Key Insights

The Nigeria Oil and Gas Midstream Market, encompassing processing, storage, and transportation of crude oil and natural gas, presents a complex landscape of opportunities and challenges. The market's size in 2025 is estimated at $15 billion, reflecting significant investment in infrastructure development and growing domestic demand. The historical period (2019-2024) witnessed fluctuating growth influenced by global oil price volatility, regulatory changes, and occasional pipeline disruptions. However, Nigeria's substantial oil and gas reserves and the government's focus on domestic gas utilization for power generation are driving market expansion. The ongoing efforts to enhance pipeline infrastructure and improve refining capacity are expected to stimulate further growth. A projected Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033 suggests a steady, albeit moderate, expansion. This growth is contingent on successful implementation of government policies aimed at attracting foreign investment, mitigating security concerns within the oil and gas sector, and streamlining regulatory frameworks.

The forecast period (2025-2033) anticipates continued growth fueled by both domestic and export markets. Increased investment in Liquefied Natural Gas (LNG) export projects will significantly impact the midstream sector, creating opportunities in liquefaction, storage, and transportation. However, challenges remain, including the need for consistent regulatory clarity, sustainable environmental practices, and tackling the issue of gas flaring. Successfully addressing these challenges is crucial for unlocking the full potential of the Nigerian oil and gas midstream market and ensuring sustainable long-term growth. A focus on technological advancements, particularly in pipeline monitoring and management, will be vital for efficiency and safety improvements.

Nigeria Oil and Gas Midstream Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Nigeria Oil and Gas Midstream Market, covering the period 2019-2033. With a focus on the Transportation, Storage, and Terminal sector, this comprehensive study offers crucial insights for stakeholders seeking to understand market trends, opportunities, and challenges within this vital sector of the Nigerian economy. The report uses 2025 as its base and estimated year, forecasting market performance through 2033. Key players such as Shell PLC, DuPort Midstream, Chevron Nigeria Limited, Phillips Oil Co Nigeria Ltd, Eni SpA, and the Nigerian National Petroleum Corporation (NNPC) are extensively analyzed. The report features detailed market sizing, valuable forecasts, and crucial insights for strategic decision-making.

Nigeria Oil and Gas Midstream Market Composition & Trends

This section delves into the competitive landscape of the Nigerian midstream oil and gas market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. We analyze market share distribution among key players, providing a clear picture of the competitive dynamics. Data on M&A deal values, where available, reveals investment trends and market consolidation patterns. The analysis also explores the influence of regulatory changes and technological advancements on the sector's evolution.

- Market Concentration: The market exhibits a moderate level of concentration, with a few major players holding significant shares. Further analysis reveals a xx% market share held by the top three players in 2024.

- Innovation Catalysts: Technological advancements in pipeline infrastructure, storage solutions, and transportation efficiency are driving innovation. Investment in digitalization and automation is also significantly impacting efficiency.

- Regulatory Landscape: Government regulations concerning environmental standards, safety protocols, and licensing procedures play a vital role in shaping market dynamics. The impact of xx new regulations enacted in 2024 is assessed.

- Substitute Products: While limited, the emergence of renewable energy sources and alternative transportation methods may pose a long-term threat to the existing market. This is analyzed based on recent adoption rates of xx%.

- End-User Profiles: The report examines the diverse end-user profiles, including downstream oil and gas companies, power generation facilities, and industrial consumers.

- M&A Activities: The report analyzes recent M&A activity, detailing significant deals and their implications for market consolidation. Total M&A deal value in the period 2019-2024 is estimated at xx Million.

Nigeria Oil and Gas Midstream Market Industry Evolution

This section meticulously analyzes the historical and projected growth trajectories of the Nigerian oil and gas midstream market. We examine the influence of technological progress, shifting consumer preferences, and emerging market demands on market growth. Specific data points, such as historical and projected annual growth rates (CAGR), are incorporated, along with an examination of the adoption rates of key technologies.

The market experienced a CAGR of xx% during the historical period (2019-2024), largely driven by increasing domestic energy demand. The forecast period (2025-2033) projects a CAGR of xx%, with substantial growth anticipated in the storage and transportation segments. Technological advancements, particularly in pipeline infrastructure modernization and automation, are projected to contribute to enhanced efficiency and drive market growth. Emerging government initiatives aimed at optimizing the gas value chain are expected to further stimulate market expansion. The impact of geopolitical factors and fluctuating global energy prices on the industry is also assessed. The growth is analyzed by segment, with specific consideration given to the adoption rates of improved safety standards and advanced data analytics within the sector.

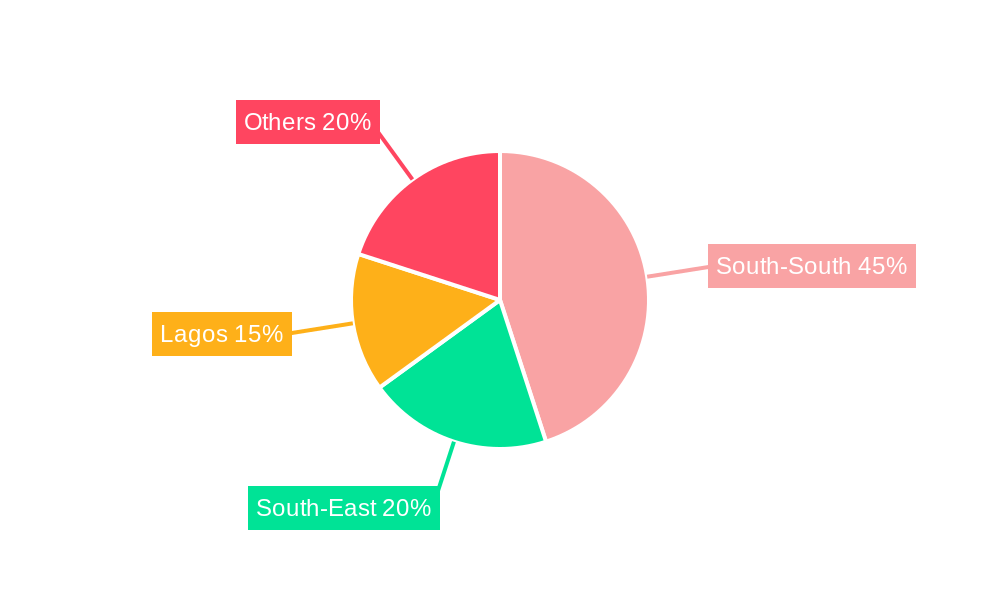

Leading Regions, Countries, or Segments in Nigeria Oil and Gas Midstream Market

This section pinpoints the dominant regions, countries, or segments within the Nigerian oil and gas midstream market, focusing specifically on the Transportation, Storage, and Terminal sector. Key drivers of dominance, such as investment trends, regulatory support, and infrastructure development, are analyzed in detail.

- Lagos State: Emerges as the dominant region due to its strategic location, well-developed infrastructure, and proximity to major oil and gas production sites.

- Key Drivers of Lagos State Dominance:

- Significant Investments: Significant private and public investments in new infrastructure projects, including pipelines, storage facilities, and terminals, have strengthened Lagos's position.

- Strategic Location: Its coastal location facilitates efficient transportation and import/export operations.

- Government Support: Favorable regulatory policies and incentives from the state government have fostered growth.

The dominance of Lagos is further analyzed in detail through an evaluation of its overall contribution to the market's total value, capacity utilization rates, and the overall economic activity generated by the sector in the region. Furthermore, the report includes a comparative analysis of Lagos's performance against other significant regions in the country, providing context and further validation of its leading status. The analysis concludes with projections for the state's continued dominance throughout the forecast period.

Nigeria Oil and Gas Midstream Market Product Innovations

Recent innovations in the Nigerian midstream oil and gas market center on enhancing pipeline efficiency, optimizing storage capacity, and improving the safety and environmental performance of operations. Technological advancements, such as the implementation of smart pipeline monitoring systems and advanced automation technologies, are improving operational efficiency and reducing downtime. The introduction of sophisticated storage tanks with increased capacity and enhanced security features is boosting the sector's overall capabilities. These innovations are characterized by improved safety standards, advanced analytics, and optimized resource utilization.

Propelling Factors for Nigeria Oil and Gas Midstream Market Growth

Several factors are driving the growth of the Nigerian oil and gas midstream market. Significant government investments in infrastructure development, such as the Nigeria-Morocco gas pipeline project, aim to expand gas supply to domestic and international markets. Increasing domestic demand for natural gas, particularly for power generation, is another significant growth catalyst. Furthermore, the liberalization of the downstream sector and regulatory reforms are creating an increasingly competitive and investor-friendly environment, attracting more private sector investment. Finally, the government’s focus on expanding LPG usage for cooking is stimulating investment in LPG storage and distribution infrastructure.

Obstacles in the Nigeria Oil and Gas Midstream Market

Despite the growth potential, several challenges hinder the development of the Nigerian oil and gas midstream sector. These include persistent pipeline vandalism, leading to significant revenue losses and safety risks estimated at xx Million annually. Regulatory uncertainties and bureaucratic bottlenecks create delays in project implementation, often exceeding planned timelines by xx%. Additionally, inadequate infrastructure, particularly in certain regions, limits the efficient transportation of gas. The lack of sufficient skilled personnel also poses a notable constraint on sustainable growth.

Future Opportunities in Nigeria Oil and Gas Midstream Market

The future of the Nigerian oil and gas midstream sector holds considerable promise. Expanding domestic gas consumption for power generation and industrial applications will be a key driver of growth. The development of new gas processing facilities will further strengthen the sector. Investments in LPG infrastructure to support the government's efforts to increase LPG penetration for domestic cooking will create significant business opportunities. The exploration and development of new gas reserves in the Niger Delta and other regions will unlock additional growth potential. Finally, export opportunities, particularly through the Nigeria-Morocco Gas pipeline, offer promising pathways for expansion.

Major Players in the Nigeria Oil and Gas Midstream Market Ecosystem

- Shell PLC

- DuPort Midstream Company Limited

- Chevron Nigeria Limited

- Phillips Oil Co Nigeria Ltd

- Eni SpA

- Nigerian National Petroleum Corporation

Key Developments in Nigeria Oil and Gas Midstream Market Industry

- September 2022: Memorandum of Understanding (MOU) signed between NNPC and ONHYM for the Nigeria-Morocco gas pipeline project (NMGP), expected to supply over 5,000 billion cubic meters of natural gas to Morocco and other West African and European countries. This significantly enhances export opportunities and regional energy security.

- January 2022: Asiko Energy commenced construction of a dual LPG and LNG terminal in Lagos, representing the first land-based LNG receiving terminal and the first dual liquefied gas terminal in Africa. This significantly improves LPG and LNG distribution capacity and enhances energy access.

Strategic Nigeria Oil and Gas Midstream Market Forecast

The Nigerian oil and gas midstream market is poised for robust growth over the forecast period (2025-2033). Government initiatives to expand gas infrastructure, coupled with increasing domestic demand and export opportunities, will fuel market expansion. The projected growth is contingent upon consistent government support, sustained investment, and effective mitigation of existing challenges, such as pipeline vandalism and infrastructure deficiencies. The market presents attractive investment opportunities for both domestic and international players looking to capitalize on the significant growth potential.

Nigeria Oil and Gas Midstream Market Segmentation

-

1. Sector

- 1.1. Transportation

- 1.2. Storage and Terminal

Nigeria Oil and Gas Midstream Market Segmentation By Geography

- 1. Niger

Nigeria Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Initiatives4.; Increasing Adoption of Solar Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Adoption of Alternative Clean Energy

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Transportation

- 5.1.2. Storage and Terminal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DuPort Midstream Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Nigeria Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Phillips Oil Co Nigeria Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eni SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nigerian National Petroleum Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Nigeria Oil and Gas Midstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Oil and Gas Midstream Market Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Oil and Gas Midstream Market Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: Nigeria Oil and Gas Midstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Nigeria Oil and Gas Midstream Market Volume Tonnes Forecast, by Sector 2019 & 2032

- Table 5: Nigeria Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Nigeria Oil and Gas Midstream Market Volume Tonnes Forecast, by Region 2019 & 2032

- Table 7: Nigeria Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Nigeria Oil and Gas Midstream Market Volume Tonnes Forecast, by Country 2019 & 2032

- Table 9: Nigeria Oil and Gas Midstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 10: Nigeria Oil and Gas Midstream Market Volume Tonnes Forecast, by Sector 2019 & 2032

- Table 11: Nigeria Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Nigeria Oil and Gas Midstream Market Volume Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Oil and Gas Midstream Market?

The projected CAGR is approximately < 1.50%.

2. Which companies are prominent players in the Nigeria Oil and Gas Midstream Market?

Key companies in the market include Shell PLC, DuPort Midstream Company Limited, Chevron Nigeria Limited, Phillips Oil Co Nigeria Ltd, Eni SpA, Nigerian National Petroleum Corporation.

3. What are the main segments of the Nigeria Oil and Gas Midstream Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Initiatives4.; Increasing Adoption of Solar Energy.

6. What are the notable trends driving market growth?

Transportation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Adoption of Alternative Clean Energy.

8. Can you provide examples of recent developments in the market?

September 2022: A memorandum of understanding (MOU) was signed between the National Nigerian Petroleum Company Limited (NNPC) and the Moroccan Office of Hydrocarbons and Mines (ONHYM) for the development of the Nigeria-Morocco gas pipeline project (NMGP) linking Nigeria to Morocco, which also aims to supply natural gas to West Africa and Europe. The project passes through 13 African countries along the Atlantic coast and supplies the landlocked states of Niger, Burkina Faso, and Mali. It is expected to supply more than 5,000 billion cubic meters of natural gas to Morocco.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Nigeria Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence