Key Insights

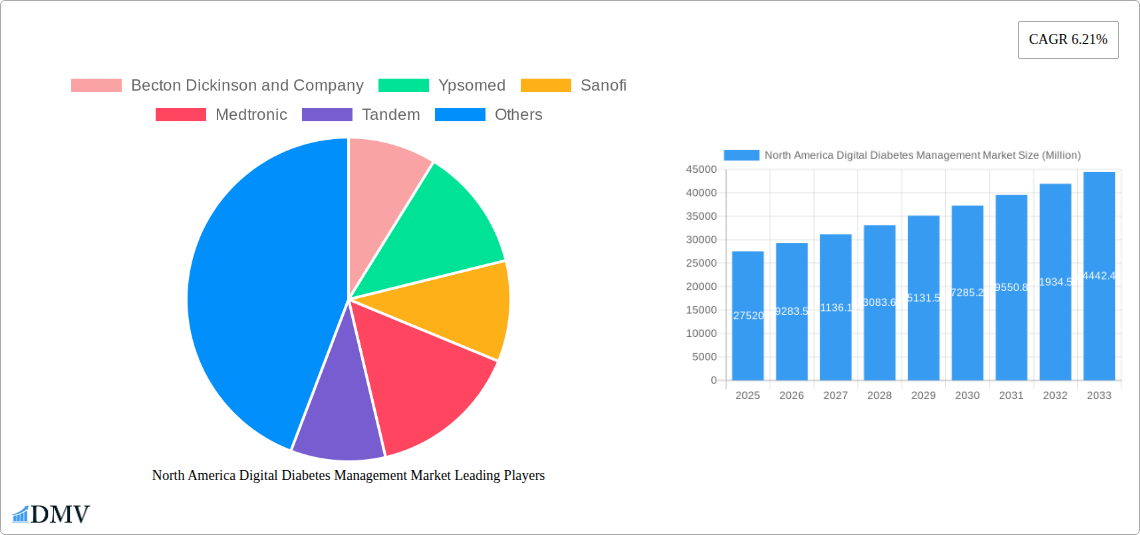

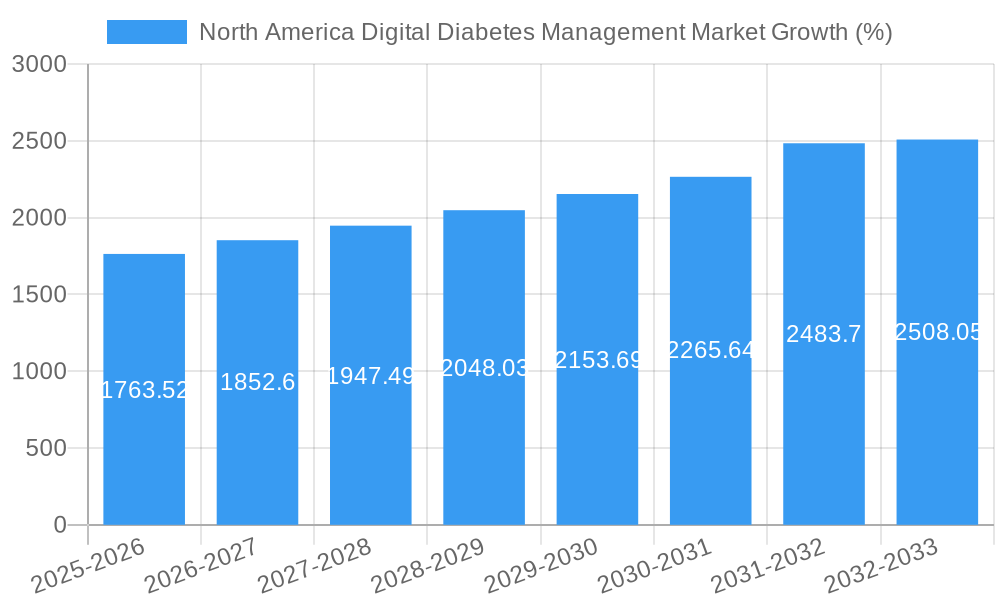

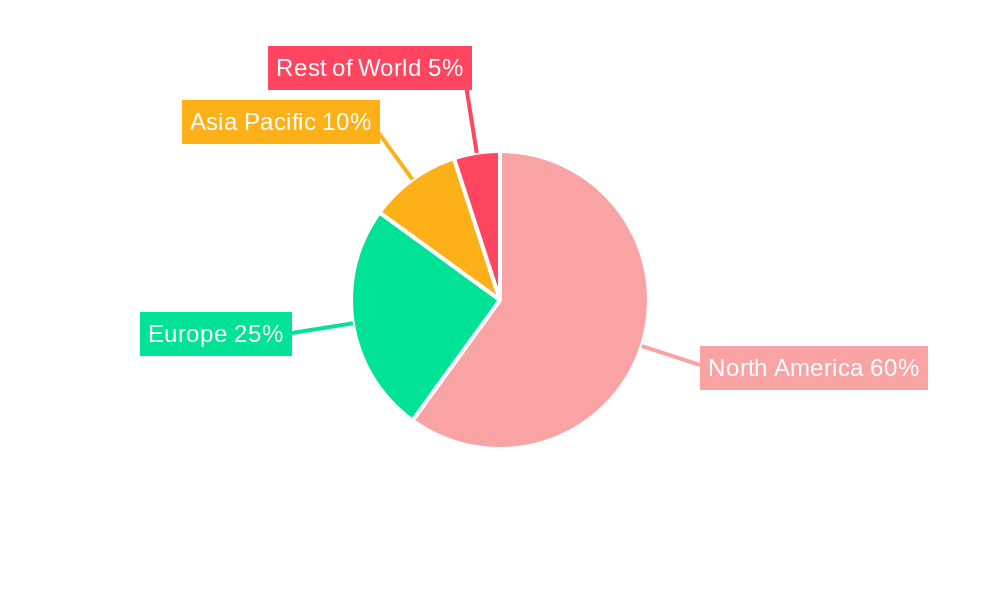

The North American digital diabetes management market, valued at $27.52 billion in 2025, is projected to experience robust growth, driven by a rising prevalence of diabetes, technological advancements in continuous glucose monitoring (CGM) and insulin pump systems, and increasing patient preference for convenient, remote healthcare solutions. The market's Compound Annual Growth Rate (CAGR) of 6.21% from 2019-2033 indicates a significant expansion over the forecast period (2025-2033). Key growth drivers include the increasing adoption of CGM systems offering real-time glucose data, improved insulin pump technology with enhanced features like automated insulin delivery, and the growing availability of integrated digital health platforms that facilitate remote patient monitoring and data management. Furthermore, the market is segmented into various product categories, including CGM (sensors, durables, management devices), insulin pumps (devices, reservoirs, infusion sets), self-monitoring blood glucose (SMBG) devices (glucometers, test strips, lancets), and other monitoring devices. Companies like Medtronic, Dexcom, Abbott, and Insulet are major players, constantly innovating and competing to capture market share. Within North America, the United States is the largest market segment, driven by high diabetes prevalence, robust healthcare infrastructure, and greater access to advanced technologies.

While the market shows considerable promise, challenges remain. High costs associated with advanced technologies like CGM and insulin pumps present a barrier to market penetration, particularly among lower-income populations. Furthermore, data security and privacy concerns related to the use of digital health platforms need careful consideration. Addressing these challenges through innovative financing models, affordability programs, and robust cybersecurity measures will be crucial to further market expansion. The continued development of more user-friendly, accurate, and affordable devices is also critical for driving broader adoption and improving patient outcomes. Overall, the North American digital diabetes management market is poised for significant growth, driven by a confluence of technological advances, rising prevalence of diabetes, and a shifting healthcare landscape.

North America Digital Diabetes Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America digital diabetes management market, offering valuable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a granular view of market trends, competitive dynamics, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Digital Diabetes Management Market Composition & Trends

This section delves into the intricate structure of the North America digital diabetes management market, examining key aspects influencing its evolution. We analyze market concentration, revealing a xx% share held by the top 7 companies, including Becton Dickinson and Company, Ypsomed, Sanofi, Medtronic, Tandem, Insulet, F Hoffmann-La Roche AG, Abbott, Novo Nordisk, Dexcom, and Eli Lilly. The analysis also incorporates a detailed 7-company share analysis (xx Million each). Innovation is a significant driver, with continuous advancements in CGM (Continuous Glucose Monitoring) and insulin pump technologies shaping market dynamics. The regulatory landscape, particularly FDA approvals, significantly impacts market access and product adoption. We examine substitute products, including traditional blood glucose monitoring methods, and assess their impact on market share. Finally, the report analyzes end-user profiles (patients, healthcare providers, payers) and assesses the impact of M&A activities, with a review of deal values totaling xx Million during the historical period.

- Market Concentration: Top 7 companies hold xx% market share.

- Innovation Catalysts: Advancements in CGM, insulin pump technology, and data analytics.

- Regulatory Landscape: FDA approvals significantly influence market entry and growth.

- Substitute Products: Traditional blood glucose monitoring methods present competitive pressure.

- End-User Profiles: Patients, healthcare providers, and payers shape market demand.

- M&A Activities: Deal values totaled xx Million during 2019-2024.

North America Digital Diabetes Management Market Industry Evolution

This section provides a comprehensive overview of the North America digital diabetes management market's historical and projected growth trajectories. From 2019 to 2024, the market experienced a CAGR of xx%, driven by factors such as the rising prevalence of diabetes, technological advancements leading to more user-friendly and accurate devices, and increasing demand for remote patient monitoring solutions. The report analyzes specific growth rates across various segments, like CGM and insulin pumps. Technological advancements, such as the miniaturization of sensors and development of integrated systems, are highlighted. We also examine shifts in consumer demands, with a focus on the preference for non-invasive, user-friendly, and connected devices that integrate with mobile applications and telehealth platforms. This section meticulously details the adoption of various digital diabetes management solutions, providing a precise picture of market penetration.

Leading Regions, Countries, or Segments in North America Digital Diabetes Management Market

The United States is the dominant market, representing xx% of the total North American market value (xx Million in 2025). This leadership stems from several key factors:

- High Prevalence of Diabetes: A significantly large diabetic population drives high demand.

- Robust Healthcare Infrastructure: Extensive access to healthcare and advanced treatment options.

- High Investment in Digital Health: Significant venture capital and government funding for digital health innovations.

- Favorable Regulatory Environment: FDA approval processes facilitate market entry for innovative products.

Within the segments, Continuous Glucose Monitoring (CGM) systems (Sensors, Durables, Management Devices) represent the fastest-growing segment, fueled by technological advancements and the rising adoption of real-time glucose monitoring. Insulin pumps (Insulin Pump Device, Insulin Pump Reservoir, Infusion Set) also constitute a substantial portion of the market, with increasing demand for advanced features like automated insulin delivery. Self-monitoring blood glucose devices (Glucometer Devices, Blood Glucose Test Strips, Lancets) maintain significant market share, particularly in underserved communities.

North America Digital Diabetes Management Market Product Innovations

Recent innovations encompass smaller, more accurate, and discreet CGM sensors, along with advanced insulin pump systems offering automated insulin delivery and sophisticated data analytics capabilities. These improvements enhance patient convenience, improve treatment outcomes, and reduce healthcare costs. Unique selling propositions center on ease of use, data integration, predictive analytics, and improved accuracy. Integration with mobile applications and cloud-based platforms fosters seamless data management and remote patient monitoring.

Propelling Factors for North America Digital Diabetes Management Market Growth

Several factors propel market growth:

- Rising Prevalence of Diabetes: The increasing incidence of type 1 and type 2 diabetes globally fuels demand.

- Technological Advancements: Miniaturization, improved accuracy, and integration of devices enhance usability.

- Growing Adoption of Telehealth: Remote monitoring and virtual consultations support effective diabetes management.

- Favorable Regulatory Support: Government initiatives promote the adoption of digital health technologies.

Obstacles in the North America Digital Diabetes Management Market

Challenges include:

- High Costs: The expense of devices and consumables creates accessibility barriers for some patients.

- Data Privacy Concerns: Data security and patient privacy are paramount concerns in digital health.

- Interoperability Issues: Seamless integration between devices and healthcare systems remains a challenge.

- Reimbursement Policies: Insurance coverage varies, potentially limiting access to advanced technologies.

Future Opportunities in North America Digital Diabetes Management Market

Future opportunities include:

- Expansion into Underserved Populations: Reaching patients with limited access to care.

- Artificial Intelligence (AI) Integration: AI-powered predictive analytics and personalized treatment plans.

- Development of Closed-Loop Systems: Fully automated insulin delivery systems offer significant potential.

- Integration with Wearable Technology: Seamless integration with smartwatches and fitness trackers.

Major Players in the North America Digital Diabetes Management Market Ecosystem

- Becton Dickinson and Company

- Ypsomed

- Sanofi

- Medtronic

- Tandem

- Insulet

- F Hoffmann-La Roche AG

- Abbott

- Novo Nordisk

- Dexcom

- Eli Lilly

- *List Not Exhaustive

Key Developments in North America Digital Diabetes Management Market Industry

- April 2023: Abbott receives FDA clearance for its FreeStyle Libre 3 iCGM system, featuring the world's smallest and thinnest sensor. This launch is expected to significantly impact market share.

- March 2022: Dexcom launches its G7 CGM system in the U.K., with planned expansion across Europe and pending FDA approval for U.S. release. This signifies a major step in advancing CGM technology.

Strategic North America Digital Diabetes Management Market Forecast

The North America digital diabetes management market is poised for robust growth, driven by technological innovation, increasing diabetes prevalence, and supportive regulatory environments. Future opportunities lie in the development and adoption of advanced closed-loop systems, AI-powered solutions, and seamless integration with other healthcare technologies. This market is expected to witness significant expansion in the coming years, offering considerable potential for stakeholders.

North America Digital Diabetes Management Market Segmentation

-

1. Product

-

1.1. Monitoring Devices

-

1.1.1. Self-monitoring Blood Glucose Devices

- 1.1.1.1. Glucometer Devices

- 1.1.1.2. Blood Glucose Test Strips

- 1.1.1.3. Lancets

-

1.1.2. Continuous Glucose Monitoring

- 1.1.2.1. Sensors

- 1.1.2.2. Durables

-

1.1.1. Self-monitoring Blood Glucose Devices

-

1.2. Management Devices

-

1.2.1. Insulin Pump

- 1.2.1.1. Insulin Pump Device

- 1.2.1.2. Insulin Pump Reservoir

- 1.2.1.3. Infusion Set

- 1.2.2. Insulin Syringes

- 1.2.3. Cartridges in Reusable pens

- 1.2.4. Insulin Disposable Pens

- 1.2.5. Jet Injectors

-

1.2.1. Insulin Pump

-

1.1. Monitoring Devices

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Digital Diabetes Management Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Digital Diabetes Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Monitoring Devices is Having the Highest Market Share in Current Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Monitoring Devices

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1.1. Glucometer Devices

- 5.1.1.1.2. Blood Glucose Test Strips

- 5.1.1.1.3. Lancets

- 5.1.1.2. Continuous Glucose Monitoring

- 5.1.1.2.1. Sensors

- 5.1.1.2.2. Durables

- 5.1.1.1. Self-monitoring Blood Glucose Devices

- 5.1.2. Management Devices

- 5.1.2.1. Insulin Pump

- 5.1.2.1.1. Insulin Pump Device

- 5.1.2.1.2. Insulin Pump Reservoir

- 5.1.2.1.3. Infusion Set

- 5.1.2.2. Insulin Syringes

- 5.1.2.3. Cartridges in Reusable pens

- 5.1.2.4. Insulin Disposable Pens

- 5.1.2.5. Jet Injectors

- 5.1.2.1. Insulin Pump

- 5.1.1. Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Monitoring Devices

- 6.1.1.1. Self-monitoring Blood Glucose Devices

- 6.1.1.1.1. Glucometer Devices

- 6.1.1.1.2. Blood Glucose Test Strips

- 6.1.1.1.3. Lancets

- 6.1.1.2. Continuous Glucose Monitoring

- 6.1.1.2.1. Sensors

- 6.1.1.2.2. Durables

- 6.1.1.1. Self-monitoring Blood Glucose Devices

- 6.1.2. Management Devices

- 6.1.2.1. Insulin Pump

- 6.1.2.1.1. Insulin Pump Device

- 6.1.2.1.2. Insulin Pump Reservoir

- 6.1.2.1.3. Infusion Set

- 6.1.2.2. Insulin Syringes

- 6.1.2.3. Cartridges in Reusable pens

- 6.1.2.4. Insulin Disposable Pens

- 6.1.2.5. Jet Injectors

- 6.1.2.1. Insulin Pump

- 6.1.1. Monitoring Devices

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Monitoring Devices

- 7.1.1.1. Self-monitoring Blood Glucose Devices

- 7.1.1.1.1. Glucometer Devices

- 7.1.1.1.2. Blood Glucose Test Strips

- 7.1.1.1.3. Lancets

- 7.1.1.2. Continuous Glucose Monitoring

- 7.1.1.2.1. Sensors

- 7.1.1.2.2. Durables

- 7.1.1.1. Self-monitoring Blood Glucose Devices

- 7.1.2. Management Devices

- 7.1.2.1. Insulin Pump

- 7.1.2.1.1. Insulin Pump Device

- 7.1.2.1.2. Insulin Pump Reservoir

- 7.1.2.1.3. Infusion Set

- 7.1.2.2. Insulin Syringes

- 7.1.2.3. Cartridges in Reusable pens

- 7.1.2.4. Insulin Disposable Pens

- 7.1.2.5. Jet Injectors

- 7.1.2.1. Insulin Pump

- 7.1.1. Monitoring Devices

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Rest of North America North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Monitoring Devices

- 8.1.1.1. Self-monitoring Blood Glucose Devices

- 8.1.1.1.1. Glucometer Devices

- 8.1.1.1.2. Blood Glucose Test Strips

- 8.1.1.1.3. Lancets

- 8.1.1.2. Continuous Glucose Monitoring

- 8.1.1.2.1. Sensors

- 8.1.1.2.2. Durables

- 8.1.1.1. Self-monitoring Blood Glucose Devices

- 8.1.2. Management Devices

- 8.1.2.1. Insulin Pump

- 8.1.2.1.1. Insulin Pump Device

- 8.1.2.1.2. Insulin Pump Reservoir

- 8.1.2.1.3. Infusion Set

- 8.1.2.2. Insulin Syringes

- 8.1.2.3. Cartridges in Reusable pens

- 8.1.2.4. Insulin Disposable Pens

- 8.1.2.5. Jet Injectors

- 8.1.2.1. Insulin Pump

- 8.1.1. Monitoring Devices

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Digital Diabetes Management Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Becton Dickinson and Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ypsomed

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sanofi

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Medtronic

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tandem

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Insulet

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 F Hoffmann-La Roche AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Abbott

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Novo Nordisk

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Dexcom

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Eli Lilly*List Not Exhaustive 7 2 Company Share Analysi

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: North America Digital Diabetes Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Digital Diabetes Management Market Share (%) by Company 2024

List of Tables

- Table 1: North America Digital Diabetes Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Digital Diabetes Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Digital Diabetes Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Digital Diabetes Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Digital Diabetes Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Digital Diabetes Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Digital Diabetes Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Digital Diabetes Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Digital Diabetes Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Digital Diabetes Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America Digital Diabetes Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Digital Diabetes Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Digital Diabetes Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: North America Digital Diabetes Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Digital Diabetes Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Digital Diabetes Management Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: North America Digital Diabetes Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Digital Diabetes Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Digital Diabetes Management Market?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the North America Digital Diabetes Management Market?

Key companies in the market include Becton Dickinson and Company, Ypsomed, Sanofi, Medtronic, Tandem, Insulet, F Hoffmann-La Roche AG, Abbott, Novo Nordisk, Dexcom, Eli Lilly*List Not Exhaustive 7 2 Company Share Analysi.

3. What are the main segments of the North America Digital Diabetes Management Market?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Monitoring Devices is Having the Highest Market Share in Current Year.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

April 2023: Abbott has announced the clearance of its FreeStyle Libre 3 integrated continuous glucose monitoring (iCGM) system by the U.S. Food and Drug Administration (FDA). This system includes a reader that has been approved as a standalone device. Notably, the glucose sensor used in this system is the smallest, thinnest, and most discreet in the world. Abbott is now focused on expediting the process of getting the FreeStyle Libre 3 system included in Medicare's list of covered systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Digital Diabetes Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Digital Diabetes Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Digital Diabetes Management Market?

To stay informed about further developments, trends, and reports in the North America Digital Diabetes Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence