Key Insights

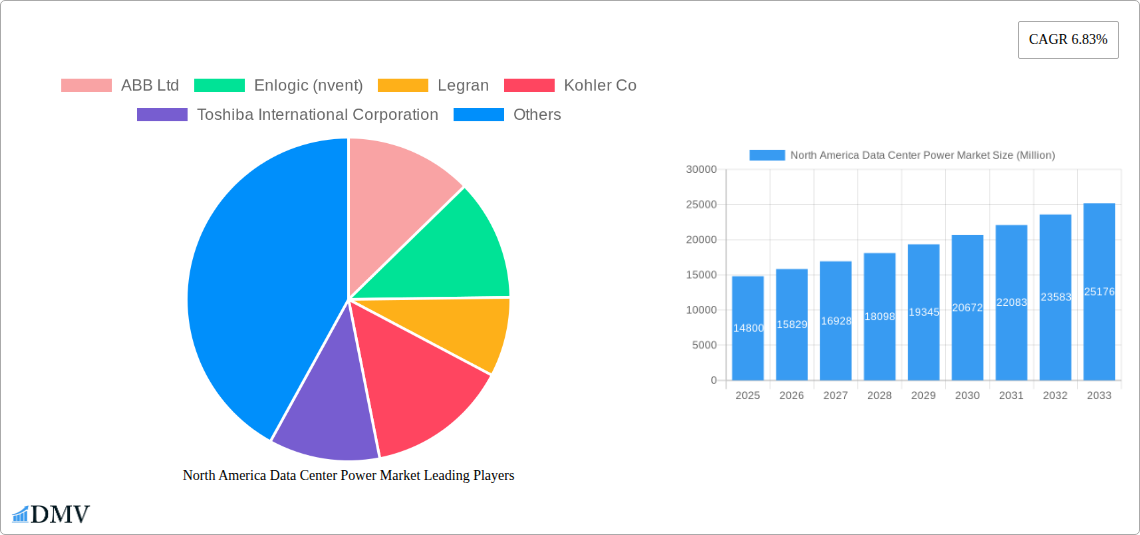

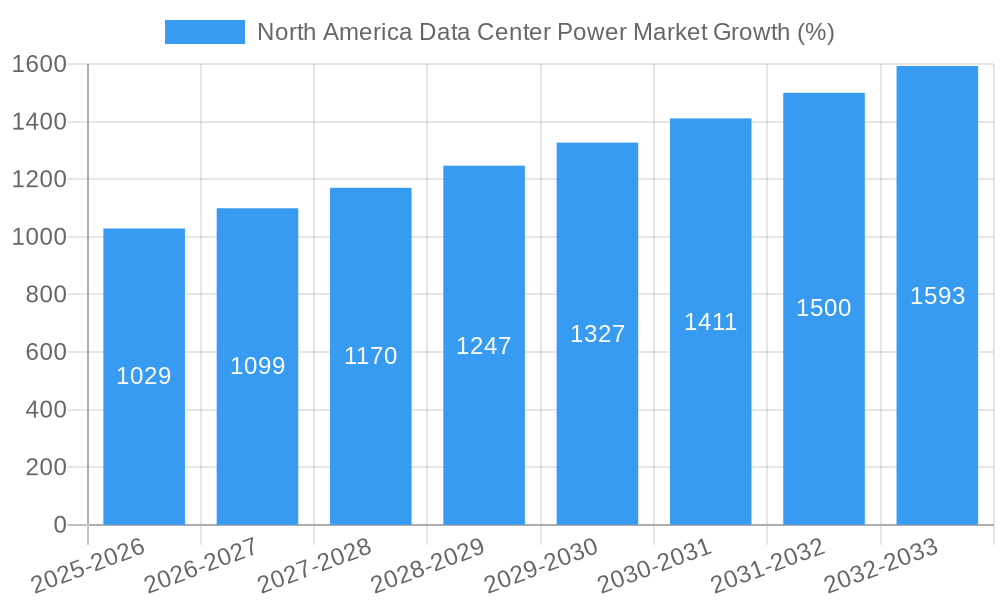

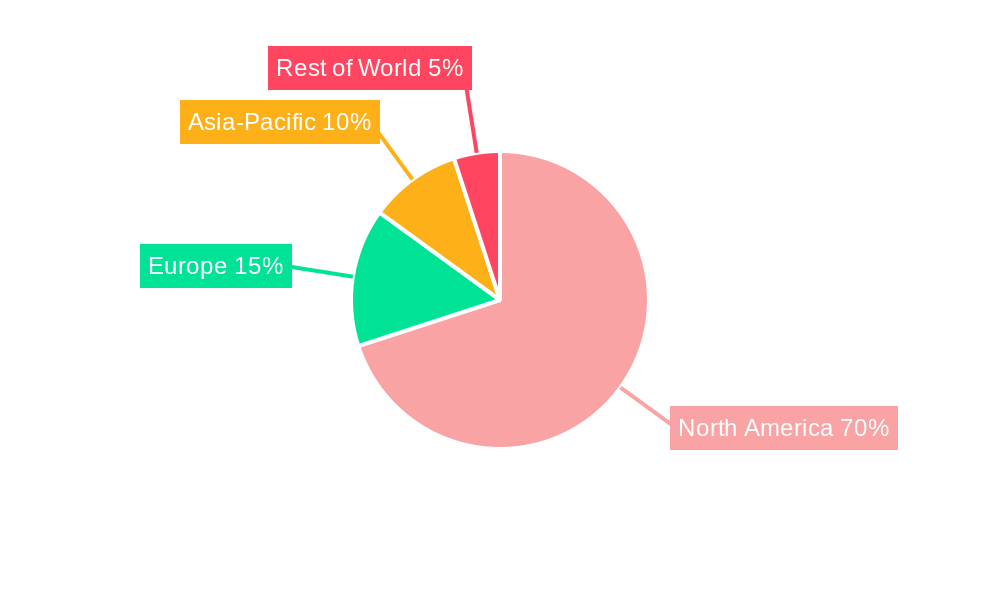

The North America data center power market, valued at $14.80 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of cloud computing, the proliferation of edge data centers, and the rising demand for high-availability power solutions. The market's Compound Annual Growth Rate (CAGR) of 6.83% from 2025 to 2033 reflects a consistent expansion, fueled by the continuous digital transformation across various sectors. Key drivers include the escalating need for reliable power infrastructure to support mission-critical data center operations, particularly within the BFSI, IT & Telecom, and Government sectors. Furthermore, advancements in power backup solutions, such as increased efficiency and integration capabilities, are contributing to market expansion. The segment breakdown indicates significant contributions from colocation data centers, emphasizing the importance of power infrastructure for shared data center environments. Leading vendors like Schneider Electric, Vertiv, and ABB are actively shaping market dynamics through their innovative offerings and strategic partnerships. The strong presence of hyperscalers and enterprise data centers further solidifies the robust demand for advanced power solutions.

Growth within North America is largely concentrated in the United States and Canada, reflecting the region's advanced digital infrastructure and high concentration of data centers. While the exact market share for each country is not provided, industry trends suggest the United States commands a significant majority, with Canada holding a substantial, though smaller, portion of the market. However, potential restraints include the fluctuating prices of raw materials impacting manufacturing costs and potential regulatory changes that could influence infrastructure development. Nonetheless, the overall outlook remains positive, with the market expected to witness continued expansion driven by ongoing technological advancements and increasing digitalization across North American industries. The diverse offerings from solution providers cater to various data center types, emphasizing a market driven by continuous innovation and evolving power demands.

This comprehensive report provides an in-depth analysis of the North America Data Center Power Market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers critical market intelligence for strategic decision-making. The market size is projected to reach xx Million by 2033, presenting significant opportunities for growth and investment.

North America Data Center Power Market Market Composition & Trends

This section delves into the competitive dynamics of the North America data center power market, examining market concentration, innovation drivers, regulatory influences, and the impact of mergers and acquisitions (M&A). We analyze the market share distribution among key players such as ABB Ltd, Schneider Electric, Vertiv Group Corp, and others, identifying potential shifts in market power. The report also assesses the influence of substitute products and technological advancements on market competition. Furthermore, it explores the evolving end-user profiles within BFSI, IT & Telecom, Government, Manufacturing, Media & Entertainment, and other sectors, highlighting their respective power consumption needs and technological preferences. The analysis of M&A activities includes a review of deal values and their impact on market consolidation and technological advancements, with an estimated xx Million in M&A activity during the historical period.

- Market Concentration: Analysis of market share distribution amongst leading vendors.

- Innovation Catalysts: Examination of technological advancements driving market growth.

- Regulatory Landscape: Assessment of government policies and their impact on market dynamics.

- Substitute Products: Evaluation of alternative solutions and their competitive influence.

- End-User Profiles: Detailed analysis of power consumption trends across different sectors.

- M&A Activity: Review of key mergers and acquisitions, including deal values and their impact.

North America Data Center Power Market Industry Evolution

This section provides a comprehensive overview of the North America data center power market's evolutionary trajectory from 2019 to 2033. It examines the market's growth trajectories, pinpointing specific data points such as compound annual growth rates (CAGRs) and adoption metrics for key technologies. Technological advancements, including the adoption of energy-efficient power solutions and the increasing integration of renewable energy sources are analyzed in detail. The report also examines the evolving consumer demands for enhanced power reliability, security, and sustainability, influencing technological shifts and market expansion. We project a CAGR of xx% for the forecast period (2025-2033), driven by factors such as the increasing adoption of cloud computing, the growth of data centers in edge locations and the rising demand for higher power density solutions.

Leading Regions, Countries, or Segments in North America Data Center Power Market

This section identifies the dominant regions, countries, and segments within the North America data center power market. We analyze market leadership across various categories, including end-user applications (BFSI, IT & Telecom, Government, Manufacturing, Media & Entertainment, Other), countries (United States, Canada), solution types, power backup solutions (by service: Design & Consulting, Integration, Support & Maintenance), and data center types (Colocation, Enterprise & Cloud, Hyperscalers). The dominance of specific segments is explained through key drivers such as investment trends, regulatory support, and other market factors.

- Key Drivers for Dominant Segments:

- United States: High concentration of data centers, robust IT infrastructure, and substantial investment in digital transformation initiatives.

- IT and Telecom: High energy consumption, stringent uptime requirements, and continuous technological upgrades.

- Hyperscalers: Massive power demands, focus on energy efficiency, and deployment of advanced power management solutions.

- In-depth analysis of dominance factors: Each dominant segment’s growth trajectory, market size, and competitive landscape is comprehensively analyzed, highlighting the unique factors contributing to their success.

North America Data Center Power Market Product Innovations

This section highlights recent product innovations within the data center power market, emphasizing their applications and performance metrics. Key advancements such as improved power distribution units (PDUs) with enhanced monitoring capabilities, intelligent power management systems, and energy-efficient power backup solutions are discussed. The report underscores the unique selling propositions (USPs) of these innovations and their contribution to improved data center efficiency and reliability. Recent developments include more efficient power conversion technologies, leading to decreased energy loss and improved total cost of ownership (TCO).

Propelling Factors for North America Data Center Power Market Growth

Several key factors are driving the growth of the North America data center power market. The increasing adoption of cloud computing and big data analytics are creating a surge in demand for reliable and efficient power solutions. Furthermore, government initiatives promoting digital infrastructure development and the growing focus on energy efficiency are also contributing to market expansion. The increasing demand for high-density computing environments is also a significant factor, necessitating robust and scalable power infrastructure. Regulatory compliance mandates for improved data center efficiency are further accelerating market growth.

Obstacles in the North America Data Center Power Market

The North America data center power market faces several challenges, including supply chain disruptions that can lead to delays in project implementation and increased costs. Moreover, intense competition among established players and new entrants can put pressure on pricing and profitability. Fluctuations in energy prices and stringent regulatory requirements also pose significant challenges to market growth, potentially impacting the financial viability of data center projects. These challenges can lead to increased operating costs for data centers, and could potentially decrease the adoption rate of certain solutions.

Future Opportunities in North America Data Center Power Market

The North America data center power market presents various future opportunities. The growing adoption of edge computing creates a significant demand for distributed power solutions and infrastructure. Furthermore, advancements in renewable energy technologies and energy storage solutions can further improve data center sustainability and reduce operating costs. The emergence of new data center designs and architectural patterns may also present opportunities for innovation.

Major Players in the North America Data Center Power Market Ecosystem

- ABB Ltd

- Enlogic (nvent)

- Legran

- Kohler Co

- Toshiba International Corporation

- LayerZero Power Systems

- Raritan Inc (Legrand)

- Siemens AG

- Tripp Lite (Eaton)

- Schneider Electric

- Cummins Inc

- Vertiv Group Corp

Key Developments in North America Data Center Power Market Industry

- June 2023: CyberPower released an update for its Three-Phase Intelligent LCD PDU firmware, adding support for a new environmental sensor (SNEV001) and allowing users to enable/disable cipher suites for the SSL Server. This enhances security and monitoring capabilities.

- June 2023: Legrand introduced next-generation intelligent rack Power Distribution Units (PDUs), the Server Technology PRO4X and Raritan PX4, redefining data center power management with improved visibility, hardware, and security.

Strategic North America Data Center Power Market Forecast

The North America data center power market is poised for substantial growth driven by several key factors, including the accelerating digital transformation, expanding cloud infrastructure, and the rising adoption of artificial intelligence and machine learning applications. The increasing demand for energy-efficient and sustainable data center solutions presents a significant opportunity for innovation and investment. The market's future trajectory will be shaped by technological advancements, regulatory changes, and evolving consumer preferences, offering significant potential for market players to capitalize on.

North America Data Center Power Market Segmentation

-

1. Type

-

1.1. By Solution Type

- 1.1.1. Power Distribution Solution

- 1.1.2. Power Back Up Solutions

- 1.2. By Servi

-

1.1. By Solution Type

-

2. Data Center Type

- 2.1. Colocation

- 2.2. Enterprise & Cloud

- 2.3. Hyperscalers

-

3. End-user Application

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Manufacturing

- 3.5. Media & Entertainment

- 3.6. Other End User

North America Data Center Power Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns will Remain a Challenge to the Growth of the Market

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. By Solution Type

- 5.1.1.1. Power Distribution Solution

- 5.1.1.2. Power Back Up Solutions

- 5.1.2. By Servi

- 5.1.1. By Solution Type

- 5.2. Market Analysis, Insights and Forecast - by Data Center Type

- 5.2.1. Colocation

- 5.2.2. Enterprise & Cloud

- 5.2.3. Hyperscalers

- 5.3. Market Analysis, Insights and Forecast - by End-user Application

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Manufacturing

- 5.3.5. Media & Entertainment

- 5.3.6. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Enlogic (nvent)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Legran

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kohler Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Toshiba International Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 LayerZero Power Systems

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Raritan Inc (Legrand)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tripp Lite (Eaton)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Schneider Electric

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Cummins Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Vertiv Group Corp

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: North America Data Center Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Data Center Power Market Share (%) by Company 2024

List of Tables

- Table 1: North America Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Data Center Power Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Data Center Power Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 4: North America Data Center Power Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 5: North America Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Data Center Power Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Data Center Power Market Revenue Million Forecast, by Data Center Type 2019 & 2032

- Table 13: North America Data Center Power Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 14: North America Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Data Center Power Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Data Center Power Market?

The projected CAGR is approximately 6.83%.

2. Which companies are prominent players in the North America Data Center Power Market?

Key companies in the market include ABB Ltd, Enlogic (nvent), Legran, Kohler Co, Toshiba International Corporation, LayerZero Power Systems, Raritan Inc (Legrand), Siemens AG, Tripp Lite (Eaton), Schneider Electric, Cummins Inc, Vertiv Group Corp.

3. What are the main segments of the North America Data Center Power Market?

The market segments include Type, Data Center Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Data Security Concerns will Remain a Challenge to the Growth of the Market.

8. Can you provide examples of recent developments in the market?

June 2023 - CyberPower released an update for its Three-Phase Intelligent LCD PDU firmware. It adds support for a new environmental sensor, SNEV001, and allows users to enable/disable cipher suites for the SSL Server.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Data Center Power Market?

To stay informed about further developments, trends, and reports in the North America Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence