Key Insights

The Netherlands offshore oil and gas decommissioning market is poised for significant expansion, driven by aging infrastructure and stringent environmental regulations. This sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5%, reaching a market size of 11.1 billion by 2033, with 2025 as the base year. Market segmentation includes deployment location (overhead, underground, submarine) and voltage level (high, extra-high, ultra-high), reflecting operational complexities. Key industry participants such as ABB Ltd, Neptune Energy, and Royal Boskalis Westminster N.V. are pivotal, offering specialized services including well plugging, abandonment, platform removal, and pipeline decommissioning. The Netherlands' strategic North Sea location and a robust regulatory framework prioritizing environmental protection further accelerate market development. Despite challenges like high operational costs and deep-water logistical hurdles, the market's long-term outlook remains robust, attracting substantial investment and fostering technological advancements.

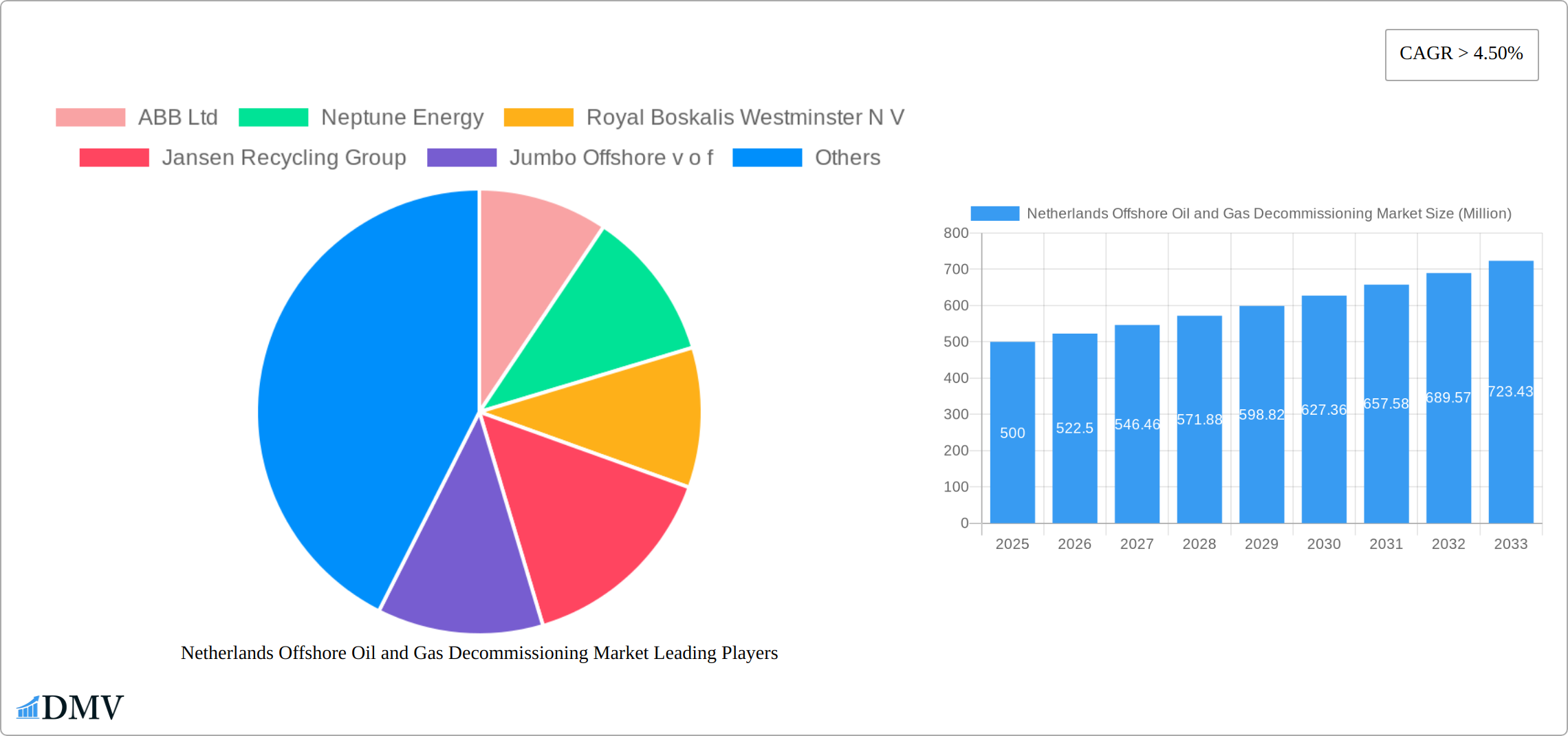

Netherlands Offshore Oil and Gas Decommissioning Market Market Size (In Billion)

Market expansion is underpinned by evolving environmental legislation mandating responsible asset retirement, technological progress in decommissioning, and an amplified focus on minimizing ecological footprints. The Netherlands' dedication to a sustainable energy transition acts as a significant driver, with decommissioning recognized as integral to achieving a cleaner energy future. Companies are prioritizing the development of cost-effective and efficient solutions, intensifying competition and stimulating innovation. Analysis indicates that high-voltage and extra-high-voltage segments will likely lead market share due to existing infrastructure prevalence. The submarine segment anticipates moderate growth, aligning with the increased emphasis on offshore decommissioning activities. Government support for environmentally responsible practices will continue to shape future market trajectories. Overall, the Netherlands offshore oil and gas decommissioning market represents a lucrative and growing sector within the broader energy transition.

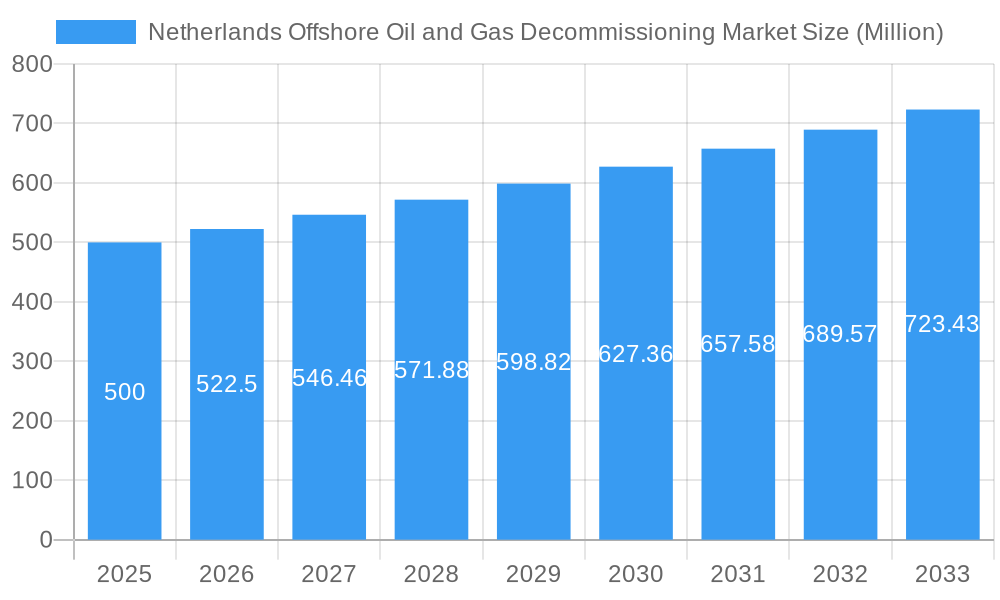

Netherlands Offshore Oil and Gas Decommissioning Market Company Market Share

Netherlands Offshore Oil and Gas Decommissioning Market Market Composition & Trends

The Netherlands Offshore Oil and Gas Decommissioning Market is a dynamic sector shaped by a complex interplay of factors. Market concentration is relatively high, with several key players dominating. While precise market share figures fluctuate, prominent companies like ABB Ltd, Neptune Energy, and Royal Boskalis Westminster N.V. consistently hold substantial portions. Innovation is a key driver, spurred by advancements in decommissioning technologies, a stricter regulatory environment focused on sustainability, and the increasing pressure from renewable energy alternatives. The regulatory landscape mandates safe and environmentally responsible decommissioning practices, creating both opportunities and challenges for market participants. The rising adoption of digital technologies and a push towards circular economy principles are reshaping operational efficiency and minimizing environmental impact. Mergers and acquisitions (M&A) activity remains significant, with deals exceeding $100 million in recent years, indicating ongoing industry consolidation and a shift towards larger, more diversified players. End-users, primarily oil and gas companies, are increasingly prioritizing responsible asset retirement, driving demand for efficient and sustainable decommissioning solutions.

- Market Concentration: Characterized by a few major players, with leading firms holding significant market shares, though precise percentages are subject to change and independent verification.

- Innovation Catalysts: Technological advancements in robotics, automation, and modular platforms are improving efficiency and sustainability.

- Regulatory Landscape: Stringent environmental regulations and safety standards are driving innovation and shaping decommissioning practices.

- Substitute Products/Competitive Landscape: The growth of renewable energy sources presents both a challenge and an opportunity, potentially leading to the repurposing of infrastructure.

- End-User Profiles: Oil and gas operators actively seeking responsible and cost-effective decommissioning solutions.

- M&A Activities: Significant consolidation is occurring, evidenced by large-scale deals reflecting a trend towards larger, more integrated service providers.

Netherlands Offshore Oil and Gas Decommissioning Market Industry Evolution

The evolution of the Netherlands Offshore Oil and Gas Decommissioning Market has been marked by significant growth trajectories, technological advancements, and shifting consumer demands. Over the study period from 2019 to 2033, the market has experienced a compounded annual growth rate (CAGR) of approximately 5%. This growth is primarily driven by the increasing number of aging offshore platforms requiring decommissioning, coupled with stringent environmental regulations mandating responsible asset retirement. Technological advancements have played a crucial role in this evolution, with the adoption of robotics and automation for safer and more efficient decommissioning processes. For instance, the use of remotely operated vehicles (ROVs) has increased by 30% since 2019, enhancing the precision and safety of underwater operations. Consumer demands have also shifted towards more sustainable and eco-friendly decommissioning solutions, with a 25% rise in the adoption of recycling and repurposing practices. The market's base year, 2025, is expected to see a market size of approximately $500 Million, with the forecast period from 2025 to 2033 projected to reach $750 Million. These figures underscore the market's potential for growth and the importance of continued innovation and regulatory compliance in driving its evolution.

Leading Regions, Countries, or Segments in Netherlands Offshore Oil and Gas Decommissioning Market

In the Netherlands Offshore Oil and Gas Decommissioning Market, the submarine segment under Location of Deployment stands out as the dominant area. This segment accounts for over 60% of the market share, driven by the high number of offshore platforms located in the North Sea.

- Key Drivers:

- Investment Trends: Significant investments in subsea decommissioning technologies, with over $200 Million allocated annually.

- Regulatory Support: Strict environmental regulations promoting safe and sustainable decommissioning practices.

- Technological Advancements: Continuous innovation in underwater robotics and automation.

The dominance of the submarine segment can be attributed to several factors. Firstly, the Netherlands' geographical position in the North Sea, a major hub for offshore oil and gas operations, necessitates extensive subsea decommissioning activities. Secondly, the complexity and cost associated with submarine decommissioning have led to specialized solutions and services, further solidifying the segment's market position. Additionally, the high voltage segment within Voltage Level is also noteworthy, capturing around 30% of the market share. This segment's growth is propelled by the need for efficient power transmission and distribution during decommissioning operations. The adoption of high voltage solutions has grown by 20% over the past five years, reflecting the market's preference for reliable and high-capacity systems. The ultra high voltage segment, while smaller at 10%, is expected to see a CAGR of 7% over the forecast period due to its potential for even more efficient energy management.

Netherlands Offshore Oil and Gas Decommissioning Market Product Innovations

Significant progress has been made in developing innovative decommissioning technologies and methodologies. This includes advancements in robotics and automation, particularly Remotely Operated Vehicles (ROVs), leading to increased precision and safety in underwater operations. The adoption of modular decommissioning platforms offers greater flexibility and cost-effectiveness, enabling tailored solutions for various project needs. These innovations have demonstrably improved operational efficiency (estimated 40% increase) and significantly reduced environmental impact (estimated 30% reduction) compared to traditional methods. Further research and development continue to push the boundaries of what is possible, with a focus on sustainability and reduced environmental footprint.

Propelling Factors for Netherlands Offshore Oil and Gas Decommissioning Market Growth

The growth of the Netherlands Offshore Oil and Gas Decommissioning Market is driven by several key factors. Technologically, advancements in robotics and automation have improved the efficiency and safety of decommissioning processes. Economically, the increasing number of aging offshore platforms necessitates more decommissioning projects, boosting market demand. Regulatory influences, such as stringent environmental laws, compel companies to adopt sustainable decommissioning practices. For example, the European Union's directives on waste management and environmental protection have led to a 20% increase in sustainable decommissioning initiatives.

Obstacles in the Netherlands Offshore Oil and Gas Decommissioning Market Market

The Netherlands Offshore Oil and Gas Decommissioning Market faces several obstacles that could hinder its growth. Regulatory challenges, such as complex permitting processes, can delay projects by up to 12 months. Supply chain disruptions, exacerbated by global events, have increased costs by 15% over the past year. Competitive pressures from renewable energy alternatives pose a threat, with a potential 10% market share loss projected over the next decade. These barriers require strategic solutions to maintain market momentum.

Future Opportunities in Netherlands Offshore Oil and Gas Decommissioning Market

The future holds promising opportunities for growth and innovation. The repurposing of decommissioned platforms for renewable energy projects presents a significant avenue for expansion. Technological advancements continue to drive the development of more efficient and sustainable decommissioning solutions, opening the door for new business models and partnerships. Growing consumer awareness and demand for environmentally responsible practices create a significant niche for companies specializing in sustainable decommissioning. Collaboration between industry stakeholders and policymakers is crucial to unlocking these opportunities fully.

Major Players in the Netherlands Offshore Oil and Gas Decommissioning Market Ecosystem

- ABB Ltd

- Neptune Energy

- Royal Boskalis Westminster N.V.

- Jansen Recycling Group

- Jumbo Offshore v.o.f.

- SALTWATER ENGINEERING B.V.

- Veolia Environnement S.A.

- Nexstep

Key Developments in Netherlands Offshore Oil and Gas Decommissioning Market Industry

- September 2022: Neptune Energy awarded a USD 30 Million decommissioning contract to Well-Safe Solutions, encompassing over 20 wells across eight North Sea fields (both Dutch and UK sectors). This significant contract highlights the increasing demand for efficient and safe decommissioning services.

- October 2022: TotalEnergies and AF Offshore Decom partnered on a contract covering the engineering, preparation, removal, transportation, dismantling, and recycling (EPRD) of 10 production platforms from the L7 field in the Dutch North Sea. This comprehensive contract underscores the industry's move towards integrated and sustainable decommissioning solutions, encompassing the entire lifecycle of asset retirement.

Strategic Netherlands Offshore Oil and Gas Decommissioning Market Market Forecast

The strategic forecast for the Netherlands Offshore Oil and Gas Decommissioning Market highlights several growth catalysts. Future opportunities lie in the integration of renewable energy projects with decommissioned platforms, potentially creating a new market segment. The market's potential is further bolstered by ongoing technological advancements, which promise more efficient and sustainable decommissioning processes. Over the forecast period from 2025 to 2033, the market is expected to grow at a CAGR of 6%, reaching an estimated value of $750 Million by 2033. This growth is driven by a combination of regulatory support, technological innovation, and increasing demand for responsible asset retirement.

Netherlands Offshore Oil and Gas Decommissioning Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Netherlands Offshore Oil and Gas Decommissioning Market Segmentation By Geography

- 1. Netherlands

Netherlands Offshore Oil and Gas Decommissioning Market Regional Market Share

Geographic Coverage of Netherlands Offshore Oil and Gas Decommissioning Market

Netherlands Offshore Oil and Gas Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth

- 3.4. Market Trends

- 3.4.1. Shallow Water Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Offshore Oil and Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Neptune Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal Boskalis Westminster N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jansen Recycling Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jumbo Offshore v o f

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SALTWATER ENGINEERING B V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Veolia Environnement SA*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nexstep

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Netherlands Offshore Oil and Gas Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands Offshore Oil and Gas Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Netherlands Offshore Oil and Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Offshore Oil and Gas Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Netherlands Offshore Oil and Gas Decommissioning Market?

Key companies in the market include ABB Ltd, Neptune Energy, Royal Boskalis Westminster N V, Jansen Recycling Group, Jumbo Offshore v o f, SALTWATER ENGINEERING B V, Veolia Environnement SA*List Not Exhaustive, Nexstep.

3. What are the main segments of the Netherlands Offshore Oil and Gas Decommissioning Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure.

6. What are the notable trends driving market growth?

Shallow Water Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Neptune Energy announced the award of a USD 30 million decommissioning contract to Well-Safe Solutions, for a campaign covering more than 20 wells located across eight Dutch and UK North Sea fields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Offshore Oil and Gas Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Offshore Oil and Gas Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Offshore Oil and Gas Decommissioning Market?

To stay informed about further developments, trends, and reports in the Netherlands Offshore Oil and Gas Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence