles

- 7.2.2. Ampoules

- 7.2.3. Caps and Closures

- 7.2.4. Cartridges

- 7.2.5. IV (Intravenous) Bags

- 7.2.6. Canisters

- 7.2.7. Medication Tubes

- 7.2.8. Vials

- 7.2.9. Syringes

- 7.2.10. Strip and Blister Packs

- 7.2.11. Pouches

- 7.2.12. Sachets

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Paper and Paperboard

- 8.1.3. Glass

- 8.1.4. Aluminum Foil

- 8.1.5. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Bottles

- 8.2.2. Ampoules

- 8.2.3. Caps and Closures

- 8.2.4. Cartridges

- 8.2.5. IV (Intravenous) Bags

- 8.2.6. Canisters

- 8.2.7. Medication Tubes

- 8.2.8. Vials

- 8.2.9. Syringes

- 8.2.10. Strip and Blister Packs

- 8.2.11. Pouches

- 8.2.12. Sachets

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Paper and Paperboard

- 9.1.3. Glass

- 9.1.4. Aluminum Foil

- 9.1.5. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Bottles

- 9.2.2. Ampoules

- 9.2.3. Caps and Closures

- 9.2.4. Cartridges

- 9.2.5. IV (Intravenous) Bags

- 9.2.6. Canisters

- 9.2.7. Medication Tubes

- 9.2.8. Vials

- 9.2.9. Syringes

- 9.2.10. Strip and Blister Packs

- 9.2.11. Pouches

- 9.2.12. Sachets

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Paper and Paperboard

- 10.1.3. Glass

- 10.1.4. Aluminum Foil

- 10.1.5. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Bottles

- 10.2.2. Ampoules

- 10.2.3. Caps and Closures

- 10.2.4. Cartridges

- 10.2.5. IV (Intravenous) Bags

- 10.2.6. Canisters

- 10.2.7. Medication Tubes

- 10.2.8. Vials

- 10.2.9. Syringes

- 10.2.10. Strip and Blister Packs

- 10.2.11. Pouches

- 10.2.12. Sachets

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Central Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 12. Eastern Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 13. Western Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 14. Southern Pharmaceutical Packaging Industry in Saudi Arabia Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Becton Dickinson and Company

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Rexam PLC (Ball Corporation)

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 CCL Industries

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Jabil Inc

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Salman Group (Noor Carton & Packaging Industry)

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Napco Group

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Aptar Group

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Amber Packaging Industries LL

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Sealed Air Saudi Arabia

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Saudi Arabia Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 3: Saudi Arabia Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Material 2024 & 2032

- Figure 5: North America Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Material 2024 & 2032

- Figure 6: North America Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Type 2024 & 2032

- Figure 7: North America Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Type 2024 & 2032

- Figure 8: North America Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Material 2024 & 2032

- Figure 11: South America Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Material 2024 & 2032

- Figure 12: South America Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Type 2024 & 2032

- Figure 13: South America Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Material 2024 & 2032

- Figure 17: Europe Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Material 2024 & 2032

- Figure 18: Europe Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Material 2024 & 2032

- Figure 23: Middle East & Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Material 2024 & 2032

- Figure 24: Middle East & Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Type 2024 & 2032

- Figure 25: Middle East & Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Type 2024 & 2032

- Figure 26: Middle East & Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Material 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Material 2024 & 2032

- Figure 30: Asia Pacific Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Pharmaceutical Packaging Industry in Saudi Arabia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Material 2019 & 2032

- Table 11: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Material 2019 & 2032

- Table 17: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Material 2019 & 2032

- Table 23: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Material 2019 & 2032

- Table 35: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Material 2019 & 2032

- Table 44: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global Pharmaceutical Packaging Industry in Saudi Arabia Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific Pharmaceutical Packaging Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Packaging Industry in Saudi Arabia?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Pharmaceutical Packaging Industry in Saudi Arabia?

Key companies in the market include Becton Dickinson and Company, Rexam PLC (Ball Corporation), CCL Industries, Jabil Inc, Salman Group (Noor Carton & Packaging Industry), Napco Group, Aptar Group, Amber Packaging Industries LL, Sealed Air Saudi Arabia.

3. What are the main segments of the Pharmaceutical Packaging Industry in Saudi Arabia?

The market segments include Material, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Health Concerns in the Country; Technological Advancements to Contribute to the Growth of Pharmaceutical Packaging.

6. What are the notable trends driving market growth?

Growing Health Concerns in the Country Drives the Market Growth.

7. Are there any restraints impacting market growth?

Environmental Concerns Related to Pharmaceutical Packaging of Raw Materials.

8. Can you provide examples of recent developments in the market?

Mar 2022: SABIC entered a partnership with Polivouga to launch the new TRUCIRCLE project that was designed to reuse plastic waste recovered from areas up to 50 km inland from the waterways.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Packaging Industry in Saudi Arabia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Packaging Industry in Saudi Arabia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Packaging Industry in Saudi Arabia?

To stay informed about further developments, trends, and reports in the Pharmaceutical Packaging Industry in Saudi Arabia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence