Key Insights

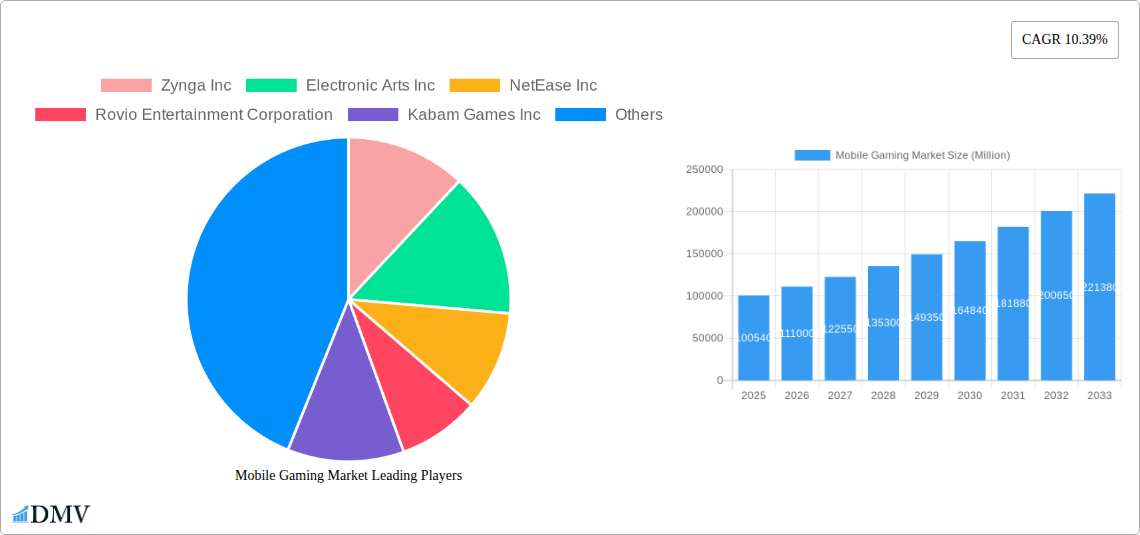

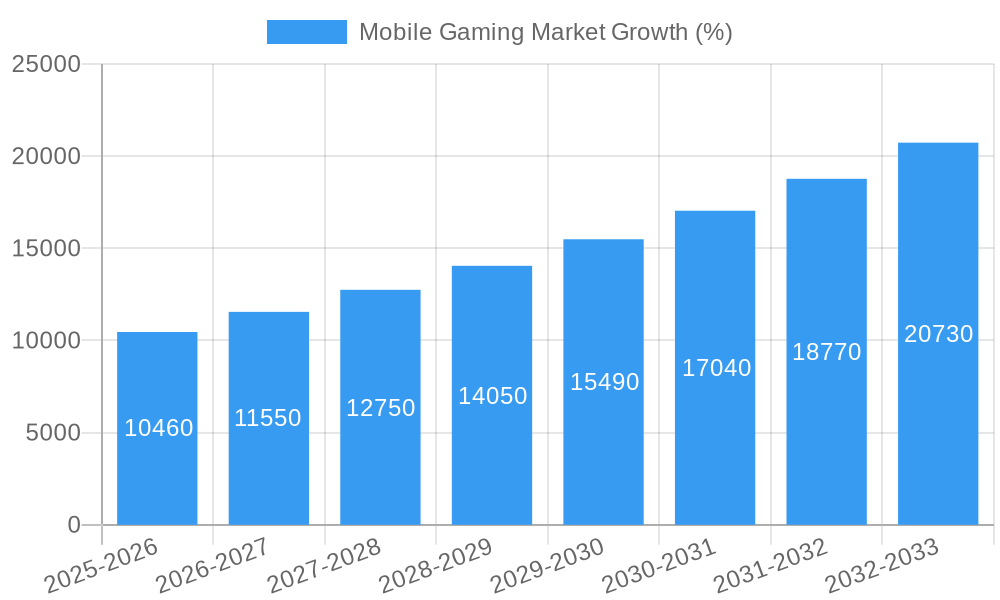

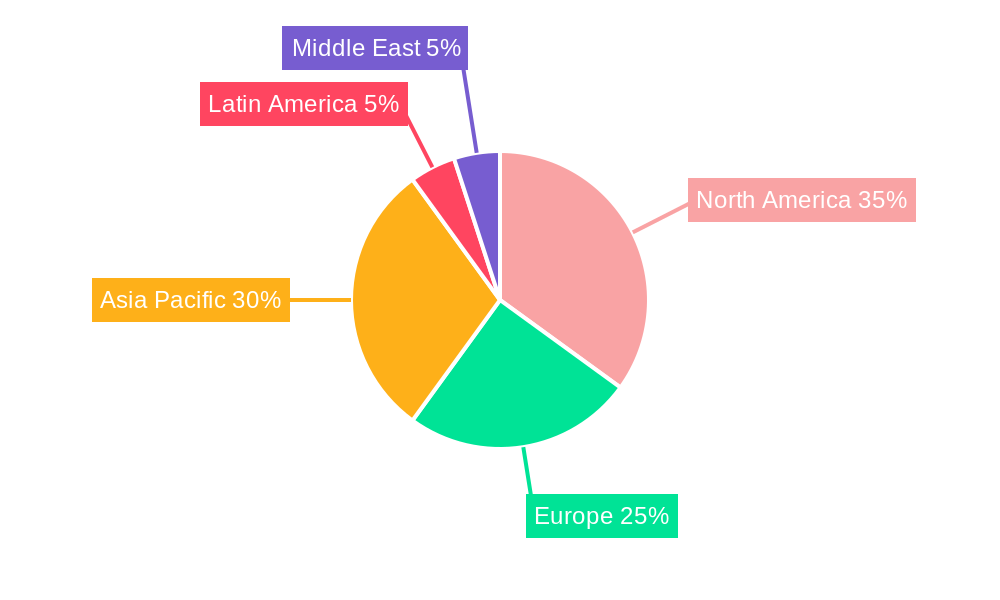

The mobile gaming market is experiencing robust growth, projected to reach $100.54 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.39% from 2025 to 2033. This expansion is driven by several factors. The increasing affordability and accessibility of smartphones globally, coupled with the development of high-quality, immersive mobile games, are key contributors. Furthermore, the rise of esports and the integration of social features within games foster engagement and community building, encouraging higher spending and playtime. The diverse monetization strategies employed, including in-app purchases, paid apps, and advertising, cater to a broad spectrum of players and contribute to the market's revenue streams. The market is segmented by platform (Android, iOS, and other third-party stores), reflecting the dominance of these operating systems and the growing importance of alternative distribution channels, particularly in regions where Google Play is less prevalent. Leading companies like Tencent, NetEase, and Activision Blizzard are at the forefront of innovation, continuously releasing engaging titles and expanding their global reach. Geographical distribution reveals strong market presence in North America and Asia-Pacific, with significant growth potential in emerging markets like Latin America and the Middle East.

The continued growth of the mobile gaming market depends on several factors. Sustained technological advancements leading to enhanced graphics, improved game mechanics, and more accessible gameplay are crucial for attracting and retaining players. Effective marketing strategies, including influencer marketing and targeted advertising, are vital for expanding the player base and driving engagement. Addressing concerns around in-app purchases and responsible gaming practices will also be crucial for long-term sustainability. The evolving landscape of mobile technology, including the development of 5G networks and advancements in augmented and virtual reality (AR/VR) technologies, present significant opportunities for innovation and further growth within the mobile gaming sector. Competition among developers and publishers is fierce, encouraging continuous innovation and the development of new and engaging game experiences.

Mobile Gaming Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global mobile gaming market, offering a comprehensive overview of its current state, future trajectory, and key players. From market size and segmentation to technological advancements and competitive dynamics, this report equips stakeholders with the knowledge needed to navigate this rapidly evolving landscape. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx% during the forecast period.

Mobile Gaming Market Composition & Trends

This section delves into the intricate structure of the mobile gaming market, evaluating its concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market is characterized by a relatively high level of concentration, with a few major players commanding significant market share. However, the emergence of independent developers and innovative studios is steadily challenging this established order.

Market Share Distribution (Estimated 2025):

- Tencent Holdings Limited: xx%

- NetEase Inc: xx%

- Activision Blizzard Inc: xx%

- Other: xx%

Innovation Catalysts: Advancements in mobile technology, including 5G adoption and improved processing power, are fueling the creation of increasingly sophisticated and immersive mobile games. The integration of augmented reality (AR) and virtual reality (VR) technologies is also opening up new avenues for innovation.

Regulatory Landscape: Varying regulations across different regions impact the market's growth and development. Data privacy concerns and age-rating systems are significant regulatory considerations that influence market players' strategies.

Substitute Products: While mobile gaming enjoys a dominant position in the entertainment industry, other forms of entertainment, such as streaming services and social media, pose a degree of competitive pressure.

End-User Profiles: The mobile gaming market caters to a diverse range of users across various age groups and demographics, with a significant portion of the user base comprising millennials and Gen Z.

M&A Activities: The mobile gaming industry witnesses substantial M&A activity, with large companies frequently acquiring smaller studios and developers to expand their portfolios and gain access to innovative technologies. Total M&A deal value in 2024 was estimated at xx Million, with significant activity expected to continue.

Mobile Gaming Market Industry Evolution

This section provides a detailed historical and prospective analysis of the mobile gaming market, examining its growth trajectories, technological progress, and shifting consumer preferences from 2019 to 2033. The market has experienced remarkable growth over the past few years, driven by increased smartphone penetration, improving internet infrastructure, and the rising popularity of mobile gaming among diverse demographics. Technological innovations, such as improved graphics capabilities, enhanced game engine technologies, and the rise of cloud gaming services, are continuously shaping the industry's evolution. Consumer demand shifts towards more immersive and social gaming experiences, including esports and competitive gaming, are also having a profound impact.

Leading Regions, Countries, or Segments in Mobile Gaming Market

This section identifies the leading regions, countries, and market segments within the mobile gaming industry. The Asia-Pacific region, particularly China, dominates the global mobile gaming market, fueled by a large and rapidly growing player base, substantial investments in the sector, and supportive government policies. The North American and European markets are also significant contributors.

By Monetization Type:

- In-app Purchases: This remains the most dominant monetization model, driving a significant portion of the market revenue. The popularity of free-to-play games with in-app purchases is a key factor.

- Paid Apps: This segment contributes substantially and is expected to continue its moderate growth.

- Advertising: While advertising revenue is also significant, the increasing preference for in-app purchase models is impacting this segment's growth rate.

By Platform:

- Android: Android holds a larger market share than iOS, owing to the widespread availability of Android devices in developing markets.

- iOS: iOS maintains a strong market presence despite its smaller market share, driven by the high average revenue per user (ARPU) for iOS gamers.

- Other Third-party Stores: This segment is experiencing rapid growth, especially in regions where Google Play Store's presence is limited, presenting opportunities for alternative app stores.

Mobile Gaming Market Product Innovations

Recent innovations have focused on enhancing user experience through advanced graphics, improved gameplay mechanics, and the incorporation of new technologies such as AR/VR and blockchain integration. The rise of cloud gaming allows players to access high-quality games on less powerful mobile devices. Unique selling propositions, such as innovative game mechanics, compelling storylines, and engaging social features, are key factors influencing market success.

Propelling Factors for Mobile Gaming Market Growth

Several factors are driving the expansion of the mobile gaming market. Technological advancements, like the widespread adoption of 5G technology and the development of more powerful mobile processors, are leading to higher-quality gaming experiences. Economic growth, particularly in developing economies, is also fueling market growth through increased smartphone penetration and rising disposable incomes. Lastly, supportive government policies and regulatory frameworks in some regions encourage investments in the mobile gaming industry.

Obstacles in the Mobile Gaming Market

Despite its rapid growth, the mobile gaming market faces several challenges. Stringent regulations concerning data privacy and age restrictions can hinder market expansion in certain regions. Supply chain disruptions and component shortages can affect the manufacturing and distribution of mobile gaming devices. Intense competition among established players and emerging developers puts pressure on profit margins and market share.

Future Opportunities in Mobile Gaming Market

The mobile gaming market presents exciting opportunities. The expansion into new, untapped markets, particularly in developing economies, offers vast potential. Advancements in cloud gaming technologies, AR/VR, and the metaverse are creating new avenues for immersive mobile gaming experiences. Emerging trends such as esports and live streaming further enhance growth prospects.

Major Players in the Mobile Gaming Market Ecosystem

- Zynga Inc

- Electronic Arts Inc

- NetEase Inc

- Rovio Entertainment Corporation

- Kabam Games Inc

- Activision Blizzard Inc

- GungHo Online Entertainment Inc ( SoftBank Group)

- Tencent Holdings Limited

- Nintendo Co Ltd

- NCsoft Corporation

Key Developments in Mobile Gaming Market Industry

- November 2023: Pley's collaboration with Tilting Point broadened the reach of Homesteads: Dream Farm to a wider web gaming audience, showcasing cross-platform potential.

- May 2024: Pudgy Penguins' partnership with Mythical Games signifies the growing integration of web3 technologies and blockchain into mobile gaming, opening new avenues for engagement and monetization.

Strategic Mobile Gaming Market Forecast

The mobile gaming market is poised for sustained growth, driven by continuous technological advancements, expanding user bases, and the rise of innovative gaming models. The integration of emerging technologies such as Web3, metaverse applications, and advanced AI will shape the future landscape, presenting significant opportunities for market players to innovate and capture market share. The market's potential for further expansion in untapped regions and demographics ensures a bright outlook for the coming years.

Mobile Gaming Market Segmentation

-

1. Monetization Type

- 1.1. In-app Purchases

- 1.2. Paid Apps

- 1.3. Advertising

-

2. Platform

- 2.1. Android

- 2.2. iOS

- 2.3. Other Th

Mobile Gaming Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Peru

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

Mobile Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration; Growth in Cloud Adoption

- 3.3. Market Restrains

- 3.3.1. User Privacy and Security Issues Along with Government Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Smartphone Penetration is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Monetization Type

- 5.1.1. In-app Purchases

- 5.1.2. Paid Apps

- 5.1.3. Advertising

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Android

- 5.2.2. iOS

- 5.2.3. Other Th

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Monetization Type

- 6. North America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Monetization Type

- 6.1.1. In-app Purchases

- 6.1.2. Paid Apps

- 6.1.3. Advertising

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Android

- 6.2.2. iOS

- 6.2.3. Other Th

- 6.1. Market Analysis, Insights and Forecast - by Monetization Type

- 7. Europe Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Monetization Type

- 7.1.1. In-app Purchases

- 7.1.2. Paid Apps

- 7.1.3. Advertising

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Android

- 7.2.2. iOS

- 7.2.3. Other Th

- 7.1. Market Analysis, Insights and Forecast - by Monetization Type

- 8. Asia Pacific Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Monetization Type

- 8.1.1. In-app Purchases

- 8.1.2. Paid Apps

- 8.1.3. Advertising

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Android

- 8.2.2. iOS

- 8.2.3. Other Th

- 8.1. Market Analysis, Insights and Forecast - by Monetization Type

- 9. Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Monetization Type

- 9.1.1. In-app Purchases

- 9.1.2. Paid Apps

- 9.1.3. Advertising

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Android

- 9.2.2. iOS

- 9.2.3. Other Th

- 9.1. Market Analysis, Insights and Forecast - by Monetization Type

- 10. Middle East Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Monetization Type

- 10.1.1. In-app Purchases

- 10.1.2. Paid Apps

- 10.1.3. Advertising

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Android

- 10.2.2. iOS

- 10.2.3. Other Th

- 10.1. Market Analysis, Insights and Forecast - by Monetization Type

- 11. United Arab Emirates Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Monetization Type

- 11.1.1. In-app Purchases

- 11.1.2. Paid Apps

- 11.1.3. Advertising

- 11.2. Market Analysis, Insights and Forecast - by Platform

- 11.2.1. Android

- 11.2.2. iOS

- 11.2.3. Other Th

- 11.1. Market Analysis, Insights and Forecast - by Monetization Type

- 12. North America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 14. Asia Pacific Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 15. Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Mexico

- 15.1.3 Peru

- 16. Middle East Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. United Arab Emirates Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1. Saudi Arabia

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Zynga Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Electronic Arts Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 NetEase Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Rovio Entertainment Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Kabam Games Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Activision Blizzard Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 GungHo Online Entertainment Inc ( SoftBank Group)

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Tencent Holdings Limited

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Nintendo Co Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 NCsoft Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Zynga Inc

List of Figures

- Figure 1: Mobile Gaming Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mobile Gaming Market Share (%) by Company 2024

List of Tables

- Table 1: Mobile Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 3: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 4: Mobile Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Peru Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Saudi Arabia Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 27: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 28: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 32: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 33: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Germany Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 39: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 40: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 46: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 47: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Brazil Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Mexico Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Peru Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 52: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 53: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 55: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 56: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Saudi Arabia Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Gaming Market?

The projected CAGR is approximately 10.39%.

2. Which companies are prominent players in the Mobile Gaming Market?

Key companies in the market include Zynga Inc, Electronic Arts Inc, NetEase Inc, Rovio Entertainment Corporation, Kabam Games Inc, Activision Blizzard Inc, GungHo Online Entertainment Inc ( SoftBank Group), Tencent Holdings Limited, Nintendo Co Ltd, NCsoft Corporation.

3. What are the main segments of the Mobile Gaming Market?

The market segments include Monetization Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 100.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration; Growth in Cloud Adoption.

6. What are the notable trends driving market growth?

Increasing Smartphone Penetration is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

User Privacy and Security Issues Along with Government Regulations.

8. Can you provide examples of recent developments in the market?

May 2024: Pudgy Penguins, the brand development company known for its globally recognized Pudgy Penguins characters, partnered with the next-generation gaming technology studio Mythical Games to co-create an innovative mobile video game with web3 capabilities. The partnership brought together the creators of the widely acclaimed Pudgy Penguins characters and the gaming studio responsible for two of the blockchain's most successful games: NFL Rivals and Blankos Block Party.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Gaming Market?

To stay informed about further developments, trends, and reports in the Mobile Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence