Key Insights

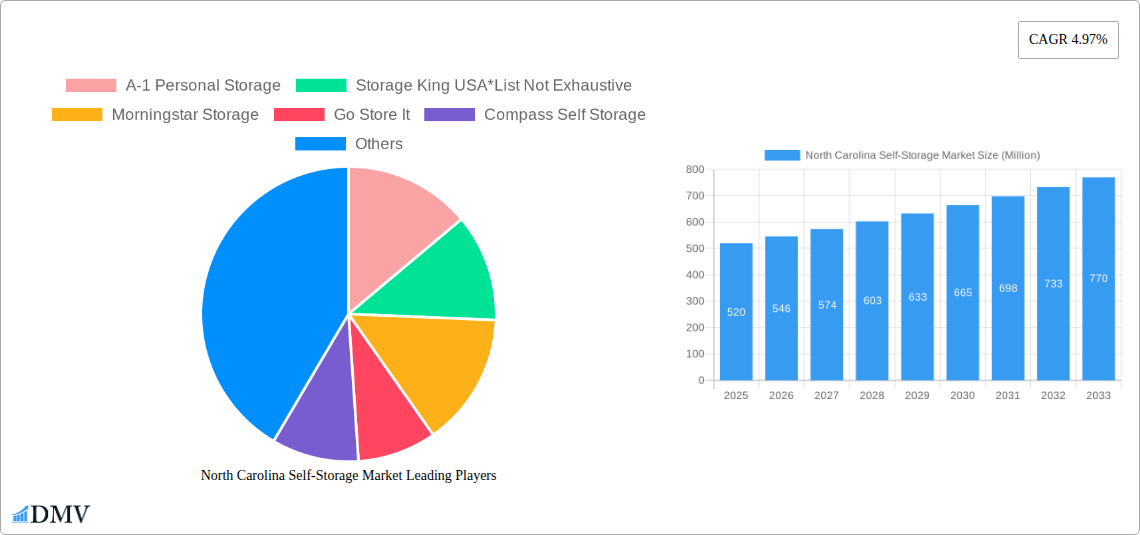

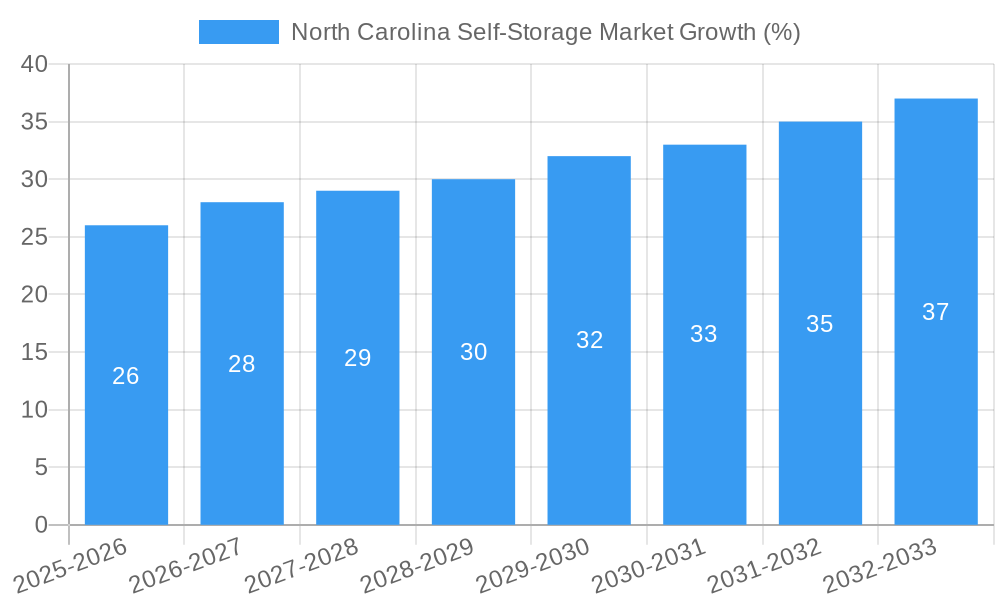

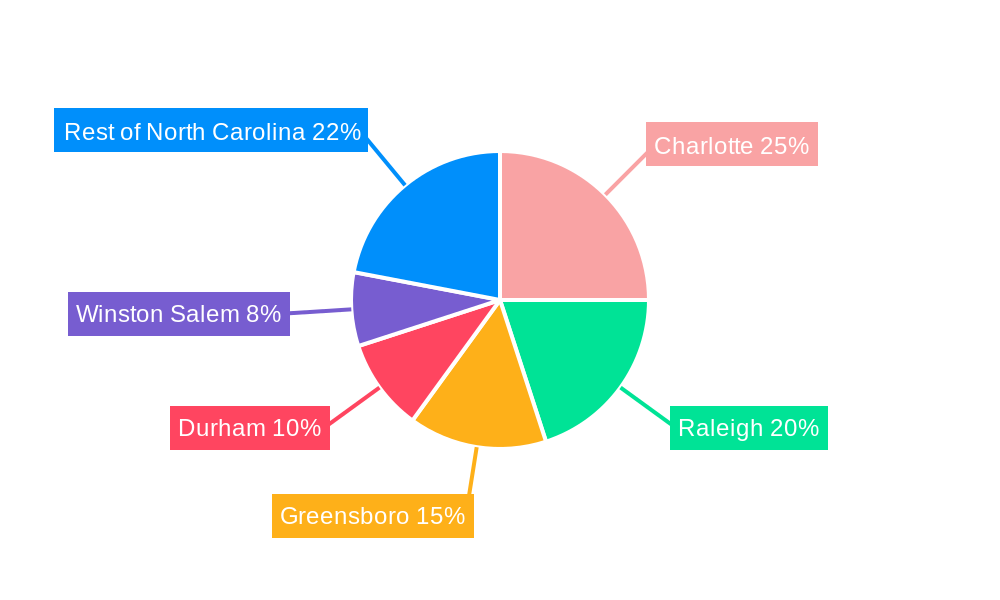

The North Carolina self-storage market exhibits robust growth potential, driven by factors such as population increase, urbanization, and a burgeoning e-commerce sector fueling inventory needs for businesses and individuals. The market's Compound Annual Growth Rate (CAGR) of 4.97% from 2019 to 2024 suggests a consistent upward trajectory. While precise market size figures for 2025 are unavailable, extrapolating from the historical CAGR and considering the ongoing trends, we can estimate a market value exceeding $500 million for 2025. This expansion is fueled by the increasing demand for flexible storage solutions among both personal and business users. The segmentation of the market into personal and business users highlights different needs and driving forces: personal users are primarily driven by lifestyle changes (like downsizing or relocation) and the need for temporary storage, while business users are driven by inventory management, record keeping, and the rise of e-commerce requiring fulfillment space. Cities like Charlotte, Raleigh, and Greensboro, as major metropolitan areas, are likely to command the largest share of the market within the state.

The competitive landscape is characterized by both large national players like Life Storage Inc. and CubeSmart LP, and regional operators such as Anchor Mini Storage and NC Self Storage. This competitive environment fosters innovation in offerings and pricing strategies, further enhancing market dynamism. While potential restraints might include economic downturns impacting consumer spending and business investment, the overall growth outlook for the North Carolina self-storage market remains positive, projected to continue its upward trend throughout the forecast period (2025-2033). Strategic expansion into underserved areas and the adoption of technology to improve facility management and customer experience will be key factors determining future success within this thriving market.

North Carolina Self-Storage Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North Carolina self-storage market, offering invaluable insights for stakeholders seeking to understand market trends, identify growth opportunities, and make informed strategic decisions. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data analysis and expert insights to deliver a clear picture of the current market landscape and its future trajectory. This report is essential for investors, industry professionals, and anyone interested in the dynamic North Carolina self-storage sector. The market size is projected to reach xx Million by 2033.

North Carolina Self-Storage Market Composition & Trends

This section delves into the competitive landscape of the North Carolina self-storage market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and user profiles. We examine the impact of mergers and acquisitions (M&A) activity on market dynamics, providing detailed analysis of significant deals.

- Market Concentration: The North Carolina self-storage market exhibits a moderately concentrated structure, with key players such as Life Storage Inc and Cubesmart LP holding significant market share. However, a number of regional and smaller operators also contribute significantly. The precise market share distribution is detailed within the full report.

- Innovation Catalysts: Technological advancements, such as online booking platforms and enhanced security features, are driving innovation within the sector.

- Regulatory Landscape: State and local regulations concerning zoning, construction, and environmental compliance impact market development. The report provides a thorough overview of the relevant regulatory frameworks.

- Substitute Products: Traditional self-storage faces competition from cloud storage solutions and other alternative storage options.

- End-User Profiles: The market caters to both personal and business users, with specific needs and preferences influencing demand patterns.

- M&A Activity: Recent years have witnessed significant M&A activity in the North Carolina self-storage sector, with deal values ranging from USD 23.6 Million (as seen in the CBRE August 2022 transaction) to larger transactions not publicly disclosed. The report provides a detailed analysis of past M&A transactions and their impact.

North Carolina Self-Storage Market Industry Evolution

This section explores the historical and projected growth trajectory of the North Carolina self-storage market. We analyze evolving technological advancements and shifts in consumer demand, highlighting key trends that have shaped the industry's evolution. The analysis incorporates data points on growth rates and adoption metrics to illustrate the market's dynamic nature. The market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024) and is projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including increasing urbanization, population growth, and the rise of e-commerce, which drives demand for storage solutions both for businesses and individuals. Furthermore, the increasing prevalence of climate change and the related increase in frequency of extreme weather events leads to a rise in people needing self-storage for disaster recovery. The report provides further details on these factors and their impact on growth.

Leading Regions, Countries, or Segments in North Carolina Self-Storage Market

This section identifies the dominant segment within the North Carolina self-storage market, focusing on the distinction between personal and business users.

- Dominant Segment: The personal self-storage segment currently dominates the North Carolina market, driven by factors such as population growth, housing trends, and lifestyle changes.

- Key Drivers for Personal Use:

- Increasing urbanization and population density in major metropolitan areas of North Carolina.

- Growing demand for flexible and convenient storage solutions.

- Rising household mobility and transient lifestyles.

- Key Drivers for Business Use:

- Expansion of e-commerce and the associated need for inventory storage and distribution.

- Growth of small and medium-sized enterprises (SMEs) requiring storage for equipment, supplies and documents.

- Increased demand for secure record management solutions among businesses.

The personal storage segment’s dominance is further analyzed in detail in the report, exploring the underlying factors driving its growth trajectory and potential shifts in the future.

North Carolina Self-Storage Market Product Innovations

The North Carolina self-storage market is witnessing continuous innovation, with new features and services being introduced to enhance customer experience and operational efficiency. Climate-controlled units, enhanced security measures, online booking and payment systems, and value-added services such as packing supplies and moving assistance are becoming increasingly common. These innovations cater to the evolving needs of customers, providing greater convenience and flexibility.

Propelling Factors for North Carolina Self-Storage Market Growth

Several key factors are driving growth in the North Carolina self-storage market. These include a growing population and increasing urbanization leading to higher demand for housing and storage solutions. Economic growth, particularly in the e-commerce sector, is also driving the need for more storage space for both businesses and individuals. Finally, favorable regulatory environments further contribute to the market’s expansion.

Obstacles in the North Carolina Self-Storage Market

The North Carolina self-storage market also faces certain challenges. Competition from existing players and new entrants, coupled with the high costs of land and construction, creates significant pressure on profitability. Supply chain disruptions impacting construction and operational costs can significantly impact market dynamics. Local regulations and zoning issues can also restrict the expansion of storage facilities, potentially affecting market supply.

Future Opportunities in North Carolina Self-Storage Market

The North Carolina self-storage market presents several promising future opportunities. Expansion into underserved areas and the introduction of innovative storage solutions, such as climate-controlled units and specialized storage for specific items, offer significant potential. Technological advancements, such as automated storage and retrieval systems, are poised to reshape market dynamics, improving efficiency and customer experience. Further market segmentation to meet more specific user needs will unlock further growth avenues.

Major Players in the North Carolina Self-Storage Market Ecosystem

- A-1 Personal Storage

- Storage King USA

- Morningstar Storage

- Go Store It

- Compass Self Storage

- NC Self Storage

- SecurCare Self Storage

- Anchor Mini Storage

- Life Storage Inc

- Cubesmart LP

Key Developments in North Carolina Self-Storage Market Industry

- August 2022: CBRE announced the USD 23.6 Million sale of two Extra Space Storage facilities outside Charlotte, highlighting significant investment activity in the market.

- March 2023: MV completed construction of a new 808-unit, 105,000 square foot self-storage facility in Fayetteville, showcasing ongoing development in the sector.

Strategic North Carolina Self-Storage Market Forecast

The North Carolina self-storage market is projected to experience robust growth over the forecast period (2025-2033), driven by continued population growth, urbanization, and increasing demand for storage solutions across both personal and business segments. Ongoing investment in new facilities, technological innovations, and favorable regulatory environments will further propel market expansion. The market's potential is significant, with ample opportunities for existing players and new entrants alike.

North Carolina Self-Storage Market Segmentation

-

1. User Type

- 1.1. Personal

- 1.2. Business

-

2. Geography

- 2.1. Charlotte

- 2.2. Raleigh

- 2.3. Greensboro

- 2.4. Durham

- 2.5. Winston-Salem

- 2.6. Rest of North Carolina

North Carolina Self-Storage Market Segmentation By Geography

- 1. Charlotte

- 2. Raleigh

- 3. Greensboro

- 4. Durham

- 5. Winston Salem

- 6. Rest of North Carolina

North Carolina Self-Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Urbanization

- 3.2.2 Coupled with Smaller Living Spaces; Improved Economic Outlook and Innovative Trends

- 3.3. Market Restrains

- 3.3.1. Government Regulations on Storage

- 3.4. Market Trends

- 3.4.1. Personal Segment to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 5.1.1. Personal

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Charlotte

- 5.2.2. Raleigh

- 5.2.3. Greensboro

- 5.2.4. Durham

- 5.2.5. Winston-Salem

- 5.2.6. Rest of North Carolina

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Charlotte

- 5.3.2. Raleigh

- 5.3.3. Greensboro

- 5.3.4. Durham

- 5.3.5. Winston Salem

- 5.3.6. Rest of North Carolina

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 6. Charlotte North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by User Type

- 6.1.1. Personal

- 6.1.2. Business

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Charlotte

- 6.2.2. Raleigh

- 6.2.3. Greensboro

- 6.2.4. Durham

- 6.2.5. Winston-Salem

- 6.2.6. Rest of North Carolina

- 6.1. Market Analysis, Insights and Forecast - by User Type

- 7. Raleigh North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by User Type

- 7.1.1. Personal

- 7.1.2. Business

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Charlotte

- 7.2.2. Raleigh

- 7.2.3. Greensboro

- 7.2.4. Durham

- 7.2.5. Winston-Salem

- 7.2.6. Rest of North Carolina

- 7.1. Market Analysis, Insights and Forecast - by User Type

- 8. Greensboro North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by User Type

- 8.1.1. Personal

- 8.1.2. Business

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Charlotte

- 8.2.2. Raleigh

- 8.2.3. Greensboro

- 8.2.4. Durham

- 8.2.5. Winston-Salem

- 8.2.6. Rest of North Carolina

- 8.1. Market Analysis, Insights and Forecast - by User Type

- 9. Durham North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by User Type

- 9.1.1. Personal

- 9.1.2. Business

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Charlotte

- 9.2.2. Raleigh

- 9.2.3. Greensboro

- 9.2.4. Durham

- 9.2.5. Winston-Salem

- 9.2.6. Rest of North Carolina

- 9.1. Market Analysis, Insights and Forecast - by User Type

- 10. Winston Salem North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by User Type

- 10.1.1. Personal

- 10.1.2. Business

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Charlotte

- 10.2.2. Raleigh

- 10.2.3. Greensboro

- 10.2.4. Durham

- 10.2.5. Winston-Salem

- 10.2.6. Rest of North Carolina

- 10.1. Market Analysis, Insights and Forecast - by User Type

- 11. Rest of North Carolina North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by User Type

- 11.1.1. Personal

- 11.1.2. Business

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Charlotte

- 11.2.2. Raleigh

- 11.2.3. Greensboro

- 11.2.4. Durham

- 11.2.5. Winston-Salem

- 11.2.6. Rest of North Carolina

- 11.1. Market Analysis, Insights and Forecast - by User Type

- 12. Charlotte North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Raleigh North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Greensboro North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Durham North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Winston Salem North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Rest of North Carolina North Carolina Self-Storage Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 A-1 Personal Storage

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Storage King USA*List Not Exhaustive

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Morningstar Storage

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Go Store It

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Compass Self Storage

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 NC Self Storage

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 SecurCare Self Storage

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Anchor Mini Storage

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Life Storage Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Cubesmart LP

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 A-1 Personal Storage

List of Figures

- Figure 1: Global North Carolina Self-Storage Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Charlotte North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Charlotte North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Raleigh North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Raleigh North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Greensboro North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Greensboro North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Durham North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Durham North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Winston Salem North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Winston Salem North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Rest of North Carolina North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Rest of North Carolina North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Charlotte North Carolina Self-Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 15: Charlotte North Carolina Self-Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 16: Charlotte North Carolina Self-Storage Market Revenue (Million), by Geography 2024 & 2032

- Figure 17: Charlotte North Carolina Self-Storage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 18: Charlotte North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Charlotte North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Raleigh North Carolina Self-Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 21: Raleigh North Carolina Self-Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 22: Raleigh North Carolina Self-Storage Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Raleigh North Carolina Self-Storage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Raleigh North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Raleigh North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Greensboro North Carolina Self-Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 27: Greensboro North Carolina Self-Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 28: Greensboro North Carolina Self-Storage Market Revenue (Million), by Geography 2024 & 2032

- Figure 29: Greensboro North Carolina Self-Storage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 30: Greensboro North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Greensboro North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Durham North Carolina Self-Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 33: Durham North Carolina Self-Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 34: Durham North Carolina Self-Storage Market Revenue (Million), by Geography 2024 & 2032

- Figure 35: Durham North Carolina Self-Storage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 36: Durham North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Durham North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Winston Salem North Carolina Self-Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 39: Winston Salem North Carolina Self-Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 40: Winston Salem North Carolina Self-Storage Market Revenue (Million), by Geography 2024 & 2032

- Figure 41: Winston Salem North Carolina Self-Storage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 42: Winston Salem North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Winston Salem North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Rest of North Carolina North Carolina Self-Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 45: Rest of North Carolina North Carolina Self-Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 46: Rest of North Carolina North Carolina Self-Storage Market Revenue (Million), by Geography 2024 & 2032

- Figure 47: Rest of North Carolina North Carolina Self-Storage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 48: Rest of North Carolina North Carolina Self-Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of North Carolina North Carolina Self-Storage Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global North Carolina Self-Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global North Carolina Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 3: Global North Carolina Self-Storage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Global North Carolina Self-Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Carolina Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North Carolina Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North Carolina Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North Carolina Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North Carolina Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North Carolina Self-Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global North Carolina Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 18: Global North Carolina Self-Storage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global North Carolina Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 21: Global North Carolina Self-Storage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global North Carolina Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 24: Global North Carolina Self-Storage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global North Carolina Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 27: Global North Carolina Self-Storage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global North Carolina Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 30: Global North Carolina Self-Storage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global North Carolina Self-Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 33: Global North Carolina Self-Storage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Global North Carolina Self-Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North Carolina Self-Storage Market?

The projected CAGR is approximately 4.97%.

2. Which companies are prominent players in the North Carolina Self-Storage Market?

Key companies in the market include A-1 Personal Storage, Storage King USA*List Not Exhaustive, Morningstar Storage, Go Store It, Compass Self Storage, NC Self Storage, SecurCare Self Storage, Anchor Mini Storage, Life Storage Inc, Cubesmart LP.

3. What are the main segments of the North Carolina Self-Storage Market?

The market segments include User Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Urbanization. Coupled with Smaller Living Spaces; Improved Economic Outlook and Innovative Trends.

6. What are the notable trends driving market growth?

Personal Segment to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Government Regulations on Storage.

8. Can you provide examples of recent developments in the market?

March 2023 - A brand-new self-storage facility that MV is building in Fayetteville, North Carolina, is also almost finished. The building at 5234 Raeford Road, which was constructed on 9 acres, has 808 units and 105,000 gross square feet of space. The opening date was set for April 1. A development, building, and property management company with a focus on multifamily and self-storage buildings is MV. More than 1.5 million square feet of self-storage have been built by it thus far.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North Carolina Self-Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North Carolina Self-Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North Carolina Self-Storage Market?

To stay informed about further developments, trends, and reports in the North Carolina Self-Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence