Key Insights

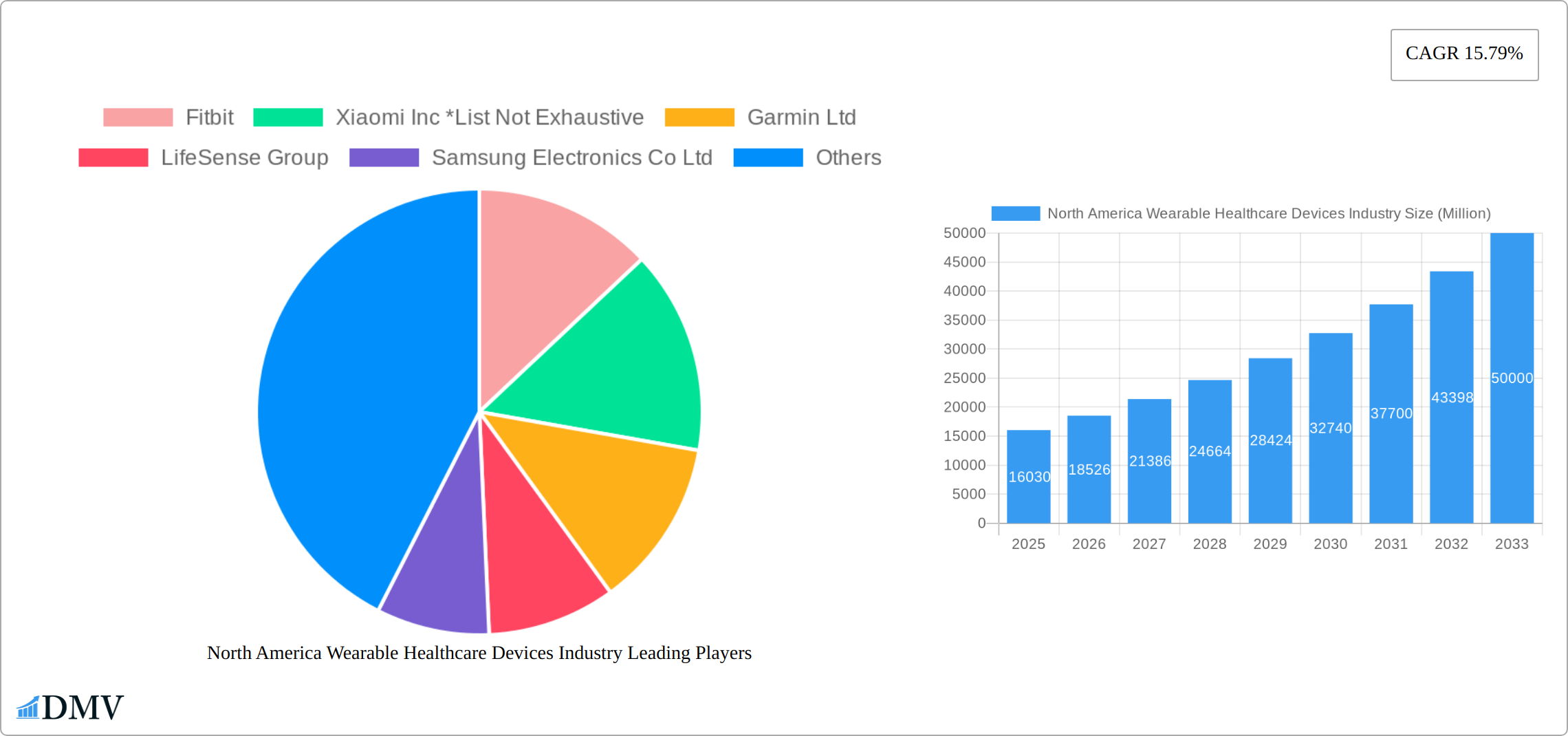

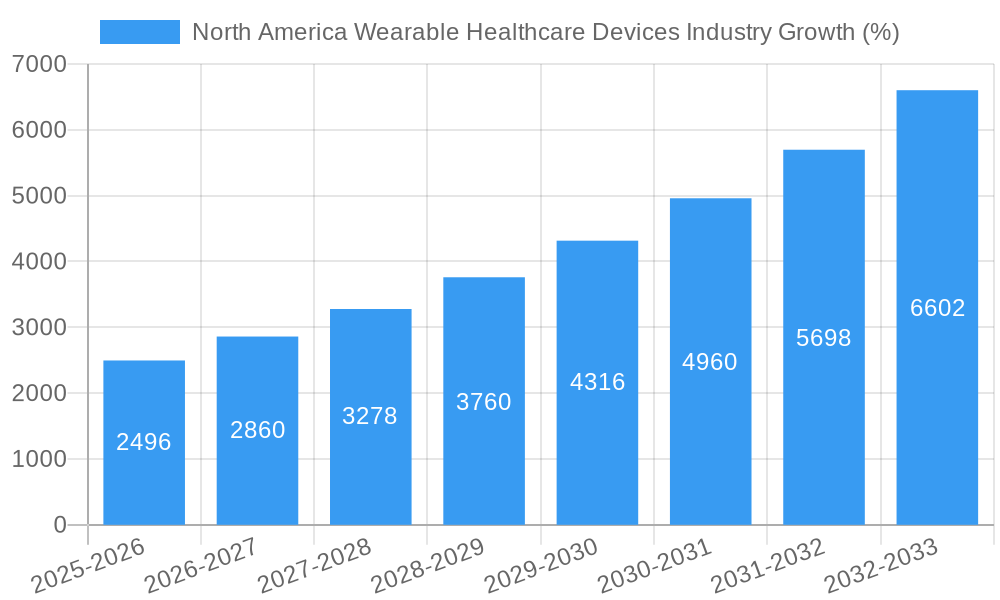

The North American wearable healthcare devices market, valued at $16.03 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 15.79% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of chronic diseases, coupled with an aging population, fuels demand for remote patient monitoring solutions. Technological advancements leading to more sophisticated and user-friendly devices, integrated with improved data analytics capabilities, contribute significantly to market growth. Furthermore, the increasing adoption of telehealth and virtual healthcare services creates a synergistic effect, driving greater adoption of wearable healthcare devices for remote monitoring and improved patient care. The convenience and proactive health management offered by these devices are major contributing factors to their rising popularity. Specific device types such as smartwatches and wristbands, due to their versatility and ease of use, are experiencing particularly strong growth within the market segments.

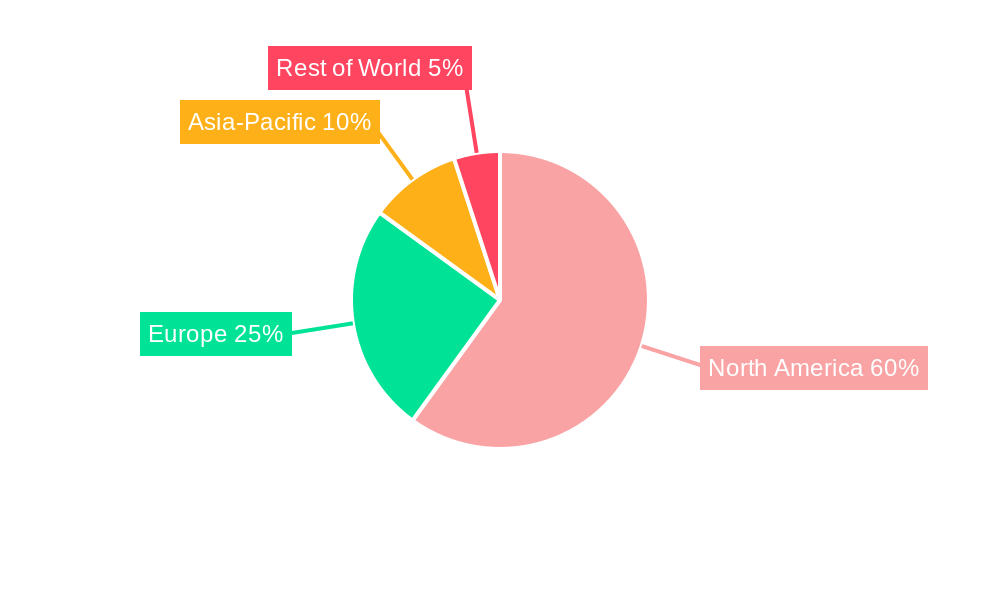

The market segmentation reveals a diverse landscape. The diagnostic devices segment, enabling early disease detection, is experiencing rapid growth, complemented by the expanding neuromonitoring devices market addressing neurological conditions. In terms of application, the sports and fitness segment remains prominent, but the remote patient monitoring and home healthcare segments show the most rapid growth, reflecting a significant shift towards proactive and decentralized healthcare solutions. Key players such as Fitbit, Xiaomi, Garmin, LifeSense, Samsung, Philips, Apple, and Sotera Wireless are competing intensely, driving innovation and fostering market competitiveness. While the North American market dominates currently, opportunities exist for expansion into other regions. The market's future trajectory strongly indicates a continued upward trend, fueled by technological innovation and evolving healthcare needs.

North America Wearable Healthcare Devices Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America wearable healthcare devices market, offering valuable insights for stakeholders seeking to understand market dynamics, future trends, and investment opportunities. Covering the period 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033, this report is essential for strategic decision-making. The market is segmented by device type (diagnostic, neuromonitoring, therapeutic), application (sports & fitness, remote patient monitoring, home healthcare), and product type (watch, wristband, ear wear, other). Key players include Fitbit, Xiaomi Inc, Garmin Ltd, LifeSense Group, Samsung Electronics Co Ltd, Koninklijke Philips NV, Apple Inc, and Sotera Wireless, among others. The report projects a market value of xx Million by 2033.

North America Wearable Healthcare Devices Industry Market Composition & Trends

The North American wearable healthcare devices market is experiencing robust growth, driven by technological advancements, increasing adoption of remote patient monitoring, and rising healthcare costs. Market concentration is moderate, with several major players holding significant market share but a healthy number of smaller, specialized companies contributing to innovation. Fitbit, Apple, and Samsung collectively hold an estimated xx% market share, while the remaining xx% is distributed amongst numerous competitors. Innovation is spurred by the development of advanced sensors, improved data analytics, and integration with existing healthcare systems. The regulatory landscape, while evolving, presents both opportunities and challenges. Stringent FDA approvals and data privacy regulations impact market entry and device functionality. Substitute products, such as traditional medical devices, exist but are often less convenient and less cost-effective in the long term. End-users comprise individuals seeking personal health monitoring, healthcare providers employing remote monitoring solutions, and institutions integrating wearable technology into their care models. M&A activity is frequent, with deal values totaling an estimated xx Million in the past five years, reflecting consolidation and strategic expansion in the sector.

- Market Share Distribution (2024): Fitbit (xx%), Apple (xx%), Samsung (xx%), Others (xx%)

- Average M&A Deal Value (2019-2024): xx Million

- Key Regulatory Bodies: FDA, HIPAA

North America Wearable Healthcare Devices Industry Industry Evolution

The North American wearable healthcare devices market has witnessed exponential growth from 2019 to 2024, with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors. Technological advancements, such as miniaturization of sensors, improved battery life, and enhanced data processing capabilities, have made wearable devices more user-friendly and effective. Simultaneously, consumer demand for convenient, accessible healthcare solutions is surging, fueled by increasing health awareness and the rise of telehealth. The COVID-19 pandemic significantly accelerated the adoption of remote patient monitoring solutions, highlighting the potential of wearable devices to improve healthcare access and outcomes. Growth is expected to continue at a CAGR of xx% from 2025 to 2033, driven by the increasing integration of artificial intelligence (AI) and machine learning (ML) in data analysis, leading to more accurate diagnoses and personalized treatment plans. Adoption of wearable devices is particularly high among the age group of 35-55, accounting for approximately xx% of total users. Further growth is anticipated through expansion into new applications, such as sleep monitoring and mental health management.

Leading Regions, Countries, or Segments in North America Wearable Healthcare Devices Industry

The United States dominates the North American wearable healthcare devices market, followed by Canada and Mexico. This dominance is driven by several factors:

United States: Higher healthcare expenditure, advanced healthcare infrastructure, and a strong focus on technological innovation. Robust venture capital investment fosters the development of new products and services within the sector. The presence of significant players and a large, tech-savvy consumer base further fuels market growth.

Canada: Government initiatives promoting telehealth and digital health, along with a well-developed healthcare system, contribute to market expansion.

Mexico: Growing healthcare awareness, increasing disposable income, and government investments in healthcare technology are driving gradual market expansion.

Dominant Segments:

By Device Type: Remote Patient Monitoring (RPM) devices show the fastest growth due to increasing demand for home-based healthcare solutions. Diagnostic devices are also gaining traction due to their ability to provide timely insights for quick medical interventions.

By Application: Remote Patient Monitoring and home healthcare are experiencing the strongest growth, driven by an aging population and rising demand for convenient care options.

By Product Type: Smartwatches dominate the market owing to their versatility and user-friendliness, followed by wristbands and other wearable devices.

North America Wearable Healthcare Devices Industry Product Innovations

Recent innovations focus on enhancing data accuracy, improving user comfort, and integrating AI and ML for advanced analytics. New devices are smaller, more durable, and offer improved features like continuous health monitoring and advanced biometric sensors. These improvements lead to better diagnostics, more proactive healthcare management, and personalized treatment plans. Key advancements involve seamless data integration with Electronic Health Records (EHR) systems and cloud-based platforms.

Propelling Factors for North America Wearable Healthcare Devices Industry Growth

Several key factors are driving market expansion:

Technological Advancements: Miniaturization, enhanced battery life, improved sensor accuracy, and AI-powered data analysis are key drivers.

Rising Healthcare Costs: Wearable devices offer cost-effective solutions for remote monitoring and preventative care.

Aging Population: The growing elderly population requires more extensive healthcare monitoring, increasing demand for wearable health tech.

Government Initiatives: Government support for telehealth and digital health initiatives further promotes adoption.

Obstacles in the North America Wearable Healthcare Devices Industry Market

Market growth faces certain challenges:

Regulatory Hurdles: FDA approval processes and data privacy regulations can slow down product development and market entry.

Data Security Concerns: Protecting sensitive patient data remains a significant concern impacting user adoption.

High Initial Costs: The high initial investment required for purchasing and implementing these devices may be a deterrent.

Future Opportunities in North America Wearable Healthcare Devices Industry

Emerging opportunities lie in:

Integration with AI and ML: Advanced analytics can enable early disease detection and personalized medicine.

Expansion into New Applications: Wearable devices are expanding into areas like mental health monitoring and sleep management.

Development of Affordable Devices: Making these devices more accessible to a wider population.

Major Players in the North America Wearable Healthcare Devices Industry Ecosystem

- Fitbit

- Xiaomi Inc

- Garmin Ltd

- LifeSense Group

- Samsung Electronics Co Ltd

- Koninklijke Philips NV

- Apple Inc

- Sotera Wireless

Key Developments in North America Wearable Healthcare Devices Industry Industry

November 2022: Ardent Health Services and BioIntelliSense launched a continuous patient monitoring initiative using the BioButton device, improving patient care and workflow efficiency.

March 2022: Biobeat's wearable remote patient monitoring device received FDA 510(k) clearance, expanding its monitoring capabilities.

Strategic North America Wearable Healthcare Devices Industry Market Forecast

The North American wearable healthcare devices market is poised for significant growth driven by technological innovation, increasing demand for remote patient monitoring, and the expanding scope of applications. The market is expected to witness robust expansion in the coming years, driven by the factors mentioned above, creating substantial opportunities for existing players and new entrants alike. This presents a considerable opportunity for companies in the healthcare technology space to invest in research and development, leading to more efficient and accessible healthcare solutions.

North America Wearable Healthcare Devices Industry Segmentation

-

1. Device Type

-

1.1. Diagnostic Devices

- 1.1.1. Vital Sign Monitoring Devices

- 1.1.2. Sleep Monitoring Devices

- 1.1.3. Electrocardiographs Fetal and Obstetric Devices

- 1.1.4. Neuromonitoring Devices

-

1.2. Therapeutic Devices

- 1.2.1. Pain Management Devices

- 1.2.2. Rehabilitation Devices

- 1.2.3. Respiratory Therapy Devices

- 1.2.4. Other Therapeutic Devices

-

1.1. Diagnostic Devices

-

2. Application

- 2.1. Sports and Fitness

- 2.2. Remote Patient Monitoring

- 2.3. Home Healthcare

-

3. Product Type

- 3.1. Wristband

- 3.2. Ear Wear

- 3.3. Other Product Types

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Wearable Healthcare Devices Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Wearable Healthcare Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements and Innovations; Increasing Incidence of Chronic Pain and Diabetes Patients; Ease of Use and Interpretation of Medical Devices

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices; Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Remote Patient Monitoring Segment is Expected to Witness A Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wearable Healthcare Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic Devices

- 5.1.1.1. Vital Sign Monitoring Devices

- 5.1.1.2. Sleep Monitoring Devices

- 5.1.1.3. Electrocardiographs Fetal and Obstetric Devices

- 5.1.1.4. Neuromonitoring Devices

- 5.1.2. Therapeutic Devices

- 5.1.2.1. Pain Management Devices

- 5.1.2.2. Rehabilitation Devices

- 5.1.2.3. Respiratory Therapy Devices

- 5.1.2.4. Other Therapeutic Devices

- 5.1.1. Diagnostic Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Fitness

- 5.2.2. Remote Patient Monitoring

- 5.2.3. Home Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Wristband

- 5.3.2. Ear Wear

- 5.3.3. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States North America Wearable Healthcare Devices Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Diagnostic Devices

- 6.1.1.1. Vital Sign Monitoring Devices

- 6.1.1.2. Sleep Monitoring Devices

- 6.1.1.3. Electrocardiographs Fetal and Obstetric Devices

- 6.1.1.4. Neuromonitoring Devices

- 6.1.2. Therapeutic Devices

- 6.1.2.1. Pain Management Devices

- 6.1.2.2. Rehabilitation Devices

- 6.1.2.3. Respiratory Therapy Devices

- 6.1.2.4. Other Therapeutic Devices

- 6.1.1. Diagnostic Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Sports and Fitness

- 6.2.2. Remote Patient Monitoring

- 6.2.3. Home Healthcare

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Wristband

- 6.3.2. Ear Wear

- 6.3.3. Other Product Types

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Canada North America Wearable Healthcare Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Diagnostic Devices

- 7.1.1.1. Vital Sign Monitoring Devices

- 7.1.1.2. Sleep Monitoring Devices

- 7.1.1.3. Electrocardiographs Fetal and Obstetric Devices

- 7.1.1.4. Neuromonitoring Devices

- 7.1.2. Therapeutic Devices

- 7.1.2.1. Pain Management Devices

- 7.1.2.2. Rehabilitation Devices

- 7.1.2.3. Respiratory Therapy Devices

- 7.1.2.4. Other Therapeutic Devices

- 7.1.1. Diagnostic Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Sports and Fitness

- 7.2.2. Remote Patient Monitoring

- 7.2.3. Home Healthcare

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Wristband

- 7.3.2. Ear Wear

- 7.3.3. Other Product Types

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Mexico North America Wearable Healthcare Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Diagnostic Devices

- 8.1.1.1. Vital Sign Monitoring Devices

- 8.1.1.2. Sleep Monitoring Devices

- 8.1.1.3. Electrocardiographs Fetal and Obstetric Devices

- 8.1.1.4. Neuromonitoring Devices

- 8.1.2. Therapeutic Devices

- 8.1.2.1. Pain Management Devices

- 8.1.2.2. Rehabilitation Devices

- 8.1.2.3. Respiratory Therapy Devices

- 8.1.2.4. Other Therapeutic Devices

- 8.1.1. Diagnostic Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Sports and Fitness

- 8.2.2. Remote Patient Monitoring

- 8.2.3. Home Healthcare

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Wristband

- 8.3.2. Ear Wear

- 8.3.3. Other Product Types

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. United States North America Wearable Healthcare Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Wearable Healthcare Devices Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Wearable Healthcare Devices Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Wearable Healthcare Devices Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Fitbit

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Xiaomi Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Garmin Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LifeSense Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Samsung Electronics Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Koninklijke Philips NV

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Apple Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sotera Wireless

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Fitbit

List of Figures

- Figure 1: North America Wearable Healthcare Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Wearable Healthcare Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 3: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 5: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Wearable Healthcare Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Wearable Healthcare Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Wearable Healthcare Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Wearable Healthcare Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 13: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 18: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 23: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Wearable Healthcare Devices Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wearable Healthcare Devices Industry?

The projected CAGR is approximately 15.79%.

2. Which companies are prominent players in the North America Wearable Healthcare Devices Industry?

Key companies in the market include Fitbit, Xiaomi Inc *List Not Exhaustive, Garmin Ltd, LifeSense Group, Samsung Electronics Co Ltd, Koninklijke Philips NV, Apple Inc, Sotera Wireless.

3. What are the main segments of the North America Wearable Healthcare Devices Industry?

The market segments include Device Type, Application, Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements and Innovations; Increasing Incidence of Chronic Pain and Diabetes Patients; Ease of Use and Interpretation of Medical Devices.

6. What are the notable trends driving market growth?

Remote Patient Monitoring Segment is Expected to Witness A Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices; Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

November 2022: Ardent Health Services and BioIntelliSense launched a new continuous patient monitoring initiative to empower clinicians with greater data-driven insights for patient care and to optimize clinical and operational workflow. Clinicians at Ardent's BSA Hospital in Amarillo, Texas, started using the BioButton wearable device and BioCloud analytics engine to automate the collection of inpatient vital signs in general care units and make both patients and clinicians happier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wearable Healthcare Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wearable Healthcare Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wearable Healthcare Devices Industry?

To stay informed about further developments, trends, and reports in the North America Wearable Healthcare Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence