Key Insights

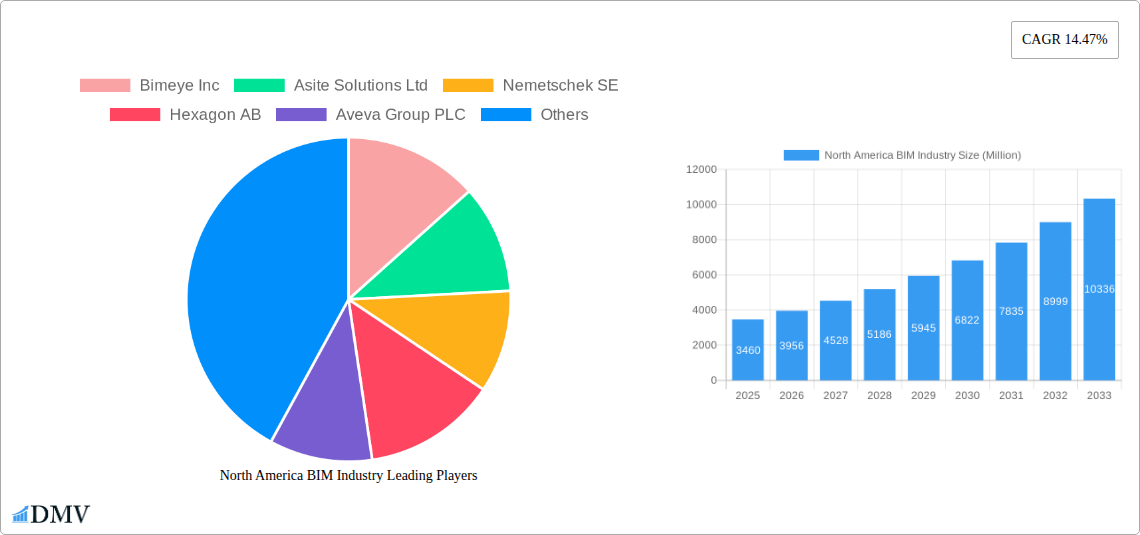

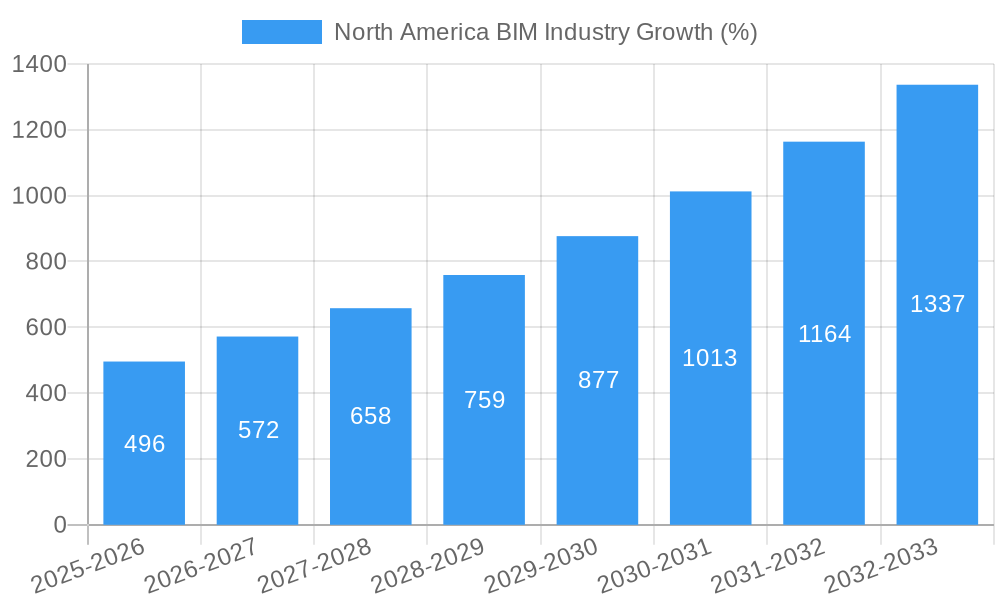

The North American Building Information Modeling (BIM) market, valued at $3.46 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 14.47% from 2025 to 2033. This expansion is driven by several key factors. Increasing government mandates for digital construction practices and a growing emphasis on sustainable building design are significant catalysts. Furthermore, the rising adoption of cloud-based BIM solutions enhances accessibility and collaboration among project stakeholders, fueling market growth. The construction industry's ongoing digital transformation, coupled with the need for enhanced project efficiency and reduced construction errors, further contributes to the market's upward trajectory. Specific applications like commercial construction projects are showing high adoption rates due to the potential for significant cost savings and improved project outcomes from better planning and coordination. The prevalence of large-scale infrastructure projects across North America also creates significant opportunities for BIM software and service providers.

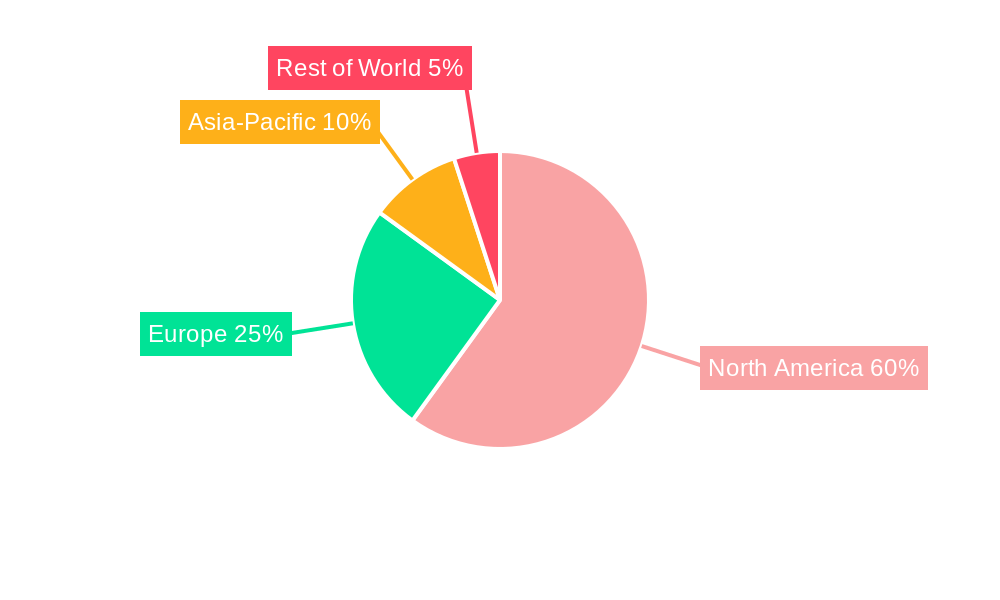

Competition within the North American BIM market is intense, with both established players like Autodesk, Bentley Systems, and Nemetschek SE, and emerging innovative companies vying for market share. This competitive landscape drives innovation, leading to the development of more sophisticated BIM software with advanced functionalities, such as improved visualization tools, 4D simulation capabilities for construction scheduling, and integrated cost estimation modules. Challenges remain, including the need for skilled BIM professionals and the initial investment costs associated with adopting BIM technology. However, the long-term benefits of improved project delivery, reduced risks, and enhanced building performance outweigh these challenges, ensuring continued market growth. The regional dominance of North America is anticipated to continue due to factors like advanced technological infrastructure, a large and mature construction industry, and consistent government support for digital transformation within the construction sector.

North America BIM Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Building Information Modeling (BIM) industry, encompassing market size, trends, leading players, and future projections from 2019 to 2033. The study period covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033). This report is crucial for stakeholders seeking to understand the dynamics of this rapidly evolving sector, identifying lucrative investment opportunities and navigating the competitive landscape. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

North America BIM Industry Market Composition & Trends

The North American BIM market is characterized by a moderately concentrated landscape, with major players like Autodesk Inc, Bentley Systems Inc, and Trimble Inc holding significant market share. However, the emergence of innovative niche players and strategic acquisitions fuels competition. The market share distribution is currently estimated as follows: Autodesk Inc (xx%), Bentley Systems Inc (xx%), Trimble Inc (xx%), and others (xx%). Regulatory landscapes, particularly concerning data security and interoperability standards, significantly influence market growth. Substitute products are limited, but the industry faces pressure from alternative construction management techniques. End-user profiles encompass architects, engineers, construction firms, and government agencies. Mergers and acquisitions (M&A) activity has been considerable, with deal values totaling xx Million in the last five years, driving consolidation and technological integration. Key M&A events include [Insert 2-3 significant M&A examples with deal values if available, otherwise state "Data unavailable"].

- Market Concentration: Moderately concentrated, with several key players dominating.

- Innovation Catalysts: Technological advancements, government initiatives promoting digitalization in construction.

- Regulatory Landscape: Growing focus on data security and interoperability standards.

- Substitute Products: Limited, but alternative construction management methods pose some competition.

- End-User Profiles: Architects, engineers, construction firms, government agencies.

- M&A Activities: Significant activity, with total deal values reaching xx Million in the last 5 years.

North America BIM Industry Industry Evolution

The North American BIM industry has witnessed exponential growth driven by increasing adoption across diverse sectors. The market grew at a CAGR of xx% during 2019-2024. This growth trajectory is projected to continue, with a forecasted CAGR of xx% from 2025-2033. Technological advancements like cloud-based BIM platforms, AI-powered design tools, and improved interoperability are driving increased efficiency and reducing project costs. Shifting consumer demands for sustainable and efficient buildings are further fueling the adoption of BIM. The construction industry's increasing emphasis on data-driven decision-making and risk mitigation has made BIM a necessity. The integration of BIM with other technologies like IoT and digital twins is further expanding its applications and potential. Adoption rates are increasing significantly, with xx% of construction projects in North America currently utilizing BIM. This number is expected to rise to xx% by 2033. Specific examples of technological advancements include the introduction of generative design tools and the increasing use of virtual and augmented reality in construction visualization.

Leading Regions, Countries, or Segments in North America BIM Industry

The United States dominates the North American BIM market, driven by substantial investment in infrastructure projects, a robust technology sector, and a high concentration of major BIM software and service providers. Canada also shows significant growth, fueled by government initiatives promoting digitalization in the construction sector.

- By Type: The software segment holds the largest market share, followed by services. The increasing demand for sophisticated BIM software and integrated solutions is a major factor in this segment's dominance.

- By Deployment Type: The cloud deployment model is gaining traction due to its scalability, accessibility, and cost-effectiveness compared to on-premise solutions.

- By Application: The commercial sector leads in BIM adoption due to the complexity and scale of commercial projects. However, residential and industrial sectors are showing strong growth.

- By Country: The United States dominates the market due to its large construction sector and higher technology adoption rates. Canada is a rapidly growing market, benefiting from government support and increasing infrastructure investments.

Key Drivers:

- United States: Strong investment in infrastructure, advanced technology adoption, and large construction projects.

- Canada: Government initiatives to promote digital construction, substantial infrastructure development.

- Software Segment: High demand for sophisticated BIM software and integrated platforms.

- Cloud Deployment: Scalability, accessibility, and cost-effectiveness drive cloud adoption.

- Commercial Sector: Complexity and scale of projects necessitate BIM implementation.

North America BIM Industry Product Innovations

Recent product innovations include AI-powered design optimization tools, cloud-based collaboration platforms with enhanced data security features, and immersive VR/AR applications for construction visualization and stakeholder communication. These innovations deliver superior design efficiency, improved collaboration, and reduced construction risks. Unique selling propositions often include improved interoperability, enhanced data analytics capabilities, and streamlined workflows to increase efficiency and reduce errors.

Propelling Factors for North America BIM Industry Growth

Technological advancements in software and hardware, increasing government investments in infrastructure projects, and the growing adoption of digitalization in the construction sector are key drivers for industry growth. Stricter building codes emphasizing energy efficiency and sustainability further propel BIM adoption. Economic factors such as rising construction costs and the need to improve project profitability are also significant drivers.

Obstacles in the North America BIM Industry Market

High initial investment costs for software and training can hinder adoption, particularly among smaller firms. The complexity of BIM implementation and the need for skilled professionals can pose challenges. Data security concerns and the lack of interoperability between different BIM software platforms remain significant obstacles. Supply chain disruptions can impact project timelines and budgets, posing challenges for BIM project execution. Intense competition among established and emerging players increases market pressure.

Future Opportunities in North America BIM Industry

Emerging opportunities include the integration of BIM with IoT and AI for real-time monitoring and predictive analytics, the expansion of BIM applications in specialized sectors like healthcare and education, and the development of sustainable design solutions. Growth in the adoption of digital twins for enhanced asset management represents significant potential. The increasing use of BIM in the prefabrication industry also presents attractive opportunities.

Major Players in the North America BIM Industry Ecosystem

- Bimeye Inc

- Asite Solutions Ltd

- Nemetschek SE

- Hexagon AB

- Aveva Group PLC

- Autodesk Inc

- Topcon Positioning Systems Inc

- Clearedge3D Inc

- Dassault Systèmes SA

- Bentley Systems Inc

- Trimble Inc

- Rib Software AG

Key Developments in North America BIM Industry Industry

- September 2023: US-based Diasphere launched BIM VDC services for MEP systems, offering a 24-hour turnaround time for constructible BIM content. This improves efficiency and reduces project risks.

- October 2023: Nouveau Monde Graphite Inc. (Canada) partnered with Pomerleau for pre-construction management of its Phase-2 facilities, integrating BIM for enhanced project management, efficiency, and cost control. This highlights the increasing adoption of BIM in large-scale industrial projects.

Strategic North America BIM Industry Market Forecast

The North American BIM market is poised for sustained growth, driven by ongoing technological advancements, increasing infrastructure spending, and a growing emphasis on sustainable construction practices. Opportunities abound in areas such as cloud-based BIM, AI-powered design tools, and the integration of BIM with other digital technologies. The market's future potential is significant, with substantial growth expected across various segments and geographic regions.

North America BIM Industry Segmentation

-

1. Type

- 1.1. Software

- 1.2. Services

-

2. Deployment Type

- 2.1. On-premise

- 2.2. Cloud

-

3. Application

- 3.1. Commercial

- 3.2. Residential

- 3.3. Industrial

North America BIM Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America BIM Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Mandates Promoting the Usage of BIM in Key International Markets; Increased Project Performance and Productivity

- 3.3. Market Restrains

- 3.3.1. Cost and Implementation Issues

- 3.4. Market Trends

- 3.4.1. Commercial Application Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America BIM Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America BIM Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America BIM Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America BIM Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America BIM Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bimeye Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Asite Solutions Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nemetschek SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hexagon AB

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Aveva Group PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Autodesk Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Topcon Positioning Systems Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Clearedge3D Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Dassault Systems SA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bentley Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Trimble Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Rib Software AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Bimeye Inc

List of Figures

- Figure 1: North America BIM Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America BIM Industry Share (%) by Company 2024

List of Tables

- Table 1: North America BIM Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America BIM Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America BIM Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America BIM Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: North America BIM Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 6: North America BIM Industry Volume K Unit Forecast, by Deployment Type 2019 & 2032

- Table 7: North America BIM Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: North America BIM Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: North America BIM Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America BIM Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America BIM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America BIM Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States North America BIM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America BIM Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada North America BIM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America BIM Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America BIM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America BIM Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America BIM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America BIM Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: North America BIM Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America BIM Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 23: North America BIM Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 24: North America BIM Industry Volume K Unit Forecast, by Deployment Type 2019 & 2032

- Table 25: North America BIM Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: North America BIM Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 27: North America BIM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America BIM Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United States North America BIM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States North America BIM Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Canada North America BIM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada North America BIM Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Mexico North America BIM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico North America BIM Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America BIM Industry?

The projected CAGR is approximately 14.47%.

2. Which companies are prominent players in the North America BIM Industry?

Key companies in the market include Bimeye Inc, Asite Solutions Ltd, Nemetschek SE, Hexagon AB, Aveva Group PLC, Autodesk Inc, Topcon Positioning Systems Inc, Clearedge3D Inc, Dassault Systems SA, Bentley Systems Inc, Trimble Inc, Rib Software AG.

3. What are the main segments of the North America BIM Industry?

The market segments include Type, Deployment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Mandates Promoting the Usage of BIM in Key International Markets; Increased Project Performance and Productivity.

6. What are the notable trends driving market growth?

Commercial Application Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Cost and Implementation Issues.

8. Can you provide examples of recent developments in the market?

September 2023: US based Diasphere, a BIM VDC services provider for MEP systems, introduced to offer an extensive working experience that enables the avoidance of any mistakes and unnecessary financial risks. The company's extensive experience in virtual design and construction allows them to make a quick turnaround time of just 24 hours, providing only constructable BIM content without any delays.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America BIM Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America BIM Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America BIM Industry?

To stay informed about further developments, trends, and reports in the North America BIM Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence