Key Insights

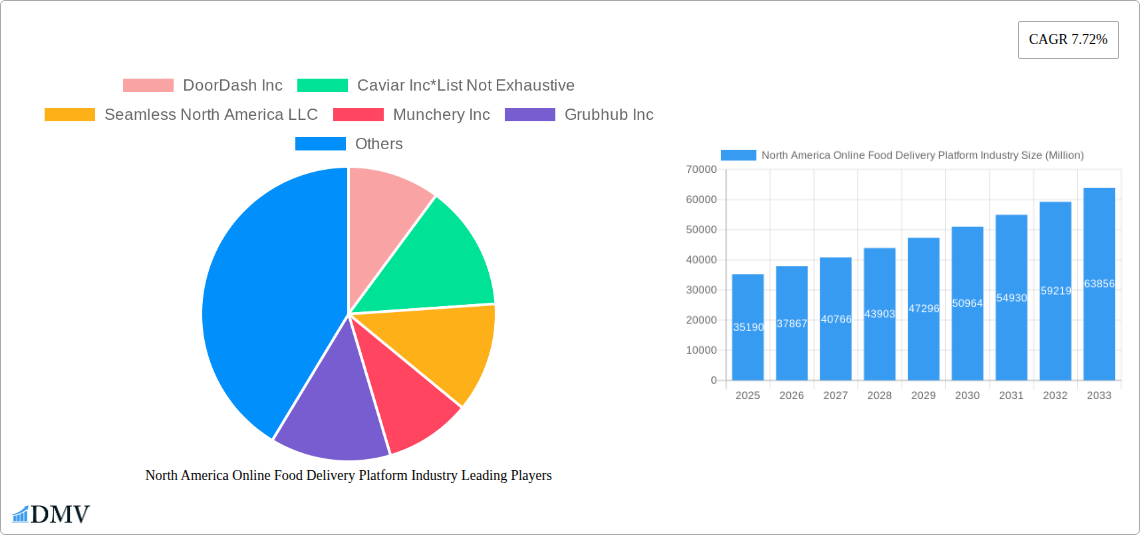

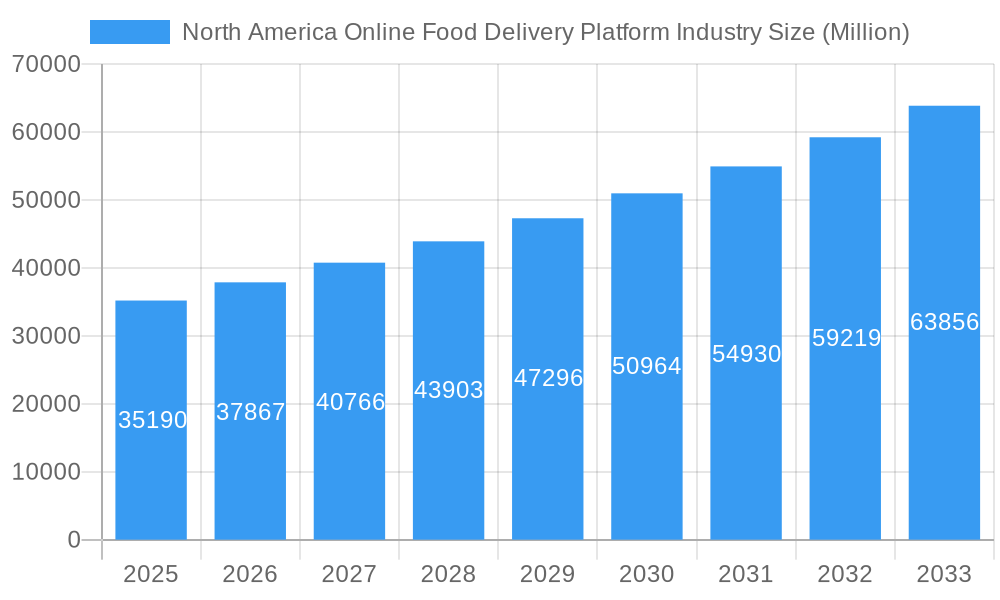

The North American online food delivery platform industry is experiencing robust growth, projected to reach a market size of $35.19 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.72% from 2025 to 2033. This expansion is driven by several key factors. Increasing smartphone penetration and internet access have broadened the market's reach, making online ordering convenient for a larger consumer base. The rise of busy lifestyles and the increasing demand for convenience are significant contributing factors. Furthermore, innovative features like real-time order tracking, diverse restaurant options, and loyalty programs are enhancing the user experience and driving platform adoption. The competitive landscape, characterized by established players like DoorDash, Grubhub, and Uber Eats, alongside emerging companies, fosters continuous innovation and service improvements. Expansion into smaller cities and towns, coupled with strategic partnerships with restaurants and grocery stores, is further fueling market growth.

North America Online Food Delivery Platform Industry Market Size (In Billion)

However, the industry faces challenges. Operational costs, including delivery fees and driver compensation, significantly impact profitability. Maintaining food quality and hygiene throughout the delivery process is paramount, requiring robust quality control measures. Regulatory hurdles, such as licensing and permits, vary across different regions, adding complexity to operations. Competition for market share among established and emerging players is intense. Finally, consumer concerns about data privacy and security need to be addressed to maintain trust and user engagement. Despite these challenges, the long-term outlook for the North American online food delivery platform industry remains positive, fueled by consistent technological advancements and changing consumer preferences. The market's geographic expansion into underserved regions, further diversification of restaurant and cuisine options, and strategic investments in technological infrastructure are expected to drive sustained growth.

North America Online Food Delivery Platform Industry Company Market Share

North America Online Food Delivery Platform Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the North America online food delivery platform industry, offering a comprehensive overview of market trends, competitive dynamics, and future growth prospects. The study covers the historical period (2019-2024), base year (2025), and forecasts until 2033, providing stakeholders with valuable insights for strategic decision-making. The market is segmented by country (United States and Canada), offering a granular understanding of regional variations. The total market value in 2025 is estimated at XX Million, with a projected value of YY Million by 2033.

North America Online Food Delivery Platform Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the North American online food delivery industry. We analyze market concentration, highlighting the leading players and their respective market share. Furthermore, the report delves into the impact of mergers and acquisitions (M&A), including significant deals like DoorDash's USD 8 Billion acquisition of Wolt Enterprises in November 2021.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players controlling a significant share. Further analysis reveals a dynamic competitive environment with ongoing consolidation.

- Innovation Catalysts: Technological advancements such as improved delivery logistics, AI-powered recommendation systems, and contactless delivery options are key innovation drivers.

- Regulatory Landscape: Varying regulations across states/provinces impact operational costs and market access. Future regulatory changes will be assessed for their potential effect on market growth.

- Substitute Products: Competition from traditional food takeout and grocery delivery services represents a key challenge. This report quantifies the market share of these substitute products.

- End-User Profiles: Detailed profiling of customer segments (e.g., demographics, ordering frequency, preferred cuisines) reveals insights into consumer behavior and preferences.

- M&A Activities: The report analyzes completed and potential M&A deals, evaluating their impact on market consolidation and competitive dynamics. Key examples include the DoorDash-Wolt acquisition and other significant deals, quantifying their values (in Millions) and influence on market share distribution. The total value of M&A deals within the studied period is estimated at ZZ Million.

North America Online Food Delivery Platform Industry Industry Evolution

This section analyzes the evolution of the North American online food delivery market, tracing its growth trajectory from 2019 to 2024 and projecting its future development until 2033. We examine the impact of technological advancements, evolving consumer preferences, and external factors such as the COVID-19 pandemic on market growth. The report presents detailed data points including Compound Annual Growth Rates (CAGR) for specific periods and adoption metrics for key technologies. Factors like increasing smartphone penetration, changing lifestyles, and the rise of on-demand services significantly impact market growth. The pandemic accelerated market expansion, with Uber Eats seeing substantial growth due to increased demand for contactless delivery (June 2021). We will outline the long-term implications of these trends and their influence on market segmentation.

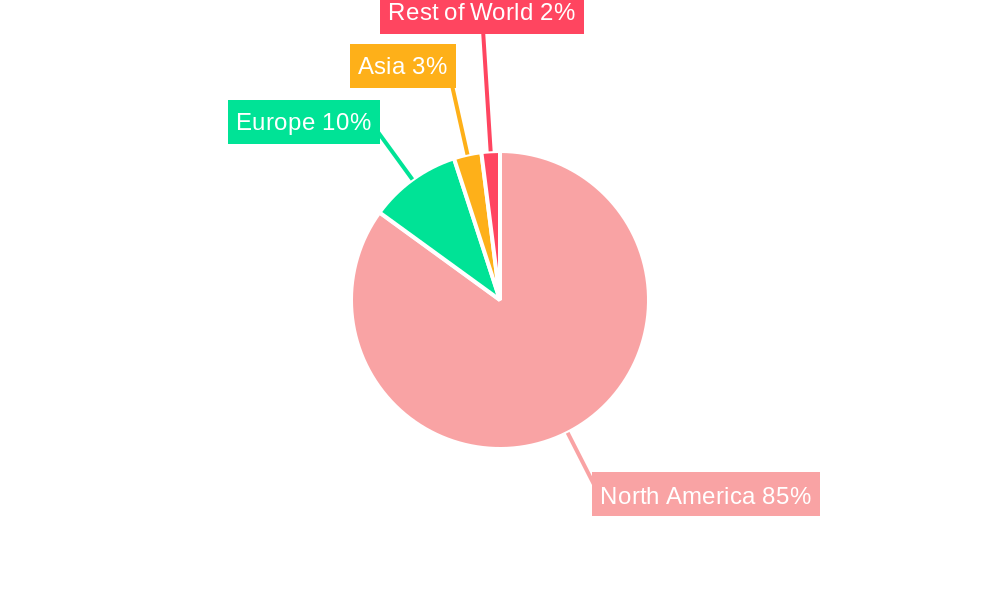

Leading Regions, Countries, or Segments in North America Online Food Delivery Platform Industry

This report identifies the dominant regions and countries within the North American online food delivery market. The United States and Canada are analyzed separately, revealing key market drivers and challenges unique to each.

- United States: The US dominates the market due to high smartphone penetration, robust consumer spending, and a dense network of restaurants and delivery drivers.

- Key Drivers: High disposable income, strong e-commerce adoption, and favorable regulatory environments in specific states stimulate significant investment in the industry.

- Canada: While smaller than the US market, Canada demonstrates robust growth potential driven by increasing urbanization and the adoption of online ordering platforms.

- Key Drivers: Increasing urbanization, rising disposable incomes, and government initiatives supporting digital infrastructure are driving market growth in Canada.

The dominance of the US market is primarily attributed to its larger population base, higher per capita income, and greater technological infrastructure. However, Canada presents a significant growth opportunity due to its increasing adoption of online ordering and delivery services.

North America Online Food Delivery Platform Industry Product Innovations

Recent innovations include advanced algorithms for efficient route optimization, integration with various payment gateways, expansion into grocery and prescription delivery, and the use of AI-powered chatbot assistance for customer service. This has led to improvements in delivery speed, customer satisfaction, and operational efficiency. Companies are increasingly focusing on unique selling propositions such as specialized delivery options (e.g., cold chain delivery for groceries), personalized recommendations, and loyalty programs to enhance customer engagement.

Propelling Factors for North America Online Food Delivery Platform Industry Growth

Several factors fuel the growth of this industry. Technological advancements, such as improved GPS tracking and route optimization software, directly enhance delivery efficiency and reduce costs. The expanding middle class and its growing preference for convenience are key economic drivers. Finally, supportive regulatory environments in certain regions facilitate market expansion.

Obstacles in the North America Online Food Delivery Platform Industry Market

The industry faces challenges, including intense competition leading to price wars and reduced profit margins. Supply chain disruptions, particularly impacting restaurant operations and delivery services, can affect overall market efficiency. Additionally, evolving regulations regarding food safety and delivery driver classification present significant hurdles.

Future Opportunities in North America Online Food Delivery Platform Industry

Future opportunities include expanding into underserved markets, leveraging advanced technologies such as drone delivery, and integrating with other services (e.g., grocery delivery, on-demand healthcare). The increasing demand for healthy and sustainable food options also presents opportunities for specialized delivery services.

Major Players in the North America Online Food Delivery Platform Industry Ecosystem

- DoorDash Inc

- Uber Technologies Inc (Uber Eats)

- Grubhub Inc

- Caviar Inc

- Seamless North America LLC

- Munchery Inc

- ChowNow

- goBrands Inc (goPuff Delivery)

Key Developments in North America Online Food Delivery Platform Industry Industry

- November 2021: DoorDash Inc. acquires Wolt Enterprises Oy for approximately USD 8 Billion, significantly expanding its global presence and market share. This acquisition reflects the ongoing consolidation in the industry.

- June 2021: Uber's Uber Eats business demonstrates strong growth, driven by the increased demand for food delivery during the COVID-19 pandemic.

Strategic North America Online Food Delivery Platform Industry Market Forecast

The North American online food delivery market is poised for continued expansion, driven by increasing smartphone penetration, evolving consumer preferences, and technological innovation. The market is projected to experience substantial growth over the forecast period (2025-2033), presenting significant opportunities for established players and new entrants. However, navigating challenges such as regulatory changes and intense competition will be crucial for sustained success.

North America Online Food Delivery Platform Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Online Food Delivery Platform Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Online Food Delivery Platform Industry Regional Market Share

Geographic Coverage of North America Online Food Delivery Platform Industry

North America Online Food Delivery Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration and Surge in Internet Penetration; Launch of Appealing and User-friendly Apps

- 3.3. Market Restrains

- 3.3.1. Uncertain Regulatory Standards and Frameworks

- 3.4. Market Trends

- 3.4.1. Rise of Mobile Penetration in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Food Delivery Platform Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DoorDash Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caviar Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Seamless North America LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Munchery Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grubhub Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ChowNow

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 goBrands Inc (goPuff Delivery)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Uber Technologies Inc (UberEats)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 DoorDash Inc

List of Figures

- Figure 1: North America Online Food Delivery Platform Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Food Delivery Platform Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Food Delivery Platform Industry?

The projected CAGR is approximately 7.72%.

2. Which companies are prominent players in the North America Online Food Delivery Platform Industry?

Key companies in the market include DoorDash Inc, Caviar Inc*List Not Exhaustive, Seamless North America LLC, Munchery Inc, Grubhub Inc, ChowNow, goBrands Inc (goPuff Delivery), Uber Technologies Inc (UberEats).

3. What are the main segments of the North America Online Food Delivery Platform Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration and Surge in Internet Penetration; Launch of Appealing and User-friendly Apps.

6. What are the notable trends driving market growth?

Rise of Mobile Penetration in North America.

7. Are there any restraints impacting market growth?

Uncertain Regulatory Standards and Frameworks.

8. Can you provide examples of recent developments in the market?

November 2021 - DoorDash Inc., DoorDash Inc said it's buying Finnish food-delivery startup Wolt Enterprises Oy for about USD 8 billion. The biggest meal-delivery service in the U.S. said it's buying Finnish food-delivery startup Wolt Enterprises Oy for about $8 billion as it seeks to stay ahead of rivals in the race to satisfy soaring demand for the fast delivery of everything from food to prescriptions and pet supplies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Food Delivery Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Food Delivery Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Food Delivery Platform Industry?

To stay informed about further developments, trends, and reports in the North America Online Food Delivery Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence