Key Insights

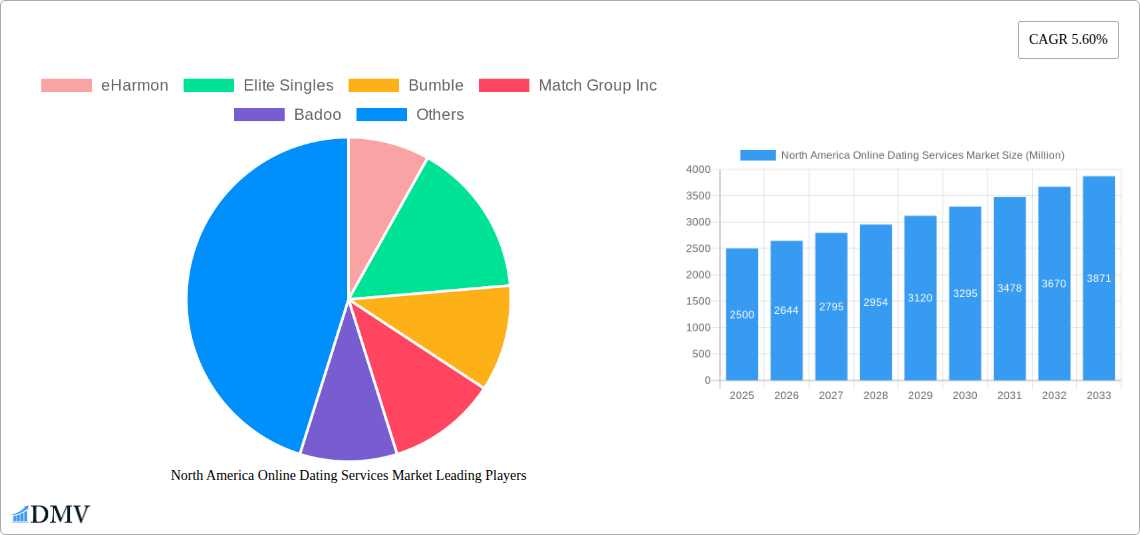

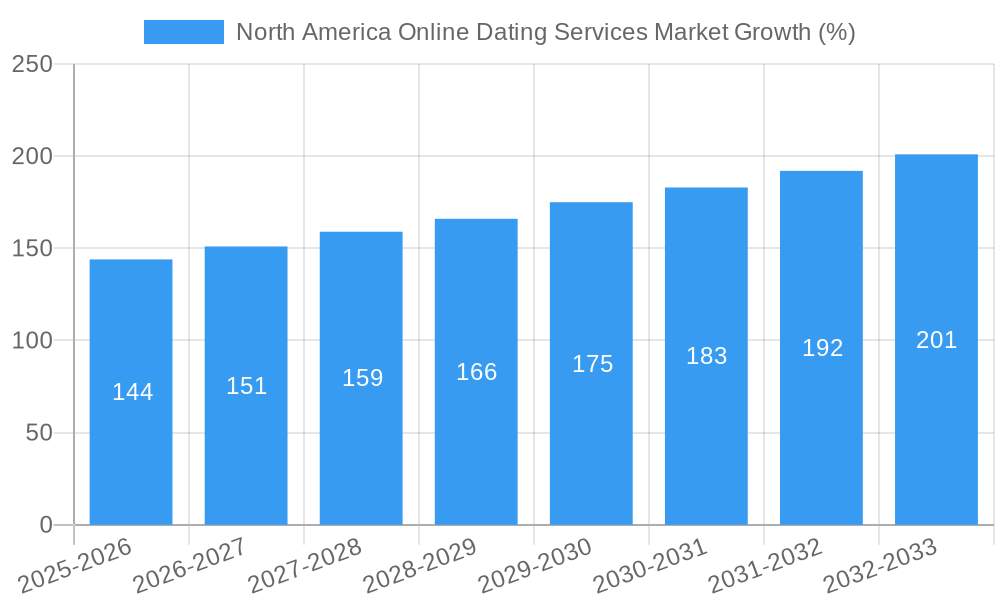

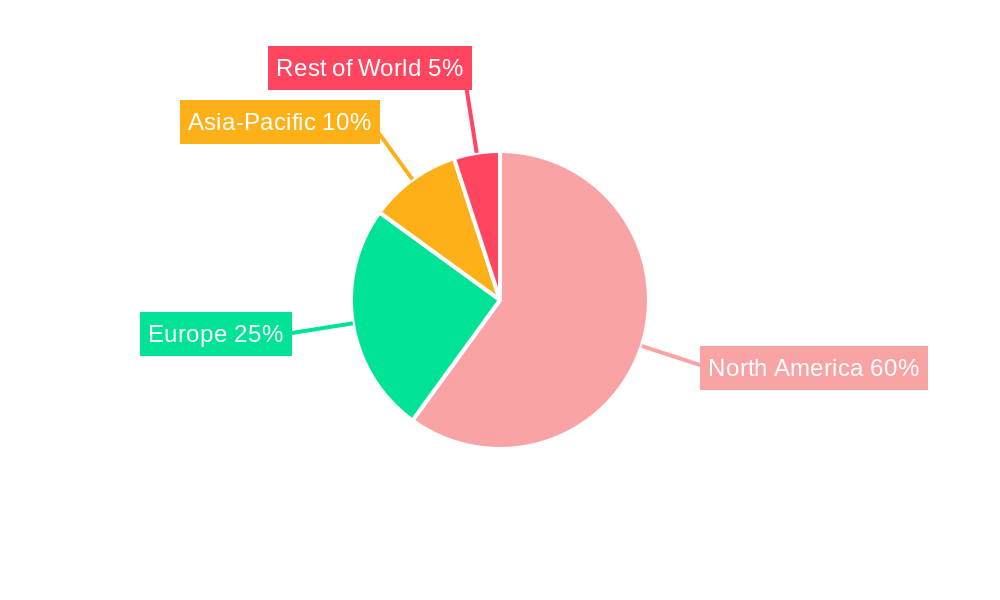

The North American online dating services market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.60%, is projected to experience significant expansion between 2025 and 2033. Driven by increasing smartphone penetration, evolving social norms around online dating, and the desire for convenient and efficient relationship-building, the market is witnessing substantial growth across various segments. The preference for paid online dating services is on the rise, reflecting a willingness to invest in premium features and enhanced matching algorithms. This segment likely accounts for a larger share of the market revenue compared to its non-paying counterpart, due to features like advanced search filters, profile verification, and customer support. Geographic concentration is notable, with the United States holding the largest share of the North American market due to its large population and higher internet penetration. Competition remains fierce, with established players like Match Group Inc. and eHarmony competing with newer entrants like Bumble and Hinge, leading to innovation in features and marketing strategies to attract and retain users. Growth is further fueled by targeted marketing campaigns that address specific demographics and relationship goals, and by continuous improvements in app user interface and algorithms to better match users with compatible partners.

The market’s growth trajectory is expected to continue, albeit potentially at a slightly moderated pace toward the end of the forecast period. While the increasing adoption of online dating remains a key driver, potential constraints include concerns about online safety and privacy, competition from alternative relationship-building platforms, and market saturation in some demographic segments. Strategies such as improved data security measures, enhanced user experience, and tailored marketing campaigns targeting untapped user segments will be crucial for sustained growth. Further segmentation analysis considering factors such as age, income level, and relationship goals, may reveal significant opportunities within niche markets. The continued success of the North American online dating services market depends on the ability of companies to adapt to evolving user preferences, navigate regulatory changes, and maintain trust and confidence among users.

North America Online Dating Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America online dating services market, encompassing market size, segmentation, key players, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, and the historical period analyzed is 2019-2024. This report is crucial for stakeholders seeking to understand the dynamics of this rapidly evolving market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Online Dating Services Market Composition & Trends

The North American online dating market is characterized by a dynamic interplay of established players and emerging competitors. Market concentration is moderate, with Match Group Inc. holding a significant share, followed by Bumble and other key players like eHarmony, EliteSingles, and Zoosk. The market exhibits high innovation, driven by the integration of AI-powered matching algorithms, enhanced user interfaces, and features focused on safety and inclusivity. Regulatory landscapes vary across states and provinces, impacting data privacy and advertising practices. Substitute products include traditional dating methods and niche social networking platforms. End-user profiles are diverse, encompassing various age groups, demographics, and relationship goals. The market has witnessed several M&A activities in recent years, with deal values ranging from xx Million to xx Million, reflecting consolidation trends within the industry.

- Market Share Distribution (2025): Match Group Inc. (xx%), Bumble (xx%), eHarmony (xx%), Others (xx%)

- M&A Deal Value (2019-2024): Total deal value approximately xx Million.

- Key Innovation Catalysts: AI-powered matching, Enhanced security features, Niche dating apps.

North America Online Dating Services Market Industry Evolution

The North America online dating services market has experienced substantial growth since 2019, driven by increasing smartphone penetration, evolving social norms around dating, and advancements in matchmaking technology. The market witnessed a xx% growth rate between 2019 and 2024. Technological advancements, such as AI-powered matching algorithms and personalized recommendations, have significantly improved user experience and engagement. Consumer demands are shifting towards more authentic connections, greater emphasis on safety and inclusivity, and diverse relationship options beyond traditional monogamy. The market has seen a surge in the adoption of subscription-based models, demonstrating the willingness of users to pay for premium features and a higher quality dating experience. The adoption rate of paid online dating services has increased by xx% since 2019. Further growth is anticipated due to improved user interfaces, enhanced security measures, and the expansion of niche dating apps catering to specific demographics and interests. The projected growth rate for 2025-2033 is xx%.

Leading Regions, Countries, or Segments in North America Online Dating Services Market

The United States represents the dominant market within North America, contributing a significant portion (xx%) of the overall revenue. This dominance is primarily driven by a large and active user base, high smartphone penetration rates, and a well-established digital economy. The paying online dating segment is experiencing faster growth compared to the non-paying segment, signifying users' increasing willingness to invest in enhanced dating experiences.

- Key Drivers for US Dominance: Large single population, High internet and smartphone penetration, Established digital infrastructure.

- Paying Online Dating Growth: Driven by premium features, enhanced user experience, and success rates.

- Non-paying Online Dating Trends: Growing competition, free trials increase adoption rate, but conversion to paid often remains lower.

North America Online Dating Services Market Product Innovations

Recent innovations in the North American online dating services market include the integration of AI-powered matching algorithms that go beyond superficial matching criteria. Features such as detailed personality assessments and compatibility scores are becoming increasingly common, while virtual reality (VR) and augmented reality (AR) technologies are exploring potential applications in creating immersive dating experiences. Furthermore, increased focus on safety features, including improved verification processes and reporting mechanisms, enhances user trust and participation.

Propelling Factors for North America Online Dating Services Market Growth

Several factors are driving market growth. Increased smartphone penetration and internet accessibility expand the potential user base. Evolving social norms and acceptance of online dating make it a mainstream option. Technological advancements, like AI-powered matching, create more efficient and personalized experiences. Finally, economic factors, including disposable income and user spending on digital services, contribute to market expansion.

Obstacles in the North America Online Dating Services Market

Significant barriers include intense competition, requiring companies to constantly innovate and differentiate. Data privacy concerns and stringent regulations require significant investment in security measures. Furthermore, maintaining user trust and combating fake profiles remain key challenges that impact user engagement and satisfaction. These obstacles lead to higher marketing and development costs, reducing profitability in certain segments.

Future Opportunities in North America Online Dating Services Market

The future holds significant opportunities. Expansion into niche dating markets, catering to specific demographics, increases market reach. Integration of emerging technologies, such as metaverse and blockchain, creates unique and engaging user experiences. Finally, improved personalization and AI-driven matching continue to enhance user satisfaction and conversion rates.

Major Players in the North America Online Dating Services Market Ecosystem

- eHarmony

- EliteSingles

- Bumble

- Match Group Inc

- Badoo

- OurTime

- Spark

- happn

- Zoosk Inc

- BlackPeopleMeet

- Hinge

Key Developments in North America Online Dating Services Market Industry

- March 2022: Match Group Inc. launches Stir, a dating app specifically designed for single parents, targeting a significant underserved market segment of approximately 20 Million single parents in the U.S. This launch signals a move towards more niche dating applications and expands the addressable market.

Strategic North America Online Dating Services Market Forecast

The North America online dating services market is poised for continued expansion, driven by ongoing technological innovation, evolving consumer preferences, and the increasing acceptance of online dating as a mainstream method for relationship formation. The market's future success hinges on addressing user privacy concerns, enhancing safety features, and creating more personalized and inclusive dating experiences. The projected growth in the forecast period suggests significant opportunities for market expansion and profitability for existing and new market entrants.

North America Online Dating Services Market Segmentation

-

1. Type

- 1.1. Non- paying online dating

- 1.2. Paying Online Dating

North America Online Dating Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Online Dating Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continuous Innovation in Service Offerings; Growing Penetration of Smartphones and Mobile Devices

- 3.3. Market Restrains

- 3.3.1. Security Concerns of Data Privacy

- 3.4. Market Trends

- 3.4.1. Rapid innovation in service offerings is driving the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Non- paying online dating

- 5.1.2. Paying Online Dating

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Online Dating Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 eHarmon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Elite Singles

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bumble

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Match Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Badoo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 OurTime

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Spark

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 happn

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zoosk Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BlackPeopleMeet

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hinge

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 eHarmon

List of Figures

- Figure 1: North America Online Dating Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Online Dating Services Market Share (%) by Company 2024

List of Tables

- Table 1: North America Online Dating Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Online Dating Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Online Dating Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: North America Online Dating Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North America Online Dating Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: North America Online Dating Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Online Dating Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Dating Services Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the North America Online Dating Services Market?

Key companies in the market include eHarmon, Elite Singles, Bumble, Match Group Inc, Badoo, OurTime, Spark, happn, Zoosk Inc, BlackPeopleMeet, Hinge.

3. What are the main segments of the North America Online Dating Services Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Continuous Innovation in Service Offerings; Growing Penetration of Smartphones and Mobile Devices.

6. What are the notable trends driving market growth?

Rapid innovation in service offerings is driving the market growth.

7. Are there any restraints impacting market growth?

Security Concerns of Data Privacy.

8. Can you provide examples of recent developments in the market?

March 2022 - Match Group has announced that it is launching the latest addition to its dating services lineup with Stir, an app designed exclusively for single parents. With the new release, the company aims to address the 20 million single parents in the U.S. who are under-served by existing dating apps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Dating Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Dating Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Dating Services Market?

To stay informed about further developments, trends, and reports in the North America Online Dating Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence