Key Insights

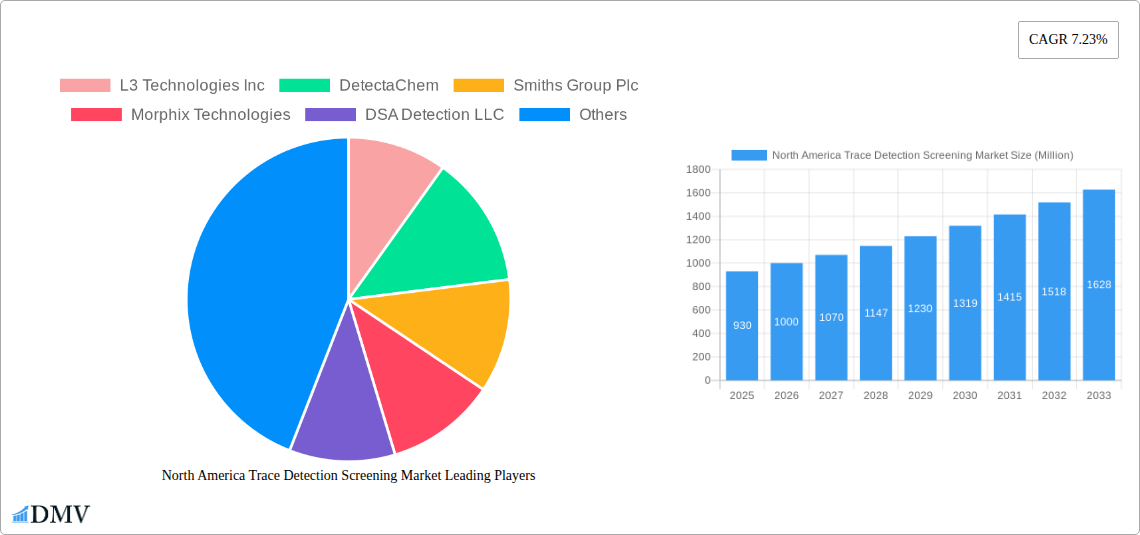

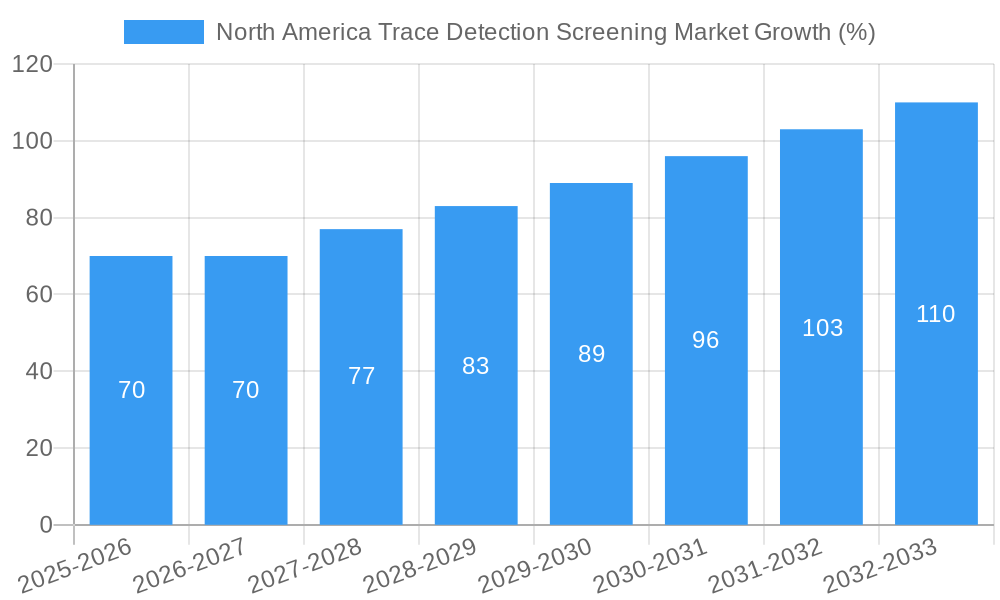

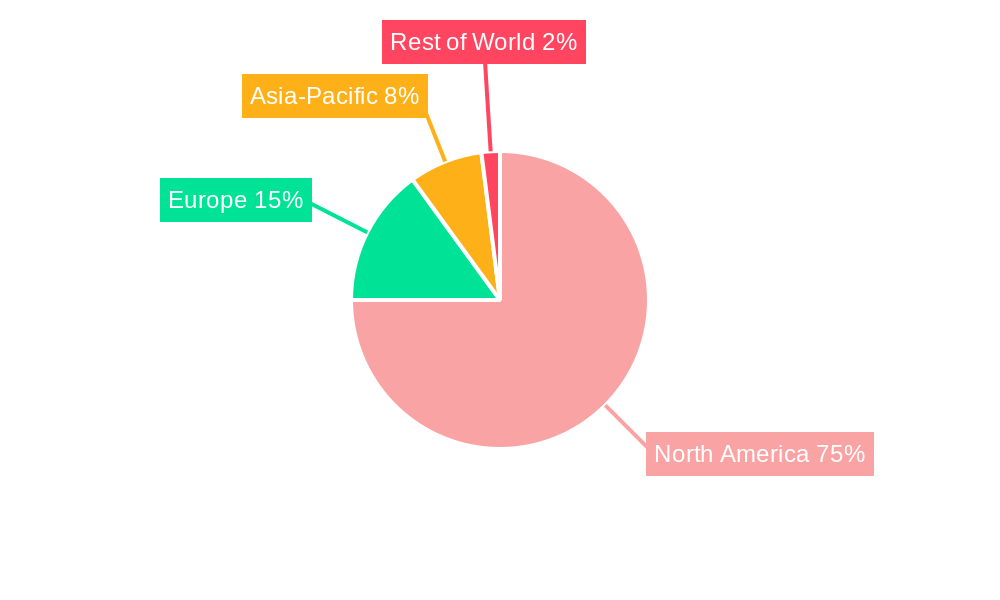

The North America trace detection screening market, valued at $0.93 billion in 2025, is projected to experience robust growth, driven by escalating security concerns and the increasing adoption of advanced technologies across various sectors. The market's Compound Annual Growth Rate (CAGR) of 7.23% from 2025 to 2033 indicates a significant expansion in market size over the forecast period. Key drivers include the rising need for enhanced security at airports, seaports, border crossings, and public venues, coupled with stricter government regulations and increased terrorist threats. Technological advancements in trace detection technologies, such as improved sensitivity and faster detection times, further contribute to market growth. The increasing adoption of handheld and portable devices for on-site screening, as opposed to solely relying on fixed systems, signifies a growing preference for flexible and easily deployable solutions. The market is segmented by end-user industry (commercial, military & defense, law enforcement, ports & borders, public safety, and others), type (explosives and narcotics), and product (handheld, portable/movable, and fixed). The North American region, particularly the United States and Canada, dominates the market, owing to substantial investments in homeland security and robust technological infrastructure.

Market segmentation reveals that the explosives detection segment is currently larger, but the narcotics detection segment is projected to exhibit faster growth due to the increasing prevalence of drug trafficking and associated security threats. The handheld and portable product segments are expected to witness higher growth compared to the fixed systems segment due to their versatility and ease of use in diverse settings. While factors like high initial investment costs and the potential for false positives pose some restraints, the overall market outlook remains optimistic. Continuous innovation in sensor technologies, improved data analytics capabilities, and the development of more user-friendly systems will likely overcome these challenges and drive continued market expansion throughout the forecast period. Competition is intense among established players like L3 Technologies Inc., Smiths Group Plc., and Rapiscan Systems Inc., as well as emerging companies focused on innovative solutions. This competitive landscape fosters innovation and the development of increasingly sophisticated and effective trace detection screening technologies.

North America Trace Detection Screening Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America trace detection screening market, offering valuable insights for stakeholders across the security, defense, and commercial sectors. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The market is expected to reach xx Million by 2033, demonstrating substantial growth potential. This report meticulously analyzes market trends, competitive dynamics, and future opportunities, providing a roadmap for strategic decision-making.

North America Trace Detection Screening Market Composition & Trends

The North America trace detection screening market is characterized by a moderately concentrated landscape, with key players such as L3 Technologies Inc, Smiths Group Plc, and Bruker Corporation holding significant market share. However, the market also features several smaller, specialized players, fostering innovation and competition. Market share distribution is currently estimated at xx% for the top three players in 2025, with the remainder distributed amongst other participants. The market is driven by escalating security concerns, stringent regulatory frameworks, and the continuous advancement of detection technologies.

- Market Concentration: Moderately concentrated, with top players controlling xx% of the market in 2025.

- Innovation Catalysts: Stringent regulatory requirements and the need for enhanced security measures.

- Regulatory Landscape: Increasingly stringent regulations driving adoption of advanced screening technologies.

- Substitute Products: Limited viable substitutes, enhancing market growth.

- End-User Profiles: Diverse, including government agencies, commercial entities, and transportation hubs.

- M&A Activities: Moderate M&A activity observed in recent years, with deal values averaging approximately xx Million per transaction in the historical period (2019-2024).

North America Trace Detection Screening Market Industry Evolution

The North America trace detection screening market has witnessed consistent growth throughout the historical period (2019-2024), fueled by rising security concerns post-2001, increasing terrorist threats, and the need for efficient screening at borders and transportation hubs. Technological advancements, particularly in the areas of sensitivity, speed, and portability of detection devices, have significantly enhanced the market's appeal. Consumer demand is shifting towards more user-friendly, rapid, and accurate detection technologies, pushing manufacturers to innovate and develop sophisticated solutions. The market is projected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing adoption across various end-user segments. The shift toward advanced technologies like Raman spectroscopy and mass spectrometry is further accelerating this growth.

Leading Regions, Countries, or Segments in North America Trace Detection Screening Market

The United States dominates the North America trace detection screening market, accounting for xx% of the total market value in 2025, primarily driven by higher security spending and the presence of major industry players. Canada, while a smaller market, displays steady growth potential, with a projected CAGR of xx% during the forecast period.

- By End-User Industry:

- Law Enforcement: Strongest segment due to increasing crime rates and the need for effective narcotics and explosive detection.

- Ports and Borders: Significant growth potential due to heightened security measures at entry points.

- Military and Defense: High investment in advanced detection technologies for homeland security applications.

- By Country:

- United States: Largest market due to high security budgets and widespread adoption.

- Canada: Growing steadily, driven by infrastructure upgrades and security investments.

- By Type:

- Explosives: Remains the largest segment driven by security concerns related to terrorism.

- Narcotics: Steady growth due to the ongoing fight against drug trafficking.

- By Product:

- Handheld: High demand due to portability and ease of use.

- Portable/Movable: Increasing adoption for flexible deployment in various locations.

- Fixed: Significant installations in high-security areas like airports and border crossings. Key drivers include increasing government investments in security infrastructure, stringent regulatory standards, and rising awareness regarding security threats.

North America Trace Detection Screening Market Product Innovations

Recent innovations focus on enhancing the speed, accuracy, and portability of trace detection systems. Handheld devices incorporating advanced technologies like Raman spectroscopy offer rapid identification of narcotics and explosives. Portable/movable units are becoming more sophisticated, while fixed systems are incorporating improved sensitivity and automation features. Unique selling propositions include reduced false positives, ease of use, and improved detection limits. The integration of AI and machine learning is poised to further revolutionize the industry, enhancing both speed and accuracy.

Propelling Factors for North America Trace Detection Screening Market Growth

Several factors are driving market growth, including increased government spending on security and defense, stringent regulations on transportation security, rising cross-border trade requiring heightened screening measures, and technological advancements such as improved sensitivity and faster detection times. The adoption of AI and machine learning for faster and more accurate results further enhances growth.

Obstacles in the North America Trace Detection Screening Market

The market faces challenges such as high initial investment costs for advanced technologies, the need for skilled personnel to operate sophisticated equipment, and potential supply chain disruptions impacting the availability of components. Competition from established players and emerging companies poses another hurdle.

Future Opportunities in North America Trace Detection Screening Market

Emerging opportunities include the integration of IoT and cloud technologies for improved data management and analysis, the development of more portable and user-friendly devices, and expanding into new markets like private sector security applications. The market is poised for significant expansion due to evolving security needs and technological innovations.

Major Players in the North America Trace Detection Screening Market Ecosystem

- L3 Technologies Inc

- DetectaChem

- Smiths Group Plc

- Morphix Technologies

- DSA Detection LLC

- Rapiscan Systems Inc

- Leidos Holdings Inc

- Westminster Group PL

- Autoclear LLC

- Bruker Corporation

- Teledyne FLIR LLC

Key Developments in North America Trace Detection Screening Market Industry

- September 2023: Rigaku Analytical Devices launched the handheld CQL Narc-ID 1064 nm Raman analyzer, enhancing narcotics detection capabilities.

- August 2023: Smiths Detection's IONSCAN 600 ETD received Qualified Technology designation on the Air Cargo Screening Technology List, boosting its market position.

Strategic North America Trace Detection Screening Market Forecast

The North America trace detection screening market is poised for sustained growth over the forecast period, driven by persistent security concerns, continuous technological advancements, and increasing government investments. The integration of AI, enhanced portability of devices, and expansion into new application areas will unlock significant market potential. The market is projected to experience robust growth, with substantial opportunities for both established players and new entrants.

North America Trace Detection Screening Market Segmentation

-

1. Type

- 1.1. Explosive

- 1.2. Narcotics

-

2. Product

- 2.1. Handheld

- 2.2. Portable/Movable

- 2.3. Fixed

-

3. End-User Industry

- 3.1. Commercial

- 3.2. Military and Defense

- 3.3. Law Enforcement

- 3.4. Ports and Borders

- 3.5. Public Safety

- 3.6. Other End-user Industries

North America Trace Detection Screening Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Trace Detection Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Upsurge in Terrorist Activities Across the Region; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. Upsurge in Terror Activities Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosive

- 5.1.2. Narcotics

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Handheld

- 5.2.2. Portable/Movable

- 5.2.3. Fixed

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Commercial

- 5.3.2. Military and Defense

- 5.3.3. Law Enforcement

- 5.3.4. Ports and Borders

- 5.3.5. Public Safety

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Trace Detection Screening Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 L3 Technologies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DetectaChem

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Smiths Group Plc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Morphix Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DSA Detection LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Rapiscan Systems Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Leidos Holdings Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Westminster Group PL

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Autoclear LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bruker Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Teledyne FLIR LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 L3 Technologies Inc

List of Figures

- Figure 1: North America Trace Detection Screening Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Trace Detection Screening Market Share (%) by Company 2024

List of Tables

- Table 1: North America Trace Detection Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: North America Trace Detection Screening Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: North America Trace Detection Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Trace Detection Screening Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Trace Detection Screening Market Revenue Million Forecast, by Product 2019 & 2032

- Table 13: North America Trace Detection Screening Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 14: North America Trace Detection Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Trace Detection Screening Market?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the North America Trace Detection Screening Market?

Key companies in the market include L3 Technologies Inc, DetectaChem, Smiths Group Plc, Morphix Technologies, DSA Detection LLC, Rapiscan Systems Inc, Leidos Holdings Inc, Westminster Group PL, Autoclear LLC, Bruker Corporation, Teledyne FLIR LLC.

3. What are the main segments of the North America Trace Detection Screening Market?

The market segments include Type, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Upsurge in Terrorist Activities Across the Region; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening.

6. What are the notable trends driving market growth?

Upsurge in Terror Activities Across the Region.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

September 2023: Rigaku Analytical Devices announced the launch of the handheld CQL Narc-ID 1064 nm Raman analyzer. This device is designed for the presumptive identification of narcotics, precursor chemicals, and cutting agents, even in non-visible amounts, with the optional QuickDetect feature. It is intended for use by counter-narcotics agencies, law enforcement, crime laboratories, prison facilities, customs agencies, and public safety efforts. The CQL Narc-ID aims to directly impact the protection of communities from dangerous chemicals that are prevalent in the illicit drug supply market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Trace Detection Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Trace Detection Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Trace Detection Screening Market?

To stay informed about further developments, trends, and reports in the North America Trace Detection Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence