Key Insights

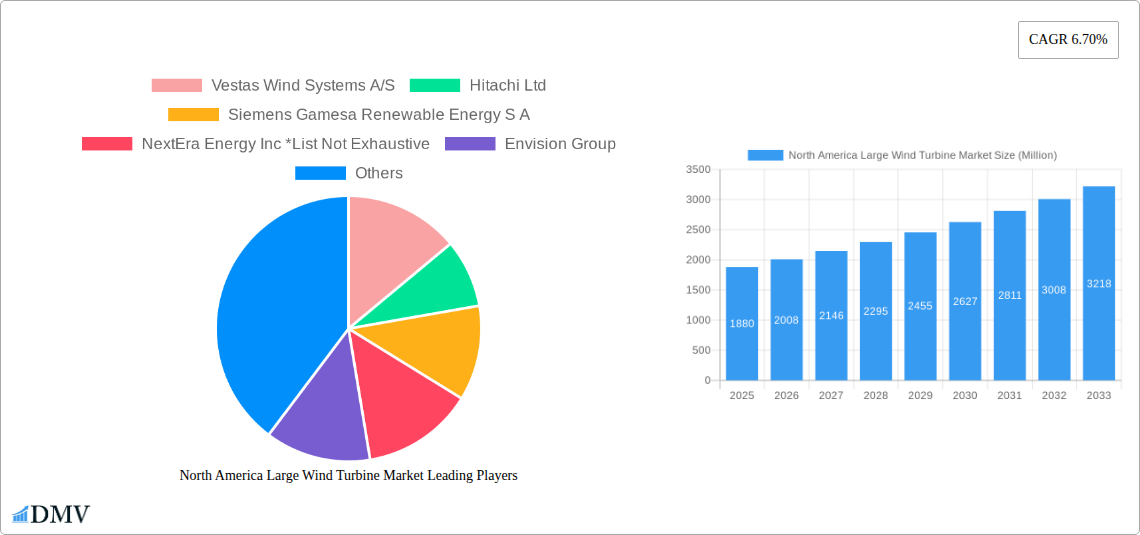

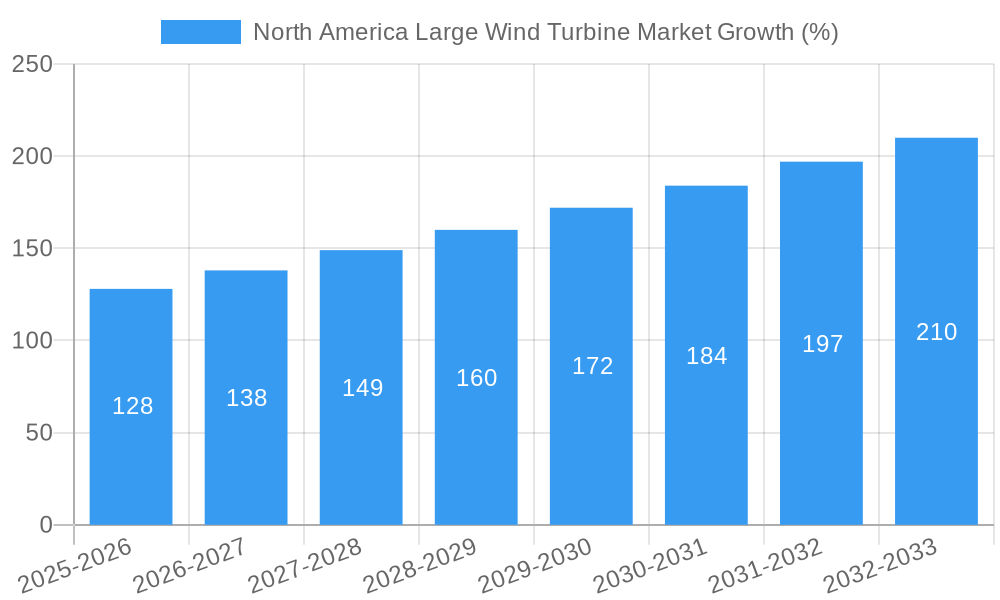

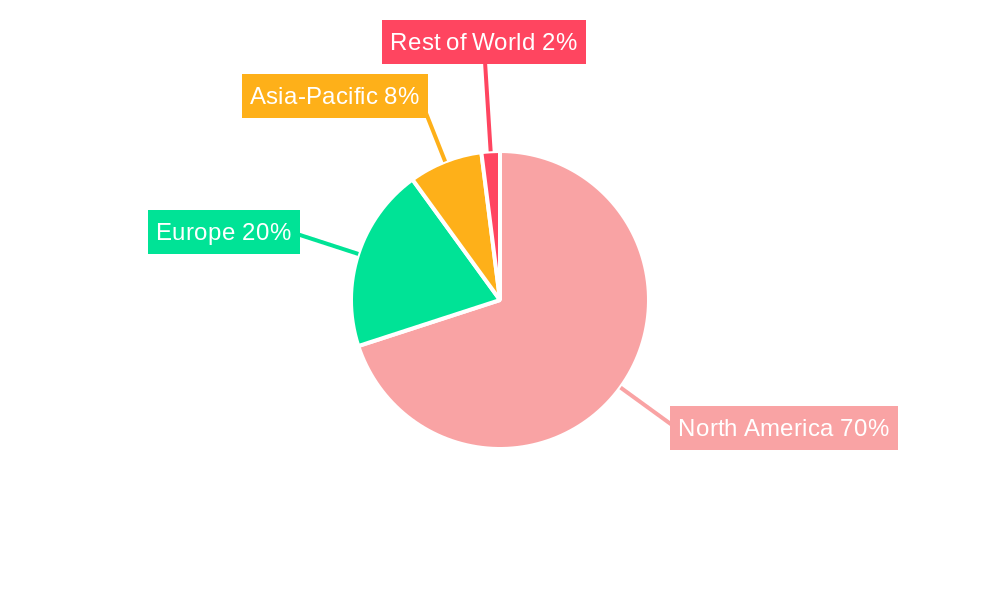

The North America large wind turbine market, valued at $1.88 billion in 2025, is projected to experience robust growth, driven by increasing demand for renewable energy, supportive government policies promoting clean energy transition, and advancements in turbine technology leading to higher efficiency and lower costs. The onshore segment currently dominates, but the offshore segment is poised for significant expansion, fueled by technological improvements enabling deeper water installations and increasing grid connection capabilities. Key players like Vestas, Siemens Gamesa, and General Electric are investing heavily in R&D and expanding their manufacturing capacities to capitalize on this growth. While challenges remain, including land acquisition complexities and regulatory hurdles, the long-term outlook remains positive, with a Compound Annual Growth Rate (CAGR) of 6.70% anticipated through 2033. This growth will be primarily driven by the United States, given its vast land area suitable for wind farms and its ambitious renewable energy targets. Canada and Mexico will also contribute to market growth, although at a potentially slower pace due to varying regulatory environments and infrastructure development. The market is expected to exceed $3 billion by 2030, driven by sustained policy support and increased private investment in renewable energy projects.

The competitive landscape is characterized by both established multinational corporations and emerging players. The market is witnessing increased mergers and acquisitions activity as companies strive to expand their market share and diversify their technology portfolios. Furthermore, the ongoing focus on improving energy storage solutions alongside wind turbine technology will be a crucial element influencing market dynamics over the forecast period. Factors such as grid modernization initiatives to accommodate the intermittent nature of wind power and technological advancements in blade design and materials will also play a significant role in shaping the market's future. The continued emphasis on sustainability and decarbonization efforts across various sectors guarantees the long-term viability and sustained growth of the North American large wind turbine market.

North America Large Wind Turbine Market: A Comprehensive Report (2019-2033)

This insightful report delivers a detailed analysis of the North America large wind turbine market, providing a comprehensive overview of market dynamics, key players, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for stakeholders seeking to understand the current landscape and make informed decisions in this rapidly evolving sector.

North America Large Wind Turbine Market Composition & Trends

This section provides a granular examination of the North American large wind turbine market's structure, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We delve into market share distribution among key players and assess the financial implications of significant M&A deals. The analysis covers the period from 2019 to 2024, offering valuable historical context for future projections. The market is expected to be valued at approximately USD xx Million in 2025.

- Market Concentration: Analysis of market share held by top players like Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A., and General Electric Company. Expected market concentration ratio (CR4) in 2025: xx%.

- Innovation Catalysts: Examination of R&D investments, technological breakthroughs (e.g., advancements in blade design, increased turbine capacity), and their impact on market growth. Projected R&D spending in 2025: USD xx Million.

- Regulatory Landscape: Assessment of government policies, incentives (e.g., tax credits, production tax credits), and regulations impacting market expansion in the US and Canada.

- Substitute Products: Analysis of competing renewable energy technologies (e.g., solar power) and their influence on market demand.

- End-User Profiles: Profiling key end-users, including utility companies, independent power producers (IPPs), and corporations. Expected contribution of utility companies to market demand in 2025: xx%.

- M&A Activity: Review of significant mergers and acquisitions in the past five years, including deal values and their strategic implications. Total M&A deal value (2019-2024): USD xx Million.

North America Large Wind Turbine Market Industry Evolution

This section traces the evolution of the North American large wind turbine market, charting growth trajectories, technological advancements, and shifting consumer preferences. We provide a detailed analysis of market growth rates, adoption rates of new technologies, and changing consumer demands. Specific data points include compound annual growth rate (CAGR) during the historical period and projected CAGR for the forecast period. The historical period reveals a CAGR of xx% (2019-2024), while the forecast period (2025-2033) is projected to experience a CAGR of xx%. This growth is driven by factors such as increasing demand for renewable energy, government support for green initiatives, and technological improvements that enhance efficiency and reduce costs. The market will be shaped by continuous technological advancements, focusing on increasing turbine capacity, improving blade designs, and optimizing energy capture.

Leading Regions, Countries, or Segments in North America Large Wind Turbine Market

This section identifies the dominant regions, countries, and segments within the North American large wind turbine market. A detailed analysis focuses on the leading deployment locations (onshore vs. offshore) and the factors driving their dominance.

- Onshore vs. Offshore: A comparative analysis of the onshore and offshore segments, exploring the market size, growth rate, and key drivers for each. Expected market share of offshore wind in 2025: xx%.

Onshore Wind:

- High concentration of wind resources in certain regions (e.g., Texas, Iowa).

- Lower initial investment costs compared to offshore projects.

- Established supply chains and infrastructure.

Offshore Wind:

- Higher energy yield potential due to stronger and more consistent winds.

- Government initiatives to expand offshore wind capacity (e.g., Biden administration's 30 GW target).

- Significant investments in offshore wind farm development.

The dominance of specific regions is analyzed considering investment trends, government policies, and geographical suitability. For example, the growth of the offshore wind segment is heavily influenced by supportive government policies and significant investments, leading to its projected faster growth rate compared to onshore in the coming years.

North America Large Wind Turbine Market Product Innovations

Recent years have witnessed significant product innovations in large wind turbines, focusing on enhanced energy capture, increased efficiency, and improved durability. Advancements in blade design, generator technology, and control systems have led to larger turbine capacities and higher energy yields. The incorporation of smart grid technologies allows for better integration with existing power networks and improved energy management. The development of floating offshore wind turbines is opening up new opportunities for harnessing wind energy in deeper waters. This is further enhanced by the use of advanced composite materials, which enhance blade performance and reduce maintenance costs.

Propelling Factors for North America Large Wind Turbine Market Growth

The North American large wind turbine market is experiencing robust growth fueled by several key factors. Government policies promoting renewable energy, such as tax incentives and carbon emission reduction targets, are major drivers. The decreasing cost of wind energy technology makes it increasingly competitive with traditional fossil fuels. Furthermore, the increasing awareness of climate change and the growing demand for clean energy are boosting market demand. The Inflation Reduction Act of 2022 is a crucial example of policy driving expansion, providing significant support for the domestic renewable energy sector.

Obstacles in the North America Large Wind Turbine Market

Despite the significant growth potential, the North American large wind turbine market faces several challenges. Permitting processes and regulatory hurdles can delay project development and increase costs. Supply chain disruptions, particularly for critical components like rare earth minerals, can impact manufacturing and project timelines. Intense competition among established players and new entrants can create price pressures and affect profitability. These factors pose significant hurdles to realizing the market's full potential.

Future Opportunities in North America Large Wind Turbine Market

The North American large wind turbine market presents several promising future opportunities. The expansion of offshore wind energy is a key area for growth, with significant potential in deep-water locations. Technological advancements, such as the development of floating offshore wind turbines and improved energy storage solutions, will further unlock new possibilities. The integration of wind energy with other renewable sources, such as solar power, is expected to increase in the coming years. These opportunities provide significant avenues for growth and innovation in the sector.

Major Players in the North America Large Wind Turbine Market Ecosystem

- Vestas Wind Systems A/S

- Hitachi Ltd

- Siemens Gamesa Renewable Energy S.A.

- NextEra Energy Inc

- Envision Group

- Duke Energy Corporation

- General Electric Company

- Enercon GmbH

- Orsted AS

- Nordex SE

- Vergnet VSA SA

Key Developments in North America Large Wind Turbine Market Industry

- February 2023: The United States Department of Energy (DOE) announced USD 30 Million in grants to promote composite materials and additive manufacturing (AM) in large wind turbines, particularly for offshore wind energy systems. This initiative directly supports the goals outlined in the DOE’s Offshore Wind Supply Chain Road Map and the Biden Administration’s Floating Offshore Wind Shot, aiming to deploy 30 GW of offshore wind energy by 2030.

- November 2022: TPI Composites Inc. (TPI) and GE Renewable Energy signed a ten-year lease extension for a rotor blade manufacturing facility in Newton, Iowa. This collaboration, facilitated by the Inflation Reduction Act of 2022, aims to enhance domestic rotor blade production and support GE's US market commitments, commencing production in 2024.

Strategic North America Large Wind Turbine Market Forecast

The North American large wind turbine market is poised for substantial growth in the coming years. Driven by supportive government policies, decreasing technology costs, and growing demand for renewable energy, the market is expected to experience significant expansion. The increasing adoption of offshore wind technology and continuous advancements in turbine design will further propel market growth. The market's future potential is substantial, offering significant opportunities for investors, manufacturers, and developers.

North America Large Wind Turbine Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Large Wind Turbine Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Large Wind Turbine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reducing Costs of Wind Energy4.; Increasing Investment in Wind Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Alternative Clean Energy Sources like Solar and Others

- 3.4. Market Trends

- 3.4.1. Offshore Segment Is the Fastest Growth Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Large Wind Turbine Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. United States North America Large Wind Turbine Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Canada North America Large Wind Turbine Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Rest of North America North America Large Wind Turbine Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. United States North America Large Wind Turbine Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Large Wind Turbine Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Large Wind Turbine Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Large Wind Turbine Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Vestas Wind Systems A/S

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hitachi Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Siemens Gamesa Renewable Energy S A

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 NextEra Energy Inc *List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Envision Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Duke Energy Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 General Electric Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Enercon GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Orsted AS

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nordex SE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Vergnet VSA SA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: North America Large Wind Turbine Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Large Wind Turbine Market Share (%) by Company 2024

List of Tables

- Table 1: North America Large Wind Turbine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Large Wind Turbine Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: North America Large Wind Turbine Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: North America Large Wind Turbine Market Volume K Units Forecast, by Location of Deployment 2019 & 2032

- Table 5: North America Large Wind Turbine Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Large Wind Turbine Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 7: North America Large Wind Turbine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Large Wind Turbine Market Volume K Units Forecast, by Region 2019 & 2032

- Table 9: North America Large Wind Turbine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Large Wind Turbine Market Volume K Units Forecast, by Country 2019 & 2032

- Table 11: United States North America Large Wind Turbine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Large Wind Turbine Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Large Wind Turbine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Large Wind Turbine Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Large Wind Turbine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Large Wind Turbine Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Large Wind Turbine Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Large Wind Turbine Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: North America Large Wind Turbine Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 20: North America Large Wind Turbine Market Volume K Units Forecast, by Location of Deployment 2019 & 2032

- Table 21: North America Large Wind Turbine Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Large Wind Turbine Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 23: North America Large Wind Turbine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Large Wind Turbine Market Volume K Units Forecast, by Country 2019 & 2032

- Table 25: North America Large Wind Turbine Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 26: North America Large Wind Turbine Market Volume K Units Forecast, by Location of Deployment 2019 & 2032

- Table 27: North America Large Wind Turbine Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Large Wind Turbine Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 29: North America Large Wind Turbine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Large Wind Turbine Market Volume K Units Forecast, by Country 2019 & 2032

- Table 31: North America Large Wind Turbine Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 32: North America Large Wind Turbine Market Volume K Units Forecast, by Location of Deployment 2019 & 2032

- Table 33: North America Large Wind Turbine Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Large Wind Turbine Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 35: North America Large Wind Turbine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Large Wind Turbine Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Large Wind Turbine Market?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the North America Large Wind Turbine Market?

Key companies in the market include Vestas Wind Systems A/S, Hitachi Ltd, Siemens Gamesa Renewable Energy S A, NextEra Energy Inc *List Not Exhaustive, Envision Group, Duke Energy Corporation, General Electric Company, Enercon GmbH, Orsted AS, Nordex SE, Vergnet VSA SA.

3. What are the main segments of the North America Large Wind Turbine Market?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.88 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reducing Costs of Wind Energy4.; Increasing Investment in Wind Energy.

6. What are the notable trends driving market growth?

Offshore Segment Is the Fastest Growth Segment.

7. Are there any restraints impacting market growth?

4.; Adoption of Alternative Clean Energy Sources like Solar and Others.

8. Can you provide examples of recent developments in the market?

February 2023, the United States Department of Energy (DOE) announced USD 30 million in grants to promote composite materials and additive manufacturing (AM) in large wind turbines comprising offshore wind energy systems. The projects financed through this initiative will promote the priorities specified in DOE’s Offshore Wind Supply Chain Road Map and the Biden Administration’s newly revealed Floating Offshore Wind Shot, as well as elevating the President’s goals to deploy 30 GW of offshore wind energy by 2030 and attain a net-zero carbon economy by 2050.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Large Wind Turbine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Large Wind Turbine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Large Wind Turbine Market?

To stay informed about further developments, trends, and reports in the North America Large Wind Turbine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence