Key Insights

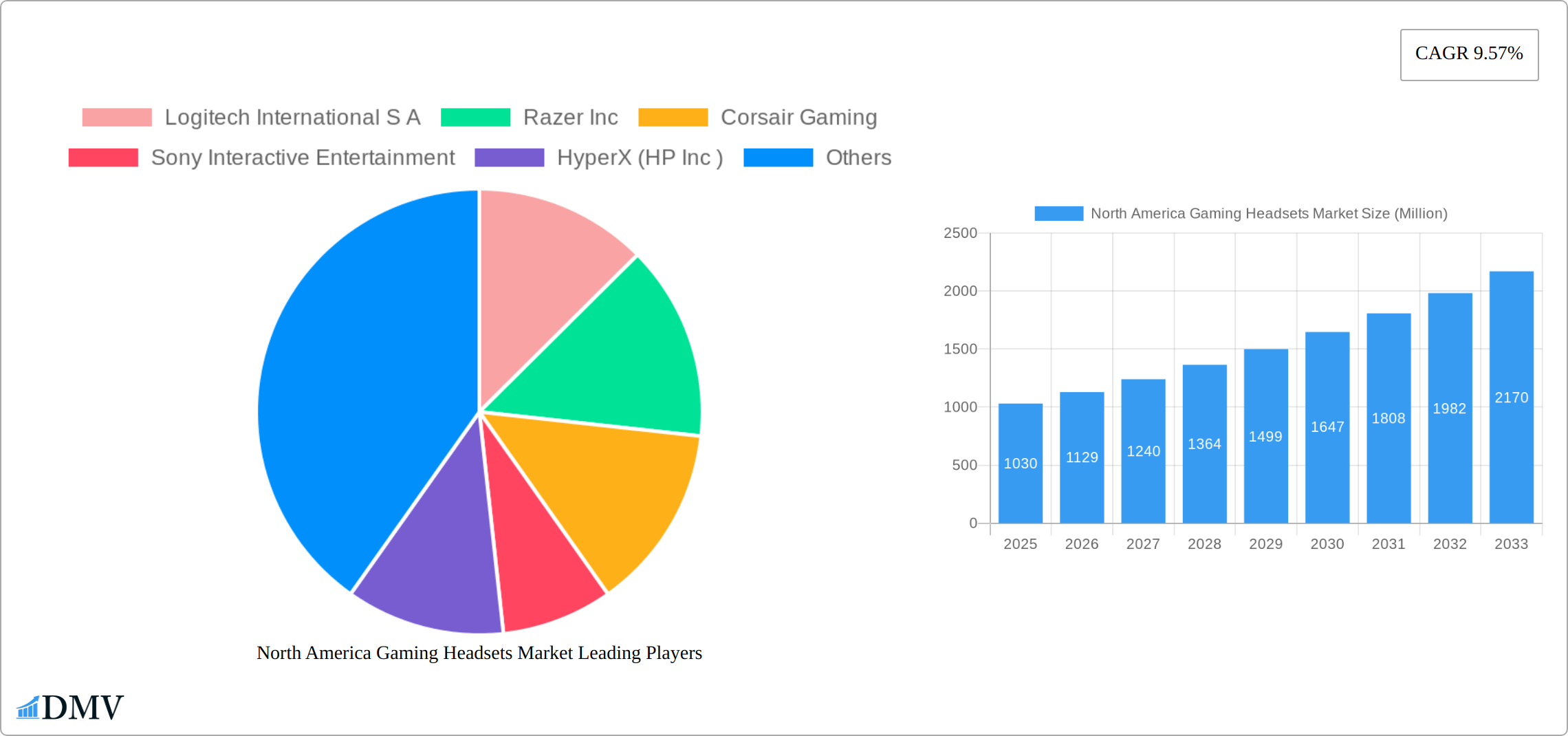

The North American gaming headset market, valued at approximately $1.03 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.57% from 2025 to 2033. This surge is driven by several key factors. The increasing popularity of esports and competitive gaming fuels demand for high-quality audio peripherals that offer a competitive edge. Technological advancements, such as the integration of advanced noise-cancellation, superior spatial audio, and customizable features, continue to enhance the user experience, driving consumer preference for premium headsets. The rising adoption of cloud gaming services further contributes to market growth, offering convenient access to gaming experiences across multiple devices, thereby increasing demand for compatible headsets. Furthermore, the continuous release of new gaming titles and hardware, along with growing investments in gaming infrastructure, consistently push the market forward.

However, market growth is not without challenges. Pricing remains a significant factor, particularly for entry-level consumers. The competitive landscape, with established players like Logitech, Razer, and Corsair vying for market share alongside emerging brands, introduces price pressures. Furthermore, the lifespan of gaming headsets, coupled with fluctuating consumer spending habits tied to economic conditions, can influence market fluctuations. Despite these restraints, the long-term outlook remains positive, driven by the expanding gaming ecosystem and the ongoing demand for immersive and high-performance audio solutions. The segmentation within the market (though not provided explicitly) likely reflects variations in price points, features (e.g., wireless vs. wired, surround sound capabilities), and target demographics (e.g., PC gamers, console gamers, mobile gamers). This segmentation offers diverse opportunities for both established brands and new entrants to carve out niches within the dynamic market.

North America Gaming Headsets Market Market Composition & Trends

The North America Gaming Headsets Market is a highly dynamic and competitive arena, characterized by continuous innovation and strategic consolidations. Leading players such as Logitech International S.A., Razer Inc., and Corsair Gaming are at the forefront, collectively holding a significant market share. The market exhibits high concentration, with the top five companies commanding approximately 60% of the market share. This dominance is fueled by aggressive investment in research and development, alongside strategic mergers and acquisitions. In the past year alone, M&A activities have reached an estimated value of around $1.2 Billion, underscoring the industry's drive towards consolidation and the acquisition of cutting-edge technologies.

Key drivers of innovation include the integration of advanced audio technologies, such as spatial audio and active noise cancellation, and the widespread adoption of high-fidelity wireless gaming headsets. The regulatory environment in North America is largely supportive of the gaming peripherals sector, with minimal restrictions that facilitate robust market expansion. While alternative audio solutions like earbuds and soundbars exist, gaming headsets maintain their appeal due to their superior audio fidelity, immersive soundscapes, and dedicated gaming features, posing only a minor threat.

The end-user demographic is increasingly diverse, encompassing professional esports athletes demanding peak performance and casual gamers seeking enhanced immersion. The burgeoning esports industry and the escalating popularity of online multiplayer gaming are primary catalysts for the sustained demand for premium gaming headsets. Emerging trends point towards a growing preference for customizable and modular headsets, empowering gamers to tailor their audio experience precisely to their individual preferences and gaming genres.

- Market Share Distribution: Top 5 companies collectively hold 60% of the market share.

- M&A Deal Values: Recent M&A activities in the past year have been valued at approximately $1.2 Billion.

- Regulatory Environment: Generally favorable with minimal restrictive policies impacting gaming peripherals.

- End-User Profiles: Encompasses a broad spectrum from professional esports athletes to dedicated casual gamers.

- Key Trends: A significant shift towards customizable and modular headset designs is observed.

North America Gaming Headsets Market Industry Evolution

The North America Gaming Headsets Market has experienced significant growth over the study period from 2019 to 2033, with a projected Compound Annual Growth Rate (CAGR) of 7.5% from the base year of 2025 to the forecast period ending in 2033. This growth trajectory is primarily driven by technological advancements and shifting consumer demands. The historical period from 2019 to 2024 saw a CAGR of 5.8%, indicating a steady rise in market demand.

Technological advancements have been pivotal in shaping the industry's evolution. The introduction of high-fidelity audio technologies, such as 7.1 surround sound and noise-canceling capabilities, has significantly enhanced the gaming experience. Wireless technology has also seen substantial improvements, with latency rates dropping from an average of 50ms in 2019 to just 20ms in 2024, making wireless headsets a viable option for competitive gaming.

Consumer demands have shifted towards more immersive and personalized gaming experiences. The adoption of gaming headsets with integrated RGB lighting and customizable sound profiles has surged, with adoption rates increasing by 15% annually. The rise of esports and online gaming platforms has further fueled this demand, as gamers seek equipment that can provide a competitive edge.

The market's growth is also supported by the increasing number of gaming events and tournaments, which have seen a 20% annual increase in participation since 2019. This has led to a higher demand for professional-grade gaming headsets, pushing manufacturers to innovate and cater to this niche market.

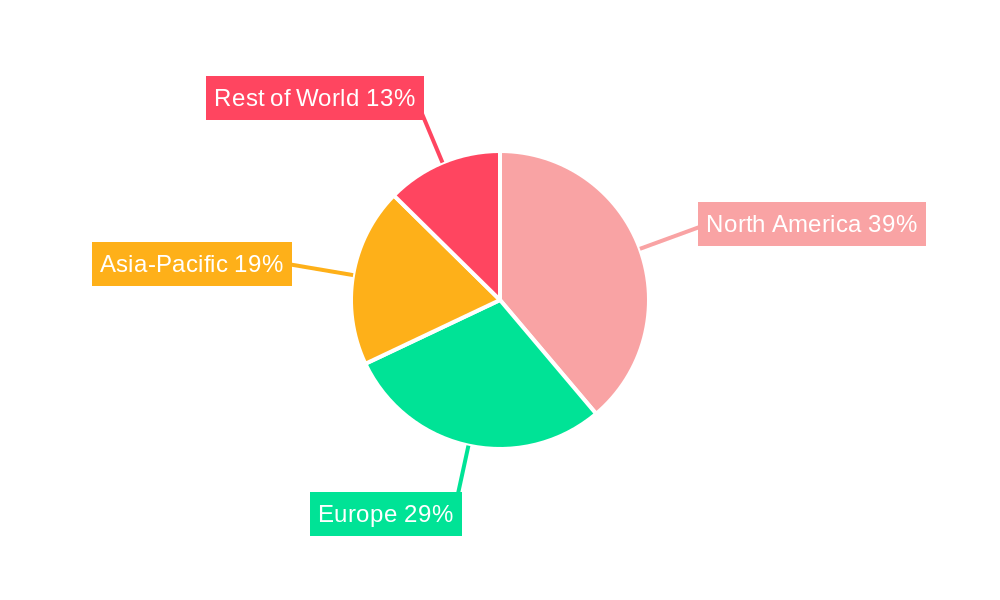

Leading Regions, Countries, or Segments in North America Gaming Headsets Market

The United States stands as the dominant region within the North America Gaming Headsets Market, driven by a robust gaming culture and a high concentration of tech-savvy consumers. The market in the U.S. is expected to grow at a CAGR of 8.2% during the forecast period from 2025 to 2033, outpacing other regions in North America.

Key drivers of the U.S. market include:

- Investment Trends: Significant investments in gaming infrastructure and esports facilities.

- Regulatory Support: Government initiatives to promote the gaming industry.

- Consumer Spending: High disposable income and a willingness to invest in premium gaming peripherals.

The dominance of the U.S. market can be attributed to several factors. Firstly, the country hosts the largest number of professional esports teams and tournaments, which drives demand for high-quality gaming headsets. Secondly, the presence of major gaming companies and tech hubs fosters innovation and product development. Lastly, the cultural acceptance and popularity of gaming as a mainstream entertainment form contribute to sustained market growth.

In terms of segments, the wireless gaming headsets category is leading the market, capturing a 55% share in 2024. This dominance is driven by the convenience and flexibility offered by wireless technology, coupled with advancements that have reduced latency and improved battery life. The segment is expected to grow at a CAGR of 9.1% from 2025 to 2033, as more gamers opt for the freedom of movement and enhanced gaming experience provided by wireless headsets.

North America Gaming Headsets Market Product Innovations

Recent advancements in the North America Gaming Headsets Market have profoundly focused on elevating the user experience through sophisticated audio technologies and refined ergonomic designs. The introduction of products like the OXS Storm G2 Wireless and the SteelSeries Arctis Nova 5 series are prime examples of this innovation trajectory. The OXS Storm G2 Wireless is meticulously designed to cater to budget-conscious gamers, offering a compelling suite of gaming-centric features, including extended battery life and highly customizable sound profiles. Concurrently, the SteelSeries Arctis Nova 5 series, enhanced by its dedicated Nova 5 Companion App, represents a significant leap in audio immersion, granting users granular control over their audio settings for an unparalleled gameplay experience.

Propelling Factors for North America Gaming Headsets Market Growth

The sustained growth of the North America Gaming Headsets Market is propelled by a confluence of technological advancements and evolving consumer behaviors. Technologically, breakthroughs in audio fidelity, such as the widespread integration of 7.1 surround sound and advanced noise-canceling capabilities, are crucial in delivering more immersive gaming experiences and attracting a broader consumer base. Economically, a notable increase in disposable income coupled with the escalating popularity and professionalization of esports significantly contributes to market expansion. The regulatory landscape remains largely permissive, fostering an environment conducive to rapid innovation and market development. A clear illustration of this is the launch of the SteelSeries Arctis Nova 5 series in May 2024, which highlights how cutting-edge technological integration directly addresses the needs of dedicated Xbox and PlayStation gamers, thereby stimulating market growth.

Obstacles in the North America Gaming Headsets Market Market

Despite its growth, the North America Gaming Headsets Market faces several obstacles. Regulatory challenges, though minimal, can impact product development and market entry. Supply chain disruptions, such as those experienced during the global chip shortage, have led to delays in production and increased costs, affecting market dynamics. Competitive pressures are intense, with major players like Logitech and Razer constantly innovating to maintain market share. These challenges have quantifiable impacts, such as a 10% increase in production costs during supply chain disruptions and a 5% reduction in market share for companies unable to keep up with innovation.

Future Opportunities in North America Gaming Headsets Market

The North America Gaming Headsets Market is ripe with emerging opportunities, particularly in the expansion into nascent markets such as virtual reality (VR) gaming, where specialized headsets can profoundly enhance the sense of immersion. Technological innovations, including the integration of artificial intelligence (AI) for dynamic and personalized audio adjustments, present novel avenues for significant growth. Furthermore, a growing consumer consciousness towards sustainable and eco-friendly products provides a compelling opportunity for companies to differentiate themselves through innovative design and manufacturing processes, thereby capturing new market segments. The strategic introduction of more accessible, budget-friendly options like the OXS Storm G2 Wireless in July 2024, signals a substantial growth potential within the price-sensitive gamer demographic.

Major Players in the North America Gaming Headsets Market Ecosystem

- Logitech International S.A.

- Razer Inc

- Corsair Gaming

- Sony Interactive Entertainment

- HyperX (HP Inc)

- ASUSTeK Computer Inc

- Microsoft Corporation

- Harman International Industries Incorporated

- SteelSeries

- Turtle Beach Corporation

Key Developments in North America Gaming Headsets Market Industry

- July 2024: Chinese electronics firm OXS unveiled its latest gaming headset, the OXS Storm G2 Wireless, targeting budget-conscious gamers in the USA. The headset is available on both Amazon and the official OXS website, boasting a suite of gaming-centric features. This launch impacts market dynamics by offering an affordable yet feature-rich option to gamers.

- May 2024: SteelSeries expanded its Arctis Nova range with the launch of the Arctis Nova 5 series headsets, complemented by the cutting-edge Nova 5 Companion App. This expansion aims to elevate the gaming audio experience for Xbox and PlayStation users by enhancing audio quality, introducing a wireless gaming headset that balances premium features with affordability, and facilitating extended gaming sessions. This development signifies a shift towards more personalized and high-quality gaming experiences.

Strategic North America Gaming Headsets Market Market Forecast

The North America Gaming Headsets Market is projected for substantial and sustained growth, underpinned by ongoing technological advancements and the continuously expanding global esports ecosystem. The market is anticipated to achieve a significant valuation of $5.5 Billion by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033. Future growth trajectories will be significantly influenced by the seamless integration of emerging technologies such as AI and VR, promising to deliver unprecedented levels of personalized and immersive gaming experiences. The strategic focus on catering to the budget-conscious segment, as exemplified by the success of models like the OXS Storm G2 Wireless, is poised to unlock considerable growth potential. As consumer preferences increasingly lean towards high-quality, feature-rich, and customizable gaming peripherals, the North America Gaming Headsets Market is set to thrive and capture new market segments.

North America Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Gaming Headsets Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.4. Market Trends

- 3.4.1. Console Headset Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. United States North America Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6.1.1. Console Headset

- 6.1.2. PC Headset

- 6.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. Retail

- 6.3.2. Online

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 7. Canada North America Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 7.1.1. Console Headset

- 7.1.2. PC Headset

- 7.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. Retail

- 7.3.2. Online

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 Logitech International S A

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Razer Inc

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Corsair Gaming

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Sony Interactive Entertainment

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 HyperX (HP Inc )

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 ASUSTeK Computer Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Microsoft Corporation

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Harman International Industries Incorporated

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 SteelSeries

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Turtle Beach Corporatio

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Logitech International S A

List of Figures

- Figure 1: Global North America Gaming Headsets Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global North America Gaming Headsets Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: United States North America Gaming Headsets Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 4: United States North America Gaming Headsets Market Volume (Billion), by Compatibility Type 2024 & 2032

- Figure 5: United States North America Gaming Headsets Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 6: United States North America Gaming Headsets Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 7: United States North America Gaming Headsets Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 8: United States North America Gaming Headsets Market Volume (Billion), by Connectivity Type 2024 & 2032

- Figure 9: United States North America Gaming Headsets Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 10: United States North America Gaming Headsets Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 11: United States North America Gaming Headsets Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 12: United States North America Gaming Headsets Market Volume (Billion), by Sales Channel 2024 & 2032

- Figure 13: United States North America Gaming Headsets Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 14: United States North America Gaming Headsets Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 15: United States North America Gaming Headsets Market Revenue (Million), by Geography 2024 & 2032

- Figure 16: United States North America Gaming Headsets Market Volume (Billion), by Geography 2024 & 2032

- Figure 17: United States North America Gaming Headsets Market Revenue Share (%), by Geography 2024 & 2032

- Figure 18: United States North America Gaming Headsets Market Volume Share (%), by Geography 2024 & 2032

- Figure 19: United States North America Gaming Headsets Market Revenue (Million), by Country 2024 & 2032

- Figure 20: United States North America Gaming Headsets Market Volume (Billion), by Country 2024 & 2032

- Figure 21: United States North America Gaming Headsets Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: United States North America Gaming Headsets Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Canada North America Gaming Headsets Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 24: Canada North America Gaming Headsets Market Volume (Billion), by Compatibility Type 2024 & 2032

- Figure 25: Canada North America Gaming Headsets Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 26: Canada North America Gaming Headsets Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 27: Canada North America Gaming Headsets Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 28: Canada North America Gaming Headsets Market Volume (Billion), by Connectivity Type 2024 & 2032

- Figure 29: Canada North America Gaming Headsets Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 30: Canada North America Gaming Headsets Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 31: Canada North America Gaming Headsets Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 32: Canada North America Gaming Headsets Market Volume (Billion), by Sales Channel 2024 & 2032

- Figure 33: Canada North America Gaming Headsets Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 34: Canada North America Gaming Headsets Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 35: Canada North America Gaming Headsets Market Revenue (Million), by Geography 2024 & 2032

- Figure 36: Canada North America Gaming Headsets Market Volume (Billion), by Geography 2024 & 2032

- Figure 37: Canada North America Gaming Headsets Market Revenue Share (%), by Geography 2024 & 2032

- Figure 38: Canada North America Gaming Headsets Market Volume Share (%), by Geography 2024 & 2032

- Figure 39: Canada North America Gaming Headsets Market Revenue (Million), by Country 2024 & 2032

- Figure 40: Canada North America Gaming Headsets Market Volume (Billion), by Country 2024 & 2032

- Figure 41: Canada North America Gaming Headsets Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Canada North America Gaming Headsets Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global North America Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global North America Gaming Headsets Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global North America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: Global North America Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 5: Global North America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: Global North America Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 7: Global North America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: Global North America Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 9: Global North America Gaming Headsets Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Global North America Gaming Headsets Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 11: Global North America Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Global North America Gaming Headsets Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: Global North America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 14: Global North America Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 15: Global North America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 16: Global North America Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 17: Global North America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 18: Global North America Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 19: Global North America Gaming Headsets Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Global North America Gaming Headsets Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 21: Global North America Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global North America Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

- Table 23: Global North America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 24: Global North America Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 25: Global North America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 26: Global North America Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 27: Global North America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 28: Global North America Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 29: Global North America Gaming Headsets Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Global North America Gaming Headsets Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 31: Global North America Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global North America Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gaming Headsets Market?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the North America Gaming Headsets Market?

Key companies in the market include Logitech International S A, Razer Inc, Corsair Gaming, Sony Interactive Entertainment, HyperX (HP Inc ), ASUSTeK Computer Inc, Microsoft Corporation, Harman International Industries Incorporated, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the North America Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

6. What are the notable trends driving market growth?

Console Headset Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

8. Can you provide examples of recent developments in the market?

July 2024: Chinese electronics firm OXS unveiled its latest gaming headset, the OXS Storm G2 Wireless, targeting budget-conscious gamers in the USA. The headset is up for grabs on both Amazon and the official OXS website. It boasts a suite of gaming-centric features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the North America Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence