Key Insights

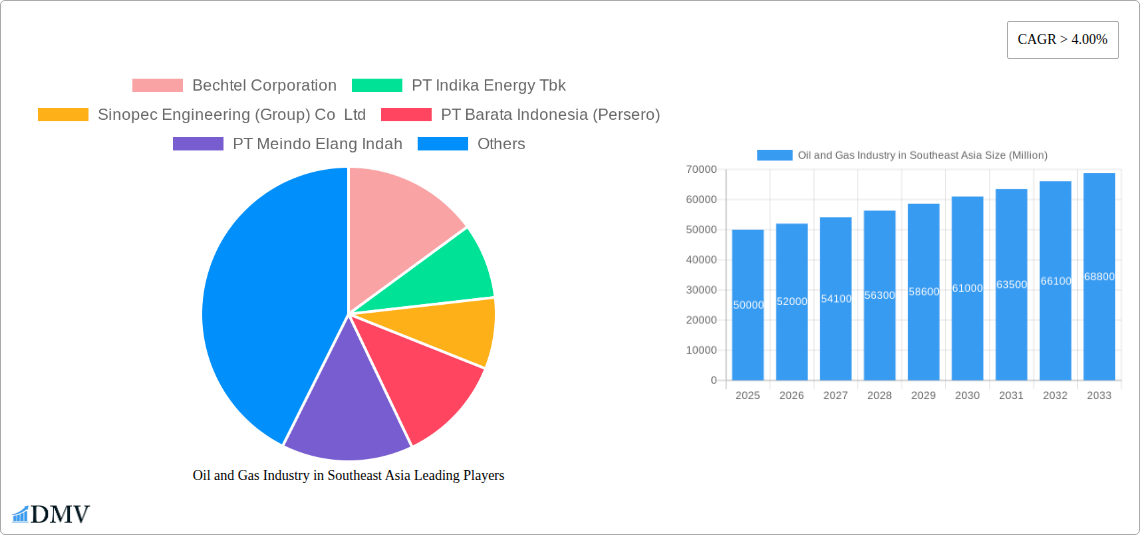

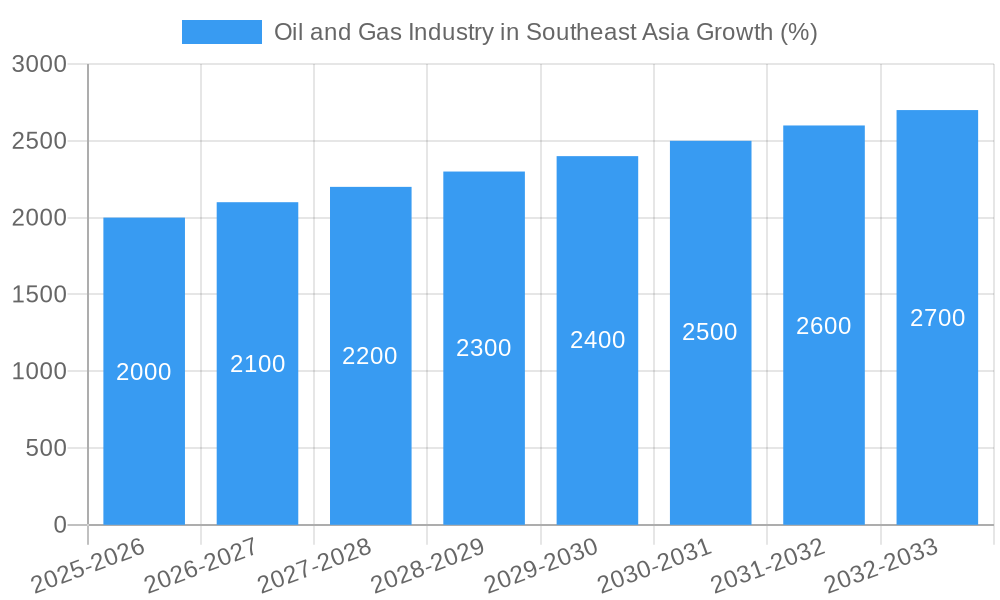

The Southeast Asian oil and gas market, encompassing upstream, midstream, and downstream sectors, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is fueled by rising energy demand driven by rapid industrialization and population growth across the region, particularly in countries like Indonesia, Vietnam, and the Philippines. Increased investments in infrastructure development, including pipelines and refineries, are further bolstering market expansion. The market is segmented by product type, with crude oil, natural gas, and refined products representing significant revenue streams. Major players like Sinopec Engineering, Bechtel Corporation, and PT Indika Energy Tbk are strategically positioned to capitalize on these opportunities, though competitive pressures from both established international firms and emerging regional players remain significant. Challenges include geopolitical instability, fluctuating global oil prices, and the growing emphasis on renewable energy sources, which could potentially moderate long-term growth. However, the region's substantial reserves and continued investment in exploration and production activities suggest a promising outlook for the foreseeable future. Focus on efficient exploration and production techniques, along with strategic partnerships to navigate regulatory complexities, will be crucial for sustained success within this dynamic market.

The Asia-Pacific region, specifically Southeast Asia, shows substantial promise, exhibiting a significant market share of the overall oil and gas industry. Within this sub-region, China, India, and Indonesia are key contributors, representing significant demand and investment. However, the market's trajectory is intricately linked to global energy prices and geopolitical factors. Navigating these variables through diversified investment strategies and technological advancements, such as enhanced oil recovery techniques and improved efficiency in refining processes, will be essential for sustained growth in the years to come. The shift towards cleaner energy sources necessitates adaptation and investment in associated infrastructure, presenting both challenges and new opportunities within the oil and gas sector.

Oil and Gas Industry in Southeast Asia: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Southeast Asian oil and gas industry, encompassing market trends, leading players, technological advancements, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for stakeholders seeking to understand the dynamic landscape of this vital sector and make informed strategic decisions. Total market value in 2025 is estimated at USD xx Million.

Oil and Gas Industry in Southeast Asia Market Composition & Trends

This section delves into the intricate composition of the Southeast Asian oil and gas market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The report meticulously examines market share distribution among key players and provides a comprehensive overview of M&A deal values exceeding USD 100 Million during the historical period (2019-2024).

- Market Concentration: The report assesses the level of market concentration, identifying dominant players and analyzing their market share. The xx% market share held by the top 5 players in 2024 indicates a moderately concentrated market.

- Innovation Catalysts: Detailed analysis of technological advancements, such as enhanced oil recovery techniques and the increasing adoption of digital technologies, driving innovation and efficiency gains.

- Regulatory Landscape: Examination of the diverse regulatory environments across Southeast Asian nations, highlighting their impact on investment decisions and operational strategies.

- Substitute Products: Assessment of the impact of renewable energy sources and alternative fuels on the demand for oil and gas products, including projected market penetration rates by 2033.

- End-User Profiles: Profiling of key end-users across different sectors, such as power generation, transportation, and industrial applications, with analysis of their respective consumption patterns.

- M&A Activities: Analysis of significant M&A activities, including deal values and strategic rationales, along with projections of future consolidation trends. For instance, total M&A deal value for 2024 is estimated at USD xx Million.

Oil and Gas Industry in Southeast Asia Industry Evolution

This section provides a comprehensive overview of the evolution of the Southeast Asian oil and gas industry from 2019 to 2033. It analyzes market growth trajectories, technological advancements (e.g., digitalization, automation), and shifting consumer demands, including a detailed examination of the transition towards cleaner energy sources. The report offers specific data points such as compound annual growth rates (CAGRs) for different segments and adoption metrics for new technologies. For example, the adoption rate of digital oilfield technologies is projected to increase by xx% from 2025 to 2033.

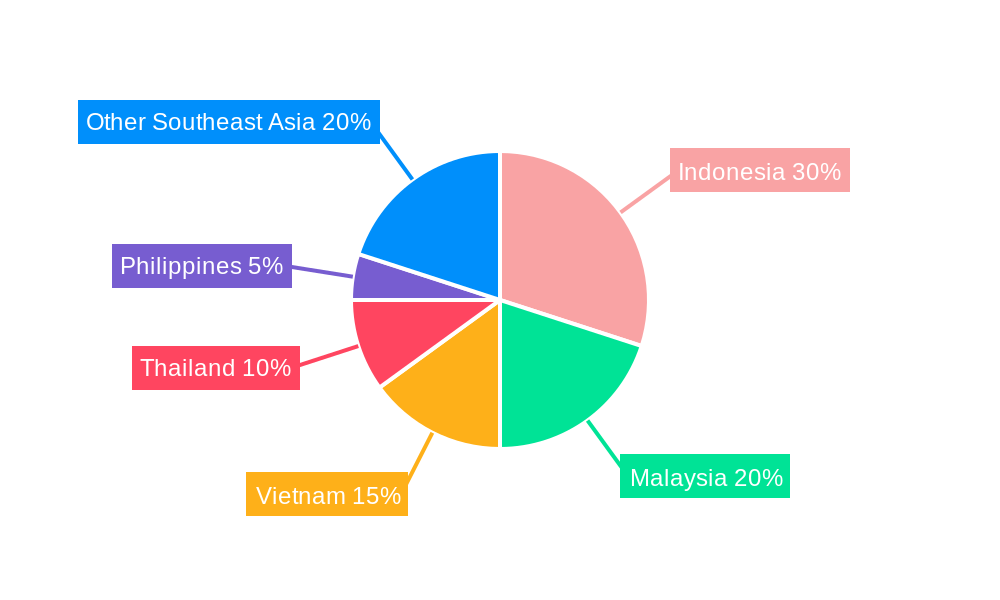

Leading Regions, Countries, or Segments in Oil and Gas Industry in Southeast Asia

This section identifies the dominant regions, countries, and segments within the Southeast Asian oil and gas industry. It assesses the upstream, midstream, and downstream sectors, examining the production of crude oil and natural gas, refining activities, and the distribution of refined products.

- Key Drivers: The report uses bullet points to highlight key drivers, including investment trends, regulatory support, and infrastructure development, providing a granular understanding of dominance factors.

- Dominance Factors: Detailed paragraphs will analyze the factors contributing to the dominance of specific regions, countries, or segments, providing insights into their competitive advantages and future potential. For example, the growth of Indonesia's upstream sector is primarily driven by substantial investment in offshore exploration and production.

Oil and Gas Industry in Southeast Asia Product Innovations

This section details the latest product innovations, including advanced drilling techniques and refined fuel formulations, highlighting their applications and performance metrics. The report emphasizes the unique selling propositions and technological advancements driving the adoption of these innovations. Examples will be used to illustrate the improved efficiency and reduced environmental impact of these new products.

Propelling Factors for Oil and Gas Industry in Southeast Asia Growth

This section identifies and analyzes the key drivers for growth in the Southeast Asian oil and gas industry. The report examines technological advancements, economic factors, and regulatory influences with specific examples. Factors like growing energy demand, supportive government policies, and ongoing investments in infrastructure development will be discussed.

Obstacles in the Oil and Gas Industry in Southeast Asia Market

This section analyzes the barriers and restraints impacting the growth of the Southeast Asian oil and gas industry. It covers regulatory challenges, supply chain disruptions, and competitive pressures, quantifying their impact on market growth. Examples of regulatory hurdles and their associated costs will be provided.

Future Opportunities in Oil and Gas Industry in Southeast Asia

This section explores emerging opportunities within the Southeast Asian oil and gas industry, focusing on new markets, technologies, and consumer trends. The report highlights the potential for growth in areas like LNG imports and the expansion of petrochemical production.

Major Players in the Oil and Gas Industry in Southeast Asia Ecosystem

- Bechtel Corporation (Bechtel Corporation)

- PT Indika Energy Tbk

- Sinopec Engineering (Group) Co Ltd (Sinopec Engineering (Group) Co Ltd)

- PT Barata Indonesia (Persero)

- PT Meindo Elang Indah

- Petrofac Limited (Petrofac Limited)

- PT Rekayasa Industri

- Saipem SpA (Saipem SpA)

- Fluor Corporation (Fluor Corporation)

- John Wood Group PLC (John Wood Group PLC)

- Samsung Engineering Co Ltd (Samsung Engineering Co Ltd)

- TechnipFMC PLC (TechnipFMC PLC)

Key Developments in Oil and Gas Industry in Southeast Asia Industry

- March 2023: Thai Oil's USD 1 Billion investment to expand its refinery capacity and transition to higher-value fuel products. This signals a significant shift towards cleaner fuels and increased refining capacity in the region.

- January 2023: Approval of a USD 67 Million LNG import terminal project in the Philippines, marking a step towards diversifying the country's energy mix and boosting the LNG sector.

- December 2022: Petronas's discovery of oil and gas at the Nahara-1 well in Malaysia. This discovery adds to the region's hydrocarbon reserves and potential for future production.

Strategic Oil and Gas Industry in Southeast Asia Market Forecast

This section provides a concise summary of growth catalysts and market potential in the Southeast Asian oil and gas industry, focusing on opportunities within specific segments and the impact of global energy trends on the region. The forecast highlights the projected growth of the LNG market, driven by increasing demand from power generation and industrial applications. The report also considers the long-term implications of the energy transition and the potential for sustained investment in the sector, focusing on the role of cleaner energy solutions in shaping the future.

Oil and Gas Industry in Southeast Asia Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Oil and Gas Industry in Southeast Asia Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Vietnam

- 4. Malaysia

- 5. Rest of Southeast Asia

Oil and Gas Industry in Southeast Asia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. The Downstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.2.2. Thailand

- 5.2.3. Vietnam

- 5.2.4. Malaysia

- 5.2.5. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Indonesia Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Thailand Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Vietnam Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Malaysia Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Rest of Southeast Asia Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Upstream

- 10.1.2. Midstream

- 10.1.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. China Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 12. Japan Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 13. India Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 16. Australia Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Bechtel Corporation

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 PT Indika Energy Tbk

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Sinopec Engineering (Group) Co Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 PT Barata Indonesia (Persero)

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 PT Meindo Elang Indah

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Petrofac Limited

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 PT Rekayasa Industri

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Saipem SpA

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Fluor Corporation

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 John Wood Group PLC

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Samsung Engineering Co Ltd *List Not Exhaustive

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 TechnipFMC PLC

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 Bechtel Corporation

List of Figures

- Figure 1: Oil and Gas Industry in Southeast Asia Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oil and Gas Industry in Southeast Asia Share (%) by Company 2024

List of Tables

- Table 1: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 15: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 21: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Southeast Asia?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Oil and Gas Industry in Southeast Asia?

Key companies in the market include Bechtel Corporation, PT Indika Energy Tbk, Sinopec Engineering (Group) Co Ltd, PT Barata Indonesia (Persero), PT Meindo Elang Indah, Petrofac Limited, PT Rekayasa Industri, Saipem SpA, Fluor Corporation, John Wood Group PLC, Samsung Engineering Co Ltd *List Not Exhaustive, TechnipFMC PLC.

3. What are the main segments of the Oil and Gas Industry in Southeast Asia?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

The Downstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

March 2023: Thai Oil announced plans to invest USD 1 billion in the capital between 2023 and 2025 to grow its business, including USD 500 million to expand its refinery capacity and transition to higher added-value fuel products as part of its Clean Fuel Project (CFP) strategy. The business intends to expand its oil refinery capacity in Sriracha (Thailand) to 400 kb/d, up from 280 kb/d, and upgrade fuel oil to higher-value products such as diesel and jet fuel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Southeast Asia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Southeast Asia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Southeast Asia?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Southeast Asia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence