Key Insights

The Netherlands renewable energy market is experiencing robust growth, driven by the country's ambitious climate targets and supportive government policies. The period from 2019 to 2024 saw significant expansion, laying a strong foundation for continued expansion through 2033. While precise market size figures for prior years are unavailable, a conservative estimate, considering the global renewable energy trends and the Netherlands' proactive stance, suggests a market size of approximately €8 billion in 2025. This is likely fueled by increasing investments in offshore wind energy, a sector where the Netherlands holds a prominent position in Europe. Further growth is expected from advancements in solar photovoltaic (PV) technology, making it increasingly cost-competitive. Government incentives, including feed-in tariffs and tax breaks, are stimulating private sector investment and fostering innovation within the sector. The increasing integration of renewable energy sources into the national grid and the growing demand for sustainable energy solutions further contribute to this positive market outlook. Challenges remain, such as grid infrastructure limitations and the intermittent nature of renewable energy sources, but continuous technological advancements and strategic planning should mitigate these issues. The Netherlands' commitment to renewable energy sources positions it as a leading European market, attracting substantial foreign direct investment and showcasing best practices for other nations.

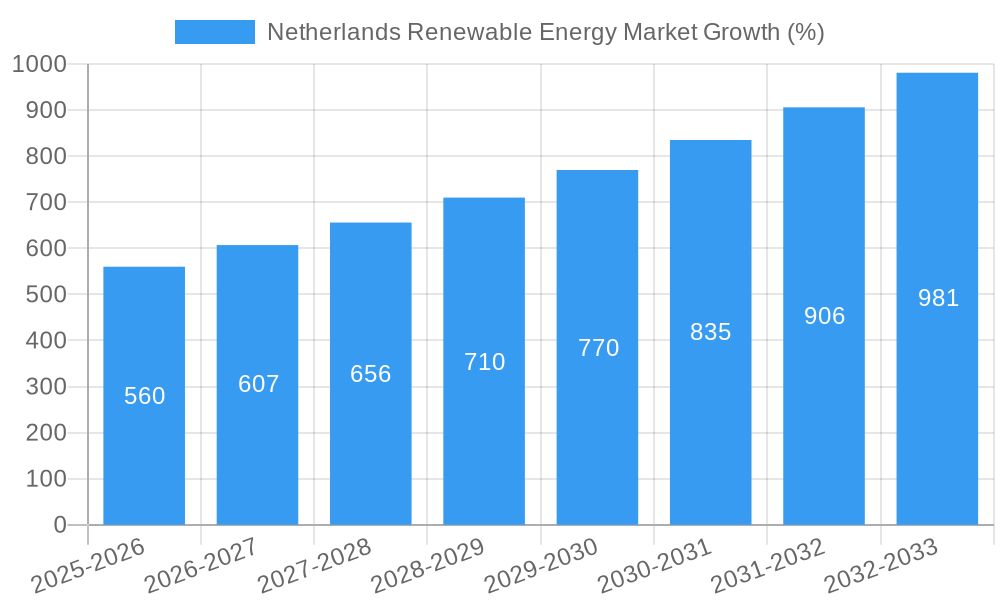

Looking ahead to 2033, the Netherlands renewable energy market is projected to continue its upward trajectory. A compound annual growth rate (CAGR) of 7% is a plausible estimation, considering both the ambitious national targets and the inherent volatility of renewable energy market growth. This moderate but steady expansion reflects the ongoing integration of renewable sources into the energy mix, the steady progress in technological innovation, and the consistent government support. The predicted growth will be predominantly driven by investments in both onshore and offshore wind power, with solar PV installations also contributing significantly. The potential for further growth lies in the exploration of innovative technologies such as wave and tidal energy, alongside increased energy storage solutions that address the intermittency of renewable sources. This continuous market evolution requires adaptive strategies from players across the value chain, including developers, investors, and policymakers, to capitalize on the opportunities and manage the challenges of a dynamic market landscape.

Netherlands Renewable Energy Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Netherlands renewable energy market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this study offers invaluable insights for stakeholders seeking to navigate this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting robust growth potential.

Netherlands Renewable Energy Market Composition & Trends

This section delves into the intricate composition of the Netherlands renewable energy market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and significant M&A activities. We analyze market share distribution among key players, providing a granular understanding of the competitive landscape. The analysis encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

- Market Concentration: The Netherlands renewable energy market exhibits a [describe level of concentration - e.g., moderately concentrated] structure, with [mention percentage] market share held by the top [number] players.

- Innovation Catalysts: Government incentives, technological advancements (e.g., improved solar panel efficiency, larger wind turbine capacity), and increasing environmental awareness are driving innovation.

- Regulatory Landscape: Stringent environmental regulations and supportive government policies, including feed-in tariffs and renewable portfolio standards (RPS), are shaping the market's growth trajectory.

- Substitute Products: While fossil fuels remain a competitive alternative, their declining cost-competitiveness and environmental concerns are increasingly favoring renewables.

- End-User Profiles: The industrial, commercial, and residential sectors represent significant end-use segments, each with distinct demand patterns and adoption rates. Analysis includes detailed breakdown of market size for each segment.

- M&A Activities: The report examines significant M&A deals, including their values and impact on market consolidation (e.g., xx Million deal in [Year] between [Company A] and [Company B]). Total M&A deal value during the study period is estimated at xx Million.

Netherlands Renewable Energy Market Industry Evolution

This section provides a detailed analysis of the Netherlands renewable energy market's evolutionary path, focusing on growth trajectories, technological advancements, and evolving consumer preferences. We provide specific data points on growth rates, adoption metrics, and technological shifts influencing the market's dynamics from 2019 to 2033. The analysis encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). Specific data will include, but is not limited to, compound annual growth rates (CAGR) for different renewable energy sources and penetration rates within various end-use sectors. The impact of technological progress, such as advancements in energy storage solutions and grid integration technologies, on market growth will be comprehensively explored. The changing consumer demands, driven by increasing environmental awareness and cost considerations, will also be analyzed. Finally, the section will offer projections for market size and growth across different segments.

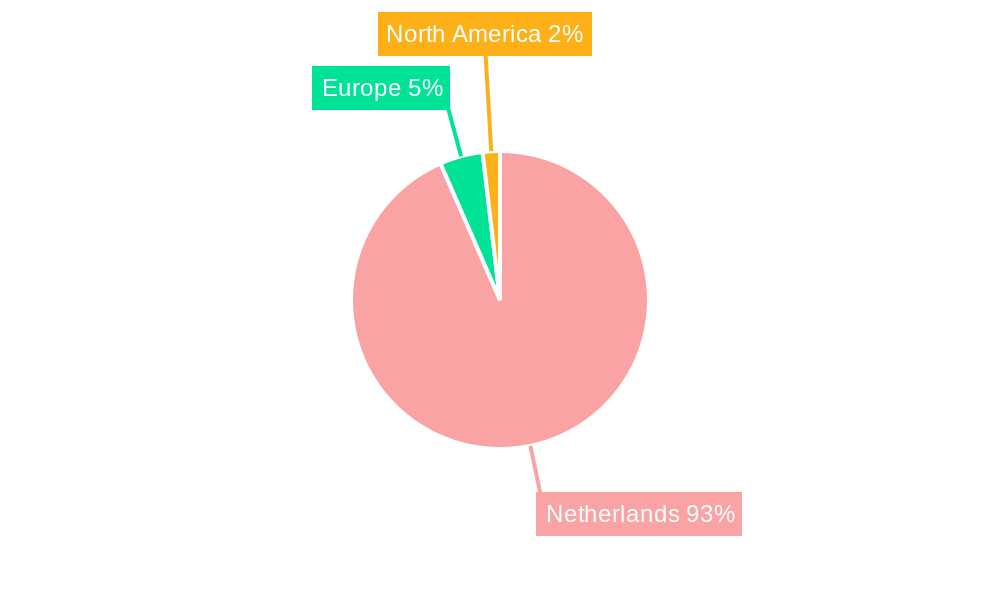

Leading Regions, Countries, or Segments in Netherlands Renewable Energy Market

This section identifies the dominant regions, countries, and market segments within the Netherlands renewable energy market, considering both source (Wind, Solar, Biomass, Other Sources) and end-use (Industrial, Commercial, Residential). The analysis will pinpoint the leading segments and the factors driving their dominance.

- Dominant Segment: [Specify dominant segment - e.g., Wind energy] holds the largest market share due to [explain reasons - e.g., favorable wind resources, government support].

- Key Drivers (Wind Energy):

- Significant investments in offshore wind farm development.

- Supportive government policies and incentives.

- Abundant wind resources, particularly offshore.

- Key Drivers (Solar Energy):

- Increasing solar irradiance levels across the country.

- Decreasing costs of solar PV technology.

- Government initiatives promoting solar rooftop installations.

- Key Drivers (Biomass Energy):

- Availability of sustainable biomass resources.

- Government support for biomass-based power generation.

- Growing demand for renewable heating solutions.

- End-Use Dominance: [Specify dominant end-use - e.g., Industrial sector] dominates due to [explain reasons - e.g., high energy consumption, government incentives for industrial renewable energy adoption].

Netherlands Renewable Energy Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics in the Netherlands renewable energy market. We analyze the unique selling propositions (USPs) and technological advancements that are transforming the industry, such as advancements in floating solar technology, more efficient wind turbine designs, and innovative energy storage solutions. The discussion will include examples of successful product launches and their impact on market dynamics.

Propelling Factors for Netherlands Renewable Energy Market Growth

Several key factors are propelling the growth of the Netherlands renewable energy market. These include:

- Technological Advancements: Significant improvements in renewable energy technologies have led to increased efficiency, reduced costs, and enhanced performance. Examples include the development of larger and more efficient wind turbines and the advancements in solar panel technology.

- Economic Incentives: Government incentives, such as subsidies, tax credits, and feed-in tariffs, are driving investment and deployment.

- Stringent Environmental Regulations: The Netherlands has implemented stringent environmental regulations aimed at reducing greenhouse gas emissions, creating a favorable environment for renewable energy adoption.

Obstacles in the Netherlands Renewable Energy Market Market

Despite significant progress, several obstacles hinder the growth of the Netherlands renewable energy market. These include:

- Grid Integration Challenges: Integrating intermittent renewable energy sources into the existing grid presents significant technical and logistical challenges.

- Intermittency of Renewable Sources: The fluctuating nature of solar and wind energy requires effective energy storage solutions to ensure reliable power supply.

- Permitting and Approvals: Delays in obtaining permits and approvals for new renewable energy projects can increase development costs and timelines.

Future Opportunities in Netherlands Renewable Energy Market

The future holds several promising opportunities for the Netherlands renewable energy market:

- Offshore Wind Expansion: The significant offshore wind potential presents substantial growth opportunities.

- Floating Solar Technology: Expanding adoption of floating solar projects on inland waters will contribute to renewable energy generation.

- Energy Storage Solutions: The development and deployment of efficient energy storage systems will help address the intermittency of renewable energy sources.

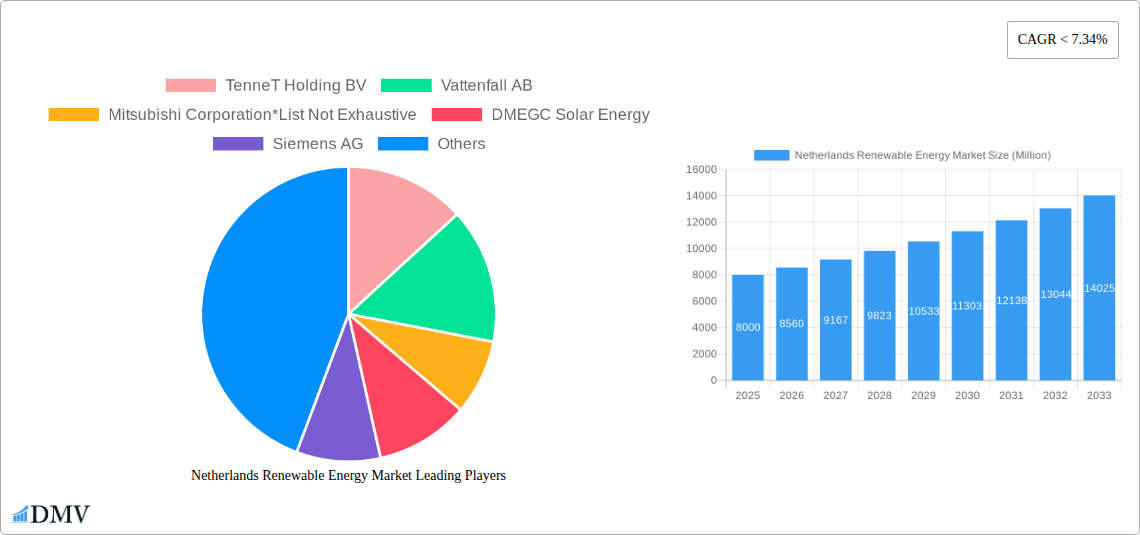

Major Players in the Netherlands Renewable Energy Market Ecosystem

- TenneT Holding BV

- Vattenfall AB

- Mitsubishi Corporation

- DMEGC Solar Energy

- Siemens AG

- Sunstroom Engineering BV

- Orsted AS

Key Developments in Netherlands Renewable Energy Market Industry

- January 2022: Energie Coöperatie Bunnik (ECB) and IX Zon plan a 16MW solar park, generating ~14.6GWh annually.

- November 2021: Falck Renewables SpA receives approval for a five-turbine wind farm in Gelderland, operational by 2025.

- March 2021: RWE AG announces a 6.1 MW floating solar project near Geertruidenberg, Noord-Brabant.

Strategic Netherlands Renewable Energy Market Market Forecast

The Netherlands renewable energy market is poised for significant growth, driven by ambitious government targets, technological advancements, and increasing public and private sector investment. The forecast period (2025-2033) anticipates robust expansion across various segments, particularly offshore wind and floating solar. This growth will be fueled by continuous innovation, improving cost-competitiveness, and the ongoing transition towards a more sustainable energy future. The market is expected to show a significant CAGR during the forecast period, exceeding xx%.

Netherlands Renewable Energy Market Segmentation

-

1. Source

- 1.1. Wind

- 1.2. Solar

- 1.3. Biomass

- 1.4. Other Sources

Netherlands Renewable Energy Market Segmentation By Geography

- 1. Netherlands

Netherlands Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 7.34% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Penetration of the Technology in Long-Duration Energy Storage Applications4.; Increasing Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Low Energy of Battery Cells

- 3.4. Market Trends

- 3.4.1. Wind Energy is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Wind

- 5.1.2. Solar

- 5.1.3. Biomass

- 5.1.4. Other Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TenneT Holding BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vattenfall AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DMEGC Solar Energy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sunstroom Engineering BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orsted AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 TenneT Holding BV

List of Figures

- Figure 1: Netherlands Renewable Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Renewable Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Netherlands Renewable Energy Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Source 2019 & 2032

- Table 5: Netherlands Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Netherlands Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Netherlands Renewable Energy Market Revenue Million Forecast, by Source 2019 & 2032

- Table 10: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Source 2019 & 2032

- Table 11: Netherlands Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Netherlands Renewable Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Renewable Energy Market?

The projected CAGR is approximately < 7.34%.

2. Which companies are prominent players in the Netherlands Renewable Energy Market?

Key companies in the market include TenneT Holding BV, Vattenfall AB, Mitsubishi Corporation*List Not Exhaustive, DMEGC Solar Energy, Siemens AG, Sunstroom Engineering BV, Orsted AS.

3. What are the main segments of the Netherlands Renewable Energy Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Penetration of the Technology in Long-Duration Energy Storage Applications4.; Increasing Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Wind Energy is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Low Energy of Battery Cells.

8. Can you provide examples of recent developments in the market?

In January 2022, Energie Coöperatie Bunnik (ECB) and IX Zon were planning to build a 16MW solar park along the A12 motorway connecting the Hague with the German border in the Gelderland province in the eastern Netherlands. The project has been under development since 2019, and it is expected to generate around 14.6GWh per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Netherlands Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence