Key Insights

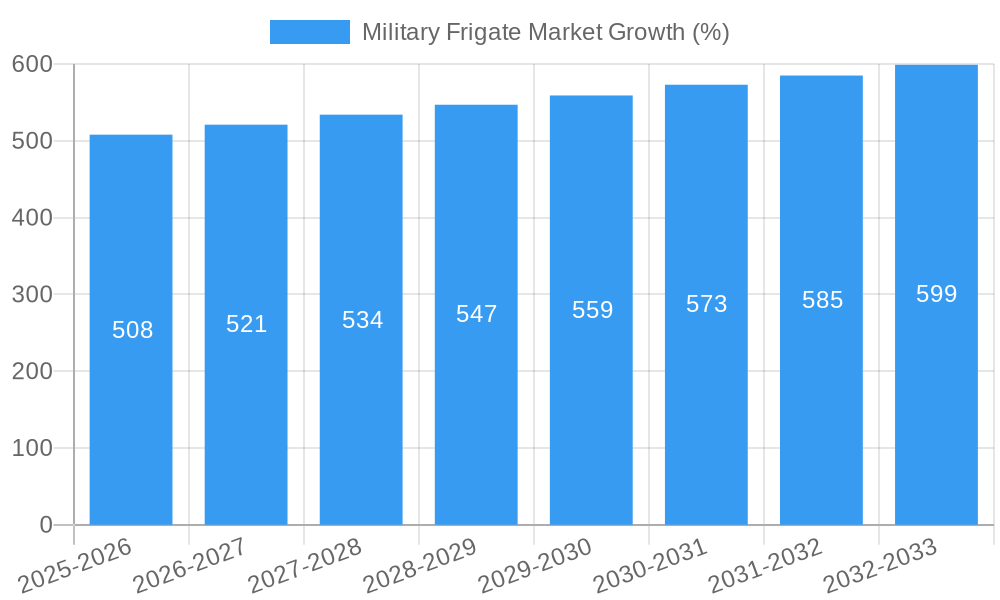

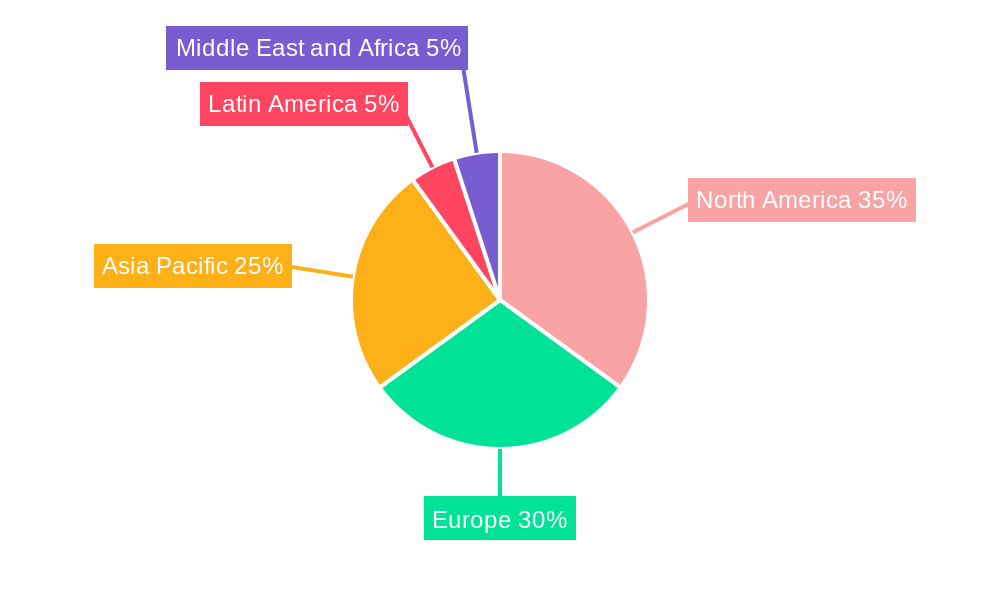

The global military frigate market, valued at $24.03 billion in 2025, is projected to experience steady growth, driven by increasing geopolitical tensions and the need for advanced naval capabilities among various nations. The Compound Annual Growth Rate (CAGR) of 2.17% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. Key drivers include modernization of existing fleets, the demand for multi-role vessels capable of anti-submarine warfare, anti-air defense, and surface combat, and the increasing focus on littoral combat capabilities. Technological advancements in areas like radar systems, missile defense, and autonomous systems are further fueling market growth. While budget constraints and economic fluctuations could potentially act as restraints, the strategic importance of frigate vessels in maintaining maritime security is expected to outweigh these challenges. The market is segmented by application, with patrol and escort missions dominating, reflecting the core functions of frigates in naval operations. Major players like General Dynamics, Lockheed Martin, and BAE Systems are actively competing, leveraging their technological expertise and established supply chains to secure contracts and market share. Regional analysis reveals a strong presence in North America and Europe, with the Asia-Pacific region also exhibiting significant growth potential driven by increasing defense spending and naval modernization efforts in countries like China and India.

The forecast period (2025-2033) suggests a gradual increase in market value, influenced by both organic growth and new vessel acquisitions. The diverse range of applications and technological integration into frigate design will continue to drive innovation and specialization within the market. Competition among leading defense contractors is likely to intensify, with a focus on offering superior performance, cost-effectiveness, and customized solutions to meet specific client needs. The continued emphasis on international collaborations and co-development projects could also reshape the market landscape in the coming years, leading to new strategic partnerships and technological advancements. Ultimately, the military frigate market's sustained growth reflects the enduring importance of naval power projection and maritime security in the global geopolitical arena.

Military Frigate Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Military Frigate Market, offering a comprehensive overview of market dynamics, technological advancements, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this dynamic market. The market is projected to reach xx Million by 2033.

Military Frigate Market Composition & Trends

The Military Frigate Market exhibits a moderately concentrated landscape, with key players like General Dynamics Corporation, Lockheed Martin Corporation, and BAE Systems plc holding significant market share. However, regional players and specialized shipbuilders are increasingly challenging this dominance. Innovation is driven by the demand for advanced capabilities like anti-submarine warfare (ASW), enhanced stealth technologies, and hybrid propulsion systems. Stringent regulatory frameworks concerning environmental compliance and safety standards significantly influence market development. Substitute products are limited, with the primary alternative being older frigate classes, but their limitations in capabilities and operational costs drive demand for newer models. End-users are primarily national navies globally, with procurement decisions heavily influenced by geopolitical factors and defense budgets. M&A activity in the sector has been moderate, with deal values averaging xx Million in recent years, reflecting strategic consolidation within the industry.

- Market Concentration: Moderately concentrated, with top 3 players holding approximately xx% market share.

- Innovation Catalysts: ASW capabilities, stealth technologies, hybrid propulsion.

- Regulatory Landscape: Stringent environmental and safety regulations.

- Substitute Products: Limited, mainly older frigate classes.

- End-User Profile: Primarily national navies worldwide.

- M&A Activity: Moderate, with average deal values of xx Million.

Military Frigate Market Industry Evolution

The Military Frigate Market has witnessed consistent growth over the historical period (2019-2024), driven by increasing global defense budgets and heightened geopolitical tensions. Technological advancements, particularly in areas like sensor technology, weapon systems, and propulsion systems, are significantly impacting market dynamics. The adoption of hybrid diesel-electric propulsion systems is gaining traction, reflecting a growing emphasis on fuel efficiency and reduced environmental impact. Demand is increasingly skewed toward multi-role frigates capable of performing diverse tasks, from anti-submarine warfare to humanitarian aid operations. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), propelled by ongoing modernization efforts by global navies. Specific data points on growth rates and technology adoption are detailed within the full report.

Leading Regions, Countries, or Segments in Military Frigate Market

The Asia-Pacific region currently holds the dominant position in the Military Frigate Market, driven by significant defense modernization programs in several countries. The demand for patrol and escort frigates is particularly high in this region, reflecting the need for enhanced maritime security and territorial defense.

- Key Drivers in Asia-Pacific:

- Substantial investments in naval modernization.

- Growing geopolitical tensions and regional security concerns.

- Government support for domestic shipbuilding industries.

The dominance of the Asia-Pacific region stems from a confluence of factors including substantial investments in naval capabilities, increasing regional security concerns, and government policies promoting domestic shipbuilding industries. North America and Europe are also significant markets, although their growth rates are comparatively lower. Within application segments, patrol and escort frigates represent the most significant proportion of market demand, followed by other specialized applications. Detailed market segmentation and regional analysis are presented in the complete report.

Military Frigate Market Product Innovations

Recent innovations in the Military Frigate Market focus on enhancing stealth capabilities, improving sensor technology, and integrating advanced weapon systems. Hybrid propulsion systems are gaining prominence, offering a blend of efficiency and power. These advancements significantly improve operational efficiency, reduce detection risks, and enhance overall combat effectiveness. Unique selling propositions include increased operational range, reduced carbon footprint, and enhanced mission adaptability.

Propelling Factors for Military Frigate Market Growth

Technological advancements in sensors, weapons, and propulsion systems are major drivers of market growth. Increased global defense spending, particularly in regions experiencing geopolitical instability, fuels demand. Furthermore, supportive government policies and initiatives promoting domestic shipbuilding and naval modernization contribute significantly to market expansion. The growing need for versatile multi-role frigates capable of diverse missions further accelerates market growth.

Obstacles in the Military Frigate Market

Supply chain disruptions, particularly in securing critical components and materials, pose significant challenges. Intense competition among major players and rising construction costs can restrict growth. Stringent regulatory frameworks and evolving international norms regarding naval capabilities introduce complexities in procurement processes. These factors could potentially limit market expansion in the coming years.

Future Opportunities in Military Frigate Market

Emerging markets in Africa and South America present significant growth potential. Advancements in autonomous systems and artificial intelligence offer exciting opportunities for enhancing frigate capabilities. The development of next-generation materials and technologies could further improve performance and efficiency, opening new avenues for market expansion.

Major Players in the Military Frigate Market Ecosystem

- General Dynamics Corporation

- Lockheed Martin Corporation

- Rosoboronexport

- China Shipbuilding Industry Trading Co Ltd

- Fr Lürssen Werft GmbH & Co KG

- Naval Group

- Fincantieri S p A

- thyssenkrupp AG

- Austal Limited

- BAE Systems plc

- United Shipbuilding Corporation

- Damen Shipyards Group

Key Developments in Military Frigate Market Industry

- June 2023: The Dutch Ministry of Defence, Damen, and Thales signed a contract for four cutting-edge ASW frigates, featuring hybrid diesel-electric propulsion and enhanced stealth capabilities.

- November 2022: The UK MoD awarded a USD 4.59 billion contract to BAE Systems for five City Class Type 26 frigates, showcasing advanced ASW and air defense capabilities.

Strategic Military Frigate Market Forecast

The Military Frigate Market is poised for sustained growth driven by ongoing naval modernization efforts, increasing defense budgets, and the demand for advanced capabilities. Future opportunities lie in emerging markets, technological advancements like autonomous systems, and the development of next-generation frigates optimized for diverse missions, guaranteeing a robust outlook for market expansion.

Military Frigate Market Segmentation

-

1. Application

- 1.1. Patrol

- 1.2. Escort

- 1.3. Other Applications

Military Frigate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Italy

- 2.2. United Kingdom

- 2.3. Spain

- 2.4. France

- 2.5. Germany

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Taiwan

- 3.3. India

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Turkey

- 5.2. Egypt

- 5.3. Saudi Arabia

- 5.4. Rest of Middle East and Africa

Military Frigate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Patrol Frigates are Expected to Have the Largest Market Share of the Military Frigates Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Patrol

- 5.1.2. Escort

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Patrol

- 6.1.2. Escort

- 6.1.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Patrol

- 7.1.2. Escort

- 7.1.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Patrol

- 8.1.2. Escort

- 8.1.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Patrol

- 9.1.2. Escort

- 9.1.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Patrol

- 10.1.2. Escort

- 10.1.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Italy

- 12.1.2 United Kingdom

- 12.1.3 Spain

- 12.1.4 France

- 12.1.5 Germany

- 12.1.6 Russia

- 12.1.7 Rest of Europe

- 13. Asia Pacific Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Taiwan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Australia

- 13.1.6 Rest of Asia Pacific

- 14. Latin America Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Military Frigate Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Turkey

- 15.1.2 Egypt

- 15.1.3 Saudi Arabia

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 General Dynamics Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lockheed Martin Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Rosoboronexport

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 China Shipbuilding Industry Trading Co Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Fr Lürssen Werft GmbH & Co KG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Naval Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Fincantieri S p A

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 thyssenkrupp AG

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Austal Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BAE Systems plc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 United Shipbuilding Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Damen Shipyards Group

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Military Frigate Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Military Frigate Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Military Frigate Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Military Frigate Market Revenue (Million), by Application 2024 & 2032

- Figure 17: Europe Military Frigate Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Military Frigate Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Asia Pacific Military Frigate Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Military Frigate Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Latin America Military Frigate Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Latin America Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Military Frigate Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Military Frigate Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East and Africa Military Frigate Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East and Africa Military Frigate Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Military Frigate Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Frigate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Military Frigate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Military Frigate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Italy Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Spain Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Russia Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Taiwan Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Mexico Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Brazil Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Latin America Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Egypt Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Saudi Arabia Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Military Frigate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Military Frigate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Italy Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Spain Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Germany Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Russia Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Europe Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Military Frigate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Taiwan Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Australia Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Military Frigate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 53: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Mexico Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Brazil Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Latin America Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Military Frigate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Military Frigate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Turkey Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Egypt Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Saudi Arabia Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa Military Frigate Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Frigate Market?

The projected CAGR is approximately 2.17%.

2. Which companies are prominent players in the Military Frigate Market?

Key companies in the market include General Dynamics Corporation, Lockheed Martin Corporation, Rosoboronexport, China Shipbuilding Industry Trading Co Ltd, Fr Lürssen Werft GmbH & Co KG, Naval Group, Fincantieri S p A, thyssenkrupp AG, Austal Limited, BAE Systems plc, United Shipbuilding Corporation, Damen Shipyards Group.

3. What are the main segments of the Military Frigate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Patrol Frigates are Expected to Have the Largest Market Share of the Military Frigates Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: The Dutch Ministry of Defence (MoD), Damen, and THALES jointly signed a contract for the construction of four cutting-edge Anti-Submarine Warfare (ASW) Frigates. This pivotal agreement marked the beginning of a new era, heralding the retirement of the current Karel Doorman Class multipurpose frigates. The primary focus of these ASW frigates will revolve around bolstering anti-submarine warfare capabilities, showcasing a strategic shift in naval operations. These state-of-the-art frigates will feature hybrid diesel-electric propulsion, embodying a commitment to technological advancement and environmental considerations. A paramount objective is to enhance stealth capabilities, enabling the vessels to navigate with utmost silence, thereby minimizing the risk of detection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Frigate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Frigate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Frigate Market?

To stay informed about further developments, trends, and reports in the Military Frigate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence