Key Insights

The North American Hair Colorants Market is poised for significant expansion, projected to reach a valuation of 53.29 billion by 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 11.89% from 2025 to 2033. This upward trend is propelled by heightened consumer demand for personalized hair styling and self-expression, driving the popularity of an extensive product portfolio, from temporary solutions to permanent dyes. The convenience of at-home hair coloring, amplified by accessible online retail and readily available DIY resources, further fuels market growth. Continuous advancements in hair color technology, offering gentler formulas with enhanced conditioning and a broader spectrum of shades, effectively address evolving consumer preferences. Key market segments encompass bleaches, highlighters, permanent, and semi-permanent colorants, with distribution primarily through supermarkets/hypermarkets, specialty stores, and online platforms. Leading brands like L'Oréal, Henkel, and Revlon maintain substantial market influence, focusing on brand loyalty and capitalizing on emergent trends such as natural and organic coloring solutions.

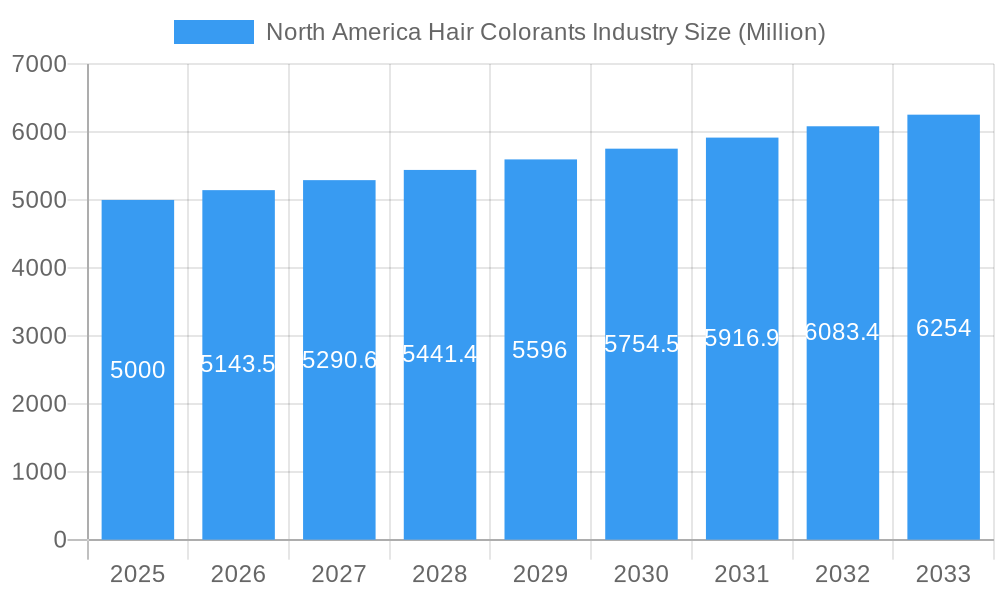

North America Hair Colorants Industry Market Size (In Billion)

Despite positive growth, the market encounters several obstacles. Volatility in raw material pricing, especially for natural components, can impact product costs and profitability. Growing consumer consciousness regarding the health implications of specific hair color chemicals, alongside more stringent regulatory oversight of chemical formulations, mandates the development and promotion of safer, environmentally friendly alternatives. Furthermore, intense competition from established entities and new entrants necessitates a focus on product differentiation, strategic marketing, and efficient distribution networks for sustained competitiveness and growth within the North American region. The market's future success hinges on effectively addressing these challenges and adapting to evolving consumer priorities and regulatory frameworks.

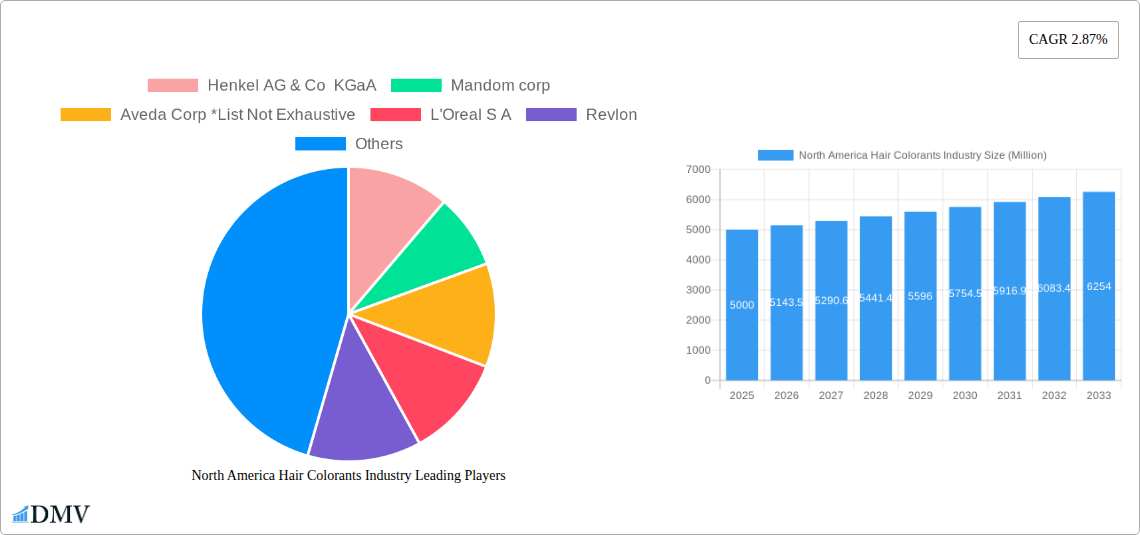

North America Hair Colorants Industry Company Market Share

North America Hair Colorants Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the North America hair colorants industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report delivers a meticulous examination of market trends, leading players, and future growth prospects. The market size in 2025 is estimated at XX Million and is projected to reach XX Million by 2033.

North America Hair Colorants Industry Market Composition & Trends

This section delves into the competitive landscape of the North American hair colorants market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market share is currently dominated by a few key players, with L'Oréal S.A. holding a significant share, followed by Henkel AG & Co KGaA and other major players like Revlon, Kao Corporation, and COTY INC. However, smaller niche brands focusing on natural and organic options are also gaining traction. Innovation is largely driven by consumer demand for more natural, less damaging, and personalized hair color solutions. Regulatory changes concerning ingredient safety and labeling significantly impact the industry. Substitute products, including temporary hair color sprays and concealers, represent a competitive challenge. The end-user profile is diverse, ranging from teenagers experimenting with color to mature consumers seeking to cover gray hair. M&A activity has been moderate in recent years, with deal values averaging approximately XX Million per transaction. Further analysis will explore this sector more in depth.

- Market Share Distribution (2025): L'Oréal S.A. (XX%), Henkel AG & Co KGaA (XX%), Revlon (XX%), Others (XX%).

- Average M&A Deal Value (2019-2024): XX Million

- Key Innovation Catalysts: Consumer demand for natural ingredients, personalized color solutions, and at-home application convenience.

- Regulatory Landscape: Stringent regulations regarding ingredient safety and labeling.

North America Hair Colorants Industry Evolution

This section provides a detailed analysis of the North America hair colorants industry's evolution from 2019 to 2024 and projects its trajectory through 2033. The historical period (2019-2024) witnessed a steady growth rate averaging approximately XX% annually, driven by increasing consumer spending on personal care products and a growing trend toward self-expression through hair color. Technological advancements, such as the development of ammonia-free and less damaging formulas, have significantly impacted market dynamics. The rise of e-commerce has also played a crucial role, increasing accessibility to a wider range of products. Shifting consumer demands toward personalized color solutions and convenient at-home application methods are reshaping the industry, while the increasing popularity of natural and organic hair colorants is gaining further momentum. Future growth is expected to be propelled by the growing demand for premium and specialized hair color products. Expected growth rate for the forecast period (2025-2033) is projected at XX% annually.

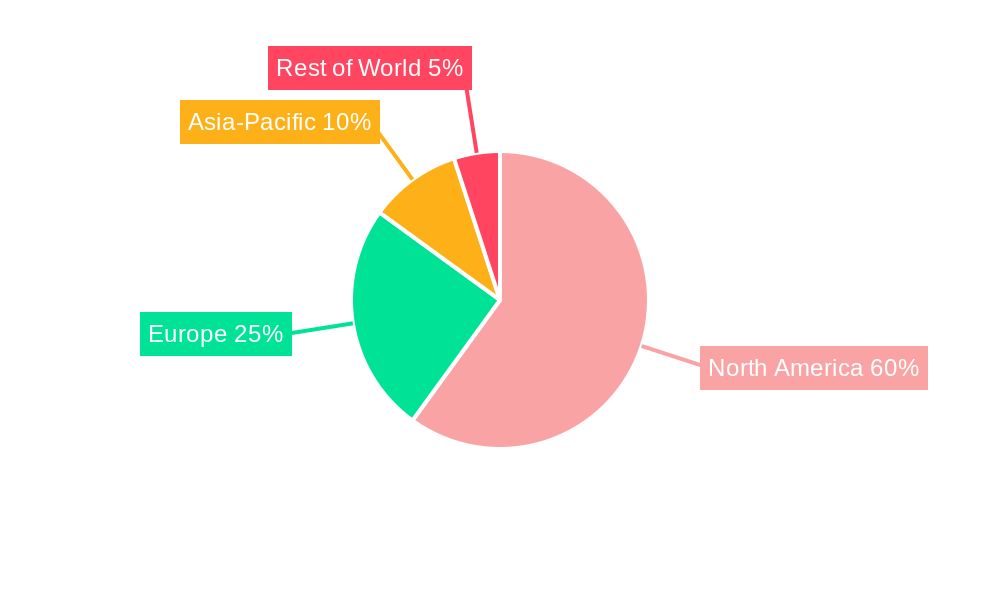

Leading Regions, Countries, or Segments in North America Hair Colorants Industry

The United States represents the dominant market within North America, accounting for approximately XX% of total sales in 2025. This dominance is attributed to higher disposable incomes, a larger consumer base, and strong demand for premium hair color products. However, Canada and Mexico also demonstrate promising growth potential.

By Product Type:

- Permanent Colorants: This segment holds the largest market share, driven by its lasting color payoff. Key drivers include increased consumer preference for long-lasting results and technological advancements resulting in gentler, more effective formulas.

- Semi-Permanent Colorants: This segment experiences steady growth due to its lower commitment and ease of application. This category benefits from increased demand for quick and trendy color solutions.

- Bleachers and Highlighters: These categories witness significant growth due to increasing consumer preference for customized highlighting, balayage, and ombre trends. This is further fuelled by the availability of professional-quality at-home kits.

By Distribution Channel:

- Supermarkets/Hypermarkets: This channel dominates sales due to its widespread accessibility and competitive pricing.

- Specialty Stores: These stores cater to consumers seeking professional-grade products and personalized advice.

North America Hair Colorants Industry Product Innovations

Recent innovations focus on developing ammonia-free, low-damage formulas that cater to sensitive scalps. The use of natural ingredients and plant-based extracts is gaining traction, appealing to consumers seeking eco-friendly options. Personalized color solutions, such as at-home hair color matching tools and custom-mixed shades, are also gaining popularity. The advancement of conditioning agents within colorant formulations aims to improve the overall health and shine of hair post-application.

Propelling Factors for North America Hair Colorants Industry Growth

Several factors fuel the growth of the North American hair colorants industry: rising disposable incomes, increasing consumer awareness of personal grooming, and a booming e-commerce sector driving easy access to diverse products are key drivers. The increasing availability of specialized and professional-quality at-home kits, coupled with the expansion of product portfolios offering tailored color solutions, is bolstering industry growth. Technological advances in formulations, emphasizing gentle and natural ingredients, attract consumers increasingly concerned about hair health and environmentally friendly products.

Obstacles in the North America Hair Colorants Industry Market

The industry faces challenges like stringent regulatory requirements and the need for continuous innovation to stay competitive. Supply chain disruptions, particularly concerning raw material sourcing, can affect production and pricing. Intense competition from established players and emerging brands puts pressure on profit margins and necessitates significant investment in research and development.

Future Opportunities in North America Hair Colorants Industry

Growing demand for customizable hair color solutions, including at-home DIY kits for advanced techniques, represents a significant opportunity. The continued expansion of the e-commerce market offers a platform to reach broader customer segments and build brand recognition. The potential for hair color products with added benefits, such as hair strengthening and conditioning properties, is also substantial.

Major Players in the North America Hair Colorants Industry Ecosystem

Key Developments in North America Hair Colorants Industry Industry

- January 2023: L'Oréal launches a new ammonia-free hair color range.

- June 2022: Henkel acquires a smaller hair color brand specializing in organic ingredients.

- October 2021: Revlon introduces a personalized hair color matching tool. (Further developments can be added here)

Strategic North America Hair Colorants Industry Market Forecast

The North America hair colorants market is poised for continued growth, driven by innovation, evolving consumer preferences, and the expanding e-commerce sector. The focus on natural ingredients, personalized solutions, and improved product performance will continue to shape the market's evolution. The market is expected to experience strong growth in the coming years, with the permanent hair colorants and at-home application segments leading the charge. This is bolstered by the continuous expansion of product portfolios and the introduction of advanced DIY solutions.

North America Hair Colorants Industry Segmentation

-

1. Product Type

- 1.1. Bleachers

- 1.2. Highlighters

- 1.3. Permanent Colorants

- 1.4. Semi-Permanent Colorants

- 1.5. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Speciality Stores

- 2.3. Online Stores

- 2.4. Convenience Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Hair Colorants Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Hair Colorants Industry Regional Market Share

Geographic Coverage of North America Hair Colorants Industry

North America Hair Colorants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure

- 3.3. Market Restrains

- 3.3.1. Prevalence of Counterfeit Goods

- 3.4. Market Trends

- 3.4.1. Emerging Styling Trend Among Young Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hair Colorants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bleachers

- 5.1.2. Highlighters

- 5.1.3. Permanent Colorants

- 5.1.4. Semi-Permanent Colorants

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. Online Stores

- 5.2.4. Convenience Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Hair Colorants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bleachers

- 6.1.2. Highlighters

- 6.1.3. Permanent Colorants

- 6.1.4. Semi-Permanent Colorants

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. Online Stores

- 6.2.4. Convenience Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Hair Colorants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bleachers

- 7.1.2. Highlighters

- 7.1.3. Permanent Colorants

- 7.1.4. Semi-Permanent Colorants

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. Online Stores

- 7.2.4. Convenience Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Hair Colorants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bleachers

- 8.1.2. Highlighters

- 8.1.3. Permanent Colorants

- 8.1.4. Semi-Permanent Colorants

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. Online Stores

- 8.2.4. Convenience Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Hair Colorants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bleachers

- 9.1.2. Highlighters

- 9.1.3. Permanent Colorants

- 9.1.4. Semi-Permanent Colorants

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. Online Stores

- 9.2.4. Convenience Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Henkel AG & Co KGaA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mandom corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aveda Corp *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 L'Oreal S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Revlon

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kao Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 COTY INC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: North America Hair Colorants Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Hair Colorants Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Hair Colorants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Hair Colorants Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Hair Colorants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Hair Colorants Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Hair Colorants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America Hair Colorants Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Hair Colorants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Hair Colorants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Hair Colorants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Hair Colorants Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Hair Colorants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Hair Colorants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Hair Colorants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: North America Hair Colorants Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Hair Colorants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Hair Colorants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Hair Colorants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Hair Colorants Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Hair Colorants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Hair Colorants Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hair Colorants Industry?

The projected CAGR is approximately 11.89%.

2. Which companies are prominent players in the North America Hair Colorants Industry?

Key companies in the market include Henkel AG & Co KGaA, Mandom corp, Aveda Corp *List Not Exhaustive, L'Oreal S A, Revlon, Kao Corporation, COTY INC.

3. What are the main segments of the North America Hair Colorants Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure.

6. What are the notable trends driving market growth?

Emerging Styling Trend Among Young Consumers.

7. Are there any restraints impacting market growth?

Prevalence of Counterfeit Goods.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hair Colorants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hair Colorants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hair Colorants Industry?

To stay informed about further developments, trends, and reports in the North America Hair Colorants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence