Key Insights

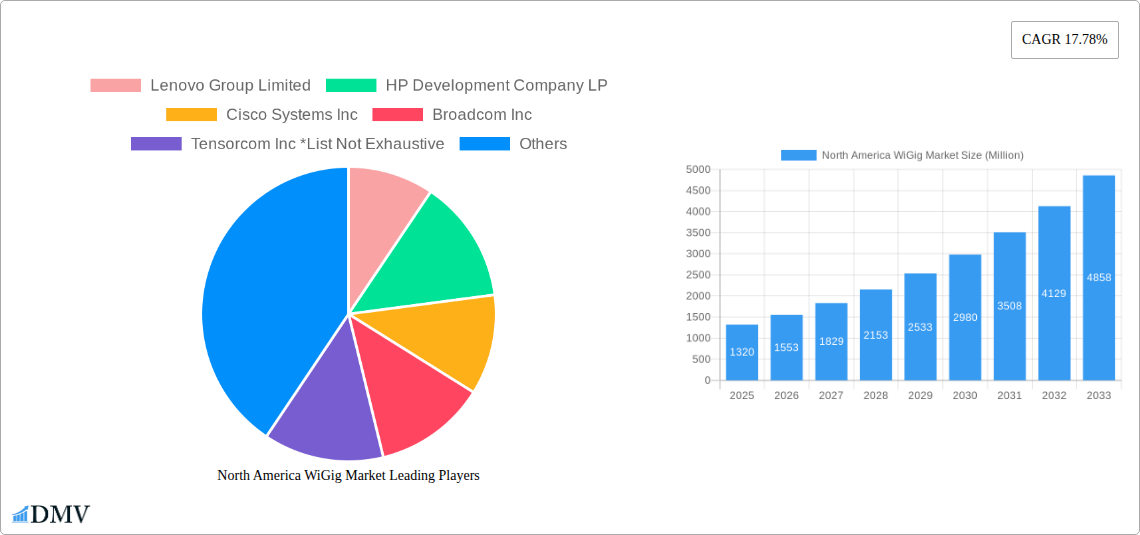

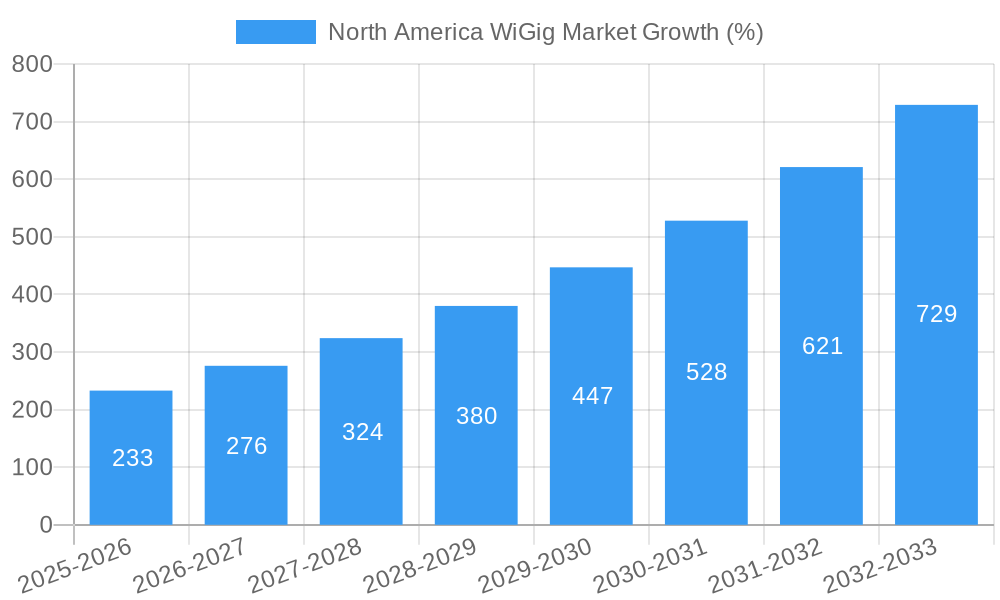

The North American WiGig market, valued at $1.32 billion in 2025, is projected to experience robust growth, driven by the increasing demand for high-bandwidth, low-latency wireless connectivity in various applications. This surge is fueled by the proliferation of high-resolution video streaming, immersive gaming experiences, and the expanding adoption of virtual and augmented reality technologies. The market's segmentation reveals a strong focus on display devices and network infrastructure, with gaming and multimedia applications leading the demand. Key players like Lenovo, HP, Cisco, Broadcom, and Qualcomm are actively shaping the market landscape through technological innovations and strategic partnerships. The United States and Canada represent the largest market segments within North America, contributing significantly to the region's overall growth. While challenges such as interoperability issues and higher device costs exist, ongoing technological advancements and decreasing manufacturing costs are expected to mitigate these restraints, fostering further market expansion.

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 17.78%, indicating a significant increase in market value. This growth trajectory is likely to be sustained by continued advancements in WiGig technology, enabling faster data transfer speeds and improved performance across diverse applications. The increasing integration of WiGig into enterprise networks, alongside the burgeoning adoption of 5G networks, further reinforces the positive outlook for the North American market. Future market growth will heavily depend on continued technological innovation, consumer adoption of supporting devices, and the development of robust regulatory frameworks to ensure seamless interoperability. The competitive landscape remains dynamic, with key players continually vying for market share through product differentiation and strategic acquisitions.

North America WiGig Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the North America WiGig market, offering valuable insights for stakeholders seeking to navigate this rapidly evolving landscape. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, technological advancements, and competitive dynamics to provide a clear picture of the market's future potential. The report's detailed segmentation by product (Display Devices, Network Infrastructure Devices), application (Gaming and Multimedia, Networking, Other Applications), and country (United States, Canada) allows for granular understanding and strategic decision-making. Expected market value is predicted to reach xx Million by 2033.

North America WiGig Market Composition & Trends

This section delves into the intricate structure of the North America WiGig market, evaluating its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and merger & acquisition (M&A) activity. The analysis reveals a moderately concentrated market with key players vying for dominance. Innovation is spurred by the demand for high-bandwidth, low-latency connectivity, while regulatory frameworks significantly influence deployment strategies. The emergence of alternative technologies presents competitive pressures, yet WiGig's unique capabilities continue to attract investment.

- Market Share Distribution: Major players, including Lenovo Group Limited, HP Development Company LP, Cisco Systems Inc, Broadcom Inc, Tensorcom Inc, Qualcomm Technologies Inc, Dell Technologies Inc, and Intel Corporation, collectively hold approximately xx% of the market share in 2025. The remaining share is dispersed among smaller players and niche providers.

- M&A Activity: The past five years have witnessed xx M&A deals in the North America WiGig market, totaling an estimated value of xx Million. These deals primarily focus on expanding market reach, enhancing technological capabilities, and accessing new customer segments. Increased consolidation is anticipated in the forecast period.

- End-User Profiles: Key end-users include enterprises, data centers, telecommunication service providers, and residential consumers in the gaming and multimedia segments.

North America WiGig Market Industry Evolution

This section provides a detailed analysis of the North America WiGig market's trajectory, highlighting technological advancements and shifts in consumer demand. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by increasing adoption in high-bandwidth applications. The forecast period (2025-2033) projects a CAGR of xx%, fueled by ongoing technological improvements and expanding application areas. Growth is particularly strong in the United States due to its robust technological infrastructure and high consumer demand. Adoption rates are expected to climb significantly, particularly within the gaming and multimedia sectors, driven by the increasing demand for seamless, high-quality streaming experiences.

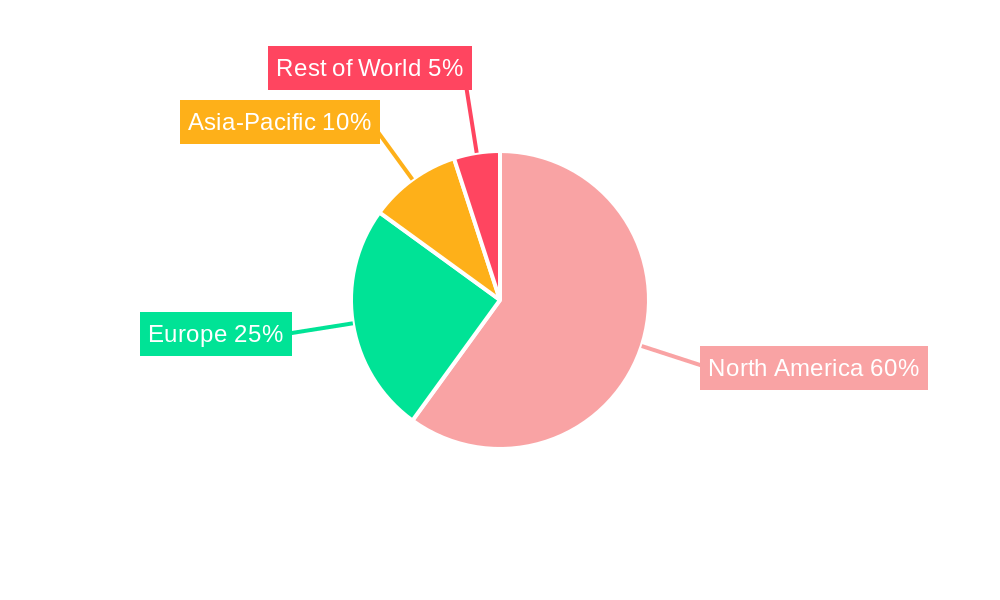

Leading Regions, Countries, or Segments in North America WiGig Market

The United States currently holds the dominant position in the North America WiGig market, fueled by significant investments in infrastructure development, supportive regulatory policies, and a high concentration of major technology companies.

- Key Drivers for US Dominance:

- High levels of private and public sector investment in advanced wireless technologies.

- A thriving ecosystem of technology providers and skilled workforce.

- Favorable regulatory environment encouraging 60 GHz spectrum allocation.

- Canada's Market: Canada's market is growing steadily, albeit at a slower pace than the US, with increasing adoption in specific sectors like enterprise networking and multimedia streaming.

North America WiGig Market Product Innovations

Recent innovations in WiGig technology focus on enhanced performance, improved range, and seamless integration with existing networks. New products feature advanced antenna designs, higher data rates (exceeding 7 Gbps), and increased power efficiency. These advancements are driving adoption across diverse applications, including high-definition video streaming, virtual reality gaming, and advanced industrial IoT deployments. The unique selling propositions of these innovations center around high speed and low latency, surpassing traditional wireless standards.

Propelling Factors for North America WiGig Market Growth

Several key factors contribute to the growth of the North America WiGig market. Technological advancements, such as the development of higher-performance chipsets and improved antenna designs, are enhancing speed, range and reliability. Economically, the increasing demand for high-bandwidth applications in various sectors drives adoption, while favorable regulatory policies regarding spectrum allocation further encourage growth. For example, initiatives promoting 5G infrastructure implicitly support the development of WiGig technologies.

Obstacles in the North America WiGig Market Market

Despite its potential, the North America WiGig market faces several challenges. Regulatory hurdles related to spectrum allocation and interference management can create uncertainty. Supply chain disruptions, particularly affecting component availability, can impact manufacturing and deployment. Furthermore, competition from other high-speed wireless technologies, like 5G and LiFi, poses a significant threat, potentially reducing market share. The impact of these constraints on overall market growth is estimated to be approximately xx% annually.

Future Opportunities in North America WiGig Market

The future of the North America WiGig market is promising, with significant opportunities for expansion. New applications in areas like augmented reality (AR), virtual reality (VR), and immersive media experiences will drive demand. Technological advancements, such as improved power efficiency and longer range, will broaden adoption in various sectors. Moreover, increased collaboration between technology providers and network operators will accelerate market penetration and create new business opportunities. The exploration of unlicensed spectrum bands could dramatically reduce deployment costs and facilitate faster market expansion.

Major Players in the North America WiGig Market Ecosystem

- Lenovo Group Limited

- HP Development Company LP

- Cisco Systems Inc

- Broadcom Inc

- Tensorcom Inc

- Qualcomm Technologies Inc

- Dell Technologies Inc

- Intel Corporation

Key Developments in North America WiGig Market Industry

- January 2023: Follett USA and Kwikbit Internet partnered to deploy WiGig broadband services to eight manufactured housing communities, demonstrating the technology's potential for affordable high-speed internet access in underserved areas. This partnership significantly increases WiGig's accessibility and market presence within the residential sector.

- March 2022: Edgecore Networks launched the MLTG-CN LR, expanding their 60GHz WiGig product line and providing a cost-effective alternative to fiber optic cable deployment for high-speed connectivity. This product launch enhances the market's competitiveness by offering a more affordable and quicker solution.

Strategic North America WiGig Market Forecast

The North America WiGig market is poised for substantial growth, driven by continued technological advancements, increasing demand for high-bandwidth applications, and supportive regulatory environments. The convergence of WiGig with other technologies, such as 5G, will unlock new applications and expand market potential. The forecast anticipates a significant expansion of the market, with substantial growth in both the enterprise and residential sectors, driven by the increasing demand for seamless high-speed connectivity.

North America WiGig Market Segmentation

-

1. Product

- 1.1. Display Devices

- 1.2. Network Infrastructure Devices

-

2. Application

- 2.1. Gaming and Multimedia

- 2.2. Networking

- 2.3. Other Applications

North America WiGig Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America WiGig Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Technological Advancement in Communication Industry; Rising Adoption of High-resolution Videos

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. Networking to Hold a major share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Display Devices

- 5.1.2. Network Infrastructure Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gaming and Multimedia

- 5.2.2. Networking

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America WiGig Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Lenovo Group Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 HP Development Company LP

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cisco Systems Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Broadcom Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tensorcom Inc *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Qualcomm Technologies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dell Technologies Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Intel Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Lenovo Group Limited

List of Figures

- Figure 1: North America WiGig Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America WiGig Market Share (%) by Company 2024

List of Tables

- Table 1: North America WiGig Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America WiGig Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America WiGig Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America WiGig Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America WiGig Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America WiGig Market Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America WiGig Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: North America WiGig Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America WiGig Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America WiGig Market?

The projected CAGR is approximately 17.78%.

2. Which companies are prominent players in the North America WiGig Market?

Key companies in the market include Lenovo Group Limited, HP Development Company LP, Cisco Systems Inc, Broadcom Inc, Tensorcom Inc *List Not Exhaustive, Qualcomm Technologies Inc, Dell Technologies Inc, Intel Corporation.

3. What are the main segments of the North America WiGig Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Technological Advancement in Communication Industry; Rising Adoption of High-resolution Videos.

6. What are the notable trends driving market growth?

Networking to Hold a major share of the Market.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

January 2023: Follett USA, a company that owns and operates manufactured housing communities across the United States, and Kwikbit Internet, a provider of wireless gigabit (WiGig) broadband services to manufactured housing communities, entered into a partnership to provide their services to eight communities in 2023. Kwikbit Internet's innovative 60 GHz wireless solution, known as WiGig, offers internet speeds comparable to fiber optics at a significantly reduced cost and faster installation time, enabling the delivery of affordable and reliable symmetrical 1 Gig service to residents in manufactured housing communities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America WiGig Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America WiGig Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America WiGig Market?

To stay informed about further developments, trends, and reports in the North America WiGig Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence