Key Insights

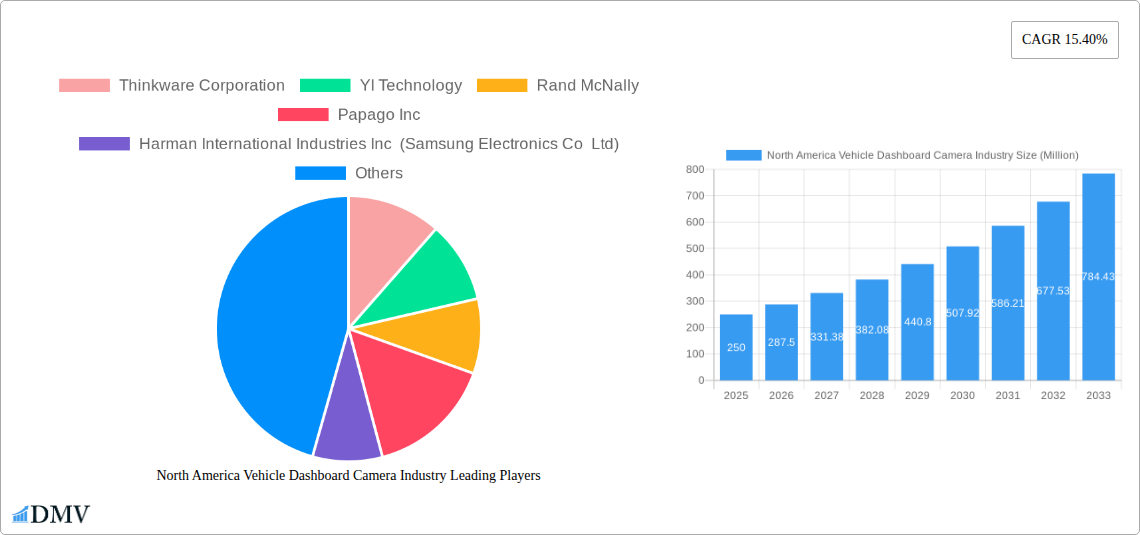

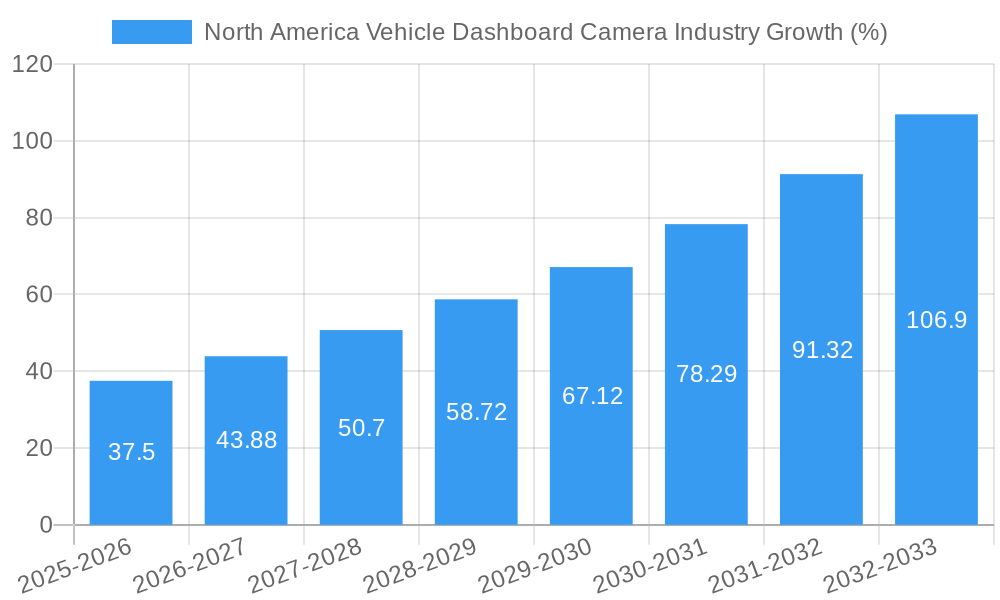

The North American vehicle dashboard camera (dashcam) market is experiencing robust growth, driven by increasing consumer awareness of road safety and the escalating need for evidence in accident claims. The market, valued at approximately $XX million in 2025 (assuming a logical estimate based on the provided CAGR of 15.40% and unspecified 2019 market size), is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by several key factors, including the rising affordability of advanced dashcams with features like 4K resolution, night vision, and GPS tracking. Furthermore, stringent traffic laws in certain regions are mandating dashcam usage in commercial fleets, significantly boosting demand. The market segmentation reveals a strong preference for smart dashcams over basic models due to their superior features and functionalities. Online distribution channels are witnessing faster growth compared to offline channels, reflecting the increasing adoption of e-commerce and the convenience it offers to consumers. The presence of established players like Garmin, BlackVue, and Thinkware, coupled with the emergence of innovative startups, ensures a highly competitive landscape, driving further innovation and price reductions.

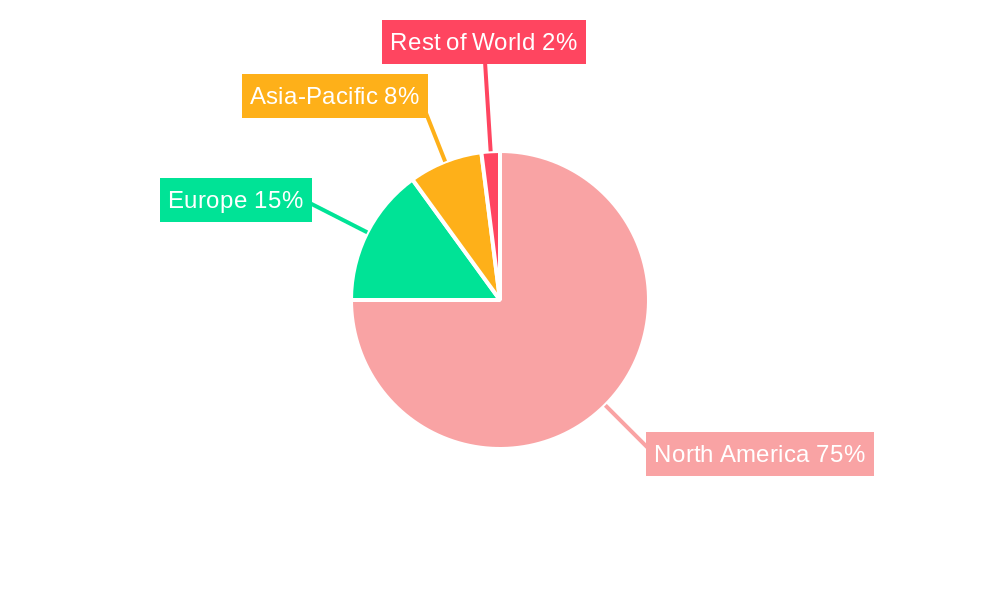

The United States currently dominates the North American dashcam market, driven by higher vehicle ownership and a comparatively advanced automotive technology adoption rate. Canada represents a substantial secondary market, exhibiting a steady growth trajectory mirroring the broader US trends. However, challenges remain, primarily in the form of privacy concerns and regulatory ambiguities surrounding dashcam footage usage. Nevertheless, the overarching positive market trends, coupled with ongoing technological advancements such as improved image processing and AI-powered features like driver monitoring, suggest a promising future for the North American vehicle dashcam industry. Future growth will likely be propelled by increasing integration with connected car technologies, expanding the functionalities and appeal of these devices. The focus on enhancing safety features and evidence collection capabilities will remain central to market expansion in the coming years.

North America Vehicle Dashboard Camera Industry Market Composition & Trends

This comprehensive report delivers an in-depth analysis of the North America vehicle dashboard camera market, encompassing the period from 2019 to 2033. The study meticulously examines market concentration, revealing a moderately fragmented landscape with key players like Thinkware Corporation, Garmin Ltd, and BlackVue (Pittasoft Co Ltd) vying for market share. We analyze innovation catalysts, including advancements in AI-powered video analytics and cloud connectivity, which are driving demand for smart dash cams. The regulatory landscape, particularly concerning data privacy and road safety regulations, is also thoroughly evaluated, highlighting its impact on market growth. The report also considers substitute products, such as in-car telematics systems, and assesses their potential impact. Finally, an analysis of end-user profiles (e.g., private car owners, commercial fleets, ride-sharing services) and a review of recent mergers and acquisitions (M&A) activities, including deal values (estimated at xx Million), completes the picture. The market share distribution amongst the top five players in 2025 is estimated at approximately xx%.

- Market Concentration: Moderately fragmented, with top players holding xx% market share in 2025.

- Innovation Catalysts: AI-powered video analytics, cloud connectivity, improved image sensors.

- Regulatory Landscape: Impact of data privacy regulations and road safety standards.

- Substitute Products: In-car telematics systems, connected car services.

- End-User Profiles: Private car owners, commercial fleets, ride-sharing services.

- M&A Activities: xx Million in deal values observed between 2019 and 2024.

North America Vehicle Dashboard Camera Industry Industry Evolution

The North American vehicle dashboard camera market has witnessed significant evolution during the study period (2019-2024). From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven by increasing consumer awareness of road safety, rising affordability of dash cams, and the proliferation of connected car features. Technological advancements, such as the integration of 4K video recording, night vision capabilities, and GPS tracking, have played a significant role in market growth. The shift in consumer demand towards smart dash cams with advanced features such as cloud storage, mobile app integration, and driver behavior monitoring is shaping the industry's trajectory. Furthermore, the growing adoption of dash cams by commercial fleets and ride-sharing services contributes to market expansion. The forecast period (2025-2033) projects a CAGR of xx%, driven by continuous technological innovation and escalating demand from various user segments. Adoption rates for smart dash cams are projected to increase from xx% in 2025 to xx% by 2033.

Leading Regions, Countries, or Segments in North America Vehicle Dashboard Camera Industry

The United States dominates the North American vehicle dashboard camera market, accounting for approximately xx% of the total market revenue in 2025. This dominance is primarily driven by the high vehicle ownership rates, strong consumer preference for advanced driver-assistance systems, and increasing awareness regarding road safety.

- United States: High vehicle ownership, strong consumer demand for safety features, advanced technological adoption.

- Canada: Lower vehicle ownership compared to the US; however, increasing adoption driven by safety concerns and government initiatives.

- Smart Dash Cams: The smart dash cam segment leads in terms of revenue and growth, driven by feature-rich capabilities.

- Online Distribution: The online distribution channel is rapidly expanding, driven by e-commerce growth and convenience.

Dominance Factors:

The US market's dominance stems from higher disposable incomes, a larger consumer base, and increased awareness of road safety and personal security. This leads to higher demand for advanced dash cam features, driving segment growth. The online distribution channel is growing faster than the offline channel due to its convenience and broader reach.

North America Vehicle Dashboard Camera Industry Product Innovations

Recent innovations in the North American vehicle dashboard camera market include the integration of AI-powered features such as driver behavior analysis, automatic incident detection, and advanced driver-assistance systems (ADAS). High-resolution video recording capabilities, improved night vision, and cloud connectivity for seamless video storage and sharing are also key features enhancing product appeal. These innovations offer unique selling propositions such as enhanced road safety, evidence capture for insurance claims, and improved fleet management capabilities. The focus is increasingly on providing a comprehensive, integrated solution that addresses multiple needs of consumers and businesses.

Propelling Factors for North America Vehicle Dashboard Camera Industry Growth

Several factors are driving the growth of the North American vehicle dashboard camera market. Technological advancements, including higher resolution cameras, wider field-of-view lenses, and AI-powered features, are attracting consumers. Economic factors, such as increasing affordability of dash cams and the growing adoption of connected car technologies, contribute to market expansion. Moreover, supportive government regulations promoting road safety and initiatives encouraging the use of dash cams as evidence in accident investigations are bolstering market growth. For instance, insurance companies often offer discounts for drivers with dash cams, incentivizing adoption.

Obstacles in the North America Vehicle Dashboard Camera Industry Market

Despite the positive growth trajectory, the North American vehicle dashboard camera market faces challenges. Concerns around data privacy and potential misuse of recorded footage could hinder wider adoption. Supply chain disruptions and the rising cost of components can impact production and pricing. Furthermore, intense competition among numerous players, particularly from Chinese manufacturers offering lower-priced alternatives, puts pressure on margins and necessitates continuous innovation to maintain a competitive edge. This competitive landscape has reduced profit margins by an estimated xx% in the past year.

Future Opportunities in North America Vehicle Dashboard Camera Industry

Future opportunities lie in the expansion into new market segments, such as the trucking and commercial fleet sectors, which require robust and durable dash cam systems. The integration of advanced ADAS features and the development of sophisticated AI-powered analytics are poised to create new avenues for growth. Furthermore, increasing consumer awareness of data privacy and the demand for secure video storage solutions present an opportunity for companies to develop innovative products and services that address these concerns. The rising adoption of electric vehicles and the increasing emphasis on sustainable transportation also offer opportunities to create specialized dash cam solutions for this rapidly expanding market segment.

Major Players in the North America Vehicle Dashboard Camera Industry Ecosystem

- Thinkware Corporation

- YI Technology

- Rand McNally

- Papago Inc

- Harman International Industries Inc (Samsung Electronics Co Ltd)

- BlackVue (Pittasoft Co Ltd)

- Transcend Information Inc

- Garmin Ltd (Garmin)

- HP Inc

- Cobra Electronics Corporation (Cedar Electronics Holdings Corp)

- Waylens Inc

- LG Innotek

- Nextbase

- Panasonic Corporation

Key Developments in North America Vehicle Dashboard Camera Industry Industry

- August 2022: Garmin International, Inc. launched the Garmin Drivecam 76 and RVcam 795, all-in-one navigators with integrated HD dash cameras.

- August 2022: Nextbase Dash Cams partnered with Grubhub to enhance driver safety and security, providing a dash cam support program.

These developments demonstrate the industry's focus on integrating dash cams into broader navigation and fleet management solutions. The Grubhub partnership highlights the growing demand for dash cam solutions in the ride-sharing and delivery sectors.

Strategic North America Vehicle Dashboard Camera Industry Market Forecast

The North American vehicle dashboard camera market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and increasing regulatory support. Future opportunities will be shaped by the integration of advanced AI and cloud-based technologies, creating intelligent dash cam systems capable of providing comprehensive driver insights and enhancing road safety. The market is expected to reach xx Million by 2033, demonstrating a significant increase from its 2025 valuation. This growth will be underpinned by rising consumer awareness, increasing adoption in commercial fleets, and the integration of dash cam technology into broader vehicle safety and telematics solutions.

North America Vehicle Dashboard Camera Industry Segmentation

-

1. Technology

- 1.1. Basic

- 1.2. Smart

-

2. Distribution Channel

- 2.1. Offline

- 2.2. Online

North America Vehicle Dashboard Camera Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Vehicle Dashboard Camera Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Driver Safety Coupled With Growing Acceptance of Dashboard Footage as Evidence in Court of Law; Technological Advancements in Smart Dashboard Camera Segment Driving Adoption in the United States; Declining Unit Prices in the Region

- 3.3. Market Restrains

- 3.3.1. High System Cost and Lack of Supporting Infrastructure in Developing Countries

- 3.4. Market Trends

- 3.4.1. Dual-channel Dashboard Camera to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vehicle Dashboard Camera Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Basic

- 5.1.2. Smart

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Vehicle Dashboard Camera Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Vehicle Dashboard Camera Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Vehicle Dashboard Camera Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Vehicle Dashboard Camera Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Thinkware Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 YI Technology

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rand McNally

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Papago Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Harman International Industries Inc (Samsung Electronics Co Ltd)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BlackVue (Pittasoft Co Ltd)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Transcend Information Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Garmin Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 HP Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Cobra Electronics Corporation (Cedar Electronics Holdings Corp )

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Waylens Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LG Innotek

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Nextbase

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Panasonic Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Thinkware Corporation

List of Figures

- Figure 1: North America Vehicle Dashboard Camera Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Vehicle Dashboard Camera Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Vehicle Dashboard Camera Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Vehicle Dashboard Camera Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: North America Vehicle Dashboard Camera Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Vehicle Dashboard Camera Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Vehicle Dashboard Camera Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Vehicle Dashboard Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Vehicle Dashboard Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Vehicle Dashboard Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Vehicle Dashboard Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Vehicle Dashboard Camera Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 11: North America Vehicle Dashboard Camera Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: North America Vehicle Dashboard Camera Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Vehicle Dashboard Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Vehicle Dashboard Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Vehicle Dashboard Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vehicle Dashboard Camera Industry?

The projected CAGR is approximately 15.40%.

2. Which companies are prominent players in the North America Vehicle Dashboard Camera Industry?

Key companies in the market include Thinkware Corporation, YI Technology, Rand McNally, Papago Inc, Harman International Industries Inc (Samsung Electronics Co Ltd), BlackVue (Pittasoft Co Ltd), Transcend Information Inc, Garmin Ltd, HP Inc, Cobra Electronics Corporation (Cedar Electronics Holdings Corp ), Waylens Inc, LG Innotek, Nextbase, Panasonic Corporation.

3. What are the main segments of the North America Vehicle Dashboard Camera Industry?

The market segments include Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Driver Safety Coupled With Growing Acceptance of Dashboard Footage as Evidence in Court of Law; Technological Advancements in Smart Dashboard Camera Segment Driving Adoption in the United States; Declining Unit Prices in the Region.

6. What are the notable trends driving market growth?

Dual-channel Dashboard Camera to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High System Cost and Lack of Supporting Infrastructure in Developing Countries.

8. Can you provide examples of recent developments in the market?

August 2022 -Garmin International, Inc., a unit of Garmin Ltd, announced the Garmin Drivecam 76 and RVcam 795 all-in-one navigators with a built-in, high-definition dash camera. Both models feature a sharp 7-inch display, 1080p HD video recording, and a wide 140-degree field of view to capture a broad picture of the road ahead. Once plugged in, the camera continually records and saves video of detected incidents, serving as an eyewitness behind the wheel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vehicle Dashboard Camera Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vehicle Dashboard Camera Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vehicle Dashboard Camera Industry?

To stay informed about further developments, trends, and reports in the North America Vehicle Dashboard Camera Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence