Key Insights

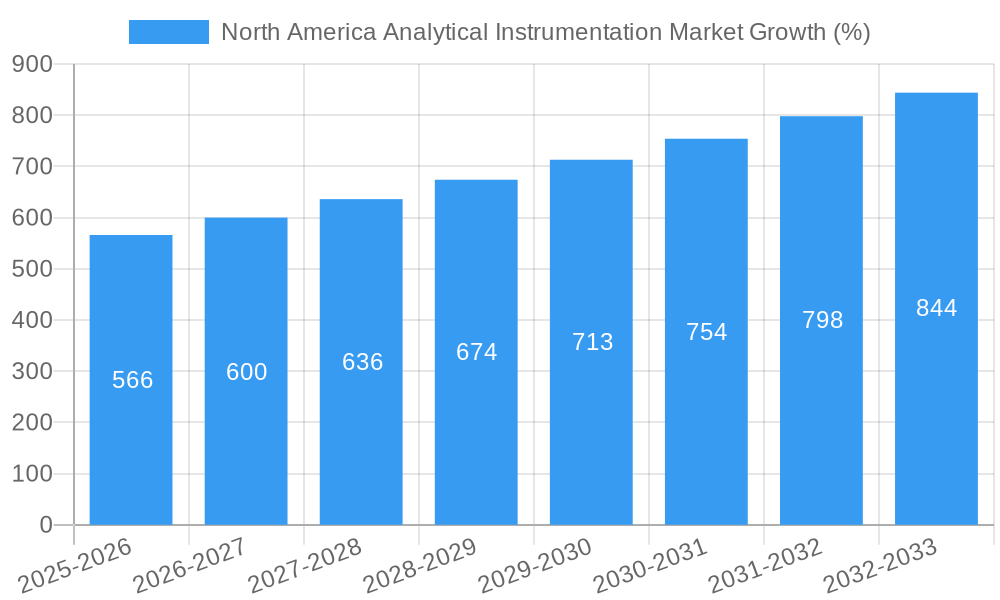

The North America analytical instrumentation market, valued at approximately $9.15 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.81% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning life sciences sector, particularly within pharmaceuticals and biotechnology, necessitates advanced analytical techniques for drug discovery, development, and quality control. The increasing prevalence of chronic diseases and the growing demand for personalized medicine further stimulate this demand. Secondly, stringent regulatory requirements across various industries, including food safety and environmental monitoring, mandate the adoption of sophisticated analytical instrumentation for compliance and quality assurance. Technological advancements, such as miniaturization, automation, and improved sensitivity of analytical instruments, contribute to market growth by enhancing efficiency and reducing operational costs. Finally, substantial investments in research and development activities across academia and industry sectors are driving the adoption of cutting-edge analytical technologies. The significant presence of major analytical instrumentation manufacturers in North America further supports this thriving market.

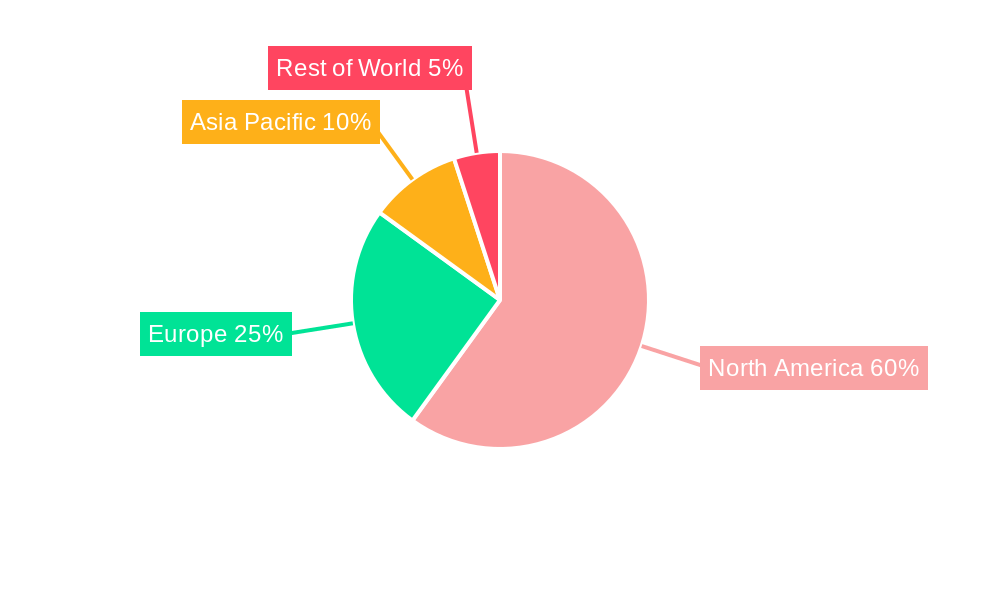

Within North America, the United States constitutes the largest market segment, followed by Canada and Mexico. The market segmentation by product type reveals a strong demand for chromatography systems, mass spectrometers, and molecular analysis spectroscopy equipment. The life sciences end-user industry segment dominates the market, owing to its extensive reliance on advanced analytical techniques. However, growing applications in chemical and petrochemical industries, materials science, and food testing are also contributing to market expansion. While challenges such as high initial investment costs for advanced equipment and the need for skilled personnel exist, the overall market outlook remains positive, driven by the aforementioned factors and a continued focus on technological innovation within the analytical instrumentation sector.

North America Analytical Instrumentation Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America Analytical Instrumentation market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this study is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

North America Analytical Instrumentation Market Composition & Trends

This section delves into the market's competitive landscape, analyzing key trends and factors influencing its evolution. We examine market concentration, revealing the market share distribution amongst leading players such as Bio-Rad Laboratories Inc, PerkinElmer Inc, Waters Corporation, Thermo Fisher Scientific Inc, Mettler Toledo International, Agilent Technologies Inc, Malvern Panalytical Ltd (Spectris Plc), Bruker Corporation, and Shimadzu Corporation. The report also investigates innovation drivers, including advancements in chromatography, mass spectrometry, and spectroscopy technologies. Regulatory landscapes impacting the market, including FDA guidelines and environmental regulations, are thoroughly assessed. The influence of substitute products and their potential market disruption is also analyzed. Furthermore, we provide a detailed profile of end-user industries, including their specific instrumentation needs and purchasing patterns. Finally, the report analyzes recent mergers and acquisitions (M&A) activities, including deal values and their implications for market consolidation. Key metrics like market share and M&A deal values will be presented both in tabular and graphical formats.

- Market Concentration: High, with top 10 players holding approximately xx% of the market share in 2025.

- Innovation Catalysts: Advancements in miniaturization, automation, and data analysis capabilities.

- Regulatory Landscape: Stringent regulations concerning data integrity, quality control, and environmental compliance.

- Substitute Products: Limited direct substitutes, but alternative analytical techniques are emerging.

- End-User Profiles: Predominantly life sciences, chemical, and pharmaceutical industries.

- M&A Activities: Significant M&A activity observed in the historical period (2019-2024), with a total deal value of approximately xx Million.

North America Analytical Instrumentation Market Industry Evolution

This section provides a detailed analysis of the North America Analytical Instrumentation market's growth trajectory from 2019 to 2033. We explore the underlying technological advancements that have driven market expansion, highlighting the impact of innovations in areas like mass spectrometry, liquid chromatography, and atomic absorption spectroscopy. The analysis also considers shifts in consumer demand, examining the increasing preference for high-throughput, automated systems, and the growing need for sophisticated data analysis software. Specific data points, including compound annual growth rates (CAGR) for different segments and adoption rates of new technologies, will be presented. The report incorporates a discussion on market challenges, such as the impact of the COVID-19 pandemic and supply chain disruptions, and their influence on market growth. We will analyze the growth rates of different segments based on product type and end-user industry. For instance, the life sciences segment shows an estimated CAGR of xx% between 2025 and 2033, primarily driven by increasing R&D investment in pharmaceuticals and biotechnology.

Leading Regions, Countries, or Segments in North America Analytical Instrumentation Market

This section identifies the dominant regions, countries, and segments within the North America Analytical Instrumentation market. We analyze the key factors driving the dominance of specific segments such as Chromatography and Life Sciences.

By Product Type:

- Chromatography: Dominant segment due to its widespread applications in various industries. Key drivers include increasing demand for high-performance liquid chromatography (HPLC) and gas chromatography (GC) systems.

- Mass Spectroscopy: Rapid growth fueled by advancements in high-resolution mass spectrometry and its applications in proteomics and metabolomics.

- Other Product Types: This segment is projected to witness steady growth, driven by the increasing demand for specialized analytical instruments.

By End-user Industry:

- Life Sciences: Largest segment driven by substantial investments in pharmaceutical R&D, genomics research, and biotechnology.

- Chemical and Petrochemical: Significant demand for analytical instruments for quality control and process optimization.

Key Drivers:

- High R&D spending in life sciences and related fields.

- Stringent regulatory requirements for quality control and safety testing.

- Growing adoption of advanced analytical techniques.

The dominance of these segments is a result of a number of factors, including strong R&D investment, stringent regulatory requirements for quality control, and increased adoption of advanced analytical techniques across industries.

North America Analytical Instrumentation Market Product Innovations

Recent years have witnessed significant product innovations in analytical instrumentation, characterized by enhanced sensitivity, improved resolution, faster analysis times, and greater automation. New mass spectrometry techniques, such as high-resolution accurate mass spectrometry (HRAM), offer unparalleled capabilities for complex sample analysis. Advancements in chromatography, such as ultra-high-performance liquid chromatography (UHPLC), provide higher speed and resolution. These advancements enhance the efficiency and effectiveness of analytical processes across diverse applications. Miniaturization of instruments contributes to reduced costs and enhanced portability.

Propelling Factors for North America Analytical Instrumentation Market Growth

The North America analytical instrumentation market is experiencing robust growth, driven by several key factors. Technological advancements leading to improved analytical capabilities, increased automation, and higher throughput are primary drivers. The pharmaceutical and biotechnology industries are significantly contributing to market expansion through robust R&D spending and stringent quality control requirements. Government regulations emphasizing environmental monitoring and food safety also fuel demand for advanced analytical instruments.

Obstacles in the North America Analytical Instrumentation Market

Several factors are hindering the growth of the North America analytical instrumentation market. High initial investment costs for sophisticated instruments can be a barrier for smaller companies and research institutions. The complexity of these instruments requires specialized training and skilled technicians, potentially restricting accessibility. Supply chain disruptions, particularly during periods of economic uncertainty, can lead to delays and increased costs. Intense competition among established players further complicates the market. The average cost of high-end instrumentation is approximately xx Million, hindering affordability for smaller organizations.

Future Opportunities in North America Analytical Instrumentation Market

Future opportunities in the North America analytical instrumentation market lie in several promising areas. The integration of artificial intelligence (AI) and machine learning (ML) into analytical instruments promises to enhance data processing, analysis, and interpretation capabilities. The growing adoption of point-of-care diagnostics, particularly in remote areas, represents a significant potential market segment. The development of more sustainable and environmentally friendly analytical technologies will drive future market growth.

Major Players in the North America Analytical Instrumentation Market Ecosystem

- Bio-Rad Laboratories Inc

- PerkinElmer Inc

- Waters Corporation

- Thermo Fisher Scientific Inc

- Mettler Toledo International

- Agilent Technologies Inc

- Malvern Panalytical Ltd (Spectris Plc)

- Bruker Corporation

- Shimadzu Corporation

Key Developments in North America Analytical Instrumentation Market Industry

- January 2022: Bruker Corporation's acquisition of Prolab Instruments GmbH expands its capabilities in high-precision liquid chromatography.

- November 2021: Shimadzu Corporation's collaboration with NCVC advances genetic risk factor detection for cerebrovascular disease.

Strategic North America Analytical Instrumentation Market Forecast

The North America analytical instrumentation market is poised for continued growth driven by ongoing technological advancements, increased R&D investments across diverse sectors, and stringent regulatory compliance requirements. Emerging trends such as AI integration, miniaturization, and sustainable technologies will further shape the market landscape. The market presents significant opportunities for innovation and expansion, particularly in rapidly growing fields such as personalized medicine, environmental monitoring, and food safety. The projected growth of xx Million from 2025 to 2033 highlights the substantial potential of this market segment.

North America Analytical Instrumentation Market Segmentation

-

1. Product Type

- 1.1. Chromatography

- 1.2. Molecular Analysis Spectroscopy

- 1.3. Elemental Analysis Spectroscopy

- 1.4. Mass Spectroscopy

- 1.5. Analytical Microscopes

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Life Sciences

- 2.2. Chemical and Petrochemical

- 2.3. Material Sciences

- 2.4. Food Testing

- 2.5. Oil and Gas

- 2.6. Research and Academia

- 2.7. Other End-Users

North America Analytical Instrumentation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Analytical Instrumentation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of Precision Medicines

- 3.3. Market Restrains

- 3.3.1. High Initial Cost

- 3.4. Market Trends

- 3.4.1. Life Sciences Segment Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Chromatography

- 5.1.2. Molecular Analysis Spectroscopy

- 5.1.3. Elemental Analysis Spectroscopy

- 5.1.4. Mass Spectroscopy

- 5.1.5. Analytical Microscopes

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Life Sciences

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Material Sciences

- 5.2.4. Food Testing

- 5.2.5. Oil and Gas

- 5.2.6. Research and Academia

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bio-Rad Laboratories Inc *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Perkinelmer Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Waters Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Thermo Fisher Scientific Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mettler Toledo International

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Agilent Technologies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Malvern Panalytical Ltd (Spectris Plc)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bruker Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Shimadzu Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Bio-Rad Laboratories Inc *List Not Exhaustive

List of Figures

- Figure 1: North America Analytical Instrumentation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Analytical Instrumentation Market Share (%) by Company 2024

List of Tables

- Table 1: North America Analytical Instrumentation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Analytical Instrumentation Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Analytical Instrumentation Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: North America Analytical Instrumentation Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: North America Analytical Instrumentation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: North America Analytical Instrumentation Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 7: North America Analytical Instrumentation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Analytical Instrumentation Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Analytical Instrumentation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Analytical Instrumentation Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Analytical Instrumentation Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Analytical Instrumentation Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 21: North America Analytical Instrumentation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: North America Analytical Instrumentation Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 23: North America Analytical Instrumentation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Analytical Instrumentation Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Analytical Instrumentation Market?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the North America Analytical Instrumentation Market?

Key companies in the market include Bio-Rad Laboratories Inc *List Not Exhaustive, Perkinelmer Inc, Waters Corporation, Thermo Fisher Scientific Inc, Mettler Toledo International, Agilent Technologies Inc, Malvern Panalytical Ltd (Spectris Plc), Bruker Corporation, Shimadzu Corporation.

3. What are the main segments of the North America Analytical Instrumentation Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Development of Precision Medicines.

6. What are the notable trends driving market growth?

Life Sciences Segment Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Initial Cost.

8. Can you provide examples of recent developments in the market?

January 2022 - Bruker Corporation announced the acquisition of Prolab Instruments GmbH, a Swiss technology company specializing in low-flow, high-precision liquid chromatography technology and systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Analytical Instrumentation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Analytical Instrumentation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Analytical Instrumentation Market?

To stay informed about further developments, trends, and reports in the North America Analytical Instrumentation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence