Key Insights

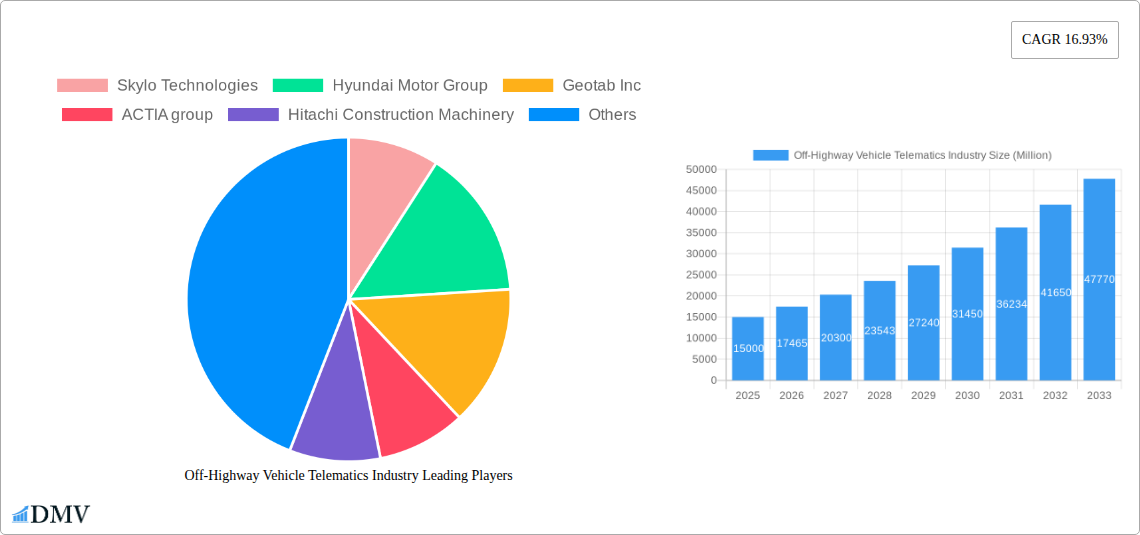

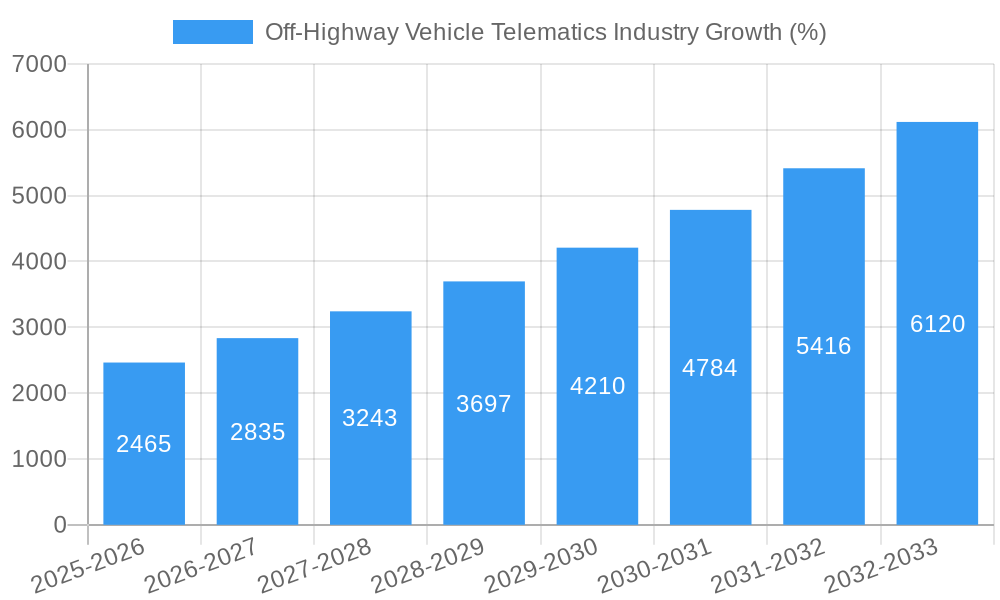

The off-highway vehicle telematics market is experiencing robust growth, driven by increasing demand for improved operational efficiency, enhanced safety measures, and better asset management across various sectors. The market's Compound Annual Growth Rate (CAGR) of 16.93% from 2019 to 2024 indicates significant expansion, projected to continue into the forecast period (2025-2033). Key drivers include stringent regulatory compliance requirements emphasizing safety and emission control, leading to wider adoption of telematics systems. Furthermore, the increasing integration of advanced technologies like IoT (Internet of Things), AI (Artificial Intelligence), and big data analytics within these systems provides valuable insights into vehicle performance, operational costs, and driver behavior, enabling proactive maintenance and optimized resource allocation. The construction, agriculture, and mining sectors are major end-users, leveraging telematics for remote monitoring, predictive maintenance, and fuel efficiency optimization. Growth is also propelled by the rising adoption of connected vehicles and the increasing availability of affordable, reliable telematics solutions. Competition is intense, with a mix of established telematics providers and original equipment manufacturers (OEMs) vying for market share.

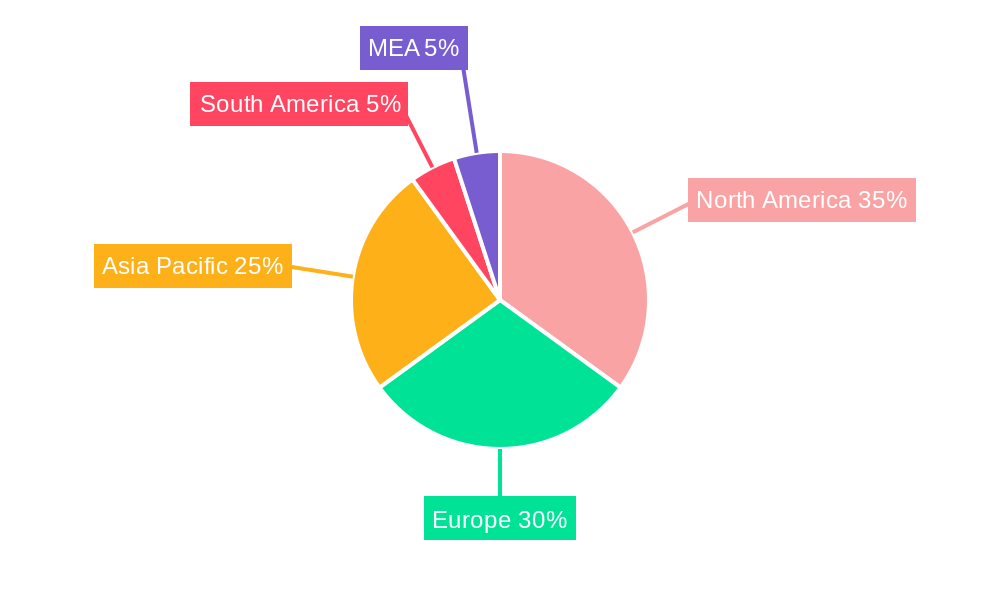

Despite the positive market outlook, certain factors may hinder growth. High initial investment costs associated with telematics system implementation could be a barrier for smaller companies. Furthermore, concerns regarding data security and privacy, especially given the sensitive nature of operational data, need to be addressed. However, technological advancements, coupled with the growing emphasis on reducing operational expenses and enhancing safety across industries, are expected to overcome these restraints, ultimately fueling continued market expansion. The market's regional distribution reflects established industrial hubs, with North America and Europe currently leading, although the Asia-Pacific region is projected to demonstrate significant growth in the coming years due to infrastructure development and industrial expansion. The ongoing development and integration of more sophisticated features, such as driver behavior monitoring and predictive maintenance capabilities, will solidify the long-term growth trajectory of the off-highway vehicle telematics market.

Off-Highway Vehicle Telematics Industry Market Composition & Trends

This comprehensive report delves into the dynamic Off-Highway Vehicle Telematics market, providing a detailed analysis of its composition and prevailing trends from 2019 to 2033. We examine market concentration, revealing a moderately consolidated landscape with key players like Deere & Company, Trimble Inc., and Caterpillar holding significant shares, but also highlighting opportunities for smaller, specialized firms. Innovation is a major driver, with advancements in GPS technology, sensor integration, and data analytics continuously reshaping the market. The regulatory environment, encompassing data privacy and safety regulations, plays a crucial role, influencing market growth and adoption. Substitute products, such as traditional methods of fleet management, pose some competitive pressure, but the increasing demand for real-time data and efficiency gains positions telematics favorably. The report analyzes end-user profiles across various segments (Construction, Agriculture, Mining, and Forestry), illustrating their specific needs and adoption rates. Finally, the report examines M&A activities, highlighting significant transactions and their implications for market consolidation and technological advancement. The total value of M&A deals in the Off-Highway Vehicle Telematics industry between 2019 and 2024 is estimated at $XX Billion.

- Market Share Distribution: Deere & Company (XX%), Trimble Inc. (XX%), Caterpillar (XX%), others (XX%).

- M&A Deal Values (2019-2024): Estimated at $XX Billion.

- Key Players: Deere & Company, Trimble Inc., Caterpillar, and other significant players.

- Regulatory Landscape: Focus on data privacy and safety regulations.

Off-Highway Vehicle Telematics Industry Industry Evolution

This section provides an in-depth analysis of the Off-Highway Vehicle Telematics industry’s evolution from 2019 to 2033. The market has experienced substantial growth, driven by the increasing adoption of telematics across various off-highway vehicle segments. Technological advancements, such as the integration of IoT sensors, AI-powered analytics, and cloud-based data platforms, have significantly improved the capabilities and applications of telematics systems. The demand for enhanced operational efficiency, reduced downtime, and improved asset utilization is fueling this growth. This report provides a detailed analysis of market growth trajectories, revealing a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). We explore shifting consumer demands, focusing on the increasing need for real-time data visibility, predictive maintenance capabilities, and improved integration with existing fleet management systems. Adoption metrics, such as the percentage of off-highway vehicles equipped with telematics, are analyzed to illustrate the market penetration and growth potential in various segments. The base year for this analysis is 2025, with historical data from 2019-2024 providing crucial context.

Leading Regions, Countries, or Segments in Off-Highway Vehicle Telematics Industry

This section identifies the leading regions, countries, and segments within the Off-Highway Vehicle Telematics industry, focusing on Construction, Agriculture, Mining, and Forestry. While precise market share data will vary based on geographic specifics, early analysis indicates the dominance of North America, Europe, and East Asia in terms of market value. Construction and Agriculture generally lead in adoption, reflecting the substantial value of efficient asset management and operational optimization in these sectors.

- Key Drivers for Dominance:

- North America: High adoption rate of advanced technologies, strong focus on fleet efficiency, and robust investment in infrastructure projects.

- Europe: Stringent environmental regulations, push for sustainable practices, and significant government support for innovation.

- East Asia: Rapid infrastructure development, rising demand for advanced machinery, and supportive government policies.

- Construction Segment: High vehicle density, significant potential for cost savings through improved maintenance and utilization.

- Agriculture Segment: Growing demand for precision farming technologies, need for real-time monitoring and remote diagnostics.

Detailed analysis of these dominance factors will be provided in the full report, which also considers factors such as economic activity, regulatory frameworks and infrastructural development.

Off-Highway Vehicle Telematics Industry Product Innovations

Recent product innovations in Off-Highway Vehicle Telematics have focused on enhancing data analytics capabilities, integrating advanced sensor technologies, and improving connectivity through cellular and satellite networks. New systems offer advanced predictive maintenance functionalities, enabling proactive identification of potential equipment failures, minimizing downtime, and reducing maintenance costs. These systems often leverage AI and machine learning algorithms to analyze vast amounts of operational data, providing valuable insights for optimizing fleet performance and enhancing safety. Unique selling propositions include improved fuel efficiency tracking, remote diagnostics and repair guidance, and real-time location and asset tracking.

Propelling Factors for Off-Highway Vehicle Telematics Industry Growth

Several factors are driving growth in the Off-Highway Vehicle Telematics market. Technological advancements in sensor technology, data analytics, and connectivity are key, allowing for more comprehensive data collection and insights. Economic pressures, particularly the increasing cost of fuel and labor, are driving the need for efficiency improvements. Furthermore, stringent government regulations focused on safety and environmental sustainability are promoting the adoption of telematics systems to monitor emissions and ensure compliance.

Obstacles in the Off-Highway Vehicle Telematics Industry Market

The Off-Highway Vehicle Telematics market faces several challenges. High initial investment costs for telematics systems can be a barrier to entry for smaller operators. Supply chain disruptions, particularly the global chip shortage, have impacted the availability of telematics hardware. Competitive pressures, both from established players and new entrants, contribute to pricing pressures. Regulatory hurdles and complexities in data privacy regulations also present significant challenges.

Future Opportunities in Off-Highway Vehicle Telematics Industry

Future opportunities lie in expanding into new markets, particularly developing economies with growing infrastructure needs and increasing adoption of advanced technologies. Integrating new technologies such as 5G and edge computing, creating more robust and responsive systems, offers significant potential. The growing emphasis on sustainability and data-driven decision-making will drive the demand for telematics systems with enhanced environmental monitoring capabilities.

Major Players in the Off-Highway Vehicle Telematics Industry Ecosystem

- Skylo Technologies

- Hyundai Motor Group

- Geotab Inc

- ACTIA group

- Hitachi Construction Machinery

- Liebherr

- Webfleet Solutions BV (Bridgestone Corp)

- Deere & Company

- Geoforce Inc

- Bridgestone Europe NV/SA (TomTom)

- UK Telematics

- Doosan Corporation

- AGCO

- CNH Industrial

- JCB

- Volvo Construction Equipment

- CLAAS Group

- Teletrac Navman

- Omnitracs LLC

- Komatsu

- KeepTruckin Inc

- MiXTelematics International

- Trimble Inc

- SANY Group

- Orbcomm Inc

- Verizon Connect

- Caterpillar

- Airbiquity Inc

- Tadano Ltd

- Samsara Networks Inc

Key Developments in Off-Highway Vehicle Telematics Industry Industry

- July 2022: Guidepoint Systems partnered with Free2move (Stellantis) to integrate vehicle data for various services. This expands the reach of telematics data into dealer inventory management, fleet management, and consumer vehicle diagnostics.

- March 2022: Navistar standardized factory-installed telematics on its Class 6-8 trucks and IC buses, enhancing data access for stakeholders and facilitating deeper integration with industry partners. This move significantly increases the amount of data available, furthering the shift to a data-driven approach.

Strategic Off-Highway Vehicle Telematics Industry Market Forecast

The Off-Highway Vehicle Telematics market is poised for continued robust growth, driven by technological innovation, increasing demand for operational efficiency, and the growing importance of data-driven decision-making. New opportunities in emerging markets and the integration of advanced technologies such as AI and 5G will further propel market expansion. The market is projected to reach $XX Billion by 2033, representing significant potential for industry players and investors.

Off-Highway Vehicle Telematics Industry Segmentation

-

1. End-User Industry

- 1.1. Construction

- 1.2. Agriculture

- 1.3. Mining

- 1.4. Forestry

Off-Highway Vehicle Telematics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Off-Highway Vehicle Telematics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulations and OEM Proliferation; Increase in Technological Developments

- 3.3. Market Restrains

- 3.3.1. Growing Reluctance of End Users to Change Business Practices; Lack of Training for the Use in Heavy Equipment

- 3.4. Market Trends

- 3.4.1. Construction Segment remains the biggest sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Construction

- 5.1.2. Agriculture

- 5.1.3. Mining

- 5.1.4. Forestry

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. North America Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Construction

- 6.1.2. Agriculture

- 6.1.3. Mining

- 6.1.4. Forestry

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. Europe Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Construction

- 7.1.2. Agriculture

- 7.1.3. Mining

- 7.1.4. Forestry

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Asia Pacific Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Construction

- 8.1.2. Agriculture

- 8.1.3. Mining

- 8.1.4. Forestry

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. Latin America Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9.1.1. Construction

- 9.1.2. Agriculture

- 9.1.3. Mining

- 9.1.4. Forestry

- 9.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10. Middle East and Africa Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-User Industry

- 10.1.1. Construction

- 10.1.2. Agriculture

- 10.1.3. Mining

- 10.1.4. Forestry

- 10.1. Market Analysis, Insights and Forecast - by End-User Industry

- 11. North America Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Off-Highway Vehicle Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Skylo Technologies

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Hyundai Motor Group

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Geotab Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 ACTIA group

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Hitachi Construction Machinery

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Liebherr

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Webfleet Solutions BV (Bridgestone Corp )

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Deere & Company

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Geoforce Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Bridgestone Europe NV/SA (TomTom)

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 UK Telematics

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Doosan Corporation

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 AGCO

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 CNH Industrial

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 JCB

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.16 Volvo Construction Equipment

- 17.2.16.1. Overview

- 17.2.16.2. Products

- 17.2.16.3. SWOT Analysis

- 17.2.16.4. Recent Developments

- 17.2.16.5. Financials (Based on Availability)

- 17.2.17 CLAAS Group

- 17.2.17.1. Overview

- 17.2.17.2. Products

- 17.2.17.3. SWOT Analysis

- 17.2.17.4. Recent Developments

- 17.2.17.5. Financials (Based on Availability)

- 17.2.18 Teletrac Navman

- 17.2.18.1. Overview

- 17.2.18.2. Products

- 17.2.18.3. SWOT Analysis

- 17.2.18.4. Recent Developments

- 17.2.18.5. Financials (Based on Availability)

- 17.2.19 Omnitracs LLC

- 17.2.19.1. Overview

- 17.2.19.2. Products

- 17.2.19.3. SWOT Analysis

- 17.2.19.4. Recent Developments

- 17.2.19.5. Financials (Based on Availability)

- 17.2.20 Komatsu

- 17.2.20.1. Overview

- 17.2.20.2. Products

- 17.2.20.3. SWOT Analysis

- 17.2.20.4. Recent Developments

- 17.2.20.5. Financials (Based on Availability)

- 17.2.21 KeepTruckin Inc

- 17.2.21.1. Overview

- 17.2.21.2. Products

- 17.2.21.3. SWOT Analysis

- 17.2.21.4. Recent Developments

- 17.2.21.5. Financials (Based on Availability)

- 17.2.22 MiXTelematics International

- 17.2.22.1. Overview

- 17.2.22.2. Products

- 17.2.22.3. SWOT Analysis

- 17.2.22.4. Recent Developments

- 17.2.22.5. Financials (Based on Availability)

- 17.2.23 Trimble Inc

- 17.2.23.1. Overview

- 17.2.23.2. Products

- 17.2.23.3. SWOT Analysis

- 17.2.23.4. Recent Developments

- 17.2.23.5. Financials (Based on Availability)

- 17.2.24 SANY Group

- 17.2.24.1. Overview

- 17.2.24.2. Products

- 17.2.24.3. SWOT Analysis

- 17.2.24.4. Recent Developments

- 17.2.24.5. Financials (Based on Availability)

- 17.2.25 Orbcomm Inc

- 17.2.25.1. Overview

- 17.2.25.2. Products

- 17.2.25.3. SWOT Analysis

- 17.2.25.4. Recent Developments

- 17.2.25.5. Financials (Based on Availability)

- 17.2.26 Verizon Connect

- 17.2.26.1. Overview

- 17.2.26.2. Products

- 17.2.26.3. SWOT Analysis

- 17.2.26.4. Recent Developments

- 17.2.26.5. Financials (Based on Availability)

- 17.2.27 Caterpillar

- 17.2.27.1. Overview

- 17.2.27.2. Products

- 17.2.27.3. SWOT Analysis

- 17.2.27.4. Recent Developments

- 17.2.27.5. Financials (Based on Availability)

- 17.2.28 Airbiquity Inc

- 17.2.28.1. Overview

- 17.2.28.2. Products

- 17.2.28.3. SWOT Analysis

- 17.2.28.4. Recent Developments

- 17.2.28.5. Financials (Based on Availability)

- 17.2.29 Tadano Ltd

- 17.2.29.1. Overview

- 17.2.29.2. Products

- 17.2.29.3. SWOT Analysis

- 17.2.29.4. Recent Developments

- 17.2.29.5. Financials (Based on Availability)

- 17.2.30 Samsara Networks Inc

- 17.2.30.1. Overview

- 17.2.30.2. Products

- 17.2.30.3. SWOT Analysis

- 17.2.30.4. Recent Developments

- 17.2.30.5. Financials (Based on Availability)

- 17.2.1 Skylo Technologies

List of Figures

- Figure 1: Global Off-Highway Vehicle Telematics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Off-Highway Vehicle Telematics Industry Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 5: North America Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 9: Europe Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 13: Asia Pacific Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 17: South America Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: North America Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 21: North America Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 25: MEA Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Off-Highway Vehicle Telematics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 28: North America Off-Highway Vehicle Telematics Industry Volume (Billion), by End-User Industry 2024 & 2032

- Figure 29: North America Off-Highway Vehicle Telematics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 30: North America Off-Highway Vehicle Telematics Industry Volume Share (%), by End-User Industry 2024 & 2032

- Figure 31: North America Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 32: North America Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 33: North America Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Off-Highway Vehicle Telematics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 36: Europe Off-Highway Vehicle Telematics Industry Volume (Billion), by End-User Industry 2024 & 2032

- Figure 37: Europe Off-Highway Vehicle Telematics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 38: Europe Off-Highway Vehicle Telematics Industry Volume Share (%), by End-User Industry 2024 & 2032

- Figure 39: Europe Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 41: Europe Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 43: Asia Pacific Off-Highway Vehicle Telematics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 44: Asia Pacific Off-Highway Vehicle Telematics Industry Volume (Billion), by End-User Industry 2024 & 2032

- Figure 45: Asia Pacific Off-Highway Vehicle Telematics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 46: Asia Pacific Off-Highway Vehicle Telematics Industry Volume Share (%), by End-User Industry 2024 & 2032

- Figure 47: Asia Pacific Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Pacific Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 49: Asia Pacific Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Off-Highway Vehicle Telematics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 52: Latin America Off-Highway Vehicle Telematics Industry Volume (Billion), by End-User Industry 2024 & 2032

- Figure 53: Latin America Off-Highway Vehicle Telematics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 54: Latin America Off-Highway Vehicle Telematics Industry Volume Share (%), by End-User Industry 2024 & 2032

- Figure 55: Latin America Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 56: Latin America Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 57: Latin America Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Latin America Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

- Figure 59: Middle East and Africa Off-Highway Vehicle Telematics Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 60: Middle East and Africa Off-Highway Vehicle Telematics Industry Volume (Billion), by End-User Industry 2024 & 2032

- Figure 61: Middle East and Africa Off-Highway Vehicle Telematics Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 62: Middle East and Africa Off-Highway Vehicle Telematics Industry Volume Share (%), by End-User Industry 2024 & 2032

- Figure 63: Middle East and Africa Off-Highway Vehicle Telematics Industry Revenue (Million), by Country 2024 & 2032

- Figure 64: Middle East and Africa Off-Highway Vehicle Telematics Industry Volume (Billion), by Country 2024 & 2032

- Figure 65: Middle East and Africa Off-Highway Vehicle Telematics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 66: Middle East and Africa Off-Highway Vehicle Telematics Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 5: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 9: United States Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 11: Canada Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Mexico Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 17: Germany Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: France Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Spain Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Italy Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Spain Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Belgium Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Belgium Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Netherland Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Netherland Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Nordics Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Nordics Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Rest of Europe Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 39: China Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: China Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Japan Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: India Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: India Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: South Korea Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 47: Southeast Asia Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Southeast Asia Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 49: Australia Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Australia Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 51: Indonesia Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Indonesia Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 53: Phillipes Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Phillipes Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Singapore Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Singapore Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: Thailandc Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Thailandc Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 61: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 63: Brazil Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Brazil Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 65: Argentina Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Argentina Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 67: Peru Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Peru Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 69: Chile Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Chile Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 71: Colombia Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Colombia Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 73: Ecuador Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Ecuador Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 75: Venezuela Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Venezuela Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 77: Rest of South America Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of South America Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 79: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 80: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 81: United States Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: United States Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 83: Canada Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Canada Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 85: Mexico Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Mexico Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 87: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 88: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 89: United Arab Emirates Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: United Arab Emirates Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 91: Saudi Arabia Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Saudi Arabia Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 93: South Africa Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: South Africa Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 95: Rest of Middle East and Africa Off-Highway Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Rest of Middle East and Africa Off-Highway Vehicle Telematics Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 97: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 98: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 99: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 100: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 101: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 102: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 103: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 104: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 105: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 106: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 107: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 108: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 109: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 110: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 111: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 112: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 113: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 114: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 115: Global Off-Highway Vehicle Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 116: Global Off-Highway Vehicle Telematics Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Off-Highway Vehicle Telematics Industry?

The projected CAGR is approximately 16.93%.

2. Which companies are prominent players in the Off-Highway Vehicle Telematics Industry?

Key companies in the market include Skylo Technologies, Hyundai Motor Group, Geotab Inc, ACTIA group, Hitachi Construction Machinery, Liebherr, Webfleet Solutions BV (Bridgestone Corp ), Deere & Company, Geoforce Inc, Bridgestone Europe NV/SA (TomTom), UK Telematics, Doosan Corporation, AGCO, CNH Industrial, JCB, Volvo Construction Equipment, CLAAS Group, Teletrac Navman, Omnitracs LLC, Komatsu, KeepTruckin Inc, MiXTelematics International, Trimble Inc, SANY Group, Orbcomm Inc, Verizon Connect, Caterpillar, Airbiquity Inc, Tadano Ltd, Samsara Networks Inc.

3. What are the main segments of the Off-Highway Vehicle Telematics Industry?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Regulations and OEM Proliferation; Increase in Technological Developments.

6. What are the notable trends driving market growth?

Construction Segment remains the biggest sector.

7. Are there any restraints impacting market growth?

Growing Reluctance of End Users to Change Business Practices; Lack of Training for the Use in Heavy Equipment.

8. Can you provide examples of recent developments in the market?

July 2022 - Guidepoint Systems, a global provider of vehicle telematics and Software as a Service (SaaS) partnered with Free2move, the global fleet, mobility, and connected data brand of Stellantis. The collaboration will enable data from properly equipped and eligible MY2018 and newer Stellantis vehicles, including Ram, Dodge, Chrysler, and Jeep, to be received within Guidepoint Air to provide inventory management services to dealers, fleet management services for commercial and government fleets, auditing services to floor plan lenders, and vehicle diagnostic reports to consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Off-Highway Vehicle Telematics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Off-Highway Vehicle Telematics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Off-Highway Vehicle Telematics Industry?

To stay informed about further developments, trends, and reports in the Off-Highway Vehicle Telematics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence